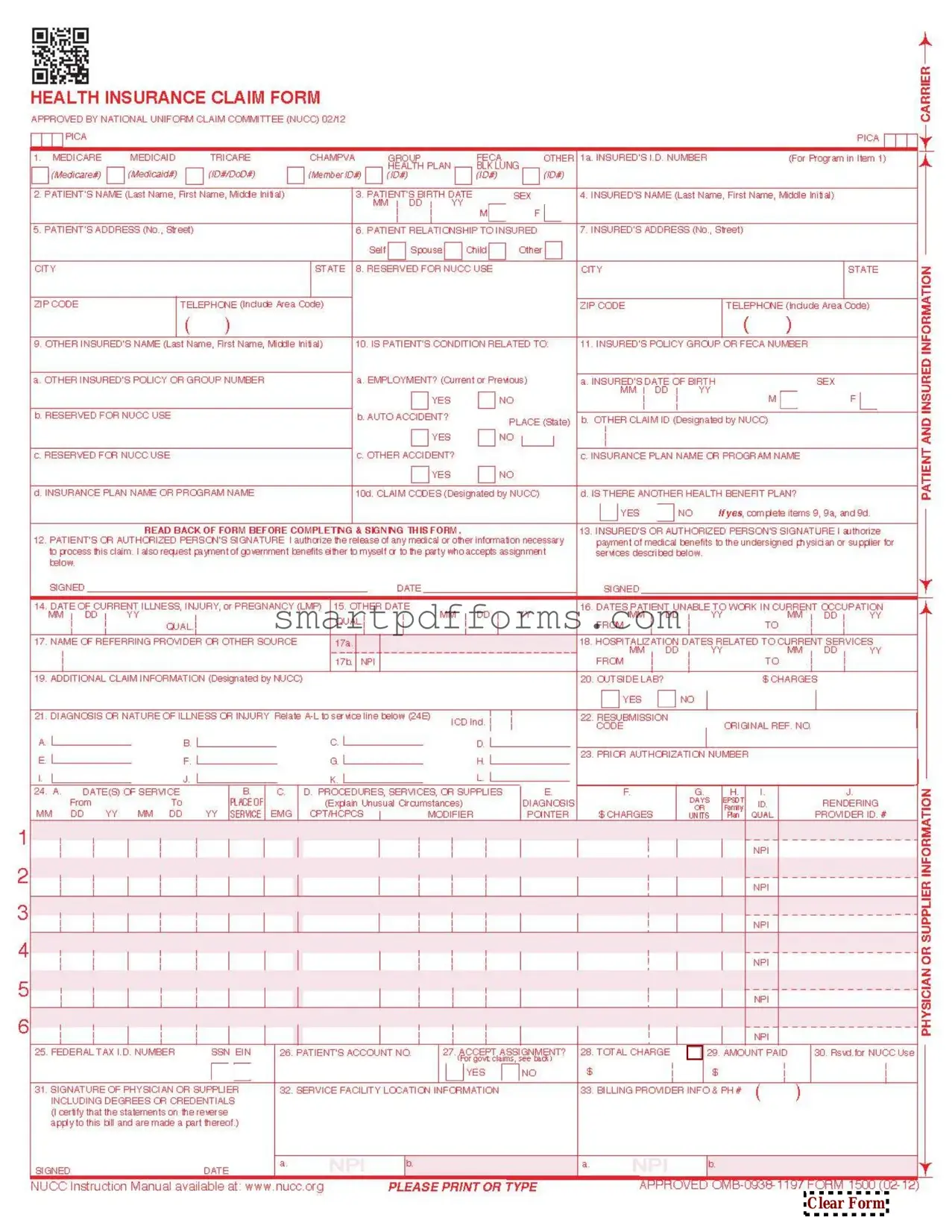

Blank CMS 1500 PDF Template

In the realm of healthcare, efficient communication between healthcare providers and insurance companies is paramount. One of the vital tools facilitating this interaction is the CMS 1500 form. Originally designed for non-institutional providers and suppliers to submit claims to Medicare and other health insurance programs, the form has evolved into a standard document recognized across the healthcare industry. Its importance cannot be overstated; it ensures that healthcare providers are reimbursed for services rendered, while also protecting the rights of patients by securing the confidentiality and accuracy of their medical information. Recognized for its comprehensive scope, the form captures a wide range of data including patient identification, diagnosis codes, dates of service, billing information, and detailed descriptions of the services provided. The CMS 1500 form stands as a testament to the ongoing efforts to streamline healthcare administration, aiming to reduce complexities, and foster a more efficient billing and processing system that benefits both providers and recipients of healthcare services.

