Blank Ct 3 S PDF Template

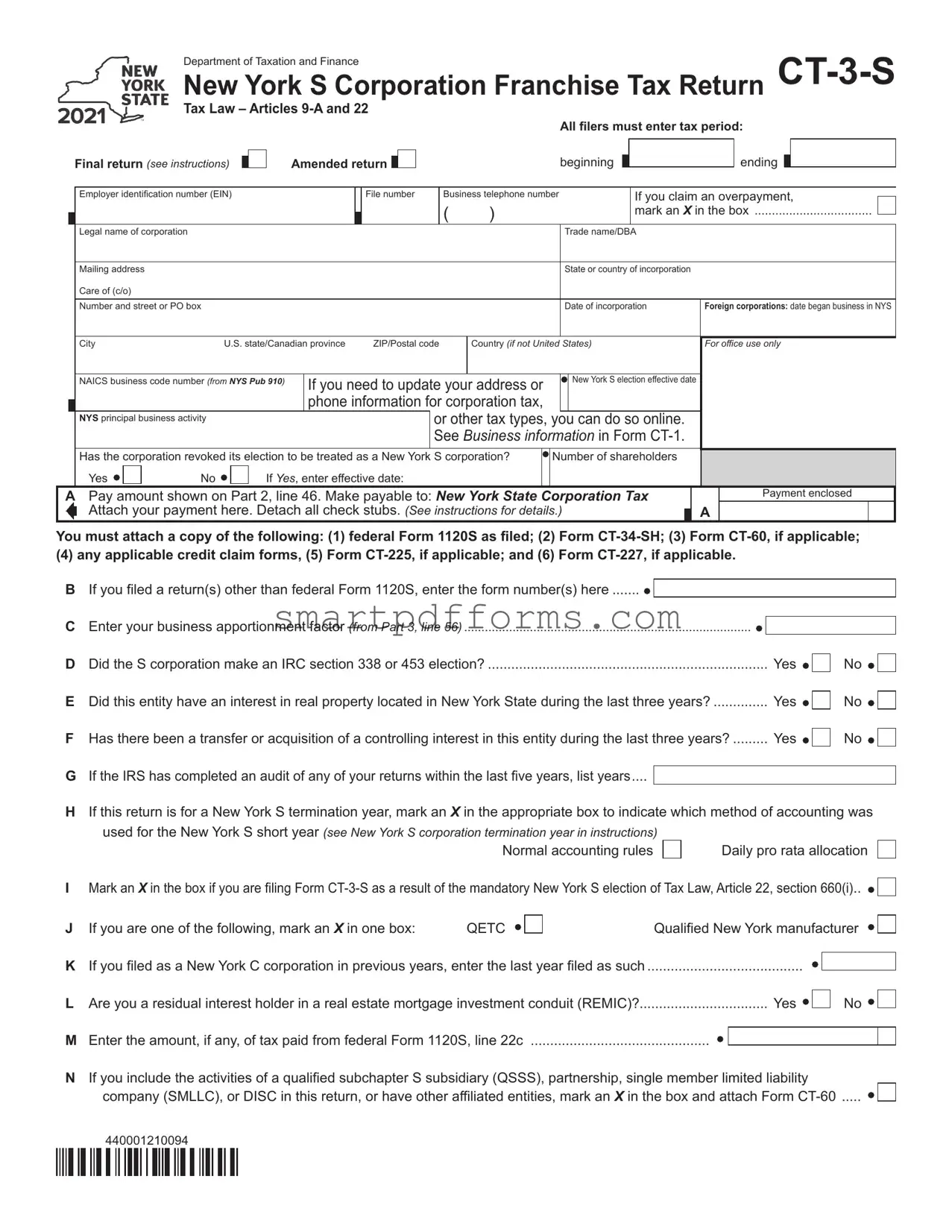

Navigating the complexities of S corporation franchise tax returns in New York can seem daunting, but understanding the CT-3-S form is a crucial part of the process. This form, designed by the Department of Taxation and Finance, is specifically tailored for S corporations to report their franchise tax obligations under Tax Law – Articles 9-A and 22. It encompasses various segments, including information on federal Form 1120S, adjustments and tax calculations specific to New York State, and details regarding shareholders and corporate activities within the state. Its comprehensive coverage ensures entities accurately reflect their taxable income, apportionment factors, and claim any applicable tax credits. Additionally, the CT-3-S form includes sections for declaring any changes in corporate status, such as the revocation of the S corporation election or changes in shareholder numbers, which could influence tax responsibilities. With mandatory attachments like the federal Form 1120S, it integrates federal and state tax reporting requirements, simplifying the process while ensuring compliance with state laws. Whether an S corporation is marking an amended return, claiming an overpayment, or updating corporate details, the CT-3-S serves as a critical tool in managing their state tax obligations efficiently.

