Blank Ct 5 4 PDF Template

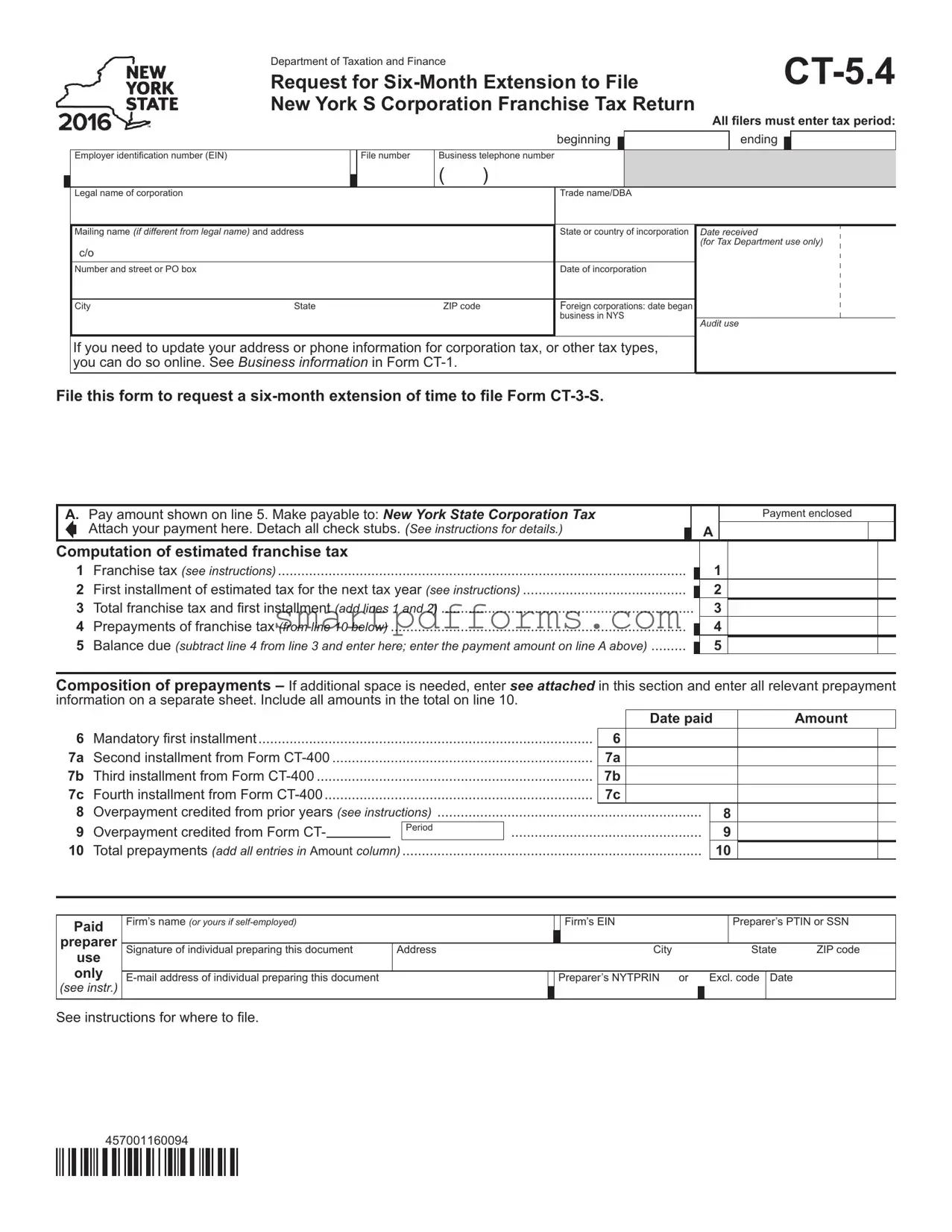

Navigating the complexities of corporate taxes in New York is a significant task for S Corporations, made somewhat easier with the CT-5.4 Form. This document, crucial for entities seeking more time to organize their franchise tax returns, serves as a formal request for a six-month extension, directly addressing the New York Department of Taxation and Finance. Required elements such as the start and end dates of the tax period, Employer Identification Number (EIN), legal names, and various contact details form the backbone of the form, ensuring that the state has all necessary information to process the request. Beyond mere contact information, the form delves into financial details, guiding filers through the computation of their estimated franchise tax and detailing prepayment compositions. This essential document not only aids in precise tax planning but also in aligning the fiscal responsibilities of corporations within the stipulated regulatory framework. Additionally, it provides avenues for updating business information, cementing its role as a critical tool for corporations operating within New York State. With sections dedicated to the preparer's details, it underscores the importance of accuracy and accountability in financial documentation, emphasizing the collective effort required to comply with state tax obligations.

Preview - Ct 5 4 Form

|

|

Department of Taxation and Finance |

|

|

|

|

|

|

|||||

|

|

Request for |

|

||||||||||

|

|

New York S Corporation Franchise Tax Return |

All ilers must enter tax period: |

||||||||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

beginning |

|

|

|

|

ending |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

Employer identiication number (EIN) |

|

File number |

Business telephone number |

|

|

|

|

|

|

|

|||

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Legal name of corporation |

|

|

|

|

Trade name/DBA |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

|

Mailing name (if different from legal name) and address |

|

|

|

State or country of incorporation |

Date received |

|||||||

|

|

|

|

|

|

|

|

|

|

(for Tax Department use only) |

|||

|

c/o |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number and street or PO box |

|

|

|

|

Date of incorporation |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

|

ZIP code |

|

Foreign corporations: date began |

|

|

|

|

|||

|

|

|

|

|

|

business in NYS |

|

|

|

|

|

||

|

|

|

|

|

|

|

Audit use |

