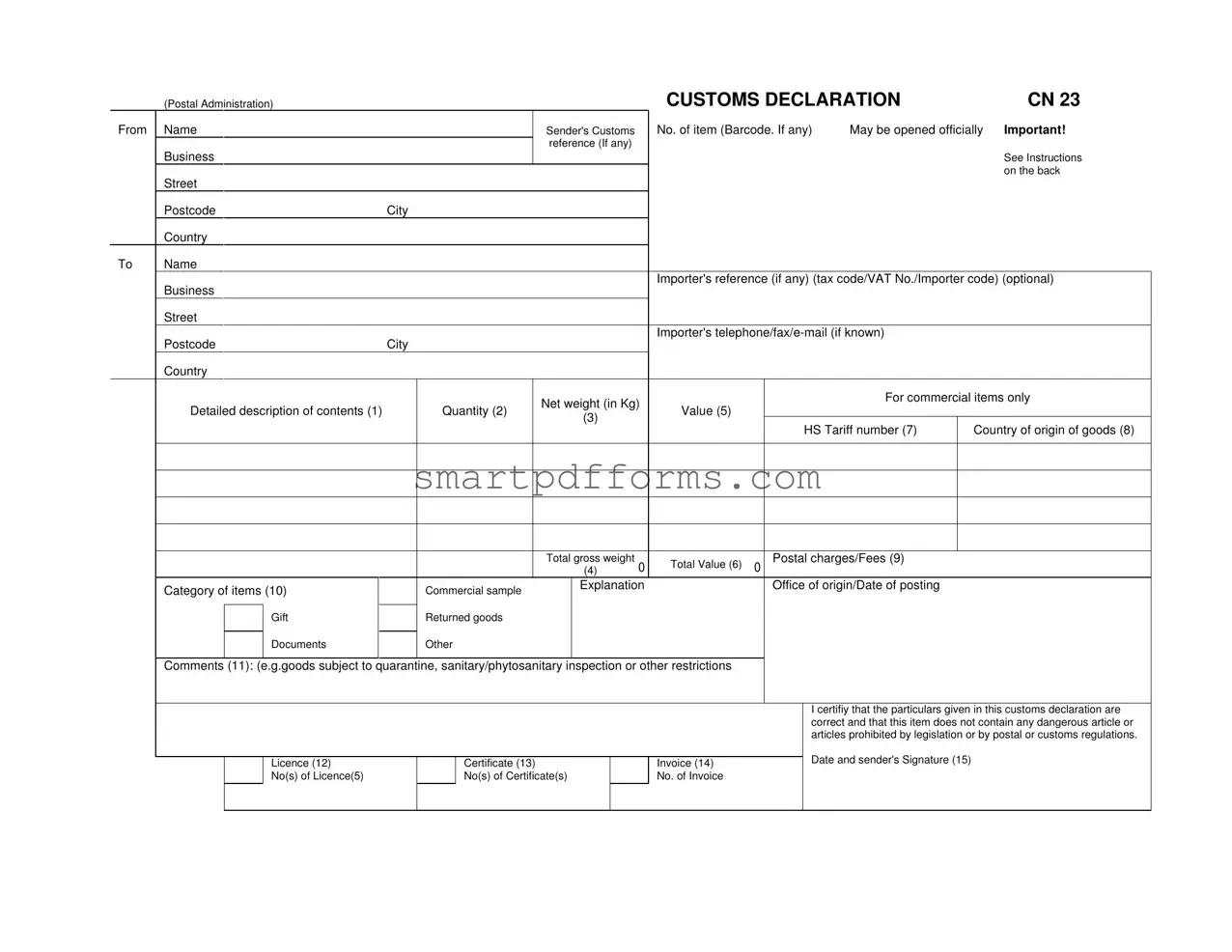

Blank Cn 23 Customs Declaration PDF Template

In the global landscape of trade and commerce, the CN 23 Customs Declaration form plays a pivotal role in facilitating international postal shipments. This document, which must accompany certain types of parcels sent across international borders, contains critical information for customs authorities. It includes the sender's details, such as their name, address, and, if available, a unique customs reference number, alongside the recipient's information like their name, address, and contact details, as well as any importer reference numbers. Furthermore, the form provides a detailed description of the parcel's contents, including the quantity, value, HS tariff number, and country of origin of the goods, which are essential for determining duties, taxes, and any import restrictions. The CN 23 form also specifies the category of the item—whether it's a commercial sample, a gift, returned goods, or documents— and includes spaces for postal charges, total gross weight, and total value of the shipment. This detailed documentation facilitates the swift processing of items through customs, ensures compliance with international shipping regulations, and aids in the accurate assessment of any applicable duties and taxes. As a part of its regulations, the form also requires a declaration from the sender, certifying the accuracy of the information provided and attesting that the package does not contain prohibited items. Such rigorous documentation underscores the importance of accuracy and attention to detail in international trade and postal services.

Preview - Cn 23 Customs Declaration Form

|

(Postal Administration) |

|

|

CUSTOMS DECLARATION |

|

CN 23 |

||

From |

Name |

|

Sender's Customs |

No. of item (Barcode. If any) |

May be opened officially Important! |

|||

|

|

|

reference (If any) |

|

|

|

|

|

|

Business |

|

|

|

|

|

|

See Instructions |

|

|

|

|

|

|

|

|

on the back |

|

Street |

|

|

|

|

|

|

|

|

Postcode |

City |

|

|

|

|

|

|

|

Country |

|

|

|

|

|

|

|

To |

Name |

|

|

|

|

|

|

|

|

Business |

|

|

Importer's reference (if any) (tax code/VAT No./Importer code) (optional) |

||||

|

|

|

|

|

|

|

|

|

|

Street |

|

|

|

|

|

|

|

|

Postcode |

City |

|

Importer's |

|

|

||

|

|

|

|

|

|

|

||

|

Country |

|

|

|

|

|

|

|

|

|

|

Net weight (in Kg) |

|

|

For commercial items only |

||

|

