Blank Ca Resale PDF Template

The California Resale Certificate, designated as CDTFA-230, formulates a pivotal component within the commerce domain, providing a structured pathway for businesses in the resale of tangible personal property. This instrument is disseminated by the California Department of Tax and Fee Administration, embodying the procedural essence for resellers to purchase items without the incumbent burden of sales tax, contingent upon the premise of resale in the ordinary course of business operations. It mandates the disclosure of a valid seller’s permit number, a clear designation of the type of goods subject to resale, and the explicit intention to resell the purchased items as tangible personal property. The certificate harbors stipulations for the description of the goods being acquired for resale, underscoring a commitment to resell prior to any utilization beyond demonstration or display. As referenced within the document, misuse or fraudulent leveraging of this certificate exposes the holder to criminal misdemeanor charges and financial penalties, highlighting the serious obligation of the purchaser to adhere to the terms of resale delineated by The State of California. This introductory glimpse into the California Resale Certificate underscores its importance in facilitating tax-compliant transactions within the reselling industry, as well as delineating the legal implications for its misuse.

Preview - Ca Resale Form

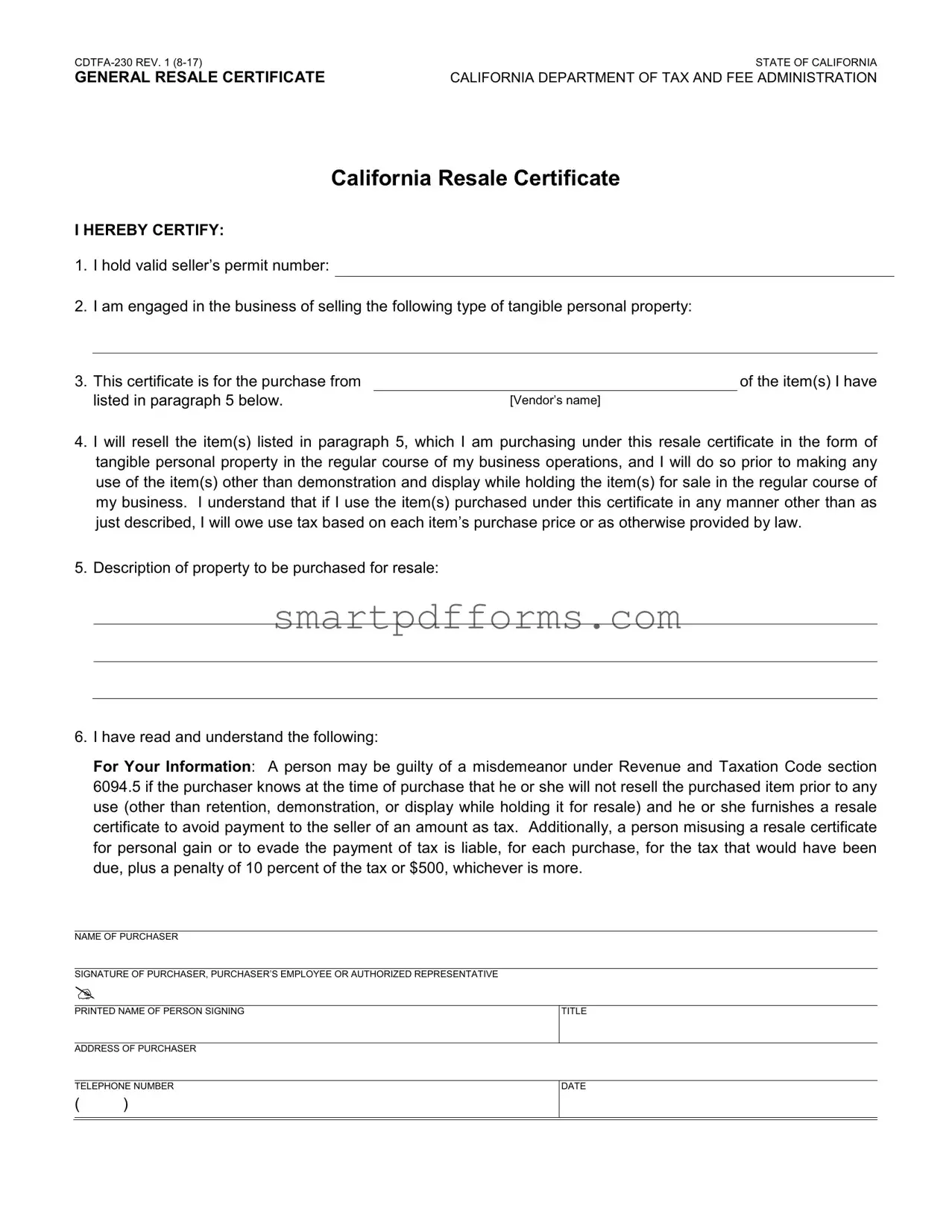

CDTFA230 REV. 1 (817) |

STATE OF CALIFORNIA |

GENERAL RESALE CERTIFICATE |

CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION |

CALIFORNIA RESALE CERTIFICATE

I HEREBY CERTIFY:

1.I hold valid seller’s permit number:

2.I am engaged in the business of selling the following type of tangible personal property:

3. This certificate is for the purchase from |

|

of the item(s) I have |

listed in paragraph 5 below. |

[Vendor’s name] |

|

4.I will resell the item(s) listed in paragraph 5, which I am purchasing under this resale certificate in the form of tangible personal property in the regular course of my business operations, and I will do so prior to making any use of the item(s) other than demonstration and display while holding the item(s) for sale in the regular course of my business. I understand that if I use the item(s) purchased under this certificate in any manner other than as just described, I will owe use tax based on each item’s purchase price or as otherwise provided by law.

5.Description of property to be purchased for resale:

6.I have read and understand the following:

FOR YOUR INFORMATION: A person may be guilty of a misdemeanor under Revenue and Taxation Code section 6094.5 if the purchaser knows at the time of purchase that he or she will not resell the purchased item prior to any use (other than retention, demonstration, or display while holding it for resale) and he or she furnishes a resale certificate to avoid payment to the seller of an amount as tax. Additionally, a person misusing a resale certificate for personal gain or to evade the payment of tax is liable, for each purchase, for the tax that would have been due, plus a penalty of 10 percent of the tax or $500, whichever is more.

