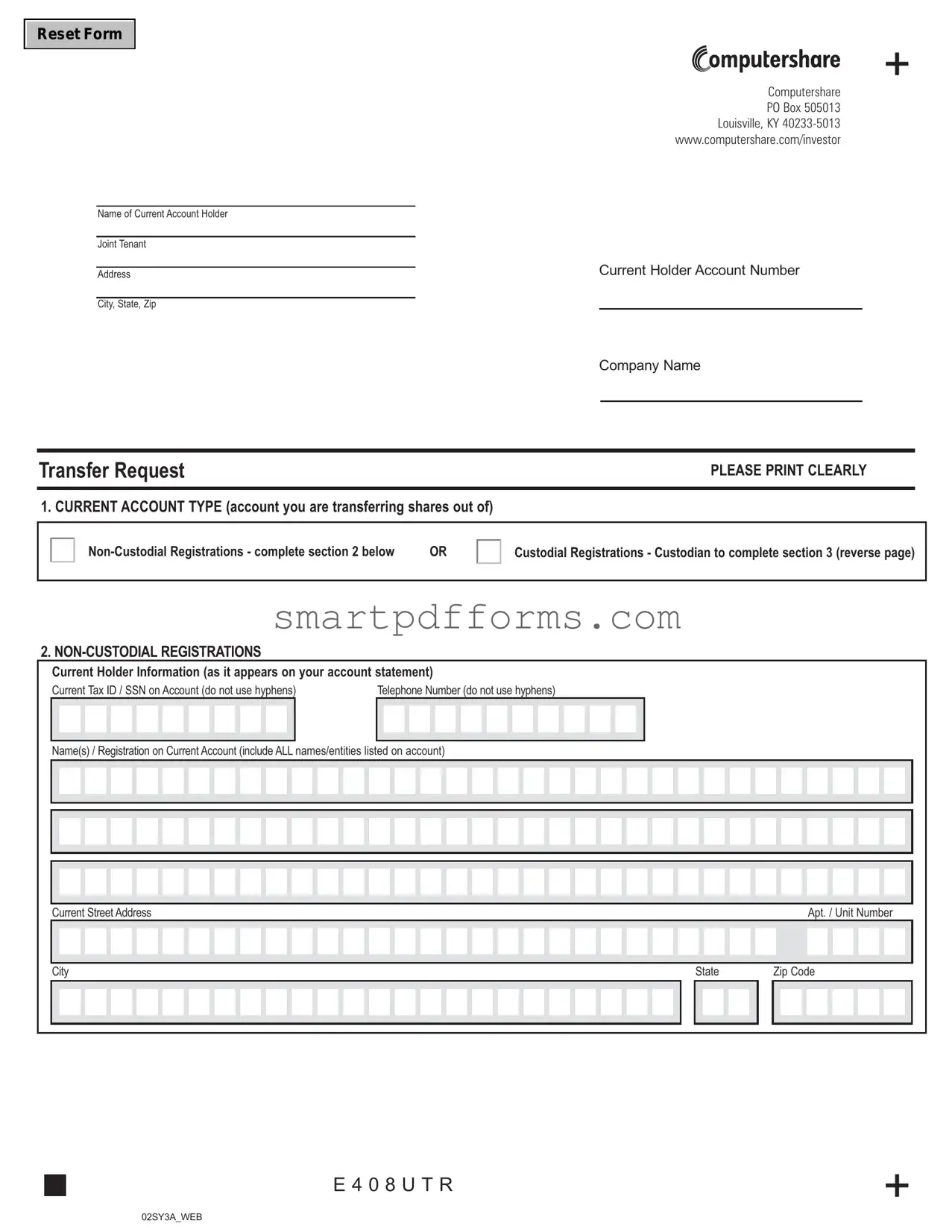

Blank Computershare Transfer Request PDF Template

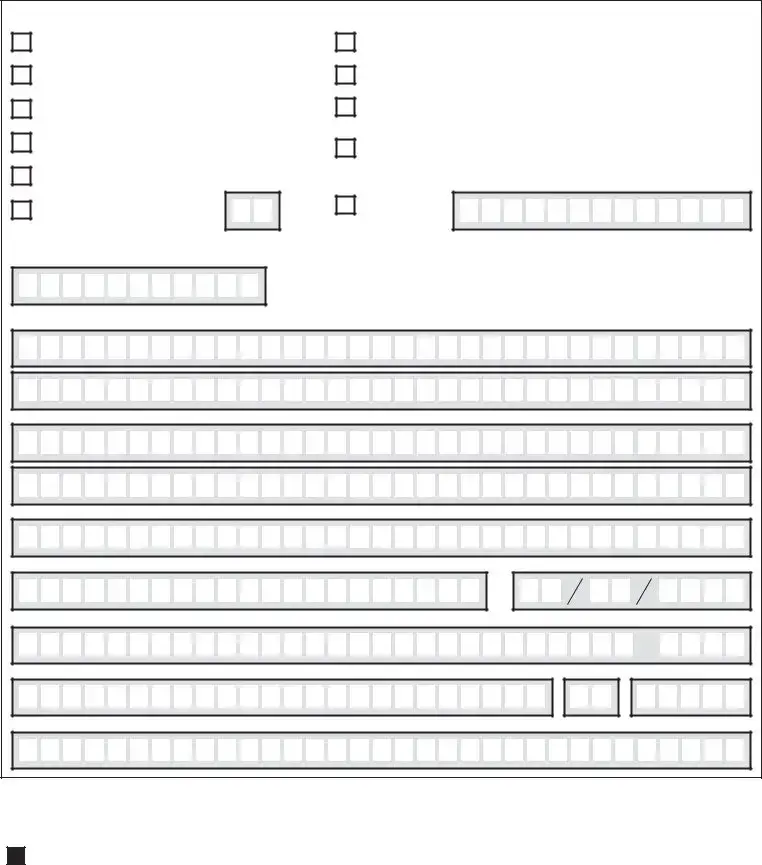

Navigating the process of transferring securities involves a myriad of details and procedures, one of the essential tools for which is the Computershare Transfer Request form. This document facilitates the movement of stocks or bonds between accounts, whether due to sale, gift, inheritance, or other reasons. It requires information from the current account holder(s) about the type of account (non-custodial or custodial), detailed personal and account information, and the specific reason for the transfer, with varying documentation depending on the purpose—sale, gift, inheritance, or no change of ownership. The form also requests instructions on whether all or part of the securities are to be transferred and mandates authorized signatures with a Medallion Guarantee Stamp, not substituting a notary seal, to prevent fraud. Additionally, for those receiving the shares, information is detailed for setting up or transferring to a new account, considering the various registration types such as individual or joint tenants, trusts, or custodial accounts for minors, among others. Precision in completing this form and adhering to its requirements ensures the smooth transition of asset ownership, underscoring the importance of accuracy and attention to detail throughout the transfer process.

