Blank Credit Report Dispute PDF Template

When inaccuracies or questionable items appear on one's credit report, taking swift action to rectify these errors is crucial for maintaining financial health. The Credit Report Dispute form serves as a primary tool in this correction process, empowering individuals to formally challenge inaccuracies with credit bureaus. This process is not only vital for ensuring the accuracy of personal financial records but also for safeguarding one’s credit score—a critical factor influencing loan approvals, interest rates, and even employment opportunities. Completing the form requires meticulous attention to detail, as it demands clear identification of disputed items and the provision of supporting documentation to substantiate one’s claim. Utilizing this form effectively can lead to the removal of erroneous information, thereby restoring creditworthiness. Understanding the intricacies of this form and the dispute process is thus indispensable for anyone looking to rectify issues on their credit report. The journey from identifying errors to successfully navigating the dispute process underscores the importance of being informed and proactive about one’s financial rights and responsibilities.

Preview - Credit Report Dispute Form

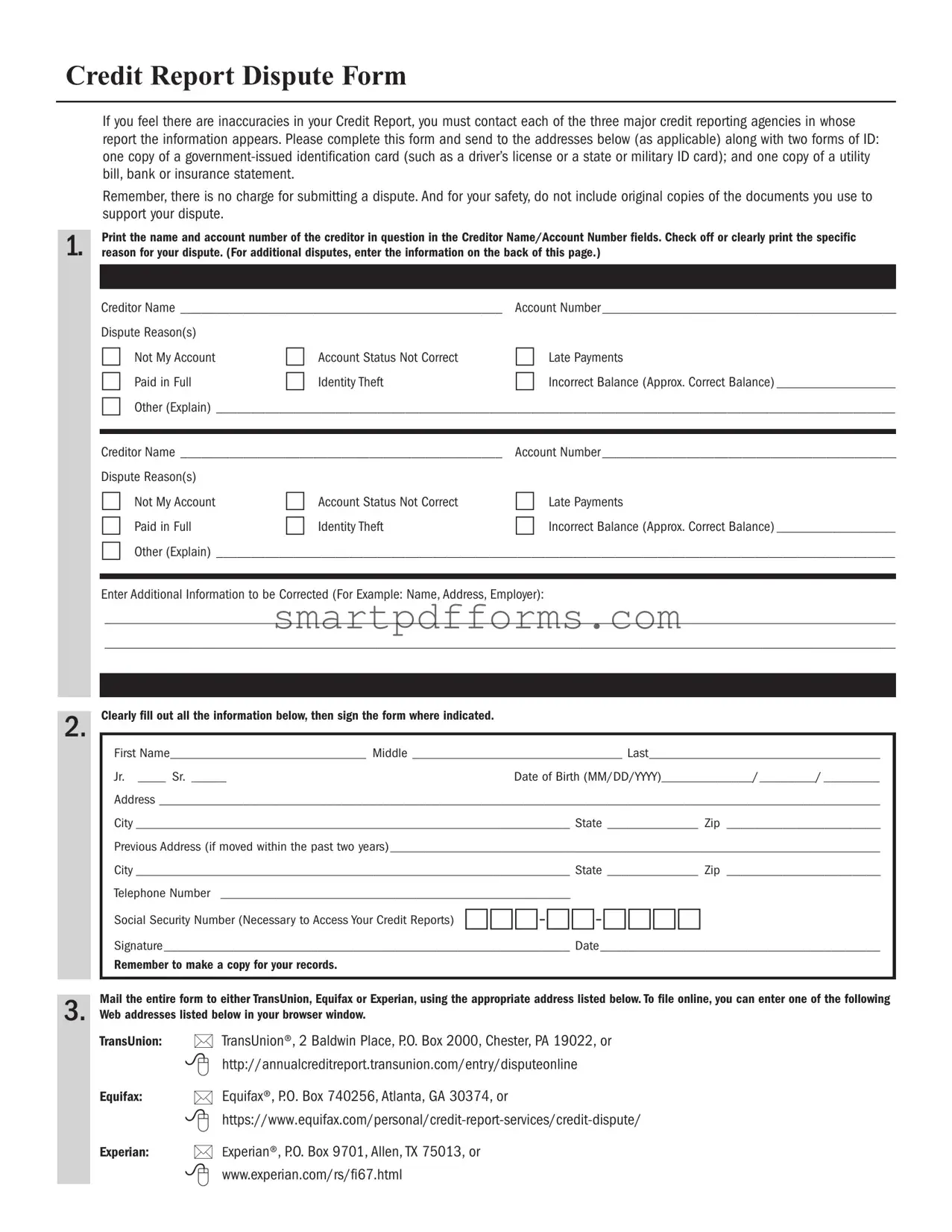

Credit Report Dispute Form

If you feel there are inaccuracies in your Credit Report, you must contact each of the three major credit reporting agencies in whose report the information appears. Please complete this form and send to the addresses below (as applicable) along with two forms of ID: one copy of a

Remember, there is no charge for submitting a dispute. And for your safety, do not include original copies of the documents you use to support your dispute.

Print the name and account number of the creditor in question in the Creditor Name/Account Number fields. Check off or clearly print the specific

1. reason for your dispute. (For additional disputes, enter the information on the back of this page.)

2.

Creditor Name ______________________________________________ |

Account Number __________________________________________ |

|

Dispute Reason(s) |

