Blank Carrs Safeway Club Card PDF Template

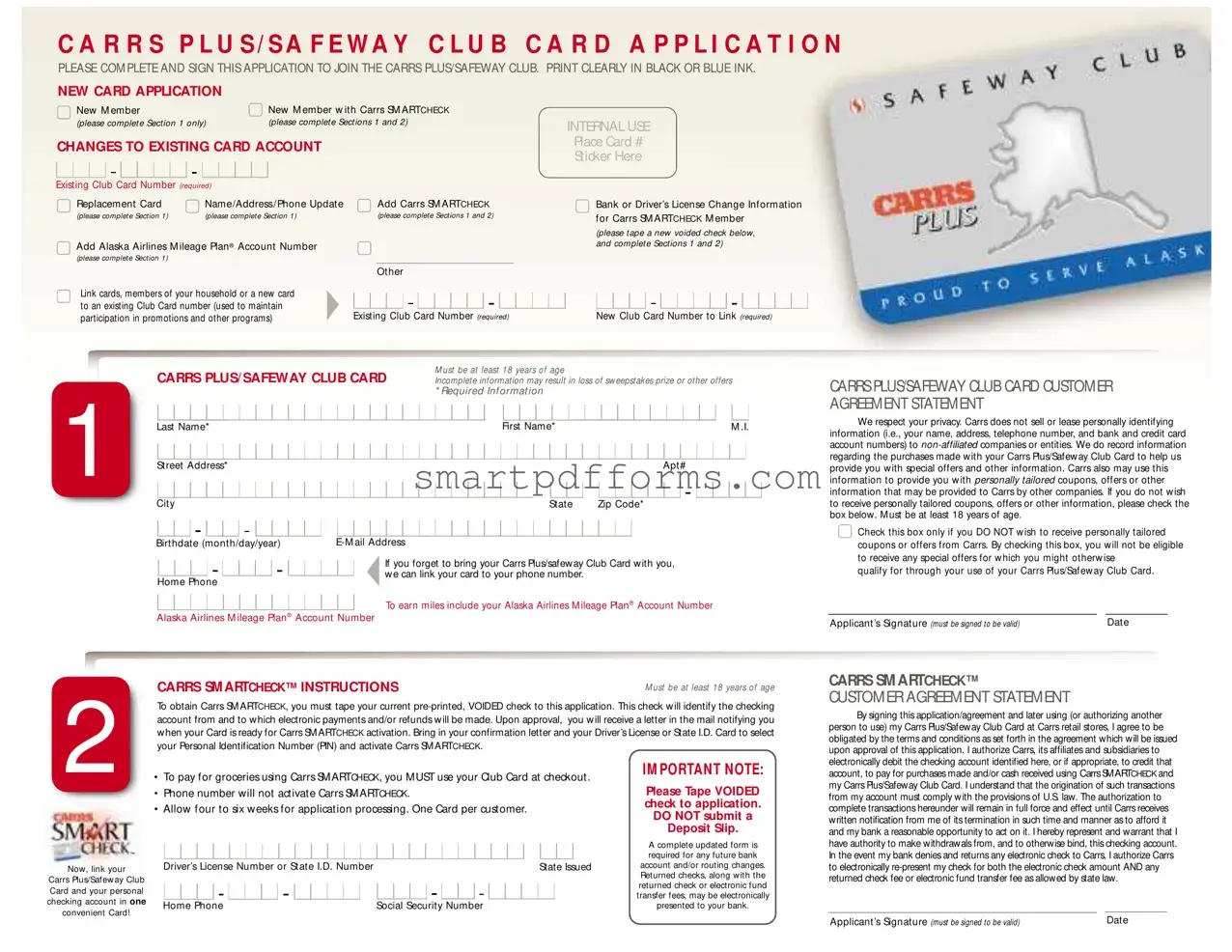

Joining the Carrs Plus/Safeway Club offers a variety of benefits, and the process begins with completing the application form. The form serves multiple purposes—it's not only for new members eager to take advantage of the club's special offers, but also caters to existing members looking to update their information or add services like Carrs SMARTCHECK. The application is straightforward, requesting basic personal details such as name, address, and contact information, along with an option to link an Alaska Airlines Mileage Plan Account for rewarding travel benefits. Applicants must be at least 18 years old and use black or blue ink for clarity. An interesting feature of this form is the integration of SMARTCHECK, which requires applicants to attach a voided check for electronic payment convenience at Carrs retail outlets. Privacy is a priority, as indicated by the customer agreement statement; personal information is handled with care, aimed at enhancing the shopping experience without compromising privacy. The form makes it clear that opting out of personalized offers is possible, emphasizing customer choice in tailoring their promotional communications. However, opting into SMARTCHECK signals agreement to specific electronic transaction terms, demonstrating the care taken to ensure transparency and trust in financial dealings. The dual function of the form, addressing both membership perks and financial transaction ease, highlights Carrs' commitment to customer satisfaction and convenience.

Preview - Carrs Safeway Club Card Form

C A R R S P L U S / S A F E W A Y C L U B C A R D A P P L I C A T I O N

PLEASE COM PLETE AND SIGN THIS APPLICATION TO JOIN THE CARRS PLUS/SAFEWAY CLUB. PRINT CLEARLY IN BLACK OR BLUE INK.

NEW CARD APPLICATION

New M ember |

New M ember w ith Carrs SM ARTCHECK |

|

(please complet e Sect ion 1 only) |

(please complet e Sect ions 1 and 2) |

INTERNAL USE |

|

|

CHANGES TO EXISTING CARD ACCOUNT |

Place Card # |

|

Sticker Here |

||

|

Existing Club Card Number (required)

Replacement Card |

Name/Address/Phone Update |

|

|

Add Carrs SM ARTCHECK |

|||||||||||||

(please complet e Sect ion 1) |

(please complet e Sect ion 1) |

|

|

(please complet e Sect ions 1 and 2) |

|||||||||||||

Add Alaska Airlines M ileage Plan¨ Account Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(please complet e Sect ion 1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|||||||||||||

Link cards, members of your household or a new card |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

to an existing Club Card number (used to maintain |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Existing Club Card Number (required) |

|||||||||||||||||

