Blank Cashiers Check Pdf PDF Template

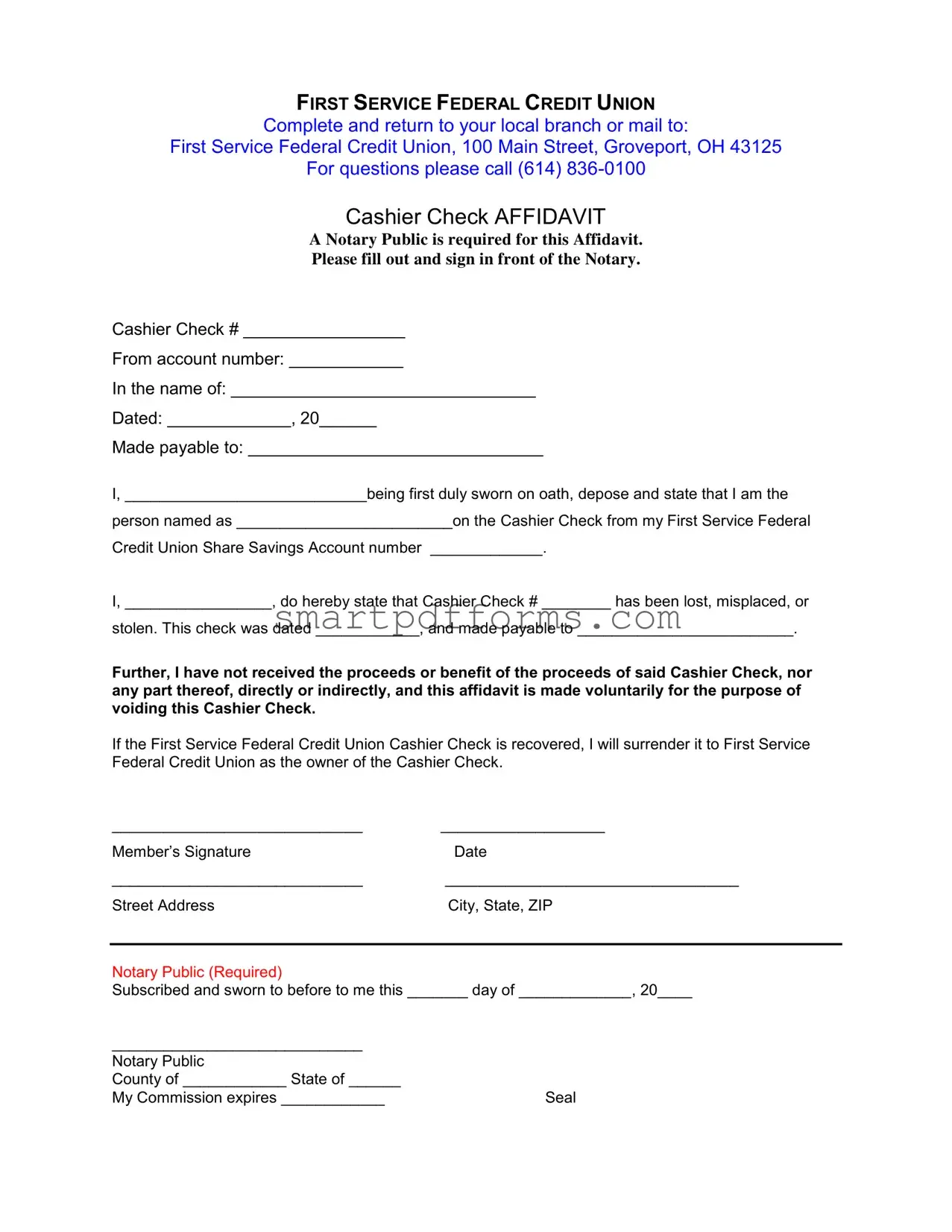

When dealing with financial transactions, especially those that require a higher level of security, cashier's checks play a crucial role. The Cashiers Check Pdf form provided by the First Service Federal Credit Union is a key document that comes into play when a cashier's check, issued by this institution, is reported lost, misplaced, or stolen. This form serves as an affidavit that must be completed and signed in the presence of a Notary Public to ensure its legality and authenticity. By filling out the form, the account holder asserts that the specific check in question cannot be located and has not been cashed or used to their benefit in any direct or indirect way. The procedure outlined in the form is straightforward, requiring details such as the cashier's check number, account number, name of the account holder, who the check was made payable to, and the date of the check. It also binds the signer under oath to surrender the cashier's check to First Service Federal Credit Union if it is ever found, ensuring that the institution can take ownership and properly void it. This safety measure is vital for both the credit union and the account holder, as it helps in mitigating financial loss and preventing potential fraud. With contact information included for further assistance, this form reflects a well-thought-out process to address and resolve issues surrounding the misplacement or theft of cashier's checks.

