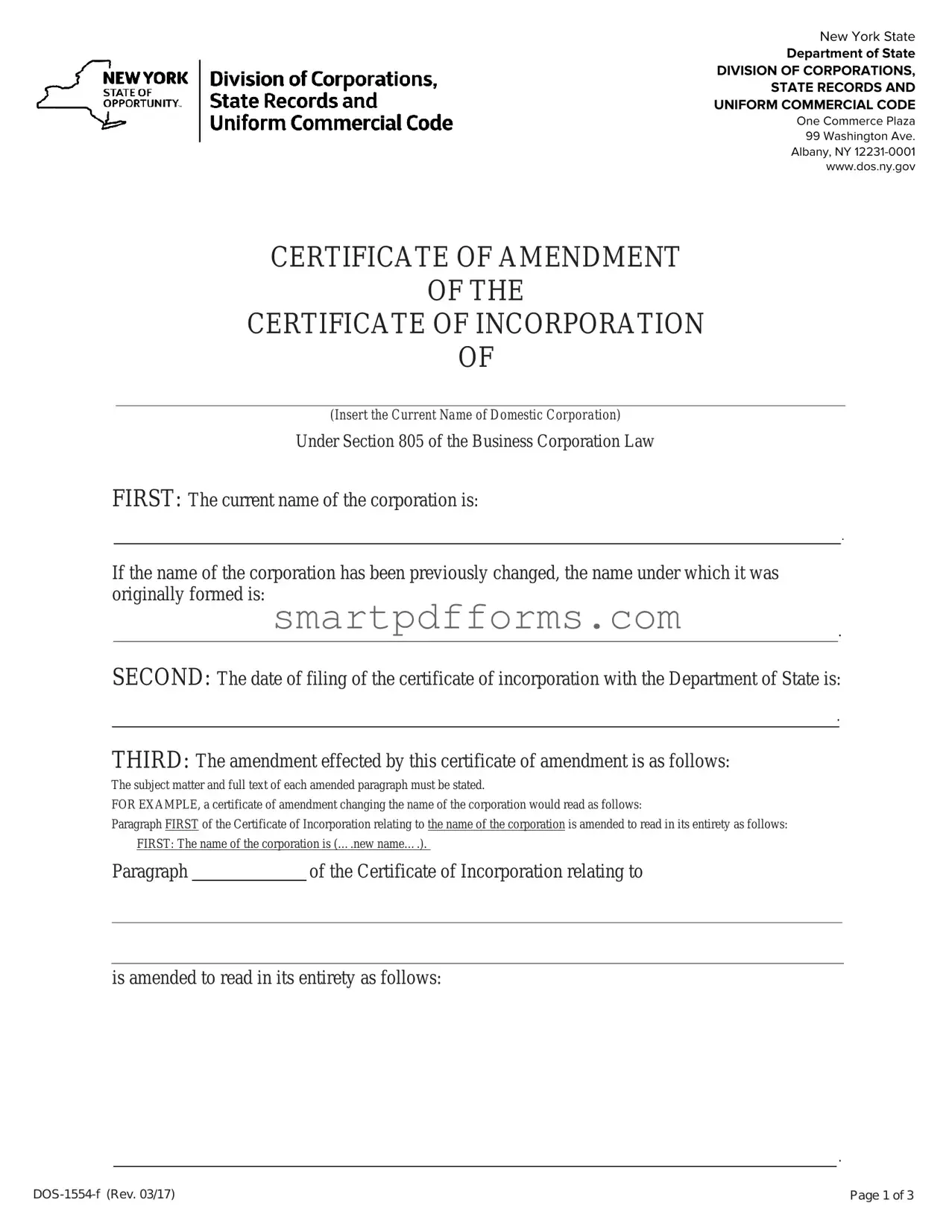

Blank Certificate Of Amendment Nys PDF Template

In the dynamic world of corporate structures, change is both inevitable and necessary for growth and compliance. Recognizing this, the New York State Department of State provides a crucial document known as the Certificate of Amendment of the Certificate of Incorporation for domestic corporations looking to make official changes to their foundational documents. This important form, governed under Section 805 of the Business Corporation Law, serves as a streamlined way for corporations to amend their Certificate of Incorporation, reflecting alterations such as name changes or adjustments to corporate purposes or powers. This procedure is meticulous, requiring precise information starting with the current name of the corporation and, if applicable, its original name at formation. It also mandates the date of filing of the original certificate of incorporation and specifies the exact amendment(s) being made. Authorization methods for these amendments are clearly outlined, offering options such as the vote of the board of directors followed by a majority vote of shareholders or unanimous written consent from all shareholders. Given its significance, the form emphasizes accuracy and completeness, necessitating that all provided information matches the records held by the Department of State exactly. Additionally, the state stresses the benefit of consulting an attorney in preparing this document, although it does provide templates for use. The document concludes with details on filing, including a submission fee, underscoring the formal process of amending a corporation's foundational legal document.

