Blank Ce200 PDF Template

The Ce200 form serves a crucial function in New York State, streamlining compliance for entities seeking exemption from the New York State Workers’ Compensation and/or Disability Benefits Insurance Coverage. Addressed by the New York State Workers' Compensation Board, this application caters uniquely to entities without employees, out-of-state entities working entirely outside New York State, and those with very limited employee engagement within the state. Its primary use is to provide a Certificate of Attestation of Exemption, a document required when such entities apply for permits, licenses, or contracts with government entities, affirming they are not mandated to carry said insurance. Filling out the application demands careful attention to detail, including applicant personal information, legal entity specifics, and the nature of the business, among others. Furthermore, the application process—which can extend up to four weeks unless done online for immediate certificate issuance—underscores the imperative to plan ahead, ensuring compliance and facilitating smooth operational proceedings for a wide range of business activities within New York State.

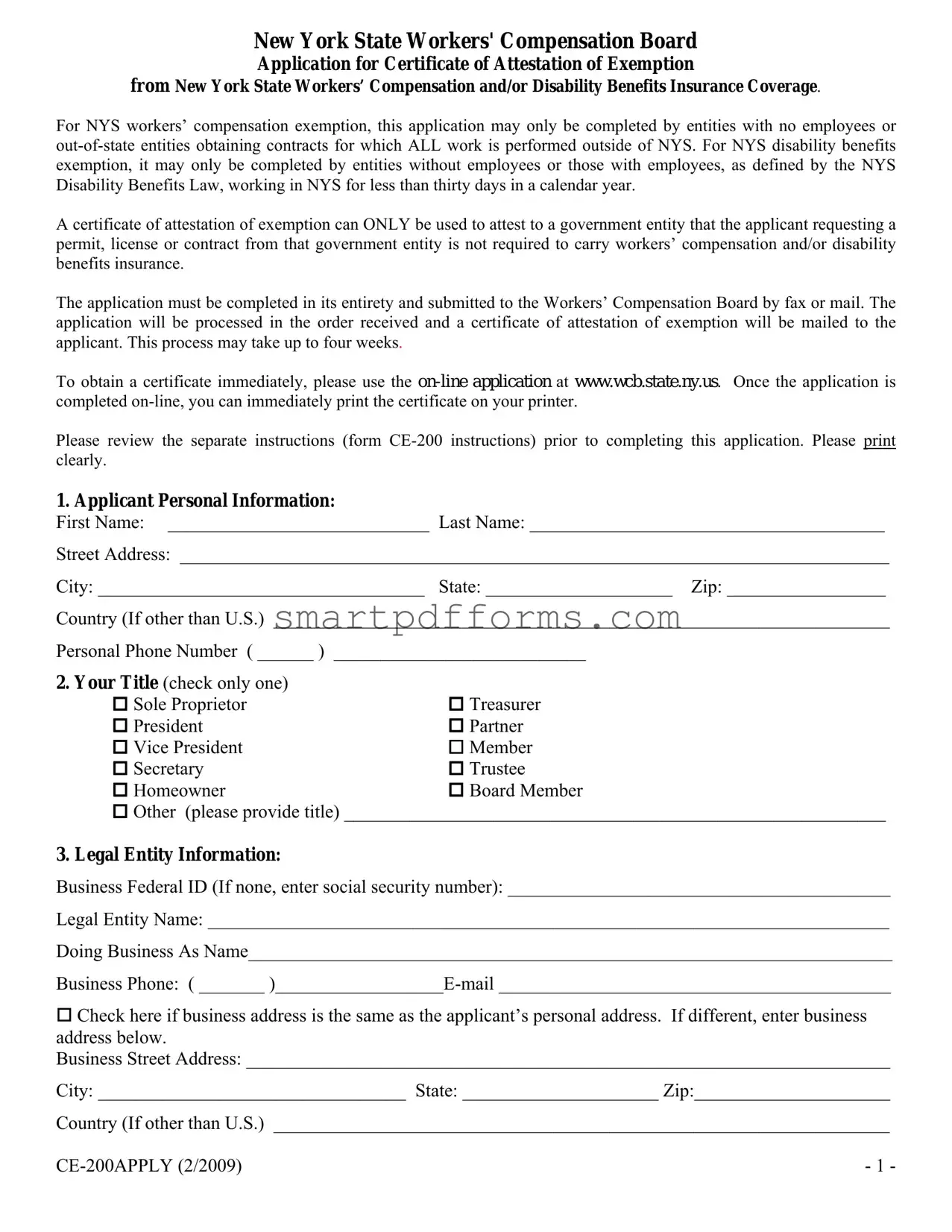

Preview - Ce200 Form

New York State Workers' Compensation Board

Application for Certificate of Attestation of Exemption

from New York State Workers’ Compensation and/or Disability Benefits Insurance Coverage.

