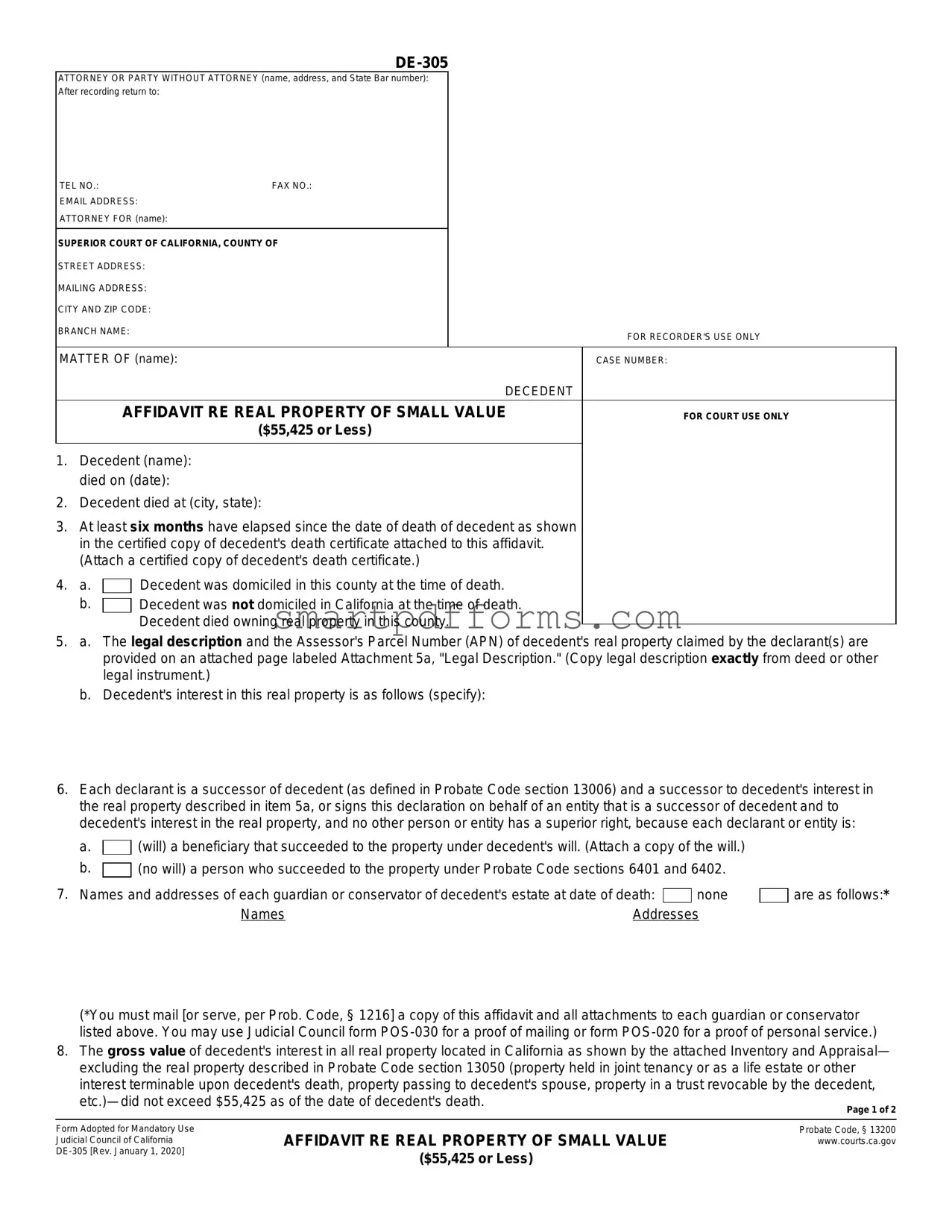

Blank California De 305 PDF Template

When someone passes away, dealing with the estate can feel overwhelming for the loved ones left behind, especially when it involves property. In California, the DE-305 form, or Affidavit re Real Property of Small Value ($55,425 or Less), offers a simplified process for transferring property when the total value of a deceased person's real estate in California does not exceed $55,425. This form is part of the probate process and is designed to minimize the complexity and time involved in transferring property ownership after someone’s death. It requires important details about the deceased, the property, and the person(s) claiming succession, and it mandates that certain criteria are met, including the passage of six months since the person’s death and the payment of the deceased's debts and funeral expenses. Additionally, the affidavit necessitates an attached certified copy of the death certificate, documentation regarding the property, and, if applicable, a copy of the decedent's will. The straightforward nature of this form belies the peace of mind it can bring to a difficult situation, helping ensure that the small but significant pieces of a loved one’s estate are taken care of according to California law, without the need for extensive legal proceedings.

Preview - California De 305 Form

ATTORNEY OR PARTY WITHOUT ATTORNEY (name, address, and State Bar number):

After recording return to:

TEL NO.: |

FAX NO.: |

|

|

EMAIL ADDRESS: |

|

|

|

ATTORNEY FOR (name): |

|

|

|

|

|

|

|

SUPERIOR COURT OF CALIFORNIA, COUNTY OF |

|

||

STREET ADDRESS: |

|

|

|

MAILING ADDRESS: |

|

|

|

CITY AND ZIP CODE: |

|

|

|

BRANCH NAME: |

|

|

FOR RECORDER'S USE ONLY |

|

|

|

|

|

|

|

|

MATTER OF (name): |

|

|

CASE NUMBER: |

|

|

DECEDENT |

|

AFFIDAVIT RE REAL PROPERTY OF SMALL VALUE |

FOR COURT USE ONLY |

||

|

($55,425 or Less) |

|

|

1.Decedent (name): died on (date):

2.Decedent died at (city, state):

3.At least six months have elapsed since the date of death of decedent as shown in the certified copy of decedent's death certificate attached to this affidavit. (Attach a certified copy of decedent's death certificate.)

4.a.

Decedent was domiciled in this county at the time of death.

Decedent was domiciled in this county at the time of death.

b. Decedent was not domiciled in California at the time of death. Decedent died owning real property in this county.