Preview - CMS 1500 Form

Clear Form

BECAUSE THIS FORM IS USED BY VARIOUS GOVERNMENT AND PRIVATE HEALTH PROGRAMS, SEE SEPARATE INSTRUCTIONS ISSUED BY APPLICABLE PROGRAMS.

NOTICE: Any person who knowingly files a statement of claim containing any misrepresentation or any false, incomplete or misleading information may be guilty of a criminal act punishable under law and may be subject to civil penalties.

REFERS TO GOVERNMENT PROGRAMS ONLY

MEDICARE AND CHAMPUS PAYMENTS: A patient’s signature requests that payment be made and authorizes release of any information necessary to process the claim and certifies that the information provided in Blocks 1 through 12 is true, accurate and complete. In the case of a Medicare claim, the patient’s signature authorizes any entity to release to Medicare medical and nonmedical information, including employment status, and whether the person has employer group health insurance, liability,

BLACK LUNG AND FECA CLAIMS

The provider agrees to accept the amount paid by the Government as payment in full. See Black Lung and FECA instructions regarding required procedure and diagnosis coding systems.

SIGNATURE OF PHYSICIAN OR SUPPLIER (MEDICARE, CHAMPUS, FECA AND BLACK LUNG)

I certify that the services shown on this form were medically indicated and necessary for the health of the patient and were personally furnished by me or were furnished incident to my professional service by my employee under my immediate personal supervision, except as otherwise expressly permitted by Medicare or CHAMPUS regulations.

For services to be considered as “incident” to a physician’s professional service, 1) they must be rendered under the physician’s immediate personal supervision by his/her employee, 2) they must be an integral, although incidental part of a covered physician’s service, 3) they must be of kinds commonly furnished in physician’s offices, and 4) the services of nonphysicians must be included on the physician’s bills.

For CHAMPUS claims, I further certify that I (or any employee) who rendered services am not an active duty member of the Uniformed Services or a civilian employee of the United States Government or a contract employee of the United States Government, either civilian or military (refer to 5 USC 5536). For

No Part B Medicare benefits may be paid unless this form is received as required by existing law and regulations (42 CFR 424.32).

NOTICE: Any one who misrepresents or falsifies essential information to receive payment from Federal funds requested by this form may upon conviction be subject to fine and imprisonment under applicable Federal laws.

NOTICE TO PATIENT ABOUT THE COLLECTION AND USE OF MEDICARE, CHAMPUS, FECA, AND BLACK LUNG INFORMATION

(PRIVACY ACT STATEMENT)

We are authorized by CMS, CHAMPUS and OWCP to ask you for information needed in the administration of the Medicare, CHAMPUS, FECA, and Black Lung programs. Authority to collect information is in section 205(a), 1862, 1872 and 1874 of the Social Security Act as amended, 42 CFR 411.24(a) and 424.5(a) (6), and 44 USC 3101;41 CFR 101 et seq and 10 USC 1079 and 1086; 5 USC 8101 et seq; and 30 USC 901 et seq; 38 USC 613; E.O. 9397.

The information we obtain to complete claims under these programs is used to identify you and to determine your eligibility. It is also used to decide if the services and supplies you received are covered by these programs and to insure that proper payment is made.

The information may also be given to other providers of services, carriers, intermediaries, medical review boards, health plans, and other organizations or Federal agencies, for the effective administration of Federal provisions that require other third parties payers to pay primary to Federal program, and as otherwise necessary to administer these programs. For example, it may be necessary to disclose information about the benefits you have used to a hospital or doctor. Additional disclosures are made through routine uses for information contained in systems of records.

FOR MEDICARE CLAIMS: See the notice modifying system No.

