Blank Commercial Invoice PDF Template

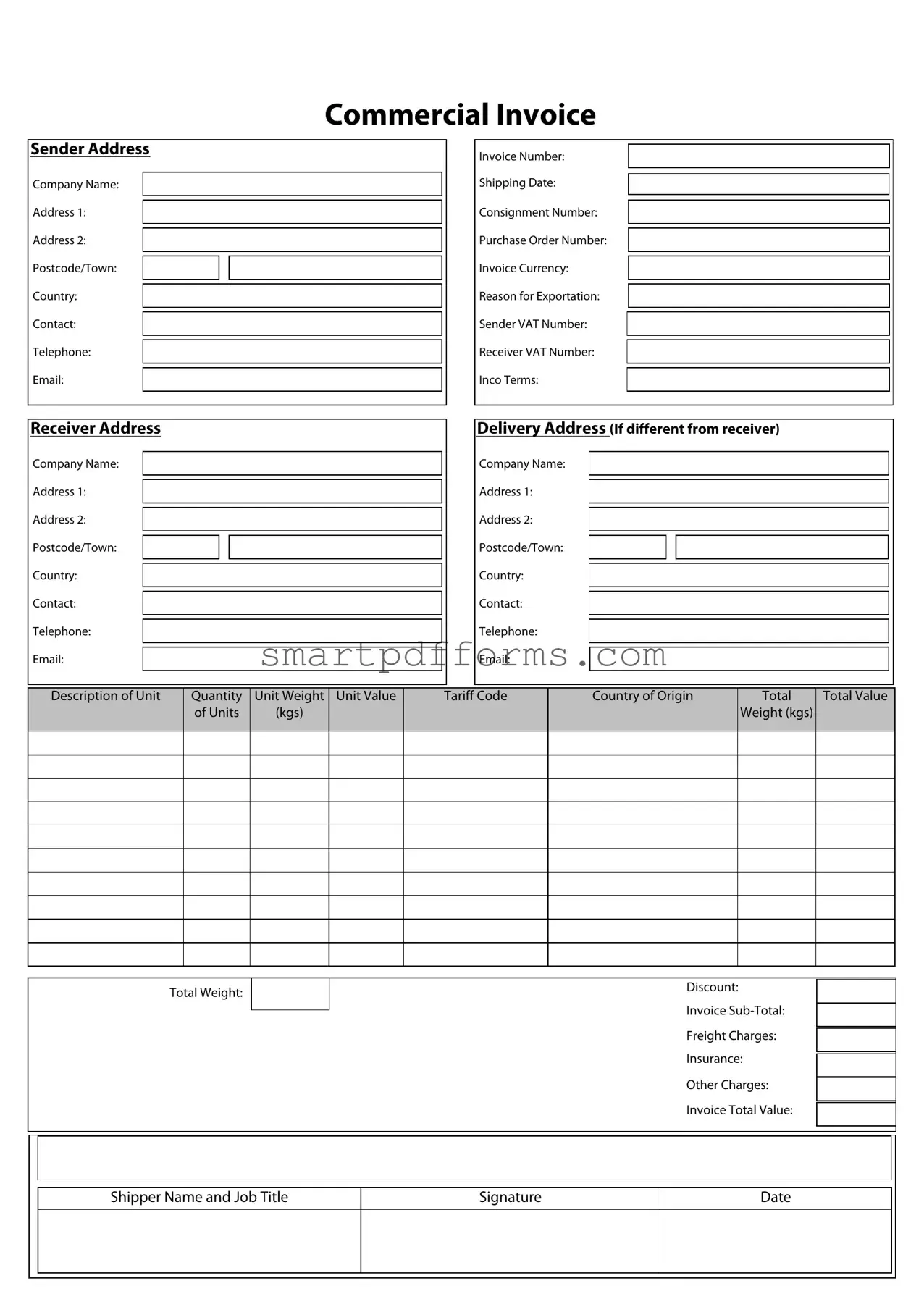

In international trade, navigating the complexities of shipping and customs clearance requires meticulous documentation. One crucial element in this process is the Commercial Invoice form, a key document that provides essential information about the transaction between the buyer and the seller. The form contains detailed sections including sender details, such as the company's name, address, and contact information, alongside receiver details mirroring this information for the party receiving the goods. It delves into specifics about the shipment, like the invoice and shipment numbers, currency of the transaction, reasons for export, and relevant VAT numbers for both sender and receiver. Terms of sale are outlined, possibly detailing Incoterms, which are standard trade definitions used globally. The document also describes the goods being shipped, with information like descriptions, quantity, unit weight, and value. Additionally, delivery details are specified, potentially differing from the receiver's data, including contact information for the delivery liaison. The invoice sums up with a total declared value, incorporating subtotal, shipping, insurance, and other costs. Crucially, it asserts the accuracy of the information provided with a declaration, typically including the name, signature, and job title of the company representative, alongside the date and additional comments about the goods (e.g., hazardous material details or compliance codes). This document not only facilitates the smooth transition of goods across borders but also serves as a key record for accounting and regulatory compliance, underscoring its importance in international commerce.

Preview - Commercial Invoice Form

$PNNFSDJBM*OWPJDF

4FOEFSEFUBJMT

$PNQBOZ "EESFTTMJOF "EESFTTMJOF 1PTUDPEF$JUZ Location 4FOEFSOBNF 5FMFQIPOF &NBJM

*OWPJDFOVNCFS PQUJPOBM

4IJQQJOHEBUF

4IJQNFOUOVNCFS

$VSSFODZ

3FBTPOGPSFYQPSU 4FOEFS7"5OVNCFS 3FDFJWFS7"5OVNCFS 5FSNTPGTBMF *ODPUFSNT

3FDFJWFSEFUBJMT

