Blank Child Support Certification PDF Template

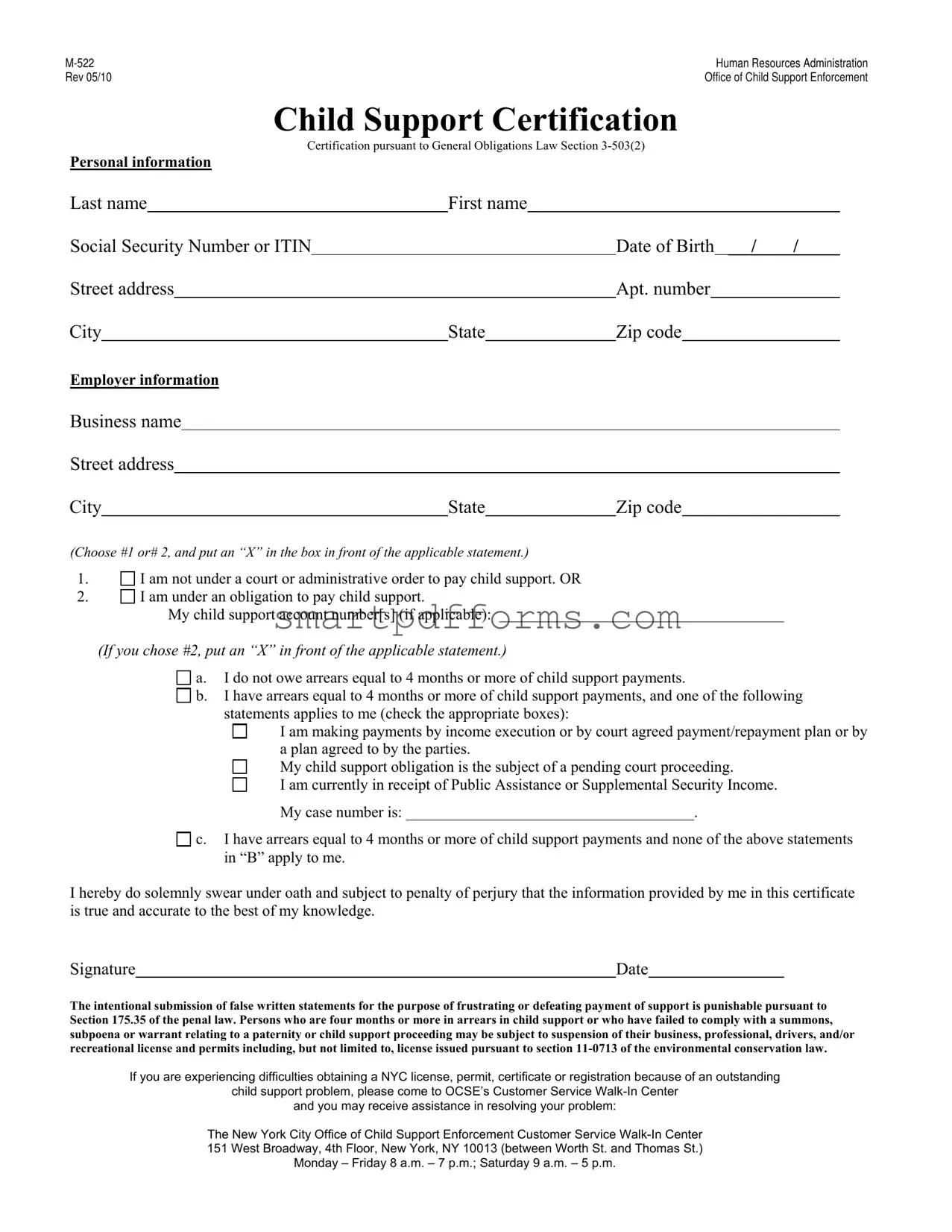

The Child Support Certification form, issued by the Human Resources Administration's Office of Child Support Enforcement, is a crucial document that plays a significant role in the lives of individuals managing their child support obligations. This form, identified as M-522 and last revised in May of 2010, serves as a sworn statement concerning an individual's child support payment status under the General Obligations Law Section 3-503(2). It requires personal identification, including name, Social Security Number or ITIN, date of birth, and contact details, alongside pertinent employer information. Notably, it demands individuals to disclose whether they are under a court or administrative order to pay child support and, if so, to state their current standing regarding arrears, which are overdue amounts equal to four months or more of child support payments. Applicants must indicate their compliance status through a series of statements, verifying whether they are adhering to payment plans, involved in pending court proceedings, receiving public assistance, or if none of these circumstances apply. The seriousness of the document is underscored by a perjury warning, emphasizing the legal implications of providing false information. Moreover, it details the potential repercussions for non-compliance, such as the suspension of various licenses and permits, thereby highlighting the broader consequences of failing to meet child support obligations. The form also points individuals experiencing license or permit issues due to outstanding child support matters towards the Office of Child Support Enforcement's Customer Service Walk-In Center in New York City for assistance, offering a lifeline to those seeking to resolve their child support challenges.

Preview - Child Support Certification Form

Human Resources Administration |

|

Rev 05/10 |

Office of Child Support Enforcement |

Child Support Certification

Certification pursuant to General Obligations Law Section

Personal information

Last name |

|

First name |

|

|

|

|

|

|

|

||||

Social Security Number or ITIN |

|

|

|

Date of Birth |

/ |

/ |

|||||||

Street address |

|

|

|

|

|

Apt. number |

|

|

|

|

|||

City |

|

State |

|

|

Zip code |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer information

Business name

Street address

City |

|

State |

|

Zip code |

|

|

|

|

|

|

|

(Choose #1 or# 2, and put an “X” in the box in front of the applicable statement.)

1.

2.

I am not under a court or administrative order to pay child support. OR I am under an obligation to pay child support.

My child support account number[s] (if applicable):

(If you chose #2, put an “X” in front of the applicable statement.)

a. I do not owe arrears equal to 4 months or more of child support payments.

b. I have arrears equal to 4 months or more of child support payments, and one of the following statements applies to me (check the appropriate boxes):

