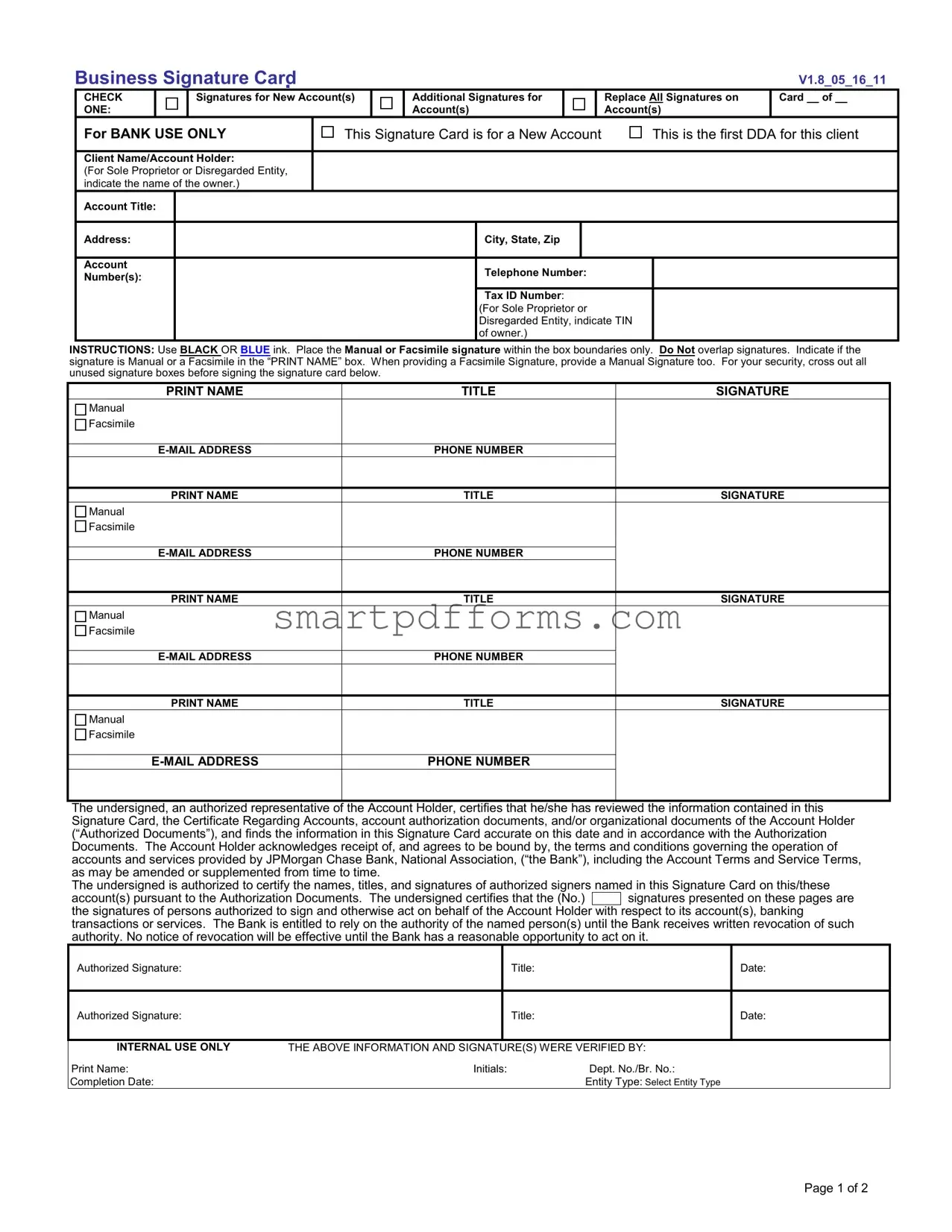

Blank Business Signature Card PDF Template

Opening a new account or updating the authorized signatures for an existing account at a bank is a crucial step for businesses to ensure smooth financial operations. The Business Signature Card form serves as a key document in this process, specifying who within the company has the authority to conduct transactions on behalf of the business. This form is multifaceted, allowing for the addition of new account(s), the inclusion of additional signatures for existing account(s), or the complete replacement of all signatures on file. Designed to cater to both new clients establishing their first Direct Deposit Account (DDA) with the bank and existing clients making updates, the form requires detailed information including the account holder's name, account title, address, account number(s), telephone number, and Tax ID Number. Special instructions emphasize the use of black or blue ink, the correct placement of manual or facsimile signatures within specified boundaries, and the provision of both manual and facsimile signatures when the latter is given. Security measures advise the crossing out of unused signature boxes to protect the account's integrity. By certifying that the information on the Signature Card matches that of official authorization documents and agreeing to the bank's terms and conditions, the authorized representative of the account holder binds the company to the operational framework set forth by the bank. This form, thus, not only records authorized signatures but also acts as an agreement between the bank and the account holder regarding the handling of the account(s).

Preview - Business Signature Card Form

Business Signature Card

|

CHECK |

|

Signatures for New Account(s) |

|

|

ONE: |

|

|

|

Additional Signatures for Account(s)

|

|

V1.8_05_16_11 |

|

|

|

|

Replace All Signatures on |

Card __ of __ |

|

Account(s) |

|

For BANK USE ONLY |

This Signature Card is for a New Account |

This is the first DDA for this client |

Client Name/Account Holder:

(For Sole Proprietor or Disregarded Entity, indicate the name of the owner.)

Account Title:

Address:

Account

Number(s):

City, State, Zip

Telephone Number:

Tax ID Number:

(For Sole Proprietor or Disregarded Entity, indicate TIN of owner.)

INSTRUCTIONS: Use BLACK OR BLUE ink. Place the Manual or Facsimile signature within the box boundaries only. Do Not overlap signatures. Indicate if the signature is Manual or a Facsimile in the “PRINT NAME” box. When providing a Facsimile Signature, provide a Manual Signature too. For your security, cross out all unused signature boxes before signing the signature card below.

