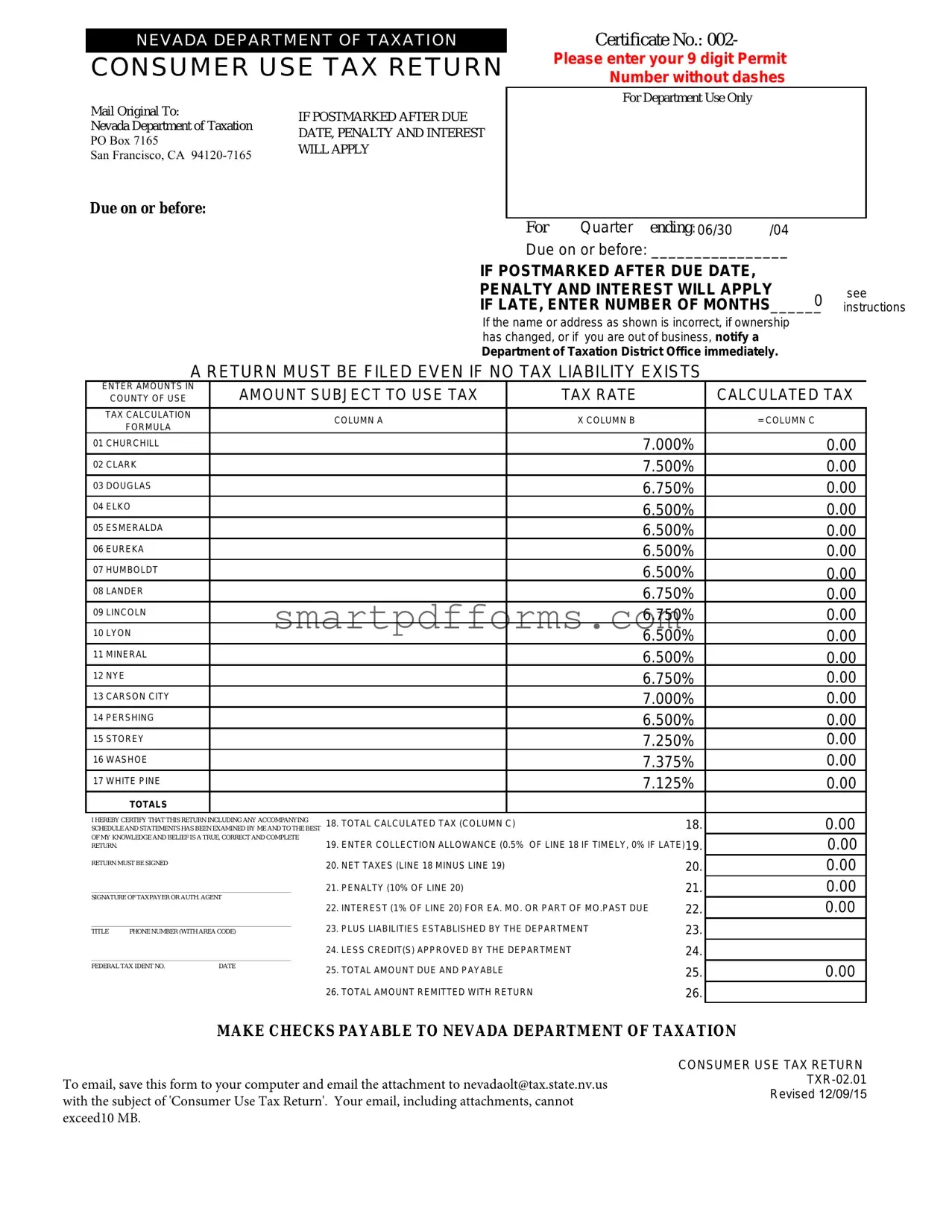

Blank Consumer Use Tax Return Nevada PDF Template

Understanding the nuances of the Consumer Use Tax Return Nevada form is essential for individuals and businesses making purchases in Nevada on which the sales tax has not been paid. The form, overseen by the Nevada Department of Taxation, serves as a crucial tool for reporting and paying use tax, ensuring compliance with state tax laws. It requires detailed information on purchases subject to use tax, broken down by county, allowing for accurate calculation of taxes owed based on varying county tax rates. The form emphasizes the importance of timely filing by outlining penalties and interest for late submissions, demonstrating the state's dedication to maintaining fiscal order. Additionally, it provides for the possibility of adjustments through collection allowances, as well as penalties that underscore the consequences of delay. With fields dedicated to credits from overpayments and liabilities from previous periods, the form ensures thorough accounting for a taxpayer's fiscal responsibilities to the state. This attention to detail not only aids taxpayers in fulfilling their obligations but also streamlines the process, making it as efficient as possible. Furthermore, with options for electronic communication and a promise of support from the Department of Taxation, the form embodies the state’s commitment to assisting taxpayers through every step of the process.

Preview - Consumer Use Tax Return Nevada Form

NEVADA DEPARTMENT OF TAXATION

CONSUMER USE TAX RETURN

Mail Original To: |

IF POSTMARKED AFTER DUE |

Nevada Department of Taxation |

DATE, PENALTY AND INTEREST |

|

PO Box 7165 |

||

WILL APPLY |

||

San Francisco, CA |

||

|

Due on or before:

Certificate No.: 002-

Please enter your 9 digit Permit Number without dashes

For Department Use Only

For Quarter ending: 06/30 /04

Due on or before: ________________

IF POSTMARKED AFTER DUE DATE, PENALTY AND INTEREST WILL APPLY

IF LATE, ENTER NUMBER OF MONTHS 0

______

If the name or address as shown is incorrect, if ownership has changed, or if you are out of business, notify a

Department of Taxation District Office immediately.

