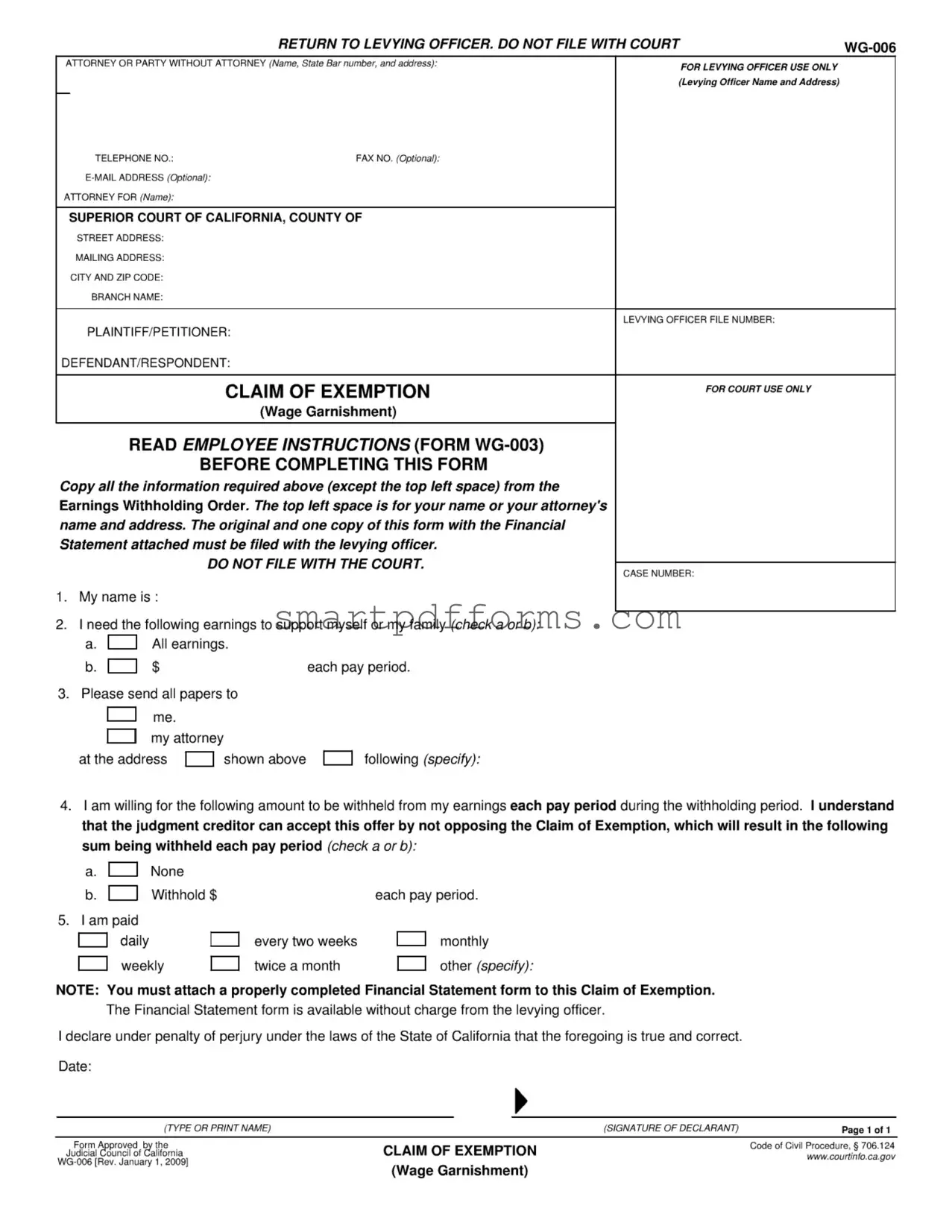

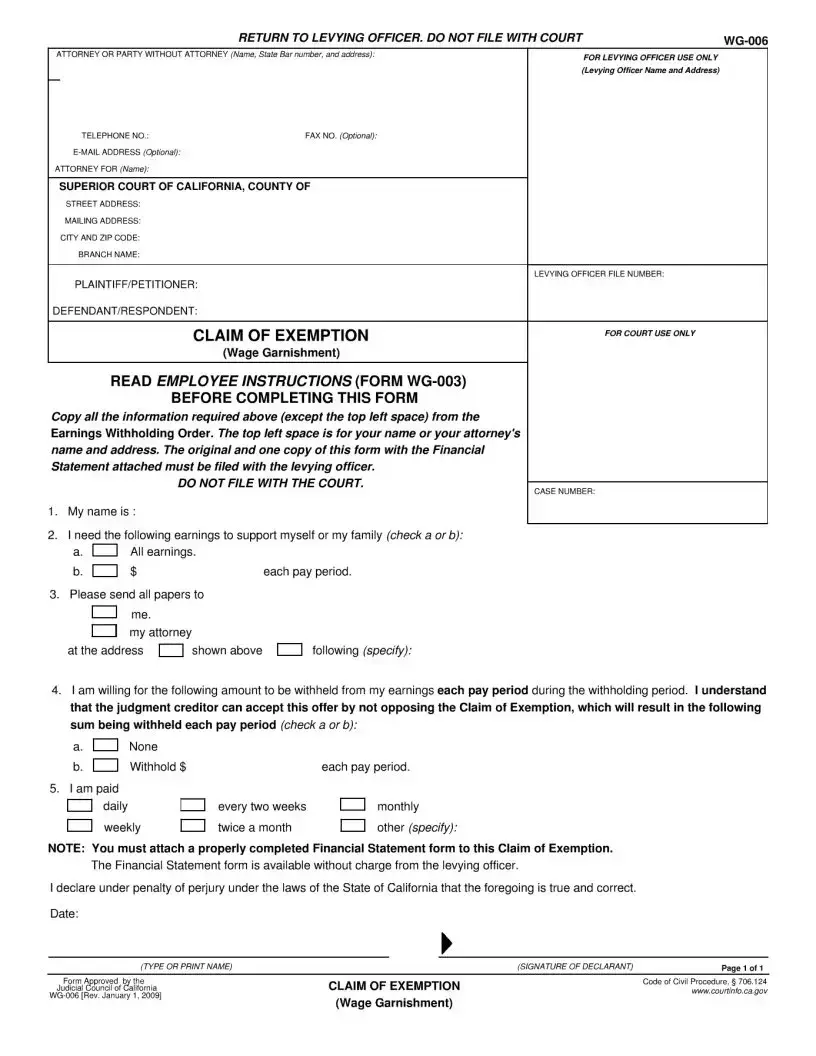

Blank Claim Of Exemption Wg 006 PDF Template

Dealing with wage garnishment is a challenging experience that can significantly impact an individual's ability to support themselves and their family. In California, the Claim of Exemption form WG-006 serves as a critical tool for those facing such financial distress. Designed to provide relief from the enforcement of judgment debts through earnings withholding orders, this form allows debtors to claim exemptions on their wages that are essential for their support. The process involves the debtor completing and submitting the form, which includes providing their name, the amount they can afford to have withheld each pay period, and a declaration of their financial status through an attached Financial Statement form. This submission is not made to the court but rather to the levying officer, emphasizing the unique procedural aspect of asserting these claims outside the traditional court filing system. Furthermore, the choice between fully exempting one's earnings from garnishment or specifying an amount that can comfortably be withheld illustrates the form's role in tailoring financial relief to an individual's specific circumstances. Most importantly, realizing the form’s potential benefits hinges on a truthful declaration under penalty of perjury, underscoring the seriousness with which this claim must be treated.