NAME OF PURCHASER

SIGNATURE OF PURCHASER, PURCHASER’S EMPLOYEE OR AUTHORIZED REPRESENTATIVE

PRINTED NAME OF PERSON SIGNING

TITLE

ADDRESS OF PURCHASER

TELEPHONE NUMBER

()

DATE

Form Data

| Fact Number | Detail |

|---|---|

| 1 | The form is called the General Resale Certificate in California. |

| 2 | It is issued by the California Department of Tax and Fee Administration. |

| 3 | The form's revision is indicated as REV. 1 (8-17). |

| 4 | Holders must have a valid seller’s permit number. |

| 5 | It is intended for those engaged in selling tangible personal property. |

| 6 | Items purchased under this certificate must be resold in the regular course of business operations. |

| 7 | Personal use of items purchased under this certificate, other than for display or demonstration, results in a tax obligation. |

| 8 | Misuse of the certificate for personal gain or tax evasion can result in significant penalties, including a penalty of the greater of 10 percent of the tax due or $500. |

| 9 | Governing laws for the certificate include Revenue and Taxation Code section 6094.5. |

Instructions on Utilizing Ca Resale

Before starting the process of filling out the California Resale Certificate, it's important to gather all necessary information related to your business and the specific items you intend to purchase for resale. This form is crucial for businesses looking to purchase goods without paying sales tax by certifying that the goods will be resold. Understanding the requirements and accurately completing the form can save time and avoid potential legal complications. Ready to fill it out? Here’s how:

- Locate the section titled "I hold valid seller’s permit number:" and write your seller's permit number in the space provided. This number is issued by the California Department of Tax and Fee Administration (CDTFA) when you register your business.

- Under the prompt, "I am engaged in the business of selling the following type of tangible personal property:" specify the type of items your business sells. Be clear and concise to avoid any ambiguities regarding your business operations.

- Fill in the vendor's name where it says "This certificate is for the purchase from ______ of the item(s) I have listed in paragraph 5 below." Here, you're indicating from whom you are buying the items.

- Review the statement in paragraph 4, ensuring you understand and agree to only use the purchased items for resale, demonstration, or display purposes. If the items are used differently, tax would then be applicable.

- In paragraph 5's "Description of property to be purchased for resale:" field, provide a detailed description of the items you intend to purchase for resale. Be as specific as possible to ensure clarity and compliance.

