Blank Clayton County Financial PDF Template

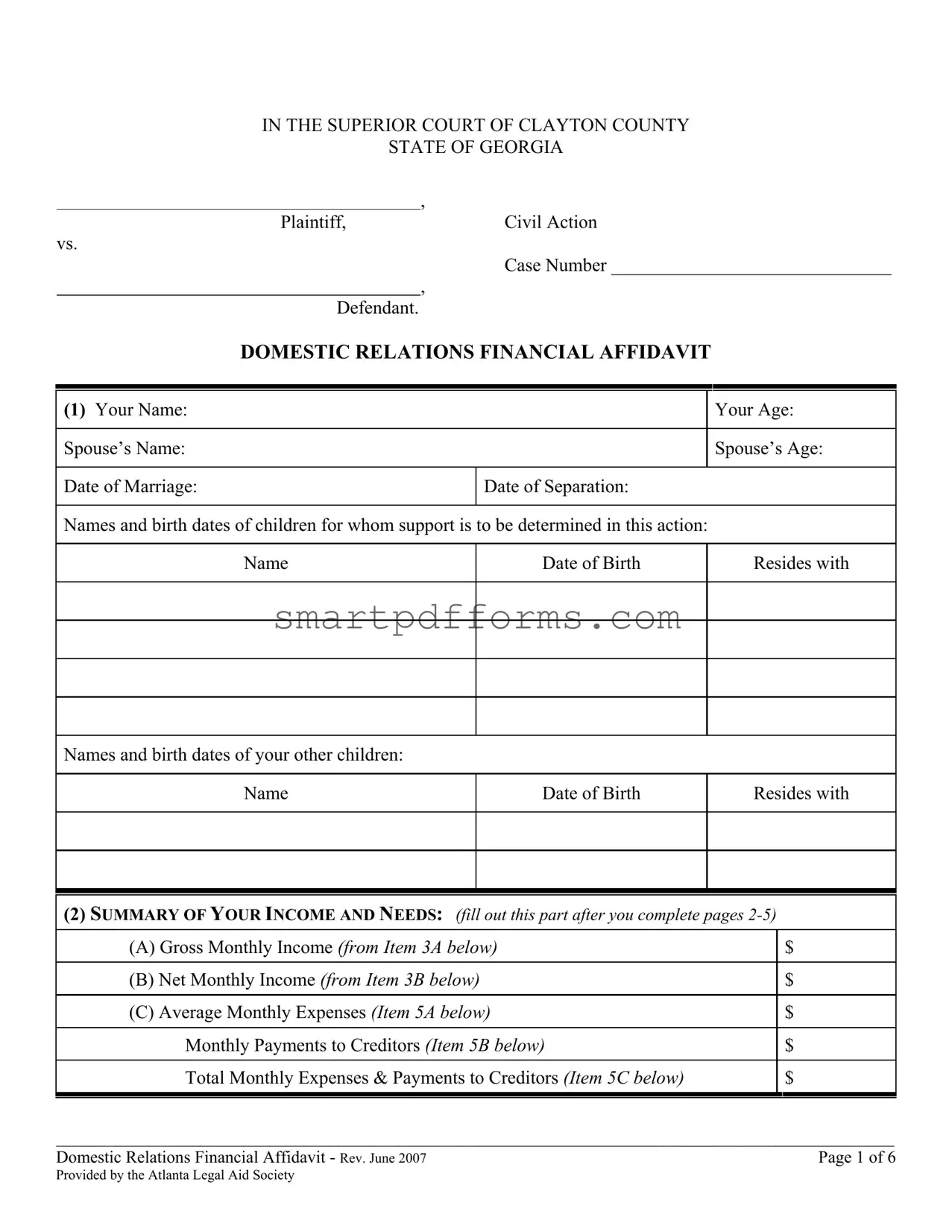

Embarking on the process of legal separation or divorce in Clayton County, Georgia, necessitates a thorough understanding of the Domestic Relations Financial Affidavit. This critical document, integral to the Superior Court of Clayton County, serves as a comprehensive declaration of an individual's financial standing. The affidavit requires the individual to detail personal information, including marriage and separation dates, children's names and birthdates, and a summary of income and expenses. It demands a meticulous account of gross and net monthly income, drawing from various sources such as salary, commissions, self-employment, or even unusual sources like lottery winnings. Additionally, the affidavit extends into an exhaustive listing of monthly expenses, spanning from household basics to specific children's needs. Moreover, it requires a detailed declaration of assets - distinguishing between marital and non-marital properties and their values. This document underpins financial disclosures in divorce proceedings, aiming to ensure a fair and equitable resolution of financial matters, including alimony, child support, and asset division. Thus, comprehensively filling out the Domestic Relations Financial Affidavit with accuracy and honesty is paramount for anyone navigating through the complexities of legal separation or divorce in Clayton County.

Preview - Clayton County Financial Form

IN THE SUPERIOR COURT OF CLAYTON COUNTY

STATE OF GEORGIA

, |

|

|

|

|

|

|

Plaintiff, |

|

Civil Action |

|

|

||

vs. |

|

|

|

|

||

|

|

|

Case Number ______________________________ |

|||

, |

|

|

|

|

|

|

Defendant. |

|

|

|

|

|

|

DOMESTIC RELATIONS FINANCIAL AFFIDAVIT |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Your Name: |

|

|

Your Age: |

|||

|

|

|

|

|

|

|

Spouse’s Name: |

|

|

Spouse’s Age: |

|||

|

|

|

|

|

|

|

Date of Marriage: |

|

Date of Separation: |

|

|

||

|

|

|

|

|||

Names and birth dates of children for whom support is to be determined in this action: |

|

|

||||

|

|

|

|

|||

Name |

|

Date of Birth |

|

Resides with |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Names and birth dates of your other children: |

|

|

|

|

||

|

|

|

|

|||

Name |

|

Date of Birth |

|

Resides with |

||

|

|

|

|

|||

|

|

|

|

|||

|

|

|

|

|||

|

|

|

|

|

|

|

(2) SUMMARY OF YOUR INCOME AND NEEDS: (fill out this part after you complete pages |

||||||

|