Preview - Claim Of Exemption Wg 006 Form

Form Data

| Fact Number | Fact Detail |

|---|---|

| 1 | The form must be returned to the levying officer, not filed with the court. |

| 2 | Includes a section for attorney or party information, including State Bar number and address. |

| 3 | Required to include the levying officer's name and address, and the levying officer file number. |

| 4 | Applicable in the Superior Court of California, governed by California's laws. |

| 5 | Claimants must specify the amount of earnings needed to support themselves or their family. |

| 6 | Claimants can specify a preferred amount to be withheld from their earnings each pay period. |

| 7 | A properly completed Financial Statement form must be attached to the Claim of Exemption. |

| 8 | Governed under the Code of Civil Procedure, § 706.124. |

Instructions on Utilizing Claim Of Exemption Wg 006

Filling out the Claim of Exemption WG-006 form is an essential step for individuals seeking to exempt part or all of their earnings from wage garnishment based on financial hardship. This document, once properly completed and attached with the required Financial Statement, must be returned to the levying officer rather than filed with the court. The completion process demands attention to detail, as incorrect or incomplete information can delay or negatively affect one's claim. The steps outlined below are designed to guide you through filling out the form accurately.

- Start by copying the information required at the top of the form, except for the top left space, from the Earnings Withholding Order you received. The top left space should contain either your name or your attorney's name, along with the address.

- In the section labeled "My name is:", enter your full legal name as it appears on your government-issued identification.

- Under the option for "I need the following earnings to support myself or my family," make a check next to either a. All earnings or b. $ each pay period to indicate the specific portion of your wages that you believe should be exempt.

- Provide the address where all correspondence related to this form should be sent under "Please send all papers to," choosing either your address or your attorney's address.

- If you are willing to have a certain amount withheld from your earnings each pay period, check the appropriate box under option 4 and specify the amount in the space provided. If you believe no amount should be withheld, check the corresponding option.

- Indicate your pay frequency by choosing one of the provided options or specifying another payment schedule in the space labeled "other."

- Attach a properly completed Financial Statement form. This form is vital for your exemption claim and is available at no charge from the levying officer.

- Finally, certify the truthfulness of the information provided by signing and dating the form at the bottom. Type or print your name and sign in the designated spaces.

After completing these steps, ensure the original and one copy of the form, along with the Financial Statement, are submitted directly to the levying officer. The accuracy and completeness of this documentation are critical to the success of your exemption claim. Remember, this process does not stop the garnishment but initiates a review which could potentially alter the garnished amount based on demonstrated financial hardship.

Obtain Answers on Claim Of Exemption Wg 006

What is the Claim of Exemption WG-006 form?

The Claim of Exemption WG-006 form is a legal document used in California when an individual wants to claim exemptions on their wages being garnished. It is a way to request that a portion of earnings be exempt from garnishment to support oneself or one's family. This form must be submitted to the levying officer, not filed with the court.

How do I complete the Claim of Exemption WG-006 form?

To complete the form, start by copying the required information from the Earnings Withholding Order into the form, except for the top left space, which is for your name or your attorney's information. You'll then need to check the appropriate boxes to indicate how much of your earnings you need to support yourself or your family and how you are paid (e.g., weekly, monthly). You must also attach a completed Financial Statement form. Finally, sign and date the form, declaring under penalty of perjury that the information provided is accurate.

Do I need an attorney to file a Claim of Exemption WG-006?

No, you do not need an attorney to file a Claim of Exemption WG-006. However, consulting with one can provide valuable guidance through the process and ensure your claim is filed correctly.

Where do I file the Claim of Exemption WG-006 form?

The Claim of Exemption WG-006 form, along with your Financial Statement, must be filed with the levying officer, not with the court. The levying officer's name and address can typically be found on the Earnings Withholding Order.

What is a Financial Statement, and why do I need to attach it?

A Financial Statement is a document that details your income, expenses, assets, and debts. It is required to be attached to your Claim of Exemption WG-006 to provide a comprehensive view of your financial situation, proving how much you need to support yourself or your family. It helps the levying officer or creditor understand your financial hardship.

What happens after I file the Claim of Exemption WG-006 form?

After filing, the creditor may agree to the exemption amount you requested by not opposing your Claim of Exemption. If the creditor disagrees with your claim, a court hearing may be scheduled to determine the validity of your claim and the appropriate amount of wages to be exempt from garnishment.

