Blank Ccis Employment Verification PDF Template

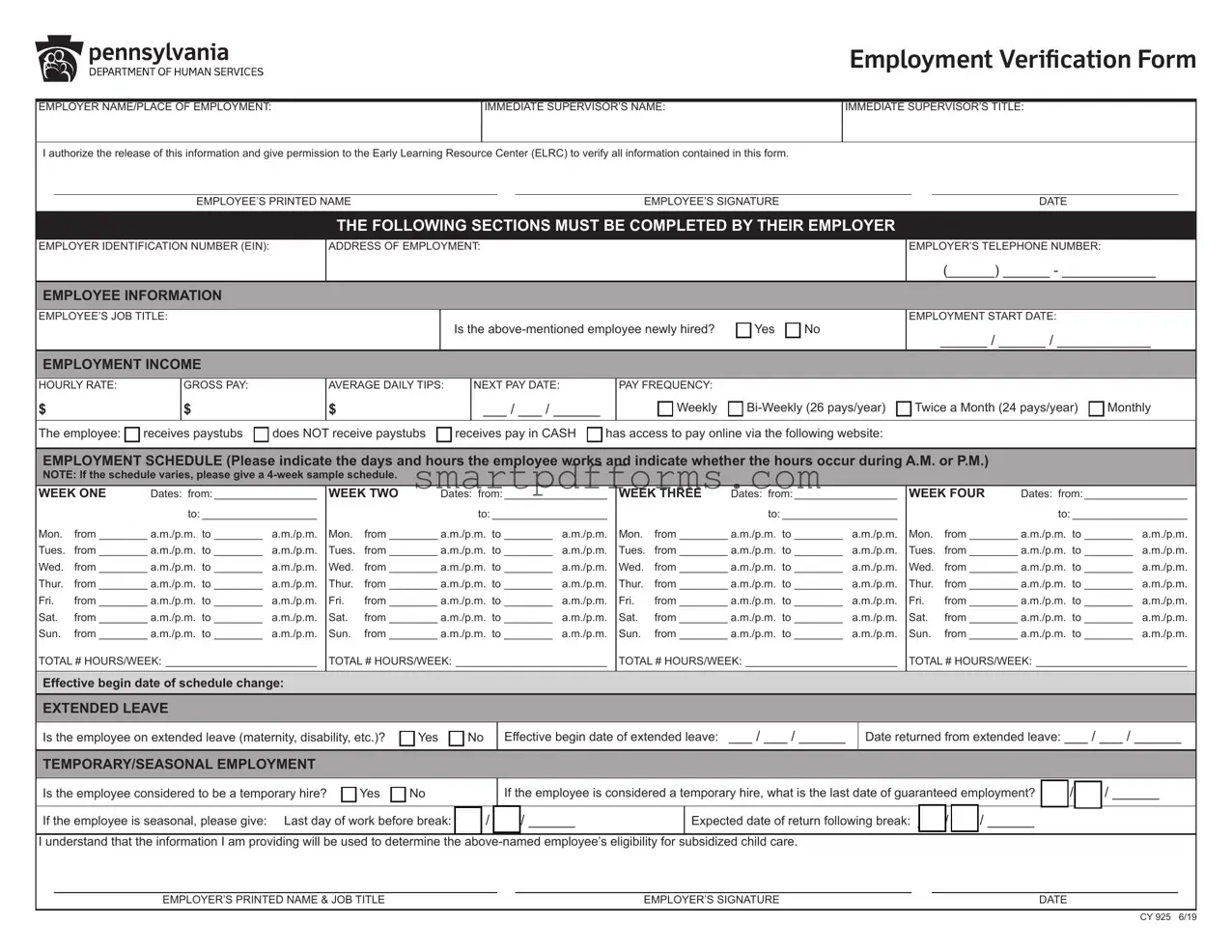

The Ccis Employment Verification form plays a crucial role in determining the eligibility of employees for subsidized child care programs, acting as a bridge between employers, employees, and child care support entities. By providing comprehensive details about an employee's job title, employment start date, income, schedule, and more, this form facilitates a smoother verification process for the Early Learning Resource Center (ELRC). It's designed not only to authenticate an employee's work-related information through employer confirmation but also to encompass specific nuances of their employment scenario such as if the position is newly acquired, the nature of their remuneration, or if they're on extended or seasonal leave. Furthermore, the form requires an employer's active involvement to outline an employee's work schedule over a four-week period if variable, which assists in an accurate assessment of child care support needs. Through signatures of both the employee and a company representative, it underscores the consent to release and verify employment details, ensuring that all parties are engaged in a unified process to support child care funding assistance.