participation in promotions and other programs) |

|||||||||||||||||

Bank or DriverÕs License Change Information for Carrs SM ARTCHECK M ember

(please t ape a new voided check below, and complet e Sect ions 1 and 2)

New Club Card Number to Link (required)

CARRS PLUS/ SAFEWAY CLUB CARD |

M ust be at least 18 years of age |

Incomplete information may result in loss of sw eepstakes prize or other offers |

|

|

* Required Inf ormat ion |

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last Name* |

|

|

|

|

|

|

|

|

|

|

|

|

|

First Name* |

|

|

|

|

|

|

|

|

|

|

M .I. |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt# |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

Zip Code* |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Birthdate (month/day/year) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you forget to bring your Carrs Plus/safeway Club Card with you, |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

we can link your card to your phone number. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

Home Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To earn miles include your Alaska Airlines M ileage Plan¨ Account Number |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Alaska Airlines M ileage Plan¨ Account Number |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

CARRSPLUS/SAFEWAY CLUB CARD CUSTOMER AGREEMENT STATEMENT

We respect your privacy. Carrs does not sell or lease personally identifying information (i.e., your name, address, telephone number, and bank and credit card account numbers) to

Check this box only if you DO NOT w ish to receive personally tailored coupons or offers from Carrs. By checking this box, you w ill not be eligible to receive any special offers for w hich you might otherw ise

qualify for through your use of your Carrs Plus/Safew ay Club Card.

ApplicantÕs Signature (must be signed to be valid) |

Date |

2

CARRS SM ARTCHECK™ INSTRUCTIONS |

M ust be at least 18 years of age |

To obtain Carrs SM ARTCHECK, you must tape your current

CARRS SM ARTCHECK™

CUSTOMER AGREEMENT STATEMENT

By signing this application/agreement and later using (or authorizing another person to use) my Carrs Plus/Safeway Club Card at Carrs retail stores, I agree to be obligated by the terms and conditions as set forth in the agreement which will be issued upon approval of this application. I authorize Carrs, its affiliates and subsidiaries to electronically debit the checking account identified here, or if appropriate, to credit that

ª

Now, link your

Carrs Plus/Safew ay Club Card and your personal checking account in one convenient Card!

¥ To pay for groceries using Carrs SMARTCHECK, you MUST use your Club Card at checkout .

¥Phone number will not activate Carrs SMARTCHECK.