|

|

||||

(A) Gross Monthly Income (from Item 3A below) |

|

$ |

||||

|

|

|

|

|

||

(B) Net Monthly Income (from Item 3B below) |

|

|

|

$ |

||

|

|

|

||||

(C) Average Monthly Expenses (Item 5A below) |

|

$ |

||||

|

|

|

||||

Monthly Payments to Creditors (Item 5B below) |

|

$ |

||||

|

|

|

||||

Total Monthly Expenses & Payments to Creditors (Item 5C below) |

|

$ |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

__________________________________________________________________________________________________

Domestic Relations Financial Affidavit - Rev. June 2007 |

Page 1 of 6 |

Provided by the Atlanta Legal Aid Society |

|

(3) (A) YOUR GROSS MONTHLY INCOME: (Complete this section or attach Child Support Schedule A.

All income must be entered based on monthly average regardless of date of receipt.

Where applicable, income should be annualized.)

Salary or Wages — ATTACH COPIES OF 2 MOST RECENT WAGE STATEMENTS |

$ |

|

|

Commissions, Fees & Tips |

$ |

|

|

Income from |

$ |

(gross receipts minus ordinary and necessary expenses required to produce income) |

|

ATTACH SHEET ITEMIZING YOUR CALCULATIONS |

|

|

|

Rental income (gross receipts minus ordinary and necessary expenses required to produce |

$ |

income) ATTACH SHEET ITEMIZING YOUR CALCULATIONS |

|

|

|

Bonuses |

$ |

|

|

Overtime Payments |

$ |

|

|

Severance Pay |

$ |

|

|

Recurring Income from Pensions or Retirement Plans |

$ |

|

|

Interest and Dividends |

$ |

|

|

Trust income |

$ |

|

|

Income from Annuities |

$ |

|

|

Capital Gains |

$ |

|

|

Social Security Disability or Retirement Benefits |

$ |

|

|

Worker’s Compensation Benefits |

$ |

|

|

Unemployment Benefits |

$ |

|

|

Judgments from Personal Injury or Other Civil Cases |

$ |

|

|

Gifts (cash or other gifts that can be converted to cash) |

$ |

|

|

Prizes & Lottery Winnings |

$ |

|

|

Alimony and maintenance from persons not in this case |

$ |

|

|

Assets which are used for support of family |

$ |

|

|

Fringe Benefits (if significantly reduce living expenses) |

$ |

|

|

Any Other Income (Do not include |

$ |

|

|

TOTAL Gross Monthly Income (also write in 2A on page one) |

$ |

|

|

|

|

|

|

__________________________________________________________________________________________________

Domestic Relations Financial Affidavit - Rev. June 2007 |

Page 2 of 6 |

Provided by the Atlanta Legal Aid Society |

|

(3)(B) Net Monthly Income From Employment (deducting only state and federal taxes and |