Decedent was not domiciled in California at the time of death. Decedent died owning real property in this county.

5.a. The legal description and the Assessor's Parcel Number (APN) of decedent's real property claimed by the declarant(s) are provided on an attached page labeled Attachment 5a, "Legal Description." (Copy legal description exactly from deed or other legal instrument.)

b.Decedent's interest in this real property is as follows (specify):

6.Each declarant is a successor of decedent (as defined in Probate Code section 13006) and a successor to decedent's interest in the real property described in item 5a, or signs this declaration on behalf of an entity that is a successor of decedent and to decedent's interest in the real property, and no other person or entity has a superior right, because each declarant or entity is:

a. (will) a beneficiary that succeeded to the property under decedent's will. (Attach a copy of the will.)

(will) a beneficiary that succeeded to the property under decedent's will. (Attach a copy of the will.)

b. (no will) a person who succeeded to the property under Probate Code sections 6401 and 6402.

(no will) a person who succeeded to the property under Probate Code sections 6401 and 6402.

7. Names and addresses of each guardian or conservator of decedent's estate at date of death: |

|

none |

|

are as follows:* |

|

|

|

||||

Names |

Addresses |

|

|

||

(*You must mail [or serve, per Prob. Code, § 1216] a copy of this affidavit and all attachments to each guardian or conservator listed above. You may use Judicial Council form

8.The gross value of decedent's interest in all real property located in California as shown by the attached Inventory and Appraisal— excluding the real property described in Probate Code section 13050 (property held in joint tenancy or as a life estate or other interest terminable upon decedent's death, property passing to decedent's spouse, property in a trust revocable by the decedent,

Form Adopted for Mandatory Use Judicial Council of California

AFFIDAVIT RE REAL PROPERTY OF SMALL VALUE

($55,425 or Less)

MATTER OF (Name):

DECEDENT

CASE NUMBER:

9.An Inventory and Appraisal of all of decedent's interests in real property in California is attached. The appraisal was made by a probate referee appointed for the county in which the property is located. (You must prepare the Inventory on Judicial Council forms

10.No proceeding is now being or has been conducted in California for administration of decedent's estate.

