Blank Cms 1 Mn PDF Template

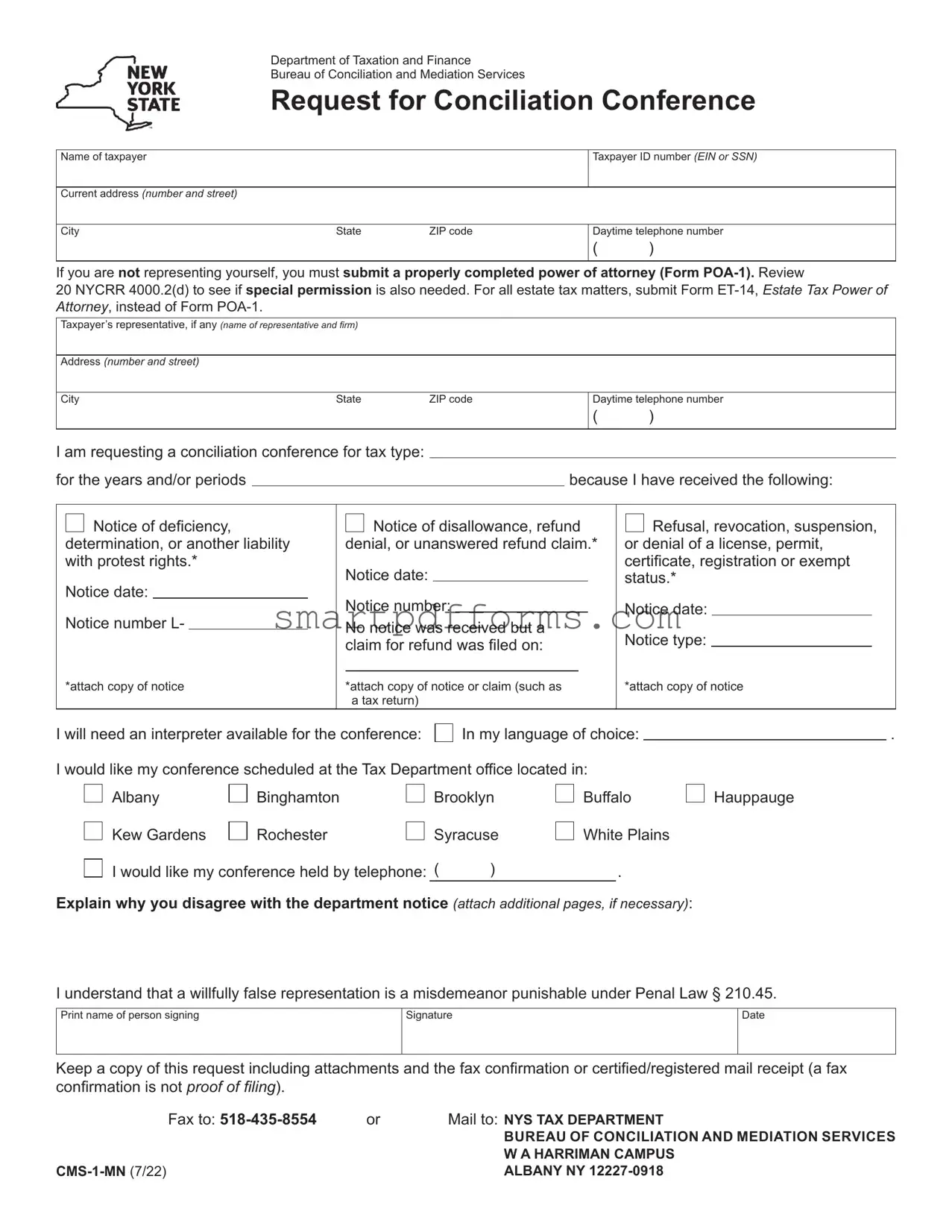

The CMS-1-MN form serves as a pivotal tool for taxpayers seeking to challenge decisions made by the Department of Taxation and Finance related to tax assessments, denials of refund claims, or alterations to various licenses and registrations. This form initiates a request for a conciliation conference, a process designed to provide an informal yet structured platform for taxpayers to present their disputes before the Bureau of Conciliation and Mediation Services. Utilized when a taxpayer disagrees with notices such as deficiency, disallowance, or revocation amongst others, it mandates the provision of basic information including the taxpayer's ID number, current address, and details regarding the contested issue. It importantly outlines the requirement for a power of attorney if representation is sought, emphasizing the necessity for formal authorization for representation in these matters. Additionally, the form explicitly caters to language needs by offering interpretation services during the conference, underpinning the bureau’s commitment to accessibility and fairness. The process laid out underscores a preference for resolving disputes amicably and efficiently, with outcomes ranging from a proposed consent agreement to a more binding conciliation order, subject to further appeal if necessary. The CMS-1-MN form and its subsequent processes embody a critical recourse for taxpayers, providing a clearly defined pathway to contest and rectify contentious tax-related decisions.

Preview - Cms 1 Mn Form

Department of Taxation and Finance

Bureau of Conciliation and Mediation Services

Request for Conciliation Conference

Name of taxpayer |

|

|

Taxpayer ID number (EIN or SSN) |

|

|

|

|

|

|

Current address (number and street) |

|

|

|

|

|

|

|

|

|

City |

State |

ZIP code |

Daytime telephone number |

|

|

|

|

( |

) |

|

|

|

|

|

If you are not representing yourself, you must submit a properly completed power of attorney (Form

20 NYCRR 4000.2(d) to see if special permission is also needed. For all estate tax matters, submit Form

Taxpayer’s representative, if any (name of representative and firm)

Address (number and street)

City |

State |

ZIP code |

Daytime telephone number

()

I am requesting a conciliation conference for tax type:

for the years and/or periods |

|

|

|

|

|

|

because I have received the following: |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

Notice of deficiency, |

|

Notice of disallowance, refund |

Refusal, revocation, suspension, |

|||||||||||

determination, or another liability |

|

denial, or unanswered refund claim.* |