- Read the "FOR YOUR INFORMATION" section carefully to understand the legal implications and responsibilities tied to the misuse of this certificate.

- At the bottom, the “NAME OF PURCHASER” requires the legal name of your business as it’s registered.

- Sign the certificate where it says “SIGNATURE OF PURCHASER, PURCHASER’S EMPLOYEE OR AUTHORIZED REPRESENTATIVE” to certify the information provided is accurate and true.

- Print your name or the name of the individual signing on behalf of the business in the “PRINTED NAME OF PERSON SIGNING” line.

- Indicate the title of the person signing in the “TITLE” section to clarify their role within the company.

- Provide your business address in the field labeled “ADDRESS OF PURCHASER” to tie the certificate to your physical location.

- Enter a current telephone number in the space provided to ensure the CDTFA or vendors can contact you if necessary.

- Last, note the date of signing in the designated "DATE" area to confirm when the certificate was completed and submitted.

Upon completing these steps, your California Resale Certificate is ready. This document enables your business to purchase items for resale without being charged sales tax at the point of purchase. It’s important to keep a copy of this certificate for your records and to provide it to sellers from whom you’re purchasing goods for resale. Remember, accuracy and honesty in filling out this form are paramount to prevent possible legal issues and to maintain compliance with California tax laws.

Obtain Answers on Ca Resale

What is a California Resale Certificate?

A California Resale Certificate, known officially as CDTFA-230, is a document that allows businesses to buy goods without paying sales tax on them, provided those goods are purchased for resale in the course of their business. The certificate is issued by the California Department of Tax and Fee Administration (CDTFA).Who needs a California Resale Certificate?

Any business that intends to purchase tangible personal property for resale in the state of California needs a California Resale Certificate. This includes retailers, wholesalers, and manufacturers who buy products to sell them to the end consumer.How do I apply for a California Resale Certificate?

To apply for a California Resale Certificate, you must first have a valid seller’s permit issued by the CDTFA. Once you have this permit, you can fill out the CDTFA-230 form, providing detailed information about the type of tangible personal property you are purchasing for resale.What information is required to complete the California Resale Certificate?

When completing the California Resale Certificate, you need to provide: your valid seller’s permit number, the type of tangible personal property you sell, the vendor's name from whom you are purchasing the items, a description of the property being purchased for resale, and a declaration that you will resell the item in the regular course of your business. You must also sign and date the certificate, providing your name, title, address, and telephone number.Can I use the California Resale Certificate for personal purchases?

No, the California Resale Certificate is specifically designed for items that will be resold as part of your regular business operations. Using this certificate for personal purchases is illegal, and can result in misdemeanor charges, payment of the tax owed, and a penalty of either 10 percent of the tax or $500, whichever is higher.What happens if I don’t resell the purchased items?

If you purchase items with a California Resale Certificate but end up using them instead of reselling, you are responsible for paying use tax on each item. The use tax is based on the purchase price of the item or as otherwise provided by law.How long is my California Resale Certificate valid?

The California Resale Certificate remains valid as long as your seller’s permit is valid and your business operations have not significantly changed. However, it’s a good practice to provide updated certificates to your vendors every few years or whenever your business information changes.Where can I find more information or get help with the California Resale Certificate?

For more detailed information or assistance with obtaining and using a California Resale Certificate, you can visit the official California Department of Tax and Fee Administration (CDTFA) website or contact them directly through their customer service.

Common mistakes

When filling out the California Resale Certificate (CDTFA-230 REV. 1), a number of common errors can lead to potential issues or misunderstandings. Ensuring accuracy and completeness helps in maintaining compliance and avoiding penalties. Here are nine mistakes often made:

Failing to provide a valid seller’s permit number. This critical piece of information verifies your eligibility to purchase goods for resale without paying sales tax.

Not specifying the type of tangible personal property sold by the business. A clear description helps to substantiate the legitimacy of the resale certificate.

Omitting the vendor's name from whom the purchase is made. This identification is necessary to trace back transactions if required.

Leaving the description of property to be purchased for resale blank or vague. Detailed descriptions prevent misunderstandings about what goods are covered.

Using the resale certificate for items that will not be resold as tangible personal property. Misuse can result in owing use tax and additional penalties.

Signing the certificate without thoroughly understanding the implications. Knowledge of your responsibilities prevents accidental misuse.