11.Funeral expenses, expenses of last illness, and all known unsecured debts of the decedent have been paid. (NOTE: You may be personally liable for decedent's unsecured debts up to the fair market value of the real property and any income you receive from it.)

I declare under penalty of perjury under the laws of the State of California that the foregoing is true and correct. Date:

(TYPE OR PRINT NAME)* |

|

|

|

|

(SIGNATURE OF DECLARANT) |

Date: |

|

|

|

||

|

|

|

|

|

|

(TYPE OR PRINT NAME)* |

|

|

(SIGNATURE OF DECLARANT) |

||

|

|

|

|

|

SIGNATURE OF ADDITIONAL DECLARANTS ATTACHED |

*A declarant claiming on behalf of a trust or other entity should also state the name of the entity that is a beneficiary under the decedent's will, and declarant's capacity to sign on behalf of the entity (e.g., trustee, Chief Executive Officer, etc.).

NOTARY ACKNOWLEDGMENT |

(NOTE: No notary acknowledgment may be affixed as a rider (small strip) to this page. If addi- |

|

tional notary acknowledgments are required, they must be attached as |

||

|

||

|

|

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not the truthfulness, accuracy, or validity of that document.

STATE OF CALIFORNIA, COUNTY OF (specify):

On (date): |

, before me (name and title): |

personally appeared (name(s)): |

|

who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the instrument in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

I certify under PENALTY OF PERJURY under the laws of the |

|

(NOTARY SEAL) |

||

State of California that the foregoing paragraph is true and correct. |

|

|

||

WITNESS my hand and official seal. |

|

|

||

|

|

|

|

|

(SIGNATURE OF NOTARY PUBLIC) |

|

|

||

|

|

|

|

|

(SEAL) |

|

|

||

|

|

|

|

CLERK'S CERTIFICATE |

I certify that the foregoing, including any attached notary acknowledgments and any attached legal description of the property (but excluding other attachments), is a true and correct copy of the original affidavit on file in my office. (Certified copies of this affidavit do not include the

(1) death certificate, (2) will, or (3) inventory and appraisal. See Probate Code section 13202.)

Date: |

Clerk, by |

, Deputy |

|

AFFIDAVIT RE REAL PROPERTY OF SMALL VALUE

($55,425 or Less)

Page 2 of 2

For your protection and privacy, please press the Clear This Form button after you have printed the form.

Print this form

Save this form

Clear this form

Form Data

| Fact Number | Fact Name | Description |

|---|---|---|

| 1 | Form Identifier | DE-305 |

| 2 | Form Title | Affidavit re Real Property of Small Value ($55,425 or Less) |

| 3 | Governing Law | Probate Code, § 13200 |

| 4 | Eligibility Criteria | Decedent's gross value of interest in all real property in California must not exceed $55,425 as of the date of decedent's death |

| 5 | Requirement for Attachments | Attachments required include certified copy of decedent's death certificate, legal description of the property, and an Inventory and Appraisal. |

| 6 | Appraisal Authority | Appraisal must be done by a probate referee appointed for the county in which the property is located. |

| 7 | Notary Acknowledgment | An acknowledged notary public or other officer verifies only the identity of the person signing the document, not the validity of the document itself. |

Instructions on Utilizing California De 305

Filling out the California DE-305 form is a streamlined process designed to transfer real property of small value (not exceeding $55,425) without the complexities of a full probate proceeding. This procedure primarily benefits successors of a decedent's estate, bringing a simpler, cost-effective path to claim their inheritance. Understanding each step is crucial to ensure accuracy and legal compliance.

- Begin by providing the name, address, and State Bar number (if applicable) of the attorney or party without an attorney. Include contact information such as telephone, fax numbers, and email address.

