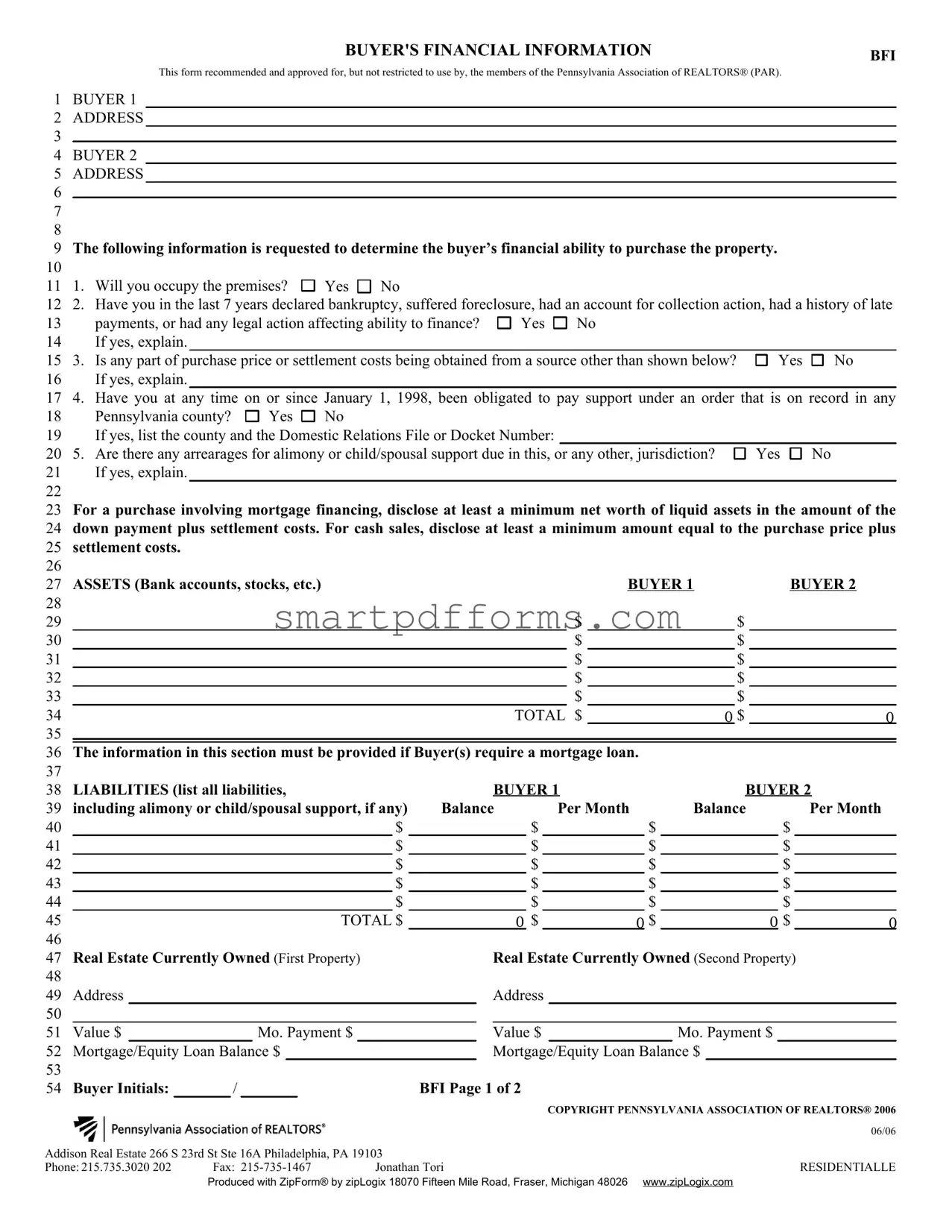

Blank Buyer Financial Information PDF Template

In the realm of real estate transactions, the Buyer Financial Information form plays a pivotal role in assessing a potential buyer's financial capability to proceed with the purchase of property. Crafted with thoroughness by the Pennsylvania Association of REALTORS®, this document serves not just as a mere formality but as a vital tool utilized by realtors to ensure that buyers are financially equipped to undertake such a significant commitment. The form encompasses a wide array of financial data points, from the basics of personal information to the intricate details of liabilities, assets, and income sources. It probes into the buyer's occupancy intentions, past financial hiccups such as bankruptcy or foreclosure, and inquiries about the origins of funds for the purchase. This financial disclosure is essential for both cash purchases and those involving mortgage financing, where it reveals the buyer’s net worth and liquidity. Moreover, it expands into realms of alimony or child support obligations, real estate ownership, employment information, and income verification, ensuring a comprehensive financial portrait is sketched. Buyers are also made aware that this information not only influences the seller’s decision but may be shared with lenders and other involved parties, with clear implications for misrepresentation. This document not only serves as a testament to financial transparency but also enforces accountability and honesty among prospective buyers, laying down a foundation of trust and legal compliance in the real estate purchasing process.

Preview - Buyer Financial Information Form

BUYER'S FINANCIAL INFORMATION |

BFI |

|

This form recommended and approved for, but not restricted to use by, the members of the Pennsylvania Association of REALTORS® (PAR).

1 BUYER 1

2ADDRESS

3

4 BUYER 2

5 ADDRESS

6

7

8

9 The following information is requested to determine the buyer’s financial ability to purchase the property.

10

111. Will you occupy the premises?  Yes

Yes  No

No

122. Have you in the last 7 years declared bankruptcy, suffered foreclosure, had an account for collection action, had a history of late

13 |

payments, or had any legal action affecting ability to finance? |

Yes |

No |

|

|

|

14 |

If yes, explain. |

|

|

|

|

|

15 |

3. Is any part of purchase price or settlement costs being obtained from a source other than shown below? |

Yes |

No |

|||

16If yes, explain.

174. Have you at any time on or since January 1, 1998, been obligated to pay support under an order that is on record in any

18Pennsylvania county?  Yes

Yes  No

No

19If yes, list the county and the Domestic Relations File or Docket Number:

20 5. Are there any arrearages for alimony or child/spousal support due in this, or any other, jurisdiction? |