Detailed description of contents (1) |

Quantity (2) |

Value (5) |

|

|

|

||

|

(3) |

|

|

|

||||

|

|

|

|

HS Tariff number (7) |

|

Country of origin of goods (8) |

||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total gross weight |

0 |

Total Value (6) |

0 |

Postal charges/Fees (9) |

|

|

|

|

|

|

(4) |

|

||||

Category of items (10) |

|

Commercial sample |

|

Explanation |

|

|

Office of origin/Date of posting |

|||

|

|

|

|

|

|

|

||||

|

|

Gift |

|

Returned goods |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Documents |

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Comments (11): (e.g.goods subject to quarantine, sanitary/phytosanitary inspection or other restrictions

|

|

|

|

|

|

|

I certifiy that the particulars given in this customs declaration are |

|

|

|

|

|

|

|

correct and that this item does not contain any dangerous article or |

|

|

|

|

|

|

|

articles prohibited by legislation or by postal or customs regulations. |

|

|

|

|

|

|

|

Date and sender's Signature (15) |

|

|

Licence (12) |

|

Certificate (13) |

|

Invoice (14) |

|

|

|

|

|

|

|||

|

|

No(s) of Licence(5) |

|

No(s) of Certificate(s) |

|

No. of Invoice |

|

|

|

|

|

|

|

|

|

Form Data

| Fact | Detail |

|---|---|

| 1. Usage | Used for international shipments to declare the contents of the package to customs authorities. |

| 2. Sender's Information | Includes sender's name, address, and optionally, customs reference number. |

| 3. Recipient's Information | Details about the recipient including name, address, and potentially a tax code, VAT number, or importer code. |

| 4. Item Details | Requires detailed description of the contents, quantity, value, HS tariff number, and country of origin. |

| 5. Weight and Value | Form must state both the net weight (in kilograms) and the total value of the items being shipped. |

| 6. Category of Items | Items are categorized as commercial samples, gifts, returned goods, documents, or others. |

| 7. Additional Documents | Declaration may require attached documents like a license, certificate, or invoice. |

| 8. Sender's Declaration | Sender must certify that the information is correct and that the package does not contain prohibited or dangerous items. |

| 9. Opening Clause | Notifies that the package may be opened officially by the postal administration. |

| 10. Governing Law | Subject to international postal regulations and the customs regulations of the destination country. |