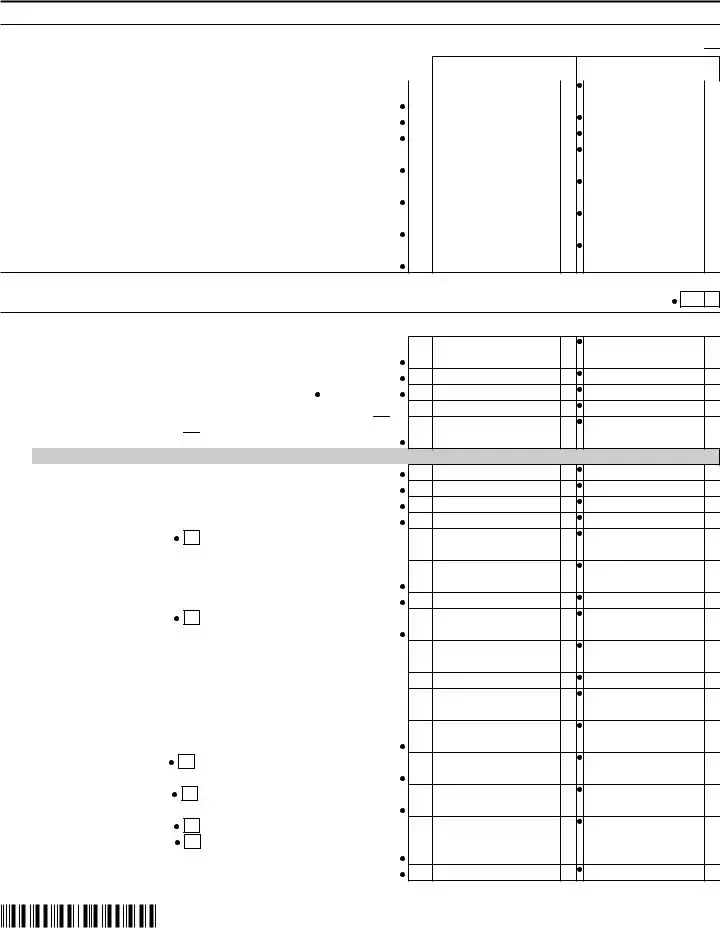

Preview - Ct 3 S Form

Department of Taxation and Finance |

|

New York S Corporation Franchise Tax Return |

|

Tax Law – Articles |

|

All filers must enter tax period: |

|

Final return (see instructions)

Amended return |

|

|

beginning |

|

ending

Employer identification number (EIN)

File number

Business telephone number

()

If you claim an overpayment,

mark an X in the box ...................................

|

|

Legal name of corporation |

|

|

|

|

|

|

|

|

|

|

Trade name/DBA |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Mailing address |

|

|

|

|

|

|

|

|

|

|

State or country of incorporation |

|

|

|

|||||

|

|

Care of (c/o) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Number and street or PO box |

|

|

|

|

|

|

|

|

|

Date of incorporation |

Foreign corporations: date began business in NYS |

||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

City |

|

U.S. state/Canadian province |

ZIP/Postal code |

Country (if not United States) |

For office use only |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

NAICS business code number (from NYS Pub 910) |

If you need to update your address or |

|

|

New York S election effective date |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

phone information for corporation tax, |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NYS principal business activity |

|

|

|

|

|

or other tax types, you can do so online. |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

See Business information in Form |

|

|

|

|||||||

|

|

Has the corporation revoked its election to be treated as a New York |

S corporation? |

|

Number of shareholders |

|

|

|

|||||||||||||

|

|

Yes |

|

|

No |

|

|

If Yes, enter effective date: |

|

|

|

|

|

|

|

|

|

|

|||

A Pay amount shown on Part 2, line 46. Make payable to: New York State |

|

Corporation Tax |

|

|

Payment enclosed |

||||||||||||||||

|

|

Attach your payment here. Detach all check stubs. (See instructions for details.) |

|

|

A |

|

|

||||||||||||||

|

|

|

|||||||||||||||||||

You must attach a copy of the following: (1) federal Form 1120S as filed; (2) Form

(4) any applicable credit claim forms, (5) Form

B |

If you filed a return(s) other than federal Form 1120S, enter the form number(s) here |

|

|

C |

Enter your business apportionment factor (from Part 3, line 56) |

|

|

D |

Did the S corporation make an IRC section 338 or 453 election? |

Yes |

|

E |

Did this entity have an interest in real property located in New York State during the last three years? |

Yes |

|

F |

Has there been a transfer or acquisition of a controlling interest in this entity during the last three years? |

Yes |

|

G |

|

|

|

If the IRS has completed an audit of any of your returns within the last five years, list years.... |

|

|

|

No

No

No

HIf this return is for a New York S termination year, mark an X in the appropriate box to indicate which method of accounting was used for the New York S short year (see New York S corporation termination year in instructions)

Normal accounting rules

Daily pro rata allocation

I Mark an X in the box if you are filing

J |

If you are one of the following, mark an X in one box: |

QETC |

Qualified New York manufacturer |

|||

K |

If you filed as a New York C corporation in previous years, enter the last year filed as such |

|

|

|

|

|

......................................... |

|

|

|

|||

|

|

|

|

|||

L |

Are you a residual interest holder in a real estate mortgage investment conduit (REMIC)? |

Yes |

No |

|||

M |

Enter the amount, if any, of tax paid from federal Form 1120S, line 22c |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|||

NIf you include the activities of a qualified subchapter S subsidiary (QSSS), partnership, single member limited liability

company (SMLLC), or DISC in this return, or have other affiliated entities, mark an X in the box and attach Form

440001210094

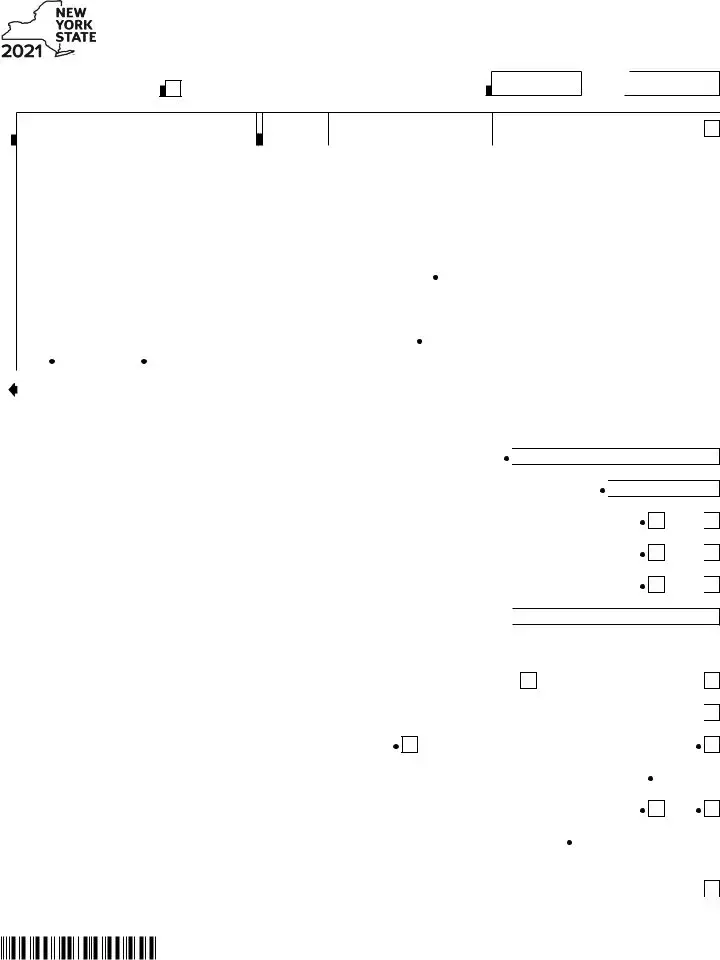

Page 2 of 6

OWere you required to report any nonqualified deferred compensation, as required by IRC § 457A, on your

2021 federal return? (see instructions) |

Yes |

No

PIf you are a foreign corporation computing your tax taking into account only your distributive shares from multiple limited

partnerships, mark an X in the box ...........................................................................................................................................

