Blank C 245 Carolina PDF Template

Engaging with the complexities of tax disputes necessitates a robust understanding of procedural avenues available for taxpayers. Among the various procedural documents, the C-245 form issued by the State of South Carolina's Department of Revenue stands out as a crucial tool for those looking to contest notices pertaining to tax assessments, penalties, or other determinations made by the state's revenue authority. This form, which must be populated meticulously by the appellant, serves as an official avenue for taxpayers to articulate their disagreements with decisions made by the Department of Revenue. It mandates the inclusion of taxpayer identification details, a thorough recounting of the reasons for protest—supported by factual narratives and relevant legal statutes or other authoritative materials—and, notably, a stringent requirement for the protestor to attach a copy of the notice being contested. Furthermore, the form explicitly stipulates the circumstances under which it should not be utilized, such as for issues related to the seizure of state refunds for debts like hospital bills or student loans and advises on alternative actions in cases of inability to pay the proposed amounts. In addition to offering a paper submission option, the state encourages the use of its free tax portal, MyDORWAY, as a means to save time and reduce paper waste. The design of the C-245 form and its associated guidelines reflect a structured approach to ensuring that protests are lodged in a detailed, informed manner, allowing the Department of Revenue to efficiently review and address the taxpayer's concerns.

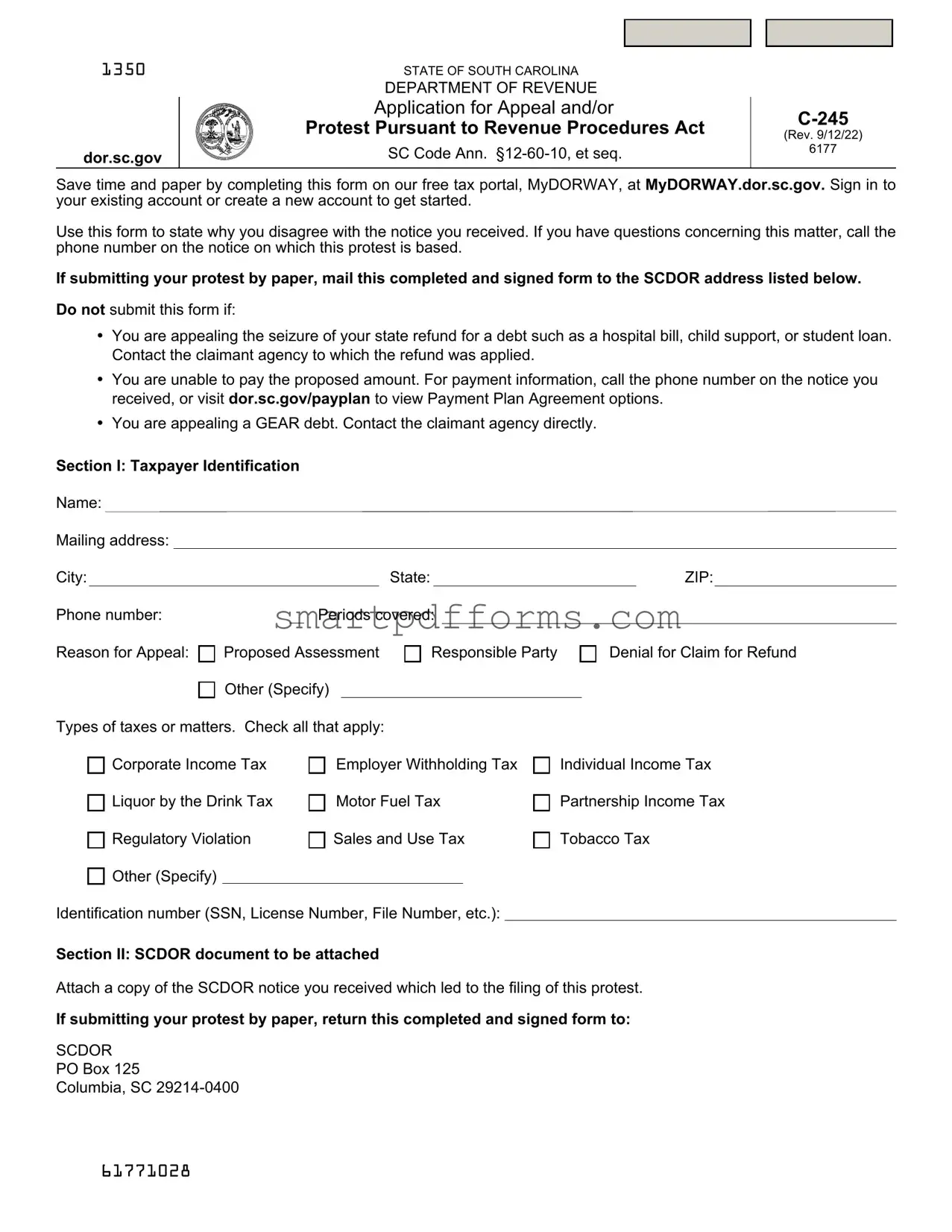

Preview - C 245 Carolina Form

1350

dor.sc.gov

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

Application for Appeal and/or

Protest Pursuant to Revenue Procedures Act

SC Code Ann.

(Rev. 9/12/22)

6177

Save time and paper by completing this form on our free tax portal, MyDORWAY, at MyDORWAY.dor.sc.gov. Sign in to your existing account or create a new account to get started.

Use this form to state why you disagree with the notice you received. If you have questions concerning this matter, call the phone number on the notice on which this protest is based.

If submitting your protest by paper, mail this completed and signed form to the SCDOR address listed below.

