Blank Capital One Direct Deposit PDF Template

Managing your finances efficiently is paramount in today’s fast-paced world, and the Capital One Direct Deposit form is a critical tool in achieving this goal. This simple, yet comprehensive form is designed to facilitate the electronic transfer of funds into your account, ensuring that your salary, benefits, or any other payments are deposited quickly and securely. By completing this form and providing it to your employer or payer, you enable a smooth transaction process that not only saves time but also enhances the reliability of receiving your payments. The form caters to up to three bank accounts, allowing for a distribution of funds that suits your financial planning needs. It requires specifying the bank name, account number, deposit amount, routing number, and the type of account - whether checking or savings. Additionally, it includes an authorization section where you give your employer permission to initiate deposits as well as withdrawals to rectify any mistaken deposit entries. The significance of this authorization cannot be understated, as it supersedes any prior arrangements and continues until expressly terminated through written notification. Recognizing the form’s importance is crucial for anyone looking to streamline their income processing and ensure their financial operations are handled with precision and care.

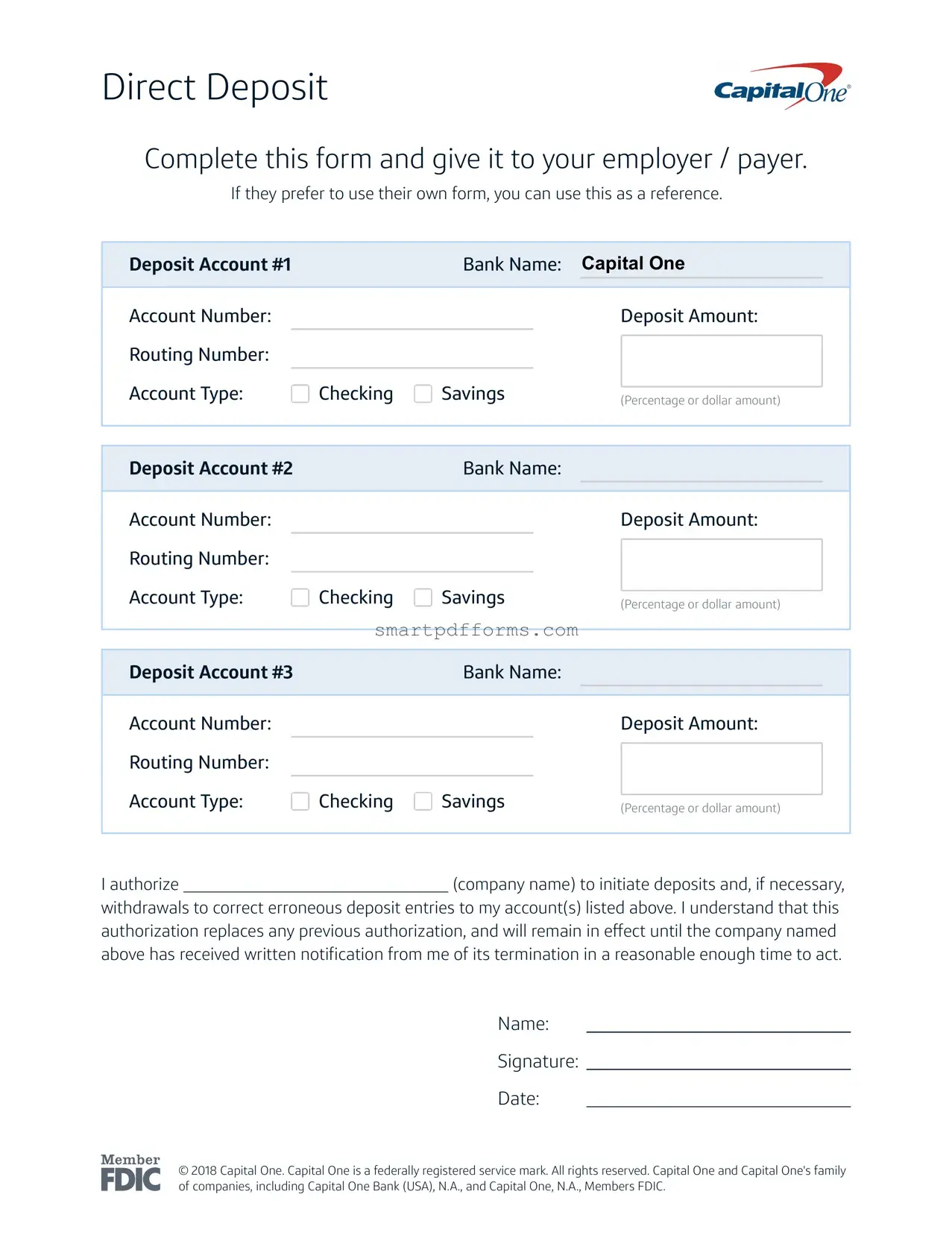

Preview - Capital One Direct Deposit Form

Direct Deposit

Complete this form and give it to your employer / payer.