Preview - Certificate Of Amendment Nys Form

New York State

Department of State

DIVISION OF CORPORATIONS,

STATE RECORDS AND

UNIFORM COMMERCIAL CODE

One Commerce Plaza

99 Washington Ave.

Albany, NY

www.dos.ny.gov

CERTIFICATE OF AMENDMENT

OF THE

CERTIFICATE OF INCORPORATION

OF

(Insert the Current Name of Domestic Corporation)

Under Section 805 of the Business Corporation Law

FIRST: The current name of the corporation is:

.

If the name of the corporation has been previously changed, the name under which it was originally formed is:

.

SECOND: The date of filing of the certificate of incorporation with the Department of State is:

.

THIRD: The amendment effected by this certificate of amendment is as follows:

The subject matter and full text of each amended paragraph must be stated.

FOR EXAMPLE, a certificate of amendment changing the name of the corporation would read as follows:

Paragraph FIRST of the Certificate of Incorporation relating to the name of the corporation is amended to read in its entirety as follows:

FIRST: The name of the corporation is (….new name….).

Paragraph |

|

of the Certificate of Incorporation relating to |

|

|

|

|

|

|

is amended to read in its entirety as follows:

.

Page 1 of 3 |

Paragraph |

|

of the Certificate of Incorporation relating to |

is amended to read in its entirety as follows:

.

FOURTH: The certificate of amendment was authorized by: (Check the appropriate box)

The vote of the board of directors followed by a vote of a majority of all outstanding shares entitled to vote thereon at a meeting of shareholders.

The vote of the board of directors followed by a vote of a majority of all outstanding shares entitled to vote thereon at a meeting of shareholders.

The vote of the board of directors followed by the unanimous written consent of the holders of all outstanding shares.

The vote of the board of directors followed by the unanimous written consent of the holders of all outstanding shares.

X

(Signature) |

(Name of Signer) |

(Title of Signer)

Page 2 of 3 |

CERTIFICATE OF AMENDMENT

OF THE

CERTIFICATE OF INCORPORATION

OF

(Insert Current Name of Domestic Corporation)

Under Section 805 of the Business Corporation Law

Filer’s Name and Mailing Address:

Name:

Company, if Applicable:

Mailing Address:

City, State and Zip Code:

NOTES:

1.The name of the corporation and its date of incorporation provided on this certificate must exactly match the records of the Department of State. This information should be verified on the Department of State’s website at www.dos.ny.gov.

2.This form was prepared by the New York State Department of State. It does not contain all optional provisions under the law. You are not required to use this form. You may draft your own form or use forms available at legal stationery stores.

3.The Department of State recommends that all documents be prepared under the guidance of an attorney.

4.The certificate must be submitted with a $60 filing fee.

For Office Use Only

Page 3 of 3 |

Form Data

| Fact Name | Detail |

|---|---|

| Applicable Law | Under Section 805 of the Business Corporation Law |

| Form Preparation Guidance | Prepared by the New York State Department of State; drafting under the guidance of an attorney is recommended |

| Filing Requirement | Mandatory matching of corporation name and incorporation date with Department of State records |

| Amendment Details | Must include the subject matter and full text of each amended paragraph |

| Authorization | Authorized by either the vote of the board of directors followed by a majority vote of all outstanding shares or unanimous written consent of all outstanding shares holders |

| Filing Fee | $60 |

Instructions on Utilizing Certificate Of Amendment Nys

Once you've decided to make an amendment to the Certificate of Incorporation for your New York State corporation, filling out the Certificate of Amendment form accurately is crucial. The steps below guide you through the process, ensuring your amendment meets state requirements. Remember, after submitting this form, the changes you're making will officially alter the structure or details of your corporation as recorded by the state. To ensure accuracy and compliance, consider consulting with a legal professional.

- Start by accessing the form on the New York State Department of State website at www.dos.ny.gov.

- In the section titled CERTIFICATE OF AMENDMENT OF THE CERTIFICATE OF INCORPORATION, insert the current name of your domestic corporation where indicated.

- If the current name of the corporation has changed from its original formation, state the original name as well.

- Note down the date your corporation's Certificate of Incorporation was initially filed with the Department of State.

- Under the section marked THIRD, detail the amendment(s) being made. Specify the subject matter and provide the full text of each amended paragraph. Ensure you replace or state the existing paragraphs with the new amendments as intended.