Do not submit this form if:

•You are appealing the seizure of your state refund for a debt such as a hospital bill, child support, or student loan. Contact the claimant agency to which the refund was applied.

•You are unable to pay the proposed amount. For payment information, call the phone number on the notice you received, or visit dor.sc.gov/payplan to view Payment Plan Agreement options.

•You are appealing a GEAR debt. Contact the claimant agency directly.

Section I: Taxpayer Identification

Name:

Mailing address:

City: |

|

State: |

|

ZIP: |

Phone number: |

|

|

Periods covered: |

||

Reason for Appeal: |

Proposed Assessment |

Responsible Party |

|||

|

|

Other (Specify) |

|

|

|

Denial for Claim for Refund

Types of taxes or matters. Check all that apply:

Corporate Income Tax

Corporate Income Tax

Liquor by the Drink Tax

Liquor by the Drink Tax

Regulatory Violation

Regulatory Violation

Other (Specify)

Employer Withholding Tax |

Individual Income Tax |

Motor Fuel Tax |

Partnership Income Tax |

Sales and Use Tax |

Tobacco Tax |

Identification number (SSN, License Number, File Number, etc.):

Section II: SCDOR document to be attached

Attach a copy of the SCDOR notice you received which led to the filing of this protest.

If submitting your protest by paper, return this completed and signed form to:

SCDOR

PO Box 125

Columbia, SC

61771028

Section III: Reason for Protest

Indicate the reasons you disagree with the findings of your notice, including a statement of facts supporting your position and the law or other authority upon which you rely. The law or other authority supporting your position must be furnished on all regulatory violations. Add additional sheets if necessary.

If the amount of proposed assessment is less than $2,500, you do not need to provide your legal authority unless you are a partnership, S corporation, an exempt organization, or an employee plan, and the proposed tax is imposed by Chapters 6, 11, or 13 of Title 12.

Section IV: Signatures

If you are appealing a notice issued on a joint Income Tax Return, both taxpayers must sign. If this protest is for a corporation, you must include the corporation's name followed by the signature and title of the corporate officer authorized to sign.

I declare that this return and all attachments are true, correct, and complete to the best of my knowledge and belief.

