Blank C 159B PDF Template

In the realm of corporate dissolution, the significance of procedural adherence cannot be overstated, with the C-159B form standing as a paramount example of such formalities. This document, crafted under the jurisprudential guidance of New Jersey's Business Corporation Act (Title 14A) and Nonprofit Corporation Act (Title 15A), paves the way for both profit and nonprofit entities domiciled within the state to disband without convening a shareholders' or members' meeting. By design, this certificate facilitates a streamlined approach whereby unanimous written consent from all eligible shareholders or members suffices to effectuate dissolution. Key to this process is the inclusion of various stipulations including, but not limited to, the full name and number of the corporation, details concerning the registered agent and office, as well as comprehensive lists of directors, trustees, and officers. Furthermore, for-profit corporations are required to procure and attach a Tax Clearance Certificate from the New Jersey Division of Taxation, integral to ensuring that all fiscal responsibilities have been fulfilled. Nonprofit entities are likewise tasked with presenting a Plan of Dissolution alongside statements detailing liabilities, underscoring a thorough vetting process prior to the actual dissolution. Amendments to the procedure post-July 1, 2003, notably the introduction of the C-159D form for profit corporations, underline ongoing refinements aimed at simplifying and enhancing the dissolution process. As such, the C-159B form embodies a critical component of New Jersey’s corporate framework, ensuring that the dissolution of corporations occurs in an orderly, transparent, and legally sound manner.

