Blank Calpers Retirement Application PDF Template

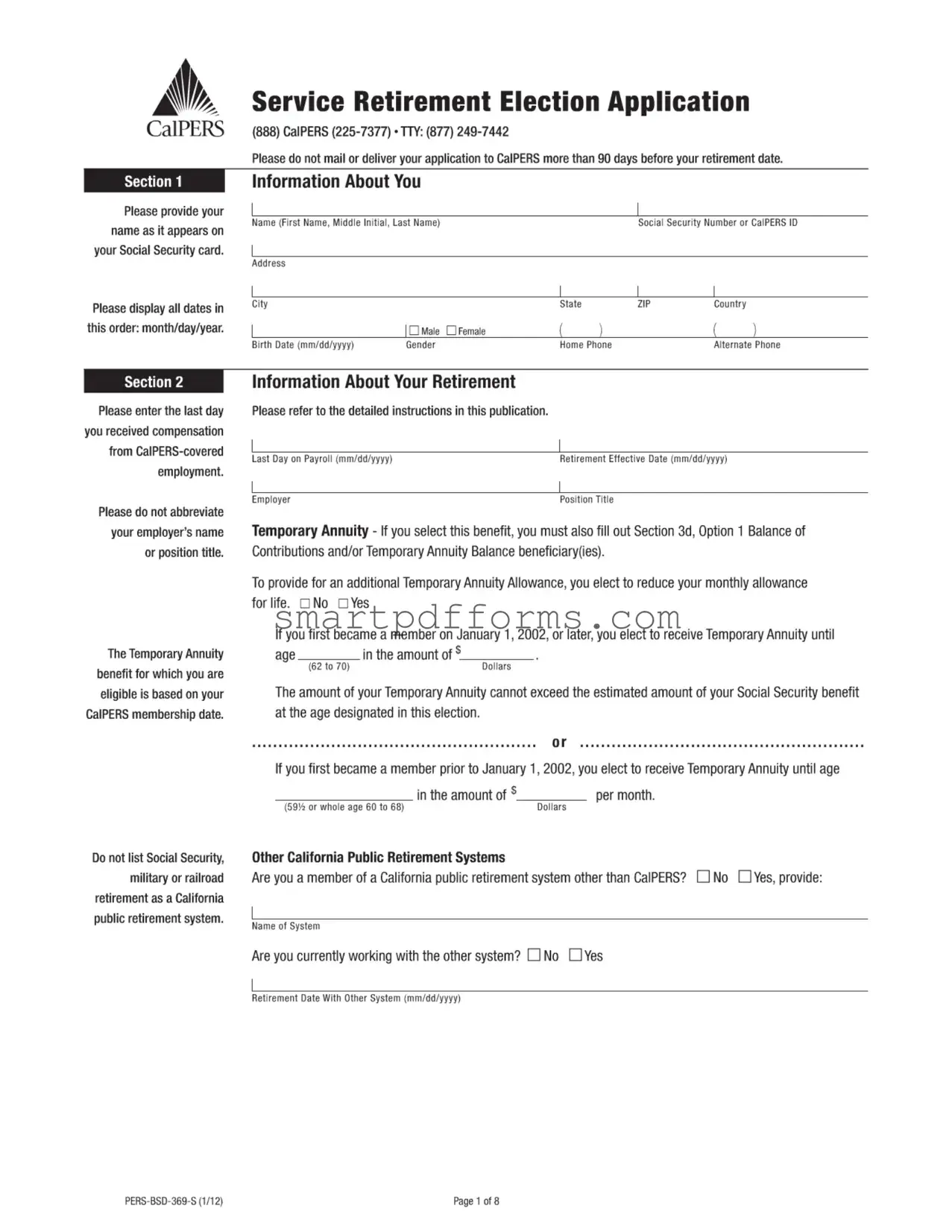

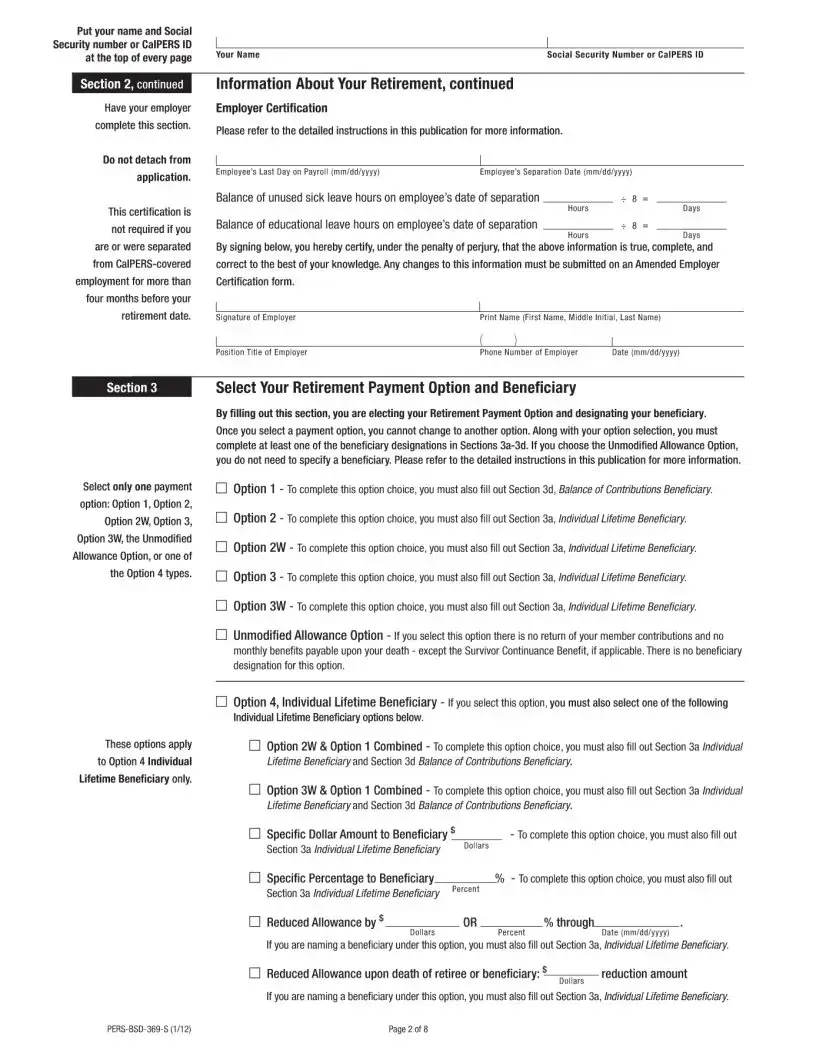

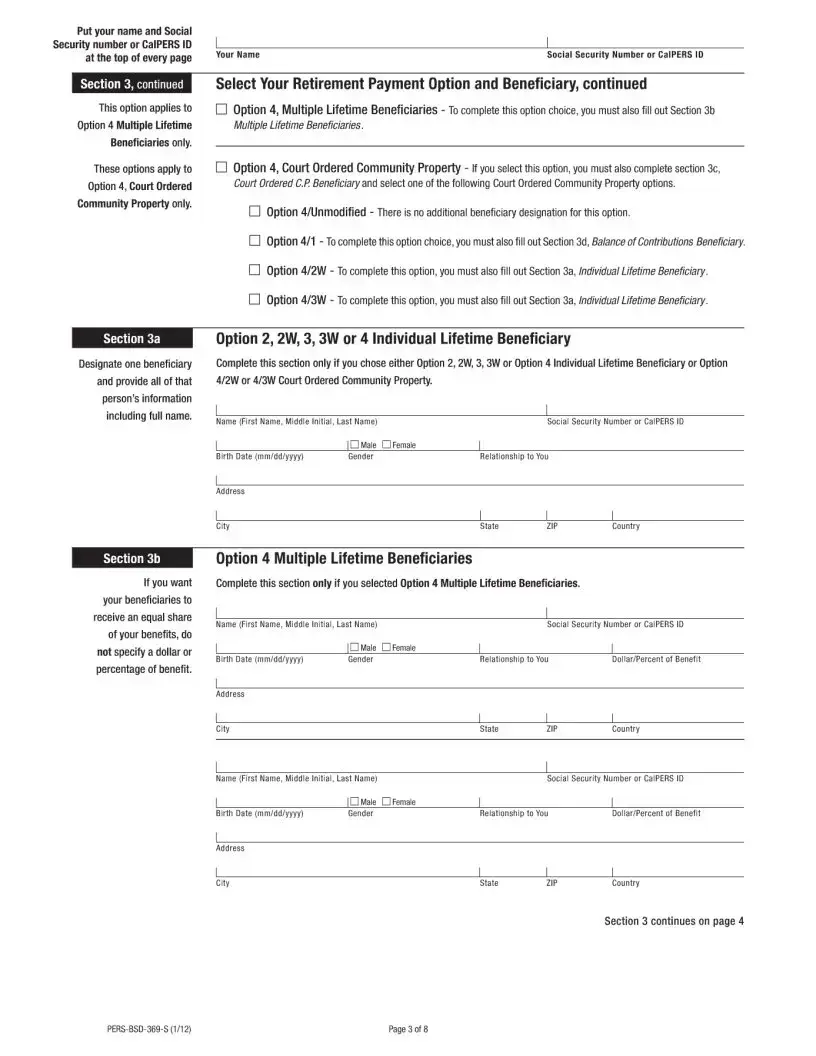

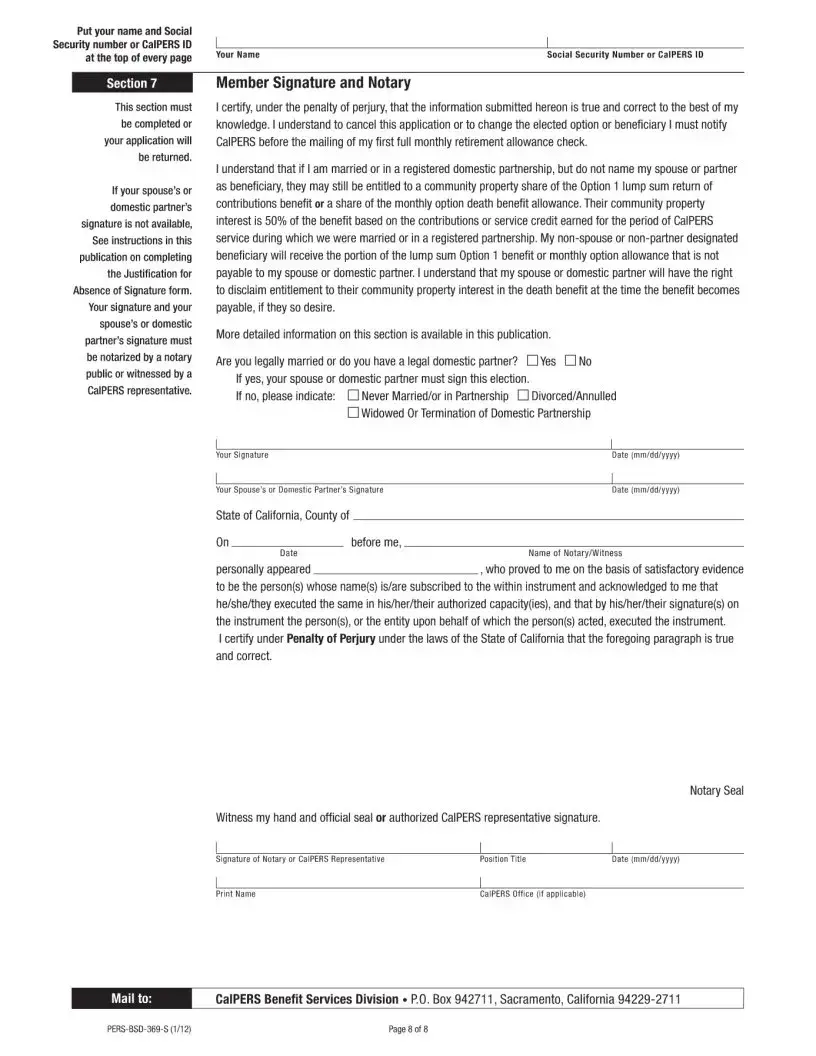

Navigating the steps towards retirement can be both an exciting and intricate process, especially when it involves completing the CalPERS Retirement Application form. This form is a crucial first step for employees covered under the California Public Employees' Retirement System, simplifying the transition from working life to retirement. The application is meticulously designed to collect essential information in several sections, starting with personal details like one's name, Social Security Number or CalPERS ID, and contact information, ensuring these align with Social Security records for consistency. The form also requests specifics about your retirement including the last day of receipt of compensation and the effective date of retirement, which cannot be more than 90 days in the future. An interesting feature is the option for a Temporary Annuity, allowing for a reduction in the monthly allowance in exchange for certain benefits, dependent on one's membership date with CalPERS. Additionally, the application