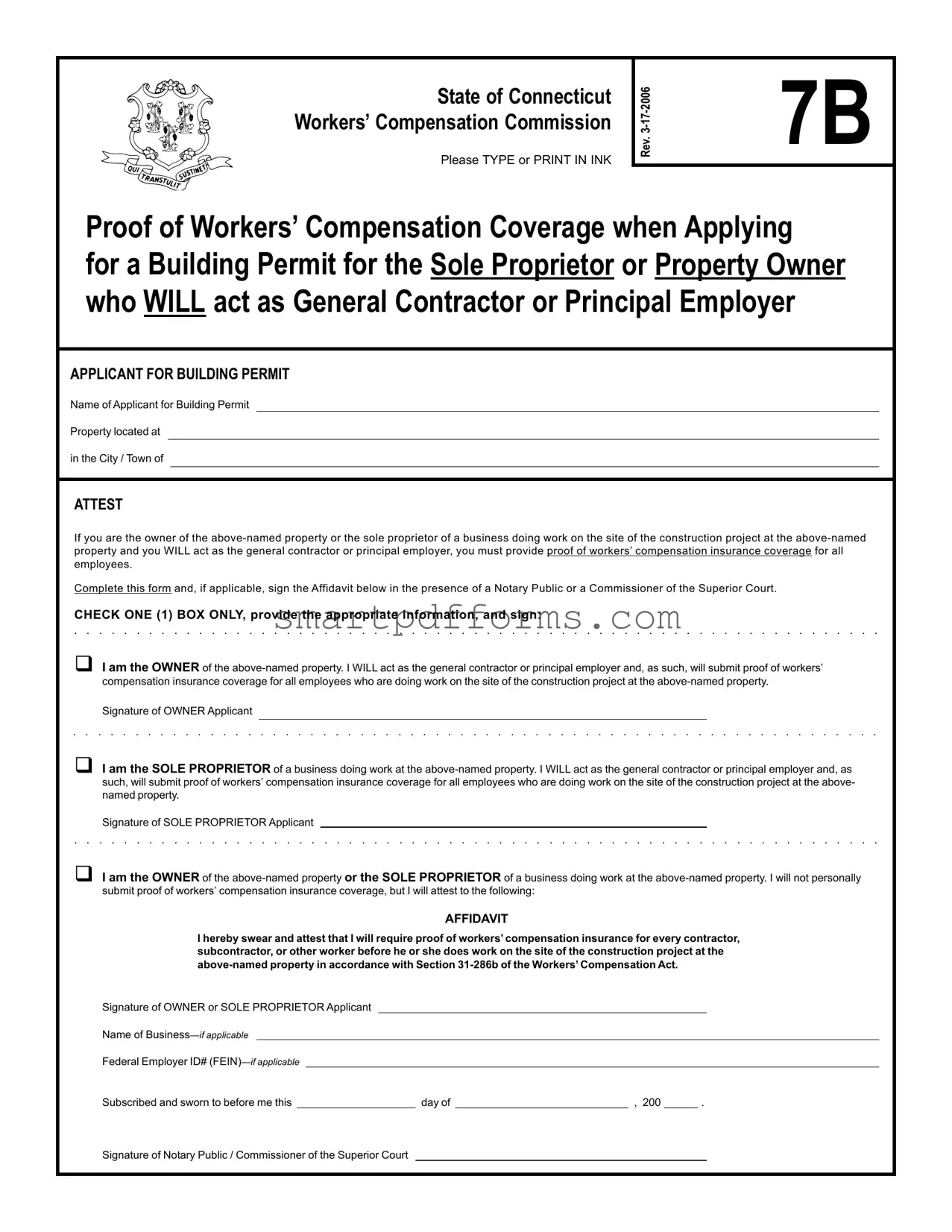

Blank Connecticut 7B PDF Template

In Connecticut, navigating the requirements for workers’ compensation insurance coverage is a critical step for sole proprietors and property owners who decide to take on the role of general contractors or principal employers on construction projects. The Connecticut 7B form serves as a cornerstone in this process, designed to ensure that those in charge of construction activities are adequately covered in terms of workers' compensation insurance. This form must be completed and submitted when applying for a building permit, signifying the applicant's responsibility for either submitting proof of workers’ compensation insurance for all employees working on the project or, alternatively, attesting to the requirement of such proof from all contractors and subcontractors involved. Whether you are the owner of the property undergoing work or the sole proprietor of a business engaged in the project, the 7B form stands as a testament to your commitment to adhering to the Workers’ Compensation Act, particularly Section 31-286b. Simplifying legal compliance and promoting a safer work environment, the diligent completion of this form, which requires notarization, underscores the importance of both understanding and enforcing workers' compensation insurance coverage for the benefit of all parties involved in construction projects within the state.