Instructions on Utilizing Cn 23 Customs Declaration

Filling out a CN 23 Customs Declaration form is an essential step in sending packages internationally, ensuring that your items are processed smoothly by customs authorities. This form provides detailed information about the package's contents, value, and sender/recipient details, crucial for tax and duty purposes. Below are the steps to properly complete the CN 23 form. Let's make sure your package gets to its destination without any unnecessary delays.

- Complete the 'From' section with your full name, address (street, postcode, city, country), and if applicable, your sender's customs reference number. Include your business name if the shipment is related to commercial activities.

- Fill in the 'To' section with the recipient's full name, address (street, postcode, city, country), and if known, their phone, fax, or email. If the shipment is commercial, include the importer's reference such as tax code, VAT No., or importer code.

- For the 'No. of item' field, if there's a barcode, enter it here. This helps in tracking the item.

- In the 'Net weight' section, specify the package's net weight in kilograms. This is particularly important for commercial shipments.

- Describe the contents of your package clearly in the designated area. Include the type of item, quantity, value, HS Tariff number, and country of origin. Be specific to avoid delays during processing.

- Indicate the Total gross weight and Total Value of the shipment — crucial for determining customs duties.

- Add any relevant Postal charges/Fees if applicable. This might include additional postage or handling fees associated with your shipment.

- Choose the Category of items from the provided options (e.g., commercial sample, gift, returned goods, documents, etc.). This helps customs quickly identify the purpose of the shipment.

- If necessary, include any Comments in the provided space. This can be information related to quarantine, inspections, or shipping restrictions.

- Attach any required documents like Licences, Certificates, or Invoices. Specify the number of each document you're including.

- Sign and date the form to certify that the information provided is accurate and that the package doesn't contain prohibited items.

By following these steps, you can ensure that your CN 23 Customs Declaration form is filled out correctly, paving the way for a smooth customs clearance process for your international shipments. Keep in mind that accurate and thorough information can help avoid delays or issues during the shipping process.

Obtain Answers on Cn 23 Customs Declaration

- What is a CN 23 Customs Declaration form?

- When do I need to fill out a CN 23 Customs Declaration form?

- What information do I need to provide on the CN 23 form?

- Why is the HS Tariff number important?

- How do I determine the value of the items I am sending?

- Are there any items I cannot send using the CN 23 Customs Declaration form?

- What happens if I fill out the form incorrectly?

- Is it necessary to sign the CN 23 Customs Declaration form?

The CN 23 Customs Declaration form is a document used by senders to declare the details of items being sent internationally through postal services. This form is required for customs clearance and informs customs authorities about the contents of the package, including the type of items, their quantity, value, and other relevant details. It helps in ensuring that the items comply with the destination country's regulations and laws.

Whenever you are sending a package internationally that does not qualify for the simpler CN 22 form (usually used for items of lesser value), you need to fill out the CN 23 form. This form is typically required for items of higher value or for packages requiring more detailed information for customs clearance.

You need to provide detailed information about the sender and the recipient, including names, addresses, and contact details. For the item(s) being sent, you must include a detailed description, quantity, value, net and gross weight, HS Tariff number, and country of origin. Additionally, you will need to specify the category of the item(s) being sent (e.g., commercial sample, gift, returned goods) and include any applicable comments, licences, certificates, or invoices.

The HS Tariff number, also known as the Harmonized System code, is a standardized numerical method of classifying traded products. It is required on the CN 23 form to help customs authorities identify the exact nature of the goods being imported and to apply the correct tariffs and taxes. Providing the correct HS code facilitates smoother and faster customs clearance.

The value of the items you are sending should reflect their actual purchase price or fair market value if they were not purchased recently. It's important to provide an accurate declaration of value, as under-declaring can lead to fines and over-declaring may increase the customs duties and taxes imposed on the recipient.