For NYS workers’ compensation exemption, this application may only be completed by entities with no employees or

A certificate of attestation of exemption can ONLY be used to attest to a government entity that the applicant requesting a permit, license or contract from that government entity is not required to carry workers’ compensation and/or disability benefits insurance.

The application must be completed in its entirety and submitted to the Workers’ Compensation Board by fax or mail. The application will be processed in the order received and a certificate of attestation of exemption will be mailed to the applicant. This process may take up to four weeks.

To obtain a certificate immediately, please use the

Please review the separate instructions (form

1. Applicant Personal Information:

First Name: ____________________________ Last Name: ______________________________________

Street Address: ____________________________________________________________________________

City: ___________________________________ State: ____________________ Zip: _________________

Country (If other than U.S.) __________________________________________________________________

Personal Phone Number ( ______ ) ___________________________

2.Your Title (check only one)

Sole Proprietor |

Treasurer |

President |

Partner |

Vice President |

Member |

Secretary |

Trustee |

Homeowner |

Board Member |

Other (please provide title) __________________________________________________________

3.Legal Entity Information:

Business Federal ID (If none, enter social security number): _________________________________________

Legal Entity Name: _________________________________________________________________________

Doing Business As Name_____________________________________________________________________

Business Phone: ( _______

Check here if business address is the same as the applicant’s personal address. If different, enter business address below.

Business Street Address: _____________________________________________________________________

City: _________________________________ State: _____________________ Zip:_____________________

Country (If other than U.S.) __________________________________________________________________

- 1 - |

4.Permit/License/Contract Information:

A. Nature of Business:(please check only one)

Construction/Carpentry |

Electrical |

Demolition |

Landscaping |

Plumbing |

Farm |

Restaurant / Food Service |

Trucking / Hauling |

Food CartVendor |

Horse Trainer/Owner |

Homeowner |

Hotel / Motel |

Bar / Tavern |

Mobile - Home Park |

Other (please explain) ______________________________________________________________

B. Applying for:

License (list type) __________________________________________________________________

Permit (list type) ___________________________________________________________________

Contract with Government Agency

Issuing Government Agency: _____________________________________________________________

(e.g. New York City Building Department, Ulster County Health Department, New York State Department of Labor, etc.)

5.Job Site Location Information: (Required if applying for a building, plumbing, or electrical permit) A. Job Site Address

Street address________________________________________________________________________

City: _________________________ State: ___________ Zip: ________County: ________________

B. Dates of project: (mm/dd/yyyy) ___________________ to:(mm/dd/yyyy) _________________________

Estimated Dollar amount of project: |

|

$0 - $10,000 |

$50,001 - $100,000 |

10,001- $25,000 |

Over $100,000 |

$25,001 - $50,000

6.Partners/Members/Corporate Officers

Name: ________________________________________ |

Title: _____________________________________ |

Name: ________________________________________ |

Title: _____________________________________ |

Name: ________________________________________ |

Title: _____________________________________ |

Name: ________________________________________ |

Title: _____________________________________ |

(Attach additional sheet if necessary) |

|

- 2 - |

Employees of the Workers’ Compensation Board cannot assist applicants in answering questions in the following two sections. Please contact an attorney if you have any questions regarding these sections.

7.Please select the reason that the legal entity is NOT required to obtain New York State Specific Workers’ Compensation Insurance Coverage:

□A. The applicant is NOT applying for a workers' compensation certificate of attestation of exemption and will show a separate certificate of NYS workers' compensation insurance coverage.

