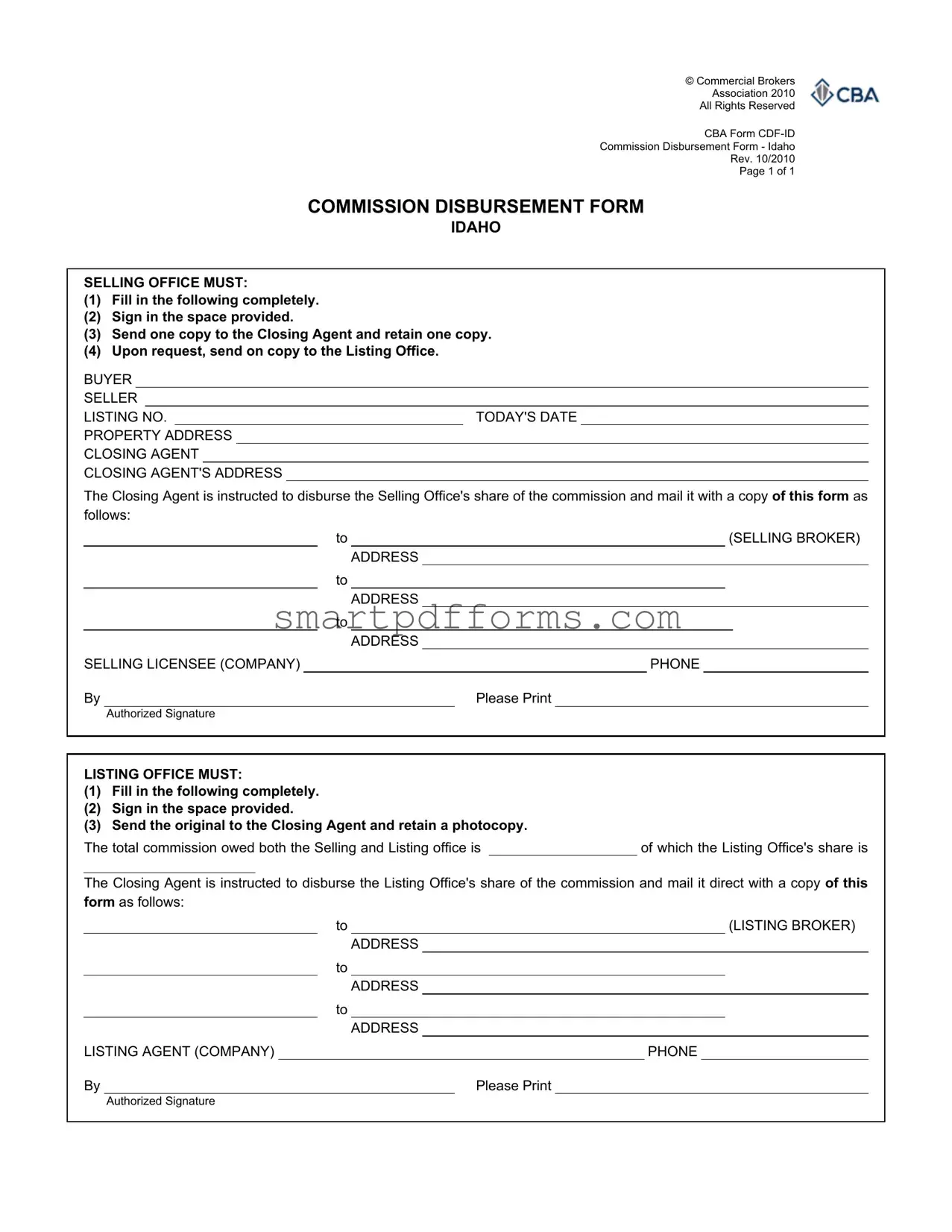

Blank Commission Disbursement PDF Template

Within the realm of real estate transactions, the Commission Disbursement Form (CDF) emerges as a crucial document, facilitating the proper allocation and disbursement of commissions among the involved parties. Specifically designed for the state of Idaho and revised in October 2010 by the Commercial Brokers Association, this form ensures clarity and efficiency in the distribution of financial rewards following the closure of a property deal. The form mandates comprehensive input from the selling office, including complete filling, signing, and the provision of copies to relevant entities such as the closing agent and, upon request, the listing office. Likewise, the listing office is bound by similar prerequisites, ensuring both the selling and listing offices' commission shares are transparently designated to the respective brokers and agents. Moreover, this document streamlines the communication between the closing agent and the brokerage offices, explicitly instructing the disbursement details to prevent any confusion. Serving as both a record and a directive, the Commission Disbursement Form underscores the meticulous processes behind real estate transactions, reinforcing the importance of clear, mutually agreed-upon procedures in the equitable division of commissions.

Preview - Commission Disbursement Form

© Commercial Brokers

Association 2010

All Rights Reserved

CBA Form

Commission Disbursement Form - Idaho

Rev. 10/2010

Page 1 of 1

COMMISSION DISBURSEMENT FORM

IDAHO

SELLING OFFICE MUST:

(1) Fill in the following completely.

(2) Sign in the space provided.

(3) Send one copy to the Closing Agent and retain one copy.

(4) Upon request, send on copy to the Listing Office.

BUYER

SELLER

LISTING NO. |

|

TODAY'S DATE |

|

|||

PROPERTY ADDRESS |

|

|

|

|||

CLOSING AGENT |

|

|

|

|||

CLOSING AGENT'S ADDRESS |

|

|

|

|||

The Closing Agent is instructed to disburse the Selling Office's share of the commission and mail it with a copy of this form as follows:

|

|

|

to |

|

|

|

|

|

|

(SELLING BROKER) |

|

|

|

|

|

ADDRESS |

|||||||

|

|

|

to |

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|||||||

|

|

|

to |

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|||||||

SELLING LICENSEE (COMPANY) |

|

|

|

|

|

