Blank Chase Print Counter Checks PDF Template

Managing finances effectively requires a solid understanding of your banking account's features, fees, and functionalities. The Chase Total Checking® account, extensively outlined in their guide, serves as a cornerstone resource for accountholders to navigate through the intricacies of everyday banking. This guide breaks down the essentials, from the avoidance of monthly service fees—achievable through direct electronic deposits, maintaining minimum daily or average balances, to linked qualifying accounts—to a comprehensive analysis of various fee structures, including ATM usage and overdraft implications. It meticulously details options for Chase Debit Card coverage, aiming to empower accountholders in making informed decisions that align with their banking habits. Additionally, it elaborates on the deposit and withdrawal processes, clarifying the order in which transactions are posted to help users manage their accounts proficiently. Highlighting essential services such as wire transfers, stop payment requests, and fees associated with special banking requests, the guide ensures users are well-informed about potential charges. Chase's commitment to transparency is also evident in their explanation of the calculations for qualifying personal deposits and investments, demonstrating a comprehensive approach to account management and customer education.

Preview - Chase Print Counter Checks Form

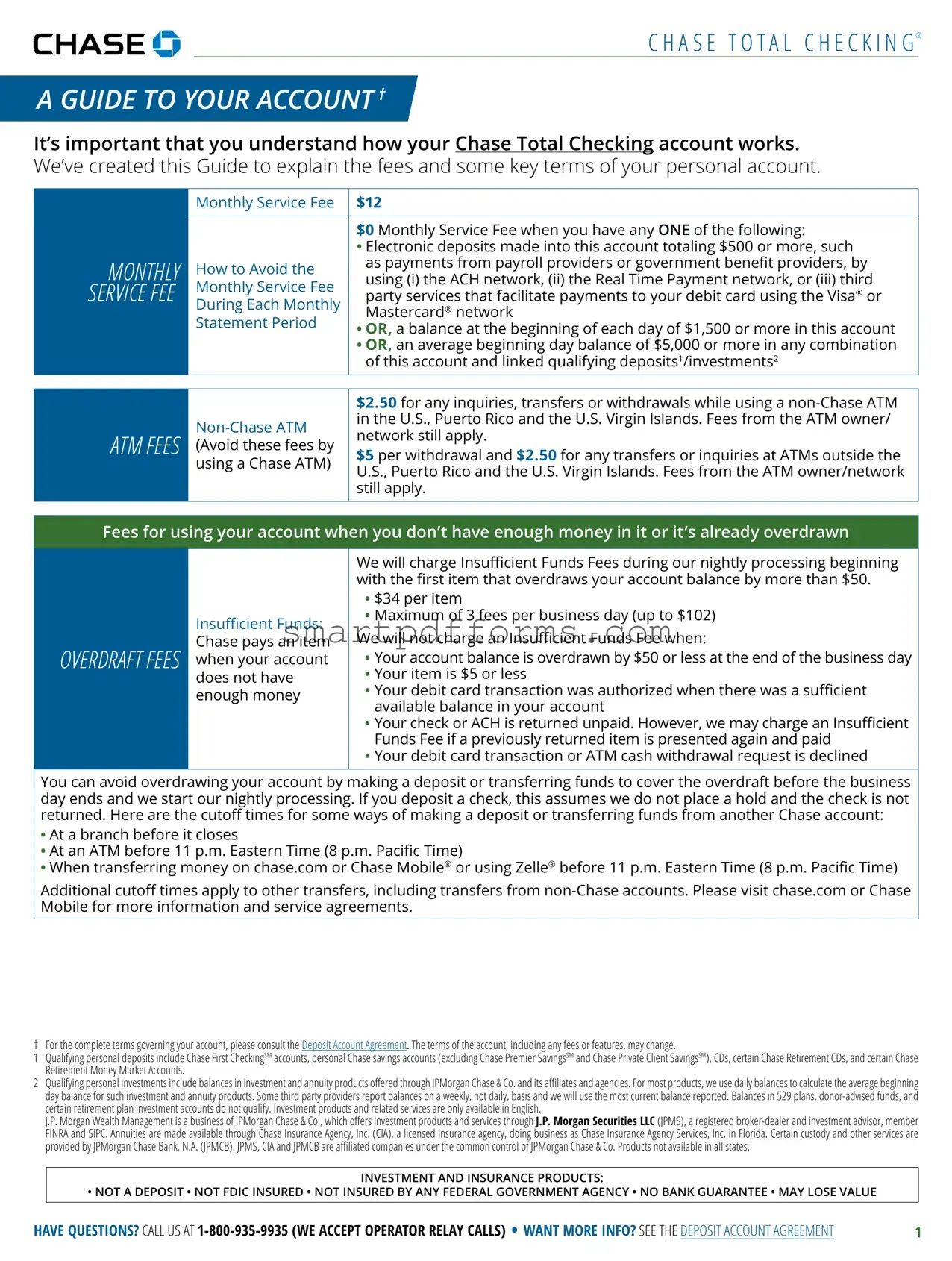

C H A S E T O T A L C H E C K I N G®

A GUIDE TO YOUR ACCOUNT †

It’s important that you understand how your Chase Total Checking account works.

We’ve created this Guide to explain the fees and some key terms of your personal account.

MONTHLY SERVICE FEE

Monthly Service Fee |

$12 |

|

|

|

|

|

$0 Monthly Service Fee when you have any ONE of the following: |

|

|

• Electronic deposits made into this account totaling $500 or more, such |

|

How to Avoid the |

as payments from payroll providers or government benefit providers, by |

|

using (i) the ACH network, (ii) the Real Time Payment network, or (iii) third |

||

Monthly Service Fee |

||

party services that facilitate payments to your debit card using the Visa® or |

||

During Each Monthly |

||

Mastercard® network |

||

Statement Period |

• OR, a balance at the beginning of each day of $1,500 or more in this account |

|

|

• OR, an average beginning day balance of $5,000 or more in any combination |

|

|

of this account and linked qualifying deposits1/investments2 |

|

|

|

ATM FEES

$2.50 for any inquiries, transfers or withdrawals while using a

$5 per withdrawal and $2.50 for any transfers or inquiries at ATMs outside the U.S., Puerto Rico and the U.S. Virgin Islands. Fees from the ATM owner/network still apply.

Fees for using your account when you don’t have enough money in it or it’s already overdrawn

OVERDRAFT FEES

Insufficient Funds:

Chase pays an item when your account does not have enough money