□B. The business is owned by one individual and is not a corporation. Other than the owner, there are no employees, day labor, leased employees, borrowed employees,

□C. The business is a LLC, LLP, PLLP or a RLLP; OR is a partnership under the laws of New York State and is not a corporation. Other than the partners or members, there are no employees, day labor, leased employees, borrowed employees,

□D. The business is a one person owned corporation, with that individual owning all of the stock and holding all

□

□

offices of the corporation. Other than the corporate owner, there are no employees, day labor, leased employees, borrowed employees,

E.The business is a two person owned corporation, with those individuals owning all of the stock and holding all offices of the corporation (each individual must hold an office and own at least one share of stock). Other than the two corporate officers/owners, there are no employees, day labor, leased employees, borrowed employees,

F.The applicant is a nonprofit (under IRS rules) with NO compensated individuals providing services except for

clergy; or is a religious, charitable or educational nonprofit (Section 501(c)(3) under the IRS tax code) with no compensated individuals providing services except for clergy providing ministerial services; and persons performing teaching or nonmanual labor. [Manual labor includes but is not limited to such tasks as filing; carrying materials such as pamphlets, binders, or books; cleaning such as dusting or vacuuming; playing musical instruments; moving furniture; shoveling snow; mowing lawns; and construction of any sort.]

□G. The business is a farm with less than $1,200 in payroll the preceding calendar year.

□H. The applicant is a homeowner serving as the general contractor for his/her primary/secondary personal residence. The homeowner has no employees, day labor, leased employees, borrowed employees,

□

□

I.Other than the business owner(s) and individuals obtained from a temporary service agency, there are no employees, day labor, leased employees, borrowed employees,

Temporary Service Agency

Name _________________________________________________ Phone #_______________________________

J.The

Carrier______________________________________Policy #__________________________________________

Policy start date _____________________________Policy expiration date ________________________________

- 3 - |

8.Please select the reason that the legal entity is NOT required to obtain New York State Statutory Disability Benefits Insurance Coverage:

□

□

A.The applicant is NOT applying for a disability benefits exemption and will show a separate certificate of NYS statutory disability benefits insurance coverage.

B.The business MUST be either: 1) owned by one individual; OR 2) is a partnership (including LLC, LLP, PLLP, RLLP, or LP) under the laws of New York State and is not a corporation; OR 3) is a one or two person owned corporation, with those individuals owning all of the stock and holding all offices of the corporation (in a two person owned corporation each individual must be an officer and own at least one share of stock); OR 4) is a business with no NYS location. In addition, the business does not require disability benefits coverage at this time since it has not employed one or more individuals on at least 30 days in any calendar year in New York State. (Independent contractors are not considered to be employees under the Disability Benefits Law.)

□

□

C.The applicant is a political subdivision that is legally exempt from providing statutory disability benefits coverage.

D.The applicant is a nonprofit (under IRS rules) with NO compensated individuals providing services except for

□

□

clergy; or is a religious, charitable or educational nonprofit (Section 501(c)(3) under the IRS tax code) with no compensated individuals providing services except for executive officers, clergy, sextons, teachers or professionals.

E.The business is a farm and all employees are farm laborers.

F.The applicant is a homeowner serving as the general contractor for his/her primary/secondary personal residence. The homeowner has not employed one or more individuals on at least 30 days in any calendar year in New York State. (Independent contractors are not considered to be employees under the Disability Benefits Law.)

□G. Other than the business owner(s) and individuals obtained from the temporary service agency, there are no other employees. Other than the business owner(s), all individuals providing services to the business are obtained from a temporary service agency and that agency has covered these individuals for New York State disability benefits insurance. In addition, the business is owned by one individual or is a partnership under the laws of New York State and is not a corporation; or is a one or two person owned corporation, with those individuals owning all of the stock and holding all offices of the corporation (in a two person owned corporation, each individual must be an officer and own at least one share of stock). A Temporary Service Agency is a business that is classified as a temporary service agency under the business’s North American Industrial Classification System (NAICS) code.

9.I affirm that due to my position with the

Signature |

Title |

Date |

- 4 - |

STATE OF NEW YORK

WORKERS' COMPENSATION BOARD

BUREAU OF COMPLIANCE

100BROADWAY ALBANY. NY

THIS AGENCY EMPLOYS AND SERVES PEOPLE WITH DISABILITIES WITHOUT DISCRIMINATION.

Attached is an application for a certificate of attestation of exemption from New York State Workers' Compensation and/or Disability Benefits insurance coverage.

A certificate of attestation of exemption can ONLY be used to attest to a government entity that the applicant requesting a permit, license or contract from that government entity is not required to carry workers' compensation and/or disability benefits insurance.

Please carefully review the instructions before completing the application.