Yes |

No |

21If yes, explain.

23For a purchase involving mortgage financing, disclose at least a minimum net worth of liquid assets in the amount of the

24down payment plus settlement costs. For cash sales, disclose at least a minimum amount equal to the purchase price plus

25settlement costs.

27 |

ASSETS (Bank accounts, stocks, etc.) |

|

|

BUYER 1 |

|

|

BUYER 2 |

|

28 |

|

|

|

|

|

|

|

|

29 |

|

|

|

$ |

|

|

$ |

|

30 |

|

|

|

$ |

|

|

$ |

|

31 |

|

|

|

$ |

|

|

$ |

|

32 |

|

|

|

$ |

|

|

$ |

|

33 |

|

|

|

$ |

|

|

$ |

|

34 |

|

|

TOTAL $ |

|

0 |

$ |

0 |

|

35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36The information in this section must be provided if Buyer(s) require a mortgage loan.

38 |

LIABILITIES (list all liabilities, |

|

|

|

|

BUYER 1 |

|

|

|

BUYER 2 |

||||||||||||||||

39 |

including alimony or child/spousal support, if any) |

Balance |

|

Per Month |

|

|

Balance |

|

|

Per Month |

||||||||||||||||

40 |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

||

41 |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

||

42 |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

||

43 |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

||

44 |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

||

45 |

|

|

|

|

|

|

|

|

TOTAL $ |

0 |

$ |

|

0 |

$ |

0 |

$ |

|

0 |

||||||||

46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

47 |

Real Estate Currently Owned (First Property) |

|

|

|

Real Estate Currently Owned (Second Property) |

|

||||||||||||||||||||

48 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

49 |

Address |

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|||||

50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

51 |

Value $ |

|

|

|

|

Mo. Payment $ |

|

|

|

|

Value $ |

|

|

|

|

Mo. Payment $ |

|

|

|

|||||||

52 |

Mortgage/Equity Loan Balance $ |

|

|

|

Mortgage/Equity Loan Balance $ |

|

|

|

||||||||||||||||||

53 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

54 |

Buyer Initials: |

/ |

|

|

|

|

|

|

|

BFI Page 1 of 2 |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COPYRIGHT PENNSYLVANIA ASSOCIATION OF REALTORS® 2006 |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

06/06 |

Addison Real Estate 266 S 23rd St Ste 16A Philadelphia, PA 19103 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Phone: 215.735.3020 202 |

Fax: |

Jonathan Tori |

|

|

|

|

|

|

|

|

RESIDENTIALLE |

|||||||||||||||

Produced with ZipForm® by zipLogix 18070 Fifteen Mile Road, Fraser, Michigan 48026 www.zipLogix.com

55The information in this section must be provided if Buyer(s) require a mortgage loan, but only to the extent necessary to

56prove the ability to qualify for the mortgage loan.