We will charge Insufficient Funds Fees during our nightly processing beginning with the first item that overdraws your account balance by more than $50.

•$34 per item

•Maximum of 3 fees per business day (up to $102)

We will not charge an Insufficient Funds Fee when:

•Your account balance is overdrawn by $50 or less at the end of the business day

•Your item is $5 or less

•Your debit card transaction was authorized when there was a sufficient available balance in your account

•Your check or ACH is returned unpaid. However, we may charge an Insufficient

Funds Fee if a previously returned item is presented again and paid

•Your debit card transaction or ATM cash withdrawal request is declined

You can avoid overdrawing your account by making a deposit or transferring funds to cover the overdraft before the business day ends and we start our nightly processing. If you deposit a check, this assumes we do not place a hold and the check is not returned. Here are the cutoff times for some ways of making a deposit or transferring funds from another Chase account:

•At a branch before it closes

•At an ATM before 11 p.m. Eastern Time (8 p.m. Pacific Time)

•When transferring money on chase.com or Chase Mobile® or using Zelle® before 11 p.m. Eastern Time (8 p.m. Pacific Time)

Additional cutoff times apply to other transfers, including transfers from

† For the complete terms governing your account, please consult the Deposit Account Agreement. The terms of the account, including any fees or features, may change.

1Qualifying personal deposits include Chase First CheckingSM accounts, personal Chase savings accounts (excluding Chase Premier SavingsSM and Chase Private Client SavingsSM), CDs, certain Chase Retirement CDs, and certain Chase Retirement Money Market Accounts.

2Qualifying personal investments include balances in investment and annuity products offered through JPMorgan Chase & Co. and its affiliates and agencies. For most products, we use daily balances to calculate the average beginning day balance for such investment and annuity products. Some third party providers report balances on a weekly, not daily, basis and we will use the most current balance reported. Balances in 529 plans,

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered

FINRA and SIPC. Annuities are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

INVESTMENT AND INSURANCE PRODUCTS:

• NOT A DEPOSIT • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NO BANK GUARANTEE • MAY LOSE VALUE

HAVE QUESTIONS? CALL US AT |

1 |

C H A S E T O T A L C H E C K I N G®

Chase Debit Card Coverage: You can choose how we treat your everyday (not recurring) debit card

transactions when you don’t have enough money available. Please note: Regardless of which option you choose for Chase Debit Card Coverage, you may also want to sign up for Overdraft Protection if you are eligible. Please visit www.chase.com/OverdraftProtection for more details, including terms and conditions.

