Blank Ca Rrf 1 PDF Template

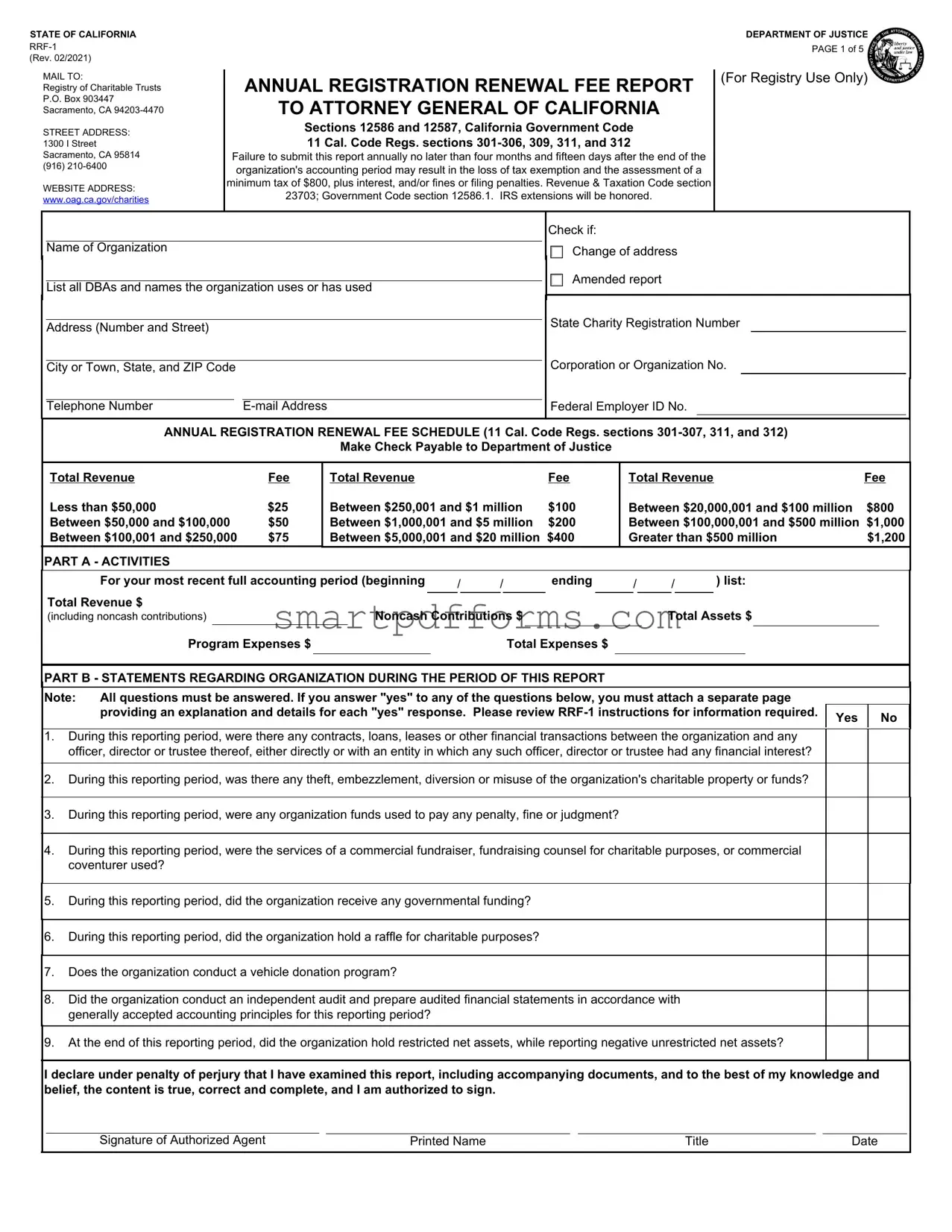

In the realm of charitable organizations operating within California, the Annual Registration Renewal Fee Report, known as Form RRF-1, plays a critical role in maintaining compliance with legal requirements set forth by the state. This document, overseen by the Attorney General's Office and specifically by the Registry of Charitable Trusts, contains essential information that charitable entities must submit annually to ensure their ongoing operation is transparent and accountable. The form requires organizations to report total revenue, noncash contributions, total assets, program expenses, and total expenses for the reported fiscal period. Organizations face the risk of losing their tax-exempt status, incurring a minimum tax of $800 plus potential interest and penalties, should they fail to submit this form within the specified deadline, which is no later than four months and fifteen days after the end of their accounting period. Additionally, the form acts as a tool for the Attorney General's Office in the early detection of fiscal mismanagement and unlawful diversion of charitable assets. It also necessitates detailed disclosures about financial transactions involving officers, directors, or trustees, the use of charitable assets for penalties or judgments, and the engagement with commercial fundraisers or coventurers, among other pertinent governance and operational details. By adhering to these requirements, including the payment of a sliding scale fee based on total revenue, charitable organizations can continue to contribute to the public good while upholding principles of accountability and transparency in their stewardship of charitable assets.