57 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

58 |

EMPLOYMENT INFORMATION |

|

|

EMPLOYMENT INFORMATION |

|

|

|||||||||||||||||||

59 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60 |

Current Employer: |

|

|

|

|

|

|

Current Employer: |

|

|

|

|

|

|

|

||||||||||

61 |

Address: |

|

|

|

|

|

Address: |

|

|

|

|

|

|

||||||||||||

62 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

63 |

Occupation: |

|

|

|

|

|

|

Occupation: |

|

|

|

|

|

|

|

||||||||||

64 |

Years at job: |

|

|

|

|

|

Years at job: |

|

|

|

|

|

|

||||||||||||

65 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

66 |

Prior Employer: |

|

|

|

|

|

|

Prior Employer: |

|

|

|

|

|

|

|

||||||||||

67 |

Address: |

|

|

|

|

|

Address: |

|

|

|

|

|

|

||||||||||||

68 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

69 |

Occupation: |

|

|

|

|

|

|

Occupation: |

|

|

|

|

|

|

|

||||||||||

70 |

Years at job: |

|

|

|

|

|

Years at job: |

|

|

|

|

|

|

||||||||||||

71 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

72 |

ANNUAL INCOME |

|

|

BUYER 1 |

|

|

ANNUAL INCOME |

|

|

|

BUYER 2 |

|

|

||||||||||||

73 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

74 |

Basic Salary |

$ |

|

|

|

Basic Salary |

$ |

|

|

|

|

||||||||||||||

75 |

Overtime |

$ |

|

|

|

Overtime |

$ |

|

|

|

|

||||||||||||||

76 |

Bonuses |

$ |

|

|

|

Bonuses |

$ |

|

|

|

|

||||||||||||||

77 |

Commissions |

$ |

|

|

|

Commissions |

$ |

|

|

|

|

||||||||||||||

78 |

Dividends |

$ |

|

|

|

Dividends |

$ |

|

|

|

|

||||||||||||||

79 |

Interest |

$ |

|

|

|

Interest |

$ |

|

|

|

|

||||||||||||||

80 |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

81 |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

82 |

|

|

|

|

|

|

|

TOTAL $ |

|

0 |

|

|

|

|

|

|

|

|

TOTAL $ |

|

0 |

|

|||

83 |

|

|

|

|

|

|

|

|

|

COMBINED TOTAL INCOME $ |

0 |

|

|

||||||||||||

84 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

85ADDITIONAL INFORMATION:

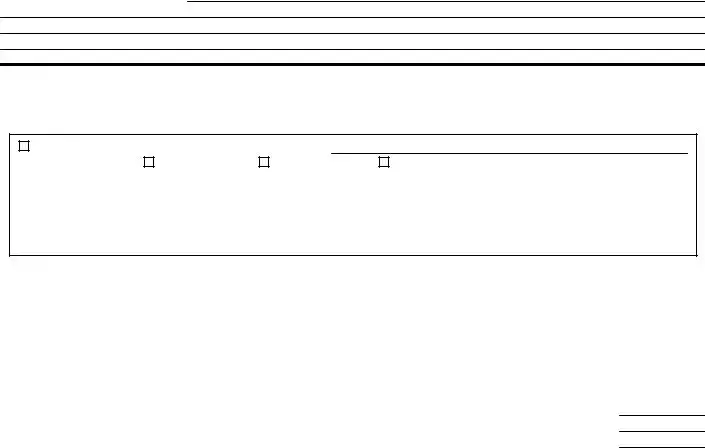

90Buyer(s) affirm that the above information is true and correct. Buyer(s) understand that the information may be used as a basis for

91the acceptance or rejection of an offer by the seller. Buyer(s) further understand that the information may be provided to a lender

92in conjunction with the placement of a mortgage loan. Buyer(s) acknowledge that failure to provide truthful and correct information

93may result in the forfeiture of any deposits made by Buyer(s) and may subject Buyer(s) to other financial loss or penalties.