OPTION #1 (YES): You ask us to add Chase Debit Card Coverage

This means you want Chase to approve and pay your everyday debit card transactions, at our discretion, when you don’t have enough money available (this includes available funds in your linked Overdraft Protection account, if enrolled). Fees may apply. You’ll have until the end of the business day to transfer or deposit enough money to avoid an Insufficient Funds Fee on these transactions.

CHASE DEBIT CARD COVERAGE SM AND FEES 3

(Please visit www.chase.com/checking/

Insufficient Funds

We will charge Insufficient Funds Fees during our nightly processing beginning with the first item that overdraws your account balance by more than $50.

•$34 per item

•Maximum of 3 fees per business day (up to $102)

We will not charge an Insufficient Funds Fee when:

•Your account balance is overdrawn by $50 or less at the end of the business day

•Your item is $5 or less

•Your debit card transaction was authorized when there was a sufficient available balance in your account

•Your check or ACH is returned unpaid. However, we may charge an Insufficient

Funds Fee if a previously returned item is presented again and paid

•Your debit card transaction or ATM cash withdrawal request is declined

OPTION #2 (NO): No Chase Debit Card Coverage (If you don’t choose an option when you open your account, Option #2 (No) is automatically selected for you)

This means you do not want Chase to approve and pay your everyday debit card transactions when you don’t have enough money available (this includes available funds in your linked Overdraft Protection account, if enrolled). Since everyday debit card transactions will be declined when there is not enough money available, you won’t be charged an Insufficient Funds Fee for everyday debit card transactions.

You can avoid overdrawing your account by making a deposit or transferring funds to cover the overdraft before the business day ends and we start our nightly processing. If you deposit a check, this assumes we do not place a hold and the check is not returned. Here are the cutoff times for some ways of making a deposit or transferring funds from another Chase account:

•At a branch before it closes

•At an ATM before 11 p.m. Eastern Time (8 p.m. Pacific Time)

•When transferring money on chase.com or Chase Mobile or using Zelle before 11 p.m. Eastern Time (8 p.m. Pacific Time)

Additional cutoff times apply to other transfers, including transfers from

See the next page for other fees that may apply.

3Important details about your Chase Debit Card Coverage: An everyday debit card transaction is a

HAVE QUESTIONS? CALL US AT |

2 |

C H A S E T O T A L C H E C K I N G®

HOW DEPOSITS AND WITHDRAWALS WORK

Posting order is the order in which we apply deposits and withdrawals to your account. We provide you with visibility into how transactions are posted and in what order to help you better manage your account.

When we transition from one business day to the next business day we post transactions to and from your account during our nightly processing. The order in which we generally post items during nightly processing for each business day is:

•First, we make any previous day adjustments, and add deposits to your account.

•Second, we subtract transactions in chronological order by using the date and time of when the transaction was authorized or shown as pending. This includes ATM and Chase banker withdrawals, transfers and payments; automatic payments; chase.com or Chase Mobile online transactions; checks drawn on your account; debit card transactions; wire transfers; and real time payments. If multiple transactions have the same date and time, then they are posted in high to low dollar order.

The Order in |

°°There are some instances where we do not have the time of the transaction |

|

Which Withdrawals |

therefore we post at the end of the day the transaction occurred: |

|

••We are unable to show the transaction as pending; or |

||

and Deposits |

||

••We don’t receive an authorization request from the merchant but the |

||

Are Processed |

||

transaction is presented for payment. |

||

|

•Third, there are some transactions that we cannot process automatically or until we’ve completed posting of your chronological transactions. This includes Overdraft Protection transfers or transfers to maintain target balances in other accounts. We subtract these remaining items in high to low dollar order.

•Finally, fees are assessed last.