or denial of a license, permit, |

|||||||||||

with protest rights.* |

|

Notice date: |

|

|

|

|

|

certificate, registration or exempt |

||||||

Notice date: |

|

|

|

|

|

|

status.* |

|||||||

|

|

|

||||||||||||

|

Notice number: |

|

|

|

|

|

|

|

||||||

Notice number L- |

|

|

|

Notice date: |

||||||||||

|

|

|||||||||||||

|

No notice was received but a |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

claim for refund was filed on: |

Notice type: |

|

|

|||||

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

*attach copy of notice |

|

*attach copy of notice or claim (such as |

*attach copy of notice |

|||||||||||

|

|

|

|

|

|

a tax return) |

|

|

|

|||||

I will need an interpreter available for the conference: |

In my language of choice: |

I would like my conference scheduled at the Tax Department office located in:

Albany |

Binghamton |

Brooklyn |

Buffalo |

||

Kew Gardens |

Rochester |

Syracuse |

White Plains |

||

I would like my conference held by telephone: ( |

) |

. |

|||

|

|

|

|

|

|

Explain why you disagree with the department notice (attach additional pages, if necessary):

.

Hauppauge

I understand that a willfully false representation is a misdemeanor punishable under Penal Law § 210.45.

Print name of person signing

Signature

Date

Keep a copy of this request including attachments and the fax confirmation or certified/registered mail receipt (a fax confirmation is not proof of filing).

Fax to: |

or |

Mail to: NYS TAX DEPARTMENT |

|

|

BUREAU OF CONCILIATION AND MEDIATION SERVICES |

|

|

W A HARRIMAN CAMPUS |

|

ALBANY NY |

Page 2 of 2

Notice of Taxpayer Rights

If you disagree with an action taken by the Department

of Taxation and Finance (the issuance of a tax deficiency/determination, the denial of a refund claim or the

denial or revocation of a license, registration or exemption certificate), you may protest by filing a Request for Conciliation

Conference or by filing a Petition for a Tax Appeals hearing.

The request or petition must be filed within a certain period of time from the date the department mailed you notice of its action. Refer to the notice you received to determine your

time limit. These time limits are established by the Tax Law and cannot be extended. We recommend you use certified or

registered mail. See Publication 55, Designated Private Delivery Services, for a list of private delivery services that can be used, and the address.

You may appear on your own behalf or you may have an authorized representative present your case for review. An authorized representative must have a power of attorney from you to appear on your behalf.

