Blank Cbp 4457 PDF Template

Travelers often find themselves in a swirl of documentation and procedures when moving across borders with personal belongings, particularly items of higher value. Amidst this complexity, the U.S. Customs and Border Protection (CBP) provides a beacon of simplicity and security in the form of the CBP Form 4457 - a Certificate of Registration for Personal Effects Taken Abroad. Designed under the auspices of the Department of Homeland Security, this form serves a critical function: to verify the ownership and prior possession of personal effects by travelers re-entering the United States. By completing this form, travelers can demonstrate to CBP officers that the items they are bringing back were previously owned and taken out of the U.S., thus potentially avoiding unnecessary duties or taxes. The process involves detailing the items on the form, presenting them for verification before departure, and retaining the signed document for presentation upon return. This seemingly straightforward form, regulated by 19 CFR 148.1, encapsulates a promise of smoother transitions through customs and protection against the possible imposition of duties on previously owned belongings. It’s a voluntary but highly recommended step for those looking to safeguard their possessions and expedite their journey through Customs. The form underscores a simple but vital aspect of travel: ensuring that the joy of bringing home personal treasures is not marred by customs complexities.

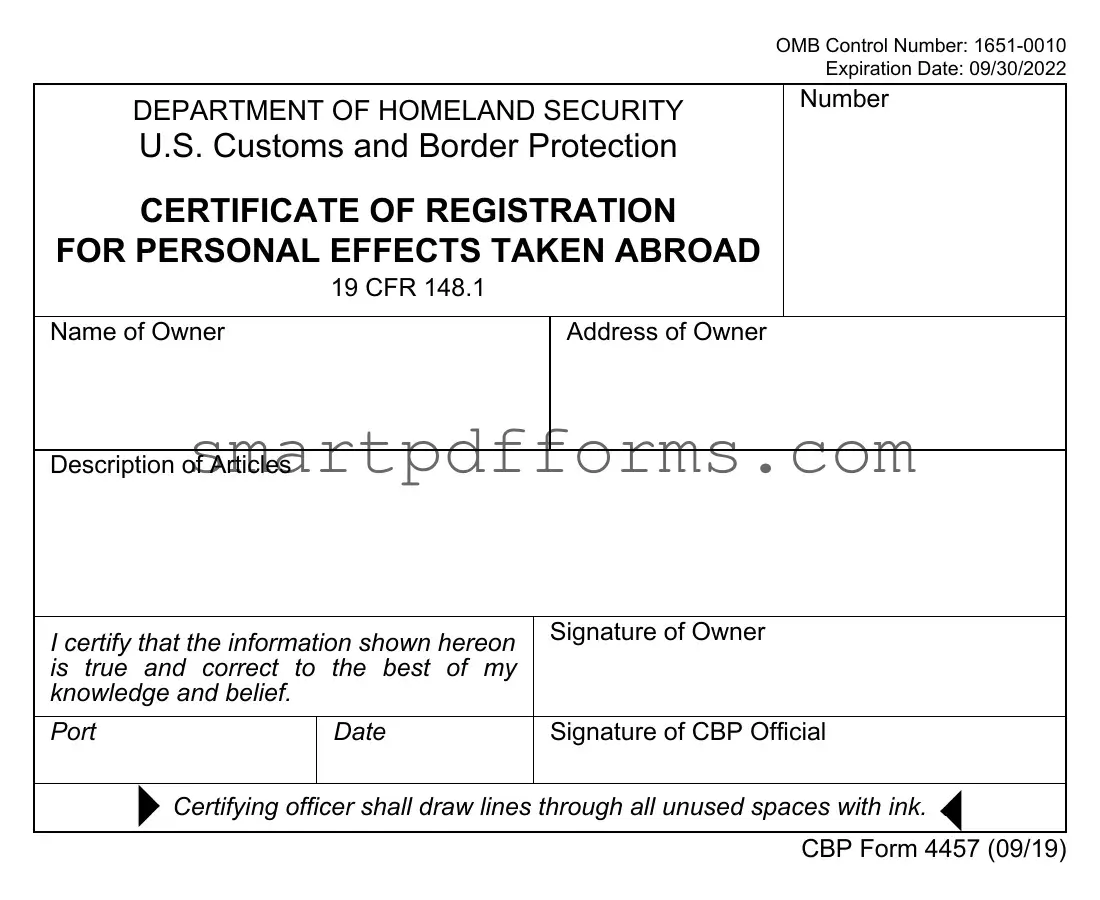

Preview - Cbp 4457 Form

OMB Control Number:

Expiration Date: 09/30/2022

DEPARTMENT OF HOMELAND SECURITY |

Number |

|

U.S. Customs and Border Protection

CERTIFICATE OF REGISTRATION

FOR PERSONAL EFFECTS TAKEN ABROAD

19 CFR 148.1

Name of Owner |

Address of Owner |

|

|

Description of Articles

I certify that the information shown hereon |

Signature of Owner |

|

is true and correct to the best of my |

|

|

knowledge and belief. |

|

|

|

|

|

Port |

Date |

Signature of CBP Official |

Certifying officer shall draw lines through all unused spaces with ink.

Certifying officer shall draw lines through all unused spaces with ink.

CBP Form 4457 (09/19)

Paperwork Reduction Act Notice: The Paperwork Reduction Act requires that we advise you of the purpose of this form and how the information will be used. The form is provided for your use, strictly at your option, in lieu of or in addition to bills of sale, appraisals, and/ or repair receipts to show the CBP officer proof of prior possession of the article(s) in the U.S. The completion of this form by you is strictly voluntary. U.S. Customs and Border Protection does not maintain copies of the completed forms.

Statement Required by 5 CFR 1320.21: The estimated average burden associated with this collection of information is 3 minutes per respondent or record keeper depending on individual circumstances. Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden should be directed to the U.S. Customs and Border Protection, Information Services Branch, Washington, DC 20229, and to the Office of Management and Budget, Paperwork Reduction Project

INSTRUCTIONS

1.Complete the Original only.

2.Prior to Departure, present the described articles and the completed form to a CBP Officer for comparison and signing of the form.

3.The signed form is to be returned to the applicant and must be shown to CBP each time the registered article(s) are returned.

4.This certificate is not transferable.

5.Note: Foreign repairs or alterations to articles (whether or not the articles are registered with CBP) are dutiable. Such repairs or alterations must be declared to Customs when the articles reenter the United States, whether or not they were done free of charge.

CBP Form 4457 (09/19)

Form Data

| Fact Name | Description |

|---|---|

| Purpose of CBP Form 4457 | This form serves as a Certificate of Registration for personal effects taken abroad, allowing U.S. Customs and Border Protection (CBP) officers to verify ownership of articles and ensure they were previously in the United States, facilitating their re-entry. |

| Voluntary Use | The completion and use of CBP Form 4457 by individuals is entirely voluntary and is utilized as proof of prior possession of the articles being brought back into the United States, potentially in lieu of or in addition to bills of sale, appraisals, and repair receipts. |

| Governing Regulation | CBP Form 4457 is governed by 19 CFR 148.1, which outlines the legal framework for the registration of personal effects taken out of the United States to expedite their re-entry. |

| Last Reviewed and Approved | The Office of Management and Budget (OMB) Control Number for this form is 1651-0010, with an expiration date of 09/30/2022, indicating the last federal approval for use. |

Instructions on Utilizing Cbp 4457

Upon planning to travel with valuable personal effects abroad, individuals are often advised to complete the CBP Form 4457 to facilitate their re-entry into the United States. This form serves as proof of prior possession of certain items within the U.S., potentially sparing travelers from unnecessary duties and ensuring a smoother process at customs. By presenting this certificate, which lists the items taken out of the country, individuals can demonstrate to Customs and Border Protection (CBP) officers that these items were in their possession before leaving the U.S. and were not acquired abroad. Following the correct steps in filling out this form is crucial for it to serve its purpose effectively.

- Start with the OMB Control Number and Expiration Date located at the top of the form to ensure its current validity.

- Enter the Name of Owner in the designated space, which should match the name on your travel and identification documents.

- Fill out the Address of Owner section with your current residential address accurately.

- In the Description of Articles field, list each item you are taking abroad that you wish to register, providing as much detail as possible to clearly identify each article (e.g., brand, model, serial number).

- After the description, the Signature of Owner section must be signed by you, affirming that the information provided is true and correct to the best of your knowledge and belief.

- Before your departure, present the items listed and the completed form to a CBP Officer at the port. The officer will compare the items to the form and then sign the Signature of CBP Official field, validating your registration.

- The Certifying officer will then mark through any unused spaces with ink to prevent unauthorized additions.

- The Port where the form was certified and the Date of the officer's signature will be filled out by the CBP official.