If you review your account during the day, you will see that we show some transactions as “pending.” For details, refer to the section “Pending” transactions in the Deposit Account Agreement. These transactions impact your available balance, but have not yet posted to your account and do not guarantee that we will pay these transactions to your account if you have a negative balance at that time. We may still return a transaction unpaid if your balance has insufficient funds during that business day’s nightly processing, even if it had been displayed as a “pending” transaction on a positive balance during the day. If a transaction that you made or authorized does not display as “pending,” you are still responsible for it and it may still be posted against your account during nightly processing.

|

• Cash deposit – Same business day |

|

|

• Direct deposit/wire transfer – Same business day |

|

When Your Deposits |

• Check deposit – Usually the next business day, but sometimes longer: |

|

Are Available |

||

next business day |

||

(See Funds |

||

Availability Policy in |

||

receipt |

||

the Deposit Account |

||

Agreement for |

||

made that your funds (including the first $225) will not be available for up to |

||

details) |

||

seven business days |

||

|

A “business day” is a |

|

|

above will determine the “business day” for your deposit. |

|

Card Replacement – Rush Request: You request express shipping of a |

$5 per card, upon request |

|

|

replacement debit or ATM card |

||

|

(Avoid this fee by requesting standard shipping) |

|

|

|

|

|

|

OTHER ATM |

3% of the dollar amount of |

||

the transaction OR |

|||

a teller at a bank that is not Chase |

|||

AND DEBIT CARD |

|

$5, whichever is greater |

|

|

|

||

FEES |

|

3% of withdrawal amount |

|

|

Foreign Exchange Rate Adjustment: You make card purchases, |

after conversion to U.S. |

|

|

dollars. For additional |

||

|

|||

|

information on exchange |

||

|

than U.S. dollars |

||

|

rates, refer to the Deposit |

||

|

|

||

|

|

Account Agreement |

|

|

|

|

|

|

See the next page for other fees that may apply. |

|

|

|

|

|

HAVE QUESTIONS? CALL US AT |

3 |

C H A S E T O T A L C H E C K I N G®

WIRE TRANSFER FEES4

|

$15 per transfer OR |

|

Domestic and International Incoming Wire: A wire transfer is |

$0 if the transfer was |

|

originally sent with the help |

||

deposited into your account |

||

of a Chase banker or using |

||

|

||

|

chase.com or Chase Mobile |

|

|

|

|

Domestic Wire: A banker helps you to send a wire to a bank account |

$35 per transfer |

|

within the U.S. |

||

|

||

|

|

|

Online Domestic Wire: You use chase.com or Chase Mobile to send a |

$25 per transfer |

|

wire from your checking account to a bank account within the U.S. |

||

|

||

Consumer USD/FX International Wire: A banker helps you to send a |

$50 per transfer |

|

wire to a bank account outside the U.S. in either U.S. dollars (USD) or |

||

foreign currency (FX) |

|

|

|

|

|

Consumer Online USD International Wire: You use chase.com or |

$40 per transfer |

|

Chase Mobile to send a wire from your checking account to a bank |

||

account outside the U.S. in U.S. dollars (USD) |

|

|

|

|

|

Consumer Online FX International Wire: You use chase.com or Chase |

$5 per transfer OR |

|

$0 per transfer if the |

||

Mobile to send a wire from your checking account to a bank account |

||

amount is equal to $5,000 |

||

outside the U.S. in foreign currency (FX) |

||

USD or more |

||

|

||

|

|

OTHER FEES

Stop Payment: You contact us and a banker places your stop payment |

$30 per request |

|

request on a check or ACH item |

||

|

||

|

|

|

Online or Automated Phone Stop Payment: You use chase.com, Chase |

$25 per request |

|

Mobile or our automated phone system to place a stop payment on a |

||

check. Only some types of stop payments are available |

|

|

|

$12 for each item you |

|

|

deposit or cash that is |

|

|

returned unpaid. Example: |

|

|

You deposit a check from |

|

Deposited Item Returned or Cashed Check Returned: You deposit or |

someone who didn’t have |

|

enough money in his/her |

||

cash an item that is returned unpaid |

||

account. The amount of the |

||

|

||

|

deposit will be subtracted |

|

|

from your balance and |

|

|

you will be charged the |

|

|

Deposited Item Returned Fee |

|

|

|

|

Order for Checks or Supplies: An order of personal checks, deposit |

Varies (based on items |

|

slips or other banking supplies |

ordered) |

|

|

|

|

Counter Check: A blank page of 3 personal checks we print upon your |

$2 per page |

|

request at a branch |

||

|

||

|

|

|

Money Order: A check issued by you, purchased at a branch, for an |

$5 per check |

|

amount up to $1,000 |

||

|

||

|

|

|

Cashier’s Check: A check issued by the bank, purchased at a branch, for |

$8 per check |

|

any amount and to a payee you designate |

||

|

||

|

|

|

Legal Processing: Processing of any garnishment, tax levy, or other |

Up to $100 per order |

|

court administrative order against your accounts, whether or not the |

||

funds are actually paid |

|

|

|

|

SAFE DEPOSIT BOX ANNUAL RENT

Assessed annually at lease renewal. We currently do not rent new Safe Deposit Boxes

Varies by size and location, includes sales tax where applicable

4 Financial institutions may deduct processing fees and/or charges from the amount of the incoming or outgoing wire transfers. Any deductions taken by us, and our affiliates, may include processing fees charged by Chase.