Preview - Ccis Employment Verification Form

|

|

|

|

|

Employment Verification Form |

|||

|

|

|

||||||

EMPLOYER NAME/PLACE OF EMPLOYMENT: |

IMMEDIATE SUPERVISOR’S NAME: |

IMMEDIATE SUPERVISOR’S TITLE: |

||||||

|

|

|

|

|

|

|

|

|

I authorize the release of this information and give permission to the Early Learning Resource Center (ELRC) to verify all information contained in this form. |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

EMPLOYEE’S PRINTED NAME |

|

|

EMPLOYEE’S SIGNATURE |

|

|

DATE |

|

THE FOLLOWING SECTIONS MUST BE COMPLETED BY THEIR EMPLOYER

EMPLOYER IDENTIFICATION NUMBER (EIN):

ADDRESS OF EMPLOYMENT:

EMPLOYER’S TELEPHONE NUMBER:

(______) ______ - ____________

EMPLOYEE INFORMATION

EMPLOYEE’S JOB TITLE:

Is the |

Yes |

No |

EMPLOYMENT START DATE:

______ / ______ / ____________

EMPLOYMENT INCOME

HOURLY RATE: |

GROSS PAY: |

AVERAGE DAILY TIPS: |

NEXT PAY DATE: |

PAY FREQUENCY: |

|

|

|

$ |

$ |

$ |

___ / ___ / ______ |

Weekly |

Twice a Month (24 pays/year) |

Monthly |

The employee:

receives paystubs

receives paystubs  does NOT receive paystubs

does NOT receive paystubs

receives pay in CASH

receives pay in CASH  has access to pay online via the following website:

has access to pay online via the following website:

EMPLOYMENT SCHEDULE (Please indicate the days and hours the employee works and indicate whether the hours occur during A.M. or P.M.)

NOTE: If the schedule varies, please give a

WEEK ONE |

Dates: from:__________________ |

||

|

|

to:____________________ |

|

Mon. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Tues. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Wed. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Thur. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Fri. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Sat. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Sun. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

TOTAL # HOURS/WEEK: _________________________

WEEK TWO |

Dates: from:__________________ |

||

|

|

to:____________________ |

|

Mon. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Tues. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Wed. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Thur. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Fri. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Sat. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Sun. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

TOTAL # HOURS/WEEK: _________________________

WEEK THREE |

Dates: from:__________________ |

||

|

|

to:____________________ |

|

Mon. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Tues. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Wed. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Thur. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Fri. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Sat. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Sun. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

TOTAL # HOURS/WEEK: _________________________

WEEK FOUR |

Dates: from:__________________ |

||

|

|

to:____________________ |

|

Mon. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Tues. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Wed. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Thur. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Fri. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Sat. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

Sun. |

from_________ a.m./p.m. to_________ |

a.m./p.m. |

|

TOTAL # HOURS/WEEK: _________________________

Effective begin date of schedule change:

EXTENDED LEAVE

Is the employee on extended leave (maternity, disability, etc.)? |

Yes |

No |

Effective begin date of extended leave: ___ / ___ / ______

Date returned from extended leave: ___ / ___ / ______

TEMPORARY/SEASONAL EMPLOYMENT

Is the employee considered to be a temporary hire? |

Yes |

No |

If the employee is considered a temporary hire, what is the last date of guaranteed employment? ___ / ___ / ______

If the employee is seasonal, please give: Last day of work before break: ___ / ___ / ______ |

|

Expected date of return following break: ___ / ___ / ______ |

|

|

|||||

|

|

|

|

||||||

I understand that the information I am providing will be used to determine the |

subsidized child care. |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

EMPLOYER’S PRINTED NAME & JOB TITLE |

|

|

EMPLOYER’S SIGNATURE |

|

|

DATE |

|

|

CY 925 6/19

Employment Verification Form

Dear Employer:

One of your employees has requested assistance paying his/her child care costs. We must verify his/her employment with you. This information will help us determine if this employee is eligible for the subsidized child care program. The form must be mailed directly to the Early Learning Resource Center (ELRC).

An authorized COMPANY REPRESENTATIVE (not the employee) must complete this form.