I am making payments by income execution or by court agreed payment/repayment plan or by a plan agreed to by the parties.

My child support obligation is the subject of a pending court proceeding.

I am currently in receipt of Public Assistance or Supplemental Security Income. My case number is: _____________________________________.

c. I have arrears equal to 4 months or more of child support payments and none of the above statements in “B” apply to me.

I hereby do solemnly swear under oath and subject to penalty of perjury that the information provided by me in this certificate is true and accurate to the best of my knowledge.

Signature |

|

Date |

The intentional submission of false written statements for the purpose of frustrating or defeating payment of support is punishable pursuant to Section 175.35 of the penal law. Persons who are four months or more in arrears in child support or who have failed to comply with a summons, subpoena or warrant relating to a paternity or child support proceeding may be subject to suspension of their business, professional, drivers, and/or recreational license and permits including, but not limited to, license issued pursuant to section

If you are experiencing difficulties obtaining a NYC license, permit, certificate or registration because of an outstanding

child support problem, please come to OCSE’s Customer Service

and you may receive assistance in resolving your problem:

The New York City Office of Child Support Enforcement Customer Service

Monday – Friday 8 a.m. – 7 p.m.; Saturday 9 a.m. – 5 p.m.

Form Data

| Fact | Detail |

|---|---|

| Form Reference | M-522 Human Resources Administration Rev 05/10 |

| Governing Law | General Obligations Law Section 3-503(2) |

| Personal Information Required | Last name, First name, Social Security Number or ITIN, Date of Birth, Street address, City, State, Zip code |

| Employer Information Required | Business name, Street address, City, State, Zip code |

| Child Support Certification Statements | Applicant must declare if they are under a court or administrative order to pay child support, and if they have arrears equal to or more than 4 months of child support payments. |

| Penalties for False Statements | Submission of false statements can be punishable pursuant to Section 175.35 of the penal law, including suspension of various licenses. |

Instructions on Utilizing Child Support Certification

Filling out the Child Support Certification form is a crucial step in ensuring that child support proceedings are accurately documented and processed in compliance with the law. It requires detailed information about personal and employer specifics, as well as clear statements regarding any child support obligations. Correctly completing this form is essential for both the integrity of the legal process and to avoid any potential legal repercussions for providing false information. Follow these straightforward steps to ensure the form is filled out accurately and entirely.