Preview - Computershare Transfer Request Form

.Reset Form

Name of Current Account Holder

Joint Tenant

Address

City, State, Zip

+

Computershare

PO Box 505013

Louisville, KY

www.computershare.com/investor

Current Holder Account Number

Company Name

Transfer Request |

PLEASE PRINT CLEARLY |

1. CURRENT ACCOUNT TYPE (account you are transferring shares out of)

OR |

Custodial Registrations - Custodian to complete section 3 (reverse page)

2.

Current Holder Information (as it appears on your account statement)

Current Tax ID / SSN on Account (do not use hyphens)Telephone Number (do not use hyphens)

Name(s) / Registration on Current Account (include ALL names/entities listed on account)

Current Street Address

City

Apt. / Unit Number

State |

Zip Code |

E 4 0 8 U T R |

+ |

|

02SY3A_WEB

.

+

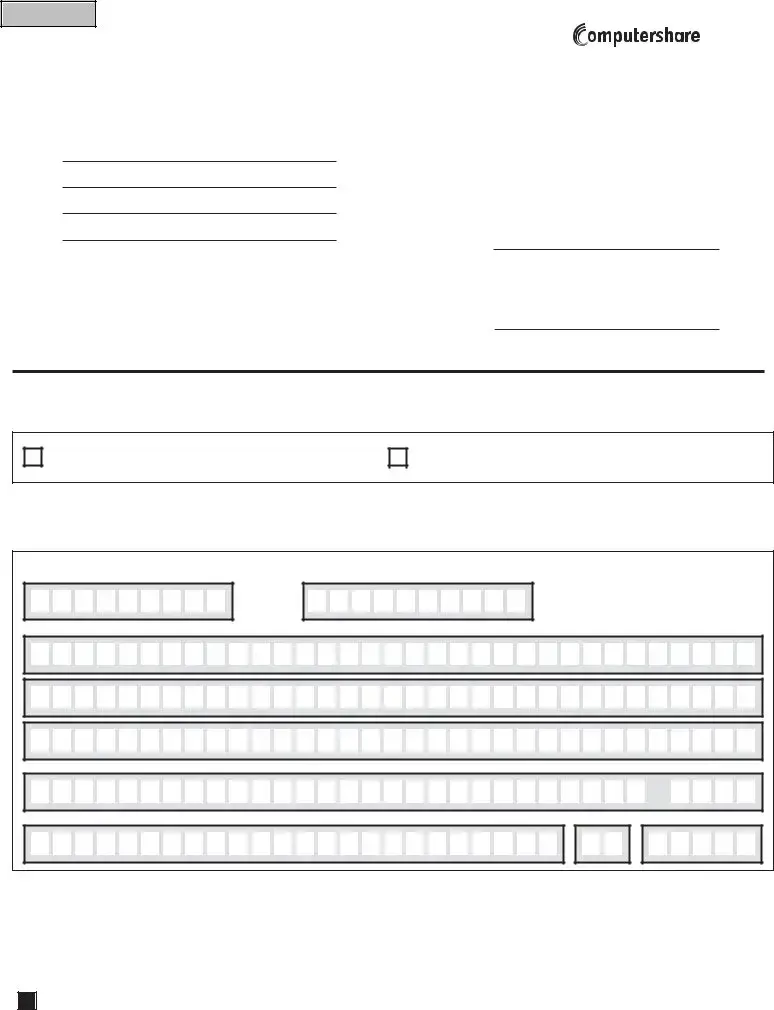

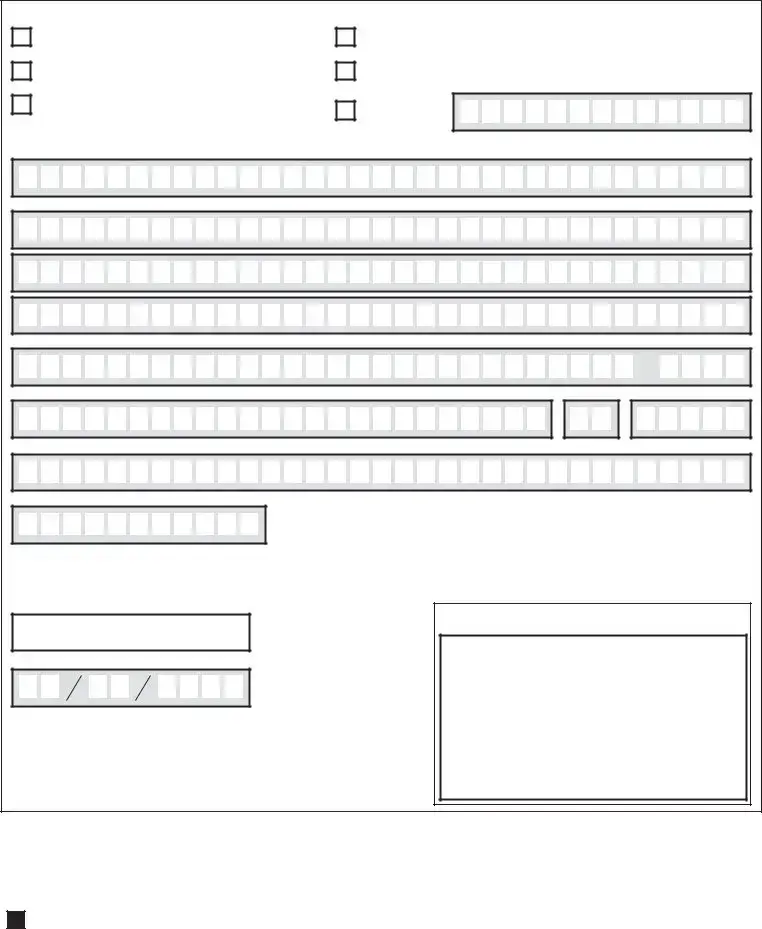

3.CUSTODIAL REGISTRATIONS Current Custodian Information

The Custodian registered to the current account (that you are transferring shares out of) must provide and/or verify the following information:

Name of Custodian

Name(s) / Registration on Current Account (include ALL names/entities listed on account)

Current Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt. / Unit Number |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City

Custodian Account Number/Investor ID at Custodian |

|

Custodian Taxpayer ID Number (do not use hyphens) |

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

Zip Code |

Custodian Telephone Number (do not use hyphens) |

|

|

|

Ext. |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. COST BASIS/REASON FOR TRANSFER

Please check off the applicable purpose of the transfer for shares acquired after 12/31/10. If this section is not fully completed, all transfers will be treated as Gifts, unless we receive documentation that this is a decedent transfer (i.e. Affidavit of Domicile) in which case the transfer will be treated as an inheritance. We recommend that you consult with your tax advisor regarding the tax implications for each type of transfer. Please check ONLY ONE box. If you check more than one box your transfer will be treated as if you had not made any selection.

Private Sale |

|

Date of Sale: |

(If Private Sale) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost Per Share: |

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

US Dollars |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gift |

|

Date of Gift: |

Inheritance |

Date of Death: |

(If blank we will default to the effective date of the transfer.)

No Change of Ownership (please specify)

(If Inheritance) Value Per Share:

.

.

US Dollars

E 4 0 9 U T R |

+ |

|

02SY3A_WEB

.

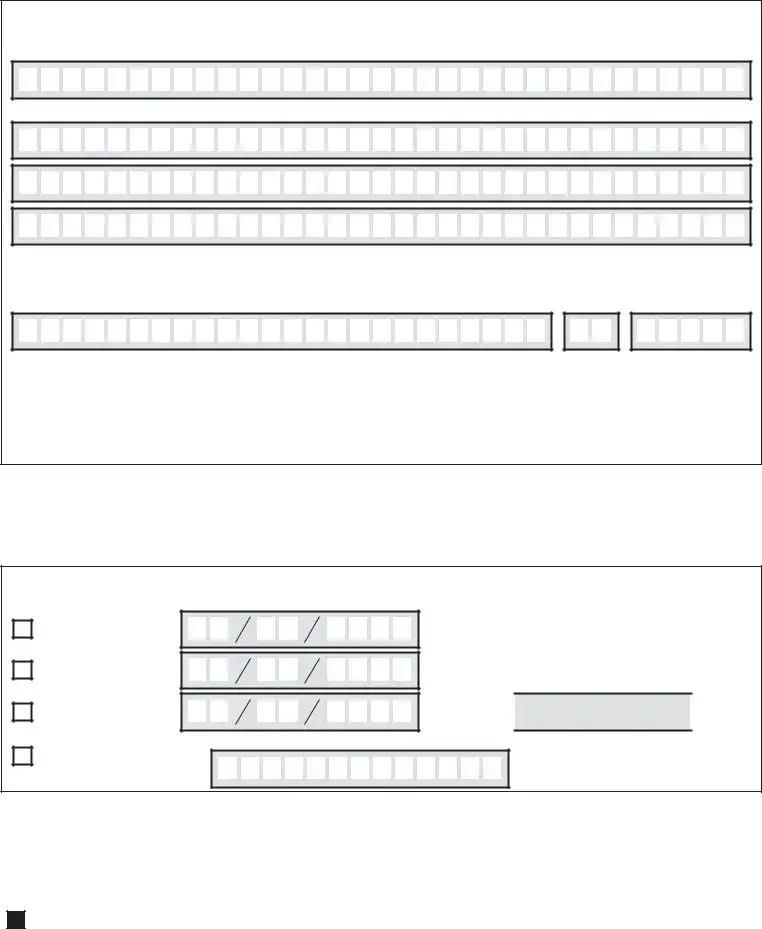

5. SHARE TRANSFER

+

A. Transfer All Securities |

OR |

B. Transfer Shares As Instructed Below

If box B is checked, complete the Security Description/Share Type details below.

Security Description / Share Type (ex: Common, Preferred, etc) |

Transfer All |

Enter number of whole and / or fractional shares to transfer, if applicable |

or

or

or

or

.

.

.

.

.

.

.

.

6. AUTHORIZED SIGNATURES

The undersigned does (do) hereby irrevocably constitute and appoint Computershare as attorney to transfer the said stock, as the case may be, on the books of said Company, with full power of substitution in the premises.

The signature(s) below on this Transfer Request form must correspond exactly with the name(s) as shown upon the face of the stock certificate or a

NOTE: Signature(s) must be stamped with a Medallion Signature Guarantee by a qualified financial institution, such as a commercial bank, savings bank, savings and loan, US stockbroker and security dealer, or credit union, that is participating in an approved Medallion Signature Guarantee Program (A NOTARY SEAL IS NOT ACCEPTABLE).

Required ►Medallion Guarantee Stamp

All Current Holder(s) or Legal Rep(s) (Notary Seal Is Not Acceptable)

Date (mm / dd / yyyy)

Signature of all Current Holders or Legal Representative(s)

Required ►Medallion Guarantee Stamp

Current Custodian (Notary Seal Is Not Acceptable)

Required ►Medallion Guarantee Stamp

All Current Holder(s) or Legal Rep(s) - Continued (Notary Seal Is Not Acceptable)

Date (mm / dd / yyyy)

Signature of Current Custodian

Date (mm / dd / yyyy)

Signature of Additional Current Holder(s) or Legal Representative(s)

E 4 1 0 U T R |

+ |

|

02T1GA_WEB

.

