Blank Church Financial Expense PDF Template

Managing church finances requires meticulousness and accountability, ensuring that every penny spent is carefully recorded and serves its intended purpose. The Church Financial Expense Form plays a pivotal role in this process, acting as both a tool for oversight and an essential record-keeping instrument. By filling out this form, individuals can request purchases, seek reimbursements, or initiate financial transactions, all under the watchful eye of the church's financial governance. Integral sections of the form include the date of the request, the payee's details, and a comprehensive breakdown of the expenses, including the amount, purpose, and a description of the items or services purchased. Additionally, it provides options for the authorization of purchases, debit and credit reconciliation, or straightforward check requests, making it adaptable to various financial actions. To ensure accountability, the form also outlines the check distribution method and requires signatures for approval, underscoring the church's commitment to financial integrity. This detailed accounting mechanism supports the church in managing its finances with transparency and precision, upholding trust within the community it serves.

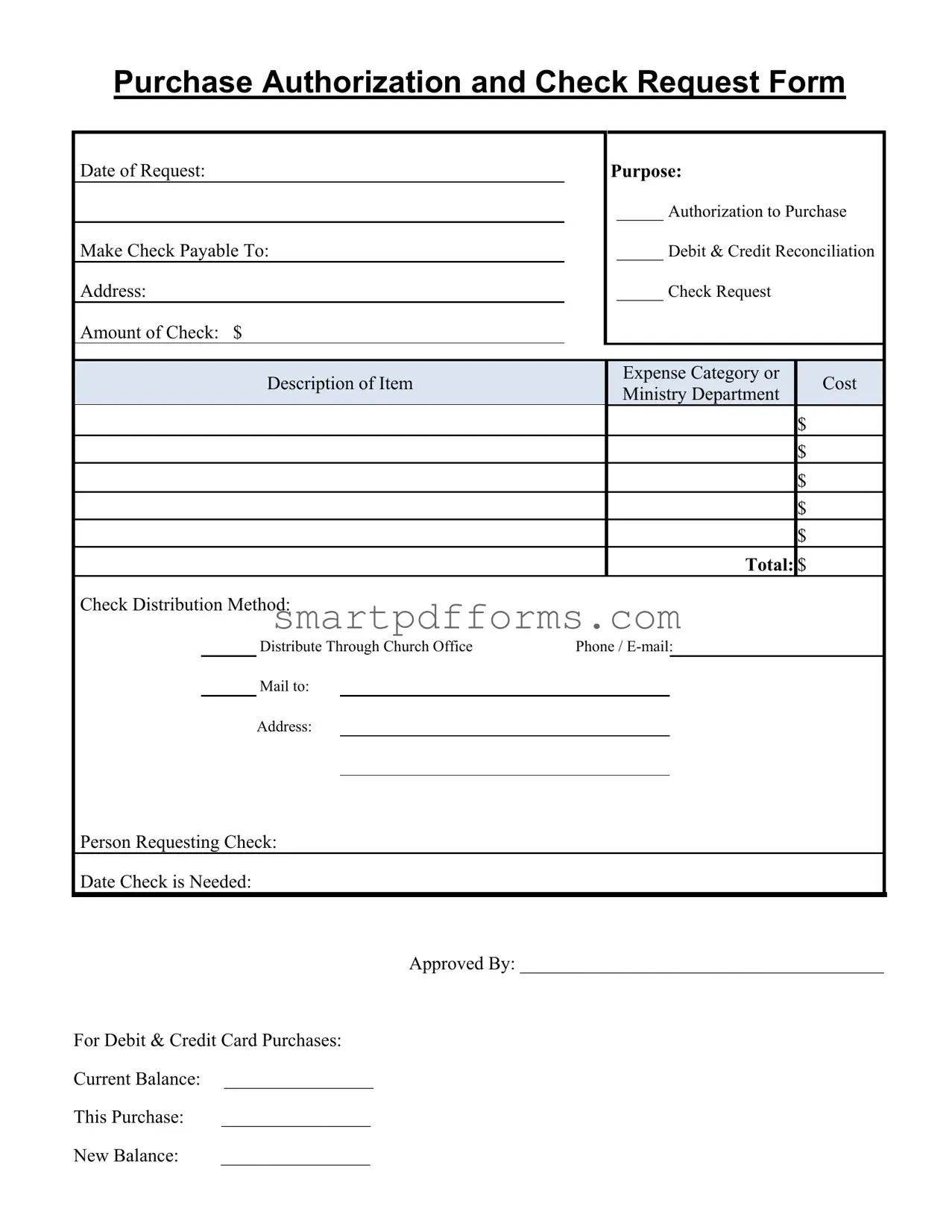

Preview - Church Financial Expense Form

Purchase Authorization and Check Request Form

Date of Request:

Make Check Payable To:

Address:

Amount of Check: $

Purpose:

_____ Authorization to Purchase

_____ Debit & Credit Reconciliation

_____ Check Request

|

Description of Item |

Expense Category or |

|

Cost |

|

|

Ministry Department |

|

|

||

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

Total: |

$ |

|

|

Check Distribution Method:

Distribute Through Church Office |

Phone / |

Mail to:

Address:

Person Requesting Check:

Date Check is Needed:

Approved By: _______________________________________

For Debit & Credit Card Purchases:

Current Balance: |

________________ |

This Purchase: |

________________ |

New Balance: |

________________ |

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form | This form is designed for multiple financial transactions within the church, including purchase authorization, check requests, and debit & credit reconciliation. |

| Financial Tracking | Enables accurate tracking and reporting of expenses by requesting detailed information about each transaction, such as the description of the item, expense category or cost, and the ministry department involved. |

| Approval Process | Requires approval signatures to ensure that expenditures are authorized and accounted for, thereby adding a layer of financial oversight and accountability within the church's financial management. |

