Blank Cms 1513 PDF Template

The CMS-1513 form, officially known as the Disclosure of Ownership and Control Interest Statement, plays a pivotal role in maintaining transparency and integrity within the vast ecosystem of healthcare services sponsored by the U.S. Department of Health and Human Services, particularly under the Centers for Medicare & Medicaid Services. Its comprehensive structure demands detailed revelations around ownership, control interests, and any significant changes in provider status, all of which must be meticulously declared by entities participating or seeking to participate in federal health care programs such as Medicare, Medicaid, and others outlined under titles V, XVIII, XIX, and XX of the Social Security Act. The requirement for this form stems from a fundamental need to prevent fraud and ensure that entities engaged with these programs operate within the bounds of legal and ethical standards. Entities are obligated to furnish information about all individuals and organizations holding direct or indirect ownership or control interest of 5 percent or more, changes in ownership or control, affiliations with management companies or chains, and any criminal offenses related to participation in federal health programs. Additionally, it mandates annual submission, with clear warning that failure to comply or provide accurate, up-to-date information could lead to serious consequences such as denial of participation or termination of existing contracts with state agencies or the Secretary. This form underscores the importance of accountability and transparency within healthcare, ensuring that only those who adhere to the highest standards of conduct can deliver or facilitate care under federally funded programs.