Preview - C 159B Form

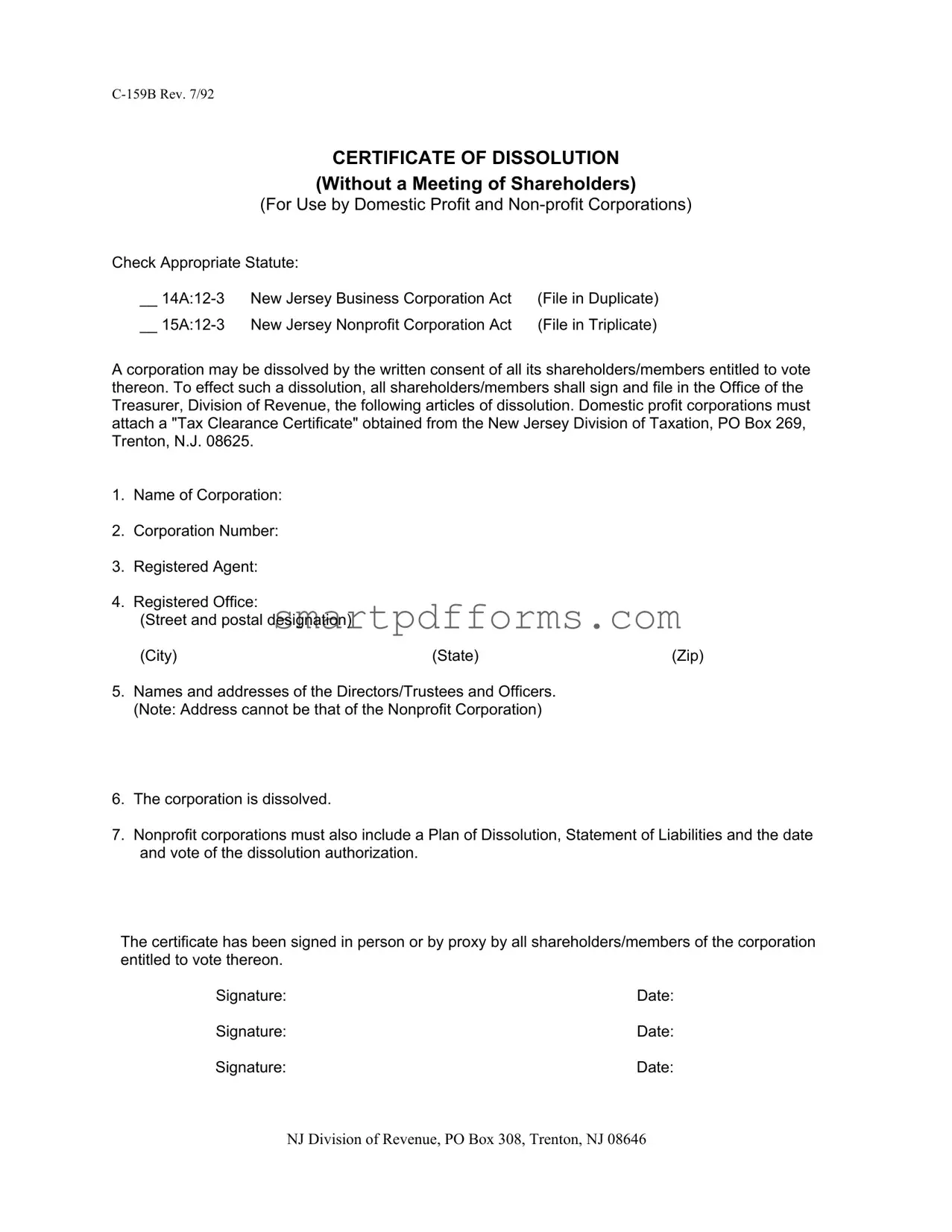

CERTIFICATE OF DISSOLUTION

(Without a Meeting of Shareholders)

(For Use by Domestic Profit and

Check Appropriate Statute: |

|

|

__ |

New Jersey Business Corporation Act |

(File in Duplicate) |

__ |

New Jersey Nonprofit Corporation Act |

(File in Triplicate) |

A corporation may be dissolved by the written consent of all its shareholders/members entitled to vote thereon. To effect such a dissolution, all shareholders/members shall sign and file in the Office of the Treasurer, Division of Revenue, the following articles of dissolution. Domestic profit corporations must attach a "Tax Clearance Certificate" obtained from the New Jersey Division of Taxation, PO Box 269, Trenton, N.J. 08625.

1.Name of Corporation:

2.Corporation Number:

3.Registered Agent:

4.Registered Office:

(Street and postal designation)

(City) |

(State) |

(Zip) |

5.Names and addresses of the Directors/Trustees and Officers. (Note: Address cannot be that of the Nonprofit Corporation)

6.The corporation is dissolved.

7.Nonprofit corporations must also include a Plan of Dissolution, Statement of Liabilities and the date and vote of the dissolution authorization.

The certificate has been signed in person or by proxy by all shareholders/members of the corporation entitled to vote thereon.

Signature:Date:

Signature:Date:

Signature:Date:

NJ DIVISION OF REVENUE, PO BOX 308, TRENTON, NJ 08646

Rev 7/11/05

Instructions for Form

CERTIFICATE of DISSOLUTION

WITHOUT A MEETING OF SHAREHOLDERS/MEMBERS DOMESTIC PROFIT & NON- PROFIT CORPORATIONS (Titles 14A AND 15A)

Effective July 1, 2003, new procedures for profit corporations were implemented. Form

STATUTORY FEE: $75 for

Clearance Filing Fee)

The MANDATORY fields are:

Statutory Authority

Check the appropriate statutory authority

Field # 1

List the name as it appears on the records of the State Treasurer.

Field #’s 3&4

List the agent and office as shown on the records of the State Treasurer.

Names(s)/ Addresses Of Directors (Domestic Profit Corporations) Or Trustees/Officers (Domestic

Provide the names and addresses as indicated. Do not list the corporate address.

ATTESTATIONS

Provide a statement indicating that the corporation is dissolved. Form

ATTACHMENTS

For

TAX CLEARANCE

Obtain and attach to your filing submission a Tax Clearance Certificate. The application form for the Tax Clearance Certificate is available online. Remember that there is a $25.00 fee for the Tax Clearance Certificate, and that the New Jersey Division of Taxation issues them.

Note: See new procedures effective July 1, 2003 for domestic and foreign profit corporations.

EXECUTION (DATE/SIGNATURE)

Have all shareholders or members sign in person or by proxy. Also, list the date of execution (signature).

* * * * * * * * * *

These documents should be filed in duplicate.

All annual report obligations should be satisfied prior to submitting the dissolution paperwork.