Signature of primary taxpayer |

|

|

Date |

|

|||||

Signature of secondary taxpayer (if applicable) |

|

Date |

|||||||

Business entity name (if applicable) |

|

|

|

|

|

|

|||

By |

|

Title |

|||||||

|

|

Owner/Partner/Officer/LLC member signature |

|

|

|

|

|||

Printed name |

|

|

Date |

|

|||||

Representative: You may appeal on behalf of another taxpayer if you meet the requirements of SC Code §

Signature

Printed name

Phone number

Date

Social Security Privacy Act Disclosure

It is mandatory that you provide your Social Security Number on this tax form if you are an individual taxpayer. 42 U.S.C. 405(c)(2)(C)(i) permits a state to use an individual's Social Security Number as means of identification in administration of any tax. SC Regulation

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the SCDOR is limited to the information necessary for the SCDOR to fulfill its statutory duties. In most instances, once this information is collected by the SCDOR, it is protected by law from public disclosure. In those situations where public disclosure is not prohibited, the Family Privacy Protection Act prevents such information from being used by third parties for commercial solicitation purposes.

61772026

Form Data

| Name of Fact | Detail |

|---|---|

| Form Title | Application for Appeal and/or Protest |

| Form Number | C-245 |

| Revision Date | February 11, 2021 |

| Governing Law | Revenue Procedures Act, SC Code Ann. §12-60-10, et seq. |

| Submission Method | Online via MyDORWAY or by paper mail |

| Not for Use | Appealing state refund seizures for debts like hospital bills, child support, or student loans |

Instructions on Utilizing C 245 Carolina

Completing the C-245 form, also known as the Application for Appeal and/or Protest Pursuant to Revenue Procedures Act, is a necessary step if you disagree with a notice you've received from the South Carolina Department of Revenue. This process allows you to officially state your case, including the reasons behind your disagreement and any legal authority on which you base your arguments. Before starting, ensure you have the notice or document from the SCDOR that prompted your appeal, as you'll need to refer to it and possibly attach it to your form. Let's walk through the steps needed to properly fill out and submit this form.

- Begin by entering your full Name, Mailing address (including city, state, ZIP), and Phone number in Section I under "Taxpayer Identification."

- In the same section, specify the Periods covered and identify the Types of taxes or matters by checking the appropriate box(es). Options include Corporate Income Tax, Employer Withholding Tax, Individual Income Tax, and more. If your issue is not listed, check "Other" and provide a specific description.

- Provide your Identification number relevant to the case (e.g., SSN, License Number, File Number).

- In Section II, attach a copy of the SCDOR notice that led you to file this protest. This is crucial for providing context and specifics about the case at hand.

- Move to Section III, titled "Reason for Protest." Here, clearly articulate why you disagree with the SCDOR's findings. Include a statement of facts supporting your position, and importantly, cite the law or other authority upon which your argument relies. Add extra sheets if necessary, especially if your case requires extensive explanation or documentation.

- If appealing a joint Income Tax Return in Section IV, ensure that both taxpayers sign the form. If this appeal involves a corporation, the form must include the corporation's name, followed by the signature and title of the corporate officer authorized to sign. Complete the signature fields, including the date and printed name for both primary and secondary taxpayers, if applicable.

- For representatives filing on behalf of another taxpayer, remember to complete an SC2848 form, available for download at dor.sc.gov/forms, and include it with your submission. Taxpayers representing themselves can skip this step.

- Finally, review your form for accuracy and completeness. Once satisfied, if submitting by paper, mail the completed and signed form to: SCDOR PO Box 125 Columbia, SC 29214-0400.

By closely following these steps, you will be able to clearly communicate your concerns and basis for appeal to the South Carolina Department of Revenue, ensuring your voice is heard in the matter. Remember, providing thorough and precise information will be key to successfully navigating this process.

Obtain Answers on C 245 Carolina

-

What is the purpose of the C-245 form in South Carolina?