$PNQBOZ

"EESFTTMJOF

"EESFTTMJOF

1PTUDPEF$JUZ

Location

3FDFJWFSOBNF

5FMFQIPOF

&NBJM

%FTDSJQUJPOPGHPPET |

2VBOUJUZ |

6OJUXFJHIU |

6OJUWBMVF |

|

LH |

||||

|

|

|

||

|

|

|

|

|

|

|

|

|

%FMJWFSZEFUBJMT JGEJGGFSFOUGSPNSFDFJWFS

$PNQBOZ

"EESFTTMJOF

"EESFTTMJOF

1PTUDPEF$JUZ

Location

%FMJWFSZDPOUBDU

5FMFQIPOF

&NBJM

)4DPEF |

Location PGPSJHJO |

5PUBM |

5PUBMWBMVF |

|

XFJHIU LH |

||||

|

|

|

||

|

|

|

|

|

|

|

|

|

/VNCFSPGQBDLBHFTJOTIJQNFOU |

5PUBMTIJQNFOUWBMVF |

|

||

%JTDPVOU |

|

|||

|

|

|

|

|

|

|

|

4VCUPUBM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4IJQQJOHDPTUT |

|

|

|

|

*OTVSBODFDPTUT |

|

|

|

|

|

|

|

|

|

0UIFSDPTUT |

|

|

|

|

|

|

|

|

|

5PUBMEFDMBSFEWBMVF |

|

|

|

|

|

|

|

|

|

|

|

%FDMBSBUJPO

*EFDMBSFUIBUUIFDPOUFOUPGUIJTJOWPJDFJTUSVFBOEDPSSFDU

/BNFBOE4JHOBUVSF

$PNQBOZBOE+PCUJUMF

%BUF

"EEJUJPOBMJOGPSNBUJPO FHIB[BSEPVTEFUBJMT &03*OVNCFS &$$/OVNCFS FUD

Form Data

| Fact Name | Description |

|---|---|

| Purpose of the Commercial Invoice | The commercial invoice acts as a critical document for international trade, providing detailed information about the transaction between the exporter and importer, facilitating customs clearance, and establishing the terms of sale. |

| Key Elements | It includes essential details such as sender and receiver information, a description of goods, quantity, unit value, total value, shipping date, and terms of sale. Also, it may include sender and receiver's VAT number for tax purposes. |

| Governing Law for State-Specific Forms | While the commercial invoice is generally standardized for international use, state-specific variations in the United States might adhere to local commercial code or regulations governing international trade documentation. |

| Significance in Export and Import | This document is crucial for the determination of tariff rates, providing proof of sale, and supporting the settlement of disputes, thereby facilitating smooth customs clearance and shipment of goods across borders. |