Exemption Application Instructions:

This application must be completed in its entirety and submitted to the Workers' Compensation Board by mailor fax. The application will be processed in the order received and a certificate of attestation of exemption will be mailed to the applicant. This process may take up to four weeks to complete.

For those who require an exemption immediately, please access the

Instructions:

1.Applicant Personal Information: Enter the name (first and last), address and phone number. The applicant must have the knowledge, information and legal authority to file the application. An accountant or lawyer may not file the application on behalf of a client. The applicant will also be required to sign the certificate of attestation of exemption prior to filing it with the government entity.

2.Your title: Title refers to the position held by the applicant. Example: Sole Proprietor, Partner, Member, President, Secretary, Treasurer.

3.Legal Entity Information: Enter Federal ID number used for tax purposes. If the entity does not have a Federal

ID number, enter your social security number. Legal Entity is the business's legally filed name with the Department of State or County Clerk. Example: Corporation (ABC, Inc.) or LLC name ( XYZ, LLC). If this does not apply, enter the applicant's name. Doing business as refersto trade name or the name the business is known by.

4.Permit/License/Contract Information: Nature of business refers to what type of work is being performed. Enter the type of permit, license or contract for which you are applying. Examples: Building permit, health permit, liquor license. Issuing Government Agency is the agency to which you will give the certificate. Examples: City of Albany,

(Continued on reverse)

Form Data

| Fact | Detail |

|---|---|

| Form Title | Application for Certificate of Attestation of Exemption from New York State Workers’ Compensation and/or Disability Benefits Insurance Coverage |

| Eligibility for Application | May only be completed by entities with no employees or out-of-state entities doing all work outside of NYS for workers’ compensation exemption, and by entities without employees or those with employees in NYS for less than thirty days a year for disability benefits exemption. |

| Purpose | To attest to a government entity that the applicant is not required to carry workers’ compensation and/or disability benefits insurance. |

| Submission Methods | Application must be submitted to the Workers’ Compensation Board by fax or mail. |

| Processing Time | Up to four weeks. For immediate processing, use the online application. |

| Online Application Website | www.wcb.state.ny.us |

| Governing Law | New York State Workers' Compensation Law and Disability Benefits Law |

| Important Notice | Applicants must review separate instructions (form CE-200 instructions) before completing the application. |

Instructions on Utilizing Ce200

Understanding and accurately completing the CE-200 form is essential for entities seeking an exemption from New York State Workers' Compensation and/or Disability Benefits Insurance Coverage. This certificate is crucial for businesses that require confirmation of exemption when applying for permits, licenses, or contracts with government entities. It's imperative to provide comprehensive and correct information to avoid delays and ensure compliance with state regulations. Below are step-by-step instructions to assist in the application process, aiming to streamline the acquisition of the exemption certificate.

- Step 1: Fill in the applicant's personal information, including first name, last name, street address, city, state, zip code, and country if outside the U.S. Additionally, provide a personal phone number.

- Step 2: Indicate your title within the entity applying for the exemption by checking the appropriate box. If your specific role is not listed, select the "Other" option and specify your title.

- Step 3: Under Legal Entity Information, enter your Business Federal ID number. If your entity does not have one, use a social security number. Fill in the legal entity name and the Doing-Business-As (DBA) name, if applicable. Include business contact details such as phone number and email. If the business address matches the applicant's personal address, mark the appropriate checkbox. Otherwise, provide the business address details.

- Step 4: For Permit/License/Contract Information, select the nature of your business from the given options and specify any other nature if not listed. Detail the type of license, permit, or contract you are applying for, including the issuing government agency.

- Step 5: If applying for a building, plumbing, or electrical permit, complete the Job Site Location Information section with the address, project dates, and estimated dollar amount of the project.

- Step 6: If your entity is not a sole proprietorship, list all partners, members, or corporate officers with their titles under the Partners/Members/Corporate Officers section. Attach additional sheets if necessary.

- Step 7: Select the reason(s) why your legal entity is NOT required to obtain New York State Specific Workers' Compensation Insurance Coverage. Choose the option that accurately reflects your situation.

- Step 8: Similarly, select the reason(s) why your entity is NOT required to obtain New York State Statutory Disability Benefits Insurance Coverage.

- Step 9: Read the affirmation statement carefully. Then, sign and date the application, indicating your position/title within the entity.