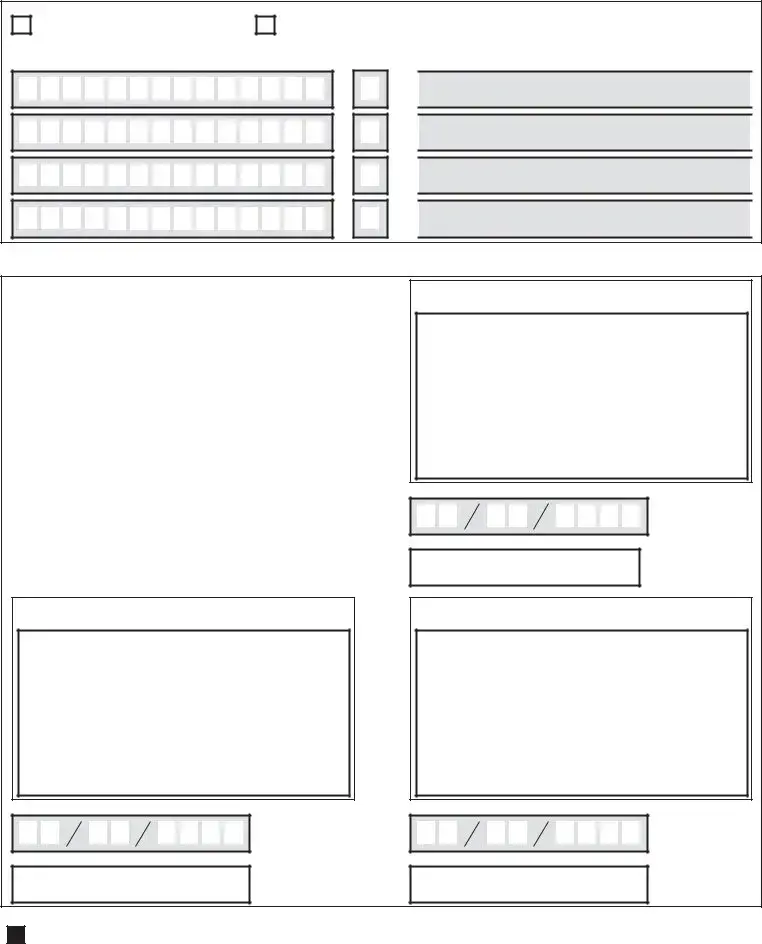

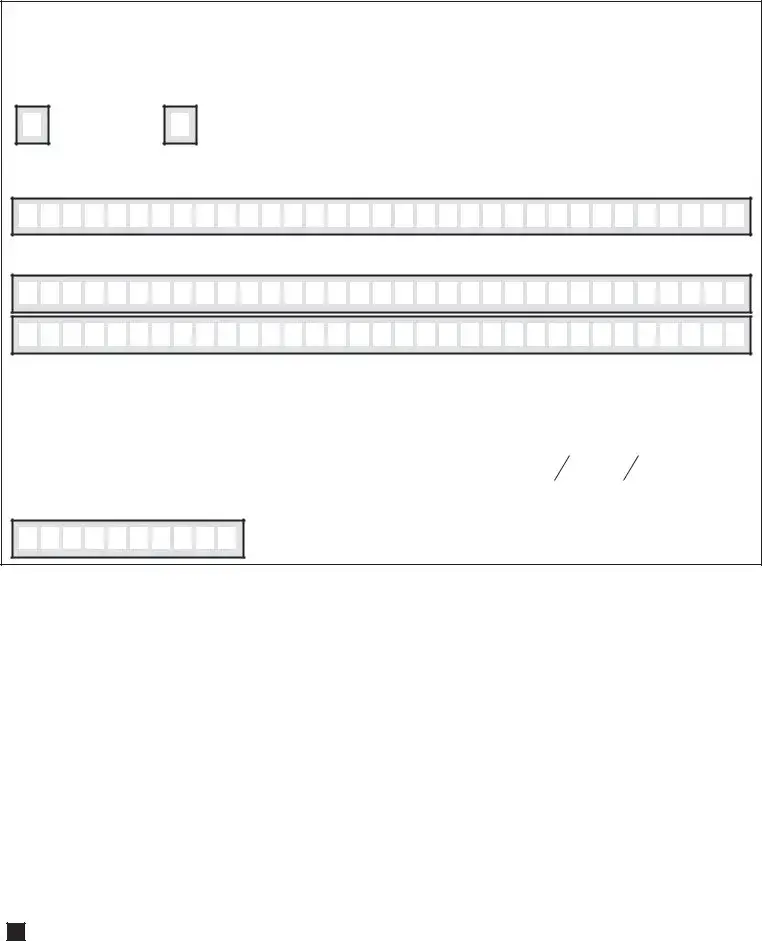

7. NEW ACCOUNT TYPE (account you are transferring shares to) |

+ |

|||

|

|

|

|

|

|

|

|

Custodial Registrations - Custodian to complete section 9 (reverse page) |

|

|

|

|

||

|

|

|

|

|

8.New Account Type (account you are transferring shares to):

Individual

Joint Tenants with Right of Survivorship

Community Property

Tenants in Common

Corporation

Custodial for Minors Act – State of:

B. New Holder Information

New Holder’s Existing Account Number (if applicable)

Name of Individual / Entity / Trustee / Executor / Other

Estate – Include Executor Name, Provide Estate EIN on Form

Qualified Pension Plan

Trust – Include Trustee Names, Trust Name, and Trust

Agreement Date below.

Transfer on Death (“TOD”) – Note: Only 1 TOD beneficiary may be registered per account. List the TOD beneficiary name below.

Other (Specify)

Name of Joint Holder / Minor /

Trust / Estate Name (if applicable)

Trust / Estate Name - continued

Current Street Address

City

Trust Agreement Date (mm / dd / yyyy) (if applicable)

Apt. / Unit Number

State |

Zip Code |

E 4 1 1 U T R |

+ |

|

02T1GA_WEB

.

+

9.New Account Type (account you are transferring shares to): Custodial Registrations A. New Custodial Registration Type

Traditional IRA

Roth IRA

KEOGH Plan

B. New Custodial Information

Simplified Employee Pension/Trust (SEP)

Pension/Profit Sharing Plan

Other (Specify)

Name of Custodian

Beneficial Holder for New Account (include ALL names/entities listed on account)

Current Street Address |

|

Apt. / Unit Number |

City |

State |

Zip Code |

Custodian |

|

|

Custodian Account Number / Investor ID at Custodian |

|

|

Custodian Telephone Number (do not use hyphens) |

|

|

|

Ext. |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of New Custodian

NOTE: Signature(s) must be stamped with a Medallion Signature Guarantee by a qualified financial institution, such as a commercial bank, savings bank, savings and loan, US stockbroker and security dealer, or credit union, that is participating in an approved Medallion Signature Guarantee Program (A NOTARY SEAL IS NOT ACCEPTABLE).