probes into affiliations with other California public retirement systems, which could influence benefits. Critical too is the Employer Certification section, which must be filled out if you were active in CalPERS-covered employment up to four months before retirement, detailing your last day of payroll, separation, and balance of unused leave, validating your application's information. Furthermore, retirees are faced with important decisions in the payment options segment, mandating a choice among several beneficiary designation options—each with its specific instructions and implications for one's retirement benefits and legacy. This form serves as a comprehensive approach to ensuring future retirees’ needs and wishes are accurately captured and effectively implemented, guiding applicants through a pivotal phase of their lives with structured clarity and support.

Preview - Calpers Retirement Application Form

Form Data

| Fact Name | Description |

|---|---|

| Application Identification | The form used is PERS-BSD-369-S(1/12). |

| Retirement Application Timeliness | Applications should not be submitted to CalPERS more than 90 days before the retirement date. |

| Personal Information Requirements | Applicants must provide personal details as they appear on their Social Security card and include a CalPERS ID or Social Security Number. |

| Date Format Specification | All dates must be displayed in the format month/day/year. |

| Employment and Compensation | Applicants are required to enter the last day they received compensation from CalPERS-covered employment without abbreviating their employer’s name or position title. |

| Temporary Annuity Option | The form allows members to elect a Temporary Annuity reduction in their monthly allowance to provide a temporary increase until a specified age. |

| Beneficiary Designation | Applicants must designate a beneficiary, which affects the choice of retirement payment options available to them. |

| Irrevocability of Payment Option | Once a retirement payment option is selected and retirement commences, it cannot be changed. |

| Employer Certification | Employer certification is required as part of the application, including details of the applicant's last day on payroll and hours of unused sick leave. |

| Other California Public Retirement Systems | Applicants must disclose if they are members of other California public retirement systems, excluding Social Security, military, or railroad retirement systems. |

