Blank Ct Os 114 PDF Template

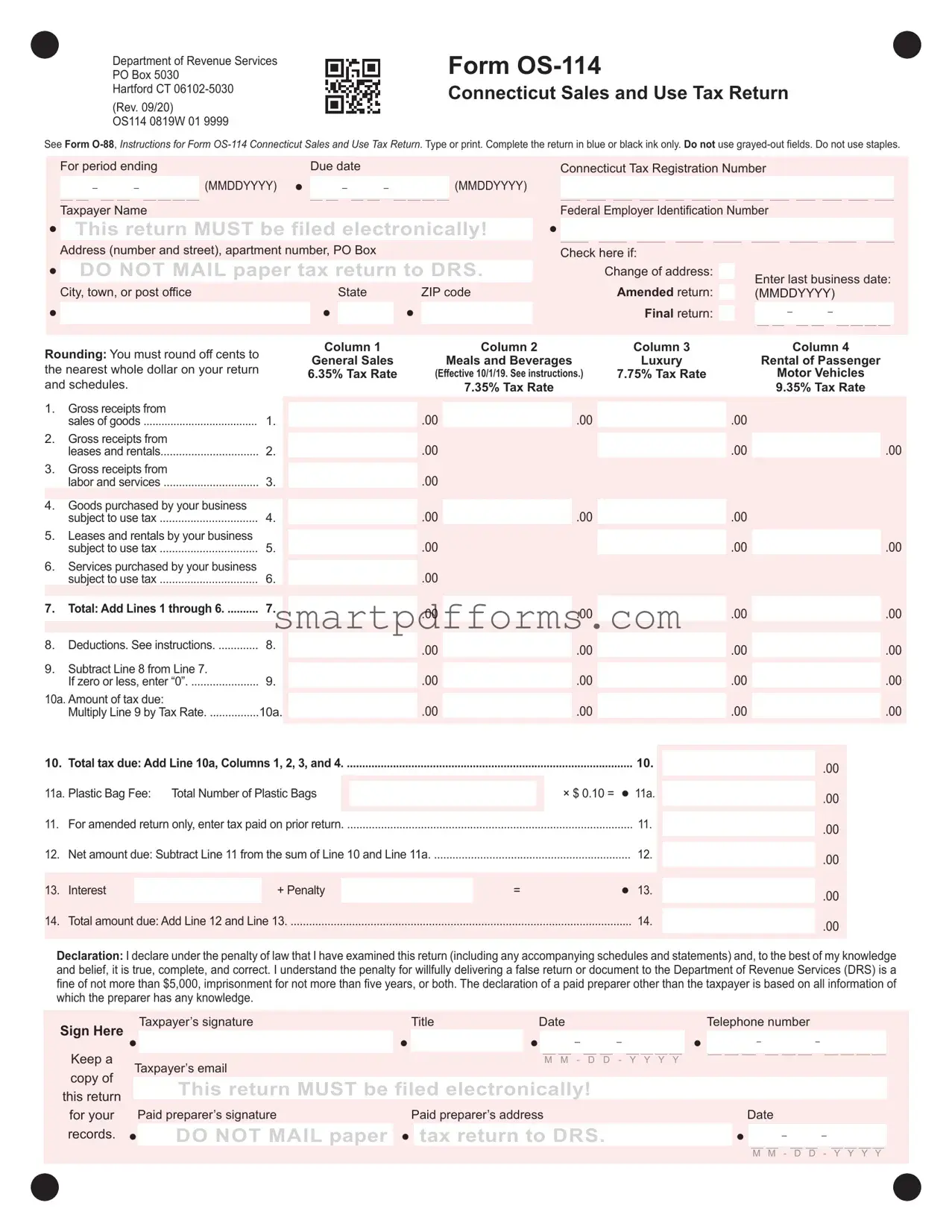

Navigating the intricacies of tax obligations marks a significant aspect of managing a business within Connecticut. The Form OS-114, Connecticut Sales and Use Tax Return, stands as a vital document for business owners, meticulously designed to reconcile sales, leases, and service transactions over a specific period. Revised in September 2020, this form mandates electronic filing, actively discouraging the mailing of paper returns, a move reflecting the state's push towards digitization and efficiency in tax administration. Unique to Connecticut, this form encompasses various tax rates applicable to general sales, meals and beverages, luxury items, and the rental of passenger motor vehicles, each tailored to distinct categories of goods and services. Furthermore, it introduces a plastic bag fee, underscoring Connecticut's environmental commitments. Businesses must calculate their gross receipts, allowable deductions, and net tax obligations across different categories, and potentially adjust for credits from previously filed returns. Importantly, this form carries legal weight, with signatories affirming the accuracy of the information under penalty of law. This declaration underlines the seriousness with which the Department of Revenue Services (DRS) treats compliance, backed by significant penalties for willful misrepresentation. Thus, Form OS-114 represents more than a tax return; it is a comprehensive framework guiding businesses through Connecticut's sales and use tax landscape, ensuring that they contribute their fair share to the state's finances while operating within a legal and regulatory framework designed to promote fair business practices and environmental stewardship.