Instructions on Utilizing Commercial Invoice

Filling out a Commercial Invoice form is a critical step in the process of shipping goods internationally. This document provides customs authorities with the necessary information to process shipments entering or leaving a country, ensuring that all goods are handled in compliance with international trade laws. Completing this form accurately is essential to prevent delays or potential legal issues during shipping. Follow these step-by-step instructions to ensure that your Commercial Invoice is filled out correctly.

- Start with the Sender Details section. Input the sender's Company Name, Address Line, Postcode, City, Location, Name, Telephone, and Email. These details identify the sender of the goods.

- For Invoice Details, enter the Invoice Number (if applicable), Shipping Date, and Shipment Number. Include the Currency used for transactions and the Reason for Export.

- Add the sender's VAT Number in the Sender VAT Number field and the receiver's VAT Number in the Receiver VAT Number field, if applicable. These are important for tax purposes.

- Under Terms of Sale, specify the Incoterms that apply to the shipment. These terms define the shipment's delivery, risk, and cost responsibilities between the buyer and seller.

- Move to the Receiver Details: Fill in the receiver's Company Name, Address Line, Postcode, City, Location, Name, Telephone, and Email. This section identifies the recipient of the shipment.

- In the Description of Goods section, provide a detailed Description, Quantity, Unit Weight, and Unit Value for each item being shipped. This information helps in assessing the shipment's value for customs.

- If delivery details differ from the receiver's address, complete the Delivery Details section with the appropriate Company Name, Address Line, Postcode, City, Location, Contact Name, Telephone, and Email.

- Enter the HS Code and Country of Origin for each item. These are crucial for determining tariff rates and confirming the goods' origin.

- Summary details should include the total shipment Number of Packages, Total Shipment Value, Discounts, Subtotal, Shipping Costs, Insurance Costs, Other Costs, and Total Declared Value.

- Under Declaration, confirm that the information provided is true and correct by entering the Name and Signature of the person filling out the form, alongside their Company Position and the Date.

- Finally, any Additional Information needed for the shipment, including special instructions or notes, should be added at the end of the form, along with any relevant EOI and ECCN Numbers for export control.

By diligently following these steps, the Commercial Invoice will be correctly completed, facilitating a smoother customs process. It's essential to double-check all information for accuracy and completeness to avoid unnecessary complications. This detailed approach ensures that your goods are shipped efficiently and in compliance with international regulations.

Obtain Answers on Commercial Invoice

What is a Commercial Invoice?

A commercial invoice is a legal document used in international trade that provides information about the items being shipped from one party to another. It includes details such as sender and receiver's contact information, a description of the goods, the quantity, and the value of the goods. It is primarily used for customs declaration in the exporting process.

Why is a Commercial Invoice important?

This document is vital for international trade as it serves several key functions. It helps in the assessment of customs duties and taxes, provides a record for international sales and shipments, and is instrumental for the customs clearance process. Additionally, it can be used as a proof of sale between the buyer and the seller.

What details are required on a Commercial Invoice?

- Sender and receiver's details (name, address, contact information)

- The invoice number

- Shipment date and shipment number

- Details of goods (description, quantity, unit value, and total value)

- Terms of sale (Incoterms)

- Reason for export and respective VAT numbers, if applicable

- Delivery details if different from receiver details

- Total number of packages, total shipment value, any discounts, shipping costs, insurance costs, and other costs

- Declaration stating the accuracy of information provided

- Additional information as required by specific regulations (e.g., HS Code, country of origin)

How does the currency impact a Commercial Invoice?