Instructions on Utilizing Calpers Retirement Application

Filling out the CalPERS Retirement Application form is a pivotal step for public employees in California entering retirement. This process involves crucial details that dictate the nature of your retirement benefits. As you embark on this journey, understanding each section and what information to provide is paramount. Thereafter, the information you submit will undergo review, and adjustments to your retirement plan will be made accordingly. Here's a step-by-step guide to navigate through the form efficiently.

- Start with Section 1. Enter your full name exactly as it is displayed on your Social Security card to avoid any discrepancies.

- Fill in your birth date using the specified format: month/day/year. This ensures clarity and consistency with official documents.

- Provide your Social Security Number or CalPERS ID, along with your full address, including city, ZIP, state, and country. This information helps in identifying your account and ensuring that all communication reaches you.

- Indicate your gender and provide your home and alternate phone numbers. This basic information is vital for record-keeping and correspondence purposes.

- Move to Section 2. Input the last day you received compensation from CalPERS-covered employment. Remember, accurate details here are crucial for calculating your benefits.

- In the same section, specify the last day on your payroll and your retirement effective date, both in the month/day/year format. Getting these dates right is critical for the initiation of your retirement benefits.

- If applicable, decide on the Temporary Annuity option. If selecting "Yes," you must fill out Section 3d, detailing the Balance of Contributions and/or Temporary Annuity Balance beneficiary(ies).

- Answer if you are a member of another California public retirement system. If "Yes," provide its name and state whether you are currently working with them, along with the retirement date with the other system.

- Ensure your employer completes their part of Section 2, verifying your last day on payroll, separation date, and balances of unused sick and educational leave.