see instructions

A RETURN MUST BE FILED EVEN IF NO TAX LIABILITY EXISTS

ENTER AMOUNTS IN |

AMOUNT SUBJECT TO USE TAX |

|

TAX RATE |

|

|

CALCULATED TAX |

|

COUNTY OF USE |

|

|

|

||||

|

|

|

|

|

|

|

|

TAX CALCULATION |

|

COLUMN A |

|

X COLUMN B |

|

|

= COLUMN C |

FORMULA |

|

|

|

|

|||

|

|

|

|

|

|

|

|

01 CHURCHILL |

|

|

|

|

7.000% |

0.00 |

|

02 CLARK |

|

|

|

|

7.500% |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

03 DOUGLAS |

|

|

|

|

6.750% |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

04 ELKO |

|

|

|

|

6.500% |

0.00 |

|

|

|

|

|

|

|||

05 ESMERALDA |

|

|

|

|

6.500% |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

06 EUREKA |

|

|

|

|

6.500% |

0.00 |

|

|

|

|

|

|

|||

07 HUMBOLDT |

|

|

|

|

6.500% |

0.00 |

|

|

|

|

|

|

|||

08 LANDER |

|

|

|

|

6.750% |

0.00 |

|

|

|

|

|

|

|||

09 LINCOLN |

|

|

|

|

6.750% |

0.00 |

|

|

|

|

|

|

|||

10 LYON |

|

|

|

|

6.500% |

0.00 |

|

|

|

|

|

|

|

|

|

11 MINERAL |

|

|

|

|

6.500% |

0.00 |

|

|

|

|

|

|

|||

12 NYE |

|

|

|

|

6.750% |

0.00 |

|

|

|

|

|

|

|||

13 CARSON CITY |

|

|

|

|

7.000% |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 PERSHING |

|

|

|

|

6.500% |

0.00 |

|

|

|

|

|

|

|||

15 STOREY |

|

|

|

|

7.250% |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 WASHOE |

|

|

|

|

7.375% |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 WHITE PINE |

|

|

|

|

7.125% |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTALS |

|

|

|

|

|

|

|

I HEREBY CERTIFY THAT THIS RETURN INCLUDING ANY ACCOMPANYING |

18. TOTAL CALCULATED TAX (COLUMN C) |

|

|

18. |

0.00 |

||

SCHEDULE AND STATEMENTS HAS BEEN EXAMINED BY ME AND TO THE BEST |

|

|

|||||

OF MY KNOWLEDGE AND BELIEF IS A TRUE, CORRECT AND COMPLETE |

19. ENTER COLLECTION ALLOWANCE (0.5% OF LINE 18 IF TIMELY, 0% IF LATE)19. |

0.00 |

|||||

RETURN. |

|

||||||

RETURN MUST BE SIGNED |

|

20. NET TAXES (LINE 18 MINUS LINE 19) |

|

|

20. |

0.00 |

|

|

|

|

|

||||

_______________________________________________________________ |

21. PENALTY (10% OF LINE 20) |

|

|

21. |

0.00 |

||

SIGNATURE OF TAXPAYER OR AUTH. AGENT |

22. INTEREST (1% OF LINE 20) FOR EA. MO. OR PART OF MO.PAST DUE |

22. |

0.00 |

||||

|

|

||||||

_______________________________________________________________ |

23. PLUS LIABILITIES ESTABLISHED BY THE DEPARTMENT |

|

23. |

|

|||

TITLE PHONE NUMBER (WITH AREA CODE) |

|

|

|||||

_______________________________________________________________ |

24. LESS CREDIT(S) APPROVED BY THE DEPARTMENT |

|