|

PRINT NAME |

TITLE |

SIGNATURE |

|

Manual |

|

|

|

Facsimile |

|

|

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|

|

|

PRINT NAME |

TITLE |

SIGNATURE |

|

Manual |

|

|

|

Facsimile |

|

|

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|

|

|

PRINT NAME |

TITLE |

SIGNATURE |

|

Manual |

|

|

|

Facsimile |

|

|

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|

|

|

PRINT NAME |

TITLE |

SIGNATURE |

|

Manual |

|

|

|

Facsimile |

|

|

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|

|

The undersigned, an authorized representative of the Account Holder, certifies that he/she has reviewed the information contained in this Signature Card, the Certificate Regarding Accounts, account authorization documents, and/or organizational documents of the Account Holder (“Authorized Documents”), and finds the information in this Signature Card accurate on this date and in accordance with the Authorization Documents. The Account Holder acknowledges receipt of, and agrees to be bound by, the terms and conditions governing the operation of accounts and services provided by JPMorgan Chase Bank, National Association, (“the Bank”), including the Account Terms and Service Terms, as may be amended or supplemented from time to time.

The undersigned is authorized to certify the names, titles, and signatures of authorized signers named in this Signature Card on this/these

account(s) pursuant to the Authorization Documents. The undersigned certifies that the (No.)

signatures presented on these pages are the signatures of persons authorized to sign and otherwise act on behalf of the Account Holder with respect to its account(s), banking transactions or services. The Bank is entitled to rely on the authority of the named person(s) until the Bank receives written revocation of such authority. No notice of revocation will be effective until the Bank has a reasonable opportunity to act on it.

signatures presented on these pages are the signatures of persons authorized to sign and otherwise act on behalf of the Account Holder with respect to its account(s), banking transactions or services. The Bank is entitled to rely on the authority of the named person(s) until the Bank receives written revocation of such authority. No notice of revocation will be effective until the Bank has a reasonable opportunity to act on it.