The C-245 form, provided by the South Carolina Department of Revenue, is designed for individuals and businesses wishing to file an appeal or protest against a notice they received from the department. This could include disagreements with tax assessments, fines, or other regulatory matters as stated in the Revenue Procedures Act (SC Code Ann. §12-60-10, et seq.). The form allows the taxpayer to clearly state their reasons for disagreement, supported by relevant facts and laws.

-

Can I use the C-245 form to appeal a state refund seizure for non-tax debts?

No, the C-245 form cannot be used for this purpose. If your state refund was seized for debts such as hospital bills, child support, or student loans, you must directly contact the agency to which your refund was applied. The C-245 form is strictly for disputing matters directly related to tax assessments and other notices issued by the South Carolina Department of Revenue.

-

How can I submit my C-245 protest form, and are there any digital options?

Individuals and businesses have the option to complete and submit the C-245 form either through paper mail or electronically. To save time and paper, the South Carolina Department of Revenue encourages the use of their free tax portal, MyDORWAY, available at MyDORWAY.dor.sc.gov. Here, you can sign into your existing account or create a new one to submit the form. If you prefer or need to submit a paper version, the completed and signed form should be mailed to the SCDOR address provided on the form.

-

What information is required when filling out Section III of the C-245 form?

Section III of the C-245 form requires you to provide a detailed explanation of why you disagree with the SCDOR notice. This includes a statement of the facts supporting your position and referencing the law or other authority upon which you base your appeal. Legal authority must be furnished for all regulatory violations. If the proposed assessment is less than $2,500, legal authority is only needed if you are a partnership, S corporation, an exempt organization, or an employee plan, and the tax is imposed by Chapters 6, 11, or 13 of Title 12. Additional sheets may be added if necessary to fully articulate your case.

Common mistakes

When filling out the C-245 Form for the State of South Carolina, individuals often make several mistakes that can be avoided. Here’s an expanded list of common pitfalls:

Not attaching a copy of the SCDOR notice that prompted the appeal. This document is crucial for providing context to your protest.

Leaving the taxpayer identification section incomplete. Every field, including the identification number, is essential for the proper processing of your appeal.

Failing to check off the appropriate tax types or matters in Section I. This mistake can lead to confusion about what the protest is regarding.

Incorrectly indicating the reason for protest. It’s important to clearly state why you disagree with the findings in a structured and factual manner.

Not providing supporting laws or authorities for regulatory violations. For such protests, specifically stating the legal basis for disagreement is mandatory.

Submitting the form without the necessary signatures. If you’re filing a joint income tax return appeal, both taxpayers’ signatures are required. For corporations, the authorized officer must sign.

Omitting additional sheets when the space provided in Section III is insufficient. Expanding on your reasons for protest might be necessary, and additional sheets ensure you have enough room to thoroughly explain your stance.

Not utilizing the free tax portal MyDORWAY to submit the protest. Although paper submissions are accepted, filing online can save time and reduce paperwork.

For representatives filing on behalf of a taxpayer, forgetting to include a completed SC2848 form. This is crucial to proving the authority to appeal.

Being mindful of these points can significantly improve the process of filing an appeal with the SCDOR using the C-245 form.

Documents used along the form

When navigating the complexities of filing an appeal or protest with the State of South Carolina Department of Revenue, it's crucial to understand that the C-245 form is often just a starting point. The process might necessitate additional forms and documents to fully articulate your case or comply with procedural requirements. Understanding these supplementary documents can streamline the appeal process and ensure that you are well-prepared.

- SC2848 - Power of Attorney: A critical document for those who are represented by an attorney, accountant, or authorized individual other than themselves. It grants the representative the authority to act on the taxpayer's behalf in matters related to the appeal.

- Notice of Assessment: The initial notification from the Department of Revenue outlining the proposed taxes owed, penalties, or any adjustments. It's the document that typically triggers the need to file a C-245 form if the taxpayer disagrees with its content.