|

|

□ Not My Account |

□ Account Status Not Correct |

□ Late Payments |

□ Paid in Full |

□ Identity Theft |

□ Incorrect Balance (Approx. Correct Balance) _________________ |

□Other (Explain) _________________________________________________________________________________________________

Creditor Name ______________________________________________ |

Account Number __________________________________________ |

|

Dispute Reason(s) |

|

|

□ Not My Account |

□ Account Status Not Correct |

□ Late Payments |

□ Paid in Full |

□ Identity Theft |

□ Incorrect Balance (Approx. Correct Balance) _________________ |

□Other (Explain) _________________________________________________________________________________________________

Enter Additional Information to be Corrected (For Example: Name, Address, Employer):

_________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________

Clearly fill out all the information below, then sign the form where indicated.

First Name____________________________ Middle ______________________________ Last_________________________________

Jr. ____ Sr. _____Date of Birth (MM/DD/YYYY)_____________/________/ ________

Address _______________________________________________________________________________________________________

City ______________________________________________________________ State _____________ Zip ______________________

Previous Address (if moved within the past two years) ______________________________________________________________________

City ______________________________________________________________ State _____________ Zip ______________________

Telephone Number __________________________________________________

Social Security Number (Necessary to Access Your Credit Reports)

Signature __________________________________________________________ Date________________________________________

Remember to make a copy for your records.

Mail the entire form to either TransUnion, Equifax or Experian, using the appropriate address listed below. To file online, you can enter one of the following

3. Web addresses listed below in your browser window.

TransUnion:

Equifax:

Experian:

•TransUnion®, 2 Baldwin Place, P.O. Box 2000, Chester, PA 19022, or

•http://annualcreditreport.transunion.com/entry/disputeonline

•Equifax®, P.O. Box 740256, Atlanta, GA 30374, or

•

•Experian®, P.O. Box 9701, Allen, TX 75013, or

•www.experian.com/rs/fi67.html

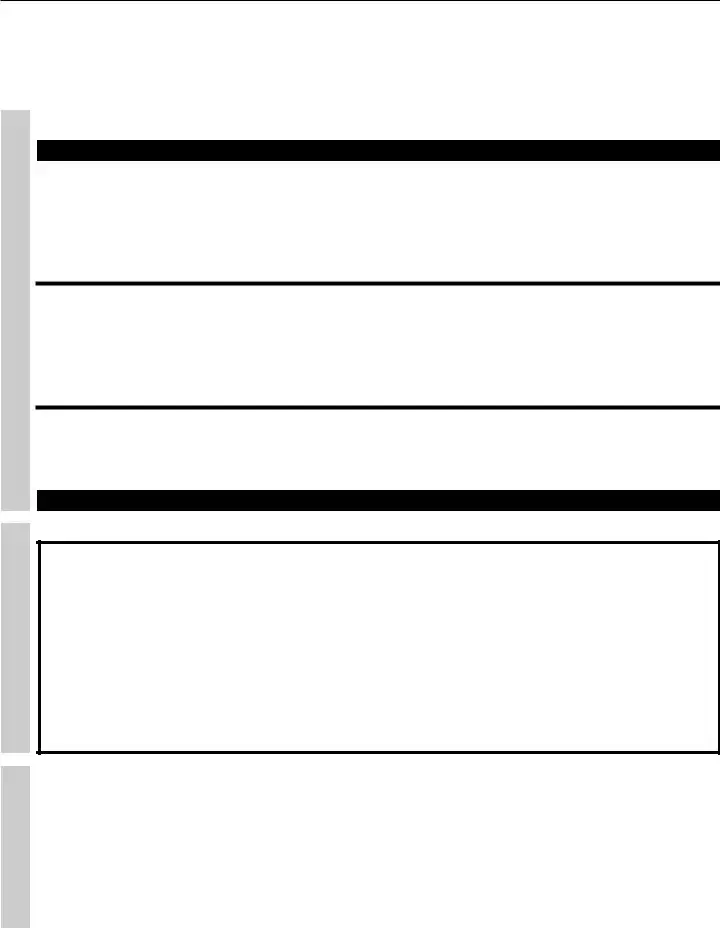

Creditor Name ________________________________________________ |

Account Number_______________________________________________ |

|

Dispute Reason(s) |

|

|

□ Not My Account |

□ Account Status Not Correct |

□ Late Payments |

□ Paid in Full |

□ Identity Theft |

□ Incorrect Balance (Approx. Correct Balance) ______________________ |

□Other (Explain) ________________________________________________________________________________________________________

Creditor Name ________________________________________________ |

Account Number_______________________________________________ |

|

Dispute Reason(s) |

|

|

□ Not My Account |

□ Account Status Not Correct |

□ Late Payments |

□ Paid in Full |

□ Identity Theft |

□ Incorrect Balance (Approx. Correct Balance) ______________________ |

□Other (Explain) ________________________________________________________________________________________________________

Creditor Name ________________________________________________ |

Account Number_______________________________________________ |

|

Dispute Reason(s) |

|

|

□ Not My Account |

□ Account Status Not Correct |

□ Late Payments |

□ Paid in Full |

□ Identity Theft |

□ Incorrect Balance (Approx. Correct Balance) ______________________ |

□Other (Explain) ________________________________________________________________________________________________________