If you are a person with a disability and you wish to request that a reasonable accommodation be provided to you in order to participate in a conciliation conference, contact our designee for reasonable accommodation at tax.sm.reasonable.accommodations@tax.ny.gov.

Tax Appeals hearing

The procedure in the Division of Tax Appeals is begun by filing a petition. The petition must be in writing and must specifically

indicate the actions of the department that are being protested.

The hearing is an adversarial proceeding before an impartial administrative law judge. The hearing will be stenographically

reported. After the hearing, the administrative law judge will issue a determination that will finally decide the matter(s) in

dispute unless either you or the department requests review by the Tax Appeals Tribunal. If such a review is requested, the record of hearing and any additional oral or written arguments

will be reviewed and the Tribunal will issue a decision affirming, reversing, or modifying the administrative law judge’s

determination, or referring the matter back to the administrative law judge for further hearing.

Court review

If you do not agree with the Tax Appeals Tribunal’s decision, you

may seek court review. There are time limits within which an application for court review must be filed. For some taxes, you

must pay the tax, interest, and penalty or post a bond for this

amount, plus court costs, when you file an application for court

review.

Conciliation conference

A conciliation conference is an efficient and inexpensive way to try to resolve a protest. The conference is conducted informally by a conciliation conferee who will review all of the evidence presented to determine a fair result. After the conference, the conferee will send you a proposed resolution in the form of

a Consent. If you indicate your acceptance by signing and returning the Consent within 15 days, the disagreement will be concluded. Otherwise, the conferee will issue a Conciliation

Order. This order is binding on the department and will be binding on you unless you file a petition for a hearing with the

Division of Tax Appeals.

To request a conference, complete page 1 of this form and fax to

Note: Failure of technology or electronic communication or

unavailability of the facsimile will not release the requestor from timely filing as required by the Tax Law.

Note: The address you provide on Form

you. If you wish to change an address you use for other Tax Department matters visit www.tax.ny.gov for directions.

Privacy notification

The right of the Commissioner of Taxation and Finance and the Department of Taxation and Finance to collect and maintain personal information, including mandatory disclosure of Social Security numbers in the manner required by tax regulations, instructions, and forms, is found in the New York State Tax Law, including subdivision

42 USC 405(c)(2)(C)(i).

The Tax Department uses this information primarily to administer proceedings in the Bureau of Conciliation and Mediation Services, to identify the taxpayer, and for any other purpose authorized by law.

Failure to provide the required information may subject you to civil or criminal penalties, or both, under the Tax Law.

This information is maintained by the Director of the Bureau of Conciliation and Mediation Services, NYS Tax Department,

W A Harriman Campus, Albany NY

Small claims option

When petitioning for a hearing, you may elect to have your hearing held in the Small Claims Unit if the amount in dispute is within the dollar limits set by the Rules of Practice and Procedure, a copy of which will be sent to you with the petition

forms. The hearing is conducted as informally as possible by an impartial presiding officer. The presiding officer’s determination

is conclusive and is not subject to review by any other unit in the Division of Tax Appeals, the Tribunal, or by any court in the state.

You may request petition forms and the Rules of Practice and Procedure of the Tax Appeals Tribunal by calling

DIVISION OF TAX APPEALS

AGENCY BUILDING 1

EMPIRE STATE PLAZA

ALBANY NY 12223

Forms and publications are also available on the division’s website at www.dta.ny.gov.

A request for petition forms and the rules is not considered the filing of a petition for hearing for purposes of the time limits, and does not extend the time limits for filing a petition.

Estate tax

Estate tax filers are not eligible for hearings before the Division

of Tax Appeals.

For estate tax, if you elect not to file a Request for Conciliation Conference, you must file a Notice of Petition and a Verified

Petition with the Surrogate’s Court of the county with jurisdiction over the estate if you wish to pursue a court action. To obtain an estate tax petition form, contact the clerk of the Surrogate’s Court having jurisdiction over the estate.