JPMorgan Chase Bank, N.A. Member FDIC

© 2022 JPMorgan Chase & Co.

Effective 1/31/2022

HAVE QUESTIONS? CALL US AT |

4 |

Form Data

| Fact Name | Description |

|---|---|

| Monthly Service Fee | $12, but can be $0 if specific conditions are met such as electronic deposits totaling $500 or more, a daily balance of $1,500, or an average daily balance of $5,000 across certain accounts. |

| ATM Fees | $2.50 for non-Chase ATM transactions in the U.S., Puerto Rico, and the U.S. Virgin Islands; $5 per withdrawal and $2.50 for other transactions at ATMs outside these regions. |

| Overdraft Fees | $34 per item with a maximum of 3 fees per business day. No fee is charged if the account is overdrawn by $50 or less, the item is $5 or less, or if specific conditions apply. |

| Chase Debit Card Coverage | Option to add overdraft coverage for everyday debit transactions which may prevent declined transactions but could result in fees. |

| Deposits Availability | Cash and direct deposits are typically available the same business day. Check deposits may be available the next business day, but the availability can be longer. |

| Wire Transfer Fees | Varies by type and method, from $0 to $50 for incoming wires, and from $25 to $50 for domestic and international outbound wires, with online options providing lower fees. |

| Other Fees | Includes fees for stop payments ($30 per request), deposited items returned ($12 per item), and cashier’s checks ($8 per check), among others. |

| Legal Processing Fees | Charges for processing garnishments, tax levies, or other court orders can be up to $100 per occurrence. |

Instructions on Utilizing Chase Print Counter Checks

Filling out the Chase Print Counter Checks form is a straightforward process designed to provide account holders with temporary personal checks directly from a branch. This service is particularly useful when immediate access to checks is needed, bypassing the wait time associated with ordering permanent checks. Following the below step-by-step instructions will ensure a smooth experience in obtaining counter checks from Chase.

- Visit your local Chase branch and approach the customer service desk to request counter checks.

- Provide the representative with a valid form of identification, such as a driver's license, state ID, or passport, to confirm your identity and account ownership.

- Confirm the account number for which you require counter checks. If unsure, the representative can assist you in locating this information based on your identification and other account details.

- Specify the number of counter check pages you need. Each page contains three checks, so consider how many individual checks you will require in the immediate future.

- Review the fee structure with the representative. As of the provided information, each page of counter checks incurs a $2 fee. Make sure you are aware of the total cost based on the number of pages you are requesting.

- Authorize the payment for the counter check pages. This can typically be deducted directly from your Chase account or paid through other means accepted by the branch.

- Wait for the representative to print and provide you with the requested counter check pages. This process usually takes only a few minutes.

- Before leaving, double-check the counter checks for any errors or misprints. Ensure your account number is correctly printed and that the checks are legible.

Upon completion of these steps, the counter checks are ready for use. They can be utilized just like standard checks for payments or any other transactions where a personal check is acceptable. Keep in mind, the temporary nature of these checks means they should be used as a short-term solution until permanent checks are received. As always, conscious management of your checking account is recommended to avoid potential overdrafts or fees associated with insufficient funds.

Obtain Answers on Chase Print Counter Checks

-

What is the monthly service fee for a Chase Total Checking account, and how can it be avoided?

The monthly service fee for a Chase Total Checking account is $12. This fee can be avoided by meeting one of the following criteria during each monthly statement period: having electronic deposits made into the account totaling $500 or more, maintaining a daily balance of $1,500 or more, or having an average daily balance of $5,000 or more in any combination of this account and linked qualifying deposits/investments.

-

What are the fees for using a non-Chase ATM?

Using a non-Chase ATM in the U.S., Puerto Rico, and the U.S. Virgin Islands incurs a $2.50 fee for inquiries, transfers, or withdrawals. Using one outside of those areas results in a $5 fee per withdrawal and $2.50 for any transfers or inquiries, though additional fees from the ATM owner/network may apply.

-

How does Chase handle overdraft fees?