| Check Distribution Method | Distinctly specifies how the approved funds will be distributed, whether through direct church office distribution or by mail, which streamlines the payment process to vendors or service providers. |

| Governing Laws | While the form itself is a standard internal document for financial transactions within a church, the use and processing of the form, especially regarding financial management and reporting, would be subject to state-specific non-profit organization laws and federal tax regulations. |

Instructions on Utilizing Church Financial Expense

Filling out a Church Financial Expense form is a methodical process that requires attention to detail. This form is utilized for various financial transactions within the church, such as purchase authorizations, check requests, and reports for debit and credit card purchases. To ensure that the financial aspect of the church's operations runs smoothly, each section of the form needs to be completed accurately. Following these steps will help you fill out the form correctly.

- Begin by entering the Date of Request at the top of the form. This should reflect the current date when you are filling out the form.

- Next, fill in the Make Check Payable To section. Here, write the name of the person or entity that will receive the check.

- Under the address field, enter the recipient's full address. This is crucial for ensuring that mailed checks reach the correct destination.

- In the Amount of Check field, write the total amount that needs to be paid or reimbursed, prefixing it with a dollar sign ($).

- Choose the purpose of your request by ticking the appropriate box: Authorization to Purchase, Debit & Credit Reconciliation, or Check Request.

- Describe the item or service you're requesting money for in the Description of Item field. Be as detailed as necessary to justify the expense.

- For each item or service, enter the corresponding Expense Category or Cost, Ministry Department, and amount in dollars. Ensure each expense is listed separately.

- Add up all the expenses and write the total amount in the Total: field at the bottom.

- Select the method of Check Distribution: whether it will be distributed through the Church Office or mailed directly to the recipient.

- Provide contact information in the Phone / E-mail field for the church office's reference.

- If the check is to be mailed, enter the mailing address in the Mail to: section.

- Fill in your name in the Person Requesting Check field.

- Specify when the check is needed by entering a date in the Date Check is Needed field.

- The form should be signed by the authorized individual in the Approved By section. A signature is essential for validating the request.

- For requests involving debit and credit card purchases, fill in the Current Balance, This Purchase amount, and calculate the New Balance. This helps in keeping track of funds.