We must have an accurate record of your employee’s work schedule and employment income. Please complete the information on the back of this page. It is very important that the hours shown are specific and defined as either A.M. or P.M. (For example, 7:30 a.m. - 3:30 p.m.). If the employee’s schedule varies, please give a

Thank you for your time and assistance. If you have any questions about how to complete this form, please contact the ELRC listed below.

ELRC:

Early Learning Resource Center Region 17

PO Box 311

1430 DeKalb Street

Norristown, PA

(610)

CY 925 6/19

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | The form is used to verify employment details for employees seeking assistance with child care costs. |

| Authorization | Employees must authorize the release of their employment information to the Early Learning Resource Center (ELRC). |

| Employer Responsibilities | The employer is required to fill in detailed information about the employee’s work schedule, income, and employment status. |

| Income Details | The form collects information on the employee’s hourly rate, gross pay, average daily tips, and pay frequency. |

| Payment Methods | It records how the employee is paid: via paystubs, cash, or online access to pay. |

| Work Schedule | Employers must outline the employee's schedule, including a 4-week sample if the schedule varies. |

| Extended Leave and Temporary Employment | The form asks about any extended leave (e.g., maternity or disability) and if the employment is temporary or seasonal. |

| Governing Law(s) | Specific to Pennsylvania, under the jurisdiction of the Early Learning Resource Center (ELRC) Region 17. |

Instructions on Utilizing Ccis Employment Verification

Filling out the CCIS Employment Verification Form is a necessary step in assisting employees in securing subsidized child care. This document plays a crucial role in assessing eligibility for assistance. By meticulously completing this form, employers provide essential information about an employee's work schedule and earnings. The following steps are intended to guide employers through the process of accurately filling out the form.

- Start by entering the Employer Name/Place of Employment at the top of the form.

- Fill in the Immediate Supervisor’s Name and their Title.

- The employee must print their name, sign, and date the form to authorize the release of the information and allow ELRC to verify the details provided.

- Under the section that must be completed by the employer, enter the Employer Identification Number (EIN).

- Provide the Address of Employment and the Employer’s Telephone Number.

- In the Employee Information section, record the Employee’s Job Title, and specify if the employee is newly hired by selecting Yes or No.

- Enter the Employment Start Date, Hourly Rate, Gross Pay, Average Daily Tips (if applicable), Next Pay Date, and Pay Frequency.

- Mark the appropriate options regarding paystubs, cash payments, and online pay information.

- Detail the employee’s weekly schedule including days and hours worked. Use A.M. and P.M. to specify times. If the schedule varies, provide a 4-week sample schedule.

- Indicate the total number of hours worked each week.

- Specify if the employee is on extended leave, such as maternity or disability leave, and provide the effective begin date and return date.

- State if the employee is a temporary hire or seasonal employee, including the last date of guaranteed employment, the last day of work before break, and the expected return date.

- Finally, an authorized company representative must print their name and job title, sign, and date the form.

After completing the form, it must be mailed directly to the Early Learning Resource Center (ELRC) mentioned in the instructions. This process ensures that the information provided is used solely to determine the employee's eligibility for subsidized child care. Employers are encouraged to contact the ELRC for any questions or clarifications needed. This cooperation is pivotal in supporting employees and their families.

Obtain Answers on Ccis Employment Verification

What is the purpose of the CCIS Employment Verification form?

Who needs to complete the Employment Verification form?

What information does the employer need to provide on the form?

What if the employee’s work schedule varies from week to week?

How does the employer submit the completed CCIS Employment Verification form?

Is it necessary to indicate whether the employee is on extended leave?

What happens if the employment information changes after the form has been submitted?

Why is it important to specify the pay frequency and method on the form?

Can an employee submit the Employment Verification form on behalf of themselves?

The form is used to verify an employee's employment details, including job title, income, and schedule to determine eligibility for subsidized child care through the Early Learning Resource Center (ELRC). It helps ensure that accurate and up-to-date information is provided to assist in the decision-making process regarding the applicant's qualification for child care financial assistance.

An authorized company representative, not the employee applying for assistance, must fill out the form. This ensures that the information provided is accurate and formally recognized by the employer.

Employers are required to detail the Employee’s Identification Number (EIN), employment address, contact information, employee's job title, if the employee is newly hired, their income details, pay frequency, whether they receive paystubs or are paid in cash, a detailed work schedule (or a 4-week sample schedule if the hours vary), and any periods of extended leave or temporary/seasonal employment status.