Q If you made a voluntary contribution to any available funds, mark an X in the box and attach Form

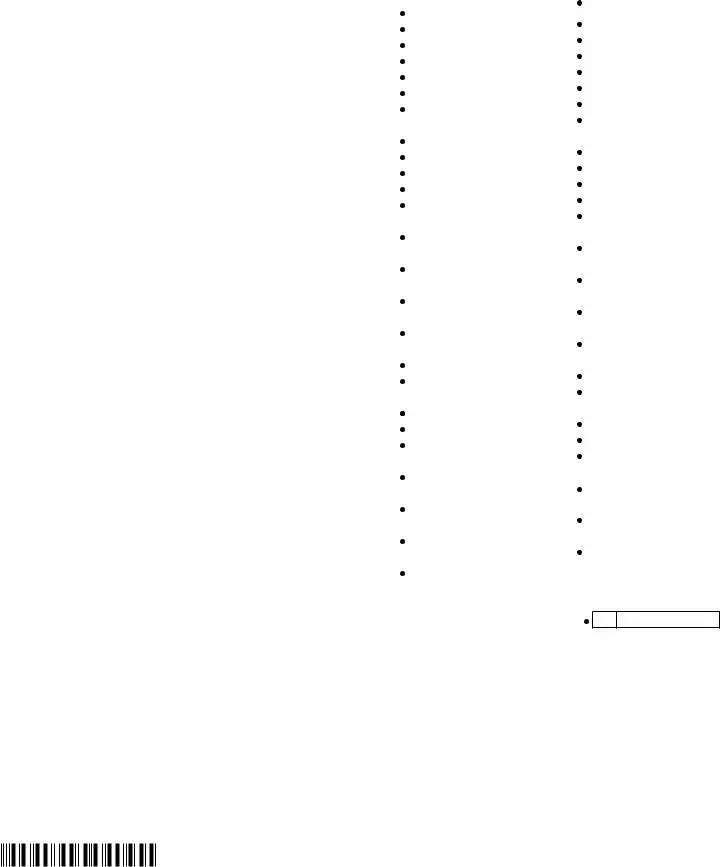

Part 1 – Federal Form 1120S information

Provide the information for lines 1 through 10 from the corresponding lines on your federal Form 1120S, Schedule K, total amount column. (Show any negative amounts with a minus

1Ordinary business income or loss...................................................................................................

2Net rental real estate income or loss...............................................................................................

3Other net rental income or loss.......................................................................................................

4 Interest income................................................................................................................................

5Ordinary dividends...........................................................................................................................  6 Royalties..........................................................................................................................................

6 Royalties..........................................................................................................................................  7 Net

7 Net  8 Net

8 Net  9 Net section 1231 gain or loss..........................................................................................................

9 Net section 1231 gain or loss..........................................................................................................

10Other income or loss.......................................................................................................................

11Loans to shareholders (from federal Form 1120S, Schedule L, line 7, columns b and d)

Beginning of tax year |

|

End of tax year |

12Total assets (from federal Form 1120S, Schedule L, line 15, columns b and d)

Beginning of tax year |

|

End of tax year |

13Loans from shareholders (from federal Form 1120S, Schedule L, line 19, columns b and d)

Beginning of tax year |

|

End of tax year |

1

2

3

4

5

6

7

8

9

10

Provide the information for lines 14 through 21 from the corresponding lines on your federal Form 1120S, Schedule

(Show any negative amounts with a minus

14Balance at beginning of

tax year................................

15Ordinary income from federal

Form 1120S, page 1, line 21..

16Other additions........................

17Loss from federal Form 1120S,

page 1, line 21.....................

18Other reductions......................

19Combine lines 14 through 18...

20Distributions..............................

21Balance at end of tax year.

Subtract line 20 from line 19...

A

Accumulated adjustments

account

B

Shareholders’