Yes, there are restrictions on what can be sent internationally, and these can vary by country. Generally, dangerous goods, perishable items, and items prohibited by legislation or postal regulations in either the sending or receiving country are not allowed. Always check the specific regulations of both the sending and receiving countries before shipping.

If the CN 23 Customs Declaration form is filled out incorrectly, it can cause delays in shipping, and your package may be held at customs. In some cases, incorrect or incomplete information can result in fines or the return of your package to the sender. It's crucial to fill out the form accurately and completely.

Yes, your signature is required on the CN 23 form to certify that the information provided is accurate and that the package does not contain any prohibited items. The declaration that the information is correct and the item complies with all regulations is a legal requirement for international shipping.

Common mistakes

Filling out a CN 23 Customs Declaration form can seem straightforward, but it's easy to make mistakes if you're not careful. These errors can lead to delays in shipping, additional fees, or even the return of your package. To help ensure a smooth customs process, here are four common mistakes people make when completing the CN 23 form:

- Not providing detailed descriptions of the contents: One of the most critical sections of the CN 23 form is the detailed description of the contents. Simply writing "clothes" or "gift" is not enough. Customs officials need to know exactly what is in the package, such as "2 cotton t-shirts, 3 pairs of jeans". The more specific you are, the less likely your package will be delayed for inspection.

- Incorrectly filling out the weight and value: It's essential to accurately enter the net weight (in Kg) of the items and their total value. Many people underestimate or round off these figures, which can cause discrepancies and lead to inspections or additional customs duties. Ensure the weight reflects the net weight of the goods, excluding any packaging, and that the value is the actual market value.

- Omitting the HS Tariff number and the country of origin: While it might seem like a minor detail, the Harmonized System (HS) Tariff number helps customs identify the type of goods being shipped and apply the correct tariffs and taxes. Similarly, the country of origin of the goods is crucial for customs procedures. Failing to provide these can result in delays and possible penalties.

- Forgetting to sign and date the form: An easy mistake to make is forgetting to sign and date the bottom of the CN 23 form. This certification is vital, as it confirms that the information provided is correct and that the item does not contain any dangerous or prohibited articles. An unsigned or undated form may not be processed, leading to delays.

By paying close attention to the details and ensuring all information is accurately provided, you can help your package swiftly clear customs. Remember, the CN 23 form is a crucial document in the international shipping process, and completion should be treated with care.

Documents used along the form

When engaging in international shipping, the process often necessitates more than just filling out the CN 23 Customs Declaration form. This document is crucial for providing detailed information about the contents of a package, but several other forms and documents frequently accompany it to ensure compliance with global trade regulations and to facilitate the smooth processing of goods through customs. The following rundown elucidates some of these additional documents, each of which plays a vital role in international logistics.

- Commercial Invoice: This document is fundamental for international trade, detailing the sale transaction between the seller and the buyer. It includes information such as a detailed description of the goods, the value of the cargo, and the terms of sale. Customs authorities use it to assess duties and taxes.

- Bill of Lading: Often required for shipping goods via sea, this document serves as a contract between the owner of the goods and the carrier. It outlines the details of the shipment, conditions for transporting the goods, and serves as a receipt once the cargo is delivered.

- Air Waybill: Similar to the bill of lading, the air waybill is used for air freight. It's a contract between the shipper and the airline that carries the goods, providing details about the shipment and stating the terms and conditions of transport.

- Packing List: This document supplements the commercial invoice by providing a detailed list of every item within the shipment. It includes information like weight, dimensions, and package type, helping in the efficient handling and accurate inspection of the cargo.

- Certificate of Origin: Required by many countries, this certification attests to where the goods were manufactured. It affects the duties and taxes imposed, as tariffs often depend on the goods’ country of origin.

- Export License: Some goods might require an export license before being shipped internationally. This document is government-issued and necessary for controlled or restricted items.

- Import License: Analogous to the export license, this document is often required by the importing country for controlled goods. It denotes permission to bring specified items into the country.