- Financial Statement for Individuals: If the appeal involves disputing a liability based on inability to pay, this comprehensive financial breakdown supports the taxpayer's claim of financial hardship.

- Business Financial Statement: Similar to the Financial Statement for Individuals, but tailored for businesses. This document is necessary when a business disputes a liability or assessment and claims inability to pay.

- Payment Plan Agreement: For taxpayers who agree with the notice but seek to arrange a payment plan due to financial constraints. This form outlines the terms and conditions of how the taxpayer will settle the outstanding liabilities.

- Request for Collection Due Process Hearing: This form applies in cases where assets have been seized or a lien has been filed. Taxpayers file this to request a hearing before enforcement actions are finalized, providing a platform to propose alternatives or dispute liabilities.

Integrating these documents with your C-245 form can comprehensively address the nuances of your case, enhancing the clarity and strength of your appeal or protest. Each document serves a unique purpose, from legitimizing representation to detailing financial hardship or negotiating payment terms. Familiarity with these forms ensures that all relevant aspects of your situation are thoroughly communicated to the Department of Revenue.

Similar forms

The IRS Form 1040X (Amended U.S. Individual Income Tax Return) is akin to the C-245 form in its primary function. Both are designed for taxpayers to dispute or amend prior submissions. While the C-245 form is specific to South Carolina, highlighting disagreements against state tax notices, the 1040X addresses amendments to federal income tax returns, allowing taxpayers to correct errors or claim a more favorable tax status.

The FTB 4107 (California Department of Tax and Fee Administration Appeal Form) shares similarities with the C-245 form through its appeal process. This form serves individuals and businesses in California wishing to contest tax decisions made by the state's Department of Tax and Fee Administration. Similar to C-245, the process involves submitting detailed reasons for disagreement, including facts and laws supporting the appeal.

The Form OTR-310 (District of Columbia Office of Tax and Revenue Appeal Form) is another document comparable to the C-245 form. Used by taxpayers in the District of Columbia, it facilitates appeals against tax notices or decisions issued by the Office of Tax and Revenue. Both forms require taxpayers to articulate their points of contention, supported by factual and legal rationale, to challenge tax assessments or penalties.

The Texas Comptroller's Form 50-312 (Application for Binding Arbitration) while distinct in its arbitration focus, is similar to the C-245 in its approach to dispute resolution related to tax matters. Specifically used for disputes over property tax valuations in Texas, it like the C-245, initiates a formal review process where taxpayers can argue against state-imposed tax decisions.

The New York State Department of Taxation and Finance’s Form IT-201-X (Amended Resident Income Tax Return) parallels the C-245 form in its amendment purpose. Designed for New York residents to make changes to their state income tax returns, it shares the core functionality of disputing or correcting previously reported information. Both forms allow taxpayers to formally communicate their disagreements or corrections to the tax authority.

Dos and Don'ts

When filling out the C-245 Carolina form for the State of South Carolina Department of Revenue, it's important to follow specific guidelines to ensure your Application for Appeal and/or Protest is processed correctly and efficiently. Below are some key do's and don'ts to be aware of:

Do's:

- Read the instructions carefully before you start filling out the form to make sure you understand what is required.

- Include your Taxpayer Identification details accurately, including your name, mailing address, city, state, ZIP, phone number, and identification number (SSN, License Number, File Number, etc.) to avoid any processing delays.

- Attach a copy of the SCDOR notice you received that led to the filing of this protest. This document is crucial for the processing of your application.

- Clearly indicate your reasons for the protest in Section III, providing a statement of facts supporting your position as well as the law or other authority you rely on.

- Ensure all signatures are included on the form. If you are appealing a notice issued on a joint Income Tax Return, both taxpayers must sign. For corporate appeals, include the corporation's name followed by the signature and title of the authorized corporate officer.

Don'ts:

- Do not submit this form for issues not related to tax notices, such as appealing the seizure of your state refund for debts like a hospital bill, child support, or student loan. Contact the claimant agency directly for these issues.