$ |

|

FICA) (also write in 2B on page one) |

|

|

|

|

|

Your Pay Period (i.e., monthly, weekly, etc.): |

Number of Exemptions Claimed |

|

|

by You for Tax Purposes: |

|

|

|

|

(4)ASSETS

(List all assets here, including both

|

|

|

Separate |

Separate |

Basis of the Claim |

|

|

|

|

Asset of |

Asset of |

|

|

Description |

Value |

|

Husband |

Wife |

inheritance, etc.) |

|

|

|

|

|

|

|

|

Cash |

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

Stocks, Bonds |

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

CD’s / Money Market Accounts |

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

Bank Accounts (list each account below): |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

(2) |

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

(3) |

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

Retirement Pensions, 401(k), IRA or |

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Money Owed to You (or Spouse) |

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

Tax Refund Owed to You |

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

Real Estate (list properties & mortgages): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Home |

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

Debt owed on Home |

$ |

|

|

|

|

|

Other Real Estate |

$ |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

Debt owed on Other Real |

$ |

|

|

|

|

|

Estate |

|

|

|

|

|

|

|

|

|

|

|

|

|

Automobiles / Vehicles (list vehicles & amounts owed on each one):

(1) |

$ |

|

|

Debt owed on Vehicle (1) |

$ |

|

|

$

$

__________________________________________________________________________________________________

Domestic Relations Financial Affidavit - Rev. June 2007 |

Page 3 of 6 |

Provided by the Atlanta Legal Aid Society |

|

(2) |

|

$ |

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt owed on Vehicle (2) |

|

$ |

|

|

|

|

|

|

|

(4) ASSETS (continued) |

|

|

|

|

Separate |

Separate |

Basis of the Claim |

||

|

|

|

|

|

Asset of |

Asset of |

|

||

Description |

|

|

Value |

|

Husband |

Wife |

|

inheritance, etc.) |

|

|

|

|

|

|

|

|

|

|

|

Life Insurance (net cash value) |

|

$ |

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Furniture / Furnishings |

|

$ |

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Jewelry |

|

$ |

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Collectibles |

|

$ |

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Assets (specify): |

|

$ |

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

$ |

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

(5)(A) AVERAGE MONTHLY EXPENSES FOR YOU AND YOUR HOUSEHOLD |

|

|

|||||||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

|

HOUSEHOLD EXPENSES |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

Mortgage or Rent Payments |

|

$ |

|

Gas |

|

|

|

$ |

|

|

|

|

|

|

|

|

|||

Property taxes |

|

$ |

|

Repairs & Maintenance |

|

$ |

|||

|

|

|

|

|

|

|

|

|

|

Homeowner’s / Renter’s Insurance |

|

$ |

|

Lawn Care |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

Electricity |

|

$ |

|

Pest Control |

|

|

|

$ |

|

|

|

|

|

|

|

|

|||

Water |

|

$ |

|

Cable TV / Internet Access |

|

$ |

|||

|

|

|

|

|

|

|

|||

Garbage & Sewer |

|

$ |

|

Misc. Household & Grocery Items |

|

$ |

|||

|

|

|

|

|

|

|

|||

Telephones |

|

|

|

Meals Outside Home |

|

$ |

|||

|

|

|

|

|

|

|

|

||

Residential Lines |

|

$ |

|

Other (specify) |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

Cellular Telephones |

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

AUTOMOTIVE |

|

|

|

|

||

|

|

|

|

|

|||||

Gasoline & Oil |

|

$ |

|