Preview - Cashiers Check Pdf Form

FIRST SERVICE FEDERAL CREDIT UNION

Complete and return to your local branch or mail to:

First Service Federal Credit Union, 100 Main Street, Groveport, OH 43125

For questions please call (614)

Cashier Check AFFIDAVIT

A Notary Public is required for this Affidavit.

Please fill out and sign in front of the Notary.

Cashier Check # _________________

From account number: ____________

In the name of: ________________________________

Dated: _____________, 20______

Made payable to: _______________________________

I, ____________________________being first duly sworn on oath, depose and state that I am the

person named as _________________________on the Cashier Check from my First Service Federal

Credit Union Share Savings Account number _____________.

I, _________________, do hereby state that Cashier Check # ________ has been lost, misplaced, or

stolen. This check was dated ____________, and made payable to _________________________.

Further, I have not received the proceeds or benefit of the proceeds of said Cashier Check, nor any part thereof, directly or indirectly, and this affidavit is made voluntarily for the purpose of voiding this Cashier Check.

If the First Service Federal Credit Union Cashier Check is recovered, I will surrender it to First Service Federal Credit Union as the owner of the Cashier Check.

_____________________________ |

___________________ |

Member’s Signature |

Date |

_____________________________ |

__________________________________ |

Street Address |

City, State, ZIP |

Notary Public (Required)

Subscribed and sworn to before to me this _______ day of _____________, 20____

_____________________________ |

|

Notary Public |

|

County of ____________ State of ______ |

|

My Commission expires ____________ |

Seal |

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used to report a cashier's check as lost, misplaced, or stolen. |

| Required Information | The form requires the cashier check's number, account number from which the check was drawn, the name on the check, the date of the check, and the payee's name. |

| Notarization Requirement | A Notary Public must witness the signing of this affidavit, making the process more secure and providing a legal acknowledgment of the claim. |

| Issuer Details | The form is issued by the First Service Federal Credit Union, specifying the address and contact number for submission or queries. |

| Governing Law | The law governing this form and the procedures surrounding a lost, misplaced, or stolen cashier's check would be dictated by the state laws of Ohio, where the First Service Federal Credit Union is located. |

Instructions on Utilizing Cashiers Check Pdf

Filling out the Cashier's Check PDF form is an essential step for those who have lost, misplaced, or had their cashier's check stolen. This document helps to notify the issuing credit union about the situation, enabling them to take the necessary actions to void the original check and potentially issue a replacement, protecting your finances. The form requires detailed information to verify your identity and the check's details, and it must be completed in the presence of a Notary Public to ensure its legitimacy. Below are the steps you need to follow to properly fill out this form.

- Start by writing the Cashier Check number in the designated space at the beginning of the form.

- Enter your account number from which the cashier's check was issued.

- Fill in your full name as it appears on the account linked to the cashier's check.

- Input the date on which the cashier's check was issued.

- Write the name of the individual or entity to whom the cashier's check was made payable.

- Under oath, affirm your identity again by entering your name in the space provided after the phrase “I, _______________, being first duly sworn on oath..”

- State the Cashier Check number again, followed by reporting that it has been lost, misplaced, or stolen.

- Repeat the date the check was issued and the name of the payee.

- Signify that you have not received any proceeds or benefits from the check by providing your signature and dating the form in the presence of a Notary Public.

- Provide your address, including street address, city, state, and ZIP code under the signature line.

- The final step involves the Notary Public. They will observe you signing the document, after which they need to fill out their section. This includes the notary's signature, the date of notarization, their commission expiration date, and their seal.