- In the section FOURTH, indicate how the amendment was authorized. If the board of directors and a majority of shareholders approved it, check the corresponding box. If it was through unanimous written consent by all shareholders, mark that option.

- Sign the form, providing the signature, name, and title of the signer in the designated area.

- On the second page, provide the name and mailing address of the filer. Include any applicable company name and full mailing address details: city, state, and zip code.

- Before submission, review all information for accuracy and completeness. Cross-reference the corporation's name and date of incorporation with records on the New York State Department of State's website to ensure they match exactly.

- Prepare a check for the filing fee, which is $60. Make sure to include this with your submission.

- Send the completed form along with the filing fee to the address provided at the top of the form: Division of Corporations, State Records and Uniform Commercial Code, One Commerce Plaza, 99 Washington Ave., Albany, NY 12231-0001.

Completing and submitting the Certificate of Amendment form is a pivotal step in updating your corporation's official records with the State of New York. It's a process that requires careful attention to detail to ensure that every piece of information provided is accurate and true. After submission, the Department of State will review your amendment. Once approved, your corporation will be recognized legally under the newly amended stipulations. Remember, keeping your corporation's records up-to-date with state regulations is not only a legal requirement but also a good business practice.

Obtain Answers on Certificate Of Amendment Nys

Welcome to the FAQ section for the Certificate of Amendment in New York State. Below, you will find answers to some of the most common questions regarding amending the Certificate of Incorporation for your domestic corporation.

- What is the purpose of the Certificate of Amendment?

The Certificate of Amendment allows a corporation to update or change information in its original Certificate of Incorporation. Changes could include altering the corporation's name, its type of business, the number of authorized shares, and more. Essentially, it's a way to make sure the corporation's official records with the New York State Department of State remain accurate and up to date.

- How do you file a Certificate of Amendment in New York State?

To file a Certificate of Amendment, you need to complete the form provided by the New York State Department of State, specifically under Section 805 of the Business Corporation Law. Your filing must include the current name of the corporation, its date of formation, and a detailed description of the amendment(s) being made. Once filled out, the form should be sent to the Department of State’s Division of Corporations, along with the required filing fee.

- Is there a filing fee for the Certificate of Amendment?

Yes, there is a filing fee of $60 required when submitting a Certificate of Amendment. This fee is for processing the document and updating the state records to reflect your corporation's changes. Make sure to include the payment with your submission to avoid any delays in processing your amendment.

- Do I need an attorney to file a Certificate of Amendment?

While it's not legally required to use an attorney, the New York State Department of State strongly recommends consulting one. An attorney can help ensure that your Certificate of Amendment is completed correctly and that it complies with all applicable laws and regulations. This can prevent potential issues and save you time and resources in the long run.

Remember, keeping your corporation's information current with the New York State Department of State is crucial for maintaining its good standing and ensuring compliance with state laws. Should you have any more specific questions or need further assistance, it might be a good idea to reach out to a legal professional who can provide tailored advice to your situation.

Common mistakes

Filling out the Certificate of Amendment for a domestic corporation in New York State is a crucial process that updates a corporation's information on the official state register. However, this process can be complex, and mistakes are common. Here are eight mistakes people frequently make when completing this form:

Incorrectly listing the current name of the corporation: The name provided must exactly match the corporation's current legal name as registered. Even minor discrepancies can invalidate the form.

Failing to include previously used names: If the corporation has changed its name before, it's necessary to list all previous names used since formation. This is often overlooked.

Providing an inaccurate date of incorporation: The date must reflect the exact day the corporation was initially filed with the Department of State. An incorrect date can cause delays.

Not fully describing the amendment: The form requires a comprehensive description of the amendment, including the full text of any amended paragraphs. Vague descriptions are not acceptable.

Omitting the paragraph number or subject matter being amended: Each amendment must specify which part of the certificate of incorporation it amends, by paragraph number or subject matter.

Incorrect authorization process: The certificate must indicate whether the amendment was authorized by a board of directors' vote and shareholder vote or unanimous written consent of all shareholders. Choosing the wrong option can raise legal issues.

Not using the signature block correctly: The form must be signed by an authorized officer of the corporation, with their title clearly indicated. Unsigned or improperly signed forms will not be accepted.

Inattention to filing fee requirements: The submission must include the correct filing fee ($60 as of the last update). Failing to include the fee, or submitting an incorrect amount, can delay processing.

Besides these common mistakes, it's vital to adhere to all instructions provided on the form and consult with a legal professional if necessary. This can ensure the amendment is processed smoothly and without unnecessary delay.