If the schedule is not consistent, the employer must submit a 4-week sample schedule detailing the employee's working hours for that period. Details should include specific start and end times for each day worked, clearly marked as either A.M. or P.M.

The form should be mailed directly to the Early Learning Resource Center (ELRC) at the address provided on the form. This ensures the information is delivered securely and directly to those responsible for assisting with the child care assistance application process.

Yes, it is crucial to specify if the employee is currently on extended leave (e.g., maternity, disability) and to provide the effective date of the leave, along with the anticipated return date. This helps the ELRC understand any temporary changes in the employee’s work status that might impact their eligibility for subsidy.

Should there be any changes to the employee's employment situation, such as a change in income, job title, or schedule, it is the employer's responsibility to notify the ELRC promptly to ensure that the employee's eligibility for child care assistance is accurately assessed based on the most current information.

Identifying how often the employee is paid and the method (e.g., check, cash, online) helps the ELRC accurately calculate the employee's income, which is a key factor in determining eligibility for child care assistance. Understanding the pay structure is essential for a thorough evaluation of the financial assistance application.

No, to maintain objectivity and ensure accuracy, the form must be filled out and submitted by an authorized company representative. This policy prevents any potential discrepancies or biases in the information provided to the ELRC.

Common mistakes

Filling out the CCIS Employment Verification form accurately is crucial for employees seeking to qualify for subsidized child care programs. However, mistakes can often occur, which may delay or affect eligibility. Here are seven common errors to avoid:

- Incorrect Employer Identification Number (EIN): Providing an incorrect EIN can lead to the verification process being halted. The EIN must match the employer’s official tax identification records.

- Leaving the employment income details incomplete: All fields related to employment income, including hourly rate, gross pay, and average daily tips, need to be filled out comprehensively. Neglecting any section could result in an incomplete understanding of the employee's financial situation.

- Omitting schedule details: Not specifying the days and hours the employee works, especially if the hours are AM or PM, creates ambiguity. A precise schedule supports the eligibility process.

- Vagueness about pay frequency: It’s important to clarify whether the pay is weekly, bi-weekly, twice a month, or monthly. Assuming this detail is clear without specifying can lead to confusion about income calculation.

- Failure to indicate employment status correctly: The form asks for clarity on whether the employee is newly hired, on extended leave, or involved in temporary/seasonal work. Failing to specify or incorrectly marking any of these conditions can misrepresent the employee's employment status.

- Not using the sample schedule option for variable hours: For employees whose schedules vary, providing a 4-week sample schedule is vital. Skipping this step can leave gaps in the verification process.

- Forgetting to authorize the release of information: Without the employee’s signature authorizing the release and verification of the information provided, processing the form can come to a standstill.

Mistakes on the CCIS Employment Verification form can easily undermine the assessment of an employee’s eligibility for child care support. Both employers and employees are encouraged to approach this document with attention to detail, ensuring that every part is completed accurately. A well-filled form not only facilitates the eligibility determination process but also helps in securing the necessary support for child care without unnecessary delays.

Documents used along the form

When processing the CCIS Employment Verification form, a comprehensive understanding of an employee's financial and employment status is crucial. This form, integral for employees seeking subsidized child care, works best when accompanied by other relevant documents. These documents provide a clearer picture of an employee's situation, ensuring a thorough and accurate verification process. Here's a list of other forms and documents often used along with the CCIS Employment Verification form:

- W-2 Form: This tax document, issued by employers, outlines the total income an employee received during the year, including taxes withheld. It's foundational for verifying annual earnings.

- Pay Stubs: Recent pay stubs give a detailed look at an employee's earnings, including hours worked, pay rate, and deductions. They're vital for confirming current income and employment status.

- Letter of Employment: A formal letter from an employer that confirms an employee's job title, salary, and employment status (full-time/part-time). It often includes the start date and is useful for newly hired employees.

- Bank Statements: These reflect an employee's financial transactions and can be used to verify income received through direct deposits, especially when pay stubs are not available.

- Tax Return Documents: Previous years' tax returns provide a comprehensive overview of an individual’s financial situation, including earned income, investments, and potential deductions.

- Proof of Identity and Employment Eligibility (I-9 Form): This form verifies an employee's legal right to work in the U.S. and establishes their identity through documents such as a passport or driver's license.