Chase charges a $34 Insufficient Funds Fee per item when your account does not have enough money, up to 3 fees per business day (up to $102). However, no fee is charged if the account is overdrawn by $50 or less at the end of the business day, the item is $5 or less, the transaction was authorized with a sufficient balance, the check or ACH is returned unpaid, or the debit card transaction or ATM withdrawal is declined.

-

What are the options for Chase Debit Card Coverage?

There are two options for Chase Debit Card Coverage: Option #1 (Yes) asks Chase to approve and pay everyday debit card transactions when there's not enough money available, potentially incurring fees. Option #2 (No), the default option, means Chase won't approve these transactions when funds are insufficient, thus avoiding Insufficient Funds Fees for those transactions.

-

How are deposits and withdrawals processed and ordered?

Chase processes transactions from one business day to the next during nightly processing. The order generally follows: previous day adjustments and deposits first, then transactions are subtracted in chronological order as authorized/pending. Some transactions are posted at the day’s end due to timing or authorization issues. Overdraft protection transfers or target balance transfers and fees are processed last.

-

When are deposits made to my account available?

Availability of deposits can vary: cash deposits and direct deposits/wire transfers are generally available the same business day. Check deposits are typically available the next business day, although there are instances where availability might extend, such as placing a longer hold on a check.

-

What fees are associated with special services like rush card replacement or foreign transactions?

- Rush card replacement requests cost $5 per card.

- Non-ATM cash withdrawals cost 3% of the transaction value or $5, whichever is greater.

- Foreign transactions incur a 3% exchange rate adjustment.

-

What are the fees for wire transfers?

Fees for wire transfers range based on the nature of the wire: $15 for incoming domestic or international wires, $35 for domestic wires initiated via a banker, $25 for online domestic wires, and varying fees for consumer international wires depending on the method and currency.

-

Are there fees for other services like ordering checks, placing stop payments, or for legal processing?

- Stop Payment fees are $30 per request via a banker or $25 for online or automated phone system requests.

- Deposited Item Returned and Cashed Check Returned fees are $12 per item.

- Charges for check orders, counter checks, money orders, and cashier's checks vary.

- Legal Processing fees can be up to $100 per order.

Common mistakes

Not meeting the requirements to avoid the $12 monthly service fee by not having at least one electronic deposit of $500 or more, maintaining a minimum daily balance of $1,500, or maintaining an average daily balance of $5,000 across qualifying accounts and investments.

Using non-Chase ATMs without considering the fees, thereby incurring $2.50 for inquiries, transfers, or withdrawals in the U.S., Puerto Rico, and U.S. Virgin Islands and $5 per withdrawal plus $2.50 for any transfers or inquiries at ATMs outside these regions.

Incurs overdraft fees by not maintaining adequate funds in the account, leading to a $34 charge per item overdrawn by more than $50 up to a maximum of three fees per business day or up to $102.

Failing to choose an option for Chase Debit Card Coverage, which by default sets to "No Chase Debit Card Coverage," potentially resulting in declined transactions for insufficient funds without prior notice.

Not taking advantage of the cutoff times to make deposits or transfer funds to avoid overdraft fees, including not using branches, ATMs, chase.com, Chase Mobile, or Zelle before the specified evening cutoff times.

Overlooking additional fees for specific services such as $5 for rush requests on card replacements, 3% of the transaction amount for non-ATM cash withdrawals, and currency exchange rate adjustments for foreign transactions.

Not being aware of wire transfer fees, leading to unnecessary costs of up to $50 for international wires or differing amounts for domestic wires, depending on the method used to initiate the wire.

Requesting stop payments without considering the fees, which are $30 per request with a banker and $25 for online or automated phone system requests.

Paying for checks, supplies, counter checks, money orders, or cashier's checks without taking into account the varying costs for these services.

Ignores the potential for legal processing fees up to $100 per order for any garnishment, tax levy, or other court administrative order against their accounts.

Documents used along the form

When managing finances, especially with a checking account like Chase Total Checking®, understanding the associated forms and documents is crucial for effective account management. Alongside the common Chase Print Counter Checks form, there are several other documents that holders often use or encounter. Here is a brief overview of four such documents.

- Direct Deposit Authorization Form: This document is used to set up electronic deposits into your checking account, including salary, government benefits, or other regular income. It requires the account holder's personal information, bank account details, and the employer or depositing institution's information.