Not providing the complete address of the purchaser. This information is essential for record-keeping and verification processes.

Misrepresenting personal use as business intents. Incorrectly claiming personal items as business purchases for resale is unlawful.

Ignoring the importance of keeping updated and accurate records. Regularly updating details as business operations change ensures ongoing compliance.

Common errors not directly related to the content of the form but affecting its validity include:

Not updating the resale certificate regularly. Certificates should be refreshed periodically to reflect any changes in business operations or ownership.

Neglecting to secure a new seller’s permit if business details change significantly. A new permit ensures that all transactions remain valid under the current business structure.

Forgetting to retain copies of filled-out resale certificates. Keeping records is crucial for audits or inquiries by the California Department of Tax and Fee Administration.

Attention to detail when completing the California Resale Certificate not only fulfills legal obligations but also protects businesses from potential fines and penalties associated with inaccuracies or misuse.

Documents used along the form

In the context of commercial transactions, particularly those involving resale in California, various forms and documents accompany the California Resale Certificate (CDTFA-230) to ensure compliance with state regulations and tax laws. These additional documents are crucial for a seamless transaction process, providing necessary information and declarations related to the purchase and resale of tangible personal property.

- Bill of Sale: This document outlines the details of the transaction between the seller and the buyer. It serves as evidence of the transfer of ownership of the property, including a description of the items sold, the sale date, and the purchase price.

- Seller’s Permit: Essential for businesses engaged in selling or leasing tangible personal property in California, this permit issued by the California Department of Tax and Fee Administration (CDTFA) authorizes the holder to collect sales tax from customers and report it to the state.

- Purchase Order: Prepared by the buyer, this document specifies the types, quantities, and agreed prices for products or services. It functions as a formal offer to buy, subject to the seller's acceptance.

- Sales Tax Exemption Certificate: Different from a resale certificate, this document is used when a purchaser is buying goods they intend to use in a manner that is exempt from sales tax, for example, goods for resale, charitable purposes, or certain types of manufacturing.

- Inventory List: Often accompanying the Resale Certificate, this provides a detailed list of the items being purchased for resale. Including descriptions, quantities, and, in some cases, the item's condition or model, it ensures clarity and accountability for both parties.

Together, these documents form a comprehensive framework that supports and defines the resale process. By accurately completing and filing these forms, businesses can avoid legal pitfalls, streamline their operations, and maintain the integrity of their transactions in accordance with California law.

Similar forms

The Uniform Sales & Use Tax Certificate is similar to the California Resale Certificate because both serve as proof that a purchase is made for resale, and not for personal use, thus exempting the buyer from paying sales tax at the point of purchase. Both certificates require the purchaser to provide specific details about their business and the type of tangible personal property being resold.

The Exemption Certificate shares similarities with the California Resale Certificate by allowing purchasers to buy goods without paying sales tax, provided the goods are purchased for specific exempt purposes, such as resale. While the Exemption Certificate can be used for various tax exemptions, the California Resale Certificate is specifically used for reselling purchased goods.

A Streamlined Sales Tax Agreement Certificate of Exemption closely matches the function of the California Resale Certificate in jurisdictions that are members of the Streamlined Sales and Use Tax Agreement. Like the California Resale Certificate, it allows businesses to purchase goods without paying sales tax when the goods are intended for resale. Both certificates require accurate business and sale details to be legally valid.

The Vehicle/Vessel Transfer and Reassignment Form (REG 262) in California, while specific to the sale and transfer of vehicles and vessels, somewhat resembles the California Resale Certificate in its requirement for detailed information about the transaction. Although it serves a different purpose, it similarly facilitates a transfer under certain conditions, exempting it from specific taxes at the point of transfer.

Dos and Don'ts

When filling out the California Resale Certificate, it's important to approach the process with attention to detail and integrity. The following list outlines essential dos and don'ts to guide you in completing this form accurately and in compliance with legal requirements.

Do:- Ensure you have a valid seller’s permit number before filling out the form.

- Clearly specify the type of tangible personal property you are in the business of selling.

- Use precise language when listing the item(s) you intend to purchase for resale in paragraph 5.

- Confirm that the item(s) will be resold in the form of tangible personal property in the regular course of your business operations.

- Sign and date the form yourself, or ensure an authorized representative does so, indicating full understanding and compliance.