Make checks payable to: TREASURER, STATE OF NEW JERSEY. (No cash, please)

Mail to: NJ Division of Revenue, PO Box 308, Trenton, NJ 08646

Form Data

| Fact Name | Description |

|---|---|

| Applicable Laws | Governed by the New Jersey Business Corporation Act (14A:12-3) for domestic profit corporations and the New Jersey Nonprofit Corporation Act (15A:12-3) for nonprofit corporations. |

| Filing Requirement | Profit corporations must file in duplicate, whereas nonprofit corporations must file in triplicate. |

| Mandatory Information | The form requires basic corporate information such as name, corporation number, registered agent and office, and names and addresses of directors/trustees and officers excluding the corporate address. |

| Attestations | Corporations must provide a statement affirming dissolution. |

| Tax Clearance Requirement | Domestic profit corporations are required to obtain and attach a Tax Clearance Certificate from the New Jersey Division of Taxation. |

| Attachments for Nonprofits | Nonprofit corporations must include a Plan of Dissolution and Statement of Liabilities if they have assets. |

| Execution | All shareholders or members entitled to vote must sign the form, in person or by proxy, and include the date of execution. |

Instructions on Utilizing C 159B

Filing the C-159B form marks an important step for corporations seeking dissolution without convening a shareholders' or members' meeting. This procedure, accessible to both profit and non-profit entities registered in New Jersey, demands careful adherence to outlined instructions to ensure compliance with state regulations. Before embarking on this process, entities must settle any outstanding annual report commitments and procure necessary documents like the Tax Clearance Certificate for profit organizations. This guide aims to facilitate your navigation through the form's completion, encapsulating essential stages from initial preparation to the final submission.

- Identify the Statutory Authority: Check the relevant box to indicate whether the dissolution falls under the New Jersey Business Corporation Act (14A:12-3) for profit corporations or the New Jersey Nonprofit Corporation Act (15A:12-3) for non-profit organizations.

- Business Name Entry: Input the exact name of your corporation as it is registered with the New Jersey State Treasurer.

- Corporation Number Specification: Provide the unique identification number assigned to your corporation.

- Registered Agent and Office Details: List the name of the registered agent along with the registered office's address, ensuring it includes the street, city, state, and ZIP code.

- Director/Trustee and Officer Information: For domestic profit corporations, enumerate the names and addresses of the directors. Non-profit entities are required to disclose the details of trustees and officers, noting addresses separate from the corporate one.

- Assert the Declaration of Dissolution: Affirm that the corporation is dissolved by selecting the statement that applies to your corporation type.

- For non-profit corporations, Attach a Plan of Dissolution: Include any relevant documents such as the Plan of Dissolution and Statement of Liabilities, as necessitated by Title 15A:12-3.

- Acquire a Tax Clearance Certificate (Profit Corporations Only): Secure this certificate from the New Jersey Division of Taxation and append it to your filing.

- Execution by Signatures: Have every required shareholder or member sign the form in person or by proxy, and ensure each signature is accompanied by the signing date.

Upon compilation of the necessitated documents and filling out the form in accordance with the listed steps, prepare your submission package. This includes the completed C-159B form (filed in duplicate for profit corporations and in triplicate for non-profits), along with any attachments like the Tax Clearance Certificate for profit corporations. Attach a check for the filing fee—$75 for non-profits, $95 for profit entities—payable to the TREASURER, STATE OF NEW JERSEY. Mail your package to the NJ Division of Revenue at the provided address. By carefully following these guidelines, you can navigate the dissolution process with more confidence and precision.

Obtain Answers on C 159B

What is the C-159B form?

The C-159B form, known as the Certificate of Dissolution, is a document used by both domestic profit and non-profit corporations in New Jersey to dissolve the corporation without a meeting of shareholders or members. It requires the written consent of all shareholders or members entitled to vote.

Who needs to file the C-159B form?

Domestic profit and non-profit corporations in New Jersey looking to dissolve their business without convening a shareholders' or members' meeting must file this form. It's important for corporations that have unanimously agreed on dissolution.

Are there different filing requirements for profit and non-profit corporations?

Yes. Profit corporations must file the form in duplicate and attach a Tax Clearance Certificate from the New Jersey Division of Taxation. Non-profit corporations must file in triplicate and include a Plan of Dissolution and Statement of Liabilities, if applicable.

What is a Tax Clearance Certificate, and why is it necessary?

A Tax Clearance Certificate is a document proving that a corporation has settled all its tax obligations with the state. Profit corporations must obtain and attach this certificate to their C-159B filing to confirm that there are no outstanding taxes due before the state can officially dissolve the corporation.

How can one obtain a Tax Clearance Certificate?

The Tax Clearance Certificate can be requested from the New Jersey Division of Taxation, with an application available online. There is a $25.00 fee for the certificate, which verifies the corporation's tax status with the state.

What mandatory information must be included on the form?