If they prefer to use their own form, you can use this as a reference.

Deposit Account #1 |

Bank Name: Capital One |

Account Number: |

Deposit Amount: |

Routing Number:

Account Type: |

Checking |

Savings |

(Percentage or dollar amount)

Deposit Account #2 |

Bank Name: |

Account Number: |

Deposit Amount: |

Routing Number:

Account Type: |

Checking |

Savings |

(Percentage or dollar amount)

Deposit Account #3 |

Bank Name: |

Account Number: |

Deposit Amount: |

Routing Number:

Account Type: |

Checking |

Savings |

(Percentage or dollar amount)

I authorize _______________________________ (company name) to initiate deposits and, if necessary,

withdrawals to correct erroneous deposit entries to my account(s) listed above. I understand that this authorization replaces any previous authorization, and will remain in effect until the company named above has received written notification from me of its termination in a reasonable enough time to act.

Name: ____________________________

Signature: ____________________________

Date: ____________________________

© 2018 Capital One. Capital One is a federally registered service mark. All rights reserved. Capital One and Capital One's family of companies, including Capital One Bank (USA), N.A., and Capital One, N.A., Members FDIC.

Form Data

| Fact | Description |

|---|---|

| Form Purpose | Used to authorize direct deposits into a Capital One account. |

| Flexibility | The form can be used as a reference if an employer prefers to use their own form. |

| Account Options | Allows deposits into checking or savings accounts, with the option to specify a dollar amount or percentage. |

| Multiple Accounts | Enables distribution of funds into up to three separate accounts. |

| Authorization | Grants the company the ability to initiate deposits and, if necessary, withdrawals to correct errors. |

| Duration of Authorization | This authorization supersedes previous ones and remains effective until the company is notified of its termination. |

| Termination Condition | Written notification is needed to terminate the authorization. |

| Trademark Notice | Capital One is a federally registered service mark, with all rights reserved. |

| Company Affiliates | References Capital One and its family of companies, including Capital One Bank (USA), N.A., and Capital One, N.A., Members FDIC. |

Instructions on Utilizing Capital One Direct Deposit

Setting up direct deposit with Capital One ensures a more efficient and secure transfer of payments directly into your bank accounts. This process involves filling out a simple form to provide your employer or payer with the necessary information to initiate the deposits. Whether you're setting it up for payroll, tax refunds, or other payments, the accuracy of the details you provide is crucial for the seamless processing of your funds. By following these steps, you'll expedite and streamline the process of receiving payments.

- Locate the section labeled Deposit Account #1.

- Insert "Capital One" as the Bank Name.

- Enter your Account Number where indicated.

- Specify your desired Deposit Amount, either in percentage or dollar amount, for this account.

- Provide the Routing Number for Capital One.

- Select the Account Type by marking either the Checking or Savings option.

- Repeat steps 1 through 6 for Deposit Account #2 and Deposit Account #3 if you wish to distribute your deposits across multiple accounts.

- In the authorization section, print the name of the company that will be initiating the deposits.

- Fill in your Name in the space provided to acknowledge your consent for the transactions.

- Sign your name on the line labeled Signature to validate the form.

- Enter the current Date to certify when this authorization was given.

After completing the form, hand it over to your employer or payer. This will allow them to process your direct deposits according to the instructions you've provided. Remember, by accurately completing this form, you are facilitating a smoother financial operation. Should you need to make changes or cancel this authorization, notifying your employer or payer in writing well in advance is important for proper handling.

Obtain Answers on Capital One Direct Deposit

-

What is the purpose of the Capital One Direct Deposit form?

This form is used to instruct your employer or payer to initiate direct deposits to your Capital One account(s). It allows for the deposits of your paycheck or other payments directly into your Capital One checking or savings account(s), ensuring a faster and more secure transfer of funds.