24. |

|

|||

FEDERAL TAX IDENT NO. |

DATE |

25. TOTAL AMOUNT DUE AND PAYABLE |

|

|

25. |

0.00 |

|

|

|

|

|

||||

|

|

26. TOTAL AMOUNT REMITTED WITH RETURN |

|

|

26. |

|

|

MAKE CHECKS PAYABLE TO NEVADA DEPARTMENT OF TAXATION

*001063004000000*To email, save this form to your computer and email the attachment to nevadaolt@tax.state.nv.us with the subject of 'Consumer Use Tax Return'. Your email, including attachments, cannot exceed10 MB.

CONSUMER USE TAX RETURN

CONSUMER USE TAX RETURN INSTRUCTIONS

COLUMN A. Amount subject to Use Tax: Enter total purchases subject to use tax on appropriate county line. All purchases of tangible personal property on which no Nevada sales tax has been paid must be entered here.

COLUMN C. Calculated Tax: Multiply taxable amount(s) (Column A) by tax rate(s) (Column B) and enter in Column C.

Note: If you have a contract exemption, give contract exemption number.

TOTALS: Enter total amount of Column A.

LINE 18. Total calculated tax from column C

LINE 19. Collection allowance: Compute 1/2% (or .005) X Line 18 if return and taxes are paid as postmarked on or before the due date as shown on the face of the return. If not postmarked by the due date the collection allowance is not allowed.

LINE 20. Net Taxes Due: Subtract Line 19 from Line 18.

LINE 21. If this return will not be postmarked, and the taxes paid on or before the due date as shown on the face of this

return, a 10% penalty will be assessed. Enter 10% (or .10) times Line 20.

LINE 22. If this return will not be postmarked and the taxes paid on or before the due date as shown on the face of this return, enter 1.5% times line 20 for each month or fraction of a month late, prior to 7/1/99. After 7/1/99, use 1% for each month or fraction of a month late.

LINE 23. Enter any amount due for prior reporting periods for which you have received a Department of Taxation debit notice. Monthly notices received from the Department are not cumulative.

LINE 24. Enter amount due to you for overpayment made in prior reporting periods for which you have received a Department of Taxation credit notice. Monthly notices received from the Department are not cumulative. Do not take the credit if you have applied for a refund.

NOTE: Only credits established by the Department may be used.

LINE 25. Total Taxes Due and Payable: Add Line 20, 21, 22, and 23. Subtract amount on Line 24. Enter total.

LINE 26. Total Amount Remitted: Enter total amount paid with this return.

PLEASE COMPLETE THE SIGNATURE PORTION OF THE RETURN AND RETURN IN THE ENVELOPE PROVIDED.

If you have questions concerning this return, please call one of the Department of Taxation offices listed below.