||||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you need to update your address or phone information for corporation tax, or other tax types, you can do so online. See Business information in Form

File this form to request a

A.Pay amount shown on line 5. Make payable to: New York State Corporation Tax

Attach your payment here. Detach all check stubs. (See instructions for details.)

A

Payment enclosed

Computation of estimated franchise tax

1 Franchise tax (see instructions).........................................................................................................

2First installment of estimated tax for the next tax year (see instructions) ..........................................

3 Total franchise tax and irst installment (add lines 1 and 2) .................................................................

4 Prepayments of franchise tax (from line 10 below) ............................................................................

5 Balance due (subtract line 4 from line 3 and enter here; enter the payment amount on line A above) .........

1

2

3

4

5

Composition of prepayments – If additional space is needed, enter see attached in this section and enter all relevant prepayment information on a separate sheet. Include all amounts in the total on line 10.

|

|

|

|

|

|

|

Date paid |

|

Amount |

||

|

Mandatory irst installment |

|

|

|

|

|

|

|

|

||

6 |

|

|

6 |

|

|

|

|

|

|||

7a |

Second installment from Form |

|

|

7a |

|

|

|

|

|

||

7b |

Third installment from Form |

|

|

7b |

|

|

|

|

|

||

7c |

Fourth installment from Form |

|

|

7c |

|

|

|

|

|

||

8 |

....................................................................Overpayment credited from prior years (see instructions) |

|

|

|

8 |

|

|

||||

9 |

Overpayment credited from Form CT- |

|

|

Period |

|

|

|

|

9 |

|

|

|

................................................. |

|

|

|

|

|

|||||

10 |

Total prepayments (add all entries in Amount column) |

|

|

|

|

|

|

|

|

||

............................................................................. |

|

|

|

|

10 |

|

|

||||

Paid

preparer

use

only

(see instr.)

Firm’s name (or yours if |

|

|

|

Firm’s EIN |

|

|

Preparer’s PTIN or SSN |

||

|

|

|

|

|

|

|

|

|

|

Signature of individual preparing this document |

Address |

|

City |

|

|

State |

ZIP code |

||

|

|

|

|

|

|

|

|

|

|

|

|

Preparer’s NYTPRIN |

or |

Excl. code |

Date |

|

|||

|

|

|

|

|

|

|

|

|

|

See instructions for where to ile.