In the intricate domain of international shipping, each of these documents interplays to delineate the specifics of the shipment, aiding both businesses and customs authorities in ensuring legal compliance, determining applicable taxes and duties, and facilitating the timely delivery of goods across borders. A thorough understanding and proper management of these forms and documents can significantly mitigate potential delays and complications, streamlining the customs clearance process.

Similar forms

Commercial Invoice: Similar to the CN 23 Customs Declaration form, a Commercial Invoice outlines the seller and buyer's details, product descriptions, quantities, and value. This document is essential for international trade, providing customs with the information needed to determine duties and taxes.

Pro Forma Invoice: While not a final invoice, the Pro Forma Invoice shares similarities with the CN 23 form by detailing the description of goods, value, and other essential trade details in advance of a shipment. It helps in declaring the value of goods for customs.

Bill of Lading: This document lists the goods being transported, similar to the detailed description of contents in the CN 23 form. It serves as a receipt of freight services, a contract between a freight carrier and shipper, and a document of title for the goods.

Packing List: A Packing List enumerates the contents of a shipment and includes information like weight and dimensions, paralleling the CN 23 form's requirement to list the net and gross weight of items being shipped internationally.

Certificate of Origin: This certificate is necessary for international trade, declaring the nationality of the produced goods. It matches the CN 23 form's requirement to state the country of origin, vital for determining tariffs and adherence to trade agreements.

Export License: Required for the export of certain goods, the Export License's details are akin to the CN 23 form's "Licence" section, which indicates if a shipment is controlled and legally exportable.

Entry Summary (CBP Form 7501) in the United States: The Entry Summary form ensures goods entering the US comply with regulations and assists in duty assessment. Both this form and the CN 23 demand detailed product descriptions, value, and origin to ensure compliance with customs regulations.

Electronic Export Information (EEI) filing through the Automated Export System (AES): EEI is required for shipments above a certain value leaving the US, detailing sender and receiver information, along with goods' descriptions, similar to the CN 23 form. It is crucial for monitoring and controlling exports.

Dos and Don'ts

Filling out the CN 23 Customs Declaration form is an essential step for anyone sending international packages that may be subject to customs examination. As straightforward as it might seem, it’s vital to pay careful attention to each section to avoid any unnecessary delays or problems. Here are some dos and don’ts that can help ensure your form is complete and correct.

Do:Read the instructions on the back of the form carefully before you start filling it out. This step can clarify any confusion and help you understand what information is required.

Include detailed and accurate descriptions of the contents. Vagueness can lead to delays, so specify each item separately along with its purpose if necessary.

Be honest about the value of each item. Undervaluing items to avoid customs charges can lead to penalties.

Ensure you use the correct HS Tariff number for each item, which is crucial for customs authorities to classify your goods.

Clearly state the country of origin for each item. This information is necessary for customs to apply the correct taxes and duties.

Sign and date the form. An unsigned form is considered incomplete and can lead to your shipment being delayed.

Leave any sections blank; if a section does not apply, mark it as "N/A" or "Not Applicable." This indicates you didn't overlook the section.

Forget to include your contact information or that of the recipient. Customs may need to contact either party for further information.

Assume you do not need to declare certain items because they are of low value or you believe they are not restricted. If in doubt, declare it.

Use unclear handwriting if filling the form out by hand. If the form is hard to read, it could lead to misunderstandings or delays.

Ignore restrictions or prohibitions based on destinations. Each country has its regulations, and it’s your responsibility to comply with them.

By following these guidelines, you can help ensure that your international shipment is processed efficiently by customs authorities. Remember, accurately completing the CN 23 Customs Declaration form is a critical step in your item’s journey across borders.

Misconceptions

Misunderstandings often arise with the CN 23 Customs Declaration form, which is crucial for the international shipment of goods. Let's demystify some common misconceptions.

It's only necessary for commercial items: While the CN 23 form is indeed essential for commercial shipments, it's also required for various types of international mail that might not be immediately recognized as commercial, such as gifts, samples, or returned goods. This clarifies that its use extends beyond purely business transactions.