Carson City (775) |

Las Vegas (702) |

Reno (775) |

CONSUMER USE TAX RETURN INSTRUCTIONS

Revised 12/09/15

Form Data

| Fact | Detail |

|---|---|

| Governing Body | Nevada Department of Taxation |

| Mailing Address | PO Box 7165, San Francisco, CA 94120-7165 |

| Due Date | Specified on the form; penalties apply if postmarked after this date |

| Penalty and Interest | Penalty of 10% and interest of 1% per month for late submissions |

| Use Tax Calculation | Total purchases subject to use tax multiplied by the applicable tax rate |

| Email Submission | nevadaolt@tax.state.nv.us with subject 'Consumer Use Tax Return' |

Instructions on Utilizing Consumer Use Tax Return Nevada

When filling out the Consumer Use Tax Return for Nevada, it's important to follow each step carefully to ensure the form is completed accurately. This form is used to report and pay tax on tangible personal property acquired for use in Nevada when no sales tax has been paid to a Nevada merchant. Details should be entered correctly to avoid penalties and interest for late submissions. Here is a step-by-step guide on how to fill out the form:

- Enter the due date located at the top right corner of the form.

- If applicable, enter the number of months past the due date to determine if penalty and interest charges apply.

- For any corrections to the name or address, or to report changes in ownership or business status, contact the Nevada Department of Taxation immediately.

- In the column labeled "COUNTY OF USE," locate the county where the tangible personal property is used.

- Under "AMOUNT SUBJECT TO USE TAX" (Column A), enter the total purchase amount for items acquired, by county, where Nevada sales tax was not paid.

- Next to each county, notice the "TAX RATE" (Column B) provided and multiply this by the amount entered in Column A to calculate the "CALCULATED TAX" (Column C). Do this for each county where taxable purchases were made.

- Add all the amounts from Column A and enter the total in the "TOTALS" row at the end of the table.

- Repeat the addition for Column C and write the sum in the "TOTAL CALCULATED TAX" (Line 18) at the bottom of the table.

- Calculate the "COLLECTION ALLOWANCE" (Line 19) by multiplying Line 18 by 0.5% (0.005); this is only applicable if the return is postmarked by the due date. Otherwise, enter 0.

- Subtract Line 19 from Line 18 and write this number in "NET TAXES" (Line 20).

- If the form is late, calculate a 10% penalty on the amount in Line 20 and enter this under "PENALTY" (Line 21).

- Calculate interest for late payment under "INTEREST" (Line 22) as 1% of Line 20 for each month or part of a month the payment is late, adjusting the interest rate based on the due date.

- Enter any additional liabilities or credits provided by the Nevada Department of Taxation in Lines 23 and 24, respectively.

- Add Lines 20, 21, and 22, then subtract Line 24, if any, to determine "TOTAL AMOUNT DUE AND PAYABLE" (Line 25).

- Enter the "TOTAL AMOUNT REMITTED WITH RETURN" (Line 26) which should match the total amount due.

- Complete the signature portion at the bottom of the form, including the signature of the taxpayer or authorized agent, title, phone number, federal tax identification number, and date.

After completing the form, review it to ensure all information is correct and mail it to the Nevada Department of Taxation at the address provided, or follow the instructions to email the form if preferred. Remember, timely submission is crucial to avoid penalties and interest charges.

Obtain Answers on Consumer Use Tax Return Nevada

-

What is the Nevada Consumer Use Tax Return, and who needs to file it?

The Nevada Consumer Use Tax Return is a form required by the Nevada Department of Taxation for reporting and paying use tax on purchases of tangible personal property that were bought without paying Nevada sales tax. Generally, individuals or businesses that have made purchases where Nevada sales tax was not collected at the point of sale are required to file this form. This includes online purchases, items bought from out-of-state vendors, and transactions conducted across state lines where the goods are then used, stored, or consumed in Nevada.

-

How is the tax rate determined on the Consumer Use Tax Return?

The tax rate applied to purchases on the Consumer Use Tax Return is determined by the county of use within Nevada. Each county has a specified tax rate that needs to be applied to the total amount of purchases subject to use tax. The return form lists the counties with their corresponding tax rates, requiring the taxpayer to multiply the taxable amount (Column A) by the specified tax rate for their county (Column B) to calculate the tax owed (Column C).

-

What happens if the Consumer Use Tax Return is filed or paid after the due date?

If the Consumer Use Tax Return is filed or the tax payment is made after the designated due date, penalties and interest will apply. A 10% penalty is assessed based on the net taxes due (Line 21), and interest is charged at a rate of 1% per month (or fraction of a month) on the net tax amount for late payments after July 1, 1999. The form encourages prompt filing and payment by offering a collection allowance of 0.5% of the calculated tax if the return and payment are postmarked on or before the due date.