- Overdraft Protection Service Agreement: For account holders looking to avoid the inconvenience of overdraft fees, this agreement outlines the terms and conditions of Chase’s overdraft protection service. It specifies how funds can be automatically transferred from a linked savings account or credit line to cover transactions that exceed the checking account balance.

- Deposit Account Agreement: An essential document for all account holders, it details the comprehensive terms and conditions of your checking account. This includes information on deposit requirements, fee structures, dispute resolution processes, and rights and responsibilities of both the account holder and the institution.

- ATM and Debit Card Agreement: This outlines the terms of use, fees, liability rules, and security procedures for the account holder's ATM and debit card usage. It is crucial for understanding how to securely manage card transactions and what to do in case the card is lost or stolen.

Together, these documents form a foundational set of materials that help individuals navigate their checking account features, avoid unnecessary fees, and securely manage their finances. Familiarity with these forms can assist account holders in making informed decisions and maximizing the benefits of their Chase Total Checking® account.

Similar forms

Personal Checking Account Agreement: This document is similar to the Chase Print Counter Checks form as it outlines the terms, fees, and key aspects of a personal checking account. It covers monthly service fees, how to avoid them, and the costs associated with overdrafts, similar to how the Chase guide explains these fees for its Total Checking account.

Overdraft Protection Agreement: This agreement shares similarities with the Chase document by explaining the options customers have regarding overdrafts, fees for insufficient funds, and the conditions under which these fees are applied or waived, parallel to the overdraft fees section in the Chase guide.

ATM and Debit Card Terms of Use: Like the section in the Chase guide that discusses ATM fees and debit card coverage options, this document details the fees associated with using ATMs (including non-network ATMs) and the terms governing the use of a debit card, including foreign transaction fees and card replacement costs.

Electronic Funds Transfer Agreement: This document, explaining how electronic deposits and withdrawals are processed, resembles parts of the Chase guide that cover direct deposits, wire transfers, and the real-time payment network, alongside the timing and availability of funds.

Wire Transfer Agreement: Similar to the section in the Chase guide, this document details the fees, terms, and conditions applicable to sending and receiving wire transfers, both domestic and international, including the costs for using online banking platforms to initiate wires.

Stop Payment Request Form: This form relates closely to the Chase guide's section on stop payment fees, outlining the process and fees involved in requesting a stop payment on a check or ACH transfer, including how to make such requests online or by phone.

Safe Deposit Box Rental Agreement: This document parallels the segment in the Chase guide regarding safe deposit box annual rent, detailing the terms of rental, fees, size options, and location-related price variations for renting a safe deposit box at a bank.

Dos and Don'ts

When managing your finances, especially with Chase Print Counter Checks, precision and understanding are paramount. Adhering to certain practices can streamline your experience and prevent common mishaps. Here’s a compiled list of things you should and shouldn't do:

Things You Should Do:

Ensure you understand all fees associated with your Chase Total Checking account as outlined in the Guide, including monthly service fees and the criteria for fee waivers.

Stay aware of the Overdraft Fees section to understand when these fees apply and how you can avoid them by making timely deposits or transfers.

Review the options available for Chase Debit Card Coverage to make an informed decision on whether or not you want Chase to cover certain transactions when funds are low.

Keep track of the deposit and withdrawal posting order to manage your account effectively and avoid overdrawing your account inadvertently.

Familiarize yourself with wire transfer fees, both for domestic and international transfers, to avoid unexpected charges.

Things You Shouldn't Do:

Don’t overlook the eligibility criteria for waiving the monthly service fee. Ensure you meet at least one criterion to avoid unnecessary charges.

Avoid overdrawing your account without understanding the terms attached to Overdraft Protection and Chase Debit Card Coverage options.

Don't delay deposits. Be mindful of the cutoff times for making deposits or transferring funds to ensure they are processed within the same business day.

Avoid unnecessary fees by understanding which transactions can be performed without additional charges, like withdrawing cash at a Chase ATM versus a non-Chase ATM.

Don’t ignore the terms governing wire transfers and the specific fees associated with each type, as these can vary significantly.

Being proactive and well-informed about these aspects can help you navigate your financial transactions with Chase more smoothly and effectively.

Misconceptions

Understanding the Chase Print Counter Checks form can be complex. Here are 10 common misconceptions explained to provide clarity:

Counter checks are free of charge. This is a misconception. There is a fee of $2 per page when requesting counter checks at a Chase branch.