- Schedule of Working Hours: A detailed schedule provided by the employer that outlines specific work hours, which can be useful to cross-reference with the Employment Verification form's reported schedule.

- Self-Employment Ledger: For self-employed individuals, this document records all business income and expenses, serving as an income verification tool.

- Letter of Offer: Before starting a job, an offer letter from an employer that outlines the position, salary, and start date can be used to document upcoming employment.

Using these documents in conjunction with the CCIS Employment Verification form allows for a thorough review of an employee's financial and employment details. This comprehensive approach ensures that all necessary information is accurately captured, facilitating the process for determining eligibility for subsidized child care programs. By gathering a complete set of relevant documents, employers can provide the Early Learning Resource Center with a fuller picture of an employee's status, making the verification process as smooth as possible.

Similar forms

The W-4 Form, also known as the Employee’s Withholding Certificate, is similar because it collects important employee information for tax purposes, such as employee's financial status which directly impacts payroll. While its purpose differs, focusing on federal tax withholdings rather than childcare subsidy eligibility, both forms are crucial for employment verification and payroll processing.

The I-9 Form (Employment Eligibility Verification) shares similarities with the CCIS Employment Verification form as both are used to confirm vital employment-related information. The I-9 focuses on verifying an employee's eligibility to work in the U.S. through documentation, contrasting with verifying employment for childcare subsidies, yet both ensure employees meet specific criteria for their roles.

A Payroll Direct Deposit Authorization Form is designed to gather bank information from employees for payroll purposes. This form, similar to the CCIS form, collects data directly from the employer or employee to facilitate the correct payment process. Though the CCIS form does not directly deal with bank details, both play significant roles in managing employee compensation arrangements.

The Employee Emergency Information Form is utilized to collect emergency contact details and critical health information from employees. Like the CCIS form, it is an essential document for human resources to maintain updated records. While the focus is more on safety and well-being rather than employment validation, each form fulfills critical administrative and supportive functions within the workplace.

The Background Check Authorization Form has employees provide consent and personal information for background investigations. It parallels the CCIS form in terms of requiring employee consent for a specific verification process, although for different end goals - one for child care subsidy eligibility and the other for criminal and financial checks.

An Annual Performance Review Form involves assessments of an employee's work performance over a set period. Similar to the CCIS form, which captures employment status and income for child care subsidy determination, performance reviews are pivotal in employment verification and decision-making regarding promotions, pay raises, and continued employment.

The Employee Timesheet, used for tracking hours worked, is akin to the CCIS form in its role in verifying employment and work schedules. Though timesheets primarily function for payroll, they also serve as a basic form of employment verification, similar to the way CCIS confirms work schedules for subsidy eligibility.

A Request for Leave Form, necessary for documenting and approving employee leave requests, shares the goal of maintaining accurate employment records like the CCIS form. Both ensure up-to-date employee status information is recorded, though they serve different purposes within human resources management and benefits administration.

The Job Application Form, the initial step in the employment process, captures an applicant's qualifications, experience, and personal data. This form is foundational for verifying the suitability for employment, akin to how the CCIS form verifies employment details for specific benefits, marking both as initial steps in broader verification and eligibility processes.

Dos and Don'ts

When filling out the CCIS Employment Verification form, adhering to a set of dos and don'ts can help ensure that the process is completed smoothly and accurately. Below are some key points to keep in mind:

- Do ensure all information is accurate and up to date, including the employer's identification number and contact details.

- Don't leave any required fields blank. If a section does not apply, indicate this appropriately rather than skipping it.

- Do obtain the necessary authorization from the employee before releasing their information, ensuring their signature and the date are clearly indicated on the form.

- Don't estimate employment income or schedule information. Use actual figures and provide a detailed schedule, including A.M. and P.M. times, to prevent any misunderstanding.

- Do include a 4-week sample schedule if the employee's hours vary from week to week, making sure all days and hours worked are clearly outlined.

- Don't forget to specify if the employee is on extended leave, such as maternity or disability leave, and include the effective begin and return dates.

- Do clarify whether the employee is considered a temporary or seasonal hire, and if so, provide the last date of guaranteed employment or the expected date of return.

- Don't sign the form as the employee. It must be signed by an authorized company representative to verify the accuracy of the provided information.

- Do double-check the form for completeness and correctness before mailing it directly to the Early Learning Resource Center (ELRC) as instructed.