457001160094

Form Data

| Fact Number | Detail |

|---|---|

| 1 | The CT-5.4 form is used to request a six-month extension for filing a New York S Corporation Franchise Tax Return. |

| 2 | Filers must specify the tax period's beginning and end dates on the form. |

| 3 | The form requires the corporation's Employer Identification Number (EIN) and file number. |

| 4 | Business telephone number, legal name, trade name (if applicable), and mailing address must be included. |

| 5 | State or country of incorporation and the date of incorporation are required fields on the form. |

| 6 | Foreign corporations must provide the date they began business in New York State (NYS). |

| 7 | The form includes a section for the computation of estimated franchise tax and prepayments. |

| 8 | Payments made with the CT-5.4 should be payable to New York State Corporation Tax. |

| 9 | Address or phone information updates for corporation tax can be done online, per the form’s instructions. |

| 10 | Governing Law for the CT-5.4 form is the tax law and regulations of the State of New York. |

Instructions on Utilizing Ct 5 4

Filing a CT-5.4 form is a crucial step for S corporations in New York seeking an extension to file their franchise tax return. This document is designed to provide those corporations with an additional six months, ensuring they have ample time to prepare and submit their franchise tax documentation accurately. Proper completion and submission of this form are essential to avoid penalties and maintain compliance with New York State taxation laws. The following steps are designed to guide you through the process of filling out the CT-5.4 form clearly and correctly.

- Enter the tax period's start and end dates at the top of the form where indicated.

- Fill in the corporation's Employer Identification Number (EIN) and file number.

- Provide the business telephone number, including the area code.

- Write the legal name of the corporation and, if applicable, the trade name/DBA (Doing Business As).

- For the mailing address, include the name (if different from the legal name) and the address, ensuring to list the c/o, number and street or P.O. Box, city, state, and ZIP code.

- State the country or state of incorporation and the date of incorporation.

- If your corporation is foreign, specify the date business commenced in New York State (NYS).

- Under "Computation of estimated franchise tax":

- Enter the franchise tax amount on line 1, following the instructions provided.

- On line 2, detail the first installment of estimated tax for the next tax year.

- Add lines 1 and 2 to compute the total on line 3.

- Subtract any prepayments of franchise tax (line 10 below) from this total and enter the balance due on line 5; this is the amount you need to pay.

- Under "Composition of prepayments", list all prepayment amounts including mandatory and voluntary installments, as well as overpayments credited from previous periods or forms. If you need more space, indicate "see attached” and provide the details on a separate sheet.

- For "Paid preparer use only," if a paid preparer completed the form, they must provide their information, including the firm’s name, EIN, the preparer’s PTIN or SSN, signature, address, e-mail, and NYTPRIN or exclusion code, along with the date of preparation.

- Review all the information entered for accuracy.

- Attach your payment to the form as instructed if you owe a balance and make the check payable to "New York State Corporation Tax".

- Follow the enclosed instructions for details on where and how to file the form.

Once you've filled out the form correctly and attached any necessary payment, the final step is to submit the form to the appropriate department as defined in the instructions. It's important to ensure that the form is submitted by the original due date of the return to avoid penalties for late filing. Successfully securing an extension can provide your corporation with the necessary time to compile a thorough and accurate franchise tax return.

Obtain Answers on Ct 5 4

What is the CT-5.4 form?

The CT-5.4 form is a document used by New York S Corporations to request a six-month extension of time to file their New York S Corporation Franchise Tax Return. This extension allows businesses to delay filing their complete tax return without facing immediate penalties for late submission.

Who needs to file the CT-5.4 form?

This form must be filed by S Corporations that are registered in New York State and need additional time beyond the usual filing deadline to submit their Franchise Tax Return. It's specifically for entities that cannot file Form CT-3-S by the due date.

What information is required on the CT-5.4 form?