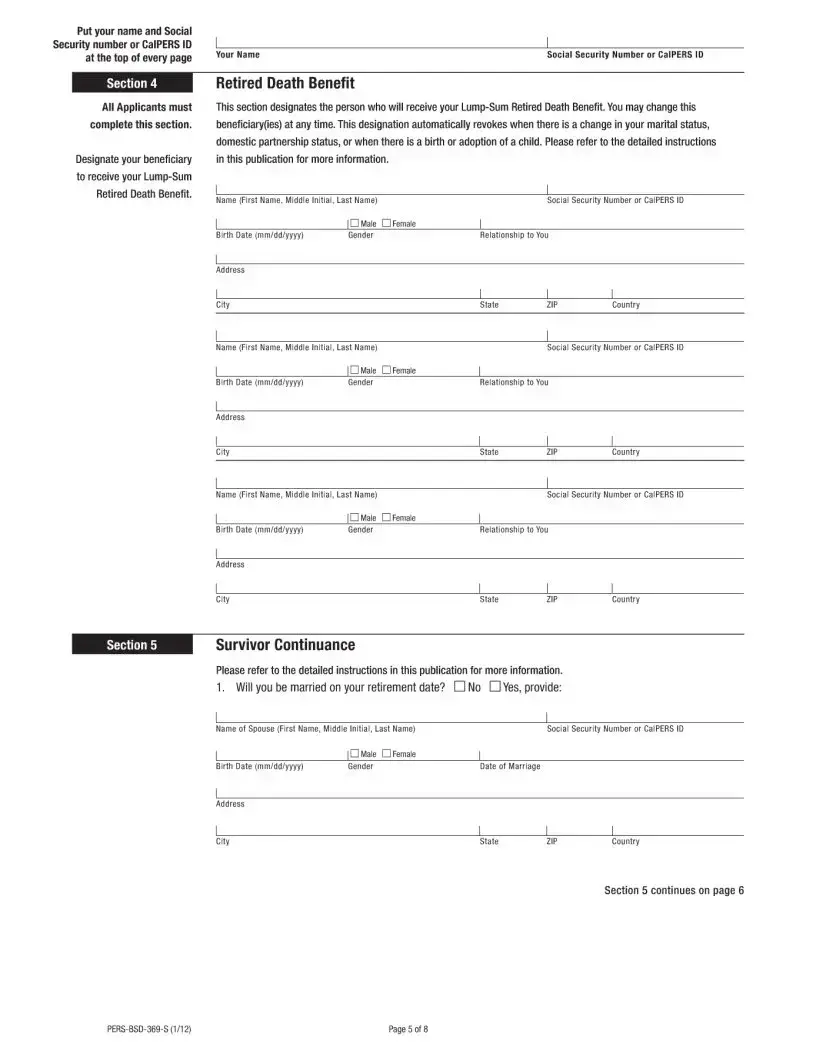

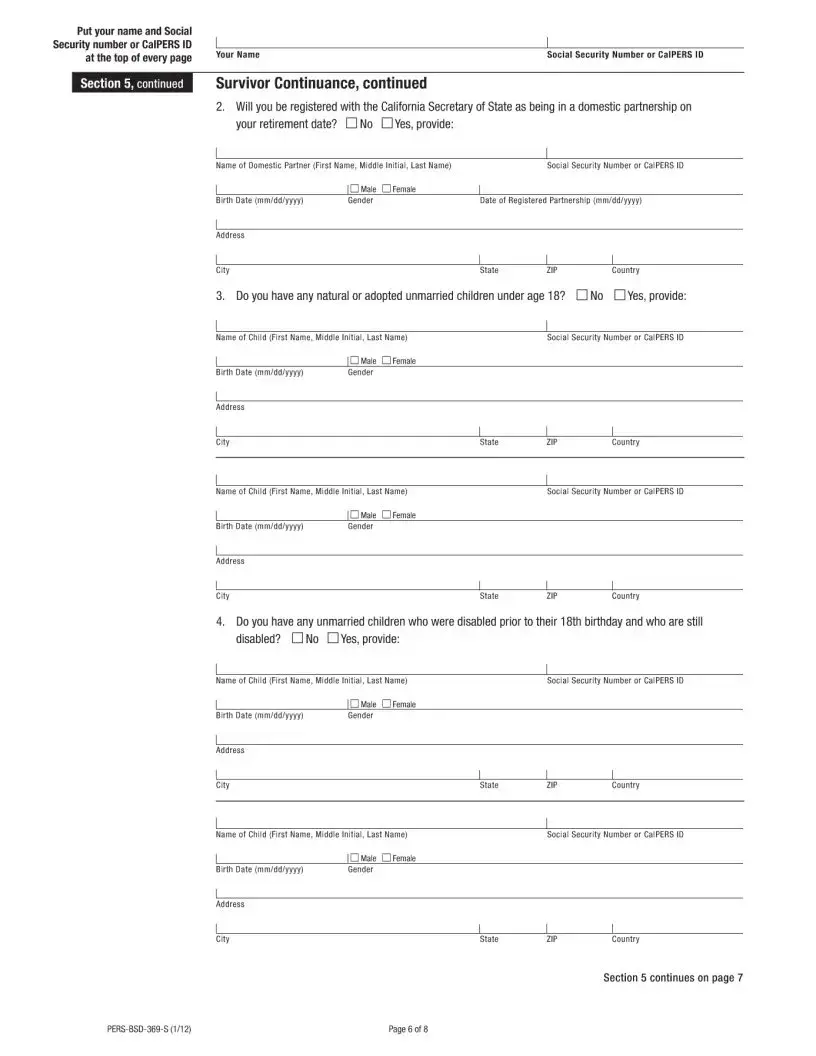

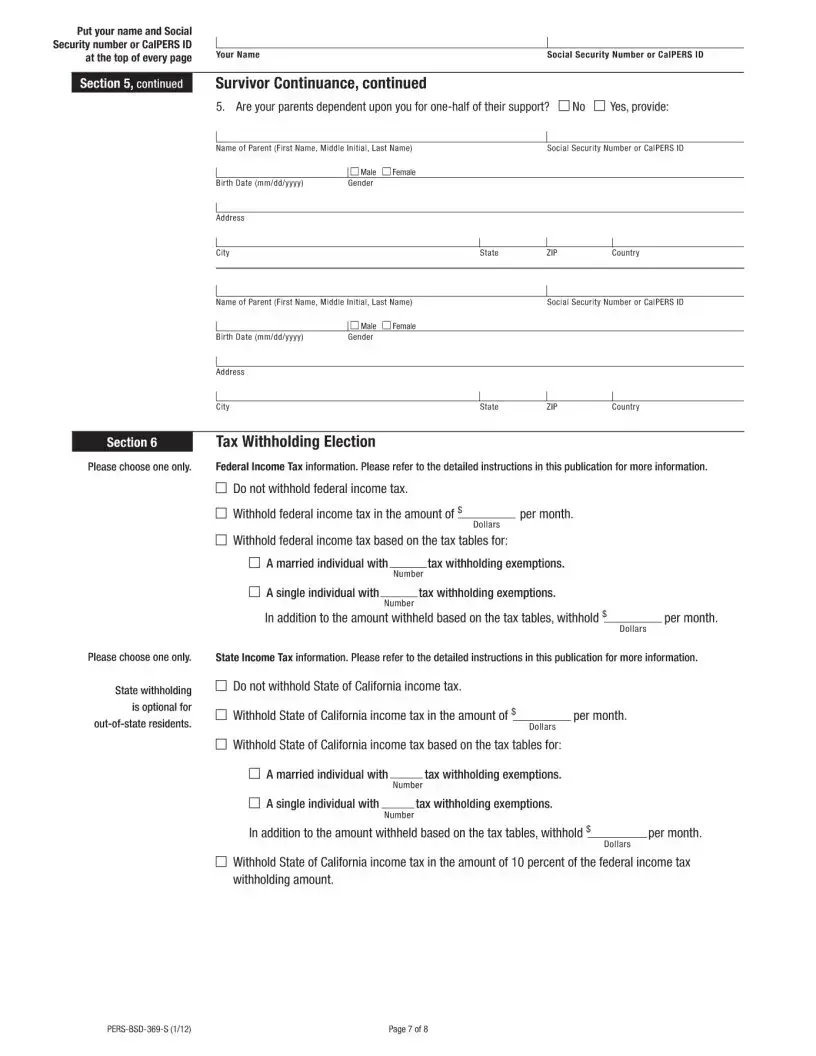

- Choose your Retirement Payment Option in Section 3. Select only one from the options provided, which include various beneficiary designation necessities based on the choice made.

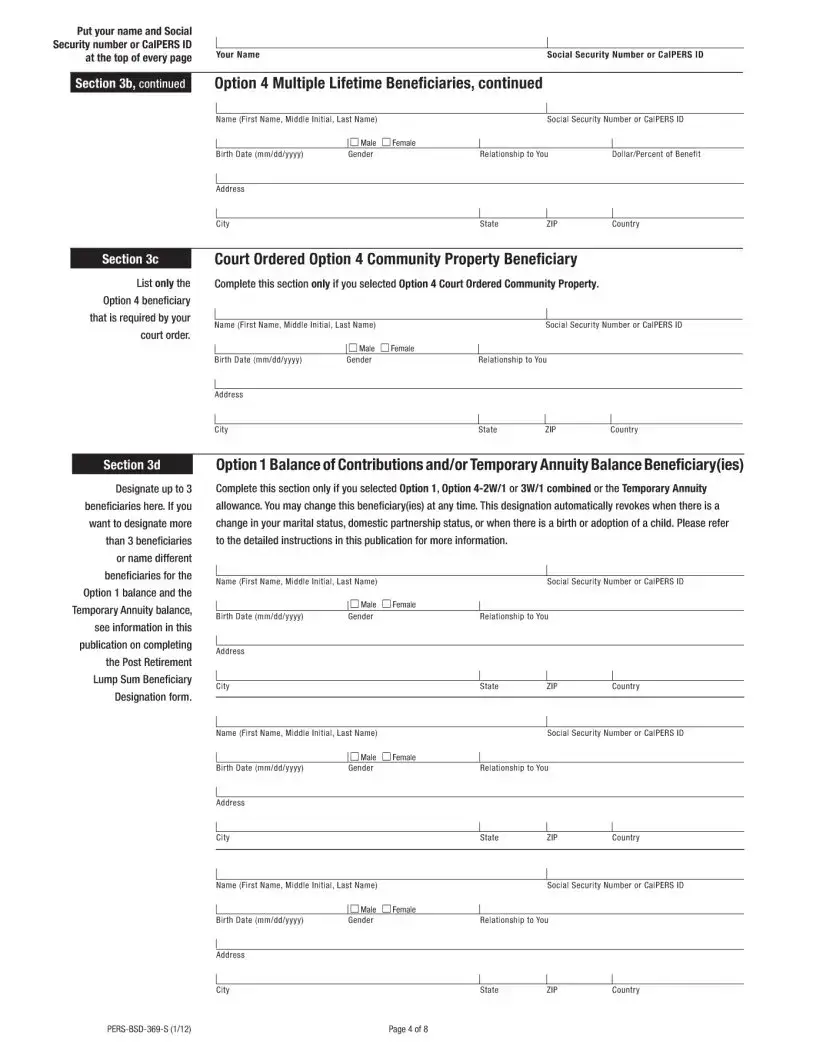

- If you select a payment option requiring a beneficiary designation (Sections 3a-3d), complete the necessary information regarding your beneficiary, such as individual lifetime beneficiary and specific dollar amount or percentage to beneficiary following the guidelines provided.

- Finally, don’t forget to put your name and either your Social Security number or CalPERS ID at the top of each page to ensure every page of your application is properly attributed to you.

Upon completion, review the form to ensure all information is accurate and complete. Submitting accurate and thorough information is crucial for the timely and correct processing of your retirement benefits. Following these steps carefully will help ensure a smooth transition into retirement.

Obtain Answers on Calpers Retirement Application

-

When should I submit my CalPERS Retirement Application?

You should not mail or deliver your CalPERS Retirement Application more than 90 days before your planned retirement date. Submitting your application within this time frame ensures that your application is processed timely for your retirement.

-

What information do I need to provide about my retirement?