Preview - Ca Rrf 1 Form

STATE OF CALIFORNIA

(Rev. 02/2021)

MAIL TO:

Registry of Charitable Trusts P.O. Box 903447 Sacramento, CA

STREET ADDRESS: 1300 I Street Sacramento, CA 95814 (916)

WEBSITE ADDRESS: www.oag.ca.gov/charities

ANNUAL REGISTRATION RENEWAL FEE REPORT

TO ATTORNEY GENERAL OF CALIFORNIA

Sections 12586 and 12587, California Government Code 11 Cal. Code Regs. sections

Failure to submit this report annually no later than four months and fifteen days after the end of the organization's accounting period may result in the loss of tax exemption and the assessment of a minimum tax of $800, plus interest, and/or fines or filing penalties. Revenue & Taxation Code section 23703; Government Code section 12586.1. IRS extensions will be honored.

DEPARTMENT OF JUSTICE

PAGE 1 of 5

(For Registry Use Only)

Name of Organization

List all DBAs and names the organization uses or has used

Address (Number and Street)

City or Town, State, and ZIP Code

Telephone Number |

Check if:

Change of address

Amended report

State Charity Registration Number

Corporation or Organization No.

Federal Employer ID No.

ANNUAL REGISTRATION RENEWAL FEE SCHEDULE (11 Cal. Code Regs. sections

Make Check Payable to Department of Justice

Total Revenue |

Fee |

Less than $50,000 |

$25 |

Between $50,000 and $100,000 |

$50 |

Between $100,001 and $250,000 |

$75 |

Total Revenue |

Fee |

Between $250,001 and $1 million |

$100 |

Between $1,000,001 and $5 million |

$200 |

Between $5,000,001 and $20 million $400

Total Revenue |

Fee |

Between $20,000,001 and $100 million |

$800 |

Between $100,000,001 and $500 million |

$1,000 |

Greater than $500 million |

$1,200 |

PART A - ACTIVITIES

For your most recent full accounting period (beginning |

/ |

/ |

|

|

ending |

/ |

/ |

) list: |

||||||||||

Total Revenue $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Noncash Contributions $ |

|

|

|

Total Assets $ |

||||||||||||||

(including noncash contributions) |

|

|

|

|||||||||||||||

Program Expenses $ |

|

|

|

|

|

|

Total Expenses $ |

|

|

|

|

|

|

|

||||

PART B - STATEMENTS REGARDING ORGANIZATION DURING THE PERIOD OF THIS REPORT

Note: |

All questions must be answered. If you answer "yes" to any of the questions below, you must attach a separate page |

|

providing an explanation and details for each "yes" response. Please review |

Yes

No

1.During this reporting period, were there any contracts, loans, leases or other financial transactions between the organization and any officer, director or trustee thereof, either directly or with an entity in which any such officer, director or trustee had any financial interest?

2.During this reporting period, was there any theft, embezzlement, diversion or misuse of the organization's charitable property or funds?

3.During this reporting period, were any organization funds used to pay any penalty, fine or judgment?

4.During this reporting period, were the services of a commercial fundraiser, fundraising counsel for charitable purposes, or commercial coventurer used?

5.During this reporting period, did the organization receive any governmental funding?

6.During this reporting period, did the organization hold a raffle for charitable purposes?

7.Does the organization conduct a vehicle donation program?

8.Did the organization conduct an independent audit and prepare audited financial statements in accordance with generally accepted accounting principles for this reporting period?

9.At the end of this reporting period, did the organization hold restricted net assets, while reporting negative unrestricted net assets?

I declare under penalty of perjury that I have examined this report, including accompanying documents, and to the best of my knowledge and belief, the content is true, correct and complete, and I am authorized to sign.

Signature of Authorized Agent |

Printed Name |

Title |

Date |

STATE OF CALIFORNIA |

DEPARTMENT OF JUSTICE |

PAGE 2 of 5 |

|

(Rev. 02/2021) |

|

Office of the Attorney General

Registry of Charitable Trusts

Privacy Notice

As Required by Civil Code § 1798.17

Collection and Use of Personal Information. The Attorney General's Registry of Charitable Trusts (Registry), a part of the Public Rights Division, collects the information requested on this form as authorized by the Supervision of Trustees and Fundraisers for Charitable Purposes Act (Gov. Code § 12580 et seq.) and regulations adopted pursuant to the Act (Cal. Code Regs., tit. 11, §§

Providing Personal Information. All the personal information requested in the form must be provided. An incomplete submission may result in the Registry not accepting the form, and cause your organization to be out of compliance with legal requirements to operate in California.