Upon completion, review the entire application to ensure all information is accurate and legible. Submit the form to the Workers' Compensation Board by fax or mail, as directed. Remember, processing can take up to four weeks; however, for immediate needs, utilize the online system available at the Workers' Compensation Board's official website. This digital option allows for the direct printing of the exemption certificate. Preparing thoroughly and understanding the CE-200 form's requirements will expedite this essential step in regulatory compliance.

Obtain Answers on Ce200

-

What is the CE-200 form?

The CE-200 form, also known as the Application for Certificate of Attestation of Exemption from New York State Workers' Compensation and/or Disability Benefits Insurance Coverage, is a document used in New York State (NYS). It is designed for entities that either have no employees or are out-of-state entities engaging in contracts wherein all work is performed outside of NYS. This form is applicable for exemptions from the NYS Workers' Compensation and/or NYS Disability Benefits Insurance Coverage. Upon approval, it certifies to a government entity that the applicant requesting a permit, license, or contract is exempt from carrying said insurance coverage.

-

Who can complete the CE-200 form?

This form may be completed by entities that have no employees or those that have employees working in NYS for less than thirty days in a calendar year. This includes individuals, sole proprietors, partners, and corporate officers of businesses planning to perform work exclusively outside New York State, or those fitting the specific criteria outlined for exemption under the Workers' Compensation and Disability Benefits Laws.

-

How can one submit the CE-200 form?

The CE-200 form can be submitted either by fax or mail to the Workers’ Compensation Board. The application process is handled in the order that the applications are received, and processing may take up to four weeks. However, for immediate processing, applicants are encouraged to complete the application online at the official website (www.wcb.state.ny.us), where they can instantly print the certificate upon completion.

-

What information is required on the CE-200 form?

- Applicant Personal Information: Name, Address, Phone Number.

- Your Title: The title must reflect the applicant's position within the entity, like Sole Proprietor, Partner, or Corporate Officer.

- Legal Entity Information: Includes Federal ID or Social Security Number, Legal Entity Name, and Doing Business As Name, if applicable.

- Permit/License/Contract Information: Nature of Business and details about the permit, license, or contract including the Issuing Government Agency.

- Site Location Information: Required if applying for specific types of permits related to construction, plumbing, or electrical work, along with project dates and estimated dollar amount.

- Reasons for Exemption: Detailed justification for why the entity is exempt from having to obtain Workers’ Compensation and/or Disability Benefits Insurance, specifying the applicable condition that exempts them.

All information must be provided clearly and truthfully, as false statements can lead to felony prosecution and civil liabilities under New York State Laws.

Common mistakes

Not providing complete personal information: Applicants often overlook filling out all fields in the personal information section, including their phone number and country if it's not the U.S. It's essential to provide all requested details to ensure the Workers' Compensation Board can process the application without delays.

Incorrect or missing title: A common mistake is not checking the appropriate title in section 2 or providing a different title without specifying what it is. The form requires the applicant to indicate their position within the company accurately (e.g., Sole Proprietor, Partner). Failure to do so can lead to processing issues.

Misunderstanding the legal entity section: In section 3, applicants either provide incorrect Federal ID numbers or, for those without one, forget to provide their social security number. Moreover, accurately distinguishing between the legal entity name and the "Doing Business As" (DBA) name is crucial, yet often mishandled.

Incorrect Permit/License/Contract Information: Applicants frequently make errors in section 4 by not specifying the nature of their business accurately or by applying for the wrong type of permit, license, or contract. It is imperative to check the applicable boxes and provide detailed information about the issuing government agency and the specific permit, license, or contract being applied for, to ensure the application pertains to the correct category and avoids unnecessary complications.

This list of common mistakes underscores the importance of reviewing and verifying all information before submitting the CE-200 form. The process demands attention to detail, as even minor errors can lead to significant delays or the denial of the application. Therefore, applicants are encouraged to read the instructions carefully, provide complete and accurate information, and double-check their application before submission. Utilizing the online application system is also advisable, as it can help streamline the process and reduce the likelihood of errors.

Documents used along the form

Filling out the CE-200 form is just one step for certain businesses in New York State that seek exemption from workers’ compensation and/or disability benefits insurance coverage. This form is crucial for entities without employees, out-of-state entities working exclusively outside of NYS, and specific other cases. However, this application often needs to be supplemented with various other forms and documents to ensure compliance, streamline operations, or apply for different permits and licenses. Here's a look at some of these important documents:

- DB-120.1: Certificate of Insurance Coverage under the NYS Disability and Paid Family Leave Benefits Law. It's required for businesses with employees in New York to prove they provide disability and family leave benefits.