After completing all steps, double-check the information for accuracy and completeness. Submit the form to the appropriate department or individual within your church's financial team for processing. Accurate and timely submission of this form helps in maintaining the financial integrity and accountability of the church's operations.

Obtain Answers on Church Financial Expense

Understanding how to properly fill out and submit a Church Financial Expense Form is crucial for ensuring that church funds are managed effectively and responsibly. Below are answers to some common questions that can help guide you through this process.

-

What is the purpose of a Church Financial Expense Form?

This form is a tool used by churches to authorize purchases, request checks, and reconcile debit and credit card purchases. It ensures that all expenses are properly documented and approved, contributing to the transparent and accountable management of church finances.

-

How do I complete the "Date of Request" field?

Enter the date on which you are filling out the form. This helps in tracking the submission and processing time of the request.

-

Who should be listed under "Make Check Payable To"?

This should be the name of the individual or entity receiving the payment. Ensure the name is spelled correctly to avoid any payment issues.

-

Can the "Amount of Check" include multiple expenses?

Yes, if the check is covering several items from the same payee. However, each expense should be detailed in the "Description of Item" field to ensure transparency and accurate financial records.

-

What should I put in the "Purpose" section?

Select the option that best describes your request: Authorization to Purchase (for new expenses), Debit & Credit Reconciliation (for reconciling card transactions), or Check Request (for issuing a check). This clarity helps in the appropriate processing of the form.

-

How do I describe the item in the "Description of Item" field?

Provide a clear and concise description of what the expense is for, such as "office supplies" or "event catering." This description assists in categorizing the expense correctly.

-

What is meant by "Expense Category or Cost Ministry Department"?

This refers to the specific budget category or church department the expense should be charged to. Accurately identifying this ensures that expenses are allocated to the correct departmental budgets.

-

What does "Check Distribution Method" mean?

This section specifies how you wish the check to be delivered, either through direct distribution at the Church Office or mailed to an address you provide. Provide the necessary contact or mailing information based on your selection.

-

Who needs to approve the Church Financial Expense Form?

The form must be approved by an authorized person, usually a church leader or finance committee member, to validate the request. The approver's signature is a necessary endorsement for processing the expense.

-

For Debit & Credit Card Purchases, how do I report the balances?

In the provided fields, record the current balance of the card, the amount being charged for this purchase, and calculate the new balance. This helps in maintaining accurate records of card usage and remaining funds.

Properly completing a Church Financial Expense Form is key to the effective financial stewardship of church resources. If more assistance is required, do not hesitate to seek help from your church's finance office or a designated financial advisor within your community.

Common mistakes

-

Not providing a clear, detailed description of the item or expense. It's crucial to elaborate, ensuring that the purpose and necessity are easily understood.

-

Failing to specify the expense category or match the expenditure with the correct ministry department. This alignment helps with budget tracking and financial management.

-

Overlooking the authorization section or not obtaining the necessary approvals before submitting the form. Authorized signatures are a must for the form's validity.

-

Omitting the Date Check is Needed can lead to timing issues, especially if the request is time-sensitive.

-

Incorrectly calculating the total amount requested, which can arise from simple math errors. Double-checking calculations can prevent this common mistake.

-

Choosing an inappropriate check distribution method without considering the most efficient or secure option for the vendor or service provider.

-

Leaving the current balance and new balance fields blank or inaccurately filled for debit and credit card purchases. These details are critical for financial oversight.

-

Forgetting to include contact information for both the person requesting the check and the payee. This omission can delay the process if clarification or follow-up is needed.

-

Lastly, not being precise with the payee address can lead to the check being mailed to the wrong location, interrupting the payment process.

Addressing these common pitfalls not only streamlines the financial operations of the church but also ensures that funds are allocated and utilized effectively, reinforcing the integrity of the church's financial processes.

Documents used along the form

Managing church finances involves meticulous record-keeping and the use of various documents to ensure accuracy, legality, and transparency. The Church Financial Expense form is a crucial document used by churches for managing expenditures, but it often works in conjunction with other forms and documents to streamline financial processes. These additional documents help in detailing transactions, approvals, and financial planning, aiding in a comprehensive financial management strategy.