A copy of the Notice of Petition and Verified Petition must be filed simultaneously with the Commissioner of

Taxation and Finance. Mail it to: Commissioner of Taxation and Finance, Office of Counsel, W A Harriman Campus, Albany NY

Form Data

| Fact Name | Detail |

|---|---|

| Purpose of Form CMS-1-MN | This form is used to request a Conciliation Conference from the New York State Department of Taxation and Finance's Bureau of Conciliation and Mediation Services. |

| Governing Law | The form and its process are governed by New York State Tax Law, specifically 20 NYCRR 4000.2(d) for representation permissions and the requirement for a Power of Attorney using Form POA-1 or Form ET-14 for estate tax matters. |

| Consequences of False Representation | Making a willfully false representation on this form is considered a misdemeanor, punishable under Penal Law § 210.45. |

| Resolution Process | After a Conciliation Conference, a proposed resolution is sent to the taxpayer. If agreed, it concludes the disagreement. If not, a Conciliation Order is issued, which is binding unless a petition for a Tax Appeals hearing is filed. |

Instructions on Utilizing Cms 1 Mn

Filing a CMS-1-MN form is a critical step for taxpayers wishing to contest actions or decisions made by the Department of Taxation and Finance. This process allows for a conciliation conference request, providing a platform for discussion and resolution of tax disputes without the need for a formal hearing. Accurate completion of this form is essential for the swift processing of a taxpayer's appeal. Following the steps below will guide individuals through the completion process of the CMS-1-MN form.

- Enter the Name of taxpayer as it appears on tax documents.

- Provide the Taxpayer ID number, which could be an EIN or SSN, depending on the nature of the taxpayer (individual or business).

- Input the Current address, including number and street, city, state, and ZIP code.

- List a Daytime telephone number, including the area code, to enable direct contact during business hours.

- If represented by an attorney or agent, a properly completed power of attorney (Form POA-1) must be attached. For estate tax matters, utilize Form ET-14 instead.

- Fill in the Taxpayer’s representative information if applicable, including the name of the representative and firm, their address, city, state, ZIP code, and daytime phone number.

- Specify the tax type and the years and/or periods related to the request for a conciliation conference.

- Indicate the reason for the request by detailing the received notice (e.g., Notice of deficiency, Notice of disallowance, Notice of denial of a license, etc.), including the notice date and notice number. Attach a copy of the notice or claim.

- If an interpreter is needed for the conference, mention the language of choice.

- Select the preferred location for the conference from the listed Tax Department offices or opt for a conference held by telephone, and include the reason if applicable.

- Explain why you disagree with the department's notice in the provided area and attach additional pages if necessary.

- Sign and date the form. It is crucial to understand that a willfully false representation is a misdemeanor punishable under Penal Law § 210.45.

- Keep a copy of the completed request along with attachments and the fax confirmation or certified/registered mail receipt for your records.

- Fax the completed form to 518-435-8554 or mail it to: NYS TAX DEPARTMENT, BUREAU OF CONCILIATION AND MEDIATION SERVICES, W A HARRIMAN CAMPUS, ALBANY NY 12227-0918.

Upon submission, the Tax Department will review the form and the accompanying documentation. The taxpayer will receive notification regarding the scheduling of the conciliation conference. This conference represents an opportunity to present one's case, addressing the disagreement with the Department of Taxation and Finance's action or decision. It is a chance to resolve the dispute amicably and efficiently, potentially avoiding the need for more formal legal proceedings.

Obtain Answers on Cms 1 Mn

-

What is the CMS-1-MN form used for?

The CMS-1-MN form is used to request a conciliation conference with the Department of Taxation and Finance Bureau of Conciliation and Mediation Services. It's a step taxpayers can take if they disagree with actions like a tax deficiency/determination, a refund claim denial, or the denial or revocation of a license, registration, or exemption certificate.

-

Who should file the CMS-1-MN form?

Any taxpayer who has received a notice from the Department of Taxation and Finance that they wish to contest should file the CMS-1-MN form. This includes notices of deficiency, disallowance, and other tax-related issues.

-

What information is required when submitting the CMS-1-MN form?

You'll need to provide your name, taxpayer ID number (either SSN or EIN), current address, and daytime telephone number. If you're represented by someone else, their information and a properly completed power of attorney (Form POA-1) must also be submitted. Additionally, details about the notice received or the claim filed, reasons for disagreeing with it, and your preferred method and location for the conference are necessary.

-

How can the CMS-1-MN form be submitted?

The form can be faxed to 518-435-8554 or mailed to the NYS Tax Department, Bureau of Conciliation and Mediation Services, at the specified address. Remember to keep a copy of the form and the fax confirmation or certified/registered mail receipt for your records.