The currency specified on the commercial invoice should reflect the currency agreed upon in the sales contract and affects the customs duties and taxes calculation. It's crucial for both parties to clearly define and agree on the currency to avoid any confusion or disputes.

Who generates a Commercial Invoice?

Typically, the seller or the exporter of the goods generates the commercial invoice as part of their export documentation. It is their responsibility to ensure all the information is accurate and complete to avoid delays in the shipment process.

Is there a standard format for Commercial Invoices?

While there is no single standardized format for commercial invoices, there are common elements that must be included. These details are generally consistent across most international trade transactions. However, specific countries or trade agreements may require additional information.

Can a Commercial Invoice be digital?

Yes, commercial invoices can be issued digitally and are widely accepted in digital format. However, it is important to verify with the destination country's customs authority, as some may still require a physical document.

How are discrepancies in Commercial Invoices handled?

Discrepancies in commercial invoices can lead to delays in customs clearance. Should there be any errors or inaccuracies, it is essential for the seller to issue a corrected invoice immediately. Communication with the customs authorities and the receiver is key to resolving these discrepancies promptly.

What happens if a Commercial Invoice is not provided?

Lack of a commercial invoice can result in significant delays in the customs clearance process, potential fines, and even the return of goods to the sender. It is a crucial document for international trade, and ensuring its accuracy and completeness cannot be overstated.

Are there legal consequences for falsifying a Commercial Invoice?

Yes, falsifying a commercial invoice is considered a fraudulent act and is subject to legal consequences. These can range from fines and penalties to criminal prosecution. Accurate representation of all information on the commercial invoice is critical.

Common mistakes

Filling out a commercial invoice form carefully is crucial for the smooth handling of international shipments. However, people often make mistakes. Here are six common errors:

Incorrect or incomplete sender details. This includes the sender's name, address, telephone, and email. These errors can lead to delays or even the inability to ship the items.

Neglecting the receiver's details, similarly encompassing name, address, post code, city, and contact information, which are essential for ensuring the package reaches its destination.

Leaving out or wrongly entering shipment numbers and dates, such as the invoice number, shipping date, and shipment number, which are critical for tracking and managing the shipment.

Not specifying or misstating financial information, including currency, total value, and reason for export. Accurate financial details are vital for customs and taxation purposes.

Incorrect item details, which encompass the description of goods, quantity, unit weight, and unit value. Precise descriptions and values are necessary for customs clearance.

Failing to include or incorrect reporting of additional costs, like shipping, insurance, and other charges. Total declared value and additional costs affect duties and taxes.

Fixing these mistakes is crucial for ensuring swift and successful shipping. Attention to detail not only saves time and money but also prevents potential legal issues with international shipments.

Documents used along the form

When processing international shipments, the Commercial Invoice form is fundamental, but it's often accompanied by other important documents. Each of these documents plays a critical role in ensuring the smooth processing, customs clearance, and delivery of goods across international borders. Below is a list of documents commonly used alongside the Commercial Invoice form, providing a comprehensive framework for international trade logistics.

- Bill of Lading (B/L): Serves as a contract between the owner of the goods and the carrier. There are two types: a straight bill of lading, which is non-negotiable, and a negotiable or shipper's order bill of lading.

- Packing List: Details the specific contents, quantities, and packaging of the shipment. This document is used by customs to determine the acceptability of the import/export and by the receiver to confirm the delivery.

- Certificate of Origin: Declares in which country the goods were manufactured. This document is critical for customs to determine whether the goods are eligible for import, and if so, what the duty will be.

- Shipper’s Export Declaration (SED): Required for shipments over a certain value and used to control exports and compile trade statistics.

- Consular Invoice: Required in some countries, it is prepared on a special form and legalized by the consular office of the destination country, verifying the shipment's value and nature.

- Insurance Certificate: Indicates that insurance has been obtained to cover the loss or damage of the cargo during transit.