FOR OWCP CLAIMS: Department of Labor, Privacy Act of 1974, “Republication of Notice of Systems of Records,” Federal Register Vol. 55 No. 40, Wed Feb. 28, 1990, See

FOR CHAMPUS CLAIMS: PRINCIPLE PURPOSE(S): To evaluate eligibility for medical care provided by civilian sources and to issue payment upon establishment of eligibility and determination that the services/supplies received are authorized by law.

ROUTINE USE(S): Information from claims and related documents may be given to the Dept. of Veterans Affairs, the Dept. of Health and Human Services and/or the Dept. of Transportation consistent with their statutory administrative responsibilities under CHAMPUS/CHAMPVA; to the Dept. of Justice for representation of the Secretary of Defense in civil actions; to the Internal Revenue Service, private collection agencies, and consumer reporting agencies in connection with recoupment claims; and to Congressional Offices in response to inquiries made at the request of the person to whom a record pertains. Appropriate disclosures may be made to other federal, state, local, foreign government agencies, private business entities, and individual providers of care, on matters relating to entitlement, claims adjudication, fraud, program abuse, utilization review, quality assurance, peer review, program integrity,

DISCLOSURES: Voluntary; however, failure to provide information will result in delay in payment or may result in denial of claim. With the one exception discussed below, there are no penalties under these programs for refusing to supply information. However, failure to furnish information regarding the medical services rendered or the amount charged would prevent payment of claims under these programs. Failure to furnish any other information, such as name or claim number, would delay payment of the claim. Failure to provide medical information under FECA could be deemed an obstruction.

It is mandatory that you tell us if you know that another party is responsible for paying for your treatment. Section 1128B of the Social Security Act and 31 USC 3801- 3812 provide penalties for withholding this information.

You should be aware that P.L.

MEDICAID PAYMENTS (PROVIDER CERTIFICATION)

I hereby agree to keep such records as are necessary to disclose fully the extent of services provided to individuals under the State’s Title XIX plan and to furnish information regarding any payments claimed for providing such services as the State Agency or Dept. of Health and Human Services may request.

I further agree to accept, as payment in full, the amount paid by the Medicaid program for those claims submitted for payment under that program, with the exception of authorized deductible, coinsurance,

SIGNATURE OF PHYSICIAN (OR SUPPLIER): I certify that the services listed above were medically indicated and necessary to the health of this patient and were personally furnished by me or my employee under my personal direction.

NOTICE: This is to certify that the foregoing information is true, accurate and complete. I understand that payment and satisfaction of this claim will be from Federal and State funds, and that any false claims, statements, or documents, or concealment of a material fact, may be prosecuted under applicable Federal or State laws.

According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless it displays a valid OMB control number. The valid OMB control number for this information collection is

Form Data

| Fact | Description |

|---|---|

| Purpose | The CMS 1500 form is used by healthcare providers to submit insurance claims to Medicare and Medicaid. |

| Origin | It was introduced by the Centers for Medicare & Medicaid Services (CMS). |

| Users | It is primarily used by physicians, certain non-physician practitioners, and suppliers. |

| Format | This form is available in both paper format and as an electronic version, known as the 837P. |

| Content | It collects information on the patient, provider, insurance, and services provided. |

| State-Specific Versions | Some states may require specific versions of the CMS 1500 form according to their own regulations. |

| Electronic Submission | Electronic submissions are encouraged for faster processing and are governed by the Health Insurance Portability and Accountability Act (HIPAA) regulations. |

| Updates and Revisions | The form is periodically updated to reflect changes in healthcare practices and insurance requirements. |