Authorized Signature:

Authorized Signature:

Title: |

Date: |

Title: |

Date: |

|

|

INTERNAL USE ONLY |

THE ABOVE INFORMATION AND SIGNATURE(S) WERE VERIFIED BY: |

|

Print Name: |

Initials: |

Dept. No./Br. No.: |

Completion Date: |

|

Entity Type: Select Entity Type |

Page 1 of 2

Client Name/Account Holder:

Account Title: |

|

Tax ID Number: |

|

Card __ of __ |

|

|

|

|

|

Account |

|

Telephone Number: |

Date: |

|

Number(s): |

|

|

|

|

|

|

|

|

|

ADDITIONAL SIGNATURES

|

PRINT NAME |

TITLE |

SIGNATURE |

|

Manual |

|

|

|

Facsimile |

|

|

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|

|

|

PRINT NAME |

TITLE |

SIGNATURE |

|

Manual |

|

|

|

Facsimile |

|

|

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|

|

|

PRINT NAME |

TITLE |

SIGNATURE |

|

Manual |

|

|

|

Facsimile |

|

|

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|

|

|

PRINT NAME |

TITLE |

SIGNATURE |

|

Manual |

|

|

|

Facsimile |

|

|

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|

|

|

PRINT NAME |

TITLE |

SIGNATURE |

|

Manual |

|

|

|

Facsimile |

|

|

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|

|

|

PRINT NAME |

TITLE |

SIGNATURE |

|

Manual |

|

|

|

Facsimile |

|

|

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|

|

|

PRINT NAME |

TITLE |

SIGNATURE |

|

Manual |

|

|

|

Facsimile |

|

|

|

|

|

|

|

PHONE NUMBER |

|

|

|

|

|

|

Page 2 of 2

Form Data

| Fact Number | Description |

|---|---|

| 1 | The Business Signature Card is used for documenting signatures for new accounts, additional signatures for accounts, or to replace all signatures on a card. |

| 2 | This form is applicable both when opening the first DDA (Demand Deposit Account) for a new client and for existing clients adding new signatures. |

| 3 | For Sole Proprietor or Disregarded Entity accounts, the name and Tax ID Number (TIN) of the owner are required. |

| 4 | Signatures must be provided in black or blue ink within the specified box boundaries without overlapping, and they can be either manual or facsimile. |

| 5 | For security purposes, all unused signature boxes should be crossed out before signing the form. |

| 6 | The account holder agrees to be bound by the terms and conditions of JPMorgan Chase Bank, National Association, including amendments or supplements to the account and service terms. |

| 7 | An authorized representative certifies the accuracy of the information on the Signature Card and its compliance with authorized documents. |

| 8 | The Bank can rely on the authority of the named signatories until written revocation is received and the Bank has had a reasonable opportunity to act on it. |

| 9 | The form has to be completed with the signer's printed name, title, signature, email address, and phone number. |

| 10 | Bank personnel are required to verify the information and signatures on the form, marking the form for internal use with print name, initials, department or branch number, and completion date. |

Instructions on Utilizing Business Signature Card

Filling out a Business Signature Card form is a critical step for any entity in managing its banking needs effectively. It involves recording authorized representatives who can sign for banking transactions on behalf of the Account Holder. This document captures essential details such as the account holder’s name, account title, address, telephone number, and tax identification number. Additionally, it covers the printing of names, titles, and whether signatures are manual or facsimile for each authorized individual. Careful attention should be paid to accurately filling in the required information to ensure the bank's recognition and validation of the authorized signatories.

Here are the steps to accurately complete the Business Signature Card form:

- Check the appropriate box at the top of the form to indicate if the signature card is for a new account, additional signatures for existing accounts, or to replace all signatures on the card.

- Under "Client Name/Account Holder," fill in the legal name of the business or entity. If the account is for a Sole Proprietor or Disregarded Entity, include the owner’s name.

- Enter the "Account Title" as registered or known by the bank.

- Provide the complete "Address" of the account holder, including the city, state, and zip code.

- Fill in the "Telephone Number" and "Tax ID Number." Sole Proprietors or Disregarded Entities should use the owner's Tax ID number.

- For each authorized signer, print their name, title, and whether their signature is "Manual" or a "Facsimile" in the designated boxes. Ensure each signature is within the boundaries of its respective box to prevent overlap.

- Enter the email address and phone number for each authorized signer next to their signature.

- If there are unused signature boxes, cross them out for security purposes.

- An authorized representative must certify that they have reviewed the information and that it is accurate and in accordance with the Authorization Documents. This is done by providing an authorized signature, print name, and title at the bottom of the form.