When completing the CT-5.4 form, corporations need to provide their tax period (both beginning and ending dates), Employer Identification Number (EIN), file number, business telephone number, legal name of the corporation, any trade name/DBA, mailing address, state or country of incorporation, and the date they began business in New York State (for foreign corporations).

How do you calculate the payment that needs to be attached with the CT-5.4 form?

The form requires an estimation of franchise tax due, including the first installment of estimated tax for the next tax year. The total franchise tax and the first installment are summed, and any prepayments of franchise tax are subtracted to find the balance due. This balance is the amount that should be paid with the extension request.

Can I update my corporation’s address or phone information on this form?

No, the CT-5.4 form is not designed for updating a corporation’s contact information. To update address or phone information for corporation tax or other tax types, corporations must do so online through the Business Information section in Form CT-1.

Where do I file the CT-5.4 form?

Specific instructions for where to file the CT-5.4 form are included with the form’s instructions. It is important to refer to these instructions to ensure the form and any payment are sent to the correct address or completed through the appropriate online platform if available.

Is a payment required with the filing of the CT-5.4 form?

Yes, a payment of the calculated balance due on line 5 of the form must be included with the request for extension. This payment represents an estimation of the franchise tax due and helps prevent potential penalties and interest for late payment.

What happens if I don’t file the CT-5.4 form and my tax return is late?

Failing to file the CT-5.4 form and subsequently filing your tax return late may result in penalties, interest charges, and other consequences imposed by the New York State Department of Taxation and Finance. Therefore, it is crucial to either file this extension form on time or ensure your tax return is filed by the original due date.

Can I file the CT-5.4 form electronically?

While the form itself doesn't specify, many New York State tax forms and payments can be submitted electronically. Businesses should check with the New York State Department of Taxation and Finance's official website or contact them directly to confirm if the CT-5.4 can be filed online and to access the electronic filing options.

What should I do if I need to correct information on a previously filed CT-5.4?

If incorrect information was submitted on a previously filed CT-5.4 form, the corporation should contact the New York State Department of Taxation and Finance as soon as possible. They will provide guidance on how to submit corrected information, whether it entails filing an amended form or taking another corrective action.

Common mistakes

Filling out the CT-5.4 form, a request for a six-month extension to file the New York S Corporation Franchise Tax Return, can be complicated. Mistakes in this process can lead to delays or penalties. Here are eight common errors:

Not entering the tax period's beginning and ending dates accurately. This basic information is critical for the Department of Taxation and Finance to process the request properly.

Incorrect Employer Identification Number (EIN) or file number entry. These numbers identify the business and must be entered correctly to avoid processing issues.

Failing to provide a current business telephone number, which is essential for any needed communication regarding the form.

Leaving the legal name of the corporation, trade name/DBA, or mailing name and address sections incomplete or inaccurate. These details are crucial for the identification and correspondence with the corporation.

Misidentifying the state or country of incorporation, or inaccurately entering the date of incorporation or the date the business began in New York State. This information helps clarify the corporation's legal status and history.

Miscalculating the estimated franchise tax due. Errors in this section could result in either underpayment or overpayment of taxes.

Incorrectly reporting prepayments of franchise tax, including the mandatory first installment and any subsequent installments or overpayments credited from prior years. Accurate reporting here is crucial for the calculation of the balance due.

Omitting the signature and contact information of the individual preparing the document. Validation of the preparer's identity and the ability to contact him or her if necessary is a legal requirement.

Being attentive to these common errors when completing the CT-5.4 form is important for timely and successful filing.

Documents used along the form

When businesses tackle their New York S Corporation Franchise Tax Returns, the CT-5.4 form is just the beginning. To successfully navigate tax season, several other forms and documents are commonly used alongside CT-5.4. Understanding these forms will simplify the tax filing process and ensure compliance with New York State tax laws.

- CT-3-S: This is the New York S Corporation Franchise Tax Return form itself, for which the CT-5.4 requests an extension. It details the income, deductions, and credits of the S Corporation.

- CT-400: The Estimated Tax for Corporations form is used for making quarterly estimated tax payments. Those payments are then reported on the CT-5.4.