Auto Tags / Registration / License |

|

$ |

|||

|

|

|

|

|

|

|

|

|

|

Repairs & Maintenance |

|

$ |

|

Insurance |

|

|

|

$ |

|

|

|

|

|

|

|||||

|

|

|

|||||||

OTHER VEHICLES (boats, trailers, RVs, etc.) |

|

|

|||||||

|

|

|

|

|

|||||

Gasoline & Oil |

|

$ |

|

Tags / Registration / License |

|

$ |

|||

|

|

|

|

|

|

|

|

|

|

Repairs & Maintenance |

|

$ |

|

Insurance |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

__________________________________________________________________________________________________

Domestic Relations Financial Affidavit - Rev. June 2007 |

Page 4 of 6 |

Provided by the Atlanta Legal Aid Society |

|

|

CHILDREN’S EXPENSES |

|

||

|

|

|

|

|

Child Care (total monthly cost) |

|

$ |

Allowance |

$ |

|

|

|

|

|

School Tuition |

|

$ |

Children’s Clothing |

$ |

|

|

|

|

|

Tutoring |

|

$ |

Diapers |

$ |

|

|

|

|

|

Private lessons (e.g., music, dance) |

|

$ |

Medical, Dental, Prescriptions |

$ |

|

|

|

|

|

|

|

|

|

|

School Supplies / Expenses |

|

$ |

Grooming / Hygiene |

$ |

|

|

|

|

|

Lunch Money |

|

$ |

Gifts from children to others |

$ |

|

|

|

|

|

Other Educational Expenses (list type & amount): |

Entertainment |

$ |

||

|

|

|

|

|

______________________ |

|

$ |

Activities (including |

$ |

|

|

school, religious, cultural, etc.) |

|

|

|

|

|

|

|

|

|

|

|

|

______________________ |

|

$ |

Summer Camps |

$ |

|

|

|

|

|

|

OTHER INSURANCE |

|

|

|

|

|

|

Health Insurance |

$ |

Life Insurance |

$ |

|

|

|

|

Children’s portion: |

$ |

Relationship of Beneficiary: |

|

|

|

|

|

Dental Insurance |

$ |

Disability Insurance |

$ |

|

|

|

|

Children’s portion: |

$ |

Other Insurance (specify) |

$ |

|

|

|

|

Vision Insurance |

$ |

|

$ |

|

|

|

|

Children’s portion: |

$ |

|

$ |

|

|

|

|

|

YOUR OTHER EXPENSES |

|

||

|

|

|

|

|

Dry Cleaning & Laundry |

|

$ |

Publications |

$ |

|

|

|

|

|

Clothing |

|

$ |

Dues, Clubs |

$ |

|

|

|

|

|

Medical / Dental / Prescription |

|

$ |

|

$ |

|

|

Religious & Charities |

|

|

expenses) |

|

|

|

|

|

|

|

|

|

Your Gifts (special holidays) |

|

$ |

Pet expenses |

$ |

|

|

|

|

|

Entertainment |

|

$ |

Alimony Paid to Former Spouse |

$ |

|

|

|

|

|

Recreational Expenses (e.g., fitness) |

|

$ |

Child Support Paid for other children |

$ |

|

|

|

|

|

Vacations |

|

$ |

Date of initial CS order: |

|

|

|

|

|

|

Travel Expenses for Visitation |

|

$ |

Other (attach sheet to list) |

$ |

|

|

|

|

|

|

|

|

|

|

__________________________________________________________________________________________________

Domestic Relations Financial Affidavit - Rev. June 2007 |

Page 5 of 6 |

Provided by the Atlanta Legal Aid Society |

|

|

|

|

|

|

|

|

|

TOTAL ABOVE MONTHLY EXPENSES (also write on first line of 2C on page one) |

|

$ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(5)(B) YOUR PAYMENTS & DEBTS TO CREDITORS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To Whom |

|

Balance Due |

Monthly |

(Please check one) |

|||

|

|

|

|

|

|||

|

Payments |

Joint |

Husband |

Wife |

|||

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

Total Monthly Payments to Creditors (also write this total on line 2 of 2C on page one) |

$ |

|

|

||||

|

|

|

|

|

|

|

|

(5)(C)TOTAL MONTHLY EXPENSES |

|

|

|

$ |

|

|

|

(Total Expenses from final line on page 5 + Total Monthly Payments to Creditors above) |

|

|

|

||||

(also write this total on line 3 of 2C on page one) |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_________________________________________________

G Plaintiff G Defendant Pro se

(Sign in front of notary public.)