Following these guidelines can help facilitate a smooth verification process, aiding in the determination of an employee's eligibility for subsidized child care through the assistance of the ELRC.

Misconceptions

Below are seven common misconceptions about the Child Care Information Services (CCIS) Employment Verification form and clarifications for each:

- Only the employee needs to fill out the form: Many people believe that employees are responsible for completing the form. However, the document clearly states that an authorized company representative, not the employee, must complete and sign the form. This ensures that the information provided is accurate and officially verified by the employer.

- The form serves as a general employment verification tool: While the form does indeed confirm an individual's employment, it's specifically designed to assess eligibility for the subsidized child care program. Its primary purpose is not to verify employment for loans, housing, or other non-childcare related needs but to assist in determining child care subsidy eligibility.

- Any section can be left blank if not applicable: Each section of the form must be completed accurately. If a part does not apply, it's crucial to indicate this appropriately, rather than leaving it blank. Complete information ensures a thorough assessment by the Early Learning Resource Center (ELRC).

- Income information is optional: Another common misconception is that providing income information is optional. In reality, detailing the employee's earnings is essential for the ELRC to evaluate eligibility for child care assistance appropriately. This includes an employee's hourly rate, gross pay, and average daily tips.

- An email submission is sufficient: The form must be mailed directly to the ELRC. Some may assume that an email copy meets requirements; however, for official processing and verification, the original document must be sent through postal mail to the address provided by the ELRC.

- Pay frequency doesn’t matter: The form asks for specific details about pay frequency, emphasizing the importance of this information. Differentiating between whether an employee is paid weekly, bi-weekly, twice a month, or monthly allows for a more accurate assessment of their financial status and eligibility for assistance.

- Extended leave details are optional: If an employee is on extended leave (e.g., maternity or disability leave), this can significantly impact their eligibility for subsidized child care. Therefore, it is critical to include details of any extended leave, such as the effective begin date and the date the employee returned from such leave.

Clarifying these misconceptions is crucial for properly completing the CCIS Employment Verification form, ensuring eligible families receive the support they need for child care services.

Key takeaways

Filling out the CCIS Employment Verification form is an important step for employees seeking assistance with childcare costs through subsidized programs. Understanding the intricacies of this form can ensure that accurate and helpful information is provided to both employers and the Early Learning Resource Center (ELRC). Here are eight key takeaways to guide you through this process.

Authorization Is Needed: The form requires the employee's authorization to release employment-related information. This is a critical step for privacy and consent, and it allows ELRC to verify the information provided.

Detailed Employer Information Is Required: The form asks for comprehensive details about the employer, including the Employer Identification Number (EIN), address, and contact information. These details are crucial for ELRC's records and any necessary follow-up.

Income Verification: Employers must provide specifics regarding the employee's income, including hourly rate, gross pay, and tips if applicable. This financial information is vital for determining the employee's eligibility for childcare assistance.

Clarity on Payment Methods and Schedule: The form inquires about how the employee is paid (e.g., cash, paystubs, online access), along with the pay frequency. Accurate details help establish the consistency and reliability of the employee's income.

Work Schedule Specifics: Employers are asked to provide a detailed work schedule, essential for understanding the employee's childcare needs. If the schedule varies, a four-week sample schedule is requested to offer a representative overview.

Accounting for Variability: The form accommodates various employment situations, including extended leave, and temporary or seasonal employment. These sections ensure that the employee's eligibility is evaluated based on current and accurate circumstances.

It's a Dual-Process Form: While the initial authorization is provided by the employee, an authorized company representative must complete the bulk of the form. This division ensures that the provided information is verified and accurate.

It's Not Just Paperwork: Completing this form accurately plays a pivotal role in determining an employee’s eligibility for subsidized childcare. It's an essential document for supporting employees in balancing their work and family needs.

Remember, this form is more than just a bureaucratic requirement; it's a tool that can significantly impact the well-being of employees and their families. Taking the time to fill it out accurately and comprehensively can make a meaningful difference in someone's life.

Popular PDF Forms

Is There a Time Limit to File Workers Compensation - Advanced Practice Registered Nurses (APRN) are also mandated to complete and submit the DWC 73 form under specific conditions outlined by the Texas Department of Insurance.

1095a Vs 1095c - Understand the importance of knowing when you become eligible for your employer’s health coverage.

Nikkah Papers - It emphasizes Islamic values and the importance of following Islamic law in marriage arrangements.