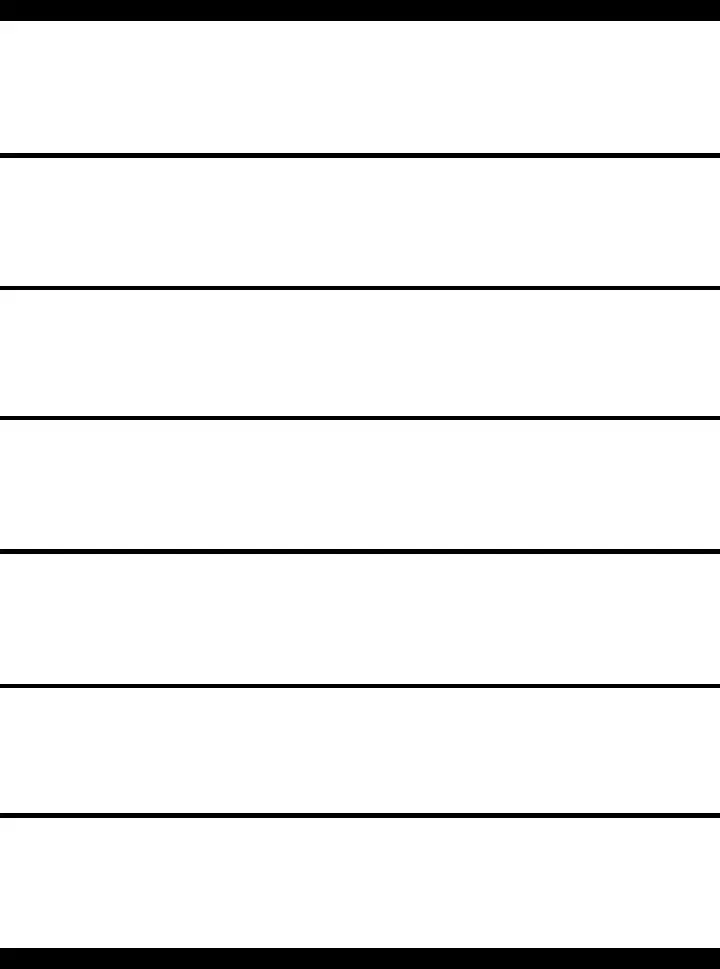

Creditor Name ________________________________________________ |

Account Number_______________________________________________ |

|

Dispute Reason(s) |

|

|

□ Not My Account |

□ Account Status Not Correct |

□ Late Payments |

□ Paid in Full |

□ Identity Theft |

□ Incorrect Balance (Approx. Correct Balance) ______________________ |

□Other (Explain) ________________________________________________________________________________________________________

Creditor Name ________________________________________________ |

Account Number_______________________________________________ |

|

Dispute Reason(s) |

|

|

□ Not My Account |

□ Account Status Not Correct |

□ Late Payments |

□ Paid in Full |

□ Identity Theft |

□ Incorrect Balance (Approx. Correct Balance) ______________________ |

□Other (Explain) ________________________________________________________________________________________________________

Creditor Name ________________________________________________ |

Account Number_______________________________________________ |

|

Dispute Reason(s) |

|

|

□ Not My Account |

□ Account Status Not Correct |

□ Late Payments |

□ Paid in Full |

□ Identity Theft |

□ Incorrect Balance (Approx. Correct Balance) ______________________ |

□Other (Explain) ________________________________________________________________________________________________________

Creditor Name ________________________________________________ |

Account Number_______________________________________________ |

|

Dispute Reason(s) |

|

|

□ Not My Account |

□ Account Status Not Correct |

□ Late Payments |

□ Paid in Full |

□ Identity Theft |

□ Incorrect Balance (Approx. Correct Balance) ______________________ |

□Other (Explain) ________________________________________________________________________________________________________

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form | This form is utilized to dispute inaccuracies or errors found in one’s credit report with the credit reporting agencies. |

| Necessary Information | When filing a dispute, personal identification information, detailed explanations of each dispute, and any supporting documentation are required. |

| Process After Submission | After submission, the credit reporting agency generally has 30 days to investigate the disputes and report back with their findings. |

| Governing Law | The Fair Credit Reporting Act (FCRA) at the federal level governs the process of disputing inaccuracies on a credit report, ensuring consumer rights are protected. |

Instructions on Utilizing Credit Report Dispute

When inaccuracies or outdated information appear on your credit report, it can have a significant impact on your financial health. Fortunately, the process to dispute these errors is straightforward, and taking action can help ensure your credit report accurately reflects your financial history. The first step is filling out a Credit Report Dispute form, a critical process to set the record straight. This guide will walk you through the form step by step, ensuring you know exactly what to do. Once you've submitted the form, the credit bureau has 30 days to investigate your dispute and provide a response, potentially improving your credit if inaccuracies are found and corrected.

- Gather all necessary documents related to your dispute, such as bank statements, loan documents, or proof of identity.

- Identify the specific inaccuracies on your credit report. Be ready to point out exactly what information is incorrect and why.

- Access the Credit Report Dispute form. This can typically be found on the website of the credit bureau that issued your report.

- Fill in your personal information accurately. This includes your full name, address, date of birth, and Social Security Number.

- Detail the disputed items on your credit report. For each item, explain why you believe it is inaccurate and provide any evidence you have to support your claim.

- If you have documents to support your dispute, note on the form that you will be attaching copies. Remember, do not send original documents.

- Review the dispute form thoroughly. Ensure all the information you've provided is accurate and complete, and check for any errors or omissions.

- Submit the form to the credit bureau. Follow the bureau’s instructions for submission, which may include options for mailing, faxing, or submitting the form online.

- Keep a copy of the dispute form and all accompanying documentation for your records. You'll want to have this information on hand should you need to follow up.

After you've submitted the dispute form, the waiting game begins. The credit bureau will investigate your claims within 30 days, reviewing the information you've provided and verifying it with the source of the disputed data. Should your dispute result in changes to your credit report, you'll be sent a copy of the updated report. This process not only helps protect your credit score but also ensures that your credit report is an accurate reflection of your financial history. While it may take some time and effort, correcting inaccuracies on your credit report is a key step in maintaining your financial health.