Documents used along the form

When corporations undergo changes, legal documents are crucial in ensuring these adjustments are recognized and legally binding. In New York State, one essential document for amending a corporation's founding document is the Certificate of Amendment of the Certificate of Incorporation. But this is just one piece of the puzzle. Various other forms and documents are often required or highly recommended to support or accompany this amendment process. From clarifying shareholder agreements to adjusting your business’s operational structure, let's explore some common forms and documents that corporations might use alongside the Certificate of Amendment.

- Articles of Incorporation: Before any amendments, the original Articles of Incorporation serve as the corporation's primary legal document, outlining its purpose, location, and structure.

- Corporate Bylaws: These internal rules govern the corporation's day-to-day operations. Amendments might necessitate updates to bylaws to reflect changes accurately.

- Meeting Minutes: Documenting the shareholder or board of directors meetings where the decision to amend was made is crucial for legal compliance and historical records.

- Shareholder Agreement: This document outlines the rights and obligations of shareholders. Amendments affecting share structure or shareholder rights require adjustments here.

- Notice of Meeting: Notifying all shareholders of the meeting to decide on amendments is not just best practice; it's often a legal requirement, ensuring decisions are made transparently.

- Consent Action by Unanimous Written Consent: If the amendment was authorized by written consent without a meeting, this document records the unanimous agreement of the shareholders or board members.

- IRS Form 8832 - Entity Classification Election: If the amendment affects the corporation’s tax status (such as changing from an S-Corp to a C-Corp), this form must be filed with the IRS.

- Amended Certificate of Authority: Corporations operating across state lines must notify other states of amendments that affect operation, typically by filing an amended certificate of authority.

- Stock Certificates: If the amendment involves changes in stock structure or allocation, existing stock certificates might need to be reissued or adjusted to reflect the changes.

- DBA (Doing Business As) Filing: If the amendment includes a change in the corporation's name, a new DBA filing might be needed, especially if the business operates under a name different from its legal name.

Whether making minor adjustments or undergoing a significant transformation, corporations need to manage and file various documents meticulously. Each document plays a role in ensuring that the legal entity remains compliant, its operations are transparent, and its stakeholders are well-informed. Keeping a checklist of these documents can streamline the process and ensure no critical step is missed as the corporation evolves. Understanding and respecting the legal framework not only safeguards the corporation's interests but also solidifies its standing in the business community.

Similar forms

Certificate of Incorporation: Like the Certificate of Amendment, the Certificate of Incorporation is a foundational document filed with the New York State Department of State for creating a corporation. While the Certificate of Amendment modifies existing information, the Certificate of Incorporation initially establishes the corporation's legal identity, names, objectives, and structure.

Articles of Organization: Used by limited liability companies (LLCs), Articles of Organization serve a similar purpose to the Certificate of Incorporation for corporations. They are fundamental for forming an LLC in New York. Amendments for LLCs, akin to the Certificate of Amendment for corporations, are made through a separate document that updates or changes the information in the Articles of Organization.

Statement of Change of Registered Agent/Office: This document is used to notify the state of a change in a corporation's or LLC's registered agent or office location, similar to how specific amendments might update similar information through the Certificate of Amendment. Both documents serve to keep official records updated with current operational details.

Biennial Statement: New York corporations and LLCs are required to file a Biennial Statement with the Department of State, updating contact information and names of directors or managers. Like the Certificate of Amendment, it ensures that the state has current details about the business, though the Biennial Statement is for ongoing updates rather than structural changes.

Application for Authority: Out-of-state or foreign corporations must file an Application for Authority to do business in New York. Though its purpose differs, it parallels the Certificate of Amendment by providing necessary company details to the state and can be amended to reflect changes in the corporation's status or information.

Certificate of Dissolution: The Certificate of Dissolution is filed when a corporation decides to dissolve and cease operations. While this document marks the end of a corporation's lifecycle, it is similar to the Certificate of Amendment in that it requires formal submission and approval by the Department of State, affecting the corporation's legal status.

Dos and Don'ts

Filling out the Certificate of Amendment for a New York State corporation is an essential task that requires precise attention to detail and adherence to specific guidelines. The process involves submitting changes to the corporation's Certificate of Incorporation to the New York State Department of State. Whether you're amending the corporation's name, purpose, or any other provision of the incorporation certificate, following the right dos and don'ts can make the process smoother and help avoid common pitfalls.

What You Should Do:

Verify the current name of the corporation and its date of incorporation against the Department of State’s records. Accuracy is crucial as any discrepancy can lead to the rejection of the amendment.

State the amendment clearly and completely within the form. If you are changing a specific paragraph, include both the original and the amended text for clarity.