Preview - Cms 1513 Form

DEPARTMENT OF HEALTH AND HUMAN SERVICES |

Form Approved |

CENTERS FOR MEDICARE & MEDICAID SERVICES |

OMB No. |

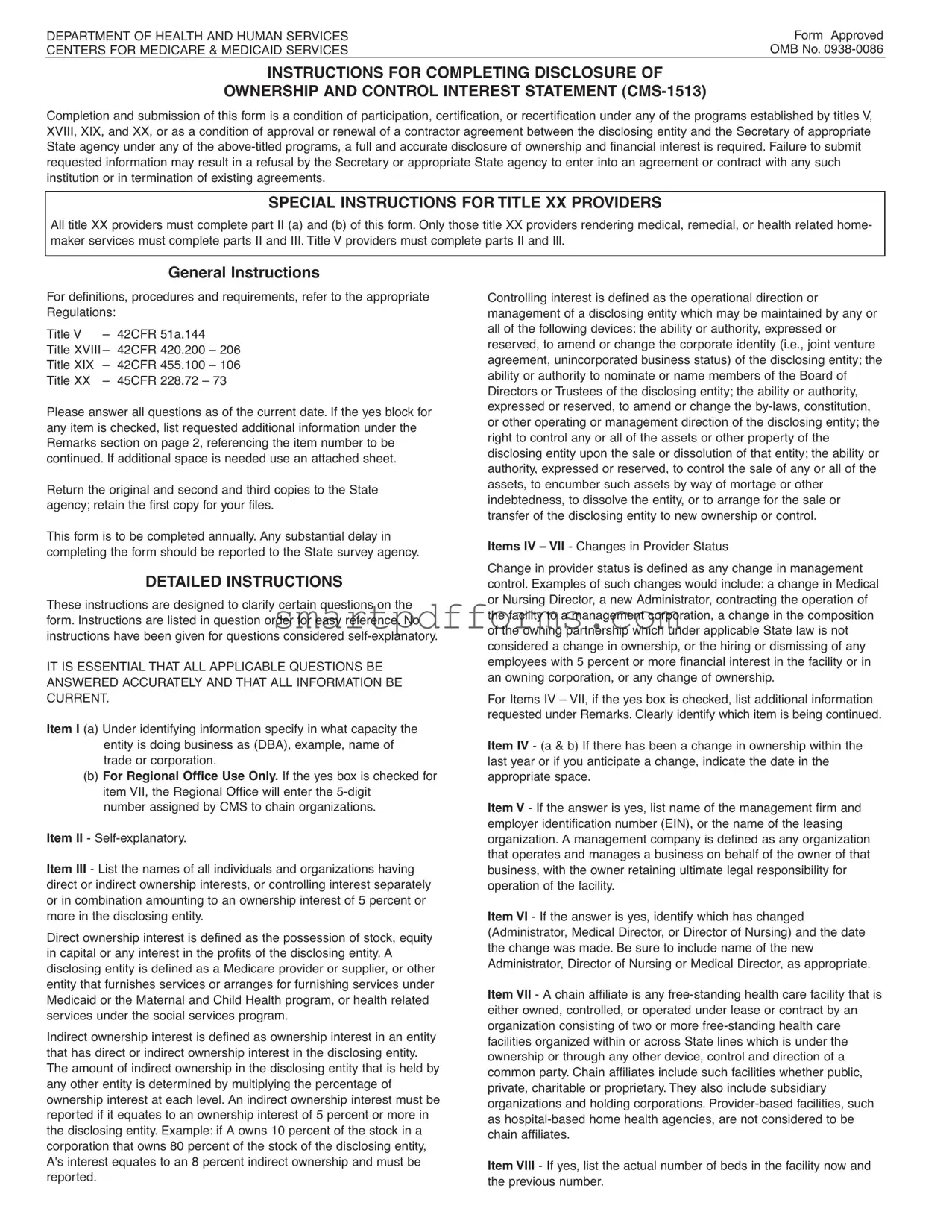

INSTRUCTIONS FOR COMPLETING DISCLOSURE OF

OWNERSHIP AND CONTROL INTEREST STATEMENT

Completion and submission of this form is a condition of participation, certification, or recertification under any of the programs established by titles V, XVIII, XIX, and XX, or as a condition of approval or renewal of a contractor agreement between the disclosing entity and the Secretary of appropriate State agency under any of the

SPECIAL INSTRUCTIONS FOR TITLE XX PROVIDERS

All title XX providers must complete part II (a) and (b) of this form. Only those title XX providers rendering medical, remedial, or health related home- maker services must complete parts II and III. Title V providers must complete parts II and Ill.

General Instructions

For definitions, procedures and requirements, refer to the appropriate Regulations:

Title V |

– |

42CFR 51a.144 |

|

|

Title XVIII – |

42CFR 420.200 |

– 206 |

||

Title XIX |

– |

42CFR |

455.100 |

– 106 |

Title XX |

– |

45CFR |

228.72 – 73 |

|

Please answer all questions as of the current date. If the yes block for any item is checked, list requested additional information under the Remarks section on page 2, referencing the item number to be continued. If additional space is needed use an attached sheet.

Return the original and second and third copies to the State agency; retain the first copy for your files.

This form is to be completed annually. Any substantial delay in completing the form should be reported to the State survey agency.

DETAILED INSTRUCTIONS

These instructions are designed to clarify certain questions on the form. Instructions are listed in question order for easy reference. No instructions have been given for questions considered

IT IS ESSENTIAL THAT ALL APPLICABLE QUESTIONS BE ANSWERED ACCURATELY AND THAT ALL INFORMATION BE CURRENT.

Item I (a) Under identifying information specify in what capacity the entity is doing business as (DBA), example, name of trade or corporation.

(b)For Regional Office Use Only. If the yes box is checked for item VII, the Regional Office will enter the

number assigned by CMS to chain organizations.

Item II -

Item III - List the names of all individuals and organizations having direct or indirect ownership interests, or controlling interest separately or in combination amounting to an ownership interest of 5 percent or more in the disclosing entity.

Direct ownership interest is defined as the possession of stock, equity in capital or any interest in the profits of the disclosing entity. A disclosing entity is defined as a Medicare provider or supplier, or other entity that furnishes services or arranges for furnishing services under Medicaid or the Maternal and Child Health program, or health related services under the social services program.

Indirect ownership interest is defined as ownership interest in an entity that has direct or indirect ownership interest in the disclosing entity. The amount of indirect ownership in the disclosing entity that is held by any other entity is determined by multiplying the percentage of ownership interest at each level. An indirect ownership interest must be reported if it equates to an ownership interest of 5 percent or more in the disclosing entity. Example: if A owns 10 percent of the stock in a corporation that owns 80 percent of the stock of the disclosing entity, A's interest equates to an 8 percent indirect ownership and must be reported.