Name: ___________________________________________

Address: __________________________________________

Daytime Phone: ( |

)_________________________ |

|

|

|

|

Subscribed and sworn before me on

, 20 .

__________________________________

Notary Public

__________________________________________________________________________________________________

Domestic Relations Financial Affidavit - Rev. June 2007 |

Page 6 of 6 |

Provided by the Atlanta Legal Aid Society |

|

Form Data

| Fact Name | Description |

|---|---|

| Document Type | Domestic Relations Financial Affidavit |

| Jurisdiction | Superior Court of Clayton County, State of Georgia |

| Revision Date | June 2007 |

| Provider | Atlanta Legal Aid Society |

| Purpose | To detail the financial status of a party in a domestic relations case, covering income, expenses, assets, and liabilities |

| Governing Laws | Georgia laws pertaining to family and divorce cases |

Instructions on Utilizing Clayton County Financial

Filling out the Clayton County Financial Form is a crucial step for individuals going through certain legal proceedings in the Superior Court of Clayton County, Georgia. This form provides a detailed account of one's financial situation, aiding the court in making informed decisions related to spousal or child support, and the division of marital assets. Completing this form accurately is paramount, as it directly influences the financial outcomes of the case. Below is a step-by-step guide to assist in filling out this form correctly.

- Begin with the case information at the top of the first page. Fill in the Civil Action Case Number, Plaintiff name, and Defendant name.

- In section (1), provide Your Name, Your Age, Spouse’s Name, and Spouse’s Age. Include the Date of Marriage and the Date of Separation.

- List the names and birth dates of children for whom support is being determined in this action, as well as any other children, specifying with whom they reside.

- Section (2) is a summary of your income and needs. This section should be filled out after completing the rest of the document.

- Under section (3)(A), detail Your Gross Monthly Income. Include all sources of income such as wages, self-employment income, rental income, and others. Attach copies of wage statements or other proof of income as indicated.

- In section (3)(B), calculate Your Net Monthly Income From Employment, after deductions. Provide your pay period type and the number of exemptions claimed for tax purposes.

- For section (4), List All Assets, including those considered non-marital and marital. For each asset, indicate its value, whom it belongs to, and the basis of the claim if it's considered non-marital.

- In section (5)(A), provide a detailed list of Average Monthly Expenses for you and your household. This includes mortgage or rent, utilities, groceries, vehicle expenses, children's expenses, and any other relevant expenses.

- Remember to include monthly payments to creditors under (5)(B) and total them with your monthly expenses under (5)(C).

- Review your entries carefully to ensure accuracy. An accurate financial depiction is critical for the court's assessment.

- After completing all sections, sign the form at the designated area to affirm the truthfulness of the information provided.

Upon completion, this form must be submitted according to the guidelines provided by the Superior Court of Clayton County, either through mail, in person, or digitally, based on the court's current protocols. It is important to keep a copy for your records. Properly completing this form is a foundational step in ensuring fair consideration of your financial circumstances throughout legal proceedings.

Obtain Answers on Clayton County Financial

What is the purpose of the Domestic Relations Financial Affidavit in Clayton County?

The Domestic Relations Financial Affidavit serves as a comprehensive document that outlines an individual's financial status in cases involving divorce, child support, and other domestic relations issues within Clayton County. It details income, expenses, assets, and liabilities, providing the court with a clear picture of the financial circumstances of the parties involved.

How should I fill out the income section of the affidavit?

For the income section, you must accurately report all sources of income on a monthly basis. This includes but is not limited to salary or wages (attach your two most recent wage statements), commissions, bonuses, self-employment income (after expenses), rental income, and any other income such as pensions, social security benefits, and alimony from other cases. Importantly, all income should be reported as a monthly average, and documentation for certain types such as wage statements or a detailed account of self-employment calculations should be attached.

What expenses need to be detailed in the affidavit?