Instructions on Utilizing CMS 1500

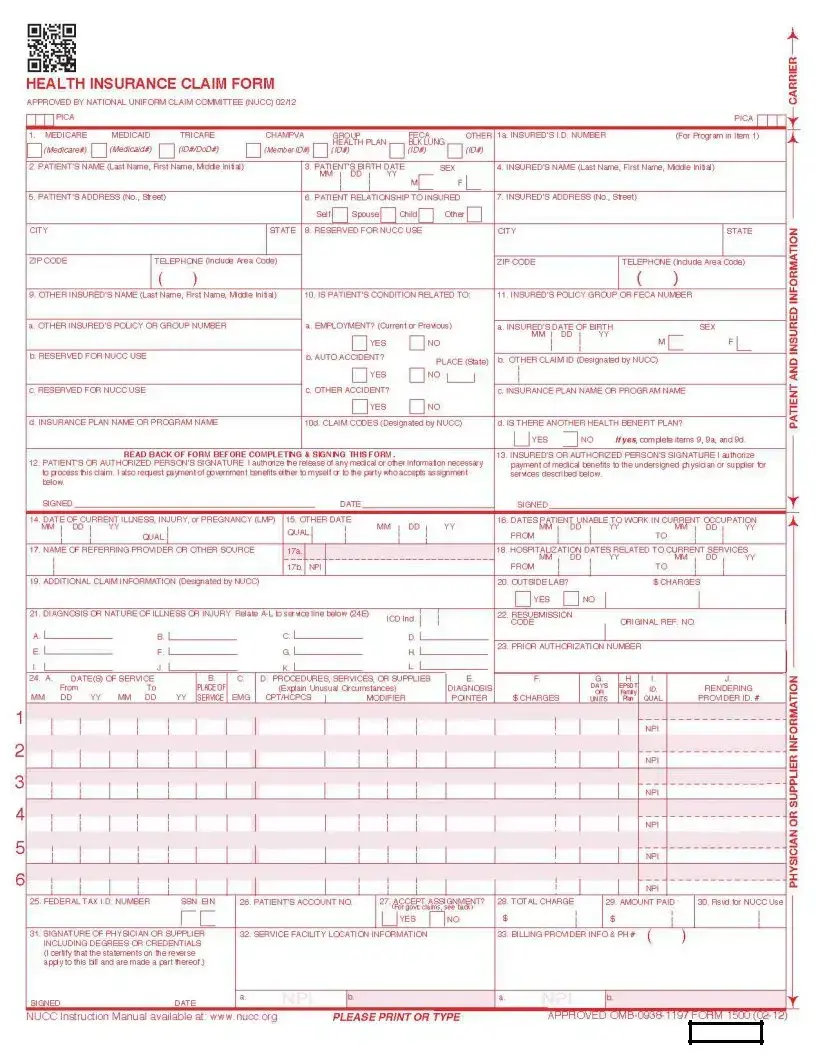

After determining the need to submit a claim using the CMS 1500 form, it is crucial to fill it out accurately to ensure the processing of the claim goes smoothly. The form requires detailed information about the patient, the medical provider, the services provided, and the insurance information. To complete the form, gather all necessary information, including patient demographics, insurance policy numbers, dates of service, and details of the treatment provided. Here are the steps to fill out the CMS 1500 form effectively.

- Gather the patient's full name, address, date of birth, and social security number.

- Obtain the insurance company's name, the patient's policy number, and group number if applicable.

- Fill in the patient's relationship to the insured if the patient is not the policyholder.

- Enter the patient's condition related to employment, auto accident, or other accident details.

- List the dates of the patient's illness, injury, or pregnancy.

- Provide information about the other insured's name, policy, or group number if there is another health benefit plan.

- Enter the codes for the patient's diagnosis.

- Detail the dates of service, place of service, procedures, services, or supplies, and the charges for each.

- Include the diagnosis or nature of illness or injury related to the services provided.

- Supply the name, address, and ID of the referring provider or other source.

- Fill in the federal tax ID number and check the appropriate box for SSN or EIN.

- Indicate the total charge, amount paid, and the balance due.

- Sign and date the form, certifying that the information is correct and that you have the right to claim.

Once the form is completed, review it thoroughly for accuracy and completeness. Corrections should be made prior to submission to avoid delays in processing. The form should then be sent to the appropriate insurance company for processing. The insurance company will review the claim and proceed according to their policies, which may involve additional information requests or direct reimbursement for covered services.

Obtain Answers on CMS 1500

-

What is a CMS 1500 form?

The CMS 1500 form is a standardized form used by healthcare providers to submit insurance claims to Medicare and other health insurance providers. It's essential for the billing process, enabling providers to receive payment for services rendered to insured patients. The form collects patient information, diagnosis codes, billing information, and details about the medical services provided.

-

Who uses the CMS 1500 form?

This form is primarily used by medical practitioners, clinics, and other healthcare providers that bill Medicare and Medicaid services, as well as private insurance companies. It is also utilized by billing specialists and medical coders within healthcare facilities to ensure accurate and compliant billing practices.

-

How can I obtain the CMS 1500 form?