Access to Your Information. The completed form is a public filing that will be made available on the Attorney General's website at www.oag.ca.gov/charities pursuant to the public access requirements of the Act. You may review the records maintained by the Registry that contain your personal information, as permitted by the Information Practices Act. See below for contact information.

Possible Disclosure of Personal Information. In order to process the applicable registration, renewal, registration update, application, or report, we may need to share the information on this form with other government agencies. We may also share the information to further an investigation, including an investigation by other government or law enforcement agencies. In addition, the information is available and searchable on the Attorney General's website.

The information provided may also be disclosed in the following circumstances:

·With other persons or agencies where necessary to perform their legal duties, and their use of your information is compatible and complies with state law, such as for investigations or for licensing, certification, or regulatory purposes;

·To another government agency consistent with state or federal law.

Contact Information. For questions about this notice or access to your records, contact the Registrar of Charitable Trusts, 1300 I Street, Sacramento, CA 95814 at rct@doj.ca.gov or (916)

STATE OF CALIFORNIA

MAIL TO:

Registry of Charitable Trusts P.O. Box 903447 Sacramento, CA

WEBSITE ADDRESS: www.oag.ca.gov/charities

DEPARTMENT OF JUSTICE

Page 3 of 5

INSTRUCTION FOR FILING

ANNUAL REGISTRATION RENEWAL FEE REPORT

TO ATTORNEY GENERAL OF CALIFORNIA

Section 12586 and 12587, California Government Code 11 Cal. Code Regs. section

(FORM

The purpose of the Annual Registration Renewal Fee Report (Form

WHO MUST FILE A FORM

Every charitable nonprofit corporation, unincorporated association or trustee holding assets for charitable purposes that is required to register with the Attorney General's Office is also required to annually file Form

(1)a government agency,

(2)a religious corporation sole,

(3)a cemetery corporation regulated under Chapter

12 of Division 3 of the Business and Professions Code,

(4)a political committee defined in Section 82013 of the California Government Code which is required to and which does file with the Secretary of State any statement pursuant to the provisions of Article 2 (commencing with Section 84200) of Chapter 4 of Title 9,

(5)a charitable corporation organized and operated primarily as a religious organization, educational institution or hospital,

(6)a health care service plan that is licensed pursuant to Section 1349 of the Health and Safety Code and reports annually to the Department of Managed Health Care,

(7)corporate trustees which are subject to the jurisdiction of the Commissioner of Financial Institutions of the State of California or to the Comptroller of Currency of the United States. However, for testamentary trusts, such trustees should file a copy of a complete annual financial summary which is prepared in the ordinary course of business. See Probate Code sections

WHAT TO FILE

ALL REGISTRANTS, regardless of the amount of total revenue, must file Form

A copy of IRS Form 990,

EXTENSIONS FOR FILING

Extensions of time for filing Form

ANNUAL REGISTRATION RENEWAL FEE

All registrants must include with Form

Total Revenue |

Fee |

Less than $50,000 |

$25 |

Between $50,000 and $100,000 |

$50 |

Between $100,001 and $250,000 |

$75 |

Between $250,001 and $1 million |

$100 |

Between $1,000,001 and $5 million |

$200 |

Between $5,000,001 and $20 million |

$400 |

Between $20,000,001 and $100 million |

$800 |

Between $100,000,001 and $500 million |

$1,000 |

Greater than $500 million |

$1,200 |

NOTE: A REGISTRATION FEE IS NOT DUE WITH AN AMENDED REPORT FOR ANY REPORT PERIOD IN WHICH A FEE HAS ALREADY BEEN PAID UNLESS AN AMENDED REPORT CHANGES THE AMOUNT OF THE FEE DUE.

STATE OF CALIFORNIA

STATE CHARITY REGISTRATION NUMBER

The State Charity Registration Number is the Charitable Trust (CT) number assigned to an organization by the Registry of Charitable Trusts at the time of registration. If you do not know the organization's State Charity Registration Number, you may look it up using the Registry Search feature on the Attorney General's website at www.oag.ca.gov/charities. If you are unable to locate the State Charity Registration Number, leave that line blank and Registry staff will insert the number when it is received in the Registry of Charitable Trusts.