Your average monthly expenses for yourself and your household are required. This covers a wide range of living expenses including mortgage or rent, utility bills, grocery items, healthcare costs not covered by insurance, child care, educational costs for children, vehicle expenses, and personal expenses such as clothing and entertainment. Each expense should be carefully evaluated and entered as accurately as possible.

How do I list assets and liabilities in the affidavit?

Assets should include everything of value you own, such as cash, bank accounts, real estate, vehicles, furniture, jewelry, and retirement accounts. Each asset must be listed with its current value, and if you claim a portion of an asset to be non-marital, you should specify the amount and basis (e.g., pre-marital, inheritance). Similarly, list all liabilities, including mortgages and vehicle loans, to provide a complete financial picture.

Is it necessary to distinguish between marital and non-marital assets?

Yes, distinguishing between marital and non-marital assets is crucial in domestic relations cases. If you claim that any part of an asset is non-marital, you must list it under the appropriate column and explain the basis for your claim (e.g., it was a pre-marital asset or inherited). This helps in the fair division of assets.

Should I include the financial information of my spouse?

While the form primarily focuses on your financial information, details relating to shared assets, liabilities, or expenses (e.g., mortgages or loans where both spouses are responsible) should be included. If you have access to your spouse’s financial information that is relevant to any joint assets or liabilities, it should be accurately reported.

What documentation is necessary to support the entries on the affidavit?

Documentation such as the two most recent wage statements, tax returns, calculations for self-employment income, rental income calculations, and statements for any assets listed (bank statements, retirement account statements, etc.) can support the figures reported. It’s important to attach any such documentation to verify your income and asset claims.

Can I amend the affidavit if my financial situation changes?

Yes, if there are significant changes to your financial situation after you have filed the affidavit, you can file an amended affidavit. This could include changes in employment, income, expenses, or asset values. It’s important to keep the affidavit updated to reflect your current financial circumstances accurately.

Where and how do I submit the completed affidavit?

The completed affidavit should be filed with the Clerk of the Superior Court of Clayton County. It can be submitted in person or, in some instances, electronically, depending on the court’s current procedures. Ensure that all required documentation is attached and that the affidavit is signed before submission.

Common mistakes

Filling out the Clayton County Financial Form is a critical step in the legal process, particularly in cases involving domestic relations. However, individuals often encounter pitfalls that can lead to inaccuracies or omissions. Understanding these common mistakes can help ensure the form is completed correctly and effectively.

Not Providing Complete Income Information: One common mistake is failing to provide comprehensive details on all sources of income. This includes omitting occasional sources like bonuses, gifts, or any side income. Given the form's instructions to include all income based on a monthly average, overlooking any component can lead to underreporting one's financial capacity.

Incorrectly Listing Assets: Another error involves inaccurately reporting assets. This could be from not understanding the value of certain assets, such as real estate, or not listing all assets like stocks, bonds, and retirement accounts. The requirement to list both marital and separate assets adds complexity, which can lead to mistakes if one is unfamiliar with the legal distinctions.

Miscalculating Monthly Expenses: Underestimating or overestimating monthly expenses is a frequent oversight. The form demands a detailed account of one's average monthly expenses, encompassing everything from mortgage or rent payments to costs associated with children's education and household needs. Errors in this section can significantly impact the perceived financial situation.

Omitting Debts or Liabilities: Individuals often forget to include monthly payments to creditors or may leave out significant liabilities like car loans or credit card debt. This can give an inaccurate picture of one's financial obligations and skew the assessment of financial needs.

Not Attaching Required Documentation: The form explicitly requests the attachment of supporting documentation, such as wage statements, calculations for self-employment income, and documentation for rental income, among others. Failure to attach these documents can result in an incomplete submission, potentially delaying the legal process.

Accuracy is paramount when filling out the Clayton County Financial Form. Avoiding these common mistakes can help ensure that the information presented is a true and complete reflection of one's financial situation. This is crucial for a fair assessment in any legal proceeding.

Documents used along the form

When navigating the complexities of a legal case, particularly within the jurisdiction of Clayton County, the completion of the Domestic Relations Financial Affidavit is often just one step in a multi-faceted process. This document is crucial for providing a clear overview of one’s financial status, which is instrumental in cases pertaining to divorce, child support, and other domestic relations issues. However, to construct a comprehensive and accurate portrayal of one’s financial scenario, several other documents and forms may need to be prepared and provided alongside this affidavit.