¥Allow four to six weeks for application processing. One Card per customer.

DriverÕs License Number or State I.D. Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Issued |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home Phone |

Social Security Number |

|||||||||||||||||||||||||||||||

I M PORTAN T N OTE:

Please Tape VOIDED check to application.

DO NOT submit a

Deposit Slip.

A complete updated form is required for any future bank account and/or routing changes. Returned checks, along w ith the returned check or electronic fund transfer fees, may be electronically presented to your bank.

account, to pay for purchases made and/or cash received using Carrs SMARTCHECK and my Carrs Plus/Safeway Club Card. I understand that the origination of such transactions from my account must comply with the provisions of U.S. law. The authorization to complete transactions hereunder will remain in full force and effect until Carrs receives written notification from me of its termination in such time and manner as to afford it and my bank a reasonable opportunity to act on it. I hereby represent and warrant that I have authority to make withdrawals from, and to otherwise bind, this checking account. In the event my bank denies and returns any electronic check to Carrs, I authorize Carrs to electronically

ApplicantÕs Signature (must be signed to be valid) |

Date |

Form Data

| Fact Name | Detail |

|---|---|

| Age Requirement | Must be at least 18 years of age to apply. |

| Ink Preference | Application must be completed in black or blue ink. |

| Privacy Policy | Carrs does not sell or lease personally identifying information to non-affiliated companies or entities. |

| Offers and Promotions | Purchase history may be used to provide special offers or tailored information. |

| Option to Decline Offers | Checking a box on the application allows applicants to decline receiving tailored offers or coupons. |

| SMARTCHECK Feature | Linking a checking account allows for electronic payments and/or refunds through Carrs SMARTCHECK. |

| Account Confirmation | A confirmation letter will be mailed upon approval for activating Carrs SMARTCHECK. |

| Club Card Functionality | The Carrs Plus/Safeway Club Card is also a prerequisite for using Carrs SMARTCHECK at checkout. |

| Application Processing Time | Applicants should allow four to six weeks for the processing of their application. |

| Voided Check Requirement | A current pre-printed, voided check must be taped to the application for Carrs SMARTCHECK activation. |

Instructions on Utilizing Carrs Safeway Club Card

Before diving into the steps required to fill out the Carrs Safeway Club Card form, it's essential to understand what's going to happen next. Once you've completed the form with all the necessary details and submitted it, the processing phase begins. This might take some weeks, during which Carrs Safeway will review your application to ensure everything is in order. If you've applied for the SMARTCHECK feature, remember to have your VOIDED check ready, as this will be attached to your application. Post-approval, you'll receive a confirmation letter indicating your Club Card is ready and prompting you to visit the store for activation and PIN selection. Keeping this in mind, complete the form accurately to ensure a smooth process.

Steps for Filling Out the Carrs Safeway Club Card Form:

- Choose the application type by marking the appropriate box: New Member, New Member with Carrs SMARTCHECK, Changes to Existing Card Account, or Other.

- If applicable, place the card number sticker or write the existing Club Card Number in the designated space.

- For new applications or changes, complete Section 1:

- Write your last name, first name, and middle initial clearly.

- Provide your complete street address, including apartment number if any.

- Fill in your city, state, and zip code.

- Enter your date of birth in month/day/year format.

- Provide your email address.

- Add your home phone number.

- For earning miles, include your Alaska Airlines Mileage Plan Account Number.

- If you are applying for Carrs SMARTCHECK, proceed to Section 2:

- Attach your current pre-printed, VOIDED check below the designated area on the form.

- Fill out the required details: Driver's License or State I.D. Number, State Issued, Home Phone, and Social Security Number.

- Read the Customer Agreement Statement carefully.

- If you prefer not to receive personally tailored coupons or offers from Carrs, check the indicated box.

- Sign and date the application/agreement to validate it.

- For Carrs SMARTCHECK section, ensure your signature and date are also applied to confirm agreement to its terms.

After completing these steps and submitting your form, Carrs will process your application. If any additional information is needed, they might reach out to you. Consequently, ensure that all provided contact information is accurate. Waiting patiently for confirmation and preparing for your in-store activation visit are the last steps to becoming a Carrs Safeway Club Card member, which opens the door to a range of benefits and convenience in your shopping experience.