Once you have completed all these steps, your form is ready to be returned to the First Service Federal Credit Union. You can either bring it to your local branch or mail it to the address provided on the form. Remember, the filled-out form serves as a formal notification and request to the credit union to take action regarding the lost, misplaced, or stolen cashier's check. It’s crucial to handle this document with care and ensure each step has been correctly followed for your financial safety.

Obtain Answers on Cashiers Check Pdf

What is a Cashier's Check Affidavit?

A Cashier's Check Affidavit is a formal statement that confirms a cashier's check has been lost, stolen, or misplaced by the account holder. It is a document filled out in the presence of a Notary Public to declare the non-receipt of the check's proceeds and to void the original check. The affidavit facilitates the process of obtaining a replacement check from the financial institution.

Why is a Notary Public required for a Cashier's Check Affidavit?

The involvement of a Notary Public is necessary to legally verify the identity of the signatory and to witness the signing of the affidavit. This requirement adds a layer of security and authenticity to the document, ensuring that the claim about the cashier's check is made by the rightful account holder. Notarization protects against fraudulent claims and helps the financial institution prevent financial losses.

What information do I need to provide in the Cashier's Check Affidavit?

You must include the cashier's check number, the account number from which the cashier's check was issued, your name as it appears on the account, the date the check was issued, and the payee's name. Additionally, you need to affirm that the cashier's check was lost, misplaced, or stolen, state that you have not benefited from its proceeds, and agree to surrender the check if it is later recovered.

How do I submit the Cashier's Check Affidavit?

The completed affidavit must be submitted either in person to your local branch of the First Service Federal Credit Union or mailed to the credit union at "100 Main Street, Groveport, OH 43125". Ensure your affidavit is duly notarized before submission to validate the claim.

What happens after I submit the affidavit?

Upon submission, the credit union will process your affidavit to verify the information provided. If everything is in order, they will proceed to void the original cashier's check and issue a replacement. The specific timeline can vary depending on the institution's policies.

Can I contact someone if I have questions about filling out the affidavit?

Yes, you can contact the First Service Federal Credit Union directly at (614) 836-0100 for any questions or assistance needed in filling out the Cashier's Check Affidavit.

What are the consequences of not notarizing the affidavit?

If the affidavit is not notarized, it will likely be considered invalid by the financial institution. Notarization is a critical step that confirms the identity of the person making the claim and legitimizes the affidavit. Without it, the process to replace the cashier's check cannot proceed.

Is there a deadline to submit the Cashier's Check Affidavit after realizing the check is missing?

While specific deadlines can vary by institution, it is generally advisable to submit the affidavit as soon as possible after discovering the cashier's check is missing. Prompt action can help prevent fraudulent use of the check and facilitate the issuance of a replacement check.

What do I do if I find the cashier's check after submitting the affidavit?

If you recover the cashier's check after submitting the affidavit, you are obligated to surrender it to the First Service Federal Credit Union. The affidavit explicitly states that if the check is found, it must be returned to the credit union as it legally owns the cashier's check once the affidavit is processed and a replacement is issued.

Why is it important to provide accurate information in the affidavit?

Providing accurate information in the affidavit is crucial because it forms the basis of processing your request for a replacement check. Incorrect or fraudulent information can lead to delays, denial of the request, or legal consequences. Accurate details ensure a smooth and efficient process.

Common mistakes

Filling out forms seems straightforward, but when it comes to dealing with financial documents, such as the Cashiers Check PDF form for the First Service Federal Credit Union, people often stumble into several common pitfalls. Here are four mistakes to avoid that can prevent unnecessary delays or complications in your transactions.

Not verifying personal information: It might seem like a no-brainer, but ensuring that your account number, name, and contact details are filled out correctly and legibly is crucial. Any discrepancy in these fundamental details can lead to the rejection of your application or delay its processing.

Skipping the notary public: The form clearly states that a Notary Public is required for this affidavit. Overlooking this step is a critical error. A notarized document is a safeguard for you, confirming your identity and the authenticity of your signature. Without it, the Credit Union has no way of verifying your claim, rendering your submission null and void.

Omitting the Cashier Check number and details: The form asks for specific information about the Cashier Check, including its number, date, and the payee's name. Failing to provide these details can complicate the matter, as the Credit Union needs this information to trace, confirm, and ultimately void the original check. This mistake could potentially lead to a lost check being cashed by an unintended party.