-

Can I divide my deposit between different accounts?

Yes, the form provides the option to split your direct deposit between up to three Capital One accounts. For each account, you can specify the deposit amount either as a percentage or a dollar amount, allowing for flexible management of your money.

-

What information is required to complete the form?

You will need the Bank Name (Capital One for all entries), your Account Number(s), the specific Deposit Amount(s) (specified as either a percentage or a dollar amount), the Routing Number for each Capital One account, and the Account Type (checking or savings). Additionally, you’re required to authorize the transaction by providing the company name, your name, signature, and the date.

-

Where do I find my Capital One routing and account numbers?

Your routing number is a nine-digit code that identifies the financial institution associated with your account. For Capital One accounts, this information can typically be found online within your account details, on your account statements, or at the bottom of your checks. Your account number is also available in these locations and is unique to your personal account.

-

Can I use the form if my employer has their own direct deposit form?

Yes, if your employer prefers to use their proprietary form for direct deposit setup, you can still reference the information provided in the Capital One Direct Deposit form. Ensure that the necessary account details and authorization are accurately transferred to your employer's form.

-

How do I submit the completed Capital One Direct Deposit form to my employer?

Once you complete the form, you can submit it to your employer’s payroll or human resources department, according to their preferred procedure. Some employers may require a hard copy, while others might accept an electronic submission.

-

Is it secure to provide this information for direct deposit?

Yes, setting up direct deposit is a secure process. However, it's essential to submit your completed form through secure means (like encrypted email or a secure upload portal, if submitting electronically), or directly to a trusted payroll or HR representative if submitting a hard copy, to protect your personal information.

-

Can I change my direct deposit settings after submitting the form?

Yes, you can update your direct deposit instructions at any time. To do so, complete a new direct deposit form with your updated information and submit it to your employer. Make sure to notify them that this new form replaces any previous authorization.

-

How long does it take for direct deposits to start arriving in my account?

The timeline for activating direct deposits can vary by employer. Typically, it may take one or two payroll cycles for your direct deposit to become effective, as employers often need to process and verify your setup. It's wise to maintain alternate arrangements until you confirm that direct deposits are successfully reaching your Capital One accounts.

-

What happens if there's an error with my direct deposit?

The form includes authorization for the company to initiate withdrawals for the purpose of correcting erroneous direct deposit entries to your account(s). If you notice a mistake with your deposit, you should also directly contact your employer’s payroll or HR department to rectify the issue promptly.

Common mistakes

Filling out the Capital One Direct Deposit form is straightforward but requires attention to detail to avoid common errors. Here are eight mistakes people often make during this process.

- Not verifying the account number and routing number: It's critical to double-check these numbers for accuracy. An incorrect account or routing number can lead to deposits being delayed or sent to the wrong account.

- Leaving the account type blank: Failing to specify if the account is Checking or Savings can create confusion and potentially delay the direct deposit setup.

- Incorrect deposit amount specification: When choosing to deposit a percentage or a specific dollar amount, clarity is key. Misunderstandings here can lead to the wrong amount being deposited.

- Forgetting to sign and date the form: An unsigned or undated form is not valid. The employer requires a signature to process and validate the request.

- Not using the most current form: Always ensure using the latest version of the form. Outdated forms might miss essential updates or information required by the bank or employer.

- Assuming one form fits all: People often assume that one direct deposit form works for every employer. Some employers may require their specific form, in which case the Capital One form can serve as a reference.

- Failing to notify of changes: Not updating the employer or Capital One about changes to banking information can lead to transactions being misdirected.

- Not providing detailed instructions for multiple accounts: If deposits are to be split across multiple accounts, clear and precise instructions need to be detailed for each. Ambiguity can cause funds to be deposited into the wrong account.

By avoiding these errors, individuals can ensure a smooth and efficient process when setting up direct deposits to their Capital One accounts.

Documents used along the form

When setting up a direct deposit with Capital One, it is common for individuals to encounter various forms and documents integral to ensuring a seamless process. These documents not only enhance the understanding of personnel and financial data but also support compliance and verification requirements. This list elucidates additional forms and documents that often accompany the Capital One Direct Deposit form, shedding light on their purposes and functions within the broader context of financial management and employment verification.

- W-4 Form (Employee's Withholding Certificate): This form is used by employers to determine the federal income tax to withhold from an employee's paycheck. It includes information such as filing status and allowances.