Obtain Answers on Carrs Safeway Club Card

-

What is the Carrs Plus/Safeway Club Card?

The Carrs Plus/Safeway Club Card is a loyalty card program that offers members exclusive discounts, promotions, and the ability to earn miles with the Alaska Airlines Mileage Plan™ when shopping at Carrs and Safeway stores. Membership is free and available to individuals who are at least 18 years of age.

-

How can I apply for a Carrs Plus/Safeway Club Card?

To apply for a Carrs Plus/Safeway Club Card, you need to complete the application form. This involves providing personal information like your name, address, phone number, and email address. If you are interested in linking your Club Card to a checking account for easy payment via Carrs SMARTCHECK™, portions of the application regarding bank information must also be filled out, requiring a voided check for account verification.

-

Are there any privacy concerns with providing personal information for the Carrs Plus/Safeway Club Card?

Carrs respects your privacy and does not sell or lease personally identifying information to non-affiliated companies or entities. Information gathered is used for providing members with special offers and promotions tailored to their shopping habits. If you prefer not to receive these customized offers, there is an option in the application form to opt out of receiving personally tailored coupons, offers, or other information.

-

What is Carrs SMARTCHECK™ and how do I enroll?

Carrs SMARTCHECK™ is a payment option that links your personal checking account to your Carrs Plus/Safeway Club Card, allowing you to pay for your purchases directly from your bank account. To enroll, you must complete the relevant sections of the Club Card application form and attach a current pre-printed, voided check. You will receive a confirmation letter in the mail, after which you can activate your SMARTCHECK™ feature by selecting a Personal Identification Number (PIN) at a participating store.

-

What should I do if I need to update my information or replace a lost Carrs Plus/Safeway Club Card?

If you need to update any details like your address or phone number, or if you need to replace a lost Carrs Plus/Safeway Club Card, you can complete the same application form indicating the changes in the "internal use changes" section. For a lost card, make sure to highlight that a replacement card is needed. For any changes related to the Carrs SMARTCHECK™, a new voided check and a completed form are required to process bank account or routing changes.

Common mistakes

When filling out the Carrs Safeway Club Card form, people often make several common mistakes that can affect the processing of their application. Paying attention to these errors can help ensure a smoother application process and prevent delays or issues with obtaining and using the club card. Here are five of the most common mistakes:

Not using black or blue ink: The form specifies that it should be filled out clearly in black or blue ink. Other colors might not be processed correctly, leading to delays.

Incomplete sections: Depending on the type of application (new member, replacement, addition of services like Carrs SMARTCHECK, etc.), certain sections are required. Skipping requisite sections can result in an incomplete application, and services might not be activated.

Forgetting to sign the form: Both the Club Card application and the SMARTCHECK agreement require signatures to be valid. An unsigned form is one of the most common oversights that delays the application process.

Omitting the voided check for SMARTCHECK: For those who want to use the Carrs SMARTCHECK feature, attaching a current pre-printed, voided check is mandatory. This step is often overlooked, resulting in delays in SMARTCHECK activation.

Entering incorrect or incomplete personal information: Mistakes like misspelling names, providing incomplete addresses, or incorrect phone numbers can lead to issues in the registration process and the linking of the Carrs Plus/Safeway Club Card to the applicant’s information.

Addressing these common mistakes can lead to a smoother and quicker application process, enabling applicants to enjoy the benefits of the Carrs Safeway Club Card without unnecessary delays.

Documents used along the form

When filling out the Carrs Plus/Safeway Club Card Application, customers often find that other forms and documents might be necessary or useful for a more complete and convenient shopping experience. These additional documents might include those related to payment options, customer preferences, or specific program enrollments, helping to ensure customers not only save money but also streamline their shopping processes.

- Direct Deposit Authorization Form: Needed for setting up electronic payments directly from a checking account, this form authorizes Carrs Safeway to deposit refunds or rebates directly into the customer's bank account.

- Personal Identification Number (PIN) Setup Request: Allows customers who have Carrs SMARTCHECK to select a PIN for their account, enabling secure transactions at checkout.

- Privacy Preference Form: Customers fill this out to specify how they want their personal information used, including opting out of marketing communications.

- Electronic Fund Transfer (EFT) Agreement: This document outlines the terms and conditions under which electronic payments are made and received, crucial for customers using Carrs SMARTCHECK for purchases.