You can get the CMS 1500 form through various channels. The form is available for purchase from the U.S. Government Printing Office (GPO) and authorized printing companies that sell CMS-approved versions. Additionally, some healthcare software systems include electronic versions of the form, which can be filled out and submitted digitally.

-

Is it mandatory to use the CMS 1500 form?

Yes, for most healthcare providers who submit claims to Medicare and Medicaid services, using the CMS 1500 form is mandatory. It is also widely accepted by private insurance companies. Using the correct form ensures the claims are processed efficiently and accurately, which is crucial for timely reimbursement.

-

What information is needed to complete the CMS 1500 form?

- Patient's name, address, and birth date.

- Patient's insurance number and policy details.

- Healthcare provider's information, including National Provider Identifier (NPI).

- Dates and services provided, including procedure codes.

- Diagnoses codes that justify the need for the services provided.

- Billing information, including the charges for each service.

Accurate and complete information is crucial to avoid delays or denials of payment.

-

Can the CMS 1500 form be submitted electronically?

Yes, the CMS 1500 form can be submitted electronically, which is often referred to as electronic data interchange (EDI). Many healthcare providers prefer electronic submission because it speeds up the claims process and reduces the likelihood of errors. To submit claims electronically, providers must use software that meets the requirements set by Medicare and Medicaid or work with a billing service that handles electronic submissions.

-

What are the common mistakes to avoid when filling out the CMS 1500 form?

- Leaving required fields blank.

- Using incorrect or outdated codes for procedures and diagnoses.

- Failing to provide complete patient information, including insurance details.

- Misaligning information in the form fields, which is particularly problematic for scanned or faxed submissions.

Attention to detail and double-checking the form for accuracy can prevent these common errors.

-

How long does it take to process a CMS 1500 claim?

The processing time for a CMS 1500 claim can vary depending on several factors, including the completeness and accuracy of the form, the method of submission, and the payer's workload. Electronic submissions typically process faster than paper forms. On average, providers can expect a processing time of about 14 to 30 days for electronically submitted claims, while paper claims may take longer.

-

What should I do if a claim is denied?

If your claim is denied, the first step is to review the notice of denial from the insurance company to understand the reason. Common reasons include errors on the form, lack of medical necessity, or services not covered under the patient's plan. After identifying the issue, correct the error if applicable, and resubmit the claim. For denials due to coverage issues, you may need to communicate further with the insurer or consider an appeal if you dispute their decision.

-

Where can I find more information about using the CMS 1500 form?

More information about the CMS 1500 form, including detailed instructions for its completion, can be found on the official website of the Centers for Medicare & Medicaid Services (CMS). Additionally, professional healthcare associations and billing experts often provide resources and training on accurately completing and submitting CMS 1500 forms.