Required ►Medallion Guarantee Stamp

New Custodian (Notary Seal Is Not Acceptable)

Date (mm / dd / yyyy)

E 4 1 2 U T R |

+ |

|

02T1GA_WEB

.

+

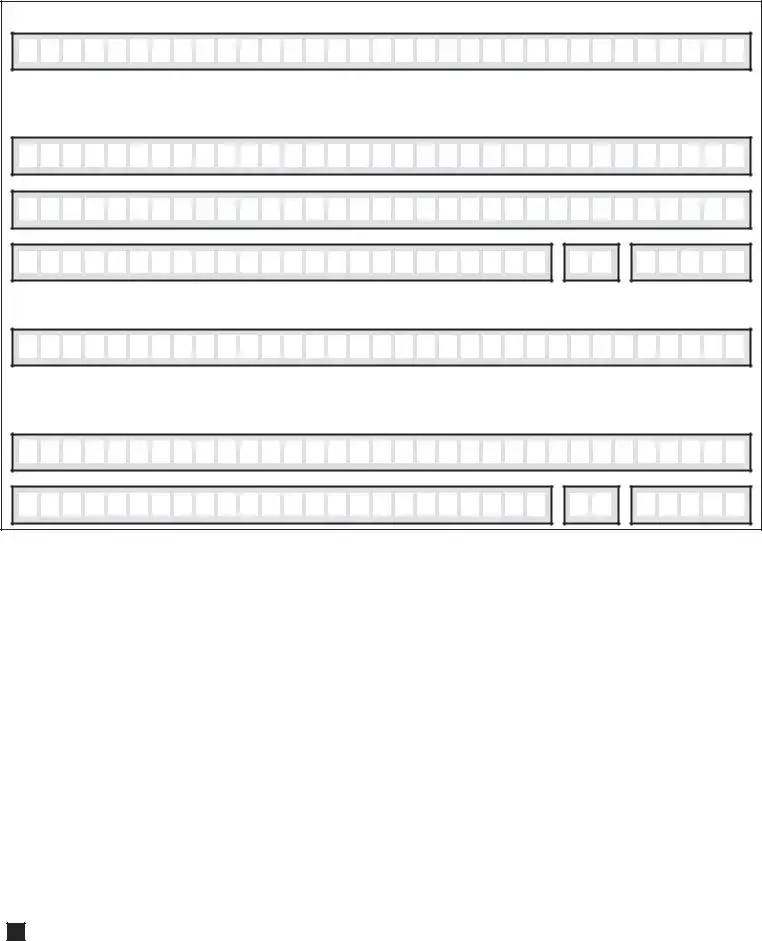

10. Distribution for new account

Bank Routing Number – this is a |

|

Bank Account Number – account numbers vary in length and must not include check numbers. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DO NOT USE YOUR CREDIT CARD NUMBER. If you are unsure of your Bank Routing Number or Bank Account Number, please check with your financial institution. Please DO NOT provide a check number in the fields above. This is commonly listed with your Account and Bank Routing Numbers on your check.

Checking Account

Savings Account

Name(s) that appear on the account at your financial institution

Name of Financial Institution

I/We hereby authorize Computershare as disbursing agent for the payer, to initiate credit entries to my (our) account; or if necessary debit entries or adjustments for any credit entries in error. This authority is to remain in effect until my (our) written authorization to terminate electronic funds transfer is received in time to afford Computershare reasonable opportunity to act on it or until this service is terminated by the payer or Computershare. All registered holders as well as all individuals listed on the financial account must sign below.

Signature 1 - Please keep signature within the box. |

|

|

Signature 2 - Please keep signature within the box. |

|

|

Date (mm / dd / yyyy) |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone Number (do not use hyphens)

E 4 1 3 U T R |

+ |

|

02T1JA_WEB

.

11.FINANCIAL ADVISOR / FINANCIAL INSTITUTION INFORMATION

A. Financial Advisor Information

Financial Advisor Name

Financial Advisor CRD Number |

|

Telephone Number (do not use hyphens) |

|

|

|

|

|

|

|

Ext. |

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Advisor

Financial Advisor Street Address/PO Box

City

B. Financial Institution Information

Financial Institution Name

State |

Zip Code |

Financial Institution CRD Number |

|

Telephone Number (do not use hyphens) |

|

|

|

|

|

|

|

Ext. |

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Institution Street Address/PO Box

City |

State |

Zip Code |

E 4 1 4 U T R |

+ |

|

02T1KA_WEB

.

+

12.Form

A.Taxpayer Identification Number (TIN)

Enter the TIN for the new Holder or new Custodian in the appropriate box. For individuals, this is your Social Security number (SSN).

For other entities, it is your Employer Identification Number (EIN). For joint tenant accounts, the TIN provided must belong to the first owner on the registration to avoid backup withholding. COMPLETE ONLY ONE BOX.

Social Security Number (do not use hyphens) |

Employer Identification Number (do not use hyphens) |

OR

B. Federal Tax Classification

Check appropriate box (required); check only ONE of the following boxes:

Individual / Sole |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trust / |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Proprietor or Single- |

|

|

|

C Corporation |

|

|

|

S Corporation |

|

|

|

Partnership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estate |

||||

Member LLC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: For a

C. Exempt Payee Code (if any)

If you are exempt from backup withholding, enter in the Exemptions box, any code that may apply to you.

See Exempt payee codes on the back of this form.

Limited Liability Company

or

Other Classification

If you are an LLC or Other Classification, do not complete this form. You must complete an IRS Form

Exemption from FATCA reporting code (if any)

Not Applicable

(Applies to accounts maintained outside the U.S.)

D. Certification

Under penalties of perjury, I certify that:

1.The number shown on this form is my correct Taxpayer Identification Number, and

2.I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and

3.I am a U.S. citizen or other U.S. person (defined on reverse).

4.The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct (defined on reverse).

Certification Instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return.

This form must be signed and dated for us to accept as proper certification. Send form to Computershare. Do not send to the IRS.