- Start by entering your last name, first name, and Social Security Number or ITIN in the designated spaces. Also, include your Date of Birth in the format of month/day/year.

- Fill in your current street address, apartment number (if applicable), city, state, and zip code in the corresponding fields.

- Under the employer information section, provide the business name and its address, including street address, city, state, and zip code.

- Indicate your child support status by placing an “X” in the box next to either statement #1, if you are not under a court or administrative order to pay child support, or statement #2, if you are under such an obligation.

- If you chose statement #2, specify your child support account number(s) if applicable.

- Further detail your child support payment status:

- Mark an “X” next to statement 2a, if you do not owe arrears equal to 4 months or more of child support payments.

- If you have arrears equal to 4 months or more, mark an “X” next to the applicable clarification under statement 2b:

- Payments being made by income execution, court agreed payment/repayment plan, or a plan agreed by the parties.

- Child support obligation is the subject of a pending court proceeding.

- Currently receiving Public Assistance or Supplemental Security Income, including your case number.

- Mark an “X” next to statement 2c if you have arrears equal to 4 months or more of child support payments and none of the clarifications in statement “B” apply to you.

- Complete the certification by signing your name and dating the form, thereby affirming under oath and the penalty of perjury that the information provided is true and accurate to the best of your knowledge.

- Remember, providing false information on this form can result in severe penalties, including the possibility of license suspension or other legal actions.

After completing and signing the Child Support Certification form, you should submit it to the relevant authority as directed, ensuring full compliance with your legal obligations and aiding the smooth processing of child support matters. Should challenges arise in obtaining necessary licenses or permits due to outstanding child support issues, the New York City Office of Child Support Enforcement's Customer Service Walk-In Center is available for assistance.

Obtain Answers on Child Support Certification

What is the Child Support Certification form?

The Child Support Certification form, also identified as form M-522, is a document created by the Human Resources Administration's Office of Child Support Enforcement. It is used to certify whether an individual is or is not under a court or administrative order to pay child support. This form is also utilized to declare if one owes arrears equal to or more than four months of child support payments, and it outlines the payer's current status regarding their child support obligations.

Who needs to fill out the Child Support Certification form?

Individuals who are either applying for or currently holding a New York City license, permit, certificate, or registration that may be influenced by their child support payment status are required to complete this form. It's essential for those who have an outstanding child support matter that could affect the status of their professional or recreational licenses and permits.

What information do I need to complete the form?

To accurately complete the Child Support Certification form, you will need your personal information (including your full name, Social Security Number or ITIN, date of birth, and contact details) and your employer's information if applicable. Additionally, you will need to provide details regarding your child support obligations, such as your child support account number(s) and information about any arrears owed.

What are the implications of owing child support arrears?

Owing child support arrears equal to four months or more can have significant consequences, including the potential suspension of business, professional, driver's, and recreational licenses and permits. It's crucial to accurately report your child support arrears status to avoid legal and professional repercussions.

How can I attest my child support payment status?

On the Child Support Certification form, you must check the appropriate box to declare your child support payment status. If you are not under any child support orders, you will check the first option. If you are under an obligation, you will select the second option and further specify your situation regarding arrears and any arrangements made to address them.

What happens if I submit false information on the form?

Submitting false information on the Child Support Certification form is a serious offense subject to penalty under Section 175.35 of the penal law. It's punishable by law and can result in additional legal and financial consequences aimed at ensuring compliance with child support payments.

Where can I get assistance if I'm having trouble due to an outstanding child support problem?

If your NYC license, permit, or other official certification is being affected by an outstanding child support issue, you can receive assistance by visiting the Office of Child Support Enforcement's Customer Service Walk-In Center. The center's address is 151 West Broadway, 4th Floor, New York, NY, and it operates Monday through Friday from 8 a.m. to 7 p.m., and Saturday from 9 a.m. to 5 p.m.