- Fill out the form if you plan to use the purchased item(s) for personal use or in a manner other than retention, demonstration, or display while holding it for resale.

- Forget to read and understand the legal implications and penalties for misuse of the resale certificate as outlined in the form.

- Overlook the necessity to list the vendor's name from whom you are purchasing the resale items in paragraph 3.

- Ignore the importance of providing your accurate business address and telephone number to facilitate potential follow-up or verification.

- Assume the form is complete without double-checking that all fields have been filled out correctly and legibly.

By following these guidelines, you not only comply with legal standards but also ensure the integrity of your business practices. Accurate completion of the California Resale Certificate is critical to maintaining your good standing with the California Department of Tax and Fee Administration and upholding the trustworthiness of your business operations.

Misconceptions

Understanding the nuances of legal documents is crucial for business operations, especially when it comes to tax-related forms like the California Resale Certificate. Some misconceptions could lead to misuse or unintentional violations. Here are four common misconceptions about the California Resale Certificate:

- Any purchase can be exempt from sales tax if a resale certificate is provided: This is not true. The resale certificate specifically applies to items that are bought for the purpose of being resold in the ordinary course of business. If an item is used in any way other than for demonstration or display while holding it for sale, the purchase is subject to use tax.

- There is no penalty for incorrect use: Misuse of the resale certificate can lead to significant penalties. If an item is purchased for resale but then used personally, the purchaser owes use tax on the item, plus a penalty that can be the greater of 10% of the tax due or $500 per incident. This highlights the importance of accurately understanding and applying the rules of the resale certificate.

- A resale certificate covers all types of products and services: This is incorrect. The resale certificate applies only to tangible personal property that is resold as tangible personal property in the regular course of business. It does not apply to services or items that are not held for resale in their tangible form.

- Submission of a resale certificate is optional: While submitting a resale certificate is not mandatory for every transaction, failing to provide this documentation when purchasing items for resale may result in the seller charging sales tax on items that technically should be tax-exempt. Properly using a resale certificate ensures that businesses can manage their finances more efficiently and comply with tax regulations.

It's essential for businesses to understand these aspects of the California Resale Certificate to navigate tax liabilities correctly and avoid unnecessary penalties. Being informed and cautious when utilizing these certificates can greatly benefit a business's operational compliance and financial management.

Key takeaways

Filling out and using the California Resale Certificate, officially known as CDTFA-230, is a straightforward process that helps businesses purchase goods for resale without paying sales tax at the point of purchase. However, understanding the key elements of this certificate is essential to ensure compliance and avoid penalties. Here are seven key takeaways:

- Valid Seller’s Permit Number: To utilize the resale certificate, it’s mandatory to have a valid seller’s permit number. This indicates that the holder is legally recognized to engage in sales within the state.

- Specifics of Tangible Personal Property: The form requires identification of the type of tangible personal property involved in the business transactions. Clarity on the nature of goods being resold is essential.

- Purpose of Certificate: The primary purpose of the certificate is to facilitate the purchase of items intended for resale without paying the sales tax upfront. It specifies that the items will be resold in their tangible form during regular business operations.

- Resale Intent: A critical condition is that the items purchased are for resale purposes only. Using the items for any other purpose before reselling them could result in owing use tax on those items.

- Detailed Description: For effective record-keeping and compliance, a detailed description of the property intended for purchase and resale is required. This helps in auditing and tracking the resale process.

- Legal and Financial Implications: Misuse of the resale certificate—for instance, using it for personal purchases or knowing upfront that the items will not be resold—can lead to misdemeanor charges, tax liabilities, and significant penalties.

- Acknowledgment and Signature: Filling the form requires acknowledgment of the terms and conditions, alongside the purchaser’s signature, printed name, title, and contact information, thereby confirming the purchaser’s understanding and acceptance of their responsibilities.

Accurate and honest use of the California Resale Certificate protects both sellers and buyers from legal issues and financial penalties. It’s crucial for businesses to understand these key aspects to maintain compliance and ensure smooth operations.

Popular PDF Forms

Authorization Form Template Word - This agreement includes explicit authorization from the vehicle owner for Auto Art Body Shop to conduct necessary repairs.

Ntsa Form C - Sellers must provide vehicle registration, make, chassis number, and if applicable, engine number.

Lawsuit Paper - Details the process and deadlines for responding to a lawsuit to avoid a default judgment against you.