PHONE |

|

||||

By |

|

|

Please Print |

||||||||

|

Authorized Signature |

|

|

|

|

|

|

|

|

||

LISTING OFFICE MUST:

(1)Fill in the following completely.

(2)Sign in the space provided.

(3)Send the original to the Closing Agent and retain a photocopy.

The total commission owed both the Selling and Listing office isof which the Listing Office's share is

The Closing Agent is instructed to disburse the Listing Office's share of the commission and mail it direct with a copy of this form as follows:

|

|

to |

|

|

|

|

(LISTING BROKER) |

|

|

|

ADDRESS |

||||

|

|

to |

|

|

|

|

|

|

|

|

ADDRESS |

||||

|

|

to |

|

|

|

|

|

|

|

|

ADDRESS |

||||

LISTING AGENT (COMPANY) |

|

|

|

PHONE |

|

||

By |

|

Please Print |

|||||

Authorized Signature

Form Data

| Fact Name | Description |

|---|---|

| Document Purpose | This form is used to instruct the Closing Agent on how to disburse the Selling Office's share of the real estate commission. |

| Required Actions for Selling Office | The Selling Office must fill in the form completely, sign it, send one copy to the Closing Agent, and retain one copy for their records. |

| Required Actions for Listing Office | The Listing Office must complete the form, sign it, send the original to the Closing Agent, and keep a photocopy for their records. |

| Governing Law | The form is governed by Idaho state law, as it is specifically designed for use within the state of Idaho. |

Instructions on Utilizing Commission Disbursement

After a real estate transaction has been agreed upon, the next step involves disbursing the commissions to the respective parties involved. The Commission Disbursement Form serves as a directive to the closing agent, outlining how the commissions should be distributed between the selling and listing offices. This process ensures that each party receives their fair share for the services rendered. Here are the steps to properly fill out the Commission Disbursement Form.

- Start by identifying whether you are completing the form as the selling office or listing office, as the instructions slightly differ for each.

- If you are the selling office, under the section labeled "SELLING OFFICE MUST," fill in all the requested details including the buyer and seller information, listing number, today's date, property address, and closing agent details.