- Budget Proposal Form: Enables departments within the church to propose their annual budgets, outlining expected income and expenses for the upcoming year.

- Income Statement Report: Summarizes the church’s revenues, expenses, and profitability over a specific period, providing insights into financial health.

- Balance Sheet: Offers a snapshot of the church’s financial standing at a specific point in time, detailing assets, liabilities, and net equity.

- Donation Receipts: Acknowledges contributions received by the church, providing donors with records for tax purposes.

- Bank Reconciliation Statements: Compares the church’s record of transactions and balances to those of the bank, verifying accuracy.

- Asset Inventory Records: Lists all physical and non-physical assets owned by the church, essential for financial and property management.

- Expense Report Form: Used by individuals to report expenses incurred on behalf of the church, often requiring receipts for validation.

- Financial Audit Reports: Compiled by an external auditor, these reports assess the accuracy and fairness of a church’s financial statements and practices.

- Vendor Contracts: Legal agreements with third-party vendors for goods or services, detailing terms of engagement and payment.

- Gift In-kind Donation Form: Records non-monetary gifts received, helping the church track the value of donated goods and services.

In summary, the Church Financial Expense form is an essential tool in the financial toolkit of a church, but it does not stand alone. Additional documents like budget proposals, income statements, and donation receipts play vital roles in ensuring financial integrity and accountability. Each document serves a unique purpose, collectively facilitating a robust financial management system that supports the church’s mission and operations.

Similar forms

Business Expense Report: Like the Church Financial Expense form, a business expense report tracks expenditures for specific purposes, such as travel or office supplies. Both documents typically require a description of the expense, its amount, and approval by a superior.

Donation Receipt Forms: These forms, used by various organizations, share similarities with the Church Financial Expense form in requiring details about the transaction, including the amount and purpose. Both forms are vital for accounting and tax purposes.

Grant Application Budgets: Similar to the Church Financial Expense form, grant application budgets detail proposed expenditures and are necessary for approval from funding bodies. Both involve detailed descriptions of how funds are allocated.

Invoice Templates: Invoices share features with the Church Financial Expense form, such as listing services or goods provided, their costs, and payment information. Both are formal requests for payment, requiring authorization and record-keeping.

Non-Profit Budget Sheets: These sheets and the Church Financial Expense form both track and report expenses for specific departments or projects, crucial for monitoring an organization’s financial health and ensuring compliance with budget restrictions.

Personal Budget Trackers: Although more individualized, personal budget trackers resemble the Church Financial Expense form in categorizing and recording expenses to monitor financial flows and adherence to budgets, helping individuals manage their finances.

Purchase Order Forms: These forms, like the church’s, initiate transactions by detailing the items to be purchased, their costs, and delivery information. Both serve as authorized agreements for the purchase and are used for accounting records.

Reimbursement Request Forms: Similar to the Church Financial Expense form, reimbursement request forms are used by employees or members to claim back expenses. Both require detailed expense descriptions, proof of payment, and authorization.

Tax Deduction Records: Both the Church Financial Expense form and tax deduction records document expenses that may qualify for tax deductions. Details such as the purpose of the expense and amounts are crucial for tax preparation and audits.

Travel Expense Reports: These reports, like the Church Financial Expense form, detail expenses incurred during travel, requiring itemization of costs, reasons for expenses, and approvals. Both are essential for financial transparency and budget management.

Dos and Don'ts

When filling out a Church Financial Expense form, several practices should be adhered to ensure accuracy and compliance. Here are some do's and don'ts to consider:

Do's

- Double-check all the information you enter, especially the numerical values like the amount for the check and the current balance.

- Ensure the date of request is accurately filled in to maintain proper financial records.

- Be thorough in describing the item or service you're requesting payment for. A detailed description helps in the approval process and for record-keeping purposes.