Controlling interest is defined as the operational direction or management of a disclosing entity which may be maintained by any or all of the following devices: the ability or authority, expressed or reserved, to amend or change the corporate identity (i.e., joint venture agreement, unincorporated business status) of the disclosing entity; the ability or authority to nominate or name members of the Board of Directors or Trustees of the disclosing entity; the ability or authority, expressed or reserved, to amend or change the

Items IV – VII - Changes in Provider Status

Change in provider status is defined as any change in management control. Examples of such changes would include: a change in Medical or Nursing Director, a new Administrator, contracting the operation of the facility to a management corporation, a change in the composition of the owning partnership which under applicable State law is not considered a change in ownership, or the hiring or dismissing of any employees with 5 percent or more financial interest in the facility or in an owning corporation, or any change of ownership.

For Items IV – VII, if the yes box is checked, list additional information requested under Remarks. Clearly identify which item is being continued.

Item IV - (a & b) If there has been a change in ownership within the last year or if you anticipate a change, indicate the date in the appropriate space.

Item V - If the answer is yes, list name of the management firm and employer identification number (EIN), or the name of the leasing organization. A management company is defined as any organization that operates and manages a business on behalf of the owner of that business, with the owner retaining ultimate legal responsibility for operation of the facility.

Item VI - If the answer is yes, identify which has changed (Administrator, Medical Director, or Director of Nursing) and the date the change was made. Be sure to include name of the new Administrator, Director of Nursing or Medical Director, as appropriate.

Item VII - A chain affiliate is any

Item VIII - If yes, list the actual number of beds in the facility now and the previous number.

DEPARTMENT OF HEALTH AND HUMAN SERVICES |

Form Approved |

CENTERS FOR MEDICARE & MEDICAID SERVICES |

OMB NO. |

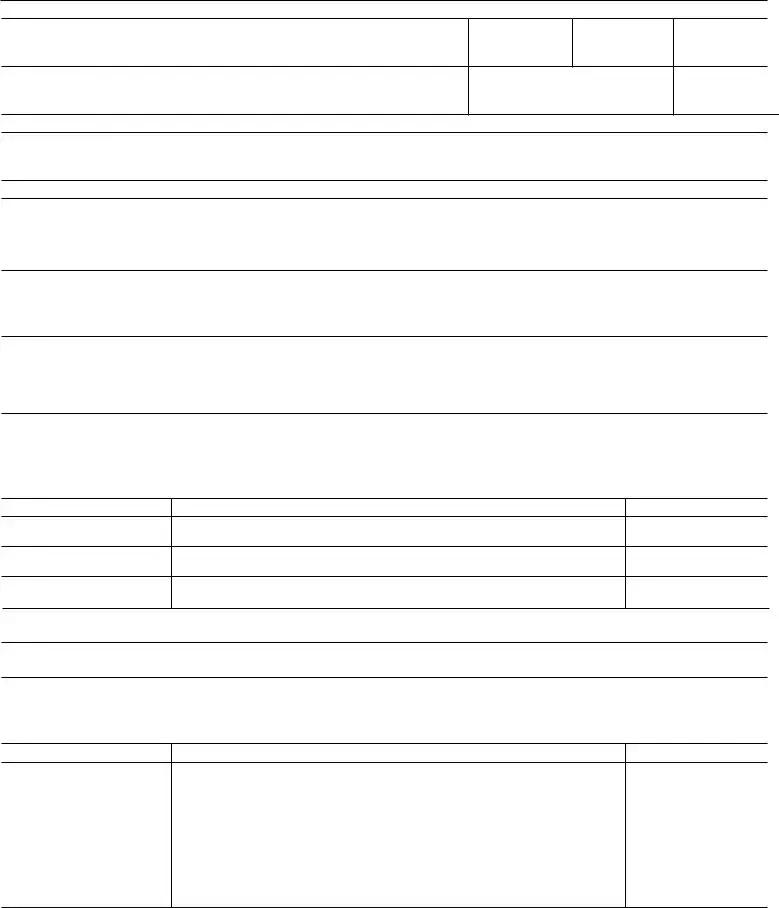

DISCLOSURE OF OWNERSHIP AND CONTROL INTEREST STATEMENT

Provider No.

Vendor No.

Telephone No.

City, County, State

Zip Code

■ ■ ■ ■ ■ LB1

II.Answer the following questions by checking "Yes" or "No." If any of the questions are answered "Yes," list names and addresses of individuals or corporations under Remarks on page 2. Identify each item number to be continued.