Preview - Connecticut 7B Form

State of Connecticut Workers’ Compensation Commission

Please TYPE or PRINT IN INK

Rev.

7B

Proof of Workers’ Compensation Coverage when Applying

for a Building Permit for the Sole Proprietor or Property Owner who WILL act as General Contractor or Principal Employer

APPLICANT FOR BUILDING PERMIT

Name of Applicant for Building Permit

Property located at

in the City / Town of

ATTEST

If you are the owner of the

Complete this form and, if applicable, sign the Affidavit below in the presence of a Notary Public or a Commissioner of the Superior Court.

CHECK ONE (1) BOX ONLY, provide the appropriate information, and sign:

I am the OWNER of the

Signature of OWNER Applicant

I am the SOLE PROPRIETOR of a business doing work at the

Signature of SOLE PROPRIETOR Applicant

I am the OWNER of the

AFFIDAVIT

I hereby swear and attest that I will require proof of workers’ compensation insurance for every contractor, subcontractor, or other worker before he or she does work on the site of the construction project at the

Signature of OWNER or SOLE PROPRIETOR Applicant

Name of

Federal Employer ID#

Subscribed and sworn to before me this |

|

day of |

|

, 200 |

|

. |

Signature of Notary Public / Commissioner of the Superior Court

Form Data

| Fact Number | Fact Detail |

|---|---|

| 1 | The form is specifically for use in the State of Connecticut. |

| 2 | Designed for sole proprietors or property owners acting as general contractors. |

| 3 | It serves as proof of workers’ compensation coverage when applying for a building permit. |

| 4 | Revision of the form took place on March 17, 2006. |

| 5 | The form requires completion in ink or typewritten format. |

| 6 | Governed by Section 31-286b of the Workers’ Compensation Act. |

| 7 | Applicants must attest to providing or requiring proof of workers' compensation insurance. |

| 8 | Includes a section for the applicant to sign in the presence of a notary public or commissioner of the Superior Court. |

| 9 | Offers checkboxes for the applicant to indicate their role as either owner or sole proprietor. |

| 10 | Applicants can attest to requiring proof of workers’ compensation insurance for any contractor, subcontractor, or other worker involved. |

Instructions on Utilizing Connecticut 7B

When applying for a building permit in Connecticut as a sole proprietor or property owner intending to serve as the general contractor or principal employer, it is crucial to demonstrate that you carry workers' compensation insurance for all employees involved in the project. The form 7B from the State of Connecticut Workers’ Compensation Commission is specifically designed for this purpose. Filling it out correctly is essential to comply with state laws and ensure a smooth process in securing your building permit. Here are the detailed steps you need to follow to complete this form accurately.

- At the top of the form, clearly type or write in ink the Name of Applicant for Building Permit. This should be your full legal name.

- Enter the Property located at section with the full address of the construction project, including any apartment or suite numbers if applicable.

- In the City / Town of field, write the name of the city or town where the property is located.

- Under the section titled ATTEST, read the statement carefully to ensure you understand the requirements.

- In the CHECK ONE (1) BOX ONLY section, mark the appropriate box that applies to you. You are either the OWNER of the property or a SOLE PROPRIETOR of a business doing work on the property. Be accurate, as this determines the type of proof you’ll need to provide.

- Sign the form in the space provided for Signature of OWNER Applicant or Signature of SOLE PROPRIETOR Applicant based on your earlier selection.

- If applicable, complete the AFFIDAVIT section by signing to attest that you will require all contractors, subcontractors, or workers to provide proof of workers' compensation insurance before they begin work on the site. This section is crucial if you will not be submitting proof of workers' compensation insurance yourself but will instead ensure that all hired parties provide it.

- Fill out the Name of Business if you are a sole proprietor and the business name is different from your personal name.

- Provide your Federal Employer ID# (FEIN) if applicable. This is required for business entities.

- The form must be finalized and made legally binding by having it Subscribed and sworn to before me this day of, with the date filled in, followed by the Signature of Notary Public / Commissioner of the Superior Court. Find a notary public or commissioner to witness your signature and fill this section.

After completing these steps, review the form to ensure all information is accurate and that no sections have been missed. The correctness of this form is vital for the legal acknowledgment of your workers' compensation coverage as it relates to your building project. Once filled out, submit the form to the appropriate department as part of your building permit application package. This step is crucial in demonstrating your compliance with state regulations regarding workers’ compensation insurance.