OTHER IDENTIFICATION NUMBERS

The corporation number is a

The organization number is a

The Federal Employer Identification Number is a

The following will assist you in responding to the questions on Form

PART A

Provide the beginning and ending dates of the most recent full accounting period (Month/Day/Year). An accounting period may be by calendar year (ex:

For each amount, report only whole dollars without rounding (e.g., $100.99 should be reported as $100).

Total Revenue - is the amount earned and received during the current year and it includes all contributions (including noncash contributions), gifts, grants, investment income, membership dues, program service revenues, special event revenue, and other revenue. For charities reporting to the IRS it is the amount reported as total revenue on IRS Form 990, Part 1, line 12; IRS Form

Noncash Contributions - Are noncash donations made to a charity. Common examples are donations of food, clothing, equipment, pharmaceutical and medical supplies. Noncash contributions exclude contributions made by cash, check, electronic funds transfer, debit card, credit card, or payroll deduction. For charities reporting to the IRS it is the amount reported to the IRS Form 990, Part VIII, line 1g.

DEPARTMENT OF JUSTICE

Page 4 of 5

Total Assets - Are resources owned by the charity which have current or future economic value that can be measured. For charities reporting to the IRS it is the amount reported in IRS Form 990, Part X, line 16, column (B); IRS Form

Program Expenses - Are expenses incurred by the organization to further its exempt purposes. For charities reporting to the IRS it is the amount reported in IRS Form 990, Part IX, line 25, column (B); IRS Form

Total Expenses - Are all expenses paid or incurred by the organization including program expenses, fundraising expenses, employee salary & wages, accounting, depreciation, management and administrative expenses. For charities reporting to the IRS it is the amount reported in IRS Form 990, Part IX, line 25, column (A); IRS Form

PART B

PART B, QUESTION #1

If “yes,” provide the following information on the attachment:

1)Full name of the director, trustee, or officer involved and position with the organization.

2)Nature of the transaction, e.g., loan to director, contract with officer's business, etc.

3)Attach a copy of the board of directors' meeting minutes authorizing the transaction.

4)Include, if applicable, the date of transaction; purpose of transaction; amount of the loan or contract; interest rates; repayment terms; balance due; type of collateral provided; copy of contract, loan or other agreement; amount paid to director, trustee, or officer for the period; evidence of other bids received related to the transaction.

PART B, QUESTION #2

If “yes,” provide the following information on the attachment:

1)Nature, date, amount of loss, and parties involved.

2)Description of the steps the organization took to recover the loss. Attach a copy of any police and/or insurance report.

3)Description of the procedures the organization implemented to prevent a recurrence of the situation.

STATE OF CALIFORNIA |

DEPARTMENT OF JUSTICE |

Page 5 of 5 |

|

(Rev. 02/2021) |

|

PART B, QUESTION #3

If “yes,” provide the following information on the attachment:

1)Description of the fine, penalty, or judgment and the circumstances that resulted in the payment, together with the name and title of the person(s) responsible and why the payment was made with the organization's funds.

2)Name of the organization or government agency that issued the fine, penalty or judgment, the amount and date of payment.

3)Copies of all communications with any governmental agency regarding the fine, penalty, or judgment.

4)Description of procedures the organization implemented to prevent a reoccurrence of the fine, penalty, or judgment.

PART B, QUESTION #4

If “yes,” provide an attachment listing the name, mailing address, telephone number, and

PART B. QUESTION #5

If “yes,” provide an attachment listing the name of each funding source, the name of the agency, mailing address, contact person, and telephone number. Do not submit IRS Schedule B as a response to this question. The required attachment must be made available for public viewing.

PART B, QUESTION #6

If “yes,” provide an attachment listing the date of each raffle.

PART B, QUESTION #7

If “yes,” provide an attachment describing whether the vehicle donation program is operated by the charity or a commercial fundraiser, together with the name, mailing address, telephone number and

PART B, QUESTION #8

If you received over $2 million in total revenue, as reported on IRS Form 990,

PART B, QUESTION #9

"Restricted assets" are assets the charity holds that may be used only for a specific purpose. The restriction may come from the governing documents, a condition imposed by the donor, or the solicitation that led to the donation. Examples of restrictions are endowment funds, building funds, gifts for specific purposes, and

If “yes,” provide the following information on the attachment:

1)A written statement confirming that all restricted funds were used consistent with their restricted purpose, and explaining why unrestricted net assets were negative at the end of the reporting period, and

2)Proof of directors' and officers' liability insurance coverage. Please include a cover note stating "confidential" when submitting the proof of insurance.