- CT-1: Supplement to Corporation Tax Instructions provides additional guidance on how to fill out corporate tax forms, including the CT-5.4.

- IT-204-CP: Used by partnerships to report and pay composite income tax on behalf of nonresident partners, this form is relevant for S Corporations with partnership investments.

- IT-2: Summarizes wages and New York State, New York City, or Yonkers tax withheld, as reported by the corporation's employees on their W-2 forms.

- Form W-2: Wage and Tax Statement from employers to employees. S Corporations must provide this to their employees to report annual wages and taxes withheld.

- Form 1099-DIV: Used to report dividends and distributions to shareholders, this form is essential for S Corporations as it details the income shareholders need to report on their personal tax returns.

- Form 1120S: Although a federal form, the U.S. Income Tax Return for an S Corporation is necessary for filing state taxes as it provides a comprehensive overview of the corporation's financial activity.

- Form 8822-B: Change of Address or Responsible Party — Business form must be completed if the S Corporation has updated its address or contact information since the last filing.

- Form SS-4: Application for Employer Identification Number (EIN). While not annually required, this form is critical for new S Corporations or those needing to update their EIN information.

Together, these forms ensure that S Corporations meet all tax obligations and maintain good standing with New York State. Each document plays a crucial role in accurately reporting the corporation's financial affairs, making the tax filing process smoother and more efficient. Ready knowledge and proper management of these forms can significantly reduce the complexity of tax season for S Corporations.

Similar forms

The Form 7004: Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns is similar to CT-5.4 because both forms are used to request an extension of time for filing tax returns. While CT-5.4 is specific to New York S Corporation Franchise Tax, Form 7004 applies to various business income taxes at the federal level.

Form 4868: Application for Automatic Extension of Time to File U.S. Individual Income Tax Return compares similarly since it allows individuals to request a six-month extension for their personal tax returns. Like CT-5.4, it serves to delay the filing deadline, but CT-5.4 is for corporations, and Form 4868 is for individual taxpayers.

The Form 8809: Application for Extension of Time to File Information Returns, shares its purpose with CT-5.4 in offering an extension to filers, though Form 8809 is for information returns instead of franchise tax returns. Both allow entities extra time to gather and submit required documentation.

Form 8868: Application for Extension of Time to File an Exempt Organization Return is akin to CT-5.4 in the way it provides nonprofit organizations with a way to seek more time for filing their tax returns. Each document caters to specific entity types, highlighting the breadth of tax responsibilities across different organizational structures.

The Form IT-370: Application for Automatic Six-Month Extension of Time to File for Individuals is similar to the CT-5.4, facilitating an extension for individuals rather than corporations in New York. Both forms cater to New York residents, albeit under different tax classifications (individual vs. S corporation).

Form CT-5: Request for Six-Month Extension to File (For Certain Business Taxes Other Than the Corporate Franchise Tax) parallels CT-5.4 by also seeking an extension for filing New York business taxes. While CT-5 covers a broader range of business taxes, CT-5.4 is specifically for the S Corporation Franchise Tax, illustrating the nuanced tax infrastructure for different business entities within the state.

Dos and Don'ts

When filling out the CT-5.4 form for requesting a six-month extension to file your New York S Corporation Franchise Tax Return, here are 8 things you should and shouldn't do to ensure accuracy and compliance:

- Do make sure to accurately enter your tax period at the top of the form, including both the beginning and ending dates.

- Do provide your Employer Identification Number (EIN) without errors, as it is crucial for the identification of your business.

- Don't forget to include your business telephone number, including the area code, as it may be used for any necessary follow-up.

- Do list the legal name of the corporation exactly as it is registered, along with any trade name/DBA (Doing Business As) if applicable.

- Don't overlook the mailing address section; ensure it is complete and up to date, especially if it differs from the legal address of the corporation.

- Do accurately calculate and enter the franchise tax and any estimated payments to avoid errors in payment amounts.

- Don't neglect to include any prepayments of franchise tax that have been made during the specified tax period.