Obtain Answers on Connecticut 7B

What is the Connecticut 7B form?

The Connecticut 7B form is a document required by the State of Connecticut's Workers’ Compensation Commission. It serves as proof of workers' compensation insurance coverage. Specifically, it is used when a building permit is applied for by a sole proprietor or a property owner who intends to act as the general contractor or principal employer on a construction project. This form ensures that all employees working on the site are covered under workers’ compensation insurance.

Who needs to complete the Connecticut 7B form?

This form must be completed by property owners or sole proprietors who are applying for a building permit and will act as the general contractor or principal employer on a construction site. Its purpose is to attest to the coverage of workers' compensation insurance for all individuals engaged in the work on the project site.

What information is required on the 7B form?

The form requires the name of the applicant for the building permit and the location of the property where construction will take place. The applicant must check one of the boxes to indicate whether they are the owner of the property or the sole proprietor of a business undertaking the work. Depending on the box checked, the applicant must provide assurance of workers' compensation insurance for all employees. If applicable, the form concludes with the signature of the applicant being notarized.

How do I submit proof of workers’ compensation insurance coverage?

Proof of workers' compensation insurance coverage can be submitted alongside the Connecticut 7B form. This typically involves providing a copy of the insurance policy that lists all employees covered by the policy. The specific details of what must be included can vary, so it is advisable to consult with an insurance professional or the Workers’ Compensation Commission for guidance on the appropriate documentation to submit.

What if I do not personally have workers’ compensation insurance but require it from contractors?

If you do not personally have workers' compensation insurance but will instead require all contractors, subcontractors, or workers to provide their own, you must attest to this commitment in the affidavit section of the Connecticut 7B form. This includes swearing and attesting to require proof of such insurance for every individual before they start work on the construction site, in compliance with Section 31-286b of the Workers’ Compensation Act.

Where can I find the Connecticut 7B form?

The Connecticut 7B form is available through the State of Connecticut Workers’ Compensation Commission. It can typically be obtained from their official website or by contacting the commission directly. They can provide the most current version of the form and any additional instructions for completing and submitting it properly.

What are the consequences of failing to provide a completed Connecticut 7B form?

Failing to provide a completed Connecticut 7B form when applying for a building permit may result in the denial of the permit application. Additionally, if it is discovered that work commenced without proper workers' compensation coverage for employees, the property owner or sole proprietor may face penalties, including fines or legal action, under Connecticut law and the Workers’ Compensation Act. Ensuring that this form is properly filled out and submitted with the requisite proof of insurance is crucial for compliance and for the protection of all individuals involved in the construction project.

Common mistakes

Filling out the Connecticut 7B form, crucial for ensuring compliance with workers' compensation insurance coverage requirements for construction projects, can be daunting. Common mistakes can lead to unnecessary delays, penalties, or even legal complications. Awareness of these pitfalls is the first step towards accurate and efficient form completion.

Not specifying the role clearly: Applicants must check one box only to indicate if they are the owner or the sole proprietor acting as the general contractor or principal employer. Overlooking this step can cause confusion regarding the applicant's responsibilities.

Failing to provide complete property details: The form requires precise location information of the construction project. Incomplete or inaccurate details can invalidate the form.

Incorrectly signing the affidavit: The affidavit section necessitates careful attention. It should be signed in the presence of a Notary Public or a Commissioner of the Superior Court, a step frequently missed or overlooked.

Using the wrong ink: The form stipulates that entries must be typed or filled out in ink. Using pencil or other erasable mediums can lead to important information being altered or becoming illegible.

Omitting the business name and FEIN: For sole proprietors, providing the name of the business and the Federal Employer Identification Number (FEIN), if applicable, is mandatory. Skipping these fields can lead to processing delays.

Not providing proof of insurance: Evidence of workers' compensation insurance coverage for all employees is essential. Neglecting to attach this proof invalidates the declaration made in the form.

Leaving the date field blank: The date when the affidavit was signed, verified by a Notary Public or Commissioner, must be precisely filled. An undated form is considered incomplete.

Inconsistent information: All provided information should be consistent across the form. Inconsistencies between the role indicated (owner or sole proprietor) and the signed declaration can lead to questions about the form's validity.

Not reviewing before submission: Failing to double-check the form for errors or omissions before submission is a common oversight. A careful review could prevent many of the mistakes listed.