- Specify how the selling office's share of the commission should be disbursed by including the selling broker's name, address, and company details. Adequately provide information regarding where the commission should be mailed.

- Ensure that the form is signed in the space provided by an authorized individual. Print the name of the signatory for clarification.

- Send one copy of the completed form to the closing agent and retain one for your records. If requested, send another copy to the listing office.

- If you are the listing office, under the section labeled "LISTING OFFICE MUST," completely fill in the total commission owed and how it is divided between the selling and listing office.

- Detail how the listing office's share of the commission should be disbursed, including the listing broker’s name, address, and company details. Provide specific instructions on where to mail the commission.

- Sign the form in the designated area, printing the name of the signifying person for the listing office, and ensure an authorized individual completes this.

- Send the original form to the closing agent and keep a photocopy for your office's records.

Once the Commission Disbursement Form is accurately filled out and submitted, the closing agent will proceed with the disbursement of funds according to the instructions given. This standardized procedure facilitates a clear and accountable transfer of commissions, ensuring peace of mind for both the selling and listing offices involved in the transaction.

Obtain Answers on Commission Disbursement

-

What is a Commission Disbursement Form (CDF)?

The Commission Disbursement Form (CDF) is a crucial document used within the real estate industry, particularly in Idaho as per the Commercial Brokers Association's 2010 guidelines. This form acts as an instruction for the closing agent to correctly disburse commission payments between the selling and listing offices after the sale of a property. It ensures that each office involved in the transaction receives their rightful share of the commission, based on the agreement made between the buyer, seller, and their respective real estate representatives.

-

Why is it necessary to fill out the CDF completely?

Filling out the Commission Disbursement Form completely is essential for several reasons. Firstly, it provides clear, undisputed instructions to the closing agent regarding the distribution of commissions, which helps to avoid any confusion or delays at the time of closing. Secondly, detailed completion ensures that all parties involved have a written record of the agreed-upon commission disbursement, which can be crucial if discrepancies or disputes arise after the transaction. Lastly, a fully completed form helps to ensure compliance with legal standards and real estate regulations, safeguarding all parties' interests in the property transaction.

-

Who needs to sign the CDF, and why?

The Commission Disbursement Form requires signatures from authorized representatives of both the selling and listing offices. The need for these signatures stems from the importance of verifying that the commission disbursement details have been mutually agreed upon by both sides. Signatures also provide a layer of legal assurance, signifying that the offices commit to the instructions laid out in the form. This part of the process ensures that the commission disbursement is conducted transparently, fairly, and with full accountability.

-

How many copies of the CDF should be distributed, and to whom?

Upon completing and signing the Commission Disbursement Form, distribution involves a few key steps:

- The selling office must send one copy to the Closing Agent and retain one copy for their records.

- If requested, they should also send one copy to the Listing Office.

- Similarly, the Listing Office must send the original form to the Closing Agent and keep a photocopy for their files.

-

What should you do if there is a disagreement about the commission split after the CDF has been signed?

In the event of a disagreement over the commission split after the CDF has been signed, it is advisable to approach the situation with a focus on peaceful resolution. The parties should first review the document together to clarify any misunderstandings. If the issue persists, involving a neutral third party, such as a mediator experienced in real estate disputes, can provide guidance towards a fair settlement. Should these steps fail to resolve the disagreement, consulting with legal professionals who specialize in real estate law may become necessary to protect the interests of all parties and seek resolution through legal channels.

-

Can the Commission Disbursement Form be amended after it has been submitted?

Amending the Commission Disbursement Form after submission is possible but requires the agreement and cooperation of all parties involved in the commission agreement. To amend the form, the selling and listing offices should jointly submit a written request for amendment to the closing agent, detailing the changes to be made. It’s critical that both parties sign off on these amendments to ensure mutual agreement and to maintain a clear, legal record of the changes. The closing agent will then adjust the commission disbursements according to the amended instructions.

-

Is there a deadline for submitting the CDF to the Closing Agent?