- Avoid submitting the form without attaching the required SCDOR notice. Without this document, your protest cannot be processed.

- Do not leave sections incomplete. Make sure to fill out every section that is applicable to your situation to prevent delays.

- Do not provide incorrect or incomplete Taxpayer Identification details. This can lead to processing errors and potential delays in resolving your protest.

- Refrain from submitting the form without the necessary signatures, as this will render your application for appeal and/or protest invalid.

Misconceptions

When it comes to navigating tax forms and processes, misconceptions can create unnecessary confusion. Addressing some common misunderstandings about the C-245 Carolina form, used for appeals and/or protests in South Carolina, can help clarify its purpose and proper use.

It's only for disagreeing with tax amounts. Many believe the C-245 form is solely for disputing the amount of tax the South Carolina Department of Revenue (SCDOR) says you owe. While it's a key use, the form also allows taxpayers to contest other tax-related issues, such as tax classifications and penalties.

Anyone can use it for any appeal. This form has specific restrictions. For instance, it's not the right form for appealing the seizure of a state refund for debts like hospital bills, child support, or student loans. For those issues, you need to contact the agency that applied your refund to the debt.

You must always submit legal authority with your protest. While it's essential to provide a solid basis for your disagreement, if the amount of the proposed assessment is less than $2,500, you don't need to include your legal authority—unless you’re a partnership, S corporation, an exempt organization, or an employee plan affected by certain chapters of Title 12.

Paper submission is the only way to protest. In our digital age, this form can be completed and submitted online through MyDORWAY, the free tax portal offered by SCDOR. This option not only saves paper but also time, making the process more efficient for taxpayers.

Understanding these aspects of the C-245 Carolina form ensures that individuals and businesses can navigate their tax protests or appeals more effectively, armed with the correct information and expectations.

Key takeaways

When dealing with the C-245 form in the State of South Carolina, it's crucial to understand its purpose and the procedures for its correct use. Here are key takeaways for effectively filling out and using this form:

- Understand the Purpose: The C-245 form is designed for taxpayers to appeal or protest against notices received from the South Carolina Department of Revenue. It provides a structured way to disagree formally with findings and to present one's case.

- Exclusions Apply: You should not use the C-245 if you are appealing the seizure of your state refund for debts such as hospital bills, child support, or student loans. These cases require direct contact with the claimant agency.

- Consider Online Submission: For convenience and to save paper, the C-245 form can be completed and submitted through the MyDORWAY portal. This online process is streamlined and user-friendly.

- Paper Submission Instructions: If you choose to submit the C-245 form via mail, make sure to send the completed and signed form to the SCDOR’s specified address, along with a copy of the notice you are protesting.

- Detail the Protest: In the protest section, clearly indicate the reasons for your disagreement. It's important to include facts supporting your position and references to relevant laws or authorities. This detailed approach aids in the understanding and assessment of your protest.

- Legal Authority Required: For amounts less than $2,500, legal authority documentation is not typically needed unless the protest involves certain types of taxpayers and taxes specified by the form. It is crucial to be aware of these exceptions to ensure compliance.

- Signature Requirements: Depending on the taxpayer's type (individual, joint, corporation, etc.), specific signature requirements apply. For corporate protests, the name and title of an authorized corporate officer must be included.

- Third-party Representation: If you're representing another taxpayer in the protest, ensure that you meet the criteria set by SC Code § 12-60-90(C) and include a completed SC2848 form. Taxpayers representing themselves are not required to submit this extra form.

Keeping these points in mind will help ensure that your use of the C-245 form is accurate, compliant, and effective in communicating your protest or appeal to the South Carolina Department of Revenue.

Popular PDF Forms

Cleaning Review Template - Discover whether your kitchen's exhaust hood effectively captures all heat and effluents, with an evaluation report detailing hood type, fan functionality, and grease containment.

Form I-765 - Students, asylum seekers, and certain spouses of visa holders use Form I-765 for work permission.