-

Is there a deadline for submitting the CMS-1-MN form?

Yes, the request for a conciliation conference must be filed within a certain period from the date the department mailed you the notice of its action. Refer to the notice you received to determine your specific time limit, as these limits are established by the Tax Law and cannot be extended.

-

What happens after submitting the CMS-1-MN form?

After submitting the form, a conciliation conference will be scheduled either at the taxpayer's choice of Tax Department office or by telephone. During the conference, all evidence will be reviewed to determine a fair result. The taxpayer will then receive a proposed resolution, which, if agreed upon, concludes the disagreement.

-

What if I do not agree with the outcome of the conciliation conference?

If you do not agree with the proposed resolution, the conciliation conferee will issue a Conciliation Order. This order is binding unless you file a petition for a hearing with the Division of Tax Appeals to contest it further.

-

Can I request an interpreter for the conference?

Yes, if you need an interpreter, you can request one for your conference. Simply indicate your language of choice on the CMS-1-MN form when submitting your request.

Common mistakes

Filling out the CMS-1-MN form, which is essential for requesting a conciliation conference with the New York State Department of Taxation and Finance, requires accuracy and attention to detail. However, individuals often make mistakes during this process. Recognizing and avoiding these common errors can streamline the process and improve the likelihood of a favorable outcome.

- Not providing complete taxpayer information: Leaving out details such as the taxpayer ID number (Social Security Number or Employer Identification Number) or current address can delay the process.

- Failing to attach necessary documents: Forgetting to include notices received or claims filed, like the notice of deficiency or refund claim, can result in an incomplete application.

- Incorrect representation information: If someone other than the taxpayer is filling out the form, not submitting the proper Power of Attorney (Form POA-1), or in the case of estate tax, Form ET-14, leads to processing delays.

- Omitting contact information: Neglecting to provide a daytime telephone number can hinder communication about the conciliation conference.

- Inaccurately stating the tax issue: Failing to clearly explain why the taxpayer disagrees with the department notice can weaken the case.

- Requesting the wrong type of conference: Not indicating a preference for an in-person conference at a specific Tax Department office or a telephone conference can result in scheduling conflicts or misunderstandings.

- Not specifying the need for an interpreter: If an interpreter is needed and this is not communicated, it could complicate communication during the conference.

- Lack of signature and date: The form is not valid unless it is signed and dated by the taxpayer or their representative, leading to it being considered incomplete.

In addition to these common mistakes, it is also crucial for individuals to:

- Keep copies of the request, including attachments, and the fax confirmation or certified/registered mail receipt for their records.

- Review the Notice of Taxpayer Rights carefully to understand the process and time limits for filing.

- Contact the Bureau of Conciliation and Mediation Services for guidance if there are any uncertainties during the process.

By addressing these areas, taxpayers can ensure that their request for a conciliation conference is complete and processed efficiently.

Documents used along the form

When dealing with tax-related issues, particularly those requiring a Request for Conciliation Conference through Form CMS-1-MN, various other forms and documents might need to be prepared and submitted alongside it. These documents ensure that the taxpayer's situation is comprehensively understood and that all legal bases are covered during the process.

- Form POA-1, Power of Attorney - This document allows an individual to grant another person the authority to represent them in tax matters before the Department of Taxation and Finance.

- Form ET-14, Estate Tax Power of Attorney - Specifically designed for estate tax matters, this form enables a designated representative to act on behalf of the decedent's estate regarding tax issues.

- Form IT-201, Resident Income Tax Return - Used by residents to file an annual income tax return, this document might be necessary to provide a history of the taxpayer’s filings and their financial situation.

- Form IT-203, Nonresident and Part-Year Resident Income Tax Return - This form is for individuals who are not full-year residents of New York State but need to report income derived from New York sources.

- Form DTF-973.52, Request for Copy or Transcript of Tax Form - Taxpayers might need to request copies of filed tax documents to support their case during the conciliation conference.

- Form DTF-505, Authorization to Release Tax Information - Allows the tax department to release a person's tax information to someone else, essential when a representative is handling the case.

- Notice of Deficiency - This is not a form but a document issued by the tax authority indicating that there was an error or omission in the taxpayer's filed returns, leading to a proposed additional tax due.