Can I file the Claim of Exemption WG-006 form without stating a specific exemption amount?

Yes, you can choose to request that no wages be garnished by ticking the option on the form. However, stating a specific exemption amount and providing a detailed Financial Statement can strengthen your claim by demonstrating your financial needs and obligations.

What if my financial situation changes after filing the Claim of Exemption?

If your financial situation changes significantly after filing the Claim of Exemption WG-006, you can file a new form reflecting your current financial status. It's important to keep the levying officer informed about any significant changes that might affect your exemption claim.

Is there a deadline for filing the Claim of Exemption WG-006 form?

Yes, there is usually a deadline specified in the notice you receive about the wage garnishment. It is crucial to file the Claim of Exemption WG-006 form as soon as possible after receiving a wage garnishment order to ensure your exemption request is considered promptly.

Common mistakes

When filling out the Claim of Exemption Form WG-006, people often make several common mistakes that can affect the outcome of their claim. Being thorough and accurate is critical to ensuring the best chance of protecting your earnings from garnishment. Here are six common errors to avoid:

- Not copying information accurately from the Earnings Withholding Order. The form requires specific information to be transferred exactly as it appears on the Earnings Withholding Order. This includes the levying officer's name and address, the case number, and other particulars.

- Failure to check the correct box under section 2 regarding the necessity of earnings to support oneself or one's family. This section is crucial for determining the amount of earnings that can be exempt from garnishment.

- Incorrectly specifying the payment frequency in section 5. This mistake can lead to misunderstandings about how much can be withheld from each pay period, affecting the calculation of exemptions.

- Omitting the financial statement. The form must be accompanied by a properly completed Financial Statement. Neglecting to attach this form can result in the rejection of the claim.

- Failing to offer a withholding amount when willing to have a specified amount withheld. Some individuals miss the opportunity to negotiate or suggest an acceptable amount for garnishment by overlooking section 4.

- Not using the correct name and address at the top left space of the form. This information is critical for ensuring all communications and documents reach the appropriate parties.

Moreover, it's worth highlighting some tips to avoid these mistakes:

- Double-check all copied information against the original Earnings Withholding Order for accuracy.

- Read every section carefully, ensuring that all applicable boxes are checked and that all filled sections are complete and accurate.

- Attach the required Financial Statement form, ensuring it's fully and accurately completed.

- Consider consulting with an attorney if there's any confusion or question about how to complete the form properly.

By avoiding these common mistakes, claimants can improve their chances of successfully claiming an exemption from wage garnishment.

Documents used along the form

When dealing with wage garnishment and using the Claim of Exemption form (WG-006), there are several other documents and forms that might be necessary to support your claim or to ensure you follow the process correctly. Understanding these forms can help make the process less daunting and can provide clarity on what steps to take next.

- Financial Statement (EJ-165): This form is integral as it provides a detailed account of your income, expenses, assets, and debts. It's required to be attached with the Claim of Exemption to offer a complete picture of your financial situation.

- Earnings Withholding Order (WG-002): This is the document initially sent to your employer, instructing them to garnish your wages. Understanding this document is crucial as it outlines the details of what is being asked from your paycheck.

- Request for Hearing Regarding Wage Garnishment (WG-009): If you disagree with the garnishment or the amount being garnished, this form can be used to request a court hearing to review and possibly contest the garnishment.

- Notice of Opposition (WG-010): This form is used by the creditor if they wish to oppose your Claim of Exemption. It prompts a court review of your claim.

- Notice of Hearing (WG-030): If a hearing is to be held, either due to a Request for Hearing Regarding Wage Garnishment or a Notice of Opposition, this form notifies all involved parties of the time and place of the hearing.

- Writ of Execution (EJ-130): This court order authorizes the enforcement of judgment, which includes wage garnishment. Understanding the specifics of this document can help you comprehend the legal backing of the garnishment.