How do I submit the completed Child Support Certification form?

Once you have completed the form, you should follow the instructions provided by the entity requesting the form for submission, which may involve mailing or delivering it to a specific address, or possibly submitting it online if such an option is available.

Can making payments or arrangements affect my certification status?

Yes, making regular payments or entering into a repayment plan for your child support arrears can positively impact your certification status. If you're making payments through income execution, a court-agreed payment plan, or a mutually agreed-upon plan, you must indicate this on the form, as it may influence the processing and outcome of your certification and any related license or permit applications.

Common mistakes

Filling out the Child Support Certification form requires careful attention to detail. Common mistakes can lead to delays or issues in the processing of the form. Here are nine mistakes to avoid:

- Not checking the correct statement box. One must choose between statement #1 and #2 to indicate their child support status. Missing or inaccurately marking the applicable statement can invalidate the form.

- Incorrect personal information. Providing incorrect details such as name, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and date of birth can cause significant processing delays.

- Incomplete address information. Failing to provide a complete and accurate street address, apartment number, city, state, and zip code can lead to communication issues.

- Missing employer information. Omitting details about the employer, including the business name and address, can impact the enforcement office's ability to maintain accurate records.

- Failure to indicate child support account numbers. If under an obligation to pay child support, not providing account number(s) can hinder proper account identification and management.

- Omitting details about arrears. If one has arrears equal to 4 months or more of child support payments, failing to accurately complete the required section can result in enforcement actions.

- Incorrectly handling arrears statements. Not correctly indicating whether one is making payments, involved in a pending court proceeding, or receiving Public Assistance or Supplemental Security Income leads to discrepancies in record keeping.

- Signing without verifying. Failure to thoroughly review the information before signing under oath can result in unintentional submission of false information, which carries legal penalties.

- Not understanding the legal implications. Overlooking the warning regarding the intentional submission of false statements and the consequences of failing to comply with child support obligations can have severe legal consequences.

Ensuring the accuracy and completeness of every section of the Child Support Certification form is crucial for compliance with General Obligations Law Section 3-503(2). Attendees are encouraged to verify their details carefully, understand the legal ramifications of their submissions, and seek clarification if needed to avoid potential issues.

Documents used along the form

When dealing with child support matters, several documents and forms often accompany the Child Support Certification form. These forms are integral for ensuring that all aspects of child support, from payment to legal obligations, are comprehensively addressed. They are designed to aid parties involved in providing the necessary information required for the effective processing and enforcement of child support.

- Financial Disclosure Affidavit: This document requires the disclosing party to list their financial assets, liabilities, income, and expenses. It's often used to determine the appropriate amount of child support one parent must pay to the other. By providing a detailed account of one’s financial situation, it ensures that child support payments are fair and reflective of the party’s ability to pay.

- Income Withholding Order (IWO): An order sent to an employer, instructing them to withhold a specific amount from the employee's wages for child support. It ensures consistent payment directly from the source of income, minimizing the risk of missed payments and the accumulation of arrears. It is particularly useful for enforcing child support obligations efficiently.

- Paternity Affidavit: A document signed to establish the legal paternity of a child. This is an essential step in the child support process for children born to unmarried parents. Establishing paternity is critical as it is the basis for child support obligations, determining the legal rights and duties of the father.

- Child Support Modification Form: This form is used when there is a need to change an existing child support order. Situations such as a change in income, cost of living, or the needs of the child could necessitate a modification. It allows parties to adjust to new circumstances while ensuring that the child’s needs continue to be met appropriately.

These documents, coupled with the Child Support Certification form, create a framework for addressing the financial needs of children through the establishment, enforcement, and modification of child support. Each form plays a unique role in providing the necessary information or action needed for the child support system to function efficiently and equitably. Understanding these documents helps streamline the process for all parties involved, ensuring that the child's best interests are always the primary focus.

Similar forms

Income Withholding Order for Support (IWO): Similar to the Child Support Certification form, an IWO requires personal and employer information to facilitate child support payments directly from an individual's earnings. Both documents play crucial roles in ensuring compliance with child support obligations.