- Ensure the form is kept safe and accessible, as it must be presented to CBP each time the registered articles re-enter the United States.

Remember, this certificate is not transferable and should only be utilized by the individual whose name appears on the form. When returning to the U.S., this prior documentation will assist in verifying that the registered articles were not acquired abroad, potentially exempting them from additional duties. It's also essential to note any foreign repairs or alterations to the items, as these may be subject to duties regardless of the item's registration status with CBP. Proper completion and utilization of the CBP Form 4457 can significantly streamline the customs process for travelers carrying valuable personal effects abroad.

Obtain Answers on Cbp 4457

What is the CBP Form 4457 and why is it important?

The CBP Form 4457, also known as the Certificate of Registration for Personal Effects Taken Abroad, plays a significant role for travelers moving in and out of the United States with valuable personal items. This form serves as an official documentation from the U.S. Customs and Border Protection (CBP) to prove that certain items were in your possession before leaving the U.S. Its primary importance lies in its ability to prevent any misunderstandings or claims of importing foreign goods that might attract customs duties when you're re-entering the U.S. Having this form ensures that your items are recognized as previously owned and not subject to additional taxes or duties upon return.

How does one complete and use the CBP Form 4457?

To complete the form, you should accurately list the personal effects you're taking abroad, including a clear description of each item. Essential details such as the brand, model, and serial number (if applicable) should be mentioned to precisely identify the items.

Prior to your departure, present the items and the filled-out form to a CBP Officer. The officer will verify the information, compare it against the actual items, and then sign the form to validate it.

Keep the signed form safe, as you will need to present it to CBP officers upon re-entering the U.S. with the registered items. This document serves as proof that these items were originally possessed in the U.S. and are not subject to duties or taxes.

Are there any items for which the CBP Form 4457 is particularly recommended?

The form is highly recommended for high-value items and personal effects that might otherwise appear as new purchases while abroad. These items include, but are not limited to, electronics (such as laptops, cameras, and smartphones), high-end jewelry, and other valuable equipment that could be subject to duty or require proof of prior possession. In general, if an item's origin might be questioned upon re-entry into the U.S., registering it on a CBP Form 4457 before departure is a wise measure.

Can the CBP Form 4457 be used multiple times, and how long is it valid?

Yes, once completed and signed by a CBP Officer, the CBP Form 4457 serves as a permanent registration of the listed items and can be used for multiple trips abroad. There's no expiration date mentioned on the form itself, meaning its validation lasts for the lifetime of the registered items. However, it's crucial to note that the form is not transferable among individuals. Each traveler must have their form for their personal effects when traveling internationally.

Common mistakes

Filling out the CBP Form 4457 correctly is crucial for travelers who wish to take personal effects abroad and bring them back without having to pay duties. However, mistakes can easily be made. Here are five common errors individuals should avoid:

Not completing the form in advance: Attempting to fill out the form at the last minute can lead to inaccuracies or missing the opportunity to have it signed by a CBP Officer before departure. It's important to complete the form prior to your trip and present the described articles along with the completed form to a CBP Officer as instructed.

Omitting the description of the articles: A thorough description of each item is required. Vague or incomplete descriptions can result in the form being rejected or items not being protected by the registration. Each article should be described clearly to ensure it is easily recognizable upon reentry.

Forgetting to sign the form: The owner’s signature is a declaration that the information provided is true and correct. An unsigned form is invalid. Always check that both the owner and a CBP Official have signed the form before leaving the CBP office.

Not drawing lines through unused spaces: This step is often overlooked but is necessary to prevent unauthorized additions to the form after it has been signed. Unused spaces must be crossed out to ensure the integrity of the information provided.

Failing to declare foreign repairs or alterations: Even if items were previously registered, any foreign repairs or alterations to these items are dutiable and must be declared. Failure to declare these changes can lead to penalties or confiscation of the items upon re-entry into the United States.

By avoiding these common mistakes, travelers can ensure their form is properly completed, helping facilitate a smoother passage through customs upon their return. It is always advisable to consult the CBP Form 4457 instructions or seek guidance from a CBP Officer if there are any uncertainties.

Documents used along the form

When traveling abroad, especially with valuable or unique possessions, it's important to have proper documentation to avoid complications with customs when re-entering your home country. The CBP Form 4457 serves as a pivotal document for U.S. residents, proving ownership and prior possession of personal effects taken out of the country. However, this form is often accompanied by several other important documents, each serving its unique purpose in facilitating smooth travel and customs clearance. Let's explore some of these key documents that might accompany the CBP Form 4457.