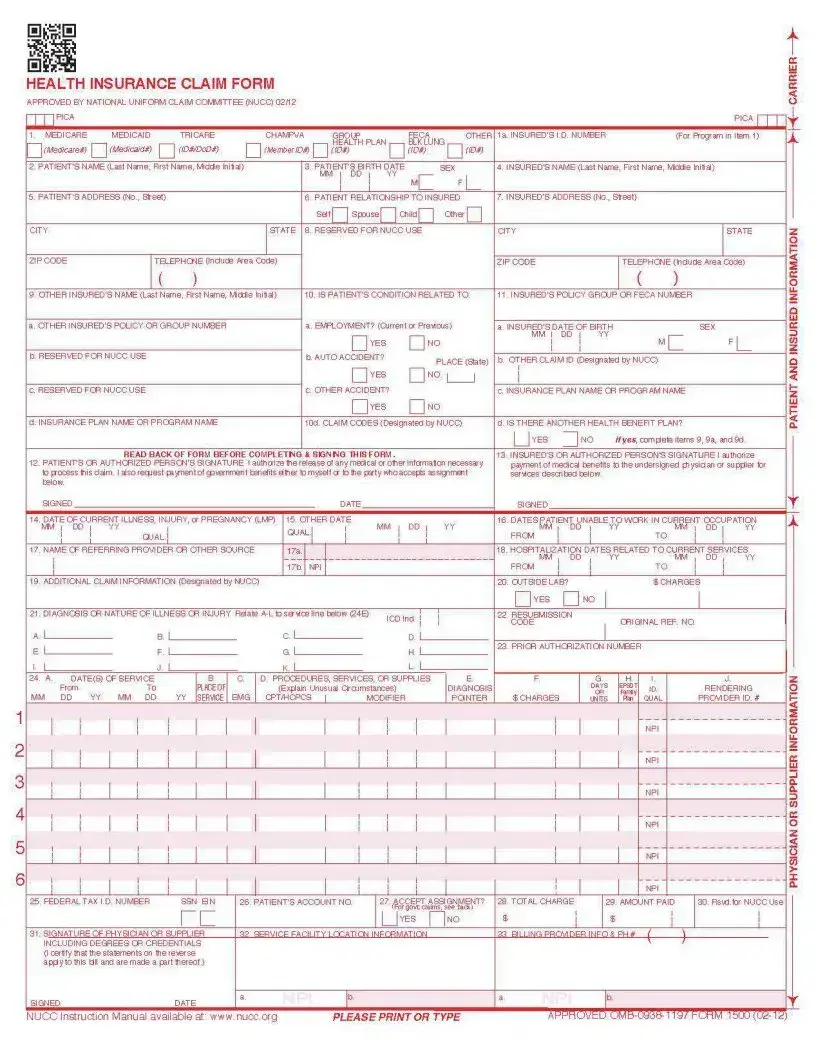

Common mistakes

When filling out the CMS 1500 form, which is critical for submitting insurance claims in the healthcare field, individuals often make errors that can lead to claim denials or payment delays. Ensuring accuracy on this form is paramount for the timely reimbursement for healthcare providers. Below are six common mistakes to avoid:

Incorrect or Missing Patient Information: One of the most frequent errors is not filling out patient information accurately. This includes the patient's full name, date of birth, and insurance ID number. Even small mistakes in this section can result in a claim being rejected.

Not Using the Correct Codes: Healthcare services and procedures are represented by specific codes. Using outdated or incorrect service codes, such as ICD-10, CPT, and HCPCS codes, will lead to claim denials.

Omitting the Date of Service: The date(s) on which the healthcare services were provided must be accurately recorded. Failure to include the service date or inputting incorrect dates can delay processing.

Provider Information Errors: The healthcare provider's details, including the National Provider Identifier (NPI) and the address, must be accurate. Incorrect or incomplete provider information can cause significant processing delays.

Not Indicating the Place of Service: Each service provided has a location, known as the place of service (POS). Not specifying the POS or using an incorrect code can affect the claim.

Failure to Sign and Date the Form: The CMS 1500 form requires a signature and date to verify that the information provided is true and accurate. A missing signature or date can result in an automatic denial of the claim.

In summary, these mistakes, often seen as minor, can notably impact the efficiency and success of insurance claim processing. Attention to detail and a thorough review of the CMS 1500 form before submission can help avoid these errors, fostering a smoother reimbursement process for healthcare services rendered.

Documents used along the form

In the realm of healthcare billing and insurance claims in the United States, the CMS 1500 form is a cornerstone document used to submit claims for reimbursement to insurance providers, including Medicare and Medicaid. This form is critical for healthcare providers to be compensated for their services. However, completing the CMS 1500 form is just one part of a complex process. Often, several other forms and documents must accompany the CMS 1500 form to ensure a successful claim submission. Understanding these documents can significantly streamline the billing process.

- EOB (Explanation of Benefits): This document is provided by insurance companies to detail the services billed, what was paid by the insurance, and any patient responsibility. It is crucial for cross-referencing the insurance's response to the submitted claim.

- Prior Authorization Forms: Certain services require prior approval from the insurance provider to confirm that a procedure or service is covered under the patient's plan. These forms are used to request such approval.

- Medical Records: Detailed records including doctors' notes, lab results, and other pertinent medical history are often required to substantiate the need for the billed services.

- Superbill: This itemized form details all services provided to a patient. Though not submitted to insurance, it's used by providers to complete the CMS 1500 form accurately.

- Prescription Records: For claims involving medication, detailed prescriptions highlighting the medicine's necessity are crucial for claim approval.

- Referral Forms: If the healthcare provided was based on a referral from another doctor, especially in managed care plans, a referral form may be needed to prove the service was necessary.