- Letter of Authorization for Tax Representative - While Form POA-1 serves a similar purpose, a letter of authorization might be used for less formal representations or specific tax matters not covered by the official form.

- Form IT-2, Summary of W-2 Statements - When income needs to be verified, this form summarizes the information contained in an individual's W-2 forms.

- Form 4506, Request for Copy of Tax Return - Although a federal form, it may be necessary for a taxpayer to obtain copies of previously filed federal returns for reference during state tax disputes.

These documents collectively enable the taxpayer to present a well-rounded argument or explanation for their tax position. Whether addressing income discrepancies, proving residency, or authorizing a representative, each plays a vital role in the conciliation process. Familiarity with these forms and when they are required can dramatically streamline resolving tax issues through the Department of Taxation and Finance's conciliation conference.

Similar forms

The Form POA-1 (Power of Attorney) shares similarity with the CMS-1-MN form in that both require the designation of a representative to act on someone's behalf in matters concerning the Department of Taxation and Finance. Specifically, the CMS-1-MN form mentions submitting a properly completed Form POA-1 unless it's an estate tax matter, highlighting the connection between authorizing representation and managing tax-related disputes or issues.

The Form ET-14 (Estate Tax Power of Attorney) is mentioned within the CMS-1-MN instructions as the required form for estate tax matters, instead of the POA-1. This similarity underlines that both documents are essential for appointing representation, albeit in specialized areas. The ET-14 specifically caters to estate tax scenarios, reflecting how different forms target distinct tax-related concerns while sharing the underlying premise of designated representation.

Request for a Tax Appeals hearing petition form carries a similar purpose to the CMS-1-MN form in providing a structured way for taxpayers to dispute decisions made by the Department of Taxation and Finance. Both documents are crucial for initiating formal challenges against determinations perceived as erroneous or unfair. The key similarity lies in their role as starting points for navigating disputes within the tax authority’s framework.

The Small Claims option available for tax appeals is akin to the CMS-1-MN's procedure in offering a simplified, less formal route for resolving disputes. This option, intended for lesser disputes, parallels the CMS-1-MN form's accessibility and focus on efficiency in addressing taxpayer grievances. It underscores the system's attempt to provide paths that accommodate different scales and complexities of tax issues.

Publication 55 (Designated Private Delivery Services), while not a form, is related to the CMS-1-MN document in its practical implications. It lists approved delivery services for submitting tax documents, including forms like CMS-1-MN, demonstrating how various components of the tax system interconnect to ensure that procedural requirements are met, from document preparation to submission.

The generic Notice of Petition and Verified Petition for Estate Tax shares its foundation with the CMS-1-MN by offering a means to formally contest decisions, albeit within the specific context of estate taxes. This connection highlights the pervasive need for structured legal processes across different tax domains, facilitating taxpayers’ rights to seek corrections or adjustments to tax authority assessments or actions.

Dos and Don'ts

When filling out the CMS-1-MN form, it's essential to pay attention to both what you should and shouldn't do to ensure your request is processed smoothly. Here are some guidelines to follow:

- Do provide accurate information for your name, taxpayer ID number (EIN or SSN), and current address. These details are crucial for identifying your case.

- Do not leave the contact information section incomplete. Providing a daytime telephone number can help speed up communication.

- Do submit a properly completed power of attorney (Form POA-1) if you're not representing yourself. This document is necessary for authorizing someone else to act on your behalf.

- Do not forget to review 20 NYCRR 4000.2(d) or the requirement for special permission in certain cases. This can be critical, especially for estate tax matters requiring a different form.

- Do include all relevant details about the tax type, years/periods in question, and attach copies of any notices received or claims filed. This information supports your case.

- Do not omit your disagreement explanation. Explain why you disagree with the department notice and attach additional pages if necessary.

- Do indicate if you need an interpreter and specify the language. This ensures that your conference goes smoothly without language barriers.

- Do choose your preferred location for the conference or opt for a telephone conference if necessary, ensuring it aligns with your convenience.

- Do not forget to keep a copy of your request, including attachments and the fax confirmation or certified/registered mail receipt. This serves as proof of your filing.

Following these guidelines can help you successfully navigate the process of requesting a conciliation conference with the Department of Taxation and Finance.