SIGNATURE

A signature of an authorized agent is required. An authorized agent may be the president or chief executive officer, treasurer or chief financial officer of a public benefit corporation; or a trustee if the organization is a trust; or other authorized agent of the organization. Signatures do not need to be original inked signature. Copies or electronic signatures are acceptable.

Form Data

| Fact Name | Detail |

|---|---|

| Governing Laws | The form RRF-1 adheres to Sections 12586 and 12587, California Government Code, and 11 Cal. Code Regs. sections 301-306, 309, 311, and 312. |

| Annual Submission Requirement | Charitable organizations must annually submit this form no later than four months and fifteen days after the end of their accounting period to avoid penalties. |

| IRS Extension Consideration | The Registry of Charitable Trusts honors IRS extensions for filing this report, aligning state and federal reporting timelines. |

| Filing Fee Scale | The renewal fee varies based on the reported total annual revenue, ranging from $25 for revenues less than $50,000 to $1,200 for revenues greater than $500 million. |

| Penalties for Non-compliance | Failure to submit the RRF-1 form can result in the loss of tax exemption, the imposition of a minimum tax of $800, plus interest, and/or fines or filing penalties. |

Instructions on Utilizing Ca Rrf 1

Filing the CA RRF-1 form is a necessary step for charitable organizations in California to maintain their registration with the Attorney General's office. This requirement helps ensure the transparency and accountability of organizations holding assets for charitable purposes. Compliance with this regulation is vital to operate legally in the state, and it aids in avoiding potential penalties or fines. Here is a straightforward, step-by-step guide to accurately completing and submitting the CA RRF-1 form.

- Start by obtaining the most recent version of the form from the California Attorney General's website at www.oag.ca.gov/charities.

- Fill out the Name of Organization at the top of the form, including any DBAs (Doing Business As) or other names the organization has used.

- Provide the organization's Address, City or Town, State, and ZIP Code.

- Enter the organization's Telephone Number and E-mail Address.

- If there has been a change of address or this is an amended report, check the appropriate box.

- Fill in the State Charity Registration Number, the Corporation or Organization No., and the Federal Employer ID No.

- Under PART A - ACTIVITIES, list the Total Revenue, Noncash Contributions, Total Assets, Program Expenses, and Total Expenses for your most recent full accounting period.

- In PART B, respond to each question about the organization's activities and transactions during the reporting period. Attach additional pages providing explanations and details for any "yes" answers, as required.

- Determine the appropriate Annual Registration Renewal Fee based on your Total Revenue and make your check payable to the Department of Justice.

- An authorized agent of the organization must sign and date the form, certifying the accuracy and completeness of the information provided.

- Gather the necessary attachments, including a copy of the IRS Form 990, 990-PF, 990-EZ, or 1120 as filed with the IRS (excluding Schedule B), or a treasurer's report if applicable.

- Mail the completed form, attachments, and payment to the Registry of Charitable Trusts at the address provided at the top of the form before the due date, which is four months and fifteen days after the end of the organization's accounting period.

Once submitted, the Registry of Charitable Trusts will review the materials to ensure compliance. It's essential to keep a copy of all documents sent for your records. Being diligent with the submission timeline and accuracy of the information provided helps to avoid unnecessary delays or queries from the registry, ensuring the organization stays in good standing.

Obtain Answers on Ca Rrf 1

- Who is required to file the CA RRF-1 form?

Charitable nonprofit corporations, unincorporated associations, or trustees holding assets for charitable purposes that are required to register with the California Attorney General's Office must annually submit the CA RRF-1 form. Exemptions apply to government agencies, religious corporations sole, cemetery corporations, political committees, certain religious organizations, educational institutions, hospitals, licensed health care service plans, and corporate trustees regulated by financial institutions authorities. However, testamentary trusts must submit a financial summary.

- What is the deadline for filing the CA RRF-1 form?

All registrants must file the CA RRF-1 form with the California Attorney General's Registry of Charitable Trusts no later than four months and fifteen days after the organization’s accounting period ends. For those on the calendar year, the deadline is May 15.

- What documents must be included with the CA RRF-1 form?

Alongside the CA RRF-1 form, organizations must submit a copy of the IRS Form 990, 990-PF, 990-EZ, or 1120 as filed with the IRS, excluding Schedule B. Organizations with revenue below the filing threshold for IRS Form 990-EZ must instead file a treasurer's report (CT-TR-1) to account for revenue, assets, and disbursements.

- Are extensions available for filing the CA RRF-1 form?

Yes, extensions granted by the IRS for filing IRS forms (990, 990-PF, 990-EZ, or 1120) will be honored by the Registry of Charitable Trusts. The RRF-1 form and the IRS form, along with documentation of the IRS extension and applicable renewal fee, should be filed concurrently at the extended deadline.