- Insurance Card Copies: A copy of the front and back of the patient’s insurance card is essential for verifying coverage and ensuring accurate billing information.

- Accident Reports: For claims related to personal injury or accidents, detailed accident reports can be necessary to distinguish between medical and liability insurance responsibilities.

- Advance Beneficiary Notice (ABN): This notice is a written communication from the provider to the patient, informing them that Medicare may not cover a particular service, which may make the patient responsible for payment. It is required for specific services not covered under Medicare.

- Assignment of Benefits (AOB) Forms: These forms are agreements that allow the insurance company to pay the healthcare provider directly. It's a critical document that affects the direction of the payment flow.

Each of these documents plays a vital role in the healthcare billing ecosystem, supporting the CMS 1500 form submission in various ways. From proving the medical necessity to detailing the payment responsibilities, these documents ensure that the billing process moves smoothly and efficiently. Familiarity and proper management of these documents not only aid in faster claim processing but also in securing the appropriate payment for healthcare services rendered.

Similar forms

The UB-04 form mirrors the CMS 1500 in its purpose, which is to facilitate billing for medical services. However, the UB-04 is typically used by hospitals and inpatient facilities, whereas the CMS 1500 is more common among physicians and outpatient providers.

Similar to the CMS 1500, the Dental Claim Form serves as a means for dental professionals to submit billing for dental services rendered. This form shares the intention of standardizing the claims process, albeit for dental care instead of general medical services.

Prescription Drug Claim Forms also share a common purpose with the CMS 1500, aimed at standardizing the submission of medication-related claims to insurance providers. These forms are designed to detail prescribed medications in a structured format, akin to how the CMS 1500 organizes medical service information.

The HCFA-1500 form is actually a previous version of the CMS 1500 form and thus shares a direct lineage. Both forms are fundamentally tasked with the same objective—to facilitate the process of healthcare providers billing insurance companies for services provided to patients. The transition to the CMS 1500 form involved updates to accommodate electronic billing requirements.

Superbill documents, although more commonly used internally within healthcare practices, share similarities with the CMS 1500 form because they list services rendered, diagnoses, and codes related to a patient visit. The key difference is that Superbills are often used as the basis for generating a formal CMS 1500 claim for submission to insurance carriers.

The Health Insurance Claim Form (HICF) is another document that has a lot in common with the CMS 1500. It is used for the submission of claims to health insurance companies, mirroring the CMS 1500’s goal. The scope and specific format might vary, emphasizing adaptability across different types of insurance claims beyond those covered by Medicare.

Dos and Don'ts

Filling out the CMS 1500 form accurately is crucial for healthcare providers to ensure prompt and correct payment for services rendered. Below are essential dos and don'ts to consider:

- Do double-check the patient's information for accuracy, including their full name, date of birth, and insurance ID number.

- Do use the appropriate ICD-10 codes to describe the diagnosis clearly. Ensure these codes are current and accurately reflect the patient's condition.

- Do include the complete billing information of the provider, ensuring it matches the information on file with the insurance company.

- Do verify the patient's insurance coverage and benefits before submitting the form to avoid claim denials due to coverage issues.

- Don't leave any mandatory fields blank. Incomplete forms are a common reason for claim rejections.

- Don't use outdated codes or incorrect billing amounts. This can lead to processing delays and denials.

- Don't forget to sign and date the form. A missing signature can invalidate the entire claim.

- Don't guess on any part of the form. If unsure about how to complete a section, seek clarification to avoid errors.

By following these guidelines, healthcare providers can minimize errors and facilitate a smoother claims processing experience. Remember, attention to detail is key in all aspects of medical billing and insurance claim submission.

Misconceptions

The CMS 1500 form, often mentioned within various healthcare settings, entails complexity that sometimes leads to misunderstandings about its usage and significance. While healthcare professionals navigate through the intricacies of medical billing and insurance claims, a few misconceptions frequently arise. Below is a list of common misconceptions about the CMS 1500 form and clarifications to demystify these misunderstandings.

- It’s only for Medicare claims: A misunderstanding exists that the CMS 1500 form is exclusively for Medicare claims. In reality, this standardized form is universally utilized by healthcare providers to submit claims to Medicare and most insurance companies, including Medicaid and private insurers. It facilitates the process of billing for medical services and supplies.