- Customer Feedback Form: Used by customers to provide feedback on their shopping experience, suggestions for improvement, or report issues.

- Electronic Receipt Enrollment Form: For customers preferring digital receipts, this form enrolls them into the program to receive receipts via email or text message instead of printed ones.

- Lost or Stolen Card Report Form: In case a Carrs Plus/Safeway Club Card is misplaced or stolen, this form allows customers to report the incident and request a replacement card.

- Subscription Service Form: Customers use this to subscribe to various delivery or pickup services offered by Carrs Safeway, including grocery delivery or special promotions.

- Special Order Request Form: For ordering specific items not regularly stocked in the store, or for large quantities of products for events.

- Pharmacy Prescription Transfer Request: Customers looking to transfer their prescription from another pharmacy to a Carrs Safeway pharmacy fill out this form for a seamless transition.

These documents are integral in maximizing the benefits of the Carrs Plus/Safeway Club Card by enhancing the shopping experience, offering convenience, and ensuring customers' preferences and needs are met comprehensively. It's important for customers to be aware of and understand how each related document can further contribute to a rewarding relationship with Carrs Safeway.

Similar forms

The Carrs Safeway Club Card form shares similarities with credit card application forms. Both require personal identification details, financial information, and a signature to validate agreement to the terms and conditions. They also inquire about linking additional benefits, such as airline mile programs, which mirror credit card benefits like rewards points.

It is akin to a bank account opening form, where applicants must provide personal and financial details, including a pre-printed, voided check for account verification. This process helps in establishing a direct link between the financial institution and the customer's personal checking account, mirroring the SMARTCHECK feature.

Much like a loyalty membership form from other retail or service-oriented businesses, the Carrs Safeway Club Card form collects demographic and contact information to offer personalized deals and coupons, enhancing customer loyalty and engagement.

The form has parallels with online service sign-up forms that require users to agree to privacy policies and terms of service. Users can opt-out of receiving personalized advertisements, similar to opting out of tailored coupons and offers in the Carrs Safeway form.

It resembles an employment application in that it collects personal information and requires a signature to consent to the terms provided by the employer, similar to the customer agreement statement. However, its primary purpose is significantly different, focusing on employment rather than consumer benefits.

The application shares elements with auto-enrollment forms for paperless billing or direct deposit payments. Applicants provide banking details and authorize electronic transactions, akin to the SMARTCHECK system’s process of linking purchases to a checking account.

Similarly, it can be compared to medical consent forms, where individuals provide personal information and agree to certain terms regarding their health care. The key similarity lies in the requirement for a signature to validate consent, although the contexts are entirely different.

This form also aligns with rental agreement applications. Applicants must disclose personal and financial information and agree to specific terms and conditions about the property rental, mirroring the process of agreeing to the Carrs Safeway Club Card’s terms and linking personal financial tools for purchases.

Dos and Don'ts

When it comes to joining the Carrs Plus/Safeway Club, filling out your application form correctly is key to making sure you can enjoy all the benefits without a hitch. Here are some do's and don'ts to help guide you through the process:

- Do print clearly using black or blue ink to ensure all your information is legible and correctly processed.

- Do not leave any required fields incomplete. Missing information could lead to delays or even prevent you from joining the Club.

- Do carefully review each section to ensure that it's filled out correctly. This includes your personal information, any existing card account changes, and Carrs SMARTCHECK details if applicable.

- Do not submit a deposit slip instead of a voided check for the Carrs SMARTCHECK section; this could invalidate your application for this particular service.

- Do ensure you are at least 18 years of age before applying, as it is a requirement for both the Club Card and SMARTCHECK program.

- Do not sign the application until you have double-checked all entered information for accuracy and completeness.

- Do remember to link your phone number to your Club Card, enabling you to still enjoy Club benefits even if you forget your card.

- Do not forget to check (or leave unchecked) the box regarding the receipt of personally tailored coupons or offers based on your preferences for privacy and personalized shopping benefits.

- Do keep in mind that processing your application for Carrs SMARTCHECK might take four to six weeks, so plan accordingly.

Adhering to these guidelines will help streamline the process, allowing you to quickly start enjoying the savings and benefits of your Carrs Plus/Safeway Club Card. Remember, the key to a smooth experience is in the details and making sure your application is filled out accurately and completely.