- Input the name of the attorney representing (if any) in the designated space.

- Fill in the details of the Superior Court of California, including county, street, and mailing address, city, zip code, and branch name.

- Identify the matter by entering the name of the decedent and case number if available.

- Specify the decedent's name and the date of death. Confirm the location of death and attach a certified copy of the death certificate.

- Indicate whether the decedent was domiciled in the county at the time of death and if the decedent owned real property in the county, requiring an attachment for the legal description and Assessor's Parcel Number (APN).

- Detail how the declarant is a successor to the decedent's interest in the described property, attaching relevant documentation such as a will or citing succession under Probate Code sections 6401 and 6402.

- Provide the names and addresses of any guardian or conservator of the decedent’s estate at date of death, if applicable. Note the requirement to serve or mail a copy of this affidavit and all attachments to each listed individual.

- Assert that the gross value of decedent's interest in all real property in California did not exceed $55,425 as of the decedent's death date.

- Attach an Inventory and Appraisal of the decedent's interests in real property, completed by a probate referee appointed for the county where the property is located. Guidance on selecting a probate referee can be found on the California State Controller's Office website or through court resources.

- Confirm that no proceeding is currently or has been conducted in California for the administration of the decedent's estate.

- Acknowledge that funeral expenses, last illness expenses, and all known unsecured debts of the decedent have been paid, understanding the potential personal liability for the decedent's debts.

- Complete the form with a declaration under penalty of perjury, including the date, printed name, and signature of the declarant. Include additional declarations if the claim is being made on behalf of multiple successors or an entity.

- Ensure a Notary Acknowledgment is attached, completed by a notary public to verify the identity of the declarants.

- Review the Clerk's Certificate section, understanding that it confirms the document's authenticity for official records, excluding specific attachments like the death certificate, will, or inventory and appraisal.

With the form duly completed and attachments in order, submit it according to the specified county’s procedures for filing legal documents. Proper submission initiates the process to legally transfer the decedent's real property to the rightful successor(s), avoiding the need for a formal probate process for small estates.

Obtain Answers on California De 305

What is a DE-305 form?

The DE-305 form, also known as the Affidavit re Real Property of Small Value ($55,425 or less), is a legal document used in California. It allows the transfer of real property valued at $55,425 or less, belonging to a deceased person, without going through a full probate process.

Who can use the DE-305 form?

This form is intended for the successors of a person deceased, defined according to Probate Code section 13006. These successors could be beneficiaries named in a will or, if there is no will, those who are entitled to the property by law.

What requirements must be met to file a DE-305 form?

- The deceased must have owned real property in California valued at $55,425 or less.

- At least six months must have elapsed since the deceased's death.

- The deceased's will (if any) and a certified copy of the death certificate must be attached to the affidavit.

- All funeral expenses, expenses of the last illness, and known unsecured debts of the deceased must have been paid.

What information is needed to complete the DE-305 form?

Required information includes the full legal description and the Assessor's Parcel Number (APN) of the real property, the value of the property, a statement that the successor(s) has a right to the property, and a certified copy of the death certificate of the decedent, among other details.

How does one determine the value of the property for the DE-305 form?

The value of the property is determined by a probate referee appointed for the county where the property is located. The Inventory and Appraisal forms DE-160 and DE-161 are used for this process.

Where should the DE-305 form be filed?

The DE-305 form should be filed in the superior court of the county where the deceased owned property or where the deceased lived.

Is a notary required for the DE-305 form?

Yes, the DE-305 form must be signed by the declarant(s) in the presence of a Notary Public or an authorized officer who can take acknowledgments.

What happens after filing the DE-305 form?

Upon approval, the court will issue a certified copy of the affidavit. This copy can be used to transfer the property to the successor(s) without the need for a formal probate process.

Are there any costs associated with filing the DE-305 form?

Yes, there may be filing fees and costs associated with the notarization and obtaining certified copies of the necessary documents. The exact fees can vary by county.