Direct deposits must exceed $500 to avoid the monthly service fee. Actually, any electronic deposit totaling $500 or more, such as payroll or government benefits, can waive the $12 monthly service fee.

Only Chase ATMs can be used without incurring fees. While using a Chase ATM avoids specific fees, there are circumstances, like meeting certain account requirements, where fees for non-Chase ATMs can be avoided, though fees from the ATM owner/network may still apply.

Overdraft fees are unavoidable. Chase offers options to avoid overdraft fees, such as depositing or transferring enough funds to cover the overdraft before the business day ends. Moreover, insufficient funds fees are not charged for transactions that overdrew the account by $50 or less at the end of the business day, among other exceptions.

All incoming wires have fees. Incoming domestic and international wires are free if they were sent with the aid of a Chase banker or using Chase's online platforms or Chase Mobile, otherwise, a fee applies.

Deposits are always available the next business day. While many deposits are available the next business day, certain conditions can delay availability, such as longer holds on checks and the type of deposit made.

Chase Debit Card Coverage automatically applies to all accounts. Account holders must opt into Chase Debit Card Coverage for Chase to approve and pay everyday debit card transactions when there’s insufficient money available. If no choice is made, the coverage is not applied.

All wire transfers have the same fees. Fees vary depending on the method used to send the wire (online or with a banker’s help), whether it's domestic or international, and if it's sent in U.S. dollars or foreign currency.

There’s no fee for placing a stop payment request. There is a fee, which varies depending on whether the stop payment is placed online, using Chase Mobile, the automated phone system, or with the help of a banker.

Account fees and policies are unchangeable. The terms of the Chase Total Checking® account, including fees or features, may change. It’s important to stay informed about any updates to your account agreement.

Key takeaways

Filling out and using the Chase Print Counter Checks form requires an understanding of the Chase Total Checking account’s features and fees. Here are nine key takeaways to ensure an informed usage of this banking option:

- Avoiding the Monthly Service Fee is possible by meeting any one of the specified criteria such as having electronic deposits totaling $500 or more, maintaining a balance of $1,500 at the beginning of each day, or keeping an average daily balance of $5,000 in any combination of this account and linked qualifying accounts.

- ATM Fees can be avoided by using Chase ATMs. A charge of $2.50 applies for non-Chase ATM transactions in the U.S., Puerto Rico, and the U.S. Virgin Islands, and a $5 charge for withdrawals at ATMs outside these areas, with additional fees possible from the ATM owner/network.

- Overdraft Fees of $34 per item can be charged during nightly processing for transactions that overdraw the account by more than $50, with a maximum of three fees per business day. However, specific transactions and conditions can exempt the account from these fees.

- Chase Debit Card Coverage offers two options regarding how everyday debit card transactions are handled when sufficient funds are not available. Customers can opt-in for Chase to approve and potentially cover these transactions at their discretion, subject to fees, or opt-out to have these transactions declined without incurring Insufficient Funds Fees.

- Deposits and Withdrawals Posting Order is crucial for account management. Chase provides transparency on how transactions are processed during nightly processing, which includes prioritizing deposits before subtracting withdrawals and fees in a specific order.

- Availability of Deposits varies by type, with same-day availability for cash deposits and direct/wire transfers, and typically next-business-day availability for check deposits, subject to holds and exceptions.

- Wire Transfer Fees depend on whether the transfer is domestic or international and whether it is initiated online or with the assistance of a Chase banker, with fees ranging from $15 to $50. Some online foreign currency transfers of $5,000 or more may incur no fees.

- Other Service Fees, including for stop payments, deposited item returns, cashier’s checks, money orders, and legal processing, can impact an account's cost of use, emphasizing the importance of understanding the specific charges that may apply.

- Customer Support is available for account holders with questions or in need of more information regarding their Chase Total Checking account, emphasizing the bank's commitment to providing assistance and clarifying the terms of their services.

By keeping these key points in mind, account holders can navigate their use of the Chase Print Counter Checks form and their Chase Total Checking account more effectively, ensuring a better banking experience.

Popular PDF Forms

How to Write a Landscaping Contract - This landscaping contract form outlines an initial cleanup process, ensuring properties meet a high standard before regular service commences, with a detailed fee structure based on workload and materials.

Dl-90a - Parents and guardians looking to instruct their children in driving must familiarize themselves with the DL 90A form's requirements and attestations.

How to Write a Letter Asking for Donations - A donation from Diamonds Direct Foundation can add sparkle to your charity event. Discover how by completing our request form.