- Income and Expense Declaration (FL-150): In some cases, providing an in-depth view of your monthly income and expenses can help support your Claim of Exemption, showcasing why the exemption is necessary for your financial stability.

These documents, when used together, provide a structured approach to contesting a wage garnishment or to understanding the process thoroughly. Each plays a distinct role in ensuring that your rights are protected while also complying with legal procedures. Handling these forms accurately can significantly impact the outcome of a wage garnishment scenario.

Similar forms

The Claim of Exemption (Wage Garnishment) WG-006 form is a document used in legal proceedings when an individual wishes to claim that their wages or earnings are exempt from garnishment. Garnishment is a legal process where a creditor can obtain a court order to seize a portion of an individual's wages directly from their employer, to repay a debt. The WG-006 form allows individuals to request that their earnings be exempt from such garnishment on the grounds of financial hardship or the need to support themselves or their family. This form is similar to other legal documents that are designed to protect personal income, assets, or to provide financial relief in various contexts. Below are ten documents similar to the WG-006 form:

Homestead Declaration: Similar to the WG-006, this document is used to protect an individual's primary residence from forced sale to satisfy debts, by declaring a portion of the home as a 'homestead'. Both aim to safeguard essential assets or income against claims by creditors.

Financial Affidavit: Like the WG-006 form, which requires attachment of a financial statement, a Financial Affidavit outlines an individual's financial status by detailing income, expenses, assets, and liabilities, typically used in divorce and child support cases to determine financial responsibility.

Bankruptcy Petition: Filing for bankruptcy provides a broad spectrum of protections against creditors, including wage garnishment. The WG-006 form offers a narrower, specific form of financial relief by preventing wage garnishment.

Automatic Stay Request: Automatically applied in bankruptcy cases, an automatic stay stops most collection actions including garnishments. While broader, it shares the aim of the WG-006 to offer temporary financial protection.

Wage Deduction Notice: This document is served to both the employee and employer, stipulating the initiation of wage garnishment, which the WG-006 form seeks to exempt from, underscoring their complementary roles in the garnishment process.

Request for Hearing on Wage Garnishment: This allows a debtor to request a court hearing to dispute or adjust a garnishment order, similar to the WG-006 form’s purpose of allowing individuals to contest garnishment based on hardship.

Child Support Claim of Exemption: Specific to child support, this document functions like the WG-006 by allowing individuals to claim that certain income or assets should be exempt from garnishment for child support payments.

Installment Payment Plan Agreement: Rather than claiming an exemption, this document allows debtors to arrange for debt repayment in manageable installments, offering an alternative approach to managing debt without the need for wage garnishment.

Debt Settlement Agreement: Similar in its goal to alleviate the burden of debt, this agreement between a debtor and creditor settles a debt for less than the amount owed, potentially avoiding the need for wage garnishment actions altogether.

Property Exemption Claim: Used to declare certain personal property as exempt from seizure by creditors or during bankruptcy proceedings, this document parallels the WG-006's role in protecting individuals' wages from garnishment.

Each of these documents serves a specific function within the broader context of financial obligations and protections. While they vary in scope and application, all share a common goal of providing individuals with mechanisms to manage, dispute, or relieve financial pressures, similar to the protections offered by the Claim of Exemption WG-006 form against wage garnishment.

Dos and Don'ts

When completing the Claim of Exemption Form WG-006, it is important to follow specific guidelines to ensure the form is filled out accurately and effectively. Below are nine do's and don'ts to consider:

- Do read the employee instructions (Form WG-003) thoroughly before starting to fill out the Claim of Exemption form. This ensures a clear understanding of the process and requirements.

- Do copy all required information from the Earnings Withholding Order to the Claim of Exemption form, ensuring accuracy in the details transferred.

- Do attach a properly completed Financial Statement form to your Claim of Exemption. This document is crucial for providing the necessary financial details to support your claim.

- Do check the correct box that applies to the amount you believe should be exempt from garnishment, clearly indicating whether you are proposing no withholding or specifying an amount.

- Do indicate the frequency of your pay accurately (e.g., weekly, monthly, twice a month) to aid in the calculation of the exempt amount.