Failure to communicate with the Credit Union: If you have questions or concerns about the form or the process, it's vital to reach out to the Credit Union directly. The provided phone number is there for your benefit. Assuming you understand all aspects of the process without seeking clarification can lead to errors in your form submission, which in turn could delay resolution of your issue.

In summary, when dealing with a document as important as a Cashier Check affidavit, attention to detail is paramount. Take your time, double-check your information, ensure proper notarization, and don't hesitate to contact your Credit Union if you need help. These steps will help streamline the process and secure your financial interests.

Documents used along the form

When dealing with the aftermath of a lost, misplaced, or stolen cashier's check, a few other forms and documents typically accompany the Cashier's Check PDF form to ensure a smooth and secure process. These documents are essential for thorough record-keeping, legal compliance, and to facilitate the steps needed either to issue a stop payment on the original check or to reissue a new one. The proper completion and submission of these accompanying documents can significantly expedite resolving issues related to cashier's checks.

- Stop Payment Request Form: This form is used to officially request the bank to stop payment on the original cashier's check. It requires detailed information about the check, including the check number, amount, date, and payee. This step is crucial to prevent unauthorized cashing of the check if it is found by someone else.

- Indemnity Agreement: To protect the bank in case the original check is presented for payment by a third party, the account holder may need to sign an indemnity agreement. This legal document holds the bank harmless against any claim, demand, or loss incurred due to the stop payment order on the original cashier's check.

- Notarized Affidavit of Loss: In addition to the affidavit provided in the Cashier's Check PDF form, a more detailed notarized affidavit of loss might be required. This serves as a sworn statement concerning the circumstances of the loss and officially documents the incident for the financial institution.

- Check Reissue Request Form: If the customer needs a replacement for the lost, stolen, or misplaced cashier's check, this form would be necessary. It typically requires similar information to the stop payment form plus any details that justify the reissuance of a new check.

In summary, while the Cashier's Check PDF form is a critical document for reporting a lost, misplaced, or stolen check, the additional forms mentioned above are equally important. They provide a comprehensive approach to dealing with such incidents, including stopping payment on the original check, protecting the bank with an indemnity agreement, formally documenting the loss, and facilitating the issuance of a new check if needed. Being prepared with all the relevant information and promptly submitting these documents can help minimize any financial risk or loss.

Similar forms

Money Order Form: A Money Order Form is similar because it also represents a prepaid payment method, just like a cashier’s check. Both documents provide a secure way to pay, issuing a guarantee of payment to the recipient. The information required, such as payee, amount, and issuer information, tends to be similar on both forms.

Personal Check Template: This is similar in that it is another method of payment drawing funds from an individual's account, though less secure than a cashier's check. Personal checks contain the account holder's name, date, payee information, and amount, which mirror elements found in the cashier's check PDF, albeit with the bank guaranteeing the cashier's check.

Bank Draft Form: Similar to cashier's checks, bank drafts are forms of payment made on behalf of an individual by a bank, guaranteeing payment. Both require detailed information about the payer and payee and are considered more secure than personal checks, due to the involvement of bank-issued guarantees.

Wire Transfer Request Form: Like the cashier's check form, a wire transfer form is used to move funds from one party to another. Both forms require detailed information about the payer and the recipient, including account numbers and amounts. However, wire transfers are electronic, while cashier’s checks are physical documents.

Direct Deposit Authorization Form: This form authorizes the deposit of funds directly into a bank account, similar to how a cashier's check provides funds to a payee. Both include the need for bank account information and details about the payer/payee, facilitating the transfer of funds without handling cash or checks.

Stop Payment Request Form: This form is used to stop the payment on a check, including a cashier’s check, due to various reasons such as loss or theft. The form often requires information about the check, similar to the cashier's check affidavit, including check number, amount, and intended recipient, to prevent its cashing.

Credit Union Membership Application: While primarily for membership rather than specific transactions, this form requires personal and banking information similar to what is provided on a cashier's check form, establishing a member's eligibility and accounts from which operations like issuing a cashier’s check can be conducted.

Lost/Stolen Credit Card Report Form: This form shares a resemblance to the section of the cashier’s check form that addresses the loss, theft, or misplacement of the check. Both require detailed information about the account holder, the document or card in question, and the circumstances of its disappearance, aiming to secure the account holder’s finances.