Check the appropriate box to indicate how the certificate of amendment was authorized, whether by the board of directors followed by a vote of a majority of all outstanding shares entitled to vote thereon or by unanimous written consent of all share holders.

Include the required filing fee with your submission. As of the latest update, the filing fee for the Certificate of Amendment is $60. Ensure the fee is included to avoid delays.

Consider consulting with an attorney to ensure all legal bases are covered, especially since the Department of State recommends preparation under the guidance of an attorney.

What You Shouldn't Do:

Forget to sign the document. The signature of the person filing, along with their title, is necessary for the form to be processed.

Use the form without verifying that it suits your specific amendment needs. While the provided form covers general amendments, your corporation might need to include additional information or documents.

Overlook the necessity to provide the filer’s name and mailing address. This information is crucial for any correspondence related to the amendment filing.

Assume the form submission alone is sufficient. Depending on the nature of the amendments, additional approvals or notifications may be required by law.

Submit without double-checking for errors or omissions. A second look can catch mistakes that might cause unnecessary delays or rejections from the Department of State.

Properly amending your corporation's Certificate of Incorporation reflects your commitment to compliance and attention to detail. By following these guidelines, you can ensure the process is completed efficiently and accurately.

Misconceptions

When it comes to altering the foundational components of an established corporation in New York State, the Certificate of Amendment is a crucial document. However, misunderstandings regarding its uses, requirements, and effects are common. Here are four misconceptions about the Certificate of Amendment NYS form:

- Misconception #1: The Certificate of Amendment is only for name changes. Many assume that this form's sole purpose is to process a corporation's name change. In reality, it's designed to formalize any amendment to a corporation's Certificate of Incorporation as filed with the New York State Department of State. This includes, but is not limited to, changes in corporate purpose, duration of the corporation, capital structure, and more.

- Misconception #2: Any member of the corporation can file the amendment. The assumption that the filing can be executed by any member or employee of the corporation is incorrect. The Certificate of Amendment must be authorized by specific governing bodies within the corporation, typically the board of directors and, depending on the nature of the amendment, by a vote of the shareholders.

- Misconception #3: Approval from the Department of State guarantees compliance with all laws. Obtaining approval of the Certificate of Amendment from the New York State Department of State does not inherently mean the amendment complies with all applicable laws. It only indicates that the document meets the basic filing requirements. Ensuring compliance with all relevant federal, state, and local laws—beyond just the filing criteria—is the responsibility of the corporation and, ideally, should be overseen by legal counsel.

- Misconception #4: The form provided by the state must be used. While the New York State Department of State provides a standard form for the Certificate of Amendment, corporations are not mandated to use this specific document. Entities are at liberty to draft their own form or to utilize alternate versions available from legal stationeries, as long as the content fulfills state requirements. The key is to ensure that the amendment is clearly stated and complies with Section 805 of the Business Corporation Law.

Understanding these misconceptions is crucial for any corporation considering an amendment to its Certificate of Incorporation. Missteps can have significant legal and operational repercussions. Therefore, consulting with legal expertise is always advisable to navigate these complexities successfully.

Key takeaways

- The Certificate of Amendment form is utilized to officially record any changes made to the Certificate of Incorporation of a corporation established in New York State under Section 805 of the Business Corporation Law.

- Before submitting the amendment, it is critical to ensure that the corporation's current name and the date of the original filing of the Certificate of Incorporation precisely match the records with the New York State Department of State.

- Verification of the corporation's details can be done through the New York State Department of State's official website at www.dos.ny.gov to prevent discrepancies or rejections.

- All amendments must be clearly outlined in the certificate of amendment, including the subject matter and the full text of each paragraph that is being amended.

- For any change, such as a corporate name change, the exact wording that is being revised must be included. An example provided for a name change amendment specifies how to format this type of amendment.

- Authorization of the certificate of amendment can be conducted in two ways: the vote of the board of directors followed by a vote of a majority of all outstanding shares entitled to vote or by unanimous written consent of all outstanding shares holders.

- The form reminds filers that although this specific certificate is provided by the New York State Department of State, using this form is not mandatory, and one has the option of drafting a unique form or using alternate forms available at legal stationery stores.

- It is recommended by the Department of State to prepare all documents with the guidance of an attorney to ensure accuracy and compliance with the law.

- A filing fee of $60 must accompany the Certificate of Amendment upon submission to the Department of State for processing.

Popular PDF Forms

3072/2 - Structured to collect detailed monthly income information, including salary and other sources of income.

Do Prenups Work in California - Creates a financial blueprint for the marriage, aligning expectations and reducing ambiguity.