undistributed taxable

income previously taxed

C

Accumulated earnings

and profits

D

Other adjustments

account

440002210094

|

|

Page 3 of 6 |

||||

|

|

|

|

|

|

|

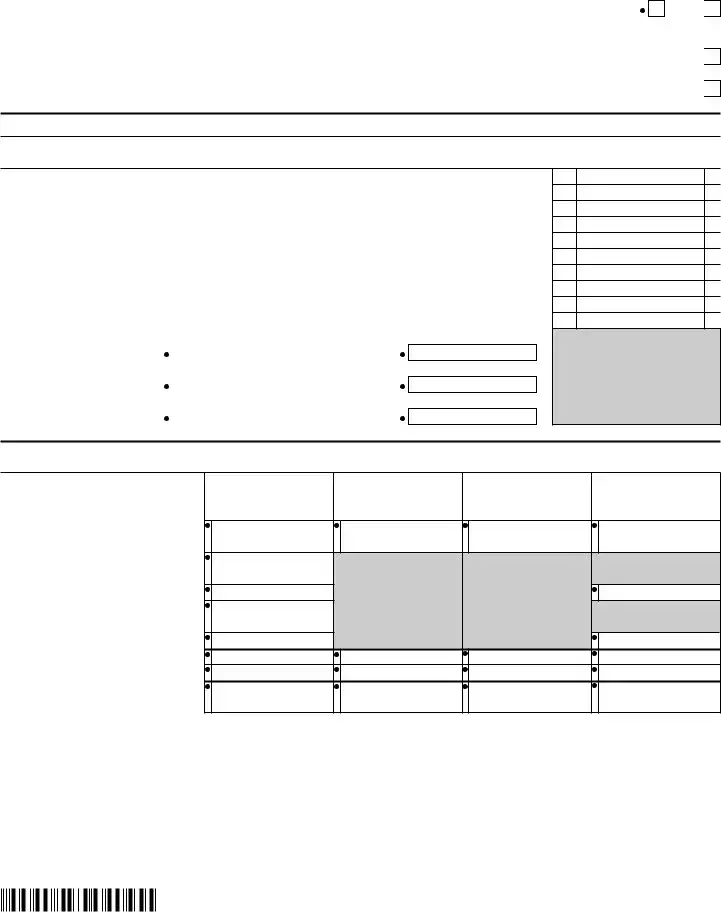

Part 2 – Computation of tax (see instructions) |

|

|

|

|

|

|

|

|

|

||||

Have you been convicted of an offense, or are you an owner of an entity convicted of an offense, defined in |

|

|

||||

New York State Penal Law Article 200 or 496, or section 195.20? (see Form |

|

Yes |

|

|

No |

|

|

||||||

|

|

|

||||

You must enter an amount on line 22; if none, enter 0. |

|

|

|

|

|

|

22 |

New York receipts (from Part 3, line 55, column A (New York State)) |

22 |

|

|

|

|

23 |

Fixed dollar minimum tax (see instructions) |

23 |

|

|

|

|

24 |

Recapture of tax credits (see instructions) |

24 |

|

|

|

|

25 |

.............................................................Total tax after recapture of tax credits (add lines 23 and 24) |

25 |

|

|

|

|

26 |

Special additional mortgage recording tax credit (current year or deferred; see instructions) |

26 |

|

|

|

|

27 |

.......................................................................Tax due after tax credits (subtract line 26 from line 25) |

27 |

|

|

|

|

First installment of estimated tax for the next tax period:

28 |

Enter amount from line 27 |

28 |

29 |

If you filed a request for extension, enter amount from Form |

29 |

30If you did not file Form

|

Otherwise enter 0 |

|

|

|

30 |

|

|

|

|

||||||

31 |

............................................................................................................Add line 28 and line 29 or 30 |

|

|

31 |

|

||

Composition of prepayments (see instructions): |

Date paid |

Amount |

|||||

32 |

Mandatory first installment |

32 |

|

|

|

|

|

33 |

Second installment from |

33 |

|

|

|

|

|

34 |

Third installment from |

34 |

|

|

|

|

|

35 |

Fourth installment from |

35 |

|

|

|

|

|

36Payment with extension request from

37 |

Form |

36 |

|

|

|

|

|

|

|

Overpayment credited from prior years (see instructions) |

37 |

|

|

|

|

|

|

||

38 |

......................................................................................Total prepayments (add lines 32 through 37) |

|

|

|

|

38 |

|

|

|

39 |

...........................................Balance (subtract line 38 from line 31; if line 38 is larger than line 31, enter 0) |

|

|

||||||

40 |

Estimated tax penalty (see instructions; mark an X in the box if |

|

............... |

40 |

|

|

|||

41 |

Interest on late payment (see instructions) |

|

|

|

|

41 |

|

|

|

42 |

Late filing and late payment penalties (see instructions) |

|

|

|

|

42 |

|

|

|

43 |

........................................................................................................Balance (add lines 39 through 42) |

|

|

|

|

43 |

|

|

|

Voluntary gifts/contributions |

|

|

|

|

|

|

|

|

|

44 |

Total voluntary gifts/contributions (from Form |

|

|

|

|

44 |

|

|

|

45 |

Add lines 31, 40, 41, 42, and 44 |

|

|

|

|

45 |

|

|

|

46Balance due (If line 38 is less than line 45, subtract line 38 from line 45 and enter here. This is the amount

due; enter your payment amount on line A on page 1.) |

46 |

47Overpayment (If line 38 is more than line 45, subtract line 45 from line 38 and enter here. This is the

|

amount of your overpayment; see instructions.) |

47 |

48 |

Amount of overpayment to be credited to next period (see instructions) |

48 |

49 |

Refund of overpayment (subtract line 48 from line 47; see instructions) |

49 |

50 |

Refund of unused special additional mortgage recording tax credit (see instructions) |

50 |

51Amount of special additional mortgage recording tax credit to be applied as an overpayment to

next period |

51 |

440003210094

Page 4 of 6

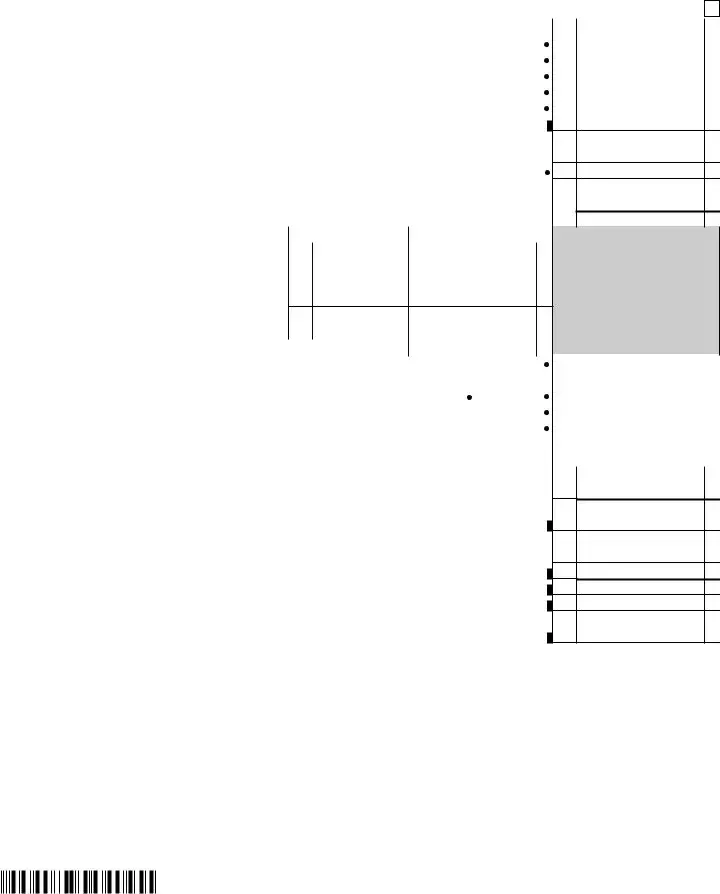

Part 3 – Computation of business apportionment factor (see instructions)

Mark an X in this box only if you have no receipts required to be included in the denominator of the apportionment factor (see instr.)....