- Passport: A government-issued document certifying the holder's identity and citizenship. It's essential for international travel and is frequently consulted along with the CBP Form 4457 to verify the owner's identity.

- Visas: Required for entry into many countries. Visas are endorsements on a traveler's passport indicating that they are allowed to enter, leave, or stay in a country for a specified period.

- Travel Insurance Documents: Provide proof of insurance coverage during international travel. These documents may be required to demonstrate financial capability for expenses related to accidents, health issues, or lost items.

- Flight Itineraries and Hotel Reservations: Proof of your travel plans and accommodations are often needed for both entry into another country and re-entry into your home country, ensuring officers that your visit is temporary.

- Receipts or Appraisals: For valuable items, receipts or appraisals can provide additional proof of ownership and value, complementing the information on the CBP Form 4457. This is particularly useful for items that are difficult to value without an expert assessment.

- Export or Import Permits: Required for certain goods that are controlled or regulated. These permits prove that you have permission to carry items that might otherwise be restricted.

- International Driver’s License: While not directly related to customs clearance, an international driver’s license is necessary for those planning to drive in a foreign country and might be requested by customs officials as part of travel documentation.

In addition to the specific role each document plays, collectively, they work towards ensuring your travels are without legal hurdles, particularly when bringing personal effects with you across borders. Keeping these documents organized and readily available, alongside your CBP Form 4457, can significantly streamline the process of dealing with customs and border protection officials, making for smoother and more enjoyable international travel experiences.

Similar forms

ATA Carnet: Much like the CBP Form 4457, the ATA Carnet facilitates the temporary importation of goods without the need to pay duties and taxes. Both documents serve as proof of ownership and registration of personal or commercial items taken across borders. However, the ATA Carnet is more widely used for items related to trade shows, exhibitions, and professional equipment.

Form 3299 - Declaration for Free Entry of Unaccompanied Articles: This form shares similarities with CBP Form 4457 in that it is used for declaring items entering the United States. While Form 4457 is for personal effects taken abroad and then re-entered, Form 3299 is specifically for the declaration of household goods and personal effects of individuals moving to the US, showing ownership and avoiding certain taxes and duties.

Export Certificate of Registration (CBP Form 4455): This document is akin to the CBP Form 4457 as both are involved in the international movement of goods. The Form 4455 is used to register items that are being temporarily exported out of the U.S. to ensure duty-free re-entry, similar to how Form 4457 registers items before they leave the U.S. for re-entry without duties.

Electronic Export Information (EEI): Formerly known as the Shipper's Export Declaration, the EEI is filed with the U.S. Census Bureau to document export information. Similar to the CBP Form 4457, it assists in the regulation and tracking of items moving across U.S. borders. Both forms help in maintaining records of goods for customs and export compliance.

Personal Effects Bond (PEB): This bond, used when moving personal belongings across international borders, ensures the compliance of the importer with customs regulations. Like the CBP Form 4457, a PEB also assists individuals in managing their personal effects during international moves, focusing on the regulatory and tax-exemption aspects of cross-border movements of goods.

Dos and Don'ts

When filling out the CBP Form 4457, it's crucial to pay attention to detail and follow certain dos and don'ts to ensure the process is smooth and error-free. Here are some guidelines to help you navigate this process effectively:

Dos:

- Complete the original form only, as copies are not accepted by the U.S. Customs and Border Protection (CBP).

- Prior to departure, present the items described in the form alongside the completed form itself to a CBP officer for verification and signing.

- Retain the signed form and present it to the CBP each time the registered articles are brought back into the United States.

- Ensure all information provided on the form is true and correct to the best of your knowledge and belief.

- Clearly describe each article on the form to avoid any confusion during the re-entry process.

- Understand that the certificate provided by this form is not transferable.

Don'ts:

- Do not leave any spaces blank. If there are unused spaces, certifying officers are instructed to draw lines through them with ink, so make sure to fill out the form fully.

- Do not forget to declare any foreign repairs or alterations to articles, regardless of whether they're registered with the CBP, as they may be subject to duties.

- Do not attempt to transfer the certificate to another individual; the certificate is strictly non-transferable.

- Do not disregard the requirement to present the described articles in person to a CBP officer prior to departure; this step is mandatory.