(a)Are there any individuals or organizations having a direct or indirect ownership or control interest of 5 percent or more in the institution, organizations, or agency that have been convicted of a criminal offense related to the involvement of such persons, or organizations in any of the programs established by titles XVIII, XIX, or XX?

■ Yes ■ No |

LB2 |

(b)Are there any directors, officers, agents, or managing employees of the institution, agency or organization who have ever been convicted of a criminal offense related to their involvement in such programs established by titles XVIII, XIX, or XX?

■ Yes ■ No |

LB3 |

(c)Are there any individuals currently employed by the institution, agency, or organization in a managerial, accounting, auditing, or similar capacity who were employed by the institution's, organization's, or agency's fiscal intermediary or carrier within the previous 12 months? (Title XVIII providers only)

■ Yes ■ No |

LB4 |

Ill. (a) List names, addresses for individuals, or the EIN for organizations having direct or indirect ownership or a controlling interest in the entity. (See instructions for definition of ownership and controlling interest.) List any additional names and addresses under "Remarks" on page 2. If more than one individual is reported and any of these persons are related to each other, this must be reported under Remarks.

Name

Address

EIN

LB5

(b) Type of Entity: |

■ Sole Proprietorship |

■ Partnership |

■ Corporation |

LB6 |

■ Unincorporated Associations |

■ Other (Specify) |

|

|

|

|

|

|

(c) If the disclosing entity is a corporation, list names, addresses of the Directors, and EINs for corporations under Remarks.

Check appropriate box for each of the following questions:

(d)Are any owners of the disclosing entity also owners of other Medicare/Medicaid facilities? (Example: sole proprietor, partnership or members of Board of Directors.) If yes, list names, addresses of individuals and provider numbers.