When filling out your application, you will need to include several important details: the last day you received compensation from CalPERS-covered employment, your retirement effective date, and if applicable, your selection regarding the Temporary Annuity. It's crucial to provide your employer's name and position title without abbreviations to avoid any confusion.

-

How do I select my retirement payment option and beneficiary?

In Section 3 of the application, you will select your retirement payment option and designate your beneficiary(ies). Once you choose a payment option, such as the Unmodified Allowance Option or one of the Option 4 types, you cannot change it. Depending on your selection, you may also need to complete additional sub-sections in Section 3 to specify your beneficiary(ies).

-

Can I include other California public retirement systems in my application?

Yes, if you are a member of another California public retirement system besides CalPERS, you should indicate this on your application by selecting 'Yes' and providing the name of the system and your retirement date with that system. However, do not list Social Security, military, or railroad retirement as a California public retirement system.

-

What if I need to make changes to my employer information after submitting my application?

If there are any changes to the employer information you provided, such as the last day on payroll or separation date, these must be submitted on an Amended Employer Certification form. Your employer will need to sign this form, certifying that the provided information is true, complete, and correct.

Common mistakes

When people fill out the CalPERS Retirement Application form, they commonly make several mistakes that can potentially delay the processing of their application or affect their retirement benefits. It's important to avoid these errors to ensure a smooth transition into retirement. Here are four common mistakes:

-

Incorrectly formatting dates: The form explicitly requests that all dates be provided in the month/day/year format. Despite this, many applicants use different formats, leading to confusion and processing delays.

-

Ambiguous employer and position information: Section 2 requires clear, unabbreviated details about the applicant's employer and job title. Often, applicants abbreviate or incompletely fill in these fields, which can hinder accurate record-keeping and benefit calculation.

-

Misunderstanding the retirement payment options: The application presents various choices regarding retirement payment options and associated beneficiaries. Applicants frequently select an option without fully understanding the implications or neglect to designate a beneficiary when required, potentially affecting their or their beneficiaries' future benefits.

-

Failure to sign and date: A common oversight is forgetting to sign and date the application. This requirement is critical for the verification and validity of the application. Without a signature and the current date, the application cannot be processed.

To avoid these mistakes, applicants should carefully read the instructions provided in the retirement application package and possibly consult with a CalPERS representative. Accurate and thorough completion of the application supports a smoother transition into retirement.

Documents used along the form

When preparing for retirement with the California Public Employees' Retirement System (CalPERS), several accompanying forms and documents typically need to be completed or gathered to ensure a smooth application process. These materials range from personal identification to detailed financial information, each serving a specific purpose in clarifying or directing the retirement benefits.

- Proof of Age Document - This could be a birth certificate, passport, or any other government-issued document that verifies the applicant's date of birth. It ensures that retirement benefits start at the correct age according to CalPERS policies.

- Beneficiary Designation Form - Identifies who will receive the death benefit associated with the retiree’s account. Applicants need to provide names, relationship types, and the percentage of the benefit each designated beneficiary should receive.

- Marriage Certificate or Domestic Partnership Registration - Required if electing a survivor continuance for a spouse or domestic partner. It verifies the legal status of the relationship for benefit distribution purposes.

- Employer Certification Form - Completed by the retiree’s employer, it confirms the last day of employment and other employment-related information crucial for calculating retirement benefits.

- Direct Deposit Authorization Form - Enables the retiree's monthly benefits to be directly deposited into their bank account, ensuring quick and secure access to funds.

- Health Benefits Enrollment Form - For retirees wishing to enroll in or change their health, dental, or vision plans through CalPERS. This form outlines the different health plan options and allows retirees to select a plan that fits their needs in retirement.

Each document plays an integral role in outlining the retiree's preferences and ensuring that all legal and financial aspects of their retirement are appropriately managed. Completing these forms accurately and submitting them alongside the CalPERS Retirement Application form can significantly streamline the transition into retirement. It is recommended that applicants consult directly with CalPERS or a retirement counselor to ensure they fully understand each form's requirements and implications.

Similar forms

The IRS Form W-4 (Employee's Withholding Certificate) is similar to the CalPERS Retirement Application in that both forms require personal identification information, including full name as it appears on the Social Security card, and both have a series of selections that dictate financial outcomes—tax withholding levels for the W-4 and retirement payment options for the CalPERS form.

The 401(k) Plan Enrollment Form shares similarities, particularly in the sections where individuals must make choices regarding the investment of their contributions and the designation of beneficiaries, similar to how the CalPERS form requires individuals to choose their retirement payment option and designate beneficiaries for specific benefits.

The Social Security Benefits Application parallels the CalPERS form as both request detailed personal identification, employment history, and direct individuals to make decisions regarding the commencement of benefits. Additionally, both applications may require members to declare other sources of retirement income or benefits, ensuring no overlap or double-dipping between programs.