- What fees must be included with the CA RRF-1 form?

Fees are based on the organization's total reported revenue and range from $25 for revenues less than $50,000 to $1,200 for revenues greater than $500 million. Amended reports do not require additional fees unless the amendment changes the fee amount due.

- What information is needed for Part A of the CA RRF-1 form?

Part A requires reporting total revenue, noncash contributions, total assets, program expenses, and total expenses for the most recent full accounting period. These figures must be reported in whole dollars without rounding.

- What happens if Part B questions on the CA RRF-1 form are answered with "Yes"?

If any questions in Part B are answered "Yes," an attachment must be provided with detailed explanations, relevant information, and supporting documents according to specific instructions for each question, ranging from financial transactions with officers to the use of commercial fundraisers.

- What is the State Charity Registration Number, and where can it be found?

The State Charity Registration Number is a unique identifier assigned by the Registry of Charitable Trusts at the time of registration. If unknown, it can be searched using the Registry feature on the Attorney General's website or left blank for Registry staff to fill in upon receipt.

- Is it necessary to submit audit financial statements with the CA RRF-1 form?

Organizations receiving over $2 million in total revenue reported on IRS Form 990, 990-PF, or 990-EZ must include audited financial statements prepared according to generally accepted accounting principles and conducted by an independent certified public accountant.

- Who can sign the CA RRF-1 form?

The form must be signed by an authorized agent of the organization, which could be the president, chief executive officer, treasurer, chief financial officer, a trustee, or any other authorized representative. Electronic or copied signatures are acceptable.

Common mistakes

Not providing all used DBAs (Doing Business As) names: Organizations often overlook listing all the names under which they operate or have operated in the past. This can lead to a misrepresentation of the organization’s identity and potentially cause delays or complications with the form’s processing.

Misunderstanding revenue categories: Incorrectly categorizing the total revenue can lead to the wrong registration fee being calculated. This mistake might not only delay processing but could also result in fines for incorrect filing.

Skipping the noncash contributions section: Failing to report noncash contributions is a common oversight that can lead to an inaccurate portrayal of the organization's financial health and activities during the reporting period.

Incorrectly answering Part B questions: Organizations sometimes rush through the questionnaire in Part B, resulting in inaccurate yes/no answers. Misinterpreting these questions or not providing necessary details and explanations for "yes" responses can cause compliance issues.

Omitting signatures: A signature from an authorized agent is compulsory for the form’s validity. Forms submitted without this signature are incomplete and will not be processed until correctly signed, delaying official filings.

Failing to attach required documents: If any of the questions in Part B are answered with "yes," additional documentation and explanations must be attached. Overlooking this requirement can result in the form being considered incomplete, leading to potential fines and penalties.

When filling out the CA RRF-1 form, ensure that every section is completed with accurate and up-to-date information. Taking the time to review each part thoroughly can save organizations from unnecessary complications and help maintain their good standing with the Attorney General’s Registry of Charitable Trusts.

Documents used along the form

Understanding the myriad of forms and documents used in conjunction with the California RRF-1 form is crucial for nonprofit organizations operating within the state. These materials play a vital role in ensuring compliance with regulatory requirements, maintaining transparent financial practices, and fostering trust among donors, stakeholders, and the governing bodies overseeing charitable activities in California. Below is a breakdown of several key documents often used alongside the RRF-1 form, providing a snapshot of their functions and importance.

- IRS Form 990, 990-EZ, or 990-PF: These are the annual informational returns that tax-exempt organizations must file with the IRS. They provide detailed information about the organization’s finances, including revenue, expenditures, and compensation. The specific form used depends on the size and type of organization.

- CT-TR-1 (Treasurer’s Report): Required for organizations whose revenue falls below the threshold for filing IRS Form 990-EZ, this document serves as a financial report detailing revenue, assets, and disbursements.

- IRS Form 1120: While not common for most nonprofits, some charitable organizations structured as corporations may need to file this income tax return form.

- Board Meeting Minutes: These are records of meetings held by the organization's board of directors. They may be required to substantiate decisions related to financial transactions, contracts, or agreements reported on the RRF-1.

- Copies of Contracts, Loans, and Leases: If an organization reports any financial transactions with officers, directors, or trustees, copies of the relevant contracts, loans, or leases must be attached.

- Police or Insurance Reports: For organizations reporting theft, embezzlement, diversion, or misuse of assets, accompanying police or insurance reports may be necessary.

- Audit Reports: Organizations with total revenue over $2 million as reported on their IRS forms are required to attach audited financial statements prepared by an independent CPA in accordance with generally accepted accounting principles.