- Finally, ensure the form is dated correctly at the bottom.

Upon completion, the form should be reviewed for accuracy and completeness. Any missing or incorrect information might delay the process, so attention to detail is crucial. The completed and signed document is then submitted to the bank for processing. The bank may require additional documentation or steps, so remaining in contact with the bank throughout the process is advisable. Once the form is processed, the bank will recognize the authorized signatories for the account, enabling them to perform banking transactions on behalf of the account holder.

Obtain Answers on Business Signature Card

What is a Business Signature Card form?

A Business Signature Card form is a crucial document for any business opening a new account with a bank. It records the signatures of those authorized to conduct financial transactions on behalf of the company. This includes both manual (handwritten) and facsimile (scanned or electronic) signatures. The form plays a pivotal role in facilitating banking operations and ensuring that only duly authorized individuals can access and manage the company's funds.

Who needs to sign the Business Signature Card form?

Authorized representatives of the account holder—typically individuals who have been given the power to execute banking transactions and make financial decisions on behalf of the company—must sign the form. This might include officers, directors, or employees designated by the company's organizational documents or resolutions. The form must be reviewed for accuracy and in accordance with the company’s authorized documents prior to signing.

What information is required on the Business Signature Card form?

The form requests specific details about the account and its authorized signatories. Required information includes the client name or account holder, account title, address, account number, city, state, zip, telephone number, and tax ID number. For Sole Proprietors or Disregarded Entities, the owner’s name and TIN are needed. Further, the signatories must provide their names, titles, signatures (both manual and facsimile if applicable), email addresses, and phone numbers.

How should the signatures be provided on the form?

Signatures need to be provided in black or blue ink, placed within the designated box boundaries without overlapping. The form explicitly requests the indication of whether a signature is manual or a facsimile. Importantly, when a facsimile signature is used, a manual signature must be provided as well, ensuring both versions are on file for verification purposes. Unused signature boxes should be crossed out for security reasons.

What is the importance of certifying the information on the Business Signature Card?

The authorized representative who certifies the information on the form affirms that they have reviewed all relevant account and organizational documents and confirms the accuracy of the information provided on the Signature Card. This certification process safeguards the company by ensuring that all authorized signatories are correctly identified and that the bank is informed about who has the authority to act on the company’s behalf. This layer of verification is crucial for maintaining the integrity and security of the company’s financial transactions.

What happens after the Business Signature Card form is signed?

Once signed, the Business Signature Card form is submitted to the bank for processing. The bank will verify the information and the signatures. This document allows the bank to recognize the authorized signatories who can perform transactions on behalf of the company. It is vital for businesses to notify the bank promptly if there are any changes in authorized signatories to avoid any unauthorized access or transactions. The bank relies on the authority of named individuals until officially notified otherwise by the company.

Can the authorized signatories on a Business Signature Card form be changed?

Yes, authorized signatories can be updated or changed. To do so, the company must provide the bank with a revised Business Signature Card form indicating the new authorized signatories. This update might be necessitated by changes in personnel, job titles, or the authorization level of existing employees. It’s a critical step to ensure that banking transactions remain secure and are conducted by currently authorized individuals. The bank must be given reasonable time to process any revocation of authority to ensure smooth transitioning and security of account operations.

Common mistakes

When filling out a Business Signature Card form, people often make a variety of mistakes that can lead to complications in managing their business banking accounts. Below is a detailed list of the common errors to avoid:

- Failing to use black or blue ink as specifically instructed, which can cause issues with the legibility and official acceptance of the form.

- Placing signatures so they overlap the box boundaries, which can lead to questions about the validity of the signature.

- Omitting to indicate whether the signature is manual or a facsimile, leaving bank personnel without crucial information on how to verify the authenticity of future signatures.

- Not providing both a manual and a facsimile signature when a facsimile signature is given, limiting the ways the bank can verify identity.

- Leaving unused signature boxes unfilled without crossing them out, which can raise security concerns or lead to unauthorized use.

- Incorrectly filling out or entirely overlooking the Tax Identification Number (TIN), especially for sole proprietors or disregarded entities, thereby potentially causing tax identification issues.

- Failing to update or replace all signatures on the card when required, which might cause discrepancies and operational inefficiencies in banking transactions.