A – New York State |

B – Everywhere |

Section |

|

|

1 |

Sales of tangible personal property |

1 |

2 |

Sales of electricity |

2 |

3 |

...................................................Net gains from sales of real property |

3 |

Section |

|

|

4 |

Rentals of real and tangible personal property |

4 |

5 |

Royalties from patents, copyrights, trademarks, and similar intangible |

5 |

6 |

personal property |

|

Sales of rights for certain |

|

|

|

of an event |

6 |

Section |

|

|

7 |

Sale, licensing, or granting access to digital products |

7 |

Section

8 To make this irrevocable election, mark an X in the box (see instructions) |

8 |

Section

Section |

|

|

|

9 |

Interest from loans secured by real property |

|

|

10 |

Net gains from sales of loans secured by real property |

|

|

11 |

Interest from loans not secured by real property (QFI |

|

.............. ) |

12Net gains from sales of loans not secured by real property (QFI

).

).

Section

)

)

13 |

Interest from federal debt |

|

14 |

|

|

15 |

Interest from NYS and its political subdivisions debt |

|

16 |

Net gains from federal, NYS, and NYS political subdivisions debt |

|

17 |

Interest from other states and their political subdivisions debt |

|

18 |

Net gains from other states and their political subdivisions debt |

|

Section |

) |

|

19Interest from

20Net gains from government agency debt or

21 |

sold through an exchange |

|

Net gains from all other |

||

Section |

) |

|

22 |

Interest from corporate bonds |

|

23Net gains from corporate bonds sold through broker/dealer or

licensed exchange ............................................................................

24 Net gains from other corporate bonds .................................................

Section

25Net interest from reverse repurchase and securities borrowing agreements.

Section

26 |

Net interest from federal funds |

|

Section |

) |

|

27 |

Net income from sales of physical commodities |

|

Section |

) |

|

28 |

Marked to market net gains |

|

Section |

) |

|

29 |

) |

|

Interest from other financial instruments |

||

30 |

Net gains and other income from other financial instruments |

|

9

10

11

12

13

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

440004210094

|

|

|

|

|

||||

|

|

|

|

|

|

|||

Part 3 – Computation of business apportionment factor (continued) |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

A – New York State |

|

|

B – Everywhere |

|

Section |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

31 |

Brokerage commissions |

31 |

|

|

|

|

|

|

32 |

Margin interest earned on behalf of brokerage accounts |

32 |

|

|

|

|

|

|

33 |

Fees for advisory services for underwriting or management of underwriting . |

33 |

|

|

|

|

|

|

34 |

Receipts from primary spread of selling concessions |

34 |

|

|

|

|

|

|

35 |

Receipts from account maintenance fees |

35 |

|

|

|

|

|

|

36 |

Fees for management or advisory services |

36 |

|

|

|

|

|

|

37 |

...................................................Interest from an affiliated corporation |

37 |

|

|

|

|

|

|

Section |

|

|

|

|

|

|

|

|

38 |

Interest, fees, and penalties from credit cards |

38 |

|

|

|

|

|

|

39 |

Service charges and fees from credit cards |

39 |

|

|

|

|

|

|

40 |

Receipts from merchant discounts |

40 |

|

|

|

|

|

|

41 |

Receipts from credit card authorizations and settlement processing ... |

41 |

|

|

|

|

|

|

42 |

..................................................Other credit card processing receipts |

42 |

|

|

|

|

|

|

Section |

|

|

|

|

|

|

|

|

43 |

Receipts from certain services to investment companies |

43 |

|

|

|

|

|

|

Section |

|

|

|

|

|

|

|

|

44 |

Global intangible |

44 |

|

0 |

00 |

|

|

|

Section |

|

|

|

|

|

|

|

|

45 |

Receipts from railroad and trucking business |

45 |

|

|

|

|

|

|

Section |

|

|

|

|

|

|

|

|

46 |

Receipts from the operation of vessels |

46 |

|

|

|

|

|

|

Section |

|

|

|

|

|

|

|

|

47 |

Receipts from air freight forwarding |

47 |

|

|

|

|

|

|

48 |

..................................................Receipts from other aviation services |

48 |

|

|

|

|

|

|

Section |

|

|

|

|

|

|

|

|

49 |

Advertising in newspapers or periodicals |

49 |

|

|

|

|

|

|

50 |

Advertising on television or radio |

50 |

|

|

|

|

|

|

51 |

Advertising via other means |

51 |

|

|

|

|

|

|

Section |

|

|

|

|

|

|

|

|

52 |

Transportation or transmission of gas through pipes |

52 |

|

|

|

|

|

|

Section |

|

|

|

|

|

|

|

|

53 |

Receipts from other services/activities not specified |

53 |

|

|

|

|

|

|

Section |

|

|

|

|

|

|

|

|

54 |

Discretionary adjustments |

54 |

|

|

|

|

|

|

Total receipts |

|

|

|

|

|

|

|

|

55 |

Add lines 1 through 54 in columns A and B |

55 |

|

|

|

|

|

|

Calculation of business apportionment factor

56New York State business apportionment factor (divide line 55, column A by line 55, column B and enter

the resulting decimal here; round to the sixth decimal place after the decimal point; see instructions) |

56 |

440005210094

Page 6 of 6

Amended return information

If filing an amended return, mark an X in the box for any items that apply and attach documentation.