■ Yes ■ No |

LB7 |

Name

Address

Provider Number

Page 1 |

DEPARTMENT OF HEALTH AND HUMAN SERVICES |

|

|

Form Approved |

|

CENTERS FOR MEDICARE & MEDICAID SERVICES |

|

|

OMB NO. |

|

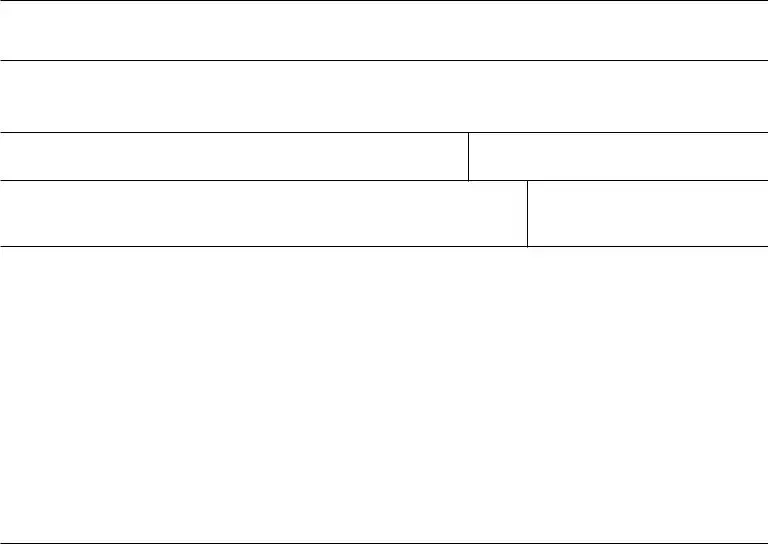

IV. (a) Has there been a change in ownership or control within the last year? |

|

|

|

|

If yes, give date _____________ |

■ Yes |

■ No |

LB8 |

|

|

|

|

|

|

(b) Do you anticipate any change of ownership or control within the year? |

|

|

|

|

If yes, when? _______________ |

■ Yes |

■ No |

LB9 |

|

|

|

|

|

|

(c) Do you anticipate filing for bankruptcy within the year? |

|

|

|

|

If yes, when? _______________ |

■ Yes |

■ No |

LB10 |

|

|

|

|

|

|

V. Is this facility operated by a management company, or leased in whole or part by another organization? |

|

|

|

|

If yes, give date |

of change in operations ____________ |

■ Yes |

■ No |

LB11 |

|

|

|

|

|

VI. Has there been a change in Administrator, Director of Nursing, or Medical Director within the last year? |

|

|

|

|

|

|

■ Yes |

■ No |

LB12 |

|

|

|

|

|

VII. (a) Is this facility chain affiliated? (If yes, list name, address of Corporation, and EIN) |

|

|

|

|

Name |

EIN # |

■ Yes |

■ No |

LB13 |

Address |

|

|

|

|

|

|

|

|

LB14 |

|

|

|

|

|

VII. (b) If the answer to Question VII.a. is No, was the facility ever affiliated with a chain? |

|

|

|

|

(If yes, list Name, Address of Corporation, and EIN) |

|

|

|

|

Name |

EIN # |

■ Yes |

■ No |

LB18 |

Address

LB19

VIII. Have you increased your bed capacity by 10 percent or more or by 10 beds, whichever is greater, within the last 2 years?

■ Yes ■ No |

LB15 |

If yes, give year of change ____________

Current beds _____________ LB16 Prior beds _____________ LB17

WHOEVER KNOWINGLY AND WILLFULLY MAKES OR CAUSES TO BE MADE A FALSE STATEMENT OR REPRESENTATION OF THIS STATEMENT, MAY BE PROSECUTED UNDER APPLICABLE FEDERAL OR STATE LAWS. IN ADDITION, KNOWINGLY AND WILLFULLY FAILING TO FULLY AND ACCURATELY DISCLOSE THE INFORMATION REQUESTED MAY RESULT IN DENIAL OF A REQUEST TO PARTICIPATE OR WHERE THE ENTITY ALREADY PARTICIPATES, A TERMINATION OF ITS AGREEMENT OR CONTRACT WITH THE STATE AGENCY OR THE SECRETARY, AS APPROPRIATE.

Name of Authorized Representative (Typed)

Title

Signature

Date

Remarks

Page 2 |

According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless it displays a valid 0MB control number. The valid 0MB control number for this information collection is

Form Data

| Fact | Detail |

|---|---|

| Form Purpose | The CMS-1513 form is required for disclosure of ownership and financial interest as a condition of participation, certification, or recertification in Medicare, Medicaid, and other specified health programs. |

| Required by Law | Completion and submission of this form is mandated under titles V, XVIII, XIX, and XX health programs, to maintain transparency about the entities providing health services. |

| Annual Submission | Entities must complete and submit the CMS-1513 form annually to remain compliant with the Department of Health and Human Services' requirements. |

| Information Required | The form requires detailed information about individuals and organizations with direct or indirect ownership or control interests of 5 percent or more, including changes in provider status or ownership. |

| Consequences of Non-Compliance | Failure to accurately complete or submit the form may result in refusal to enter into an agreement or termination of existing agreements with the Department of Health and Human Services. |

Instructions on Utilizing Cms 1513

When the time comes to complete the CMS-1513 Form, it's vital to understand the process and requirements. This form plays a crucial role in the relationship between health service providers and agencies like the Centers for Medicare & Medicaid Services (CMS). It serves as a disclosure of ownership and control interest statement, which is mandatory for participation, certification, or recertification in various healthcare programs. Detailed and accurate information is a must to avoid the potential consequences of noncompliance, including the refusal or termination of agreements with governmental agencies. Below is a step-by-step guide to assist in filling out this form correctly.

- Begin with Item I (a), where you should specify the capacity in which the entity is doing business (DBA)—for instance, the name of the trade or corporation.

- Move to Item II, which is self-explanatory and should be filled out accordingly.

- For Item III, list the names of individuals and organizations with a direct or indirect ownership or controlling interest of 5% or more. Be precise in identifying the nature of these interests.

- Under Items IV to VII, notify of any changes in provider status as defined. If you tick "Yes" for any of these, remember to provide the additional requested information in the Remarks section on the second page.

- In Item IV (a & b), if there has been or you anticipate a change in ownership or control within the last year or the upcoming year, indicate the date(s) appropriately.

- For Item V, if the facility is operated by a management company or leased, specify the date of this operational change.

- Item VI requires information about any change in key personnel within the last year. Include names and the date of the change.