- Child Support Worksheet: Utilized in child support cases to calculate the financial obligations based on the parents' incomes, health insurance costs, and other child-related expenses.

- Marital Settlement Agreement: This document outlines the terms agreed upon by both parties regarding the division of marital assets, debts, alimony, and other financial matters in a divorce proceeding.

- Parenting Plan Form: Required in cases involving children, this plan details the custody arrangements, visitation schedules, and how decisions about the child will be made.

- Income Verification: Copies of recent pay stubs, income tax returns, and other documents verifying personal income, necessary for accurately filling out the Domestic Relations Financial Affidavit and other financial calculations.

- Asset and Debt Statements: Lists and documentation that detail all marital and non-marital assets and liabilities, providing a clear picture of the financial stakes in the case.

- Health Insurance Coverage Statement: Documentation regarding the health insurance policies available or currently in place, including costs and coverage details, especially pertinent in child support and alimony considerations.

- Real Estate Appraisals: Official appraisals or market analyses of any real property involved in the case, necessary for equitable division of assets.

- Retirement Account Statements: Current statements of 401(k), IRA, and other retirement accounts that might be subject to division or consideration in the case.

- Petition for Divorce or Separation: The initial filing document in a divorce or legal separation case, setting forth the grounds and initial requests for relief.

- Temporary Orders Request: Forms requesting temporary court orders for support, custody, or protection, often submitted at the start of a case to provide immediate relief.

In essence, the journey through family law matters often requires the compilation of diverse legal documents and forms, each serving a unique purpose in painting a full picture of the financial and familial situations at hand. The documents listed offer a glimpse into the breadth of information needed to navigate these personal and often intricate legal landscapes. Collectively, they empower individuals and legal professionals to pursue fair and informed outcomes in the sensitive realm of domestic relations law.

Similar forms

The Income and Expense Declaration form used in family law cases shares similarities with the Clayton County Financial form, particularly in the extensive detailing of an individual's income sources and monthly expenses. Like the Clayton County form, it requires documentation of salary, rental income, benefits, and other financial assets, ensuring the court has a comprehensive understanding of the party's financial standing.

Child Support Worksheet is another document that mirrors the Clayton County Financial form, primarily in its focus on the financial aspects that affect child support calculations. This worksheet includes sections for listing children’s needs, incomes of both parents, and other expenses, paralleling the detailed financial declaration needed in domestic relations cases.

The Property and Debt Statement, typically used during divorce proceedings, aligns with the Clayton County form in its requirement for disclosing all assets and liabilities. Both documents necessitate listing real estate, vehicles, bank accounts, and debts, providing a clear picture of each party’s financial state to assist in the division of assets and debts.

A Financial Statement for prenuptial agreements can be similar to the Clayton County Financial form in the way it requires full financial disclosure from both parties before entering into marriage. Detailing assets, liabilities, incomes, and expenses helps define pre-marital assets and expectations regarding financial dealings during the marriage.

The Bankruptcy Schedules and Statements filed during a bankruptcy case show resemblances in their thorough account of the debtor’s financial situation, including assets, liabilities, income, and expenditures. Much like the Clayton County form, these schedules aim to provide a complete financial overview for legal proceedings.

Loan Applications often necessitate a detailed rundown of an applicant's financial position, mirroring the depth of financial disclosure seen in the Clayton County Financial form. Applicants must disclose their income sources, monthly expenses, assets, and liabilities, underlining the document's utility in evaluating one’s ability to manage additional debt.

Dos and Don'ts

When filling out the Clayton County Financial form, it is critical to approach the task with care and attention to detail. Here are essential dos and don'ts to follow:

Things You Should Do:

- Be accurate: Ensure all the information you provide, including income, expenses, and assets, is accurate and reflects your current financial situation.

- Provide documentation: Attach all required documents such as the two most recent wage statements, and any other paperwork that verifies the income and expenses claimed on the form.

- Annualize irregular income: If you receive income that is not regular, like bonuses or commissions, calculate an average and annualize this figure to provide a monthly average income.

- Disclose all sources of income: It is important to list every source of income, including rental incomes, dividends, pensions, and even gifts that can be converted to cash.