-

How can a taxpayer obtain a refund or credit for overpaid taxes?

A taxpayer can claim a refund or credit for overpaid taxes on the Consumer Use Tax Return by entering the amount due to them for overpayments made in prior reporting periods (Line 24). This amount could be from a credit notice received from the Department of Taxation. However, it is important to note that only credits established by the Department may be used on this form, and the credit should not be taken if the taxpayer has applied for a refund. If in doubt, or to resolve any discrepancies, contacting the Nevada Department of Taxation directly is advised.

Common mistakes

When filling out the Consumer Use Tax Return for Nevada, individuals often make several mistakes that can lead to inaccuracies or even penalties. Understanding these common errors can help ensure that the tax return is completed correctly.

- Not reporting all taxable purchases: Individuals sometimes overlook or forget to report certain purchases on which Nevada sales tax was not paid. It's crucial to include all applicable items bought during the reporting period to avoid underreporting.

- Miscalculating the tax rate: Each county in Nevada has a specific tax rate. Mistakes can happen if the incorrect rate is applied. It is important to use the correct rate for the county where the goods are used or stored.

- Incorrectly calculating the total calculated tax: Errors in multiplying the taxable amount by the tax rate (Column A X Column B) can lead to an incorrect tax liability. Double-checking these calculations can help prevent such errors.

- Forgetting to adjust for timely payment: If taxes are paid on or before the due date, there’s a collection allowance of 0.5% of line 18. Failing to subtract this allowance from the total calculated tax when eligible leads to an overstatement of the net taxes due.

- Not applying the correct penalty and interest: Late submissions are subject to a 10% penalty and 1% interest charge for each month or part of a month past due. Not correctly calculating these amounts can significantly affect the total amount due.

- Omitting prior liabilities or overpayment credits: If there are amounts due from previous periods or credits for overpayments, these should be accurately reflected in the return. Failing to do so can result in discrepancies with the Department of Taxation's records.

- Submission without signature: A common yet critical mistake is to send in the return without the required signature of the taxpayer or authorized agent. This omission can lead to the return being considered incomplete and possibly incurring penalties.

By paying careful attention to these aspects of the Consumer Use Tax Return, filers can avoid common mistakes and ensure their returns are accurate and comply with Nevada tax rules.

Documents used along the form

When handling the Consumer Use Tax Return for Nevada, several other documents often complement the filing process to ensure compliance and accuracy in reporting. These documents range from proving the tax-exempt status of purchases to maintaining accurate records of transactions that may affect the consumer use tax owed.

- Nevada Resale Certificate: This document is crucial for businesses that purchase goods intended for resale. It allows businesses to buy items without paying sales tax at the point of purchase, on the condition that the items are resold and the sales tax is collected from the final customer. The certificate must be presented to the seller at the time of purchase to avoid the sales tax charge.

- Sales and Use Tax Exemption Certificate: Used by eligible entities, such as government agencies and nonprofit organizations, this certificate exempts the holder from paying sales and use tax on qualified purchases. The entity must provide the seller with this certificate to make tax-exempt purchases legally.

- Purchase Invoices: Keeping detailed invoices of all purchases made by a business is crucial. These records should clearly indicate whether sales tax was paid at the point of purchase. Invoices serve as the primary documentation when reporting taxable purchases on the Consumer Use Tax Return if the items were not taxed or were under-taxed at the time of purchase.

- General Ledger Accounts: Companies often use general ledgers to record and track all their financial transactions. Regarding consumer use tax, the ledger should reflect the purchase of tangible personal property for which Nevada sales tax was not paid. This record helps businesses accurately report and pay their consumer use taxes.

- Exemption and Exclusion Documentation: If a business makes purchases that are exempt from sales and use tax under Nevada law, proper documentation must be maintained. This may include contracts or agreements that qualify the purchase for a specific exemption status, thus affecting the consumer use tax filing.

Together, these documents support the accurate and efficient completion of the Nevada Consumer Use Tax Return. They not only ensure that businesses comply with local tax laws but also help in the proper documentation and tracking of taxable and exempt purchases. It's essential to consult with a tax professional or the Nevada Department of Taxation for guidance on how these documents apply to specific situations.