Misconceptions

When individuals consider joining or updating their Carrs Plus/Safeway Club Card, several misconceptions may steer their understanding and decisions in the wrong direction. Clarifying these misconceptions is essential for allowing consumers to make informed choices regarding their membership and its benefits.

Misconception #1: Personal information will be sold or leased. Many individuals are concerned that their personal information, such as names, addresses, and contact details, will be sold or leased to third parties. However, Carrs explicitly states that it does not sell or lease personally identifying information to non-affiliated companies or entities. Instead, the information recorded about purchases made with the Carrs Plus/Safeway Club Card is used to provide members with special offers and other information that may be of interest to them.

Misconception #2: The Carrs SmartCheck feature can be activated without a club card. Some members believe that they can activate the Carrs SmartCheck feature to pay for groceries with a phone number alone, bypassing the need for a club card. However, to use Carrs SmartCheck for grocery payment, a club card must be used at checkout. The application process requires attaching a voided check for the account from which payments will be made, underscoring the link between the SmartCheck feature and the club card.

Misconception #3: Immediate enrollment and activation of Carrs SmartCheck. There is a belief that the Carrs SmartCheck feature is activated immediately upon application. This is not the case. After submitting the application with a voided check for Carrs SmartCheck, there is a processing period of four to six weeks. Applicants receive a confirmation letter in the mail when their card is ready for SmartCheck activation, after which they need to visit a store to select a Personal Identification Number (PIN) and activate the feature.

Misconception #4: Checking the box to not receive offers will not affect eligibility for all promotions. Some members may choose to opt-out of receiving personally tailored coupons or offers, assuming it only impacts direct marketing communications. However, by checking this box, members eliminate their eligibility to receive any special offers they might otherwise qualify for through their use of the Carrs Plus/Safeway Club Card. This action has broader implications than some might anticipate, affecting eligibility for a range of promotions and special offers linked to card usage.

Clarifying these misconceptions helps potential and current Carrs Plus/Safeway Club Card members understand the terms of their membership more clearly, ensuring they can make the most of their memberships while being fully informed of their rights and the company's policies concerning their personal information and participation in various programs.

Key takeaways

Joining the Carrs Plus/Safeway Club offers several benefits, but it's important to understand the key aspects of filling out and utilizing the Carrs Safeway Club Card form to make the most of your membership. Here are six crucial takeaways to keep in mind:

- Eligibility and Ink Requirements: Applicants must be at least 18 years old. It's essential to fill out the application clearly using black or blue ink, ensuring legibility and avoiding processing delays.

- Linking Phone Numbers: For convenience, your phone number can be linked to your Club Card. This feature is particularly useful if you forget to bring your card to the store, allowing you to still enjoy membership benefits.

- Privacy Matters: Carrs values your privacy. Your personally identifying information will not be sold or leased to non-affiliated companies. However, information regarding your purchases will be recorded to provide you with tailored offers. If you prefer not to receive these personalized coupons or offers, there is an option to opt-out.

- Alaska Airlines Mileage Plan: For those interested in earning miles, you can include your Alaska Airlines Mileage Plan Account Number on the application. This adds a layer of benefit for frequent flyers looking to accumulate miles.

- SMARTCHECK Feature: The application offers the SMARTCHECK feature for a more streamlined shopping experience. By taping a voided check to your application, you link your personal checking account, enabling electronic payments and refunds. Remember, this process requires your Carrs Plus/Safeway Club Card at checkout and does not activate with a phone number alone.

- Processing Time and Application Updates: Allow four to six weeks for the processing of your application. Furthermore, should there be any future changes to your bank account and/or routing number, a complete updated form must be submitted to avoid any disruption in your SMARTCHECK service.

Understanding these key points ensures that your experience with the Carrs Plus/Safeway Club Card not only meets your shopping needs but also enhances your overall shopping experience with tailored offers and convenient payment options.

Popular PDF Forms

Dr2395 - Submission of the DR 2395 form requires an oath of accuracy under penalty of perjury in the second degree.

Who Delivers Court Summons - Alerts the Respondent of their responsibility to inform the court and other parties of any changes to their contact information.

Cna Renewal Online California - Limits online training hours for CNAs, encouraging a balance between digital learning and direct, hands-on training experiences.