Given the significance of the Connecticut 7B form in ensuring compliance with workers' compensation laws, avoiding these common errors is imperative. Attention to detail, careful review, and adherence to instructions can expedite the approval process, facilitating a smoother path towards commencing construction projects legally and safely.

Documents used along the form

In Connecticut, when a sole proprietor or property owner decides to act as a general contractor on a construction project, submitting the Connecticut 7B form is a critical step. This form serves as proof of workers' compensation coverage for all employees engaged in the project. However, form 7B is often not the only document required during this process. Other forms and documents frequently accompany the Connecticut 7B form to ensure compliance with state regulations and to facilitate various aspects of construction project management. Understanding these additional requirements can greatly assist applicants in navigating the legal landscape of construction work in Connecticut.

- Certificate of Insurance: This document serves as proof from an insurance company that the contractor holds the necessary workers' compensation insurance. It outlines the policy's scope, including effective dates and coverage limits.

- Notice of Transaction (Form 6B): Used to notify the Workers’ Compensation Commission when an employer’s business is sold, merged, or otherwise changes hands, ensuring that there's a clear record of who is responsible for providing workers' compensation coverage.

- Construction Permit Application: Required by local municipalities, this application is necessary for approval before any construction work can begin. It usually requires detailed information about the project, including plans and specifications.

- IRS Form W-9: Request for Taxpayer Identification Number and Certification. This form is used to provide the correct taxpayer identification number (TIN) to the person who is required to file an information return with the IRS, ensuring that the contractor complies with tax laws.

- Building Plans and Specifications: Detailed drawings and outlines of the proposed construction project, which are typically reviewed as part of the building permit process to ensure they meet all zoning and building codes.

- Independent Contractor Agreement: A legal document that outlines the terms of the contract between the sole proprietor or property owner and any independent contractors hired for the project. It typically includes details about the work to be performed, deadlines, and payment information.

Together, these forms and documents create a comprehensive framework that supports legal and efficient project management. They not only comply with the state's legal requirements but also help protect the interests of all parties involved in the construction project. While the Connecticut 7B form is a crucial component for proving workers' compensation coverage, the additional documents ensure that the project adheres to broader aspects of legal and fiscal responsibility.

Similar forms

The Form W-9 (Request for Taxpayer Identification Number and Certification) bears similarity to the Connecticut 7B form in that it requires the provision of a Federal Employer Identification Number (FEIN) for entities conducting financial transactions. While the Form W-9 focuses on tax reporting, the 7B form uses the FEIN to establish the legitimacy of businesses for workers' compensation coverage.

Form I-9 (Employment Eligibility Verification) shares traits with the 7B form as both necessitate the validation of legal eligibility - the I-9 for employment in the United States, and the 7B for ensuring that general contractors or principal employers have the necessary workers' compensation insurance for their employees.

The Certificate of Insurance (COI) is akin to the Connecticut 7B form in its role of verifying insurance coverage. A COI provides proof of insurance to third parties, while the 7B necessitates evidence of workers' compensation insurance specifically for those involved in construction projects.

The Building Permit Application has a parallel function with the 7B form as it is another essential document for construction projects. It grants official permission to begin construction, whereas the 7B form ensures that individuals acting as general contractors or employers have secured workers' compensation insurance for their workers.

The OSHA Form 300 (Log of Work-Related Injuries and Illnesses) relates to the Connecticut 7B form by emphasizing workplace safety and compliance. The 7B form ensures workers' compensation coverage upfront, while the OSHA Form 300 tracks any resulting injuries or illnesses from work, contributing to a safer work environment.

Affidavit of Independent Contractor Status presents similarities to the 7B form as it involves the verification of a worker's status. This affidavit assists in classifying a worker as an independent contractor rather than an employee, which affects workers' compensation obligations. In contrast, the 7B form lays the groundwork by requiring proof of workers' compensation insurance for employees.

Dos and Don'ts

Filling out the Connecticut 7B form is a crucial step for sole proprietors or property owners acting as general contractors or principal employers on construction projects. It's essential to complete this form accurately to ensure compliance with workers' compensation insurance requirements. Here are five things you should and shouldn't do when completing this form:

Things You Should Do:

Make sure to type or print in ink to ensure that all information is legible and can be understood clearly by the Workers’ Compensation Commission.

Accurately identify whether you are the property owner or the sole proprietor of a business working on the construction site, as this determines the appropriate proof of insurance you must submit.

Provide all required information related to the construction project, including the specific location and any business or Federal Employer ID# (FEIN), if applicable.

Carefully review the affidavit section before signing, especially if you will not personally submit proof of workers' compensation insurance but will require it from contractors.