- Do ensure that if a paid preparer completes this form, all preparer information is filled out, including the preparer’s name, identification numbers, and contact information.

Following these guidelines will help ensure that your CT-5.4 form is completed accurately, which is crucial for obtaining the needed extension without any issues.

Misconceptions

Misconception 1: The CT-5.4 form grants an automatic extension for all corporation tax responsibilities. The purpose of the CT-5.4 form is specifically to request a six-month extension to file the New York S Corporation Franchise Tax Return (Form CT-3-S) only. It does not extend the due date for payment of the tax owed. Taxpayers are required to estimate and pay any owed franchise tax by the original due date to avoid penalties and interest.

Misconception 2: Filing CT-5.4 is only necessary if you owe taxes. Regardless of whether an S Corporation expects to owe taxes or not, they must file Form CT-5.4 if they need additional time to file their Franchise Tax Return. This extension ensures that corporations remain compliant with filing deadlines and helps avoid late filing penalties, even if they do not anticipate a tax liability.

Misconception 3: The CT-5.4 form updates business information with the New York Department of Taxation and Finance. While the form requires basic business information, its primary purpose is not to update the corporation's records with the Department of Taxation and Finance. Changes to address or phone information should be made separately through the Business Information section in Form CT-1 or online, as indicated on the form. The CT-5.4 focuses solely on requesting an extension for filing the tax return.

Misconception 4: The payment enclosed with CT-5.4 is for the extension fee. There is no fee to request an extension using Form CT-5.4. Instead, the payment that accompanies the form is an estimated payment towards the corporation’s franchise tax liability. This prepayment is applied to the franchise tax due for the fiscal year in question. Ensuring that an accurate estimated tax payment is made with the CT-5.4 can help avoid interest and penalties on underpaid taxes.

Key takeaways

The process of requesting a six-month extension for filing the New York S Corporation Franchise Tax Return using the CT-5.4 form is critical for businesses to ensure compliance and avoid potential penalties. Below are key takeaways for businesses preparing to file this extension request.

- Eligibility: The CT-5.4 form is specifically designed for S Corporations seeking additional time to file their Franchise Tax Return. It's important to understand that this extension is for filing the return, not an extension of time to pay any taxes due.

- Required Information: Completing the form necessitates detailed information about the corporation, including the Employer Identification Number (EIN), file number, legal and trade names, business address, and the state or country of incorporation. Providing accurate and complete information is vital for proper processing.

- Payment Calculations: Corporations must estimate and report their franchise tax liability on the form. This includes any installments for the current and next tax year, prepayments, and amounts due. Accuracy in these calculations helps avoid discrepancies and potential interest or penalties on underpayments.

- Due Date: To effectively use the extension, corporations must file the CT-5.4 form by the original due date of their Franchise Tax Return. Filing after this date can result in the extension request being denied, leading to late filing penalties.

- Address and Phone Updates: If there have been changes to the corporation's address or telephone information, these can be updated online rather than on the form. This ensures clear communication channels with the Tax Department for any notices or updates regarding the tax filing.

- Professional Preparation: While corporations can prepare and file this form themselves, many choose to use a tax professional. The form includes a section for preparer information, emphasizing the importance of having a knowledgeable individual or team handle tax matters. Utilizing professional services can provide additional assurance that the form is filled out correctly and that all tax liabilities are accurately calculated.

In summary, the CT-5.4 form is a crucial document for New York S Corporations needing more time to compile their Franchise Tax Return. By following these key points, businesses can navigate the extension process more smoothly, ensuring compliance and maintaining good standing with the New York Department of Taxation and Finance.

Popular PDF Forms

Ohio Llc Formation - By offering both regular and expedited service options, the Ohio Secretary of State accommodates various business needs and urgencies in processing filings.

What Is Assignment of Benefits in Healthcare - Patients acknowledge full financial responsibility for any treatments received from Dr. Silver, agreeing to pay for any portion not covered by insurance.

4 Main Financial Statements - The form’s design for categorizing different types of income facilitates a clear understanding of the individual's earning mechanisms.