While the specific deadline for submitting the Commission Disbursement Form to the Closing Agent can vary depending on the sale agreement and local real estate practices, it is generally expected that the form should be submitted well before the closing date of the property transaction. Timely submission ensures that the closing process proceeds smoothly, with all financial distributions clearly outlined and agreed upon, thereby avoiding unnecessary delays or complications at closing.

-

What legal implications does the CDF have?

The Commission Disbursement Form carries significant legal implications, as it serves as a binding agreement regarding the distribution of commissions from the property sale transaction among the real estate offices involved. By signing the CDF, the parties agree to the specified division of commission and instruct the closing agent accordingly. This form can be utilized as a legal document in the event of a dispute, misunderstanding, or litigation related to the commission payments. Therefore, ensuring accuracy, completeness, and clarity in the CDF is paramount for protecting the legal rights and financial interests of all parties involved.

Common mistakes

When filling out the Commission Disbursement Form for real estate transactions, it's crucial to avoid common pitfalls to ensure a smooth closing process. Here are six mistakes individuals often make:

Not fully completing the form. Every section should be filled out with the appropriate information to avoid delays or confusion.

Failing to sign the form in the designated area. A signature is a validation of the information provided and is essential for the form’s legitimacy.

Sending the form to the wrong party. It's important to send the form to the correct closing agent and keep copies for the necessary parties as outlined.

Inaccurate financial details. Mistakes in the commission amounts or how they are split between the listing and selling offices can lead to disputes and delayed payments.

Omitting contact information. Providing comprehensive contact details for the selling and listing brokers facilitates easy communication if there are any issues or clarifications needed.

Not retaining a copy of the form. It's vital for both the selling and listing offices to keep a copy of the form for their records and future reference.

Avoiding these mistakes can lead to a more efficient process and ensure that all parties involved are satisfied with the transaction's outcome.

Documents used along the form

When handling real estate transactions, the Commission Disbursement Form is a crucial document, particularly for detailing how commissions should be distributed among the real estate professionals involved. However, this form rarely stands alone in the paperwork necessary to complete a property sale or purchase. Several other documents are typically used in conjunction to ensure the transaction is legally sound and bound, each serving a specific purpose in the real estate process.

- Listing Agreement: A contract between a property owner and a real estate broker authorizing the broker to represent the seller and find a buyer for the property under specified terms.

- Purchase Agreement: This legally binding document outlines the terms and conditions of the sale between the buyer and seller, including the purchase price, closing date, and contingencies.

- Closing Statement (HUD-1): A detailed list of all the costs associated with the transaction, provided to both the buyer and seller. It outlines who has paid for what and the remaining amounts due at closing.

- Title Insurance Policy: Protects the buyer and lender from loss due to title defects, liens, or other issues. It assures the property title is transferred free and clear of problems.

- Property Appraisal: A report from a licensed appraiser giving an opinion of the property's market value. Lenders require this to ensure the property is worth the loan amount.

- Home Inspection Report: Provides an in-depth look at the property's condition, highlighting any problems or repairs that may be needed.

- Loan Application: A document submitted by a potential borrower detailing their financial status, employment history, credit information, and more, used by lenders to determine loan eligibility.

- Loan Estimate and Closing Disclosure: Documents provided by the lender to the borrower outlining the terms of the mortgage, the costs associated with the loan, and the closing costs, respectively.

- Deed of Trust/Mortgage: Legal documents that secure the loan by using the property as collateral, detailing the legal obligations and rights of both the borrower and the lender.

- Proof of Homeowners Insurance: Verifies that the property has adequate insurance coverage as required by the lender to protect against losses from fire, floods, and other hazards.

In conclusion, while the Commission Disbursement Form is essential for outlining how commissions are paid out, it is just one component of a comprehensive suite of documents necessary for a real estate transaction. Real estate professionals and clients alike must ensure these documents are accurately completed and filed to protect their investments and interests in property sales and purchases.