- Proforma Invoice: An initial bill of sale sent to buyers in advance of a shipment or delivery of goods. It typically contains the same information as the commercial invoice but is not a final bill.

- Letter of Credit (L/C): A document from a bank guaranteeing that a seller will receive payment from the buyer under the condition that certain delivery conditions have been met.

- Export License: Required for certain goods that are controlled for export, this document authorizes the export of goods in specific quantities to a specific destination.

- Import License: Required by some countries for certain goods, it grants permission to import goods in specific quantities from a specific destination.

Each document listed plays a pivotal role in global trade by providing necessary details and assurances to all parties involved, from regulatory authorities to the businesses engaging in the transaction. Understanding the purpose and requirements of these documents helps in navigating the complexities of international shipping and customs processes.

Similar forms

A Proforma Invoice is similar to a commercial invoice in that it provides a detailed quote of the goods or services being sold, including prices and delivery details, before the transaction is finalized. The key difference is that a proforma invoice is often used as a preliminary bill of sale while a commercial invoice is used after the sale has been completed.

A Packing List shares similarities with a commercial invoice in detailing the contents of a shipment. It lists the quantities, descriptions, and sometimes the weight and dimensions of the items being shipped. Unlike the commercial invoice, it doesn't include price or value information.

The Bill of Lading is another document closely related to the commercial invoice. It serves as a contract between the shipper and the carrier detailing what is being shipped, the origin and the destination. Like the commercial invoice, it is crucial for international shipments but focuses more on the terms of shipping rather than the sale of goods.

A Certificate of Origin is necessary for international trade, like the commercial invoice. It certifies the country in which the goods were manufactured. This document is essential for determining tariffs and is often required by customs, but it does not include transactional details such as prices or terms of sale.

The Shipper's Export Declaration (SED) is used for export compliance and statistics, similar to how the commercial invoice is used for export control. It provides detailed information about the nature of the goods being shipped but primarily focuses on legalities and export information rather than the commercial transaction itself.

A Consular Invoice is required in some countries for customs clearance, much like the commercial invoice. It is specially prepared and verified by the consulate of the destination country, providing details about the shipment. While it serves a similar purpose in ensuring correct tariff assessments, it emphasizes compliance with specific international regulations.

A Customs Invoice serves a function similar to the commercial invoice in international trade. It is specifically designed for customs authorities to assess duties and taxes. This document must detail the nature, quantity, and value of the goods but is more focused on regulatory compliance than the broader transactional details covered in a commercial invoice.

Dos and Don'ts

When completing a Commercial Invoice form, it is vital to ensure accuracy and thoroughness to avoid delays or complications in the shipping process. Below is a list of things you should and shouldn't do when filling out this form.

Things You Should Do- Double-check the sender and receiver information: Ensure the company names, addresses, and contact details are accurate to prevent any shipping mishaps.

- Provide a detailed description of goods: Include comprehensive descriptions for the items being shipped. This helps customs officials understand exactly what is being transported.

- Correctly declare the value of goods: It's essential to declare the true value of the goods being shipped, as this information is used to calculate duties and taxes.

- Use the correct currency: Indicate the currency used for transaction values clearly to avoid confusion during the customs process.

- Sign and date the invoice: A signature and date certify that the information on the invoice is accurate and truthful, fulfilling a legal requirement for most international shipments.

- Avoid estimations: Do not estimate weights, quantities, or values. Always use precise figures to ensure customs compliance.

- Skip HS codes: Neglecting to include the Harmonized System (HS) code for each item can lead to processing delays. These codes are crucial for tax and duty assessments.

- Omit terms of sale (Incoterms): Failing to specify the terms of sale could result in disputes or confusion regarding shipment costs responsibility.

- Leave sections blank: If a section does not apply, indicate this with N/A (Not Applicable) instead of leaving it empty. This confirms that no information was mistakenly omitted.

- Use vague language: When describing the goods, avoid vague terms. Specificity helps customs authorities efficiently process your shipment.