94

95

96

97

98

99

100

If checked, Buyer(s) expressly authorize and direct |

|

|

(Broker) acting as |

Broker for Seller Broker for Buyer |

Transaction Licensee, to obtain any information or |

reports from a credit reporting agency including, but not limited to consumer reports, credit reports, criminal history reports, judgments of record and verification of employment and salary history deemed necessary for furthering the completion of this and any related transactions, and for the evaluation of the information provided by Buyer(s). Upon signing this form, Buyer(s) agree to provide their social security number(s) to the broker identified above for the purposes of obtaining such reports and information.

101Buyer(s) expressly authorize Broker to provide the information contained in this form and any reports or information obtained by

102Broker for the purposes stated above, to the seller(s), cooperating broker(s), mortgage broker(s) and lender(s) involved in this trans-

103action or any related transaction. BUYER(S) UNDERSTAND THAT BROKER HAS NO CONTROL OVER THE USE OF ANY

104INFORMATION AFTER IT IS DISCLOSED TO A THIRD PARTY; BUYER(S) AGREE TO RELEASE AND HOLD BROKER

105HARMLESS FROM ANY AND ALL LIABILITY FOR ANY MISUSE OR SUBSEQUENT DISCLOSURE BY ANY THIRD PARTY

106OF THE INFORMATION OR REPORTS DISCLOSED BY BROKER PURSUANT TO THE TERMS OF THIS AUTHORIZATION.

107

108Buyers’ signatures serve as an acknowledgement of receipt of a copy of this financial information sheet.

109 |

|

|

|

110 |

BUYER |

|

DATE |

111 |

BUYER |

|

DATE |

112 |

BUYER |

|

DATE |

BFI Page 2 of 2

Produced with ZipForm® by zipLogix 18070 Fifteen Mile Road, Fraser, Michigan 48026 www.zipLogix.com |

RESIDENTIALLE |

Form Data

| Fact Name | Fact Detail |

|---|---|

| Form Use Approval | Recommended and approved for use by the Pennsylvania Association of REALTORS® (PAR). |

| Purpose of Form | To determine the buyer’s financial ability to purchase the property. |

| Occupancy Question | Buyers are asked if they will occupy the premises. |

| Financial History Inquiry | Questions include past bankruptcies, foreclosures, collection actions, late payments, and legal actions affecting financing ability. |

| Alternative Financing Sources | Inquires if any part of the purchase price or settlement costs comes from sources not listed in the form. |

| Support Obligations | Asks if buyers have been obligated to pay support under an order in any Pennsylvania county since January 1, 1998. |

| Assets Disclosure Requirements | For mortgage financing, a minimum net worth of liquid assets equal to the down payment plus settlement costs is disclosed. For cash sales, a minimum amount equal to the purchase price plus settlement costs is disclosed. |

| Authorization to Obtain Information | Buyers authorize the broker to obtain information or reports from a credit reporting agency for transaction completion and evaluation purposes. |

| Governing Law | Guided by the laws of Pennsylvania as it is recommended by the Pennsylvania Association of REALTORS®. |

Instructions on Utilizing Buyer Financial Information

Once you’ve found the property you’re interested in purchasing, providing your financial information becomes an essential step in the buying process. This information helps sellers and lenders understand your financial strength and ability to complete the purchase. Carefully filling out the Buyer Financial Information form is crucial. Here's how you can accurately complete this form.

- Start with basic information about each buyer. Include your name(s) under "BUYER 1" and "BUYER 2" if applicable, followed by your addresses.

- Answer the questionnaire honestly. This includes your plans to occupy the premises, any past financial difficulties like bankruptcy or foreclosure, and whether any part of the purchase price or settlement costs comes from sources not listed on this form.

- If you answered "yes" to any questions in the questionnaire, provide detailed explanations in the spaces provided.

- Disclose your assets. List all your bank accounts, stocks, and any other assets, along with their values, for both buyers if applicable. Make sure to total your assets at the end.

- List all liabilities including alimony or child/spousal support payments, their balances, and monthly payments for both buyers if applicable. Total the liabilities after listing them.

- Include information regarding any real estate you currently own. This should cover the address, the property's value, your monthly payment, and the balance of the mortgage or equity loan.

- Provide employment information for each buyer. Detail your current and prior employers, addresses, occupations, and years at each job.