- I-9 Form (Employment Eligibility Verification): Employers use this form to verify an employee's identity and eligibility to work in the United States, complying with federal laws.

- State Tax Withholding Form: Similar to the federal W-4, this document specifies the amount of state income tax to withhold from the employee's earnings. The requirements and forms vary by state.

- Pay Stub Request Form: This document allows employees to request copies of their pay stubs, which reflect earnings, taxes withheld, and direct deposit allocations.

- Bank Authorization Form for Direct Deposit: Some employers and banks require a specific authorization form to set up direct deposit services, including account verification and routing information.

- Employee Information Form: This document collects basic employee data such as name, address, social security number, and emergency contact information, ensuring the employer's records are up to date.

- Benefit Enrollment Forms: These documents are vital during the hiring process or open enrollment periods, allowing employees to select and modify their benefits, which may include health insurance and retirement savings plans.

- Change of Address Form: Employees use this form to officially notify their employer of a change in address, essential for maintaining accurate and timely communications.

Together, these documents form a comprehensive toolkit, facilitating various employer-employee interactions beyond the transactional dynamics of payroll processing. By understanding and properly handling these forms, both parties contribute to a clearer, more efficient financial and administrative environment. Emphasizing the correct use and timely submission of these documents can help avoid delays in payments and ensure compliance with legal requirements, making the complex world of finance slightly more manageable for everyone involved.

Similar forms

Authorization for Automatic Bill Payment Form: Just like the Capital One Direct Deposit form, this document is used to authorize a company to make automatic withdrawals from an individual's bank account to pay recurring bills, such as utilities or mortgage payments. The required information typically includes the bank name, account number, routing number, and the account type, mirroring the structure of the direct deposit authorization form.

Bank Account Verification Form: Similar to direct deposit forms, bank account verification forms require account details like the bank name, account number, routing number, and account type. These forms are used to verify the existence and status of a bank account for various financial transactions or requirements.

ACH Credit Authorization Form: This form resembles the direct deposit form because it's used to authorize credit transactions via the Automated Clearing House (ACH) network from one bank account to another. It collects similar information to initiate the transfer process, ensuring funds are credited accurately and efficiently.

Payroll Authorization Form: This form shares its purpose with the Capital One Direct Deposit form in facilitating the electronic transfer of funds into an employee's bank account. It gathers bank account details to set up the deposit of an employee's wage or salary, streamlining the payroll process.

Vendor Direct Payment Form: Similar to the Capital One form, a vendor direct payment form is used by businesses to set up electronic payments to their vendors. It requires entering the vendor's banking information, such as account and routing numbers, to automate payments for goods or services, ensuring a timely and accurate transaction process.

Tax Refund Direct Deposit Form: This document is used to authorize the direct deposit of a tax refund into an individual's bank account. It collects similar information, like account and routing numbers, to ensure the refund is deposited into the correct account, offering a faster and more secure alternative to receiving a physical check.

Social Security Direct Deposit Enrollment Form: The form used to sign up for direct deposit of social security benefits mirrors the structure of the Capital One Direct Deposit form. It requires beneficiaries to provide their bank account details to receive their payments electronically, which is more efficient and secure than traditional check payments.

Investment Account Transfer Form: While used for a different financial purpose, this form resembles the direct deposit form as it is necessary to transfer funds between investment accounts. It requires the investor's account information, such as the routing number and account number, to accurately move funds while maintaining the integrity of the investment process.

Dos and Don'ts

When filling out the Capital One Direct Deposit form, it is crucial to follow a precise set of dos and don'ts to ensure a smooth and error-free setup of your direct deposit. Below is a guide to help you navigate this process confidently.

Things You Should Do:

Double-check all the bank details you enter, such as your account number and Capital One’s routing number. Accuracy is key to ensuring your funds are deposited correctly.

Decide whether you want the funds to go into a checking or savings account, and then clearly specify your choice by marking the appropriate option on the form.

Indicate the deposit amount clearly. If you're splitting your paycheck between multiple accounts, specify the exact dollar amount or percentage for each account.

Sign and date the form at the bottom. A physical signature is often required to authenticate your authorization for direct deposit.

Inform your employer or payer if you decide to change or close the accounts listed on the form to avoid any deposit errors or delays.