Final federal determination

If marked, enter date of determination:

Third – party |

Yes |

|

No |

|

|

Designee’s name (print) |

|

|

|

|

|

|

|

|

Designee’s phone number |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|||||

designee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Designee’s email address |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

(see instructions) |

|

|

|

|

|

|

|

|

|

|

PIN |

|

||||||||

Certification: I |

certify that this return and any attachments are to the best of my knowledge and belief true, correct, |

and |

complete. |

|||||||||||||||||

Authorized |

|

Printed name of authorized person |

|

Signature of authorized person |

|

|

|

Official title |

|

|

||||||||||

person |

|

Email address of authorized person |

|

|

|

Telephone number |

|

|

|

Date |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

Paid |

|

Firm’s name (or yours if |

|

|

Firm’s |

EIN |

|

|

|

|

|

Preparer’s PTIN or SSN |

||||||||

preparer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

use |

|

Signature of individual preparing this return |

Address |

|

|

City |

|

|

State |

ZIP code |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

only |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Email address of individual preparing this return |

|

|

Preparer’s NYTPRIN or |

Excl. code |

Date |

|

|||||||||||||

(see instr.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

See instructions for where to file.

440006210094

Form Data

| Fact Number | Fact Name | Description |

|---|---|---|

| 1 | Form Purpose | The CT-3-S form is used by S Corporations to file their New York State Franchise Tax Return. |

| 2 | Governing Laws | This form is governed by New York Tax Law – Articles 9-A and 22. |

| 3 | Amendment and Final Return Options | Corporations can file amended returns or indicate if it is a final return directly on the form. |

| 4 | Information Required | Corporations must provide basic information such as Employer Identification Number (EIN), business telephone number, legal name, and mailing address. |

| 5 | Attachments | Specific attachments are required, including federal Form 1120S and various New York State forms depending on applicable credits or affiliations. |

| 6 | Payment Instructions | Detailed instructions are provided for how to calculate and submit payment with the tax return. |

| 7 | Questionnaire Section | There are several yes/no questions regarding the corporation's activities and elections that can affect the tax responsibility. |

| 8 | Business Apportionment Factor | Part 3 of the form is dedicated to calculating the business apportionment factor, essential for determining the tax due. |

| 9 | Computation of Tax | Part 2 deals with the computation of tax, including deductions, credits, prepayments, and penalties. |

| 10 | Voluntary Contributions | Corporations have the option to make voluntary contributions to specific funds through Form CT-227, which should be attached if applicable. |

Instructions on Utilizing Ct 3 S

Filing the New York S Corporation Franchise Tax Return (CT-3-S form) is a straightforward process when approached with careful attention to detail. Gathering all pertinent information before beginning, including the federal Form 1120S and any related documents, will streamline the process. Below are step-by-step instructions to help ensure that the form is completed accurately.

- Enter the tax period for which you are filing at the top of the form, including both the beginning and ending dates.

- Fill in the corporation's Employer Identification Number (EIN), file number, and business telephone number.

- If claiming an overpayment, check the corresponding box.

- Provide the legal name of the corporation, any trade name/DBA, the complete mailing address, state or country of incorporation, and the date of incorporation.

- For foreign corporations, specify the date business began in New York State (NYS).

- Enter the North American Industry Classification System (NAICS) business code number as found in NYS Publication 910.

- Answer whether the corporation has revoked its election to be treated as a New York S corporation, and if so, provide the effective date.

- Enter the amount due on Part 2, line 46, and attach the payment as instructed.

- Attach copies of federal Form 1120S as filed, Form CT-34-SH, Form CT-60 if applicable, any applicable credit claim forms, Form CT-225 if applicable, and Form CT-227 if applicable.

- Provide details of any other tax forms filed if not filing federal Form 1120S.

- Enter your business apportionment factor from Part 3, line 56.

- Indicate if the S corporation made an IRC section 338 or 453 election, had interest in real property located in NYS during the last three years, experienced a transfer or acquisition of controlling interest in the last three years, or if the IRS has completed an audit of any returns within the last five years.

- Indicate the method of accounting used for the New York S termination year, if applicable.

- Specify whether the filing is due to a mandatory New York S election as per Tax Law, Article 22, section 660(i).

- Provide additional information as requested in sections K through Q related to previous New York C corporation filings, residual interest holders in a REMIC, any tax paid from federal Form 1120S line 22c, and whether you are computing your tax as a foreign corporation only from distributive shares of multiple limited partnerships.

- Part 1: Input information from lines 1 through 10 and 11 through 21 from your federal Form 1120S, reflecting the corporation's financial activities.

- Parts 2 and 3: Carefully calculate the tax due, fill out the details for computation of tax, and determine the business apportionment factor as instructed.

- Review all entries for accuracy, attach any required documents, and sign where indicated.

- Submit the completed CT-3-S form and any payment due to the Department of Taxation and Finance by the specified deadline.

Filling out the CT-3-S requires a meticulous approach to ensure all information is accurate and complete. Following the steps methodically helps to avoid errors and ensures compliance with NYS tax laws. Remember to regularly consult the Department of Taxation and Finance for updates or changes in filing requirements.

Obtain Answers on Ct 3 S

What is the CT-3-S New York S Corporation Franchise Tax Return?

Who needs to file the CT-3-S form?

What documents must be attached to the CT-3-S form?

- The federal form 1120S as filed

- Form CT-34-SH

- Form CT-60, if applicable

- Any applicable credit claim forms

- Form CT-225, if applicable

- Form CT-227, if applicable

Is it possible to amend a previously filed CT-3-S form?

How do S Corporations pay the franchise tax and any associated fees?

What happens if an S Corporation fails to file the CT-3-S form or pay the associated taxes on time?

Can foreign S Corporations file the CT-3-S form?

The CT-3-S is a tax form that S Corporations in New York State must file to report their income, losses, and other financial information for the tax year. It outlines the franchise tax obligations of S Corporations under Articles 9-A and 22 of the New York State Tax Law. An S Corporation must file this form to disclose earnings, claim deductions or credits, and determine the tax due or refund owed by the state.

Any corporation that has elected S Corporation status for federal tax purposes and is recognized by New York State as an S Corporation must file the CT-3-S form. This includes corporations operating in New York, foreign (out-of-state) S Corporations doing business in New York, and those required to make a mandatory New York S election under Article 22, section 660(i).