- Detail the annual income for each buyer. This includes basic salary, overtime, bonuses, commissions, dividends, interest, and any other sources of income. Provide a combined total income at the end.

- Review the additional information section carefully. Affirm that all the information provided is true and correct and understand how this information will be used.

- If you agree to allow the broker to obtain further information, including credit reports, check the appropriate box and understand the terms of this authorization.

- Finally, all buyer(s) must sign and date the form to acknowledge receipt and accurate completion of the financial information sheet.

After submitting this form, the next steps typically involve the seller or their agent reviewing your financial information to ensure you meet the criteria for purchasing the property. If your offer is contingent upon obtaining a mortgage, your lender will also review this information as part of your loan application process. Remember, accuracy and honesty in providing your financial information are key to a smooth purchasing process.

Obtain Answers on Buyer Financial Information

Frequently asked questions about the Buyer Financial Information form:

What is the purpose of the Buyer Financial Information form?

The Buyer Financial Information form, recommended by the Pennsylvania Association of REALTORS® (PAR), is designed to collect crucial financial details from potential buyers. This information helps determine a buyer's financial capability to purchase property. It includes details on assets, liabilities, current and previous employment, annual income, and any factors that may affect the buyer's ability to finance the purchase, such as bankruptcy history or obligations to pay support.

Is it mandatory to fill out all sections of the form?

Yes, all sections relevant to your purchase must be completed. This includes personal information for all buyers involved, financial details such as assets and liabilities, employment information, and any additional relevant information that impacts your ability to secure financing or complete the purchase. Certain sections are specifically required if the purchase involves mortgage financing.

What happens if I have declared bankruptcy or have had foreclosure in the past?

You are required to disclose if you have declared bankruptcy, suffered foreclosure, had accounts collected, experienced late payments, or faced any legal actions that could affect your financing abilities within the last 7 years. Detailed explanations must be provided for any "yes" responses. This information is crucial for assessing your financial stability and eligibility for a mortgage or other financing options.

How should I report assets and liabilities?

When reporting assets, include all liquid assets such as bank accounts and stocks. Liability information should encompass all outstanding debts including, but not limited to, alimony or child/spousal support. Each asset and liability must be clearly listed with corresponding values to accurately represent your financial position.

What does "Real Estate Currently Owned" section entail?

This section requires you to list any real estate you currently own, including the address, the current market value, monthly payment, and the remaining mortgage or equity loan balance. This information provides a more complete view of your financial obligations and assets.

Can the information I provide be shared?

By signing the form, you authorize the broker (whether acting for the seller, buyer, or as a transaction licensee) to obtain and share your financial and credit information with relevant parties involved in the transaction. This includes, but is not limited to, sellers, cooperating brokers, mortgage brokers, and lenders. It's important to note that while the broker can control the distribution of your information to these parties, they cannot control subsequent use or disclosure.

What are the implications of providing incorrect information?

Providing truthful and accurate information is imperative. Any failure to do so may lead to the forfeiture of deposits, financial losses, or other penalties. The information you provide is used as a basis for accepting or rejecting an offer and for the placement of a mortgage loan; therefore, accuracy is crucial to avoid any negative outcomes in the transaction process.

Common mistakes

Not accurately disclosing current and previous employment details, including the years at each job, can lead to a misrepresentation of the buyer's financial stability.

Failure to list all assets, such as bank accounts, stocks, etc., for each buyer accurately, thereby underrepresenting the buyer's true financial capability.

Omitting or inaccurately reporting any liabilities, including alimony or child/spousal support, can affect the assessment of the buyer's financial obligation and repayment capability.

Incorrectly stating the intention to occupy the premises may lead to a misunderstanding about the buyer's qualifications for certain types of mortgages or financial benefits.

Not being forthcoming about any financial adversities, such as bankruptcy, foreclosure, or history of late payments within the last 7 years, which is crucial for evaluating the buyer's financial reliability.

Failing to disclose whether any part of the purchase price or settlement costs is being obtained from sources other than those shown, which could potentially hide important aspects of the buyer's financial health.

Neglecting to provide information about real estate currently owned, including address, value, monthly payments, and mortgage/equity loan balances, which is necessary to assess the buyer's existing financial commitments.

By avoiding these mistakes, buyers can present a more accurate and complete picture of their financial situation, increasing the likelihood of a favorable assessment.