- Statutory Authority

- Business Name

- Registered Agent and Office information

- Names and addresses of Directors/Trustees and Officers (excluding the corporate address)

- Attestation of dissolution

How does one file the C-159B form?

The completed form should be mailed to the New Jersey Division of Revenue, along with the required attachments and applicable fee. Profit corporations should include the filing fee and the tax clearance filing fee, while non-profits should submit the stated filing fee. All forms and correspondences should be addressed to the Treasurer, State of New Jersey.

What are the filing fees for the C-159B form?

Non-profit corporations must pay a $75 filing fee. For profit corporations, the fee is $95, which includes a $75 certificate fee and a $20 Tax Clearance Filing Fee. Payments should be made via check payable to the Treasurer, State of New Jersey.

Is there any prerequisite before filing for dissolution?

All annual report obligations and any other state requirements must be satisfied prior to submitting the dissolution paperwork. This ensures that the corporation is in good standing and eligible to dissolve without pending obligations.

Common mistakes

When stepping through the process of dissolving a corporation, the C 159B form becomes a critical document for both profit and non-profit entities. However, properly completing this form requires attention to detail and a comprehensive understanding of the requirements. Here are eight common mistakes individuals often make when filling out this form:

Incorrect statute selection: Not checking the appropriate statute (either 14A:12-3 for Business Corporations or 15A:12-3 for Non-Profit Corporations) can lead to processing delays or even the rejection of the application.

Business name discrepancies: Listing a business name that doesn't exactly match the records of the State Treasurer may result in a mismatch and potential processing issues.

Registered agent and office errors: Providing incorrect information for the registered agent and office, such as outdated or inaccurate addresses, can complicate legal communications.

Failure to attach mandatory Tax Clearance Certificate for profit corporations, which is essential for confirming the entity's tax obligations are cleared before dissolution.

Omitting the names and addresses of directors, trustees, or officers, or listing the corporate address instead of their personal or alternative addresses, contradicts form requisites.

Neglecting to include a Plan of Dissolution and Statement of Liabilities for non-profits that outlines the distribution of assets and settlement of liabilities.

Inadequately dating and signing the form by all shareholders or members entitled to vote thereon, which is crucial for the document's legality and validity.

Submitting incomplete duplicates or triplicates: Forgetting that profit corporations must file in duplicate and non-profits in triplicate can lead to processing delays.

By avoiding these common mistakes, individuals can ensure smoother processing of their dissolution application, ultimately facilitating a more efficient conclusion to their corporate responsibilities.

Documents used along the form

When a corporation decides to dissolve formally, several forms and documents must be rounded up, each serving a critical role in the dissolution process. Besides the C-159B form, or Certificate of Dissolution Without a Meeting of Shareholders/Members, utilized by domestic profit and non-profit corporations in New Jersey, other forms act as pillars to ensure a smooth and compliant dissolution process. These documents work together to fulfill legal requirements and provide a structured roadmap for dissolving the entity in accordance with state laws.

- Tax Clearance Certificate: For profit corporations, a Tax Clearance Certificate from the New Jersey Division of Taxation is mandatory. This document proves that the corporation has satisfied all its tax liabilities. By submitting this certificate, the corporation assures the state that it has no outstanding tax obligations.

- Plan of Dissolution: Non-profit corporations are required to attach a Plan of Dissolution. This document outlines how the corporation’s remaining assets will be distributed after paying all debts and obligations. It ensures that assets are allocated in a manner consistent with legal requirements and the corporation’s mission.

- Statement of Liabilities: Alongside the Plan of Dissolution for non-profit corporations, a Statement of Liabilities must also be submitted. This statement provides a detailed list of all debts and financial obligations the corporation owes at the time of dissolution. It is critical for ensuring all creditors are identified and paid.

- Annual Report: Fulfilling all annual report obligations is a prerequisite for the dissolution process. Although not submitted with the C-159B form, ensuring that all annual reports are filed and up to date is necessary before commencing dissolution. These reports give a comprehensive account of the corporation's financial and operational status during its final year of operation.

Together, these documents form a comprehensive package ensuring that the corporation's dissolution is executed properly and in compliance with state regulations. They protect the corporation's directors, officers, and shareholders by showing due diligence in satisfying all legal and financial obligations. The process, albeit intricate, is designed for transparency and fairness to all parties involved, including creditors and the state itself.