Dos and Don'ts

Filling out a Cashier's Check PDF form requires attention to detail and an understanding of the process to ensure accuracy and legality. Below are the dos and don'ts to consider:

Do:

- Ensure all information is accurate and complete, including the Cashier Check number, account number, name of the issuer, and the payee. Mistakes can lead to delays or issues with the check's validity.

- Fill out the form in the presence of a Notary Public, as their signature and seal are required to verify the affidavit and your identity.

- Immediately notify your local branch or the relevant authority within First Service Federal Credit Union if the Cashier Check is discovered after reporting it lost, misplaced, or stolen.

- Keep a copy of the completed form for your records. This can be helpful in tracking the status of the report and can serve as evidence in case of disputes.

Don't:

- Attempt to fill out the form without having all the necessary information at hand, such as the Cashier Check number and the exact date it was issued.

- Sign the affidavit before you are in front of a Notary Public. Your signature needs to be witnessed and authenticated by the Notary.

- Leave any fields blank. If a section does not apply, write N/A (not applicable) to indicate that the question has been considered and intentionally left unanswered.

- Forget to immediately report the recovery of the check to First Service Federal Credit Union. Holding onto a check that has been reported lost, misplaced, or stolen could lead to legal complications.

Misconceptions

When dealing with a Cashier's Check PDF form, especially in the context of the First Service Federal Credit Union's process, there are several common misconceptions that need to be clarified to ensure individuals understand their rights, responsibilities, and the procedural nuances involved. Here are four of those misconceptions explained:

- Cashier's checks are as good as cash: While cashier's checks are generally considered a secure form of payment, they are not immune to fraud. The belief that these checks cannot bounce or be fraudulent is incorrect. It is essential to treat them with the same caution as any financial transaction.

- Immediately available funds: Another misconception is that funds from a cashier's check are available immediately upon deposit. Banks may place a hold on the funds until the check is verified, which can take several days. Understanding your bank's policy on check holds is critical.

- No need for a notary: As clearly stated in the First Service Federal Credit Union Cashier Check Affidavit, a Notary Public is required for the affidavit to be valid. This step is crucial in verifying the identity of the person claiming the cashier's check lost, misplaced, or stolen, adding an extra layer of security to the process.

- Once lost, the funds are gone: Losing a cashier's check does not necessarily mean that the funds are lost forever. By completing the affidavit provided by First Service Federal Credit Union and fulfilling any additional requirements, such as the notarization of the affidavit, individuals can take steps toward voiding the lost check and securing a reissue. This process, however, can be time-consuming and may involve fees.

Addressing these misconceptions emphasizes the importance of understanding the specifics of handling cashier's checks, especially when it involves procedures set by financial institutions like the First Service Federal Credit Union. Proper knowledge and adherence to these procedures can protect individuals from potential financial loss and complications.

Key takeaways

Completing and using the Cashiers Check Pdf form from the First Service Federal Credit Union requires attention to detail and an understanding of the process. Here are five key takeaways:

- Filling out this form is necessary when a cashier's check is lost, misplaced, or stolen. It serves as a formal request to nullify the original check and potentially issue a new one.

- The form requires the cashier's check number, the account number from which the check was drawn, the name of the account holder, the date of the check, and the payee's name.

- To complete the affidavit, the account holder must swear an oath before a Notary Public, affirming that the cashier's check was indeed lost, misplaced, or stolen, and that they have not received any proceeds from the check.

- It is mandatory to sign the form in the presence of a Notary Public. This adds a layer of verification to the process, ensuring that the request is legitimate. Make sure to check the expiration date of the Notary Public's commission.

- If the lost cashier's check is eventually found, the form obligates the account holder to return the check to the First Service Federal Credit Union. This ensures that the check cannot be cashed or deposited after the affidavit has been filed and a stop payment has been issued.

Understanding these key points can simplify the process of dealing with a lost, misplaced, or stolen cashier's check and ensure that the proper procedures are followed for its cancellation and, if applicable, the issuance of a new check.

Popular PDF Forms

When Must a Competent Person Conduct an Inspection of a Sling - Offers a detailed approach to sling safety, checking for fabric damage in synthetic web slings like acid burns and punctures, ensuring they meet safety criteria.

How to Stop Social Security Payments After Death - This document is for reporting the death of a client at a California care facility, requiring prompt communication with relevant agencies.