- Don't file the Claim of Exemption form with the court. This form, along with the attached Financial Statement, must be filed with the levying officer instead.

- Don't leave out your name or your attorney's name and address in the top left space of the form. This information is essential for identification and communication purposes.

- Don't forget to sign and date the form. Your declaration under penalty of perjury is a legal requirement and your signature validates the form.

- Don't submit the form without carefully reviewing all provided information for accuracy and completeness. Errors or omissions can delay the processing of your Claim of Exemption.

Following these guidelines will assist in effectively communicating your exemption claim to the levying officer, contributing to a smoother process in managing wage garnishment issues.

Misconceptions

Understanding the Claim of Exemption (WG-006) form is fundamental for individuals facing wage garnishment in California. However, there are several misconceptions associated with this legal document that need to be clarified:

- Misconception 1: The form needs to be filed directly with the court.

This is incorrect. As stated on the form, it should be returned to the levying officer, not filed with the court. This process ensures the correct handling and review of the claim by the appropriate authority.

- Misconception 2: Completing the form guarantees that no wages will be garnished.

Completing the form does not automatically stop wage garnishment. The debtor's claim must first be accepted, and even then, a specific amount agreed upon (if any) may still be withheld from earnings.

- Misconception 3: Any amount declared by the debtor will be accepted.

It's not just up to the debtor to decide how much can be exempted from garnishment. The declared amount must be reasonable and is subject to approval by the levying officer or a court, depending on the circumstances and the judgment creditor’s response.

- Misconception 4: The form is overly complicated and requires an attorney to complete.

While seeking legal advice is beneficial, the Claim of Exemption form is designed to be filled out by individuals. Clear instructions are provided, and a financial statement must be attached. However, assistance from a professional can help ensure the form is filled out accurately and the claim is well-supported.

- Misconception 5: Once submitted, the Claim of Exemption takes effect immediately.

The process does not provide immediate relief. After submission, there is a review period during which the claim is evaluated, and the judgment creditor can contest the claim. The specific timing can vary based on the levying officer’s schedule and the processing of the documentation.

Individuals facing wage garnishment should carefully review the instructions on the WG-006 form and consider consulting with a legal professional to enhance their understanding and navigate the process effectively.

Key takeaways

Filing the Claim of Exemption (WG-006) is a crucial step for individuals in California facing wage garnishment who believe that their earnings are necessary for the support of themselves or their family. Here are five key takeaways to keep in mind when dealing with this form:

- Do not file with the court: It's important to note that this form, along with the required Financial Statement, should be returned to the levying officer – not filed with the court. This is a common misunderstanding that can delay the process.

- Attach a Financial Statement: A completed Financial Statement form must accompany the Claim of Exemption. This document provides a detailed account of your financial situation, which is necessary for the levying officer to assess your claim. This form can be obtained from the levying officer at no charge.

- Specify your required earnings: The form asks you to indicate the earnings needed to support yourself or your family. Carefully considering and accurately representing this amount is crucial, as it will affect the outcome of your claim.

- Offer for wage withholding: You have the option to suggest an amount that can be withheld from your earnings each pay period without significantly affecting your financial well-being. This proactive approach can sometimes lead to a quicker resolution.

- Complete all sections accurately: From your name and contact information to the details about your employment and earnings, every section of the form must be filled out completely and accurately. Errors or omissions can result in the delay or denial of your exemption claim.

Finally, remember that submitting a Claim of Exemption is a declaration under penalty of perjury under the laws of the State of California that the information provided is true and correct. Thus, honesty and accuracy in completing the form cannot be overstated.

Popular PDF Forms

Navpers 1070/6 - Reflects the Navy's commitment to thorough preparation for international assignments.

Employee Equipment Checkout Form - Addresses the administrative aspects of off-campus equipment use, ensuring a smooth operational process.

Drop Ball Test Certification - An official document that attests to a company's compliance with safety regulations, demonstrating that their eyewear products are tested and verified for impact resistance.