When filing the CT-3-S form, corporations need to attach several documents, including:

Yes, corporations can amend a previously filed CT-3-S form if necessary. To do this, they must mark the "Amended return" box at the top of the form and include any corrected information or additional documents required to amend the return.

Payment of the franchise tax and any associated fees should be made payable to the New York State Corporation Tax and submitted with the CT-3-S form. The form provides a section for calculating the tax due, including any installments for estimated taxes for the next tax period. Payment details and methods are provided in the instructions accompanying the form.

If an S Corporation fails to file the CT-3-S form or pay the taxes due on time, it may be subject to penalties and interest. The New York State Department of Taxation and Finance can impose late filing and late payment penalties, in addition to charging interest on the unpaid tax from the due date until the tax is paid.

Yes, foreign S Corporations that conduct business in New York State are required to file the CT-3-S form if they have elected S Corporation status federally and are recognized as such by New York State. These corporations must report their New York income and calculate their franchise tax obligation in the same manner as domestic S Corporations.

Common mistakes

Filling out the CT-3-S form for New York S Corporation Franchise Tax Return can be tricky. Many people make mistakes, some of which could potentially lead to issues with the Department of Taxation and Finance. Here are five common mistakes:

Incorrect Employer Identification Number (EIN) or File Number: It sounds basic, but entering an incorrect EIN or File Number is a frequent mistake. This error can lead to processing delays or the return being considered unfiled.

Failing to Attach Required Documents: The CT-3-S form requires attaching several documents, including the federal Form 1120S and Form CT-34-SH. Omitting these attachments can result in an incomplete return, subjecting the corporation to penalties and delays.

Miscalculating the Business Apportionment Factor: This calculation, required on Part 3, line 56, is critical for determining your tax obligation. Errors here can lead to underpaid or overpaid taxes, potentially incurring penalties, interest, or leaving money on the table.

Incorrectly Reporting Tax Payments and Credits: On Part 2, lines 22 through 51, inaccuracies in reporting past payments, estimated tax payments, or applicable tax credits could not only affect your current tax liability but might also impact future tax periods.

Overlooking Final and Amended Return Boxes: The initial section of the form asks whether this filing is a final or amended return. Missing these boxes can cause significant administrative headaches and potentially affect the corporation's status.

Steering clear of these errors can save a lot of time and ensure compliance with New York State taxation laws. Always double-check the form before submission and, when in doubt, consult a tax professional.

Documents used along the form

Completing the New York S Corporation Franchise Tax Return (CT-3-S) is an integral process for S corporations operating in New York State. To accurately file this return, several other forms and documents might be required, depending on the specific circumstances of the business. Understanding these forms and their purposes can ensure that companies meet all necessary legal and tax obligations. Below is a comprehensive list of documents frequently used alongside the CT-3-S form, each briefly described for clear understanding.

- Form 1120S: The U.S. Income Tax Return for an S Corporation. This is the federal tax return document that all S corporations must file. A copy of this form is required when filing the CT-3-S to provide a detailed record of the company's income, deductions, and tax liability.

- Form CT-34-SH: New York S Corporation Shareholders’ Information Schedule. This form reports each shareholder's pro-rata share of the corporation's items of income, deduction, and credit to New York State.

- Form CT-60: Affiliated Entity Information Schedule. Applicable if the S corporation includes activities of affiliated entities in its return. This form is essential for corporations that are part of a larger group of companies.

- Form CT-225: New York State Modifications. This form is used to make certain adjustments specific to New York State tax law to the federal taxable income reported on Form 1120S.

- Form CT-227: Voluntary Contributions. Corporations opting to make a voluntary contribution to specified New York State causes must do so by including this form.

- Form CT-5.4: Request for Six-Month Extension to File the CT-3-S. If the corporation needs additional time to file its CT-3-S return, this form should be submitted to request a six-month extension.

- Form CT-400: Estimated Tax for Corporations. S corporations making estimated tax payments throughout the year will use this form to calculate and report those payments.

- Form CT-222: Underpayment of Estimated Tax by a Corporation. If the corporation underpays its estimated tax, this form is used to calculate any penalties due.

- Schedule K-1 (Form 1120S): Shareholder’s Share of Income, Deductions, Credits, etc. Each shareholder receives this schedule, which details their portion of the corporation's income and deductions. It's important for both federal and state tax filings.

- Form CT-1: Supplement to Corporation Tax Instructions. This form provides additional guidance and instructions related to filing corporate taxes in New York State, including the CT-3-S.

Each of these documents plays a crucial role in ensuring that an S corporation accurately reports its income and calculates its tax obligations to New York State. It's important for businesses to review their specific circumstances and consult with a tax professional to determine which documents are necessary for their tax return. Proper and timely filing of the CT-3-S and its accompanying documents is essential for compliance with New York State tax laws.

Similar forms

The Form 1120S is similar to the CT-3-S form because it is the tax return form used by S Corporations to report their income, gains, losses, deductions, credits, and other information to the Federal government. Both forms serve as the primary tax documents for S Corporations, with the CT-3-S specifically tailored for New York State.

Form CT-34-SH, akin to the CT-3-S, necessitates disclosure related to the shareholders of the S Corporation. It requires detailed information about each shareholder's share of income, deductions, and credits. This form complements the CT-3-S by providing a more focused look at shareholder-specific information, which is crucial for New York State's tax administration.

Similar to the CT-3-S, the Form CT-60 is utilized by S Corporations to report tax items related to affiliated entities. This includes information on tax obligations arising from transactions or relations with other corporations within the same group, emphasizing the inter-corporate financial connections with relevance to New York State taxation.

Form CT-225 is related to the CT-3-S as it involves adjustments specific to New York State tax calculations, such as modifications for Article 9-A taxpayers. This connection is vital for S Corporations seeking to reconcile their federal taxable income with adjustments required under New York State's tax law.

The Form CT-227 shares a purpose with the CT-3-S in allowing S Corporations to apply for certain New York tax credits. Specifically, this form deals with claims for the Voluntary Contributions Credit, underscoring the nuanced options available for S Corporations to potentially lower their tax liability within New York State.