Adhering to these guidelines will help ensure that your Commercial Invoice is complete and clear, paving the way for a smoother shipping process.

Misconceptions

When it comes to international trade, the Commercial Invoice form is a critical document. However, there are several misconceptions about it that businesses may encounter. Understanding these can help in ensuring the smooth processing of shipments and compliance with relevant regulations.

It’s Just a Simple Form: Many believe that a Commercial Invoice is just a basic form to be filled out. In reality, it must contain detailed information about the transaction, including sender and receiver details, description of goods, quantity, value, and terms of sale, among other things. Its accuracy is vital for customs clearance.

One Size Fits All: There's a misconception that one standard commercial invoice template works for all transactions globally. Different countries may have specific requirements or additional fields that need to be completed based on domestic regulations or international agreements.

No Need for Detailed Goods Description: Some think a brief description of the shipped goods is sufficient. However, a detailed description including the type, purpose, and if applicable, the material of goods, is necessary to classify the shipment correctly for duties and taxes.

Value Declared Doesn’t Affect Customs: The declared value of goods on the Commercial Invoice significantly impacts customs duties and taxes. Undervaluing goods to save on customs costs can lead to penalties and delays in clearance.

Only Physical Goods Need a Commercial Invoice: This is not true, as the form is also required for international shipments of repairs, replacements, and returns. It serves as a declaration of the transaction value for customs purposes, regardless of whether a sale is involved.

Shipping Costs and Insurance Are Irrelevant: The misconception here is that shipping and insurance costs are not part of the Commercial Invoice. These costs must be included as they contribute to the total declared value of the shipment, affecting duty and tax calculations.

Signature Is Optional: The belief that a signature is not imperative is incorrect. A signature, usually from the shipper, declaring that the information on the invoice is accurate and true, is required for the document to be considered valid for customs purposes.

Electronic Commercial Invoices Are Not Accepted: With advancements in digital documentation, many assume that customs authorities only accept paper invoices. This isn’t the case, as many countries now accept or even prefer electronic Commercial Invoices to streamline processing and reduce paper use.

Understanding these misconceptions can help exporters and importers ensure their Commercial Invoices are correctly prepared, promoting efficient and trouble-free customs clearance.

Key takeaways

When dealing with international trade, the Commercial Invoice is a crucial document that serves not only as a bill for goods but also provides important details for customs clearance. Here are some key takeaways about how to properly fill out and use this form:

- Ensure that the sender's details are complete, including the company name, address, and contact information. This helps in identifying the origin of the goods.

- Do not forget to include the receiver's details in the same comprehensive manner as the sender's to facilitate smooth delivery and customs clearance.

- The invoice number and, crucially, the shipment number must be clearly stated to link the invoice to the specific shipment it covers.

- Specify the shipping date to help track the shipment’s journey and expected delivery timelines.

- Clearly stating the currency used is important for the accurate processing of payments and conversions by customs authorities.

- The reason for export, along with the sender and receiver's VAT number if applicable, is essential for tax purposes and possible exemptions.

- Listing the terms of sale (Incoterms) defines the responsibilities of the seller and buyer, affecting the valuation and duties at customs.

- A thorough description of the goods, including quantity, unit weight, and total value, is necessary for customs classification and duty determination.

- The total declared value of the shipment must include the cost of goods, shipping, insurance, and any other costs to accurately assess duties and taxes.

The Commercial Invoice should be filled out with attention to detail to ensure that all regulatory and customs requirements are satisfied, avoiding delays or complications during shipping. It is not just an invoice; it is a key document that facilitates international trade by providing necessary details to all parties involved.

Popular PDF Forms

Where Does Form 5498 Go on Tax Return - Details corrective actions for taxpayers identified incorrectly by their employment status on tax documents.

Kuehne Nagel Eei - Allows exporters to include detailed item descriptions and corresponding Schedule B numbers, ensuring precise export declarations.

Recognizance Vs Undertaking - Any money or property given to the bail bond provider as collateral can be used by them to cover any liabilities, costs, or expenses laid out in the agreement.