- It’s outdated and no longer in use: Some might consider the CMS 1500 form obsolete, but it remains essential in today’s healthcare industry. While electronic health records (EHRs) and electronic submission of claims have gained prominence, the CMS 1500 form serves as the basis for electronic submissions and is still used in paper format, especially in smaller practices or for specific situations that require manual submission.

- Any healthcare provider can fill it out: While it might seem that any healthcare provider could complete the CMS 1500 form, accurate and compliant completion requires specific knowledge of coding systems like CPT, ICD-10, and HCPCS. Incorrect or incomplete forms can lead to claim denials or delays, emphasizing the need for specialized training or expertise in medical billing.

- It is only for submitting diagnosis information: While diagnosis information is a critical component of the CMS 1500 form, it encompasses much more. The form also includes sections for procedure codes, dates of service, patient demographics, billing information, and other crucial details necessary for claim processing. It provides a comprehensive view of a patient's encounter for billing purposes.

- No personal information about the patient is required: On the contrary, patient personal information is crucial for the CMS 1500 form. Accurate patient demographics, including name, address, birthdate, insurance ID numbers, and relationship to the insured, are essential for the insurance company to process the claim. Any discrepancy in this information can result in claim rejection or denial.

- Filling out the form is quick and straightforward: Completing the CMS 1500 form can be a detailed and meticulous process. It requires precise coding and understanding of billing guidelines to ensure all information is correctly captured and compliant with the payer’s requirements. Simplifying this process can lead to errors, claim rejections, or audit issues.

- Electronic and paper forms are processed at the same speed: Electronic submissions of the CMS 1500 form are generally processed faster than their paper counterparts. Electronic claims have the advantage of being easier to track and less likely to be lost or delayed in the mail, leading to quicker processing times and reimbursements.

- Corrections on the form can be made easily: Making corrections on a CMS 1500 form, especially after submission, can be complicated. It often requires the submission of an entirely new form with the corrections, indicating the previous claim was an error. This can delay processing and payment, highlighting the importance of accuracy in the initial submission.

- There is no need to keep a copy of the submitted form: Keeping a copy of the submitted CMS 1500 form is crucial for record-keeping and in case of disputes or audits. It serves as evidence of the claim submission and helps in tracking the claim's progress. Efficient record-keeping promotes transparency and accountability in medical billing practices.

Understanding these misconceptions about the CMS 1500 form can significantly improve the efficiency and accuracy of medical billing processes. Education and training on the form’s correct usage are essential for healthcare providers and billing professionals to ensure smooth operations and timely reimbursements.

Key takeaways

The CMS 1500 form is the standard paper claim form used by healthcare professionals and suppliers to bill Medicare Part B services and some Medicaid state agencies. Understanding how to properly fill out and utilize this form is crucial for ensuring timely and accurate reimbursement for healthcare services. Here are key takeaways regarding the CMS 1500 form:

- Accuracy is paramount: Every field on the CMS 1500 form must be filled out accurately. This includes patient information, insurance details, dates of service, billing codes, and provider identification. Errors or omissions can lead to claim denials or delays in payment.

- Use the correct codes: Healthcare providers must use the appropriate Current Procedural Terminology (CPT) codes, Healthcare Common Procedure Coding System (HCPCS) codes, and International Classification of Diseases (ICD) codes to describe the services provided. Incorrect coding can also result in claim denial or incorrect reimbursement.

- Stay updated: Codes and billing practices are subject to change. Therefore, it's essential for providers to stay informed about the latest updates to ensure compliance and maximize reimbursement.

- Know the payer's requirements: While the CMS 1500 form is standardized, different insurance companies may have specific instructions for submission. Providers should familiarize themselves with each payer's guidelines to avoid processing issues.

- Retain copies: Providers should always keep a copy of the completed CMS 1500 form and any supporting documentation. This is crucial for resolving any disputes with payers and for audit purposes.

Popular PDF Forms

Basic Template Printable Employee Information Form - Insights into the applicant's linguistic capabilities may highlight valuable skills for customer or client interactions.

How to Read a Scale Ticket - 2-PART Scale Ticket forms in White, Canary provide an instant duplicate for record-keeping or customer copies.