- Do not fill out the form incorrectly by providing false information or omitting details about the articles.

- Do not submit the form without ensuring that every item mentioned is accompanied by a proper and clear description.

Misconceptions

There are several misconceptions surrounding the CBP Form 4457, which is crucial for travelers who wish to take personal effects abroad. Understanding these misconceptions can help in properly utilizing the form and ensuring smooth travel experiences. Here are ten common misconceptions explained:

- It's mandatory for all travelers: Completing the CBP Form 4457 is not mandatory for all travelers. It is strictly voluntary and is used to register items that will be taken out of the U.S. and brought back, to facilitate the re-entry process.

- It's for commercial items: The form is specifically designed for personal effects, not for commercial items. Its main purpose is to document items that an individual already owns and is taking abroad, to prevent duties on these items upon return.

- The government keeps a copy: U.S. Customs and Border Protection (CBP) does not retain copies of completed CBP Form 4457. It is the traveler's responsibility to keep the form and present it upon re-entry to the U.S.

- It's valid for a single trip: Once completed and signed by a CBP official, the form does not have an expiration for the items listed. It can be used multiple times for the items it covers, as long as they are not altered abroad.

- It covers all items brought back to the U.S.: CBP Form 4457 only covers items specifically listed and described on the form. Items acquired abroad or not listed will not be covered by this certificate.

- It can be transferred: The certificate is not transferable. It is issued to the owner of the items and cannot be used by someone else.

- It replaces the need for a bill of sale: While the form can serve as proof of prior possession of items brought back into the U.S., it does not replace the need for a bill of sale or other proof of purchase for items not previously owned and taken abroad.

- It must be completed in person at a port of entry: While the form must be presented to and signed by a CBP officer, travelers can complete the form prior to their arrival at a port of entry to expedite the process.

- Every item needs a separate form: Multiple items can be listed on a single CBP Form 4457, as long as there is enough space to clearly describe each item.

- It guarantees no customs inspections: Completing the form and having it does not exempt the traveler from customs inspections. It merely aids in proving prior possession of listed items to avoid unnecessary duties.

Correct understanding and use of CBP Form 4457 can assist travelers in ensuring that their personal effects are documented for smooth travel across borders without the imposition of additional duties for items they already own.

Key takeaways

The Certificate of Registration, known as CBP Form 4457, serves a significant purpose for individuals traveling abroad with personal effects. This form helps to ensure that travelers can re-enter the U.S. with their previously possessed items without facing unnecessary delays or duties. Here are key takeaways about filling out and utilizing the CBP Form 4457 correctly:

- Completion Is Voluntary: Filling out CBP Form 4457 is entirely optional for travelers. It is designed to provide proof of prior possession of items in the U.S., which can be useful in lieu of, or in addition to, bills of sale, appraisals, or repair receipts.

- Must Be Presented Before Departure: To validate the form, it is imperative that travelers present the described articles along with the completed form to a CBP Officer prior to departure. This allows for comparison and official signing.

- Keep the Form Accessible: Once signed by a CBP Officer, the form is returned to the traveler. It is important to keep this form handy, as it must be shown to CBP officers each time the registered articles re-enter the United States.

- Form Is Not Transferable: The Certificate of Registration is assigned to the individual owner of the goods and cannot be transferred to another person. It is personal to the owner's registered items.

- Foreign Repairs or Alterations: Any foreign repairs or alterations made to the items, regardless of whether they were conducted free of charge, could be subject to duties. Such modifications must be declared to Customs upon re-entry into the U.S., even if the items were previously registered with CBP.

- No Copies Maintained by CBP: It's crucial for travelers to keep their original Form 4457 safe, as U.S. Customs and Border Protection does not keep copies of the completed forms. Losing the form could result in complications when re-entering the U.S. with the registered articles.

Adhering to these guidelines ensures a smoother travel experience, facilitating the re-entry process for travelers returning to the U.S. with valuable personal effects or items of significance. It not only aids in avoiding potential misunderstandings but also helps in streamlining customs procedures, making for an overall more pleasant journey.

Popular PDF Forms

Wells Fargo Wire Routing - Direct contact with a service agent is available for more personalized assistance.

Dd 1561 Army Pubs - The form structures the service member's claim for FSA, guiding them through the requirements and details needed for approval.

Certificate of Appreciation Wording Samples - Holding considerable value, this document certifies the successful conclusion of training segments mandatory for engaging in licensed security and locksmith services as per Illinois law.