Obtain Answers on Credit Report Dispute

-

What is a Credit Report Dispute form?

A Credit Report Dispute form is a document used to highlight inaccuracies or errors on your credit report. By filling out and submitting this form to the credit bureau, you request an investigation into the items you believe are incorrect. This could include personal information discrepancies, incorrect account details, or fraudulent accounts reported in your name.

-

How can I obtain a Credit Report Dispute form?

You can obtain a Credit Report Dispute form directly from the major credit bureaus’ websites. Each bureau (Equifax, Experian, and TransUnion) offers a version of the form online, or you can request to have a paper copy mailed to you. It's important to download or request the form from a reputable source to ensure your personal information is protected.

-

What information do I need to include in the form?

The form requires your personal information, such as your full name, Social Security number, date of birth, and current address. Additionally, you'll need to provide details about the specific items you're disputing. This includes the account name, account number (if applicable), and a detailed explanation of why the item is inaccurate. Attaching any supporting documentation can also help strengthen your dispute.

-

How do I submit my Credit Report Dispute form?

Once you've completed the form, you can submit it to the credit bureau either online, by mail, or by fax. The bureau's website will provide specific instructions based on the submission method you choose. If submitting by mail, it's recommended to send it via certified mail with a return receipt requested, so you have proof the bureau received your dispute.

-

How long does it take for a dispute to be resolved?

Credit bureaus typically investigate disputes within 30 days of receipt. However, this process can take longer if additional documentation is requested or if the dispute requires more in-depth investigation. Once the investigation is complete, the credit bureau will send you the results along with an updated copy of your credit report if changes were made.

-

What should I do if my dispute is resolved in my favor?

If the credit bureau resolves your dispute in your favor, they will correct the error and update your credit report accordingly. It's a good idea to obtain a new copy of your credit report to verify that the changes were made. Additionally, you may also want to inform any creditors who received your report with the error, so they too can update their records.

-

What happens if my dispute is not resolved to my satisfaction?

If you're not satisfied with the outcome of your dispute, you have the right to add a statement of dispute to your credit report, explaining your position. This statement (up to 100 words) will be included in your credit report whenever it is requested. It's also recommended to reach out directly to the creditor that reported the information to see if they're willing to correct the error.

-

Can I dispute information on my credit report online?

Yes, all three major credit bureaus offer the ability to file disputes online. This is often the fastest way to submit a dispute and allows you to easily upload any supporting documentation. Check each bureau's website for detailed instructions on how to file a dispute online.

-

Is there a charge for disputing an error on my credit report?

No, there is no charge for disputing inaccuracies on your credit report. The Fair Credit Reporting Act (FCRA) gives you the right to dispute errors for free. Be cautious of any service that charges fees for disputing errors on your behalf.

-

How often should I check my credit report for errors?

It's advisable to check your credit report at least once a year. This helps ensure the information is accurate and up to date. You're entitled to one free credit report from each of the three major credit bureaus every year through AnnualCreditReport.com. Reviewing your credit report regularly can help you catch errors or fraudulent activity early on.

Common mistakes

When individuals endeavor to correct inaccuracies on their credit reports through a dispute form, errors can occur, potentially hindering the process. Recognizing and avoiding these mistakes is crucial for a successful resolution. Here, we outline seven common errors made during this process:

Not providing enough information. Individuals often fail to offer comprehensive details regarding their dispute, making it challenging for the credit bureau to investigate and rectify the issue effectively.

Ignoring errors due to misunderstanding their significance. Some people overlook smaller inaccuracies, not realizing that even minor errors can negatively impact their credit score.

Failing to check all credit reports. People sometimes dispute errors on one report but neglect to verify that the same inaccuracies are not present on their other credit reports from different bureaus.

Overlooking the necessity of following up. After submitting a dispute, some individuals do not follow up with the credit bureaus, missing the chance to ensure their issue has been addressed adequately.

Disputing information without evidence. Claims made without the backing of supporting documents or evidence are often less likely to be resolved in the individual's favor.

Using an incorrect or outdated form. Using the wrong version of a dispute form can lead to delays or the rejection of the dispute altogether.