- If your facility is chain affiliated, answer Item VII(a) with "Yes" and provide the necessary name, address, and EIN number of the corporation. If it is not currently but was previously affiliated, fill in the details under VII(b).

- Regarding Item VIII, disclose if there has been a significant increase in bed capacity. Include the years of change, along with current and prior bed numbers.

- Finish by providing the name, title, and signature of the authorized representative, along with the date, in the designated section at the bottom of the second page.

Once you have ensured all information is accurately and thoroughly provided, submit the original form along with the second and third copies to the State agency, and retain the first copy for your records. This form should be renewed annually, and any significant delays in its submission need to be communicated to the State survey agency. Taking these steps carefully is essential for compliance and maintaining a good standing with federal and state healthcare programs.

Obtain Answers on Cms 1513

What is the CMS-1513 form?

The CMS-1513 form is used for disclosing ownership and control interests in entities that participate in health programs like Medicare, Medicaid, and certain others established by the Department of Health and Human Services. It's a way for the Centers for Medicare & Medicaid Services (CMS) to ensure transparency and prevent conflicts of interest.

Who needs to fill out the CMS-1513 form?

This form must be completed by entities seeking participation, certification, or recertification under certain health programs, such as Medicare or Medicaid. This includes providers or suppliers of medical services, as well as any entity that arranges for the furnishing of health services under these programs.

What happens if the CMS-1513 form is not submitted?

Failure to provide the requested information may result in the entity being denied participation in the relevant health programs. Additionally, if an entity is already participating, not submitting the form could lead to termination of their agreement or contract with the state agency or the Secretary of Health and Human Services.

What information is required on the CMS-1513 form?

The form requires detailed disclosure of any individual or organization with a direct or indirect ownership or control interest of 5 percent or more in the disclosing entity. It also asks about changes in management or ownership status, operation by a management company, or affiliation with a chain of health care facilities.

How often does the CMS-1513 form need to be completed?

Entities are required to complete and submit this form annually. Any substantial delays in submitting the form should be promptly reported to the State survey agency.

Can additional pages be added to the CMS-1513 if more space is needed?

Yes, if additional space is needed to provide complete information, you can attach extra sheets. Make sure to reference the item number your information continues from.

What should be done if there's been a change in the information provided in a previously submitted CMS-1513 form?

If there has been a significant change in the information previously provided, such as changes in ownership or management, the disclosing entity should report these changes as soon as possible by submitting an updated CMS-1513 form.

Where should the completed CMS-1513 form be sent?

The original and copies of the completed form should be returned to the State agency mentioned in the instructions, while the submitting entity should retain a copy for their records.

Common mistakes

Filling out the CMS-1513 form, which is crucial for disclosing ownership and control interests in entities providing health services under various federal programs, can be intricate. Avoiding common mistakes can ensure timely and accurate submission. Here are five commonly made mistakes:

Not providing current information: All questions must be answered with the most up-to-date information. Failing to review and ensure all details are current can lead to inaccuracies, affecting compliance and the approval process.

Skipping sections that are considered self-explanatory: Some respondents may overlook or misunderstand the importance of sections labeled as "self-explanatory." However, it is crucial to address every item, as missing data can result in incomplete disclosures.

Inadequate explanation of ownership interests: For Section III, detailing direct and indirect ownership or controlling interest is essential. Failure to comprehensively describe these interests, including the nature and extent, can obscure the true ownership structure.

Not using the Remarks section or additional sheets when needed: When space provided in the form is insufficient, many mistakenly cram information instead of using the Remarks section or attaching additional sheets. This can lead to unclear or incomplete responses.

Omitting related persons or entities: If more than one individual is reported under ownership or control interests, their relationships to each other must be disclosed under Remarks. Omitting these details can lead to a lack of transparency about potential conflicts of interest.

Attention to these details ensures the CMS-1513 form is filled accurately, reflecting the disclosing entity's current ownership and control structure, thus maintaining compliance with federal requirements.

Documents used along the form

When dealing with the CMS-1513 form, several other forms and documents are commonly utilized in the healthcare regulatory framework. These documents support the completion and submission of the CMS-1513 by providing detailed information about an entity's ownership, control interest, and operational status. Understanding these documents can facilitate compliance with federal health program requirements. Here's a list and brief description of each:

- NPI Application/Update Form (CMS-10114): This document is used to apply for or update a National Provider Identifier (NPI), essential for healthcare providers to submit claims and conduct other transactions as mandated by HIPAA.