- Review for completeness: Before submitting, meticulously go through the form to ensure every section is completed and no necessary information is omitted.

Things You Shouldn't Do:

- Omit information: Leaving out any income, assets, or liabilities can result in an inaccurate portrayal of your financial situation, leading to potential issues or disputes later.

- Underestimate expenses: It is crucial not to guess or undervalue your monthly expenses. Be thorough and precise in calculating your actual average monthly expenses.

- Overlook small assets or debts: Even seemingly insignificant assets or debts can impact your financial statement and should, therefore, be included.

- Use vague descriptions: Avoid using unclear or ambiguous descriptions of assets, income, or liabilities. Be as specific and detailed as possible.

- Forget to update the form: If your financial situation changes before your case is concluded, ensure you update and submit a new form to reflect these changes accurately.

Misconceptions

When dealing with the Clayton County Financial Form, several misconceptions can lead to confusion and mistakes. Understanding the form’s requirements and how it should be filled out is crucial for anyone going through legal proceedings in Clayton County. Here are seven common misconceptions:

- Only income from employment needs to be disclosed. This is not accurate. All sources of income must be reported, including self-employment, rentals, investments, alimony from previous marriages, and any other recurring income, to ensure a complete financial picture is presented.

- Assets owned prior to the marriage do not need to be listed. Even if an asset was acquired before marriage, it must be included. The form allows for indicating whether an asset is considered non-marital and its basis, such as pre-marital, gift, or inheritance.

- Monthly expenses only refer to personal expenses. In reality, all monthly household expenses should be accounted for, including those related to children, home maintenance, and any others that contribute to the household's overall expenses.

- Gross monthly income is the same as take-home pay. Gross monthly income refers to earnings before any deductions, such as taxes or retirement contributions, whereas take-home pay is the net income after these deductions.

- Debts and liabilities should be omitted from the form. All debts, including mortgages, car loans, and credit card debts, should be detailed to ensure a comprehensive evaluation of one’s financial obligations.

- The form only covers current financial situations. While the form focuses on the current financial status, it also serves as a basis for evaluating future needs and responsibilities, especially in relation to child support and alimony.

- Financial information can be estimated. Accuracy is paramount when completing the financial affidavit. Estimations can lead to errors and potentially affect the outcome of the case. Where possible, actual figures should be used, supported by documentation.

Understanding these misconceptions is vital for accurately completing the Clayton County Financial Form, ensuring that all parties have a clear, comprehensive view of the financial situation at hand.

Key takeaways

Filling out the Clayton County Financial form is a meticulous process that requires attention to detail and an understanding of one’s financial situation. Here are four key takeaways to ensure that the process is as smooth and accurate as possible:

- Comprehensive Income Reporting: All sources of income must be reported on the form. This includes salary, commissions, rental income, social security benefits, and more. It's crucial to annualize your income if it isn't already on a monthly basis and attach necessary documentation like wage statements or calculation sheets for self-employment income.

- Detailed Asset List: You need to provide a thorough list of all assets, specifying whether they are marital or non-marital property. This includes everything from cash, stocks, and real estate to vehicles and personal valuables like jewelry. For each asset, its current value and the basis for claiming it as non-marital (if applicable) must be clearly stated.

- Accurate Expense Tracking: Monthly expenses are a significant part of the affidavit. It's essential to accurately list your average monthly expenses, including household expenses, automotive, children's expenses, insurance, and any other personal expenses. Honest and precise reporting helps in determining your financial needs and obligations.

- Documentation and Verification: The form requires that you attach supporting documentation for various sections. This includes two most recent wage statements for salary verification, sheets itemizing calculations for self-employment, and rental income among others. Providing accurate documentation is key to verifying the financial information you declare.

Attention to these details can significantly impact the outcome of the financial affidavit process, making it essential to approach this task with diligence and care.

Popular PDF Forms

How to Write a Construction Bid - Enables project managers to document and compare bids for services like surveying, impact fees, and equipment rental in one place.

Unenrolling From Plano Isd - The intended date of withdrawal and the date of enrollment at the next school are crucial for timing and record-keeping.

What Is W-9 - Discover an organized way to track your real estate business earnings and expenditures with our Real Estate Agent Profit form.