- Correctly specify the expense category or cost ministry department to ensure the expense is allocated to the right budget area.

- Choose the right check distribution method and provide clear instructions for it, whether it’s through the church office or mail.

Don'ts

- Avoid leaving blanks in sections that are mandatory, such as the ‘Make Check Payable To’ or ‘Amount of Check’ fields. Incomplete forms may result in processing delays.

- Don't rush through the authorization section ; ensure it is signed by the appropriate authority within the church to validate the request.

- Refrain from estimating costs without proper research or quotes. Accurate figures are essential for budgeting and financial planning.

- Do not overlook the date the check is needed by. Timing is crucial, especially for events or obligations that require payment by a specific deadline.

- Avoid any assumptions about balances for debit and credit card purchases. Always check the current balance before making a new purchase request.

By following these guidelines, you can fill out the Church Financial Expense form with confidence, ensuring all requests are processed efficiently and accurately.

Misconceptions

Church financial processes, particularly regarding the expense form, are often misunderstood. Here are nine common misconceptions clarified to provide better understanding:

- It's only for large purchases: The form is designed for all transactions, big or small, ensuring accountability for every dollar spent.

- Authorization is optional: Every purchase or expense must be authorized. This step is crucial for budget management and financial integrity.

- Only ministry leaders can fill it out: Anyone in the church making a purchase or requesting a check, regardless of their role, should use the form, subject to approval protocols.

- Purpose details aren't important: Clearly stating the purpose of the expense is essential for proper categorization and future reference. It supports transparent financial practices.

- Debit and credit reconciliation is rare: Regular reconciliation is vital for accurate financial statements, ensuring that expenses match the approved budgets and financial records.

- Check distribution method is a minor detail: Specifying how the check is to be distributed (e.g., mail or direct hand-off) is important for managing timelines and ensuring secure delivery.

- Personal information isn’t necessary: Including contact information of the person requesting the check is crucial for any follow-up or clarification needed, enhancing accountability.

- Approval signatures are just a formality: An approval signature is a vital safeguard, ensuring that expenditures have been reviewed and approved by authorized personnel.

- Expense categories are flexible: Utilizing predetermined expense categories helps in accurately tracking and managing the church’s finances. Categorization must align with the church's accounting system.

Correcting these misunderstandings promotes a more effective and transparent management of church funds. It underscores the importance of adherence to established financial protocols, aiding in stewardship and accountability.

Key takeaways

When filling out and using the Church Financial Expense Form, there are several key takeaways to remember to ensure the process is handled efficiently and accurately. These takeaways are essential for managing church finances responsibly and keeping accurate records.

- Complete all sections meticulously: Every field in the form, from the date of request to the check distribution method, needs to be filled out thoroughly. This includes the description of the item, expense category, and the total cost. Accurate and complete information prevents possible delays or confusion.

- Clear purpose identification: Specify the purpose of the expense clearly by selecting the appropriate option such as 'Authorization to Purchase', 'Debit & Credit Reconciliation', or 'Check Request'. This helps in categorizing expenses correctly and simplifies financial tracking and reporting.

- Adhere to deadlines: Pay attention to the 'Date Check is Needed' section to ensure requests are submitted in a timely manner. This allows for the adequate processing time required by the church office and avoids financial bottlenecks.

- Secure necessary approvals: The 'Approved By' line must be signed by the authorized individual before any purchase is made or check is issued. This step is crucial in maintaining financial accountability and preventing unauthorized spending.

- Monitor debit and credit card balances: For transactions using church cards, note the current balance before the purchase, the amount of the purchase, and the new balance afterwards. This practice helps in managing budgets more effectively and alerts to potential overdrawn accounts.

By following these guidelines, church administrators and financial officers can ensure that the Church Financial Expense Form is used correctly, leading to better financial management and accountability within the congregation.

Popular PDF Forms

Vtr 275 - Guides through the steps required to lawfully request motor vehicle records for various purposes.

Da Form 7598 - With areas to note cargo compartment dimensions, the form aids in planning and verifying that loads meet specific requirements.