- CMS-855A: Medicare Enrollment Application for Institutional Providers, required for entities that provide medical or health services and bill Medicare for those services.

- CMS-855B: For clinics, group practices, and certain other suppliers to enroll in the Medicare program.

- CMS-855I: The enrollment application for individual physicians and non-physician practitioners who wish to bill Medicare.

- CMS-855R: This form is used when reassigning benefits or privileges to another entity or individual.

- CMS-855S: For suppliers of durable medical equipment, prosthetics, orthotics, and supplies (DMEPOS) to enroll in Medicare.

- IRS Form W-9: Request for Taxpayer Identification Number and Certification, used to provide the correct taxpayer identification number (TIN) to entities that must file information returns to report interest, dividends, and certain other income paid.

- Ownership or Control Interest Statement (OCS): This document provides details about individuals or entities that have a 5% or greater ownership or controlling interest in the healthcare entity.

- Electronic Funds Transfer (EFT) Authorization Agreement (CMS-588): This form authorizes Medicare to deposit payments directly into a bank account, a practical necessity for efficiently receiving funds.

- Health Insurance Benefit Agreement (CMS-1561): A contractual agreement with CMS that must be signed by providers participating in the Medicare program to ensure compliance with Medicare laws and regulations.

These documents collectively support a healthcare provider's compliance framework when participating in Medicare, Medicaid, and other federal health programs. By accurately completing and appropriately submitting these forms, healthcare entities can ensure smooth operations and adherence to regulatory standards. Beyond facilitating billing and payments, these documents also help maintain transparency about ownership, control, and significant operational changes which might affect compliance status.

Similar forms

The CMS-855A form, used by health care providers to enroll in the Medicare program, shares similarities with the CMS-1513 form in that both require disclosure of ownership, control interests, and management structure. Like the CMS-1513, the CMS-855A mandates full transparency regarding individuals or entities with significant control or influence over the health care provider, aiming to ensure compliance with Medicare program requirements.

The CMS-855B form, designated for clinics, group practices, and certain other suppliers enrolling in Medicare, also parallels the CMS-1513 form in its requirement for disclosing ownership and control details. This includes information on individuals or entities with a 5 percent or greater ownership or controlling interest, mirroring the CMS-1513's aim to maintain integrity within the Medicare system by monitoring those in positions of influence.

The CMS-855I form, which is required for individual physicians and non-physician practitioners enrolling in Medicare, similarly necessitates the disclosure of financial interests and affiliations, akin to the CMS-1513 form. Although focused on individual practitioners, the intent to identify and manage potential conflicts of interest and ensure compliance with federal program standards remains consistent.

The CMS-855R form, used for reassigning Medicare benefits, shares the CMS-1513 form's goal of transparency in financial and ownership interests, albeit in a different context. This form allows practitioners to delegate their Medicare billing privileges to an organization, necessitating clear disclosure of the arrangement to prevent fraud or abuse, resonating with the CMS-1513's emphasis on clarity regarding control and ownership.

The OIG's Provider Self-Disclosure Protocol form, while not part of CMS, operates under a similar ethos to the CMS-1513 by encouraging voluntary disclosure of ownership and financial interests that may influence health care practices. This form facilitates transparency and accountability, aiming to address and rectify compliance issues proactively, in line with the objectives of the CMS-1513 form.

Dos and Don'ts

When filling out the CMS-1513 form, individuals and organizations should be mindful of both the actions that are recommended and those that should be avoided to ensure accuracy and compliance. Below are lists that outline these do's and don'ts:

Things You Should Do:

- Ensure that all information provided is current and accurate, as the form must reflect the most up-to-date data regarding ownership and control interests.

- Answer every question on the form, even those that may seem self-explanatory. Leaving sections incomplete can result in processing delays or outright refusal.

- For any item where a "Yes" response is required, provide all requested additional information in the Remarks section, making a clear reference to the item number in question.

- Attach additional sheets if necessary, to adequately provide all pertinent details or to continue explanations that cannot be confined to the space provided on the form.