Documents used along the form

When preparing for a property purchase, buyers and their agents use a variety of forms and documents in addition to the Buyer Financial Information form. These documents are essential for completing the transaction and ensuring all parties are well-informed about the financial aspects of the deal. Here are five common forms and documents that are often used in conjunction with the Buyer Financial Information form:

- Pre-approval letter: This document, issued by a lender, indicates how much money the lender is tentatively willing to loan to the buyer, based on an initial review of the buyer's creditworthiness. It shows sellers that the buyer has the financial backing to make a purchase.

- Purchase Agreement: This legal document outlines the terms and conditions of the sale, including the purchase price, closing details, and any contingencies that must be met before the sale can be completed. It is a binding agreement between buyer and seller.

- Property Disclosure Statement: Completed by the seller, this form discloses information about the property's condition, including any known defects or issues. It helps buyers understand what they are purchasing and any potential problems that may need attention.

- Title Insurance Policy: This ensures against financial loss from defects in the title to the property and from the invalidity or unenforceability of mortgage loans. It provides peace of mind by protecting the buyer's and lender's interest in the property.

- Home Inspection Report: This report, generated by a professional home inspector, provides a detailed analysis of the property's physical condition. It covers various systems and components, giving the buyer a comprehensive overview of the property’s state.

Together, these documents, alongside the Buyer Financial Information form, create a comprehensive overview of a property transaction, enabling all parties to proceed with clarity and confidence. By understanding the role and importance of each document, buyers can navigate the purchase process more effectively, ensuring a smoother transition to their new home.

Similar forms

The Mortgage Application Form shares similarities with the Buyer Financial Information form by requiring detailed data about applicants' employment, income, and assets. Both forms assess financial stability and the ability to meet financial obligations, crucial for lenders to determine mortgage eligibility.

Credit Report Authorization Form is akin to the requirement within the Buyer Financial Information form that permits the broker to obtain credit reports. This process involves evaluating credit history, ensuring buyers have a responsible credit usage pattern, influencing their real estate purchase capabilities.

The Personal Financial Statement document closely aligns with sections detailing assets and liabilities, providing a snapshot of an individual's net worth. This comprehensive overview supports various financial assessments, including loan considerations and financial planning in related real estate transactions.

A Rental Application bears resemblance in gathering applicant’s financial and employment information to ascertain their ability to afford rental obligations. Similarly, it includes questions about past financial challenges that might impact the current financial responsibility assessment.

The Loan Pre-approval Application parallels the financial scrutiny observed in the Buyer Financial Information form. This form examines debt-to-income ratios, employment history, and creditworthiness to pre-approve buyers for a specific loan amount before they commit to a property purchase.

Income Verification Form complements sections of the Buyer Financial Information form by requiring proof of income through documents or an employer’s verification to confirm the buyers’ financial declarations. This ensures a reliable measure of their capacity to afford the property.

Similar to the asset declarations in the Buyer Financial Information form, the Asset Verification Form is required in various financing situations to authenticate the existence and value of assets claimed, reinforcing the buyers' financial position.

The Debt-to-Income Ratio Calculation Form reflects the liabilities section, helping to evaluate whether a buyer has a healthy balance between debt and income. This ratio is crucial for lenders to understand if the buyer can comfortably absorb new debts.

An Alimony or Child Support Declaration Form is specifically comparable to queries about obligations towards support payments. This form confirms whether such payments exist, impacting the overall financial assessment by acknowledging fixed outgoings.

Dos and Don'ts

When filling out the Buyer Financial Information form, it’s crucial to approach the process with diligence and honesty. The form, recommended by the Pennsylvania Association of Realtors®, is designed to assess a buyer's financial capability to make a purchase. To help navigate the completion of this form, here is a list of dos and don'ts:

Do:

Review the entire form before beginning to ensure you understand what information is required.

Be honest and accurate in all your responses. False information can lead to serious legal consequences.

Include all sources of income and assets, including secondary or part-time employment, to provide a comprehensive picture of your financial status.

Disclose any past financial difficulties, such as bankruptcy or foreclosure, as these will need to be explained in detail.

Obtain documentation for all figures reported, such as bank statements or pay stubs, as they may be required by the lender or seller.

Sign and date the form to authenticate it, acknowledging the truthfulness and accuracy of the information provided.