Affidavit of Income Declaration: This document, like the Child Support Certification form, collects detailed personal and financial information to assess an individual's ability to pay child support. It's a sworn statement that may include employment status and earnings, paralleling the certification’s requirement for factual and accurate information under penalty of perjury.

Voluntary Acknowledgment of Paternity: This form establishes the legal fatherhood of a child, similar to how the Child Support Certification can affirm a person's child support responsibilities. Both documents impact child support proceedings and determinations.

Modification Petition for Child Support: Like the Child Support Certification, this petition involves providing detailed personal information and circumstances to adjust child support orders. Each document serves a legal function in modifying or enforcing child support arrangements based on current information.

Financial Affidavit: Required in various legal proceedings, including divorce and child support cases, this affidavit resembles the Child Support Certification by necessitating a thorough disclosure of financial status. Both are used to evaluate financial responsibilities towards child support.

Declaration Under Uniform Child Custody Jurisdiction and Enforcement Act (UCCJEA): This declaration, required in custody cases, shares similarities with the Child Support Certification by requiring detailed personal information. Both forms contribute to judicial decisions regarding child welfare.

Application for Services from the Office of Child Support Enforcement (OCSE): This application, like the Child Support Certification, is used to initiate or manage child support cases. Both involve the submission of personal and financial information to ensure compliance with child support laws.

Notice of Delinquency: This notice, which informs an individual of overdue child support payments, is akin to the Child Support Certification’s section identifying if one is in arrears. Both documents are integral to the enforcement and management of child support obligations.

Request for Review and Adjustment of Child Support Order: Similar to the Child Support Certification form, this request requires detailed financial information to reassess child support amounts. Both forms are pivotal in ensuring child support orders reflect current financial situations.

Employment Verification Form: Used in various contexts, including child support cases, to verify an individual's employment status and income. Like the Child Support Certification, it serves to establish or confirm one's financial capacity and reliability in meeting child support obligations.

Dos and Don'ts

When filling out the Child Support Certification form, there are several important do's and don'ts to ensure accuracy and compliance. Below are four of each to guide you through the process:

Do:- Provide accurate personal and employer information. Make sure your last name, first name, Social Security Number or ITIN, date of birth, and full address, including the zip code, are correctly entered. This also applies to your employer’s details.

- Check the correct box regarding your child support obligation status. You must accurately state whether you are under a court or administrative order to pay child support.

- Disclose arrears accurately if applicable. If you have arrears equal to 4 months or more of child support payments, it’s crucial to indicate whether you are making payments under a plan or if your obligation is the subject of a pending court proceeding.

- Sign and date the form. Your signature attests that the information provided is true and accurate to the best of your knowledge, under penalty of perjury.

- Submit incomplete forms. Review the form thoroughly before submission to ensure that no required field is left blank. This is essential for processing your certification without delay.

- Provide false information. Accuracy is crucial, as intentionally submitting false information is punishable by law. Ensure all details, especially regarding child support payments and arrears, are truthful and up-to-date.

- Overlook the penalty clause. Understand the serious implications of non-compliance or submitting false statements, including potential penalties under the penal law and the suspension of various licenses.

- Delay seeking assistance if needed. If you encounter any difficulties or discrepancies, particularly with NYC licenses or permits due to outstanding child support issues, do not hesitate to visit the Customer Service Walk-In Center for support.

Misconceptions

Misconception #1: The form is only for those who are delinquent in child support. Many believe the Child Support Certification form is exclusively for individuals who are behind on child support payments. However, this form must be completed by anyone subjected to a child support order, regardless of their current payment status. It serves both to certify compliance with child support obligations and to identify those who are not in compliance.

Misconception #2: You only need to disclose child support obligations in your current state of residence. Some might think they only need to declare child support obligations tied to their current state. However, the certification requires disclosure of any child support obligations, regardless of where the order was established. This includes orders from other states or countries.

Misconception #3: Personal income information must be provided on the form. While financial details are crucial in the calculation and management of child support, the Child Support Certification form does not ask for income information. It focuses on compliance status with child support orders and any arrears.