Signature - Please keep signature within the box. |

|

|

Date (mm / dd / yyyy) |

|

|

|

|

|

|

|

Telephone Number (do not use hyphens) |

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E 4 1 5 U T R |

+ |

|

02T1JA_WEB

.

+

How to complete this form

Backup Withholding

The Internal Revenue Service (IRS) requires us to withhold taxes for the applicable rate of backup withholding for U.S. persons without a

Receipt of a completed Form

What Name and Number To Give the Requester

|

For this type of account: |

Give name and SSN of: |

1. |

Individual |

The individual |

2. |

Two or more individuals (joint account) |

The actual owner of the account or, if |

|

|

combined funds, the first individual on |

|

|

the account |

3. |

Custodian account of a minor |

The minor |

|

(Uniform Gift to Minors Act) |

|

4. |

a. The usual revocable savings |

The |

|

trust (grantor is also trustee) |

The actual owner |

|

b. |

|

|

not a legal or valid trust under state |

|

|

law |

|

5. |

Sole proprietorship or disregarded |

The owner |

|

entity owned by an individual |

|

6. |

Grantor trust filing under Optional |

The grantor |

|

Form 1099 Filing Method 1 |

|

|

(see Regulation section |

|

|

|

|

For this type of account: |

Give name and EIN of: |

7. |

Disregarded entity not owned by an |

The owner |

|

individual |

|

8. |

A valid trust, estate, or pension trust |

Legal entity |

9. |

Corporation or LLC electing |

The corporation |

|

corporate status on Form 8832 or |

|

|

Form 2553 |

|

10. |

Association, club, religious, |

The organization |

|

charitable, educational, or other tax- |

|

|

exempt organization |

|

11. |

Partnership or |

The partnership |

12. |

A broker or registered nominee |

The broker or nominee |

13. |

Account with the Department of |

The public entity |

|

Agriculture in the name of a public |

|

|

entity (such as a state or local |

|

|

government, school district, or |

|

|

prison) that receives agricultural |

|

|

program payments |

|

14. |

Grantor trust filing under the Form |

The trust |

|

1041 Filing Method or the Optional |

|

|

Form 1099 Filing Method 2 (see |

|

|

Regulation section |

|

|

|

Exempt payee code. Generally, individuals (including sole proprietors) are not exempt from backup withholding. Corporations are exempt from backup withholding for certain payments, such as interest and dividends. Corporations are not exempt from backup withholding for payments made in settlement of payment card or third party network transactions.

Note. If you are exempt from backup withholding, you should still complete this form to avoid possible erroneous backup withholding.

The following codes identify payees that are exempt from backup withholding:

1

2

3

4

6

7

9

11

12

Limited Liability Company or Other Classification

If you are a Limited Liability Company or Other entity, complete an IRS Form

Definition of a U.S. Person. For federal tax purposes, you are considered a U.S. person if you are:

●An individual who is a U.S. citizen or U.S. resident alien,

●A partnership, corporation, company, or association created or organized in the United States or under the laws of the United States,

●An estate (other than a foreign estate), or

●A domestic trust (as defined in Regulations Section

Exemption from FATCA reporting: If you are submitting this form for an account that is maintained in the United States, you are exempt from FATCA reporting.

E 4 1 6 U T R |

+ |

|

02T1JA_WEB

Form Data

| Fact Name | Description |

|---|---|

| Address for Submission | The Computershare Transfer Request form should be sent to Computershare PO Box 505013, Louisville, KY 40233-5013. |

| Website Information | More information can be found at www.computershare.com/investor. |

| Medallion Signature Guarantee Requirement | Signatures on the Transfer Request form must be stamped with a Medallion Signature Guarantee, not a notary seal. |

| Types of Transfers | The form allows for the specification of transfer type such as Private Sale, Gift, Inheritance, or No Change of Ownership, with a default to Gift if not specified. |

Instructions on Utilizing Computershare Transfer Request

When you're preparing to transfer securities through Computershare, filling out the Transfer Request form accurately is a critical step. This form is used to officially record the change of ownership from the current holder to a new one. To ensure the process runs smoothly and efficiently, it's important to follow each step carefully, providing all required details in a clear and legible manner. After submission, Computershare will process your request, which may involve verifying the information provided and ensuring all necessary signatures and legal requirements are met. By understanding and following the steps below, you'll be on your way to successfully transferring your securities.

- Start by writing the Name of Current Account Holder as it appears on your account statement.

- Include Joint Tenant information if applicable.

- Fill in the Address, including City, State, Zip, and note the Computershare PO Box number as well as their website.

- Provide the Current Holder Account Number and the Company Name associated with the securities being transferred.

- Indicate the current account type: choose between Non-Custodial Registrations and Custodial Registrations. Follow the instructions specific to your selection:

- For Non-Custodial Registrations, complete section 2.

- For Custodial Registrations, the Custodian completes section 3 on the reverse page.

- If applicable, enter all required information under Non-Custodial Registrations or Custodial Registrations, such as Tax ID/SSN, telephone number, names/registrations on the current account, address details, and custodian information.

- Clearly indicate the Cost Basis/Reason for Transfer by checking the applicable box and providing additional information such as date of sale, cost per share, date of gift, or date of death and value per share for inheritance.

- Decide whether to Transfer All Securities or to Transfer Shares As Instructed Below. If selecting option B, specify the security description/share type and the exact number of shares to transfer.

- All current holders or legally authorized representatives must sign the form. Note that a Medallion Guarantee Stamp is required for each signature, and a Notary Seal is not acceptable.

- Finally, specify the New Account Type you are transferring the shares to, complete the relevant section (Non-Custodial Registrations section 8 or Custodial Registrations section 9), and provide all requested information regarding the new account.

After completing these steps, review your form for accuracy before submitting it to Computershare. Ensure all required sections are filled out and that you've obtained the necessary Medallion Guarantee Stamps. Submitting a correctly filled form helps in avoiding delays or issues in the transfer process.

Obtain Answers on Computershare Transfer Request

Understanding how to properly fill out and use a Computershare Transfer Request form is key to a smooth transfer process. Below are some frequently asked questions that may help guide you through this procedure.

What is a Computershare Transfer Request form?