Ensure that the form is signed in the presence of a Notary Public or Commissioner of the Superior Court to validate the affidavit.

Things You Shouldn't Do:

Do not leave any sections incomplete; if a section does not apply to you, indicate this appropriately instead of skipping it.

Avoid guessing information; ensure that every detail you enter, especially your Federal Employer ID# (FEIN) and property details, is accurate and verified.

Never sign the affidavit without understanding every statement within it, as this is a legal document attesting to your commitment to comply with workers' compensation requirements.

Don’t use a pencil or any erasable writing tool; all entries should be made permanently to prevent alterations.

Refrain from submitting the form without reviewing it for errors or missing information to avoid delays in your building permit process.

Misconceptions

When it comes to understanding the Connecticut 7B form, there are several misconceptions that can lead to confusion. Here are five common misunderstandings explained:

Only large construction companies need to submit the form. This is incorrect. The form is required from any sole proprietor or property owner who acts as the general contractor or principal employer on a construction project, regardless of the size of the project. This includes individuals overseeing smaller projects or renovations.

The form is optional if you have no employees. Even if you are a sole proprietor without any employees, you are still required to complete and submit the 7B form if you are acting as the general contractor or principal employer. This ensures compliance with state regulations regarding workers' compensation coverage.

Submission of the form is a one-time requirement. Actually, this form must be submitted for each construction project where the individual acts as the general contractor or principal employer. It is not a one-off submission but rather a requirement for each separate project to ensure ongoing compliance with Connecticut's workers' compensation laws.

You only need to submit the form at the end of the project. This is a misconception. The form should be submitted at the time of applying for a building permit, not at the conclusion of the project. Early submission ensures that all workers are covered by workers' compensation insurance before the commencement of the project.

Filling out the form negates the need for actual workers’ compensation insurance. Filling out the 7B form is merely a validation of compliance with the requirement to provide proof of workers' compensation insurance. It does not replace the actual procurement of insurance. Property owners and sole proprietors must still secure and maintain appropriate workers’ compensation insurance coverage for all employees working on the project.

Understanding these misconceptions is crucial for complying with Connecticut's workers' compensation laws and ensuring that all individuals involved in a construction project are properly protected.

Key takeaways

The Connecticut 7B form is a crucial document for sole proprietors or property owners in Connecticut who intend to act as general contractors or principal employers on a construction project. Understanding the key aspects of completing and utilizing this form can ensure compliance with the state's Workers’ Compensation Act. Below are several important takeaways.

- Identification of Role: The Connecticut 7B form requires the applicant to clearly identify whether they are acting as the sole proprietor of a business or the owner of the property where the construction project will take place. This distinction is essential for determining the appropriate legal and insurance obligations.

- Proof of Workers’ Compensation Coverage: It mandates that the applicant must provide proof of workers’ compensation insurance coverage for all employees working on the construction site. This is a critical requirement aimed at protecting workers under the Workers’ Compensation Act.

- Affidavit Requirement: For those not directly submitting proof of workers’ compensation insurance coverage, the form includes an affidavit section. In this part, the applicant swears to require proof of such insurance from every contractor, subcontractor, or worker involved in the construction project. This ensures compliance with Section 31-286b of the Workers’ Compensation Act.

- Notarization: The signature of the applicant, whether they are the owner or the sole proprietor, must be subscribed and sworn to in the presence of a Notary Public or a Commissioner of the Superior Court. This legal acknowledgment is necessary to validate the submission.

- Choice of Commitment: The form provides checkboxes for applicants to indicate their commitment regarding workers’ compensation insurance, emphasizing the importance of a clear declaration concerning their role and responsibilities on the construction project.

- Requirement for Detailed Information: Applicants need to provide specific information, including the name of the business (if applicable) and the Federal Employer ID# (FEIN), ensuring that there is clarity about the entity or individual undertaking the project and their legal and tax identification.

- State Compliance: By completing and signing the Connecticut 7B form, property owners or sole proprietors are not only ensuring compliance with the state’s requirements for construction projects but are also taking an important step towards the health and safety of their workers by confirming the presence of workers’ compensation insurance coverage.

In summary, the Connecticut 7B form serves as a vital tool for maintaining legal and ethical standards in construction projects within the state, emphasizing the safety and protection of every worker involved.

Popular PDF Forms

Shipper's Export Declaration - Features a mandatory declaration affirming the shipment meets all air transport requirements for dangerous goods.

Standard Teaching Application Pa - Encouragement to list preferences for grade levels or subjects indicates the application’s aim to match applicant strengths with school needs.