Similar forms

The C-159B form, known as the Certificate of Dissolution Without a Meeting of Shareholders/Members, is a document used by domestic profit and non-profit corporations in New Jersey to dissolve the corporation without convening a formal meeting. This specific process requires the unanimous written consent of all shareholders or members entitled to vote. While unique in its purpose, the C-159B shares similarities with other legal documents in form and function. Here are eight documents comparable to the C-159B form:

Articles of Incorporation: Like the C-159B, this document is foundational for establishing the legal existence of a corporation. It outlines the corporation's basic structure and is filed with the state's governmental authority, similar to the filing requirements of the C-159B for dissolution.

Bylaws: Corporate bylaws dictate the internal rules governing the management of a corporation. Although more detailed and internally focused than the C-159B, both documents are essential for the operational and legal frameworks within which corporations function.

Articles of Dissolution: This document is closely related to the C-159B as it also serves to dissolve a corporation. However, unlike the C-159B, which is specific to New Jersey and executed without a shareholders' meeting, Articles of Dissolution can vary by state and may require different procedures.

Annual Reports: Corporations are often required to file annual reports with their state’s division of corporations, providing updates on their operational and financial status. Similar to the C-159B, these reports are official filings that keep the state informed of the corporation's current standing.

Amendment of Articles of Incorporation: This document modifies the original Articles of Incorporation. Both the amendment documents and the C-159B involve official filings with the state to reflect significant changes in the corporation's status or structure.

Operating Agreement: Although typically associated with Limited Liability Companies (LLCs), the operating agreement shares similarities with the C-159B in that it outlines the governance of an entity’s operations. Both documents help define the internal regulations and procedures of a business.

Shareholder Agreements: These agreements outline the rights and responsibilities of the shareholders among each other and in relation to the corporation. The unanimous consent requirement for dissolution in the C-159B reflects the collaborative decision-making process often detailed in shareholder agreements.

Tax Clearance Certificate (For-Profit Corporations): As part of the dissolution process, for-profit corporations must obtain a Tax Clearance Certificate, indicating all state tax obligations have been satisfied. This certificate, while not a form akin to the C-159B, is a crucial document that accompanies the C-159B upon filing for dissolution.

These documents, while serving varied purposes, collectively represent the lifecycle and governance of corporations from formation to dissolution, illustrating the intricate legal framework within which corporations operate.

Dos and Don'ts

When filling out the C-159B form, which is essential for the dissolution of both domestic profit and non-profit corporations without a meeting of shareholders or members, it's crucial to follow specific guidelines. These recommendations are aimed to ensure that your filing is both compliant and processed efficiently. Below is a list of things you should and shouldn't do when preparing this form:

- Do check the applicable statutory authority at the top of the form, ensuring that you select either 14A:12-3 for business corporations or 15A:12-3 for non-profit corporations appropriately.

- Don't overlook the mandatory fields. Ensure the business name, registered agent, and office fields are completed correctly, as these are required for the form to be processed.

- Do provide accurate names and addresses of the directors/trustees and officers. Remember, the address for non-profit corporations cannot be the same as the corporation’s address.

- Don't forget the attachments. For non-profit corporations with assets, you must attach a plan of dissolution and a statement of liabilities as per Title 15A:12-3.

- Do obtain a Tax Clearance Certificate if you're dissolving a for-profit corporation. This must be requested from the New Jersey Division of Taxation and attached to your form.

- Don't file a certificate without signatures. All shareholders or members entitled to vote must sign the form either in person or by proxy.

- Do ensure all annual report obligations are satisfied before submitting the dissolution paperwork to avoid delays.

- Don't send cash. When paying the statutory fee, make sure your check is payable to the TREASURER, STATE OF NEW JERSEY.

- Do mail your documents to the correct address: NJ Division of Revenue, PO Box 308, Trenton, NJ 08646, and remember that non-profits should file in triplicate while for-profits file in duplicate.

Adhering to these dos and don'ts will navigate you smoothly through the dissolution process, ensuring a hassle-free closure of your corporation.

Misconceptions

A common misconception is that the C-159B form is exclusively for for-profit corporations. In reality, this form serves both domestic profit and non-profit corporations seeking dissolution without a meeting of shareholders or members. Different sections are applicable based on the nature of the corporation, underscoring the necessity to correctly identify and follow the guidelines relevant to the entity’s status.