- DB-155: Certificate of Disability Benefits Insurance. Companies use this to show they have the required NYS disability benefits insurance coverage.

- WC/DB-100: This document is a change request form to update information regarding workers’ compensation and/or disability and paid family leave benefits insurance coverage with the NYS Workers’ Compensation Board.

- C-105.2: Certificate of Workers' Compensation Insurance. Businesses with employees in New York must have this form to verify workers' compensation insurance coverage.

- SI-12: Affidavit of Compliance for Service Providers Exempt from Workers’ Compensation Insurance. Independent contractors or service providers with no employees may need this for certain contractual arrangements.

- U-26.3: State Insurance Fund Certificate of Workers' Compensation Insurance. This is specific to businesses insured through the New York State Insurance Fund, providing evidence of workers’ compensation coverage.

- BPN-105: Business Permit Application. Required for business owners applying for permits to operate, this form potentially supplements CE-200 if the permit application necessitates exemption proof.

- AC-302-S: Sworn Statement for Subcontractors. This document is vital for subcontractors to state their insurance status in projects that require detailed documentation of insurance coverage from every party involved.

It’s essential to remember that the CE-200 form and these related documents help maintain the legal and operational integrity of a business. Each document serves a purpose, from proving insurance coverage to updating business information with the state. Handling them accurately ensures that a business remains in good standing and compliant with New York State laws and regulations. While the CE-200 caters to a specific exemption need, the interconnectedness of these forms reflects the comprehensive nature of business compliance.

Similar forms

The IRS Form W-9, "Request for Taxpayer Identification Number and Certification," shares similarities with the CE-200 form by requiring individuals or entities to provide their taxpayer identification numbers (such as SSN or EIN), and to certify certain information under penalty of perjury. Both forms serve a legal and compliance function, the former for tax reporting and the latter for insurance exemption attestation.

The Form SS-4, "Application for Employer Identification Number," issued by the IRS, like the CE-200 form, is filled out by entities to identify their business structure and provide essential details about their entity for regulatory compliance. While the SS-4 is specific to obtaining a tax ID number, the CE-200 is focused on workers' compensation and disability benefits insurance exemption.

The Form I-9, "Employment Eligibility Verification," also shares common ground with the CE-200. It requires employers to verify the identity and employment authorization of their employees to comply with U.S. employment laws. Both forms involve regulatory compliance and verification processes, although they serve different government requirements.

The DBA (Doing Business As) Certificate filed with county clerks or state agencies, necessary for businesses operating under a trade name, aligns with the CE-200 in its role of formalizing a business's operational identity. Both documents involve declaring business activities to governmental bodies, albeit for different purposes.

The Uniform Commercial Code (UCC-1) Financing Statement is another form with parallels to the CE-200. This document is used to declare a secured interest in a debtor's assets to the public and similar to the CE-200, which is also a declaration but specifically for exemption statuses to a public authority, both play roles in legal identifications and declarations within the business operations context.

Dos and Don'ts

When filling out the CE-200 form, it's crucial to approach this task with care to ensure accuracy and compliance. Here are some dos and don'ts to help guide you through the process:

Do:- Review all instructions carefully before you start filling out the form. This ensures that you understand each requirement and reduces the chances of making mistakes.

- Ensure all information provided is accurate and up to date. Double-check personal details, business information, and contact numbers to avoid any discrepancies.

- Complete the form in its entirety. Missing information can delay the processing time or even lead to the rejection of your application.

- Use the online application if you need the certificate immediately. The online platform allows you to print the certificate right after completing the application.

- Sign the application before submitting it. An unsigned application is considered incomplete and will not be processed.

- Overlook the specifics of your business situation. Make sure the reason for exemption selected accurately reflects your business structure and employment situation.

- Guess if you are unsure about a section. If you have questions, it's better to seek clarity from a professional than to risk providing incorrect information.

- Use a P.O. Box as the only address. Provide a physical street address for both personal and business sections, if applicable.

- Assume one exemption covers all your needs. Verify whether you need to attest to both workers' compensation and disability benefits exemptions.

- Ignore the affirmation section. By signing the application, you affirm that all information is true and acknowledge the legal responsibilities and potential consequences of submitting false information.