Misconceptions

Understanding the CMS-1-MN form and its process can sometimes be marred by misconceptions. These misunderstandings can range from its purpose to how it's processed. Below, common misconceptions about the CMS-1-MN form are clarified.

- Only taxpayers can request a conciliation conference: It's believed that only the individual or entity that owes taxes can file this request. However, a taxpayer's representative, equipped with a properly completed power of attorney (Form POA-1 or Form ET-14 for estate tax matters), can also submit the request on behalf of the taxpayer.

- Requesting a conciliation conference is an admission of guilt: Some people think that by requesting a conciliation conference, they are admitting to owing the disputed tax or agreeing with the deficiency or denial. In reality, this request is a proactive step in disputing an action taken by the Department of Taxation and Finance.

- All tax disputes qualify for a conciliation conference: There's a misconception that any tax issue can be resolved through a conciliation conference. However, the process is specifically designed for notices of deficiency, disallowance, refund refusal, revocation, suspension, and other formal protest rights mentioned in the form.

- A conciliation conference will delay penalties: People often believe that simply requesting a conciliation conference will pause any penalties associated with their case. However, penalties and interest may continue to accrue until the dispute is resolved, regardless of the conference request.

- The CMS-1-MN form changes the address on file with the department: Completing and submitting this form doesn't update the taxpayer's address for all communications with the Department of Taxation and Finance. Taxpayers looking to change their address for other purposes must take additional steps as outlined by the department.

- Faxing the CMS-1-MN form is sufficient proof of filing: It's a common belief that a fax confirmation serves as a proof of filing. However, keeping a copy of the request, including attachments and the fax confirmation or certified/registered mail receipt, is crucial, as a fax confirmation alone does not serve as proof of filing.

- A conciliation conference is the final step in the dispute process: Some individuals think that a conciliation conference is the last chance to resolve a dispute. In fact, if the taxpayer disagrees with the outcome of the conference, they can file a petition for a hearing with the Division of Tax Appeals for further review.

Dispelling these misconceptions about the CMS-1-MN form helps in understanding the conciliation process better, ensuring taxpayers and their representatives can navigate the procedure with clear expectations.

Key takeaways

Filling out and using the CMS-1-MN form is a crucial step for taxpayers who disagree with a decision made by the Department of Taxation and Finance. Below are six key takeaways to help navigate this process:

- Timeliness is Crucial: If you disagree with a tax determination or any other decision made by the department, you must request a conciliation conference or file a petition for a tax appeals hearing within a strict timeframe. This period is specified in the notice you received from the department. Missing this deadline could forfeit your right to challenge the decision.

- Completeness of the Form: When completing the CMS-1-MN form, it is essential to provide all requested information accurately. This includes taxpayer identification numbers, current addresses, details about the tax matter in dispute, and any notices received from the Department of Taxation and Finance. Failing to complete the form correctly may delay the process or affect the outcome of your case.

- Representation: You have the option to represent yourself or appoint a representative to handle the conciliation conference on your behalf. If choosing a representative, you must submit a properly completed power of attorney (Form POA-1) or, for estate tax matters, Form ET-14. This ensures your representative can legally act on your behalf in the conciliation process.

- Necessity of Documentation: Attaching copies of all relevant notices or claims to your CMS-1-MN form is crucial. These documents provide the necessary context and specifics about your dispute, helping the Bureau of Conciliation and Mediation Services understand your position and prepare for your conference.

- Choice of Conference Type: You have the choice to have your conciliation conference in person or by telephone. This flexibility allows you to select the option that best suits your situation. Indicating your preference on the form helps the department schedule the conference accordingly.

- Accuracy and Honesty: The CMS-1-MN form explicitly warns that intentionally providing false information is a misdemeanor. Ensuring that all information you provide is accurate and truthful is not only critical for the integrity of your case but also to avoid potential legal consequences.

Understanding and following these key points can significantly impact the effectiveness of your conciliation conference request. Whether you are challenging a tax deficiency, the denial of a refund claim, or any other decision made by the Department of Taxation and Finance, navigating the process accurately ensures your dispute is heard and adjudicated fairly.

Popular PDF Forms

What Is a Due Diligence Period - It provides a legal framework for negotiating property sales, with built-in provisions for addressing any issues discovered during due diligence.

8500-7 - By submitting this form, applicants contribute to ensuring the safety of airspace users.