- Government Grants and Contracts Documentation: If an organization receives governmental funding, documentation regarding these grants and contracts may be requested to ensure funds are allocated and spent as agreed.

- Proof of Directors' and Officers' Liability Insurance: If applicable, organizations may need to provide evidence of liability insurance for their directors and officers, especially if there are financial constraints or negative unrestricted net assets reported.

Each of these documents plays a specific role in the broader context of nonprofit regulation and accountability. Whether it's providing a transparent view into an organization's financial health, ensuring that conflicts of interest are properly managed, or demonstrating compliance with specific grant or contractual obligations, these forms and records are integral to maintaining good standing and fulfilling the legal responsibilities inherent in managing a nonprofit. By diligently preparing and submitting these documents when required, nonprofits can not only avoid potential penalties but also build stronger relationships with their supporters and the communities they serve.

Similar forms

IRS Form 990, 990-EZ, 990-PF, or 1120: Similar to the CA RRF-1 form, these IRS documents require detailed financial information from nonprofit organizations regarding their revenue, expenses, and program activities. Both sets of forms aim to ensure transparency and compliance with financial regulations.

Form CT-TR-1 (Treasurer's Report): This form, much like the CA RRF-1, is designed for smaller organizations not required to file Form 990s with the IRS. It provides a simplified means to report financial activity, including total revenue and disbursements.

State Charity Registration Forms: Many states have their own version of the CA RRF-1 form for charitable organizations to register and report annually. These forms generally require similar information about the organization's finances, activities, and governance.

Form SI-100 (Statement of Information): Filed with the California Secretary of State, this form also collects information on an organization's address, officers, and functions, similar to the RRF-1's collection of organizational details for compliance purposes.

Nonprofit Annual Report (Various states): Similar to the CA RRF-1, nonprofit annual reports required by other states often ask for details on organizational structure, governance, and financials to maintain good standing and transparency.

Audited Financial Statements: For organizations generating a high level of revenue, as mentioned in the CA RRF-1 requirements, audited financial statements provide a detailed and verified report of financial health, similar in purpose to ensure organizational integrity and public trust.

Conflict of Interest Policy Statements: While not a form per se, many organizations must declare conflicts of interest annually, which ties back to the CA RRF-1’s inquiries about transactions involving officers, directors, or trustees, ensuring organizational decisions are made in its best interest.

Government Grant Applications and Reports: These documents often require detailed financial information and narratives about programs and activities, akin to the RRF-1's sections on funding sources, ensuring that funds are used appropriately and for the benefit of the public.

Schedule B (Form 990): Although not required with the CA RRF-1, this form lists donors' names and contributions to non-profits, similar to the RRF-1's interest in sources of funding and the relation of those sources to the organization's activities.

Financial Conflict of Interest Disclosure Forms (in academia and research): These forms, required within the scholarly community, like the CA RRF-1, aim to disclose financial interests that may influence research activities, ensuring integrity and public trust in institutional activities.

Dos and Don'ts

When working with the California Annual Registration Renewal Fee Report (RRF-1), it's essential to approach the process with care, to ensure your charitable organization remains in good standing. Below are key recommendations to guide you through the completion of the form:

Do's:

- Double-check all information for accuracy before submission. Ensuring the accuracy of your data, such as total revenue, assets, and program expenses, shields your organization from potential complications or discrepancies that may arise during the review.

- Include all required attachments. If the form indicates the need for additional details or documentation, such as explanations for "yes" answers on certain questions, make sure these are comprehensive and attached.

- File on time to avoid penalties. Submitting your RRF-1 form no later than four months and fifteen days after the end of your organization’s accounting period is critical to avoid fines or the loss of tax exemption.

- Honor IRS extensions. If your organization has been granted an extension by the IRS, include documentation of this extension with your filing to ensure compliance and avoid unnecessary penalties.

Don'ts:

- Do not overlook the signature of an authorized agent. The omission of the signature of an authorized agent at the end of the RRF-1 form can lead to the rejection of your submission. Ensure the form is signed by an individual with the appropriate authority within your organization.

- Do not leave fields blank. Incomplete forms can result in processing delays or denial. If a question does not apply to your organization, consider marking it “N/A” rather than leaving it empty, to indicate that you have reviewed the question.

- Do not forget to update your organization’s contact information. If there have been changes to your address, email, or telephone number, make sure to update this information on the form to ensure you receive all correspondence from the Registry of Charitable Trusts.