Keep a copy of the completed form for your records. It’s important to have a reference of what was submitted, in case any discrepancies arise later.

Things You Shouldn't Do:

Don’t leave any fields blank. If a section doesn’t apply to you, write “N/A” to indicate this. An incomplete form may delay the direct deposit setup.

Avoid guessing your account information. If you're unsure, contact Capital One or check your online banking details to get the correct numbers.

Do not use pencil or any erasable ink when filling out the form. Use black or blue ink to ensure the information cannot be altered after submission.

Resist the temptation to sign the form without reviewing all the information you’ve entered. Mistakes could lead to delays or lost payments.

Avoid ignoring Capital One’s instructions or guidelines provided with the form. They are there to help you fill out the form correctly.

Don’t forget to notify your payer of the change if you switch banks or accounts in the future. This prevents your funds from being sent to the wrong account.

Adhering to these guidelines will help ensure that your direct deposit is set up efficiently and correctly, giving you immediate access to your funds as soon as they are deposited by your employer or payer.

Misconceptions

Many people find the process of setting up direct deposit to be straightforward, yet there are several misconceptions about the Capital One Direct Deposit form. Busting these myths can ensure that individuals have a smoother experience when navigating their banking needs.

Only one account can be used for direct deposits. Contrary to this belief, Capital One's Direct Deposit form allows for the splitting of deposits across multiple accounts, offering flexibility in managing funds.

You can't designate deposits as a percentage. The form explicitly allows for the allocation of funds either as a specific dollar amount or a percentage, catering to those who wish to automatically manage their savings or budgeting practices.

Changes or updates require a bank visit. Modifying direct deposit details doesn't necessitate a visit to the bank. A written notice to the employer or payer suffices, making the process convenient and less time-consuming.

The form is only for payroll deposits. This is a misconception. The form is versatile and can be used for other types of payments beyond payroll, including tax refunds, government benefits, and more.

Setting up direct deposits is time-consuming. Filling out the Capital One Direct Deposit form is simple and straightforward, involving minimal steps. This quick process contradicts the belief that setting up direct deposits takes a lot of time.

Direct deposits are not secure. Capital One uses rigorous security measures to protect transactions, ensuring that direct deposits are a safe way to receive funds.

You need to provide a voided check. While providing a voided check can be helpful for verifying account details, it's not always necessary. The essential information needed is the bank name, account number, routing number, and account type.

You can't stop direct deposits once they start. The authorization section clearly states that this arrangement can be terminated at any time, provided that written notification is given to the employer with enough time to make adjustments.

All banks use the same form. Each bank may have its own version of a direct deposit form. While the Capital One form can be used as a reference, it's important to follow the employer's or payer's preference.

Understanding these misconceptions and clarifying the facts can enhance individuals’ experiences with managing their finances and navigating direct deposit processes seamlessly.

Key takeaways

Filling out the Capital One Direct Deposit form is an important step in automating deposit transactions into your bank account. This allows for a smooth, secure, and efficient way to receive funds from your employer or other payers. Here are key takeaways to keep in mind:

- Complete Accuracy is Essential: Ensure that all details, including the bank name (Capital One), account number, routing number, and your chosen account type (checking or savings), are accurately filled out. Mistakes can lead to delays or misdirected deposits.

- Authorization is Crucial: By signing the form, you authorize your employer or payer to deposit money into your account and, if necessary, to make withdrawals to correct mistaken deposits. This authorization overwrites any previous arrangements and will stay in effect until you formally revoke it.

- Notification for Changes: Should you need to change any information or cancel the direct deposit service, it's mandatory to inform the company making the deposits in writing. Provide this notification in enough time for them to process the changes, helping prevent any transaction errors.

- Keep Documentation: Once you've filled out the form, keep a copy for your records before handing it to your employer/payer. If they prefer using their form, you can still use the Capital One form as a guide to ensure you provide all necessary information accurately.

Following these guidelines when completing the Capital One Direct Deposit form will help ensure that your direct deposit setup process is done correctly and with minimal hassle, enabling a more efficient management of your finances.

Popular PDF Forms

It 2 - Must be filed as an entire page, instructions for separating records not provided.

Preschool Enrollment Form Template - Asks for detailed information regarding the child’s eating schedule, aiding the preschool in syncing the child’s eating habits with their meal service.

What Is the Par-q - The form effectively communicates the dual priority of participant safety and experience enjoyment.