Can the DE-305 form be used if there are multiple pieces of property or if the total value exceeds $55,425?

No, if the deceased's total real property value in California exceeds $55,425 or there are multiple properties that individually or collectively exceed this amount, the DE-305 form cannot be used, and a more formal probate process may be necessary.

Common mistakes

Filling out the California DE-305 form, which pertains to the affidavit regarding real property of small value (currently $55,425 or less), involves several critical steps that require close attention to detail. This form is used after a person has passed away, allowing the transfer of property without a formal probate process if the real estate's value falls below a certain threshold. Making errors on this form can lead to delays, legal complications, or the rejection of the application. Here are eight common mistakes people make when completing the DE-305 form:

- Not attaching a certified copy of the decedent's death certificate - This is a critical requirement for validating the circumstances of the property transfer.

- Incorrectly describing the property - The legal description and Assessor's Parcel Number (APN) must match exactly those in official records. An attached page labeled "Attachment 5a, Legal Description" should contain precise details.

- Failing to attach a copy of the decedent's will (if applicable) - When the property transfer is being made under the terms of a will, a copy must be attached to prove the declarations made in the affidavit.

- Omitting the names and addresses of any guardians or conservators of the decedent's estate - If applicable, this information must be included, and copies of the affidavit and all attachments must be mailed or served to these individuals.

- Not accurately reporting the gross value of the decedent's interest in real property located in California - This value should exclude certain types of property as outlined in the Probate Code section 13050 and must not exceed $55,425 as of the date of decedent's death.

- Failure to attach an Inventory and Appraisal of all real property interests in California conducted by a probate referee - The Inventory on Judicial Council forms DE-160 and DE-161 is mandatory and must be prepared properly.

- Incorrectly stating that no proceeding is being or has been conducted in California for the administration of the decedent's estate - If such proceedings exist or have existed, they must be disclosed.

- Forgetting to declare that funeral expenses, expenses of the last illness, and all known unsecured debts of the decedent have been paid - This declaration is crucial to avoid personal liability for the decedent’s debts.

Each of these mistakes can significantly impact the process of transferring real property under the affidavit of small value system. To ensure a successful submission, careful review and adherence to all form requirements is necessary.

Documents used along the form

When handling estate matters in California, especially for those dealing with the probate process or managing a decedent's small estate, the California DE-305 form plays a crucial role. This form is just one of several documents you might need throughout the process. Here’s a list of other forms and documents commonly used alongside the DE-305 form to ensure the estate is managed and distributed according to California law.

- Death Certificate: A certified copy of the decedent’s death certificate is necessary to accompany the DE-305 affidavit, validating the date and location of death.

- Legal Description of Property Document: This provides a detailed description of the real property’s boundaries and location, which is required for the attachment 5a in the DE-305 form.

- Inventory and Appraisal (Forms DE-160 and DE-161): These forms list and appraise the value of the decedent’s real and personal property within California, excluding certain joint tenancy assets and others specified by law.

- Copy of the Will: If the decedent left a will declaring beneficiaries, a copy needs to be attached to the DE-305 form to clarify the successors.

- Probate Referee’s List: To complete the Inventory and Appraisal, you must select a probate referee from the list provided by the California State Controller's Office or the local court. This official will appraise the property’s value.

- Notice of Proposed Action (Form DE-165): If there’s an action proposed regarding the estate that requires notifying interested parties, this form is used to inform and potentially obtain consent or hear objections.

- Proof of Mailing (Form POS-030) or Proof of Personal Service (Form POS-020): To confirm that all required notifications or documents have been properly sent to guardians, conservators, or other relevant parties, these forms provide the necessary verification.

- Order for Final Discharge: After all activities related to the estate have been completed, this court order releases the personal representative from their duties, indicating the estate can be officially closed.

Each of these documents serves a specific purpose in the estate management process, ensuring that all legal requirements are met and the decedent's assets are handled appropriately. It's essential to familiarize yourself with these forms, alongside the DE-305 affidavit, to navigate the complexities of estate administration in California smoothly.