The form is too complicated for individual use: Although it may appear intimidating at first glance, the CN 23 form is designed to be filled out by anyone participating in international shipping, including individuals. Instructions on the form assist in completing it accurately.

Every field must be filled out: Not all sections of the CN 23 form apply to every shipment. For example, "Importer's reference" and "Business" fields may not be relevant for personal shipments. The key is to provide all necessary information related to your specific shipment.

Net weight and gross weight are interchangeable: These are distinct concepts on the CN 23 form. Net weight refers to the weight of the goods alone, while total gross weight includes packaging. Accurately reporting these figures is essential for customs purposes.

A detailed item description isn't crucial: A thorough description of the contents is vital for customs clearance. Vague descriptions can lead to delays or inspections. Be as specific as possible to facilitate a smooth customs process.

Postal charges/fees are automatically included in the total value: Postal charges or fees need to be listed separately on the form. These are not part of the total value of the goods but are crucial for determining duties and taxes.

Sender's declaration is just a formality: The declaration signed by the sender is a legal statement confirming the accuracy of the form's information and compliance with international shipping regulations. It should be taken seriously as incorrect or false declarations can result in penalties.

HS Tariff numbers are optional: While not always mandatory for every type of shipment, including the Harmonized System (HS) tariff number helps customs quickly identify and process items. This can significantly speed up the customs clearance process.

Understanding the CN 23 Customs Declaration form and its requirements can significantly impact the efficiency and success of shipping goods internationally. Dispelling these misconceptions ensures compliance with global shipping regulations, fostering a smoother customs clearance process for all involved parties.

Key takeaways

Filling out the CN 23 Customs Declaration form is a critical process for ensuring the smooth handling of international shipments. This guide highlights key takeaways to help you accurately complete the form and comply with global shipping regulations.

- Accurate Information: It's imperative to provide accurate and complete information about the sender and recipient, including full names, addresses, and contact details. This ensures that the package can be properly processed by postal services and customs authorities in both the originating and destination countries.

- Item Description: A detailed description of the contents should be provided. This means not just what the item is, but also its quantity, value, Harmonized System (HS) tariff number, and country of origin. This information is crucial for customs to classify the item accurately and determine any duties or taxes.

- Net and Gross Weight: Include both net and total gross weight of the package in kilograms. This helps in assessing freight charges and may impact the customs processing.

- Value Declaration: You must declare the total value of the contents accurately. This is used to calculate duties and taxes and is also important for insurance purposes.

- Category of Item: Indicate the category of the item (e.g., commercial sample, gift, or returned goods). Different categories may be subject to different regulations or tax treatments.

- Optional References: Utilize optional fields like the sender's customs reference and the importer's reference (including tax code/VAT No./Importer code) if applicable. These references can facilitate tracking and processing by customs.

- Supplementary Documentation: Attach any necessary supplementary documentation such as licenses, certificates, or invoices when required. Depending on the nature of the shipped item, presenting these documents can be crucial for compliance with international trade laws.

- Declaration of Compliance: The sender must certify that the package does not contain any dangerous articles or items prohibited by legislation, postal, or customs regulations. Signing the declaration also confirms the accuracy of the information provided.

- Understanding Restrictions: Be aware of any goods subject to quarantine, sanitary/phytosanitary inspections, or other restrictions. These items may require additional documentation or may be prohibited altogether.

- Postal Charges/Fees: Document any postal charges or fees paid. This can include shipping costs or pre-paid duties and taxes, which might be relevant for customs processing or reimbursement procedures.

The CN 23 form is a critical document that facilitates international shipments by providing customs authorities with the information needed to process packages efficiently. By following these guidelines, senders can contribute to a smoother customs clearance process, potentially avoiding delays or additional charges. Remember, when in doubt, it's advisable to consult with postal or customs officials to ensure compliance with all international shipping requirements.

Popular PDF Forms

Use of Force Incident - During a nighttime burglary response, officers encountered a suspect attempting to flee, necessitating the use of a TASER to prevent escape.

Dd 603 1 - The form outlines specific details about the souvenir(s), including a thorough item description and the manner in which the item was acquired.