Similar forms

The Commission Disbursement Form used by the Commercial Brokers Association is a crucial document in real estate transactions, specifically for the disbursement of commissions. It ensures that both the selling and listing offices get paid their due share of the commission in a transaction. This document shares similarities with several other forms and documents used in real estate and financial transactions. Each has its unique purpose, but their functions overlap in the ways they facilitate payments, record agreements, or ensure the distribution of funds. Here are six documents similar to the Commission Disbursement Form:

- Closing Disclosure Form: This document is used in real estate transactions to outline the final closing costs. Like the Commission Disbursement Form, it provides a detailed breakdown of payments owed and distributed at the closing of a real estate transaction, ensuring transparency and agreement on all charges and credits involved.

- Settlement Statement (HUD-1): Before the Closing Disclosure, the HUD-1 Settlement Statement was used in real estate closings to itemize all charges imposed upon the buyer and the seller. Similar to the Commission Disbursement Form, it includes detailed financial transactions, including the commission paid to real estate agencies.

- Escrow Instructions: These instructions are given to an escrow agent, detailing the conditions under which the escrow agent can distribute funds held in escrow. Analogous to the Commission Disbursement Form, it directs the distribution of funds, but it’s more comprehensive, covering various aspects of the real estate transaction, not just commissions.

- Broker’s Commission Agreement: This is an agreement between a broker and a client that outlines the commission structure, how and when the commission will be paid. While it focuses on the agreement aspect rather than the disbursement, it’s connected to the Commission Disbursement Form as it sets the terms under which commission disbursements are made.

- Direct Deposit Authorization Form: This form authorizes the transfer of funds electronically to an account specified by the recipient. Like the Commission Disbursement Form, it provides instructions for disbursing funds, although it’s used in a wider range of transactions, not just real estate commissions.

- Invoice: An invoice is a request for payment that details goods or services rendered. Similarities include providing a detailed breakdown of amounts due which supports the distribution of funds. Although not specific to real estate commissions, the fundamental concept of detailing payments and facilitating transactions aligns with the Commission Disbursement Form’s purpose.

Each of these documents plays a vital role in their respective areas, ensuring clear communication, agreement on financial matters, and the proper distribution of funds. While their specific applications may vary, their importance in facilitating smooth and transparent transactions is undeniable.

Dos and Don'ts

When filling out the Commission Disbursement Form for the Commercial Brokers Association, certain practices should be followed to ensure accuracy and compliance with professional standards. Equally, there are actions you should avoid to prevent any issues or delays in processing. Below is a list of dos and don'ts when completing this form.

Things You Should Do

Ensure all the information required is filled in completely. This includes details such as property address, closing agent's details, and commission distribution information.

Verify that both the selling office and listing office portions are accurately completed, reflecting the agreement between the parties.

Sign the form in the designated areas to authorize the commission disbursement officially.

Make copies of the completed form. Send one to the closing agent, keep one for your records, and provide a copy to the listing office upon request.

Double-check the amounts to be disbursed to ensure they align with the agreed-upon commission rates.

Include accurate and clear addresses for both the selling and listing brokers to avoid any miscommunication or delays in payment.

Contact the closing agent to confirm receipt of the form and understand any additional requirements they may have.

Things You Shouldn't Do

Leave any section incomplete. Missing information can lead to delays or incorrect disbursement of funds.

Forget to sign the form. An unsigned form is not valid and will not be processed.

Overlook the need to make copies for all parties involved. Each party should have a record of the disbursement agreement.

Ignore discrepancies between the form and the original commission agreement. Any differences should be resolved before submitting the form.

Misstate the commission amounts or the payee details. Accuracy is crucial for correct payment processing.

Assume the closing agent will correct any mistakes. It is the responsibility of the selling and listing offices to provide accurate and complete information.

Delay sending the form to the closing agent. Timeliness is essential to ensure that commissions are disbursed promptly.

Misconceptions

When navigating through real estate transactions, the Commission Disbursement Form (CDF) is a critical document utilized to ensure the correct distribution of commission fees among brokers. However, several misconceptions about this form can lead to confusion and mismanagement of expectations. Here are eight such misunderstandings:

It's Only for the Selling Broker: One common misconception is that the Commission Disbursement Form is exclusively for the selling broker's benefit. In truth, this form equally serves the listing broker by outlining how commissions are split and ensuring that both parties receive their agreed-upon share.