Similar forms

The Small Estate Affidavit is closely related to the California DE 305 form. Both are used to expedite the transfer of assets when an estate falls below a certain value threshold, avoiding the often lengthy probate process. However, the Small Estate Affidavit is more broadly used for personal property, while the DE 305 specifically addresses real property of small value.

The Affidavit for Transfer of Personal Property without Probate shares similarities with the DE 305 form in its purpose to simplify the estate settlement process for assets beneath a certain value. Unlike DE 305, which is strictly for real property in California, this affidavit can apply to various types of personal property and is used in many jurisdictions beyond California.

The Affidavit of Succession to Real Property is used in some states as a way for heirs to claim ownership of real property without going through probate when the estate is under a specific size. Like the DE 305 form, it requires detailed information about the decedent and the property but varies by state in terms of value limits and qualifying criteria.

The Transfer on Death Deed (TODD) is a document that also avoids the probate process for real estate, similar in aim to the DE 305. However, a TODD must be executed by the property owner before their death, designating a beneficiary, whereas the DE 305 form is completed by heirs or successors after the owner's death.

The Petition to Determine Succession to Real Property shares objectives with the DE 305 form but is used for larger estates that exceed the DE 305's value cap. While both seek to bypass comprehensive probate proceedings for real estate, this petition usually involves a more detailed court process.

Joint Tenant with Right of Survivorship Deed, while not an affidavit or petition, similarly facilitates the transfer of real property upon death without probate. This deed type allows ownership to pass directly to the surviving co-owner(s), contrasting with the DE 305, which requires a post-death declaration by successors.

The Declaration of Homestead provides a mechanism for protecting a portion of a homeowner's equity from creditors, which indirectly affects heirs. Unlike the DE 305 form's focus on transferring property rights, this declaration is about safeguarding an asset's value, benefiting successors in a more roundabout way.

Revocable Living Trust Documents can include provisions for the direct transfer of real property upon death, bypassing probate similarly to the DE 305 form's intent. Trusts, however, require setup during the owner's lifetime and can cover a broader range of assets and more complex instructions for distribution.

The Beneficiary Deed, available in some states, allows property owners to name beneficiaries who will receive the property when the owner dies, avoiding probate. Like the DE 305, it streamlines property transfer but must be prepared and recorded before death, contrasting with the DE 305's post-death filing requirement.

Dos and Don'ts

Filing out the California DE-305 form, which is used for transferring real property of small value ($55,425 or less) without formal probate proceedings, can seem daunting at first. Here are some do's and don'ts to help guide you through the process.

Do:- Ensure all information is accurate: Double-check all the details you enter, such as addresses, names, and numbers, to ensure they match the official documents.

- Attach a certified copy of the decedent's death certificate: This is a crucial step to confirm the decedent's passing and to validate the affidavit.

- Provide a legal description of the property: This includes the Assessor's Parcel Number (APN) and must be copied exactly from the deed or other legal instrument.

- Include proof of your right to claim the property: If the property is inherited through a will, attach a copy of the will. Otherwise, demonstrate your succession under Probate Code sections 6401 and 6402.

- Complete an Inventory and Appraisal form: This, done by a probate referee, verifies the value of the property does not exceed the statutory limit.

- Check for any notary requirements: Some sections may require notarization. Ensure that these are completed properly to avoid delays or rejection of the form.

- Skip mailing notifications: If there are named guardians or conservators of the decedent’s estate, you must mail them a copy of this affidavit following the specified rules.

- Ignore debts and expenses: Confirm that funeral expenses, expenses of last illness, and all known unsecured debts of the decedent have been paid before claiming the property.

- Forget to attach necessary documents: Missing attachments, such as the death certificate, will, or Inventory and Appraisal, can cause your form to be incomplete.

- Overlook the property's value limit: Ensure the gross value of the decedent's real property in California does indeed not exceed $55,425. If it does, this form cannot be used.