This form is used when an individual or entity wishes to transfer ownership of stocks or securities. This could be due to a sale, gift, inheritance, or changes in account type or custodian. The form captures all necessary details to ensure a correct and legal transfer.

Who needs to sign the Computershare Transfer Request form?

All current registered holders listed on the account must sign the form. If a legal representative is acting on behalf of the holder(s), their signature is required alongside their capacity (e.g., executor, trustee). Keep in mind, the signature(s) need a Medallion Signature Guarantee.

What is a Medallion Signature Guarantee, and why is it required?

A Medallion Signature Guarantee is a stamp that verifies your identity and your signature. It is a security measure to prevent fraud. Banks, savings institutions, and brokers can provide this service. A notary seal cannot replace this requirement.

Can I submit a transfer request without a Medallion Signature Guarantee?

No, a Medallion Signature Guarantee is a strict requirement for the form to be processed. Attempting to submit without one will likely result in the transfer being delayed or rejected.

How do I complete the 'Cost Basis/Reason for Transfer' section?

You must indicate the purpose of the transfer here, selecting from options like private sale, gift, inheritance, or no change of ownership. For sales and inheritances, you'll provide the date and value per share. This section helps determine how the transfer is processed and its tax implications.

What should I do if I'm transferring shares to a new type of account?

The form has sections to indicate whether you're transferring to a non-custodial or custodial registration. Fill in the appropriate section based on the new account type, providing all requested details about the new holder or custodian.

Where do I send the completed form?

The form should be sent to Computershare at the address provided at the top: PO Box 505013, Louisville, KY 40233-5013. Always review for any updates on the Computershare website before mailing.

How do I know if my transfer request has been processed?

Computershare typically notifies account holders once a transfer is complete. However, for peace of mind, you can contact them directly to inquire about the status of your transfer request, using the telephone number or email provided on their website.

Each transfer request is unique, and situations may vary. If you have any doubts or specific circumstances not covered here, it's recommended to directly consult Computershare for the most accurate guidance.

Common mistakes

Failing to print clearly: When details are not legible, this can lead to errors in processing the transfer request, impacting the timeliness and accuracy of the transaction.

Incorrectly filling out the Current Account Type: Many people skip or incorrectly complete the section regarding whether their account is a Non-Custodial or Custodial registration, which is crucial for proper handling of the transfer.

Using hyphens in telephone numbers and tax IDs: The form specifies that these should be written without hyphens, but this detail is often overlooked, potentially leading to processing delays.

Not including all names/entities listed on the account in the Current Holder Information or Current Custodian Information sections: Every name and entity must be accurately listed to ensure the correct parties are involved in the transfer.

Choosing more than one reason for the transfer without clear indication leads to confusion and improper treatment of the transfer, especially for transactions made after 12/31/10 where specific tax implications need clarity.

Incomplete share transfer instructions: When opting to transfer specific shares (Option B), failure to provide comprehensive details about the securities can stall the process.

Not obtaining a Medallion Signature Guarantee for authorization: Signatures must be verified through this specialized certification, and using a notary seal instead, which is a common mistake, is not acceptable.

Leaving the New Account Type section incomplete or incorrectly filled: This information is vital for directing the shares to the proper account type, and any mistakes here can lead to the rejection of the transfer request.

Adhering to every detail requested on the form and avoiding these common mistakes will make the transfer process smoother and less stressful for all parties involved. Following instructions closely avoids unnecessary delays or the need to resubmit the form, ensuring that the transfer of securities is executed as intended.

Documents used along the form

When engaging in stock transactions or transfers through Computershare, individuals often find it necessary to supplement their Computershare Transfer Request form with various additional forms and documents. These additional materials help in ensuring the transfer process is executed smoothly and complies with legal and regulatory requirements. The following forms and documents are commonly used alongside the Computershare Transfer Request form:

- Stock Power Form: This document grants authority to transfer ownership of stock from the seller to the buyer. It is particularly useful when physical stock certificates are involved, helping facilitate the transfer without requiring the certificate itself to be endorsed.

- W-9 Form (Request for Taxpayer Identification Number and Certification): To comply with tax laws, this form is often required for verifying the taxpayer identification number (TIN) or Social Security number (SSN) of the individuals involved in the transfer. It helps in preventing tax withholding on interest, dividends, and other income associated with the shares.

- Medallion Signature Guarantee: While not a form per se, a Medallion Signature Guarantee is typically required on the Computershare Transfer Request form to verify the identity of the signatories, adding an extra layer of security to prevent fraud. It must be obtained from an eligible financial institution participating in the Medallion program.

- Death Certificate: In the event that the transfer involves shares from a deceased individual's estate, a certified copy of the death certificate is usually required. This document serves as legal proof of death and is crucial for transferring assets under the name of the deceased.

- Affidavit of Domicile: This legal document is used to confirm the legal residence of the deceased at the time of death. It is often necessary when transferring securities or shares as part of settling an estate, as it helps establish the jurisdiction for tax purposes.

Each of these documents plays a pivotal role in ensuring that the transfer of shares through Computershare is handled effectively and in accordance with the relevant laws and regulations. Whether it's confirming the legal authority to transfer shares, verifying taxpayer information, or proving the circumstances of a transfer due to inheritance, these documents complement the Computershare Transfer Request form, facilitating a smoother transaction process.

Similar forms

Stock Power Form: Similar to the Computershare Transfer Request form, a Stock Power Form is used when transferring ownership of stocks. Both require detailed information about the current and new owner, the type of registration, and authorized signatures with a Medallion Signature Guarantee.

Transfer on Death (TOD) Registration Form: This document also facilitates the transfer of securities, but specifically at the death of the account holder, similar to how the Computershare form handles inheritances. Both require information about the current account, the beneficiary, and must be properly authorized.

Real Property Deed Transfer Form: Although this form pertains to the transfer of real estate, it shares the requirement for detailed descriptions of the property (in this case, shares) being transferred, the need for clear instructions regarding the transfer, and official notarization or guarantee stamps.

Vehicle Title Transfer Form: Used for transferring ownership of a vehicle, this document requires information similar to that on the Computershare Transfer Request form, such as the current owner's details, the recipient's details, and an authorized signature, albeit for a different type of asset.

Change of Account Ownership Form: Financial institutions use this for changing the account holder's name, closely mirroring the Computershare form’s function for transferring securities between account types or owners, including verification and authorization sections.