Misconceptions

When it comes to the CE-200 form, also known as the New York State Workers' Compensation Board Application for Certificate of Attestation of Exemption from New York State Workers’ Compensation and/or Disability Benefits Insurance Coverage, there are several common misconceptions among the applicants. These misunderstandings can lead to confusion, delays, and even penalties. Here, we aim to clarify some of these misconceptions to provide a clearer understanding of the CE-200 application process.

Only construction-related businesses can apply: It's a common misconception that the CE-200 form is exclusively for construction-related businesses. In reality, any eligible entity, regardless of its industry, can apply for this exemption if it meets the specific criteria set forth by the New York State Workers' Compensation Board. This includes entities with no employees or those with employees working outside of New York State for less than thirty days in a calendar year.

Applying guarantees exemption: Simply completing and submitting the CE-200 form does not guarantee an exemption. The application must meet all the eligibility requirements, and it is subject to review by the Workers' Compensation Board. Each application is processed in the order received, and approval is at the Board's discretion.

The process is instant: While online submissions can lead to an immediate printout of the certificate, the overall process is not always instant. Mailed applications or those requiring further review might take up to four weeks to process. Applicants should plan accordingly and not assume instant approval.

Any business can file: A common misunderstanding is that any business, regardless of its structure or operations, can file for this exemption. However, only entities without employees or out-of-state entities performing all work outside New York State are eligible. Moreover, there are specific criteria for the kinds of employees and work arrangements that qualify an entity for exemption.

No need to renew the certificate: Another myth is that once you receive the CE-200 certificate, it's valid indefinitely. However, this certificate covers only the specific permit, license, or contract period listed on the application. New projects or renewals of permits, licenses, or contracts require a new CE-200 application and certificate.

All government entities accept the CE-200: While the CE-200 certificate is widely recognized, it's possible that certain government entities or situations may require additional or different documentation. Applicants should verify the specific requirements of the government agency they are dealing with to ensure compliance.

No penalty for false information: Unfortunately, some believe that inaccuracies or false statements on the CE-200 form carry no real consequences. This is incorrect. Providing false information on the CE-200 application can lead to felony prosecution, jail time, civil liabilities, and other penalties under New York State Laws.

Understanding these misconceptions about the CE-200 form and the exemption application process is crucial for all applicants. It is always recommended to review the form and its instructions thoroughly or consult with a professional if there are any doubts or questions, ensuring a smooth and compliant experience with the New York State Workers' Compensation Board.

Key takeaways

Filling out and using the CE-200 form, which is the Application for Certificate of Attestation of Exemption from New York State Workers’ Compensation and/or Disability Benefits Insurance Coverage, is crucial for certain businesses in New York. Understanding its key takeaways ensures that entities can correctly navigate through the process. Here are some essential points to consider:

- Eligibility Criteria: The CE-200 form can only be completed by businesses without employees or out-of-state entities that perform all work outside of New York State, aiming for an exemption from NYS workers' compensation. For NYS disability benefits exemption, it applies to both these entities and those with employees working in the state for less than thirty days in a calendar year.

- Usage of Certificate: The certificate you get after submitting the CE-200 form can only be used to prove to a government entity that your business is exempt from carrying workers’ compensation and/or disability benefits insurance when applying for permits, licenses, or contracts.

- Application Process: The form must be filled out completely and submitted either via fax or mail to the Workers’ Compensation Board. Processing can take up to four weeks, but there's an online option for immediate certificate printing.

- Accurate Information is Crucial: Providing false information on the CE-200 form is a serious offense. It's not just about potential felony charges; it also includes the risk of civil liabilities. Ensuring all details are accurate and true is paramount, adhering to the seriousness of perjury implications.

- Details Required: From personal details and your relationship to the applying entity, to specific legal entity information and in-depth details about the permit, license, or contract being applied for, precise and comprehensive information is required. This includes specifying the nature of the business and potentially listing partners or members, depending on the entity's structure.

Adhering to these key points ensures a smoother process in obtaining your Certificate of Attestation of Exemption. It's all about understanding eligibility, the correct use of the certificate, navigating the application process efficiently, providing accurate information to avoid legal repercussions, and knowing exactly what details need to be included.

Popular PDF Forms

Imm 5257 Form Fill Online - Applicants should also specify the duration and details of their planned stay in Canada.

Forensic Science Simplified - Medical examiner is admitted to confirm the cause of death and to perform a preliminary examination of the victim.

I 751 - The form requires detailed information about the conditional resident, including current marital status and residence history.