- Not reviewing the information contained in the Signature Card, Authorization Documents, or acknowledging the terms and conditions, which may result in miscommunication or disagreements with the bank.

- Misunderstanding the importance of certifying the names, titles, and signatures of authorized signers, which is crucial for the bank's reliance on such authority for account operations and transaction approvals.

By avoiding these mistakes, businesses can ensure a smoother process with their banking needs, keeping their accounts secure and operational as intended.

Documents used along the form

Creating a new business banking account involves more than just filling out a Business Signature Card. Several other forms and documents are typically required to ensure the account is set up properly and reflects the ownership and structure of the business accurately. Understanding these documents will help streamline the process and ensure all necessary information is provided from the start.

- Resolution of Authority: This document is used by corporations, partnerships, and other entities to specify which individuals have the authority to act on behalf of the company in banking matters. It spells out who can sign checks, enter into agreements, and make financial decisions.

- Articles of Incorporation or Organization: For corporations and Limited Liability Companies (LLCs), these documents are filed with the state and outline the basic structure and purpose of the business. They are necessary to verify the legal existence of the company and determine who is authorized to open and manage the account.

- Operating Agreement: Mainly used by LLCs, an Operating Agreement describes the operations of the LLC, including the responsibilities and powers of its members and managers. It provides banks with insight into who has financial authority within the company.

- Partnership Agreement: For businesses operated as partnerships, this agreement defines the roles, responsibilities, and financial contributions of each partner. It also clarifies how profits and losses will be shared amongst the partners and who has the authority to bind the partnership in agreements.

Together with a Business Signature Card, these documents ensure that the bank understands the legal and operational structure of your business and can accurately record who has authority over the account. Providing clear, complete documentation up front can help avoid delays and ensure your business banking needs are met efficiently.

Similar forms

Corporate Resolution Form: Similar to the Business Signature Card, the Corporate Resolution Form identifies individuals authorized to act on behalf of the corporation, including opening bank accounts and signing financial documents. Both documents establish the authority of designated persons to conduct transactions for the entity.

Board of Directors Meeting Minutes: These provide a written record of decisions made during a meeting, including authorizing certain individuals to act on behalf of the company, similar to how the Business Signature Card records the authorization of individuals to manage banking transactions on behalf of the business.

Partnership Agreement: This document outlines the duties, responsibilities, and financial contributions of each partner. Similar to the Business Signature Card, it can specify which partners have authority to sign on the company’s bank accounts and enter into agreements on behalf of the partnership.

Operating Agreement for LLCs: Just like the Signature Card specifies who within a business can sign and conduct banking transactions, an Operating Agreement identifies the members or managers who can make decisions and bind the LLC in business matters, including financial transactions.

Power of Attorney (POA): A POA grants an individual the authority to act on another person's behalf. Similarly, the Business Signature Card designates individuals authorized to execute banking transactions on behalf of the business. Both documents are formal declarations of representation.

Bank Loan Agreement: This agreement requires the specification of individuals authorized to sign on behalf of the business, which aligns with the purpose of the Business Signature Card in identifying those with signing authority for business bank accounts and transactions.

Account Opening Form for Business Accounts: Similar in purpose to the Business Signature Card, this form is used to establish a new bank account in the name of the business, collecting detailed information on the business itself and identifying individuals authorized to manage the account.

Dos and Don'ts

When completing the Business Signature Card form, it's crucial to adhere to certain do's and don'ts to ensure the form is filled out correctly and efficiently. The list below highlights these essential points.

- Do use black or blue ink to complete the form. This makes the document legible and official.

- Do ensure that signatures are placed within the designated box boundaries without overlapping. This maintains the form's clarity and readability.

- Do indicate whether the signature is manual or a facsimile. Providing both where asked is vital for verification purposes.

- Do cross out all unused signature boxes. This action prevents unauthorized additions after submission.

- Do verify all the details on the Signature Card against your Authorized Documents. Accuracy here is key to the validity of the form.

- Don't rush through reading the terms and conditions. Understanding your agreement with the bank is crucial.

- Don't leave any mandatory fields blank. Incomplete forms can lead to processing delays or rejections.