- Retain the first copy for your records after submitting the original and second and third copies to the State agency as directed.

Things You Shouldn't Do:

- Avoid rushing through the form without reviewing the detailed instructions provided for certain questions, as misunderstanding these guidelines can lead to mistakes.

- Do not overlook the requirement to list any changes in provider status, including changes in management, ownership, or control, that have occurred within the last year or are anticipated to happen in the near future.

- Refrain from omitting information about any individuals or organizations with a direct or indirect ownership or control interest of 5 percent or more, regardless of whether the interest seems minor.

- Do not forget to disclose any relationships among individuals reported to have ownership interests if more than one individual is listed.

- Avoid submitting the form without the signature of an authorized representative, as this is a critical component of the form's validity and legality.

Misconceptions

One common misconception about the CMS-1513 form is that it's only relevant for new healthcare providers or suppliers. In reality, the requirement to complete and submit this form applies not just at the initial stage of becoming a provider or supplier. It's also a crucial part of maintaining your status with Medicare, Medicaid, or any related healthcare programs. Whether you're certifying for the first time, recertifying, or changing your information, this form plays a vital role in ensuring transparency in ownership and control interests.

Another misconception is that all parts of the CMS-1513 form are necessary for every healthcare provider or supplier to fill out. The truth is a bit more nuanced. While it's essential that the form be completed thoroughly, different sections are relevant for different types of providers. For instance, Title XX providers have specific parts to complete that may not apply to Title V providers, and vice versa. Understanding which parts of the form apply to your specific situation is critical to providing accurate and complete disclosure.

Many believe that once the CMS-1513 form is filled out and submitted, there's no need to update or revisit the document unless explicitly requested. This belief can lead to compliance issues. Healthcare entities must update and resubmit the form annually or whenever there's a significant change in ownership, control, or management information. Keeping this information up to date is not just a regulatory requirement; it also affects the integrity of the provider's or supplier's relationship with Medicare and Medicaid services.

Finally, some might think that failing to fully complete the CMS-1513 form is a minor oversight that can be easily corrected without any real consequences. This is unfortunately not the case. Incomplete or inaccurate disclosures can lead to serious repercussions, including the refusal of the Secretary or appropriate State agency to enter into or renew an agreement, and in some cases, termination of existing agreements. It's crucial to approach this document with the seriousness it requires, ensuring that all information is current, accurate, and fully disclosed.

Key takeaways

Filling out the CMS-1513 form correctly is crucial for entities wishing to participate in, certify, or recertify under federal health programs such as Medicare and Medicaid. Here are key takeaways to ensure accurate and compliant submissions:

- Completion of the CMS-1513 form is mandatory for participation in federal health programs like Medicare and Medicaid. It requires full disclosure of ownership and control interests to avoid penalties or denial of participation.

- The form requires annual submission to the appropriate State agency, with entities retaining a copy for their records. This ensures ongoing compliance with federal regulations.

- For Title XX providers, parts II (a) and (b) are essential, while those offering medical services must also fill out parts II and III. Title V providers have specific sections to complete, underscoring the importance of knowing the program-specific requirements.

- All information must be current and accurate, highlighting the necessity for entities to review and update their disclosures annually or as changes occur.

- Direct and indirect ownership or controlling interests of 5 percent or more must be disclosed, along with details about any changes in provider status or management that could affect the entity's control or ownership.

- Entities must report any affiliations with management companies or if the facility is part of a chain, which can affect the entity's compliance status and eligibility for federal health programs.

- Any anticipated changes in ownership, control, or operational management within the year must be disclosed, allowing for transparency and updated records that reflect current operational structures.

- The document emphasizes the legal implications of failing to provide accurate information, including potential prosecution and termination of participation in federal programs, reinforcing the necessity for honesty and thoroughness in completing the form.

By closely following these guidelines when completing the CMS-1513 form, entities can navigate the disclosure process more efficiently, ensuring compliance with federal health program requirements.

Popular PDF Forms

Counseling Printable Mental Health Treatment Plan Template - An actionable plan that underscores the need for direct patient involvement and agreement in setting therapy goals, fostering a collaborative treatment process.

Mo Tax Forms - Missouri's form for requesting tax return copies respects your privacy while ensuring you have access to your critical financial records.