Don't:

Omit any liabilities or debts. This includes personal loans, credit card debt, alimony, or child support obligations.

Underestimate expenses or overestimate income. This can lead to challenges in securing financing and could jeopardize the transaction.

Forget to list any real estate currently owned, including corresponding mortgages or equity loans, as this is critical for assessing your financial obligations.

Leave sections blank. If a section does not apply, indicate this with a “N/A” (not applicable) to demonstrate that the question was considered and answered.

Fail to explain any yes answers to questions about financial difficulties or sourcing of funds for the purchase. Details are necessary for a comprehensive assessment.

Wait until the last minute to fill out this form. Take your time to gather all the necessary information and documents to ensure accuracy.

Misconceptions

One common misconception is that the Buyer Financial Information form is only necessary for those purchasing homes with a mortgage. In reality, even cash buyers are required to disclose their financial situation to show they have the funds to cover the purchase price plus settlement costs.

Many believe that only current financial obligations matter. However, the form also requires disclosure of past financial issues such as bankruptcies, foreclosures, collections, legal actions affecting financing, or any support obligations that might impact the buyer's financial stability.

It's often misunderstood that personal financial details beyond assets and liabilities are not needed. Yet, employment information, including current and previous employers, annual income, and other sources of income like bonuses and commissions, are crucial for assessing the buyer's ability to maintain their financial commitment to the property.

There's a misconception that the form's information is only shared with the real estate and lending agencies involved in the transaction. The truth is, by signing the form, buyers authorize the broker to obtain and share their financial and personal information with sellers, cooperating brokers, mortgage brokers, lenders, and even credit reporting agencies as necessary for completing the transaction.

Some think that the information provided on the form has limited impact on the purchasing process. In fact, buyers affirm that the information is true and correct, understanding it forms the basis for the seller's acceptance or rejection of an offer. Providing false or inaccurate information can result in forfeiture of deposits and subject the buyer to other financial losses or penalties.

Key takeaways

Filling out and using the Buyer Financial Information (BFI) form is a crucial step for individuals looking to purchase property through the Pennsylvania Association of REALTORS®. Understanding the significance and accurate completion of this form can facilitate a smoother real estate transaction. Here are five key takeaways to consider:

- The BFI form requires detailed financial information from prospective buyers to assess their ability to purchase the property. This includes queries about residence occupancy, financial hardships such as bankruptcy or foreclosures, and whether the purchase price or settlement costs are being financed through alternate sources not disclosed in the form.

- Transparency and honesty are paramount when providing information on the BFI form. Potential buyers must disclose any past financial difficulties, including bankruptcy, foreclosure, accounts sent to collections, late payments, or any legal actions that could impact their financing abilities. Failure to provide truthful information could lead not only to the rejection of an offer but also to potential legal repercussions.

- Disclosure of assets and liabilities is a critical component of the BFI form. Buyers are required to list their assets (such as bank accounts and stocks) and liabilities (including alimony or child/spousal support) to determine their net worth and ability to cover the down payment plus settlement costs for mortgage financing, or the purchase price plus settlement costs for cash sales.

- Employment information plays a vital role in the financial assessment. The form demands details regarding current and prior employment for all buyers involved, including their basic salary, overtime, bonuses, commissions, dividends, and interest income. This comprehensive income data aids in evaluating the buyers' financial stability and mortgage loan qualification.

- Authorization to verify financial information is a critical aspect of the BFI form. By signing the form, buyers grant permission for the involved brokers to obtain and share credit reports, consumer reports, criminal history reports, and more, with sellers, cooperating brokers, mortgage brokers, and lenders. It's integral to understand that once this information is disclosed to third parties, the original distributor has no control over its subsequent use or disclosure.

Comprehending these key facets of the Buyer Financial Information form not only empowers buyers by ensuring they are well-informed but also underscores the importance of accuracy and transparency in the home buying process. Properly completed, this document aids all parties involved in making informed decisions, thereby fostering a transparent and efficient real estate transaction.

Popular PDF Forms

What Are Phantom Stocks - Explore the practical benefits of implementing a Phantom Stock Plan, from administrative simplicity to enhanced employee satisfaction.

Form I-765 - It is essential to read the Penalties section of the Form I-765 instructions before signing.

Eddm Usps Pricing - Through specifying the delivery type and weight of a single piece, mailers can tailor their campaigns to meet specific marketing objectives.