Misunderstanding the dispute process. Some individuals have unrealistic expectations about the outcomes of a dispute or misconceive the time it takes to resolve disputed items, leading to disappointment and frustration.

By understanding and avoiding these common errors, individuals can more effectively navigate the credit report dispute process, increasing their chances of correcting inaccuracies and improving their credit score.

Documents used along the form

When you're taking steps to correct errors on your credit report through a Credit Report Dispute form, it isn't just about filling out that one form. There are several other documents that could support your case and make the process smoother. Let's look at some of the key ones you might need to gather.

- Proof of Identity: This includes copies of government-issued identification like your driver's license or passport. These documents help verify that you are who you claim to be when disputing items on your credit report.

- Billing Statements: These are often used to show your payment history and prove that you have made payments that may not be accurately reflected in your credit report. They can be crucial in disputes regarding account balances or late payments.

- Credit Card Statements: Similar to billing statements, credit card statements provide evidence of your account activities. They can help in disputing wrongful charges or identity theft issues that have affected your credit score.

- Correspondence from Creditors: Sometimes, communication from creditors acknowledging a mistake, confirming a payment, or detailing an account closure can be immensely helpful. These documents serve as direct evidence from the creditor related to the dispute.

- Police Reports: In cases of identity theft or fraud, a police report can add significant weight to your dispute. It formally documents the crime and helps credit bureaus understand the context of the disputed entries.

Gathering these documents before you start your credit report dispute can save you time and strengthen your case. Each piece of evidence you provide helps the credit bureaus accurately investigate and resolve your dispute. Remember, it's not just about contesting errors but proving your claim with the right documentation.

Similar forms

A Debt Validation Letter is significantly similar as it also involves communication with credit bureaus or creditors. This letter is a request for proof that the consumer owes the debt in question. Both documents are used to ensure the accuracy of financial information and protect the consumer's credit score.

The Identity Theft Report shares a common goal with the Credit Report Dispute form: to correct inaccuracies on one’s credit report, although the inaccuracies in this case are due to fraudulent activities. Victims of identity theft submit this report to credit bureaus to block fraudulent information.

A Credit Freeze Request is related in terms of its protective function towards one’s credit. While it is a preventive measure, freezing one’s credit restricts access to the credit report, much like a dispute aims to remove inaccuracies that unjustly alter access or terms of credit.

The Goodwill Letter to creditors, though more informal, seeks a similar outcome as the dispute form: the adjustment of negative marks on one’s credit report. However, it appeals to the creditor’s leniency for a late payment forgiveness, relying on the consumer’s positive payment history and goodwill.

An Error Correction Letter to a bank or financial institution is akin to the Credit Report Dispute form in its objective to correct inaccuracies. However, it typically targets errors within account statements or transactions rather than credit reports.

The Letter of Explanation (LOE) submitted during the mortgage application process addresses potential red flags on a credit report, similar to how a dispute form might challenge them. The key difference is that an LOE provides context to the underwriter, not dispute to a bureau.

A Personal Information Update Letter to a credit bureau shares similarities with the dispute form by aiming to update or correct information on one’s credit report, such as address or name changes, to ensure the report’s accuracy.

A Limit Increase Request on a credit card involves the consumer’s credit history and score, where accuracy and the absence of errors can directly impact the outcome. Like disputing inaccuracies, it’s integral in managing one’s financial health and credit access.

Bankruptcy Notice of Dispute is related due to its function in disputing specific items on a credit report, particularly those affected by bankruptcy. It requires detailed information and follows legal procedures to ensure that the credit report accurately reflects the consumer's discharged debts.

Dos and Don'ts

When disputing errors on your credit report, it's crucial to understand the best practices for filling out the Credit Report Dispute form. Handling this process correctly can make a significant difference in the outcome. Here are several dos and don'ts to guide you through the process:

Do:Gather all necessary documents supporting your dispute before filling out the form to ensure accuracy and consistency in your claims.

Be specific about each dispute. Clearly identify the item you're disputing and explain why it's incorrect, providing evidence to back up your claims.

Use certified mail to send your dispute form and supporting documents. This provides you with a delivery receipt and ensures that your documents are received.

Keep detailed records of all communications, including copies of the dispute form, correspondence, and delivery receipts. This can be important if you need to escalate your dispute.