Life Insurance Application Forms are akin to the CalPERS Retirement Application form because they both require the applicant to provide thorough personal information, choose among options that impact financial outcomes (e.g., coverage amounts vs. retirement payment options), and necessitate the designation of beneficiaries for the benefits conferred by the completed contracts.

Dos and Don'ts

When you're ready to embark on the next chapter of your life with CalPERS retirement, filling out your retirement application accurately and thoroughly is crucial. Here are some guidelines to help you navigate the process smoothly.

- Do: Provide your name exactly as it appears on your Social Security card in Section 1. This helps in verifying your identity and ensures your retirement benefits are correctly attributed to you.

- Do: Use the month/day/year format when entering any date, including your birth date and the last day you received compensation. Consistency in formatting helps avoid delays in processing your application.

- Do: Clearly state the last day you received compensation from CalPERS-covered employment and your retirement effective date in the designated sections. Accurate dates facilitate the timely commencement of your retirement benefits.

- Do: Review each section carefully and provide detailed information as instructed, especially when electing your retirement payment option and designating your beneficiary. This decision is pivotal as it influences your retirement benefits and cannot be changed once submitted.

- Don't: Abbreviate your employer’s name or your position title in Section 2. Full, accurate descriptions ensure your employment history is properly documented and verified.

- Don't: Mail or deliver your application to CalPERS more than 90 days before your intended retirement date. Submitting within the specified timeframe is crucial for the processing of your application.

- Don't: Overlook the need for your employer to complete certain sections if you haven't been separated from CalPERS-covered employment for more than four months before your retirement date. This information is essential for validating your employment details.

- Don't: Include retirement systems like Social Security, military, or railroad as a California public retirement system. Focus on providing relevant information to CalPERS to avoid confusion in your retirement account.

Misconceptions

When it comes to filling out the CalPERS Retirement Application form, there are several misconceptions that can lead to confusion or errors. Here are five common misunderstandings:

- Timing is flexible for submitting your application. A common myth is that you can submit your retirement application at any time. In reality, you should not mail or deliver your application to CalPERS more than 90 days before your retirement date. This ensures that your application is processed in a timely manner, right before your retirement begins.

- Any form of your name is acceptable. It's crucial that you provide your name exactly as it appears on your Social Security card in Section 1. Variations or nicknames can lead to discrepancies and potential delays in processing your application.

- You can change your retirement payment option anytime. Once you select your Retirement Payment Option in Section 3 and your application is processed, you cannot change to another option. This decision is final, so it’s important to consider your choice carefully.

- You must list all retirement systems. When asked about "Other California Public Retirement Systems," you should not list Social Security, military, or railroad retirement. This question is specifically looking for memberships in other California public retirement systems beyond CalPERS.

- Any date format is acceptable. Dates must be displayed in the month/day/year format across the application. Using different formats can lead to misunderstandings or processing delays.

Understanding these nuances can help ensure that filling out the CalPERS Retirement Application form is a smoother, error-free process. Always refer to the detailed instructions provided with the publication to avoid common mistakes. Taking these guidelines into account can lead to a more efficient handling of your retirement application.

Key takeaways

Filling out the CalPERS Retirement Application form is an essential step for California public employees planning their retirement. To ensure a smooth process, pay attention to the following key takeaways:

- Use your legal name and information exactly as they appear on your Social Security card when filling out the application. This helps to prevent any delays or issues in processing your retirement benefits.

- All dates should be displayed in the month/day/year format, ensuring consistency and avoiding confusion throughout the document.

- It's crucial to accurately report your last day of compensation from CalPERS-covered employment. This date impacts your retirement effective date and benefits.

- When listing your employer and position title, avoid abbreviations. Full, accurate information assists in the verification process and ensures your benefits are calculated based on the correct employment data.

- Applications should not be submitted to CalPERS more than 90 days before your chosen retirement date. Timing your application properly is important for a seamless transition to retirement.

- Selecting a retirement payment option is a significant decision and cannot be changed once the choice is made. Examine each option carefully and consider how it will affect your financial planning and beneficiaries.

- If you are also a member of another California public retirement system, you must disclose this information. Being part of multiple systems can influence your retirement benefits and requires careful coordination.

- Your employer plays a role in the retirement application process, especially if you are still employed or have separated from CalPERS-covered employment within four months of your retirement date. They must fill out their part of the application, validating your employment and compensation details.

Understanding these key points can help ensure that your CalPERS Retirement Application is filled out correctly and submitted at the appropriate time, leading to a smoother transition into retirement.

Popular PDF Forms

Iris Number - Underscores the necessity of participant and guardian signatures to validate the choices and information provided in the plan.

Miss Punch Application - Provides a clear and formal procedure for employees to correct missed time clock punches, promoting integrity in the record of work hours.

Ilife Timesheets Printable - Stipulates that timesheets must clearly indicate each day's service provision with corresponding hours in the designated service code columns, promoting clear and detailed submissions.