- Fill out the form without consulting if needed: If you're uncertain about any steps or legal jargon, consulting with an attorney can prevent mistakes that could jeopardize your claim.

- Use outdated information: Verify that all information, especially concerning probate referees and legal descriptions, is current and accurate to prevent issues.

Following these dos and don'ts can make navigating the DE-305 form much smoother and help ensure your filing is successful. Remember, this process is a legal declaration, so taking the time to do it correctly is crucial.

Misconceptions

When navigating the process of handling a decedent's real property in California, particularly with the use of Form DE-305, Affidavit for Real Property of Small Value ($55,425 or Less), there are several misconceptions that can lead to confusion. Understanding these misconceptions is crucial to correctly managing and transferring small estate properties.

- Misconception 1: The DE-305 form can be used immediately after the decedent's death.

Many believe that the DE-305 form can be filed immediately following a person's death. However, the form stipulates that at least six months must have elapsed since the decedent passed away. This waiting period allows time for all debts and obligations of the estate to be identified and addressed.

- Misconception 2: The DE-305 form applies regardless of the decedent's domicile.

Another common misunderstanding is that the DE-305 form can be used for any decedent who owned property in California, regardless of where they were domiciled at the time of death. In reality, Section 4 of the form differentiates between those who were domiciled in the county and those who were not domiciled in California at all, affecting the process of filing the affidavit.

- Misconception 3: Filing the DE-305 form transfers property ownership immediately.

There's a belief that once the DE-305 form is filed and recorded, the property ownership instantly transfers to the successor. The truth is more complex, as this form is part of a legal process involving the assessment of the estate's value, fulfilling any debts, and ensuring no other superior claims exist. It does signify the claimant's right but does not by itself complete the property transfer.

- Misconception 4: No appraisal is needed for properties valued at $55,425 or less.

Some think that because the property falls under the small value threshold, no formal appraisal is necessary. However, the form explicitly requires an attached Inventory and Appraisal—including the probate referee's appraisal—of the decedent's interest in all real property located in California, to ensure the value does not exceed $55,425 as of the date of the decedent's death.

Clarifying these misconceptions ensures that individuals are better prepared to correctly complete and submit the DE-305 form, facilitating a smoother process for the legal transfer of the decedent's real property of small value in California.

Key takeaways

Filing a California DE-305 form is an essential process for those handling the real estate of a decedent whose property in California is valued at $55,425 or less. This affidavit is a critical document for successors of the decedent, enabling them to manage or distribute the property according to the state's probate laws. Here are six key takeaways about filling out and using the DE-305 form:

- The DE-305 form requires detailed information about the decedent and their property, including the decedent's name, date of death, and a legal description of the real property. This ensures a precise record for legal and official use.

- It is mandatory to attach a certified copy of the decedent's death certificate to the affidavit. This serves as proof of the decedent's death and the starting point for the six-month waiting period before the affidavit can be filed.

- Successors must clarify their relationship to the decedent to establish their legal right to the property, whether through a will or, in the absence of a will, as defined by Probate Code sections 6401 and 6402. Documentation, such as a copy of the will, may be required.

- An Inventory and Appraisal of the decedent's real property must be attached, evaluated by a probate referee. This step is necessary to officially determine the property's value, ensuring it does not exceed the $55,425 threshold.

- The form stipulates that no probate proceedings for the decedent's estate should be underway or completed in California. This requirement helps to prevent potential legal conflicts or overlaps in estate administration.

- Signing the DE-305 form incurs a legal declaration under penalty of perjury that all provided information and attached documents are true and correct. This underscores the importance of accuracy and honesty in completing the form.

Understanding these key aspects of the DE-305 form helps ensure that the process is handled correctly, respecting both legal obligations and the decedent's legacy.

Popular PDF Forms

Devry University Transcript Request - Whether you're a current student or a graduate, this form enables you to receive your Keller academic transcript.

Ysq-r - Explores feelings of dependency on others and fear of being left alone.