- Don't use erasable ink or pencil. These can be altered, leading to potential disputes or confusion.

- Don't forget to review and ensure that all information is up-to-date and in accordance with the Authorization Documents before signing and dating the form.

Adherence to these guidelines ensures the process is smooth and safeguards against potential setbacks or errors. Always double-check your entries and consult with a legal advisor if you have any concerns regarding the form or the information required.

Misconceptions

When it comes to the Business Signature Card form, there are several common misconceptions that can lead to confusion. Understanding these can help ensure that the process of setting up or modifying bank accounts for businesses is as smooth as possible.

- Misconception 1: Any color ink is acceptable for signing.

Only black or blue ink should be used to ensure the signature is properly recognized and to maintain the document's official appearance.

- Misconception 2: All boxes for signatures need to be filled out.

Only the necessary signature boxes should be used. It's important to cross out all unused signature boxes for security reasons, allowing for clear identification of valid signatures.

- Misconception 3: Facsimile signatures are optional.

If a facsimile signature is provided, a manual signature must also be included on the form to validate the facsimile signature.

- Misconception 4: Any part of the form can contain signatures.

Signatures should only be placed within the designated box boundaries to ensure they are properly captured and recorded.

- Misconception 5: The form is only for new accounts.

This form is versatile; it can be utilized for creating new accounts, adding additional signatories to existing accounts, or replacing all signatures on an account.

- Misconception 6: The account holder’s name and title are optional details.

Clearly printing the name and title of each signatory is required to ensure the bank can accurately identify and verify the authorized individuals associated with the account.

- Misconception 7: Only the account holder needs to review the form.

An authorized representative of the account holder must certify that they have reviewed not only the information on the signature card but also relevant authorization documents, ensuring all details align.

- Misconception 8: Immediate changes to the authorized signers take effect.

The bank is entitled to rely on the existing signatures until they have received and processed a written revocation, which might not be immediate.

- Misconception 9: The account terms and conditions do not need to be acknowledged.

By signing the card, the account holder acknowledges and agrees to be bound by the bank's current terms, including any future amendments or supplements, highlighting the importance of understanding these terms fully.

Dispelling these misconceptions ensures that businesses can manage their banking needs more effectively, avoiding unnecessary delays or complications in the process of handling the signature card form.

Key takeaways

When filling out and using a Business Signature Card form, it's important to keep several key points in mind to ensure the process goes smoothly and your accounts are properly managed. Here’s a comprehensive guide to understanding vital aspects of this process:

- Ensure that all signatures are done using black or blue ink to comply with the form requirements. This helps in maintaining the legibility and official nature of the document.

- Signatures must be kept within the box boundaries indicated on the form. This organization is crucial in preventing overlap and ensuring that each signature can be easily identified and authenticated by the bank.

- For every signature provided on the form, it's necessary to indicate whether it is a manual or a facsimile by marking the appropriate option in the "PRINT NAME" box. This clarity assists in differentiating between handwritten signatures and authorized stamps or electronic signatures, where applicable.

- It's important to cross out all unused signature boxes before finalizing the form. This precaution enhances security, preventing unauthorized use of the document by clearly indicating which signatures are valid and active.

- The completing and signing of the Business Signature Card form involves a certification by an authorized representative of the Account Holder. This certification confirms that the information on the form is accurate and in agreement with the Account Holder's authorization documents.

- Finally, with the submission of this form, the Account Holder acknowledges and agrees to be bound by the bank's terms and conditions governing the operation of accounts and services, which may be subject to amendments or supplements over time. This agreement underscores the importance of thoroughly reviewing and understanding these terms before signing the form.

By adhering to these guidelines, Account Holders can ensure their Business Signature Card forms are correctly filled out and submitted, establishing the groundwork for secure and efficient banking transactions and services.

Popular PDF Forms

Shipper's Export Declaration - Effectively bridges the information gap between shippers and carriers regarding hazardous cargo, promoting safer air transport.

Can You Collect Unemployment If You Are Fired After Fmla - This document serves as a weekly log for recipients to prove their ongoing job search efforts to the Department of Labor & Industry.

Navpers 1070/6 - Integrates health, conduct, and financial stability considerations into assignment decisions.