Misconception #4: You don't need to complete the form if you're receiving public assistance. Contrary to what some might think, receiving Public Assistance or Supplemental Security Income (SSI) does not exempt one from completing the form. It does, however, affect the information you provide, especially concerning the handling of arrears.

Misconception #5: Submitting this form will automatically resolve any outstanding child support issues. Filling out and submitting the Child Support Certification form is a step in the right direction but it does not by itself resolve outstanding child support issues. Those with arrears equal to or exceeding four months may still need to seek assistance or engage in further legal processes to resolve their situation.

Misconception #6: If you are currently involved in a court proceeding, you do not need to declare your child support obligations. Even if your child support obligation is under review in a pending court proceeding, you must still disclose this on the form. This is crucial for maintaining transparency and ensuring all obligations are appropriately managed.

Misconception #7: The form only applies to biological parents. While child support typically involves biological parents, the obligation can also apply to adoptive parents or other guardians legally responsible for a child's financial support. Therefore, anyone subject to a child support order should complete the form regardless of their biological relation to the child.

Misconception #8: Completing the form is voluntary. Some might think that completing and submitting the Child Support Certification form is optional. In reality, failure to comply with this certification can have serious consequences, such as the suspension of business, professional, driver's, and recreational licenses, illustrating the importance of accurately completing and submitting the form when required.

Misconception #9: The form is only relevant for enforcing child support within New York City. Though it is facilitated by the New York City Office of Child Support Enforcement, the implications of the form extend beyond city limits. Child support enforcement is a nationwide concern, and the information supplied on this form can affect licensure and legal standing in multiple jurisdictions.

Key takeaways

Filling out the Child Support Certification form is a significant task that requires careful attention to detail and honesty. This document, created by the Human Resources Administration's Office of Child Support Enforcement, plays a critical role in various legal and administrative processes, including but not limited to the acquisition or maintenance of certain licenses and permits. Here are six key takeaways about filling out and utilizing this form:

- Personal and Employer Information: The form requires detailed personal information such as your last name, first name, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), date of birth, and full address. Additionally, it asks for your employer's information. This data serves to accurately identify the individual and ensure the proper handling of child support matters.

- Child Support Obligation Declaration: You must declare your child support status, selecting either that you are not under an order to pay child support or that you are under such an obligation. This section is crucial for determining your compliance with child support enforcement efforts.

- Status of Arrears: If you are under an obligation to pay child support, you must disclose whether you owe arrears equivalent to four months or more of child support payments. Your response here highlights your current standing regarding past-due child support obligations.

- Compliance Efforts for those with Arrears: For individuals with arrears of four months or more, the form requires additional information on efforts to comply with child support payments. Whether through income execution, a court-agreed payment plan, a pending court proceeding, or receipt of Public Assistance/Supplemental Security Income, declaring these efforts is essential for evaluating your attempt to resolve outstanding child support issues.

- Perjury Warning: By signing the form, you swear under oath that the information provided is true and accurate, subjecting yourself to penalties for perjury if found otherwise. The form emphasizes the seriousness of submitting false statements, outlining specific legal consequences for those who attempt to frustrate or defeat the payment of support.

- Consequences of Non-Compliance: The form makes it clear that failing to comply with child support obligations, especially being in arrears for four months or more, or failing to comply with a summons, subpoena, or warrant related to paternity or child support proceedings, can lead to the suspension of various licenses and permits. This pertains to business, professional, driver’s, and recreational licenses, including those issued under environmental conservation law. Such measures underscore the broad impacts non-compliance can have on an individual’s professional and personal life.

Understanding the importance of accurately completing the Child Support Certification form is paramount for individuals navigating child support obligations. Compliance not only impacts one’s legal standing but also one’s livelihood, highlighting the form’s role in enforcing child support laws and ensuring that children receive the financial support they are due.

Popular PDF Forms

Gcaar Residential Lease Washington Dc - Contains clauses specific to local regulations in Maryland and DC, including military/diplomatic clauses and contingencies for special equipment.

Ata 106 - A crucial document for audit trails and compliance checks within the aerospace industry’s regulatory framework.