IRA (Individual Retirement Account) Transfer Form: This form is used to move IRA assets between custodians, similar to the Computershare's handling of custodial registrations. It includes identifying information for both the current and new custodian, plus the owner's authorization.

Gift Letter for Mortgage Down Payment: While its purpose is different, being a document to prove that funds given for a down payment are not a loan, it requires similar attestations to a gift transfer in the Computershare form, including details about the giver, recipient, and the nature of the transfer.

Life Insurance Policy Change of Beneficiary Form: This form, used to designate or change a beneficiary on a life insurance policy, requires the policy owner's details, the current beneficiary's details, and the new beneficiary's details — echoing the transfer sections of the Computershare form.

Bank Account Authorization Change Form: For altering who can control or access a bank account, this form necessitates information on the account, the current authorized individuals, and the new ones, similar to the Computershare requirement for signatures and details of both current and new holders for transfers.

Probate Transfer Form: Related to the legal process following death, this form assists in transferring assets as dictated by a will or inheritance laws, requiring details about the decedent's assets similar to how the Computershare form handles inherited stocks or securities.

Dos and Don'ts

When filling out the Computershare Transfer Request form, accuracy and attention to detail are crucial to ensure the smooth transfer of securities. Below are nine essential dos and don'ts to help guide you through the process:

- Do print clearly throughout the form to avoid misinterpretation or delays in processing your request.

- Do ensure all current holder information matches exactly with the information as shown on the stock certificate or a Computershare-issued statement for book-entry shares.

- Do check the appropriate box under the "COST BASIS/REASON FOR TRANSFER" section to clarify the purpose of the transfer, as failing to do so may result in the default treatment of the transfer as a gift.

- Do acquire a Medallion Signature Guarantee for all required signatures from a qualified financial institution to validate the identity of the signatories.

- Do include all current registered holders' signatures or that of a legally authorized representative, indicating their capacity next to the signature.

- Don't use hyphens when entering Social Security or Tax Identification Numbers, telephone numbers, or Custodian Account Numbers.

- Don't check more than one box in the "COST BASIS/REASON FOR TRANSFER" section to avoid confusion or incorrect processing of your transfer request.

- Don't leave the date of sale or death blank in the "COST BASIS/REASON FOR TRANSFER" section if selecting a Private Sale or Inheritance transfer, as defaults may not accurately reflect your situation.

- Don't use a notary seal as a substitute for the required Medallion Signature Guarantee.

By following these guidelines, you can facilitate a smoother, error-free transfer process with Computershare.

Misconceptions

There are several misconceptions about the Computershare Transfer Request form that can lead to confusion and errors in the process of transferring securities. Understanding these misconceptions is crucial for a smooth transfer process.

Only the current account holder needs to sign: All current registered holders, or a legally authorized representative, must sign the form. This ensures that the transfer has the consent of all parties involved in the current account.

A notary seal is sufficient for authorization: The form requires a Medallion Signature Guarantee, not a notary seal. The guarantee provides a higher level of security and is recognized by financial institutions.

Any type of transfer requires tax information: While the form asks for tax information, the necessity of these details varies depending on the type of transfer. It's always best to consult with a tax advisor for the specific implications of each transfer.

Personal address changes can be made on this form: Address changes are not the purpose of this form. It is specifically designed for transferring securities, not for updating personal details.

Checking multiple purposes of transfer is allowed: You can only select one purpose for the transfer. Checking multiple boxes will lead to your transfer being processed without any specific designation, potentially causing delays.

The cost basis is automatically calculated: The form requests information on the cost basis for certain types of transfers, but this does not mean it's calculated automatically. Proper documentation must be provided, especially for private sales or inheritances.

Shares can only be transferred in whole numbers: Fractional shares can also be transferred using this form. This is crucial for ensuring that an entire portfolio is moved without needing to sell or buy shares to make a whole number.

The form is only for individual accounts: It can be used for various types of registrations, including joint tenants, corporations, trusts, and custodial registrations. This allows for flexibility in managing and transferring securities across different account types.

Electronic submission is an option: Currently, the form must be printed, filled out, and mailed. The requirement for a Medallion Signature Guarantee makes electronic submission not feasible at this time.

There's no need to specify the new account type: The form requires details about the account the shares are being transferred to. Failing to provide this information could lead to delays or the transfer not being processed according to the account holder's intentions.

Debunking these misconceptions is essential to ensure that the process of transferring securities via Computershare is carried out correctly and efficiently. Always read the instructions carefully and consult with a professional if in doubt.

Key takeaways

When dealing with the Computershare Transfer Request form, it's essential to adhere to specific guidelines to ensure a smooth transfer process. Below are five key takeaways that should be kept in mind:

- Ensure that all the information entered matches exactly what is found in your account statements. This includes the correct spelling of names, the current address, and the accurate account number. Any discrepancy could lead to delays or rejection of the transfer request.

- A Medallion Signature Guarantee is required for all signatures on the form. This is different from a notary seal. A Medallion Signature Guarantee can typically be obtained from an eligible financial institution, like a bank or brokerage. Its purpose is to protect against fraudulent transfers.

- Clearly indicate the type of transfer you intend to make by checking the appropriate box in the "Cost Basis/Reason for Transfer" section. Whether it's a gift, sale, or inheritance, this information will determine how the transfer is processed and may have tax implications.

- If transferring shares to a new type of account, accurately completing the details about the new account holder or custodian is crucial. This includes choosing the right registration type and providing the necessary contact and identification details.

- For those transferring only a portion of their shares, the form provides an option to specify which shares and how many of them you wish to transfer. It's important to complete this section thoroughly to ensure that only the intended shares are moved.

By paying close attention to these details and carefully filling out the Computershare Transfer Request form, you can help ensure that your share transfer proceeds smoothly and efficiently.

Popular PDF Forms

8500-7 - This official form is critical for recording eye health evaluations specifically for aviation purposes.

Donate My Motorcycle - Embark on a journey with peace of mind by signing the release form, safeguarding the organizers and yourself as you enjoy the ride for a cause.

Wood Destroying Organism Inspection Report - Details previous treatments and provides no assurances regarding work done by other companies, urging consultation with them for warranty details.