Review your credit report from all three major credit bureaus. Reporting errors may not be consistent across Experian, Equifax, and TransUnion, so it's important to file a dispute with each bureau that lists the error.

Assume that minor errors on your credit report don't need to be corrected. Even small inaccuracies can have a significant impact on your credit score.

Give up if your first dispute is not resolved in your favor. You have the right to escalate your dispute, including asking for a statement to be included in your file or seeking legal advice if necessary.

Misconceptions

Understanding the Credit Report Dispute process is crucial for maintaining accurate financial records. However, there are widespread misconceptions about how the dispute form functions and its impact. Below are ten common misunderstandings that need clarification:

Submitting a dispute form will instantly fix errors on your credit report. In reality, the credit bureau has up to 30 days to investigate a dispute and may require further information from the filer.

Disputing a credit report entry will remove it permanently. The truth is, if the creditor verifies the information as accurate, the item will remain on the report, though it can be updated or annotated to reflect the dispute.

You can only dispute inaccuracies online. While online disputes are common, consumers also have the right to dispute inaccuracies via mail or over the phone, providing different avenues to ensure their concerns are addressed.

Disputes are always resolved in the consumer's favor. The outcome of a dispute depends on the verification of the information by the creditor. Not all disputes result in changes to the credit report.

All disputes will improve your credit score. Disputing and correcting inaccuracies can potentially improve your credit score, but not all disputes affect credit scores. Some corrections may have minimal or no impact.

Filing a dispute is complicated and requires legal assistance. Most people can fill out and file a dispute form without any legal help. Credit bureaus provide guidance on how to do this effectively.

There is a fee to dispute credit report errors. Disputing errors on a credit report is a right protected under the Fair Credit Reporting Act (FCRA), and there are no fees associated with filing a dispute.

You can dispute any information you disagree with, including legitimate debts. While you can technically dispute any item, only inaccuracies and errors are likely to be removed. Legitimate debts, even those you believe are unfair, are not removed unless inaccurately reported.

A credit repair company can resolve disputes more effectively than individuals. Credit repair companies offer to manage disputes for a fee, but individuals have the same rights and can achieve similar outcomes by disputing inaccuracies themselves.

Once a dispute is resolved, it cannot be reopened or re-disputed. If new or additional evidence supports the inaccuracy of a credit report item, consumers have the right to submit another dispute.

Clarifying these misconceptions empowers individuals to more effectively manage their credit reports and ensures that they undertake the dispute process with correct expectations and understanding.

Key takeaways

When dealing with inaccuracies on your credit report, using a Credit Report Dispute form can be an effective way to address and rectify errors. Understanding the process and preparing your dispute accurately can increase your chances of having your credit report corrected. Here are key takeaways to consider:

- Complete the form with accurate information: Ensure that all the information you provide on the dispute form is accurate and complete. Inaccuracies in your dispute form can delay the correction process. Big or small, mistakes can lead to your dispute being overlooked or denied due to lack of clarity or missing information.

- Be specific about the dispute: Clearly identify what you are disputing on your credit report, including account names, numbers, and the specific nature of your dispute. Providing a detailed description helps the credit bureau understand your concern and investigate it properly.

- Include supporting documents: Whenever possible, attach copies of documents that support your dispute. This could include account statements, identity theft reports, or letters from a creditor acknowledging an error. Supporting documents can be crucial in proving the validity of your dispute.

- Stay organized and follow up: Keep a copy of your dispute form and all correspondence between you and the credit bureau. Note the date you sent your dispute and flag a date to follow up. Credit bureaus typically have 30 to 45 days to investigate disputes, so knowing when to expect a response is crucial. Following up ensures that your dispute is not forgotten and allows you to address any additional questions or requests from the credit bureau in a timely manner.

Popular PDF Forms

What Is a Odometer Statement - A necessary legal formality for documenting the condition of leased vehicles accurately and transparently.

Child Support Increase - Sections dedicated to both assigning agencies and individual petitioners, acknowledging the diverse actors in support modification processes.

Funeral Contract Sample - Appreciate the integration of detailed information for every party involved, including the Certificate of Authority Holder and the financial institution, ensuring legal compliance and protection.