- Do not attach Schedule B of the IRS Form 990. While you must attach a copy of your IRS Form 990, 990-PF, or 990-EZ, remember that Schedule B is not required and should not be included in your submission to the Attorney General's Office.

Misconceptions

Understanding the State of California RRF-1 form involves navigating common misconceptions that can confuse or mislead charitable organizations. Shedding light on these misunderstandings is crucial for compliance and ensuring charities operate within the legal framework set forth by the state.

Misconception #1: All Charitable Organizations Must File the RRF-1 Form Regardless of Revenue

Many believe that every charitable entity in California must file the RRF-1 form, ignoring the nuances related to revenue. The truth is that while a significant number of charitable organizations are required to file this form annually, exemptions exist. For instance, governmental agencies, religious corporations solely, and certain types of trusts, among others, are not required to file. The need to file is primarily determined by the organization's registration status with the Attorney General's Office and its total annual revenue, not its mere existence or commitment to charitable activities.

Misconception #2: The Submission Deadline is the Same for All Organizations

A common misunderstanding is that the RRF-1 form has a universal deadline for all organizations. However, the actual submission deadline is specific to each organization, calculated as four months and fifteen days after the end of the organization's accounting period. This can lead to confusion among organizations that mistakenly believe they all share a single deadline, potentially resulting in late submissions and penalties.

Misconception #3: IRS Extensions Do Not Apply to the RRF-1 Filing Deadline

There exists a misconception that extensions granted by the IRS for filing federal returns do not affect the due date for the RRF-1 form. This is not accurate. The State of California will honor the same extensions granted by the IRS, allowing organizations additional time to submit their RRF-1 forms if they have received an IRS extension. This flexibility is crucial for organizations that encounter delays in finalizing their financial reports or face unforeseen circumstances affecting their ability to file on time.

Misconception #4: The RRF-1 Form is Solely About Reporting Financial Information

Many assume that the RRF-1 form is strictly a financial report detailing income, assets, and expenses. While financial information is a significant component, the form also requires disclosures regarding the organization's activities, governance, and relationships with third parties. Questions about financial transactions with officers, theft or embezzlement of funds, the use of commercial fundraisers, and the receipt of government funding highlight the form's broader scope. This comprehensive approach helps the Attorney General's Office monitor not just the financial health of charities but also their governance and operational integrity.

- Organizations must evaluate their specific situation to determine their filing requirement.

- Understanding the precise deadline based on the organization's fiscal year is essential.

- Securing and acknowledging IRS extensions can be crucial for timely compliance.

- A thorough review of organizational activities beyond finances is necessary for accurate reporting.

Key takeaways

Here are 10 key takeaways about filling out and using the California RRF-1 form:

- The RRF-1 form must be submitted annually to the Attorney General's Office by charitable organizations registered in California, with the purpose of assisting in the early detection of fiscal mismanagement and unlawful diversion of charitable assets.

- Organizations required to file include charitable nonprofit corporations, unincorporated associations, or trustees holding assets for charitable purposes, with certain exemptions like government agencies, religious corporations sole, and political committees, among others.

- The form should be filed no later than four months and fifteen days after the end of the organization's fiscal year, aligning with IRS filing extensions if applicable.

- Filing fees for the RRF-1 form vary based on the total annual revenue of the organization, with specific fees set for different revenue ranges.

- Along with the RRF-1 form, organizations must also submit a copy of their IRS Form 990, 990-PF, 990-EZ, or 1120, except for Schedule B which is not required. Organizations with revenue below the threshold for filing IRS Form 990-EZ shall provide a treasurer's report (CT-TR-1).

- If an organization has received an extension from the IRS for its Form 990, it can use this extension for the RRF-1 filing, provided that all requested documentation regarding the extension is provided.

- Part A of the form requires detailed financial information for the reporting period, including total revenue, noncash contributions, total assets, program expenses, and total expenses.

- Part B contains questions about specific transactions, relationships, and activities of the organization during the reporting period, such as contracts with officers, theft or misuse of assets, use of commercial fundraisers, governmental funding, raffles, and audits.

- Any "yes" responses to questions in Part B require an attachment with detailed explanations and, if applicable, supporting documents.

- The form must be signed by an authorized agent of the organization, which could be a principal officer or other authorized individual, with electronic or copied signatures accepted.

It is critical for organizations to adhere to the filing deadlines and requirements to ensure compliance and maintain their good standing with California's Registry of Charitable Trusts.

Popular PDF Forms

Capital One Voided Check - This Capital One form not only simplifies the direct deposit process but also aligns with federal banking regulations to ensure security.

Lic 215 - Applicants must thoroughly document their work history on the Lic 215, including periods of unemployment, for a holistic professional profile.