Similar forms

The Sales and Use Tax Return is remarkably similar to the Consumer Use Tax Return, mainly because both require the taxpayer to calculate taxes due based on purchases. Just as in the Consumer Use Tax Return where the amount subject to use tax is calculated per county, the Sales and Use Tax Return asks for a declaration of sales made, with tax calculated based on jurisdiction-specific rates.

The Business Tax Return shares several similarities with the Consumer Use Tax Return, as both involve the declaration of financial activities to a state's department of taxation. The key difference lies in the nature of the activities reported: while the Consumer Use Tax Return focuses on taxable purchases, the Business Tax Return encompasses a broader range of business financial activities, including income and operational expenses.

Vehicle Use Tax Return forms, required in some jurisdictions for registering vehicles bought out of state, parallel the Consumer Use Tax Return. Both necessitate the reporting and payment of taxes on items purchased without the applicable sales tax, albeit the Vehicle Use Tax Return is specifically designed for vehicle acquisitions.

The State Income Tax Return also bears resemblance to the Consumer Use Tax Return in its fundamental purpose of reporting to a state tax authority. However, it diverges in content and function, focusing on income earned by individuals or entities, and calculating taxes owed based on that income, contrasting with consumption-based tax calculations.

Excise Tax Return forms, used for reporting taxes on specific goods and services like gasoline, alcohol, and tobacco, share the Consumer Use Tax Return’s principle of taxing consumption. The difference primarily lies in the scope of taxed items, with Excise Taxes applying to specific categories of goods or services.

The Property Tax Declaration form, required annually in many jurisdictions for real estate and sometimes personal property, shares the Consumer Use Tax Return's essence of reporting assets to tax authorities. However, it focuses on the valuation of property and calculation of taxes based on property values rather than on consumer purchases.

Gross Receipts Tax Return documents, which apply to businesses in certain areas, necessitate reporting of the total revenue without deductions for business expenses, contrasting with the more focused reporting of untaxed purchases in the Consumer Use Tax Return.

The Employer’s Quarterly Federal Tax Return (Form 941), mandates reporting of payroll taxes withheld from employees' wages, along with the employer's portion of social security and Medicare taxes. Despite its difference in focus—payroll versus consumer purchases—it similarly involves periodic reporting and tax calculation to a governmental authority.

A Charitable Contributions Tax Deduction Form, typically a part of individual income tax returns, shares with the Consumer Use Tax Return the concept of reporting activities that impact one's tax liability, although in this instance, the activity (charitable giving) potentially reduces rather than increases the tax owed.

Dos and Don'ts

When filling out the Nevada Consumer Use Tax Return form, it's essential to be meticulous and informed. The goal is to achieve accuracy in reporting and to avoid common errors that can lead to penalties or delays. Here are some key dos and don'ts to guide you through the process:

Do:- Double-check the permit number: Ensure that the 9-digit Permit Number is entered correctly and without dashes. This is crucial for the Department of Taxation to identify your account.

- Accurately report purchases: In Column A, meticulously list all tangible personal property purchases subject to use tax, for which no Nevada sales tax was paid. Accurate reporting is crucial for compliance and to avoid underpayment penalties.

- Apply the correct tax rates: Different counties have different tax rates. Make sure to apply the correct tax rate in Column B for each county where the personal property is used, as specified on the form.

- Calculate taxes correctly: In Column C, meticulously multiply the taxable amounts by the appropriate county tax rates to determine the calculated tax. Doing this correctly ensures that you're paying the right amount of tax due.

- Sign the form: Ensure that the return is signed by the taxpayer or an authorized agent. An unsigned return can be considered incomplete and lead to processing delays or penalties.

- Miss the deadline: Submitting the form postmarked after the due date will result in penalties and interest. Being punctual avoids unnecessary additional costs.

- Overlook the collection allowance: If eligible (i.e., if your return and payment are on time), remember to enter the collection allowance in Line 19. Missing out on this could mean paying slightly more than necessary.

- Ignore the signature block: Failing to sign the return can lead to its rejection. Ensure that all required fields are filled out and that the return is duly signed.

- Forget to update personal information: If there have been changes to your name, address, ownership, or if your business has closed, inform the Department of Taxation District Office immediately. Failure to do so can lead to communication issues and misdirected notices.