Many believe that non-profit corporations do not need to submit a Tax Clearance Certificate. While it is true that for-profit corporations must obtain this certificate from the New Jersey Division of Taxation, non-profits are not required to submit one. However, non-profits with assets must attach a plan of dissolution/statement of liabilities, highlighting the distinct requirements based on the corporation's profit status.

There is a misconception that filing the C-159B form can be done electronically. The instructions explicitly necessitate that the documents be mailed to the New Jersey Division of Revenue. The requirement emphasizes the formal process of dissolution, necessitating physical submission rather than digital, to ensure that all procedural steps are meticulously followed.

Some people incorrectly assume there is a standard filing fee for the C-159B form. The statutory fees vary: non-profit corporations are charged $75, while for-profit corporations are subject to a $95 fee. This distinction underscores the differing regulatory landscapes that non-profit and for-profit entities navigate, even in dissolution.

Another misconception is that only the names and addresses of directors are required on the form. The form actually requires the names and addresses of not only the directors/trustees but also the officers, and notably, the provided addresses cannot be that of the corporation itself. This requirement ensures a clear record of the responsible individuals at the time of dissolution.

It is mistakenly thought that corporations can delay fulfilling annual report obligations until after dissolving. All annual report obligations must be satisfied prior to submitting the dissolution paperwork, emphasizing the corporation's responsibility to remain compliant with reporting requirements up to the point of dissolution.

A common error is believing that shareholder or member signatures are not critical if the board votes for dissolution. The certificate must be signed by all shareholders or members entitled to vote, either in person or by proxy, reinforcing the significance of unanimous consent in the dissolution process.

Lastly, there's a misconception that all necessary forms for dissolution are included within the C-159B package. In fact, additional documents may be required, such as the Tax Clearance Certificate for for-profit corporations and the plan of dissolution/statement of liabilities for non-profits. This necessitates a careful review of all required materials prior to submission, ensuring compliance with New Jersey’s regulations.

Key takeaways

When it comes to dissolving a corporation without convening a meeting of shareholders or members, the C-159B form serves as a crucial document. This Certificate of Dissolution outlines a set of procedures and requirements for both domestic profit and non-profit corporations within New Jersey. Here are six key takeaways for correctly filling out and using this form:

- Specify the Statutory Authority: It's mandatory to check the appropriate statutory authority box on the form, indicating whether the dissolution is under the New Jersey Business Corporation Act (14A:12-3) for profit corporations or the New Jersey Nonprofit Corporation Act (15A:12-3) for non-profit corporations.

- Accurate Information is Critical: Ensure that the corporation name, as well as the names and addresses of the registered agent, office, directors (for profit corporations), or trustees/officers (for non-profit corporations), are correctly listed as these details must match the records of the State Treasurer.

- Attachments are Necessary for Non-Profits: Non-profit corporations are required to attach a plan of dissolution and a statement of liabilities to their filing. This step is vital for detailing how assets will be handled and confirming the addressing of any liabilities.

- Tax Clearance for Profit Corporations: Profit corporations must obtain a Tax Clearance Certificate from the New Jersey Division of Taxation. This certificate, which comes with a fee, needs to be attached to the form to assure the state that all tax obligations have been satisfied.

- Signatures are a Must: The form requires the signatures of all shareholders or members entitled to vote on the dissolution, either in person or by proxy. This unanimity is crucial for the approval of the dissolution process.

- Filing and Fees: The completed form must be filed in duplicate for profit corporations and in triplicate for non-profit organizations. Additionally, a filing fee is required, with differing amounts for profit ($95) and non-profit ($75) entities. Checks should be made payable to the Treasurer, State of New Jersey, and sent to the NJ Division of Revenue. All annual report obligations must also be fulfilled before submission.

While this process can seem daunting, paying close attention to each of these areas will ensure a smooth dissolution process for your corporation. Always double-check details for accuracy and ensure all necessary documentation and fees accompany your submission to avoid delays or rejections.

Popular PDF Forms

Bsa 680 001 - A section is dedicated to listing individuals not authorized to transport the participant, ensuring the child's safety and parent's peace of mind.

Dd 93 Army - While the form primarily serves to protect the interests of service members' families, it also includes provisions for designating persons of trust outside the immediate family.

Usps Forms in Numerical Order - Eligibility for engagement in certain roles with the USPS might be contingent upon the information disclosed through this questionnaire.