Any Closing Agent Can Modify It: The belief that any closing agent can alter the form at will is incorrect. Changes to the Commission Disbursement Form require consent from both the listing and selling offices, as documented through their authorized signatures, to prevent unauthorized amendments.

A Signature Is Optional: Contrary to what some might think, the requirement for an authorized signature is not optional. This form must be signed by a duly authorized representative of both the selling and listing offices to validate the agreement on commission splits.

It Doesn't Need to Be Sent in Advance: Another misunderstanding is the timing of sending the form. It is crucial to send this form to the closing agent well in advance of the closing date to ensure that all parties have agreed to the commission distribution, thus avoiding delays at closing.

Electronic Copies Are Not Acceptable: While it's true that the original form is important, both selling and listing offices can retain photocopies or electronic copies for their records. However, the closing agent should receive the original signed form to process the disbursement.

Listing Information Is Not Necessary: Some might think listing details are irrelevant on this form. However, including information such as the listing number and property address is critical for identification purposes and to ensure commission disbursement is linked to the correct transaction.

It's a Standard, Unmodifiable Document: Though the Commission Disbursement Form has a standard format, specific details such as the commission split percentage and payment instructions can vary by transaction. These aspects are negotiated between the selling and listing offices and must be clearly outlined on the form.

Only Necessary for Residential Transactions: Lastly, there is a notion that this form is exclusively for residential real estate transactions. In reality, the Commission Disbursement Form is utilized across both residential and commercial transactions to ensure proper commission distribution.

Clarifying these misconceptions is crucial for all parties involved in a real estate transaction to navigate the process smoothly and ensure all financial obligations are met accurately and timely.

Key takeaways

Filling out and using a Commission Disbursement Form is a vital process in real estate transactions, ensuring that the commission is correctly distributed among the parties involved. Here are key takeaways to help guide you through this process:

- Accuracy is Crucial: Make sure all the information provided on the Commission Disbursement Form is accurate and complete to prevent any delays or misunderstandings in commission payments.

- Signatures Required: Both the selling and listing offices must sign the form in the designated areas to validate the agreement on commission disbursement.

- Distribution Instructions: The form clearly dictates how the commission split will be distributed between the selling and listing offices, including the exact amounts and where they should be sent.

- Copy Distribution: After completion, a copy of the form needs to be sent to the closing agent, with the selling office retaining one copy and, upon request, sending another to the listing office.

- Close Attention to Addresses: Pay close attention to the accuracy of all addresses on the form, including where the commission checks should be mailed, to ensure prompt and correct delivery.

- Today’s Date and Property Address: Don't forget to fill in today's date and the complete address of the property involved in the transaction.

- Retain a Photocopy: The listing office must send the original form to the closing agent but also keep a photocopy for their records.

- Authorized Signature: The form must be signed by an authorized representative from both the selling and listing offices to officially authorize the commission disbursement.

- Communication with Closing Agent: The form serves as an instruction manual to the closing agent on how to distribute the commissions, making clear communication essential.

- Comprehensive Completion: Each section of the form is designed to capture essential details regarding the commission disbursement. Ensuring each part is filled out completely and accurately is crucial.

Remember, the Commission Disbursement Form is a legally binding document that facilitates the smooth operation of real estate transactions by clearly outlining the distribution of commissions. Taking the time to fill it out carefully and correctly is in the best interest of all parties involved.

Popular PDF Forms

Irs Form 4490 - A document used by IRS agents to declare a taxpayer's debt to the U.S. for unpaid taxes, interest, and penalties.

Dhsmv Forms - The HSMV 85054 form requires the requester’s signature under penalty of perjury, affirming entitlement to the requested information.

Tenant Move Out Letter - An obliging notification to landlords regarding a tenant's move-out and a formal request to return the security deposit.