- Discard instructions: Retaining and referring to the Consumer Use Tax Return instructions can be incredibly helpful, especially for clarifications on filling out specific sections of the form or understanding the requirements.

Misconceptions

Understanding the Consumer Use Tax Return in Nevada involves clearing up some common misconceptions. These misunderstandings can lead to errors in filing, potentially resulting in unnecessary penalties or interest charges. Let's clarify some of these misconceptions:

Misconception #1: "If I don't owe any tax, I don't need to file a Consumer Use Tax Return." - Even if no tax is owed, a return must still be filed to stay compliant with Nevada tax laws.

Misconception #2: "Penalties and interest only apply if I’m significantly late with my return." - Penalties and interest can apply immediately following the due date if the return is postmarked after this date, regardless of how late it is.

Misconception #3: "I can estimate the amount subject to tax without receipts." - Accurate records, such as receipts, must be used to determine the total purchases subject to use tax to ensure correctness.

Misconception #4: "The tax rate is the same across all counties." - Tax rates vary by county, making it crucial to apply the correct rate when calculating the tax due.

Misconception #5: "I need a separate form for each county where I owe tax." - The Consumer Use Tax Return form allows for reporting for multiple counties, each in its designated line.

Misconception #6: "Emailing the form without a subject line or exceeding the attachment size is acceptable." - The form must be emailed with the specific subject 'Consumer Use Tax Return' and the attachment size must not exceed 10 MB to be processed correctly.

Misconception #7: "I can only deduct credits approved by the Department of Taxation from my current tax liability." - Although credits established by the Department can reduce the amount owed, they cannot be applied if seeking a refund.

Misconception #8: "The signature portion is optional if I have calculated that no tax is due." - The return must be signed regardless of whether tax is due to be considered complete and valid.

Misconception #9: "I should call any Department of Taxation office for questions about my return." - While it's true you can contact any office, calling the office nearest you may provide faster access to local guidance and support.

Addressing and understanding these misconceptions can help ensure that the Consumer Use Tax Return is filed accurately and on time, thereby avoiding unnecessary penalties and interest.

Key takeaways

Understanding the Consumer Use Tax Return form in Nevada is crucial for individuals and businesses making taxable purchases, where Nevada sales tax has not been previously charged. Here are six key takeaways to ensure compliance and avoid penalties:

- All taxable purchases of tangible personal property, for which no Nevada sales tax has been paid, should be reported in Column A. It's essential to accurately enter the total amount of these purchases to calculate the owed use tax correctly.

- The use tax rate varies by county. As a taxpayer, you must apply the correct tax rate, as shown in Column B, to the amount in Column A to determine the calculated tax in Column C.

- A timely filed return, postmarked on or before the due date indicated on the form, qualifies for a collection allowance. This is calculated as 0.5% (or .005) of Line 18. However, if the return is late, this allowance does not apply, increasing the total amount owed.

- Late returns are subject to penalties and interest. Specifically, a 10% penalty is assessed on the net taxes due (Line 20) if not postmarked by the due date. Additionally, interest is charged at 1% for each month or part of a month the payment is late—calculated from the amount in Line 20.

- It is possible to reduce the amount payable by claiming credits for overpayments or adjustments made in prior reporting periods, as approved by the Nevada Department of Taxation. These credits are entered in Line 24 and can lower the total tax liability.

- The form mandates a signature from the taxpayer or an authorized agent, certifying that the information provided is accurate and complete. This signature portion is crucial for the return’s validity and legal standing.

In summary, attention to detail and adherence to deadlines are paramount when filing the Consumer Use Tax Return in Nevada. Missteps can lead to penalties and increased financial obligations. Therefore, it's advisable for taxpayers to carefully review their purchases, apply the correct tax rates, and ensure timely submission of their use tax returns.

Popular PDF Forms

Certificate of Appreciation Wording Samples - Trainees are provided with this document as evidence of their dedication to upholding the professional standards defined by Illinois statutes for private security careers.

Motion for Contempt Colorado - It serves as an affidavit detailing specific violations of court orders in family or juvenile court matters.

How to Get Msds Sheets - Recommended measures for exposure control and personal protection, including use of specific protective equipment.