Form CT-1, Supplement to Corporation Tax Instructions, is akin to the CT-3-S form as it provides additional guidance tailored to New York State's corporation taxes. While the CT-3-S is the tax return form itself, Form CT-1 offers supplementary information and clarifications, assisting corporations in accurately completing their returns.

Like the CT-3-S, the Form CT-3 is also a franchise tax return form but for general business corporations as opposed to S Corporations. Both forms cater to different corporate entities under New York State's tax law, ensuring that each entity is taxed according to its specific classification and operations.

The Form CT-400, Estimated Tax for Corporations, parallels the CT-3-S form in handling the estimated tax payments required from corporations. For S Corporations specifically completing the CT-3-S, CT-400 provides the mechanism through which they make quarterly estimated tax payments, critical for compliance with New York State tax requirements.

Dos and Don'ts

When filling out the CT-3-S form for the New York S Corporation Franchise Tax Return, there are specific steps you should follow to ensure accuracy and compliance. Here are the dos and don'ts to consider:

Do:

- Review all instructions carefully before beginning the form to avoid any mistakes that could arise from misunderstanding the requirements.

- Double-check the Employer Identification Number (EIN) and other critical information like the legal name of the corporation and the mailing address to ensure they are correct and match the official records.

- Attach all required documents mentioned in the form instructions, including the federal Form 1120S as filed and any applicable credit claim forms. Ensuring all pertinent documentation is included is crucial for a complete submission.

- Calculate the apportionment factor accurately, as this is essential for determining the correct amount of tax owed. Use the guidelines provided in the form instructions to make sure your calculations are correct.

Don't:

- Forget to sign and date the form. An unsigned form is considered incomplete and can lead to processing delays.

- Overlook marking appropriate boxes, especially those indicating if it's a final return, an amended return, or if any special elections or revocations have been made. These indicators are critical for the form's proper processing.

- Ignore the estimated tax payment section if it applies to your corporation. Not making the required payments can result in penalties.

- Omit information about any changes in business activities or affiliations with other entities, as these can affect your tax liability and need to be reported accurately on the return.

Misconceptions

When navigating the complexities of filing the New York S Corporation Franchise Tax Return, the CT-3-S form, certain misconceptions are common among filers. Clarification on these points can aid in achieving a more accurate and compliant submission.

Misconception 1: Only New York-based S corporations must file the CT-3-S form. This is not accurate; any S corporation that conducts business, owns property, or employs capital in New York State is required to file, regardless of where it is based.

Misconception 2: Filing a federal Form 1120S exempts an entity from filing the CT-3-S. In reality, filing Form 1120S with the IRS is a separate requirement. The CT-3-S must be filed with the New York State Department of Taxation and Finance to meet state obligations.

Misconception 3: The CT-3-S form is only for reporting income. While the form does collect information on income, it also encompasses deductions, tax credits, apportionment factors, and other financial details pertaining to both New York State and overall operations.

Misconception 4: All S corporations pay the same flat tax rate. The reality is more complex, with taxes calculated based on a variety of factors, including fixed dollar minimum taxes that vary by New York receipts amounts and other applicable tax credits and deductions.

Misconception 5: The business apportionment factor is always 100%. The business apportionment factor, which determines the portion of income attributable to New York State, can vary significantly depending on the specifics of an S corporation’s operations in and outside of New York.

Misconception 6: A single member LLC (SMLLC) treated as a disregarded entity for federal tax purposes does not need to be included in the CT-3-S. However, the activities of a qualified SMLLC, along with those of qualified subchapter S subsidiaries (QSSSs), can impact the CT-3-S and must be reported if they affect the S corporation’s New York tax responsibilities.

Misconception 7: Penalties for late filing or payment are always a fixed amount. The truth is both penalties and interest are calculated based on the specifics of the lateness and the amount due. Strategies such as requesting an extension can mitigate these penalties.

Understanding these nuances ensures compliance and helps in optimizing the tax positions of S corporations active in New York State. Correctly navigating the CT-3-S requirements is crucial for accurate tax reporting and minimizing obligations within the bounds of the law.

Key takeaways

When filling out and using the CT-3-S New York S Corporation Franchise Tax Return form, there are several crucial key takeaways:

- The CT-3-S form is designed for S Corporations in New York State to file their franchise tax returns, following the guidelines under Tax Law – Articles 9-A and 22.

- All filers must specify the tax period for which they are filing, including the start and end dates, and must indicate if the return is a Final or Amended return.

- S Corporations are required to attach several essential documents along with the CT-3-S form, including the federal Form 1120S as filed, Form CT-34-SH, Form CT-60 if applicable, any applicable credit claim forms, Form CT-225 if applicable, and Form CT-227 if applicable.

- It’s important to accurately enter the New York business apportionment factor, which is calculated in Part 3 of the form. This factor is crucial for determining the portion of income subject to New York State tax.

- If the S Corporation has made any elections under IRC section 338 or 453, or if it has an interest in real property located in New York State, this information must be disclosed on the form.

- Corporations that have undergone a transfer or acquisition of a controlling interest, or had the IRS complete an audit of any returns within the last five years, must provide this information.

- Payment of the tax shown on Part 2, line 46, should be made payable to New York State Corporation Tax, and filers should ensure that their payment is attached securely to the form.

- If the corporation made voluntary contributions to any available funds, an X must be marked in the appropriate box, and Form CT-227 attached.

These takeaways are essential for ensuring that S Corporations comply fully with New York State tax filing requirements and avoid common pitfalls that could result in inaccuracies or delays in processing their tax returns.

Popular PDF Forms

Va Ratings for Hypertension - Designed with considerations for a straightforward completion, estimated to take about 15 minutes to fill out.

Ky Cdl Self-certification Online - This documentation is critical for CDL holders seeking to understand their rights and responsibilities under Kentucky law, especially concerning medical and operational qualifications.

Which States Have Reciprocity for Lawyers - Incorporates an officer or director’s declaration from the employing institution, verifying the legitimacy and eligibility of the applicant.