Preview - Ct Os 114 Form

Department of Revenue Services PO Box 5030

Hartford CT

(Rev. 09/20)

OS114 0819W 01 9999

Form

Connecticut Sales and Use Tax Return

See Form

For period ending |

Due date |

||||||||

|

|

|

|

(MMDDYYYY) |

|

|

|

|

(MMDDYYYY) |

|

|

|

|

|

|||||

Taxpayer Name

This return MUST be filed electronically!

Address (number and street), apartment number, PO Box

DO NOT MAIL paper tax return to DRS.

City, town, or post office |

State |

ZIP code |

|

|

|

Connecticut Tax Registration Number

Federal Employer Identification Number

Check here if: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change of address: |

|

Enter last business date: |

|||||||||||||||||||

|

|||||||||||||||||||||

Amended return: |

|

||||||||||||||||||||

|

(MMDDYYYY) |

||||||||||||||||||||

Final return: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rounding: You must round off cents to |

Column 1 |

|

Column 2 |

Column 3 |

Column 4 |

||

General Sales |

|

Meals and Beverages |

Luxury |

Rental of Passenger |

|||

the nearest whole dollar on your return |

|

||||||

6.35% Tax Rate |

(Effective 10/1/19. See instructions.) |

7.75% Tax Rate |

Motor Vehicles |

||||

and schedules. |

|

|

7.35% Tax Rate |

|

9.35% Tax Rate |

||

1. |

Gross receipts from |

1. |

.00 |

.00 |

.00 |

|

|

|

sales of goods |

|

|||||

2. |

Gross receipts from |

2. |

.00 |

|

|

.00 |

.00 |

|

|

||||||

|

leases and rentals |

|

|

||||

3. |

Gross receipts from |

3. |

.00 |

|

|

|

|

|

labor and services |

|

|

|

|

||

4. |

Goods purchased by your business |

4. |

.00 |

.00 |

.00 |

|

|

|

subject to use tax |

|

|||||

5. |

Leases and rentals by your business |

5. |

.00 |

|

|

.00 |

.00 |

|

subject to use tax |

|

|

||||

6. |

Services purchased by your business |

6. |

.00 |

|

|

|

|

|

subject to use tax |

|

|

|

|

||

7. |

Total: Add Lines 1 through 6 |

7. |

.00 |

.00 |

.00 |

.00 |

|

|

|

|

|||||

8. |

Deductions. See instructions |

8. |

.00 |

.00 |

.00 |

.00 |

|

|

|

|

|||||

9. |

Subtract Line 8 from Line 7. |

9. |

.00 |

.00 |

.00 |

.00 |

|

|

If zero or less, enter “0” |

||||||

10a. Amount of tax due: |

10a. |

.00 |

.00 |

.00 |

.00 |

||

|

Multiply Line 9 by Tax Rate |

||||||

10. |

Total tax due: Add Line 10a, Columns 1, 2, 3, and 4 |

|

|

10. |

.00 |

||

|

|

|

|

|

|

|

|

11a. |

Plastic Bag Fee: Total Number of Plastic Bags |

|

× $ 0.10 = |

11a. |

.00 |

||

|

|

|

|

|

|

|

|

11. |

For amended return only, enter tax paid on prior return |

|

|

11. |

.00 |

||

|

|

|

|

|

|

|

|

12. |

Net amount due: Subtract Line 11 from the sum of Line 10 and Line 11a |

|

12. |

.00 |

|||

|

|

|

|

|

|

|

|

13. |

Interest |

+ Penalty |

|

= |

|

13. |

.00 |

|

|

|

|

|

|

|

|

14. |

Total amount due: Add Line 12 and Line 13 |

|

|

14. |

.00 |

||

|

|

|

|

|

|

|

|

Declaration: I declare under the penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to the Department of Revenue Services (DRS) is a fine of not more than $5,000, imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Sign Here

Keep a copy of this return for your records.

Taxpayer’s signatureTitleDateTelephone number

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Taxpayer’s email |

|

|

|

|

M |

M |

D |

D |

Y |

Y |

Y |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

This return MUST be filed electronically! |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Paid preparer’s signature |

|

Paid preparer’s address |

|

|

|

|

|

|

Date |

|||||||||||||||||||||||||||||||||||||||||||

|

DO NOT MAIL paper |

|

|

tax return to DRS. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

M M - D D - Y Y Y Y

Form

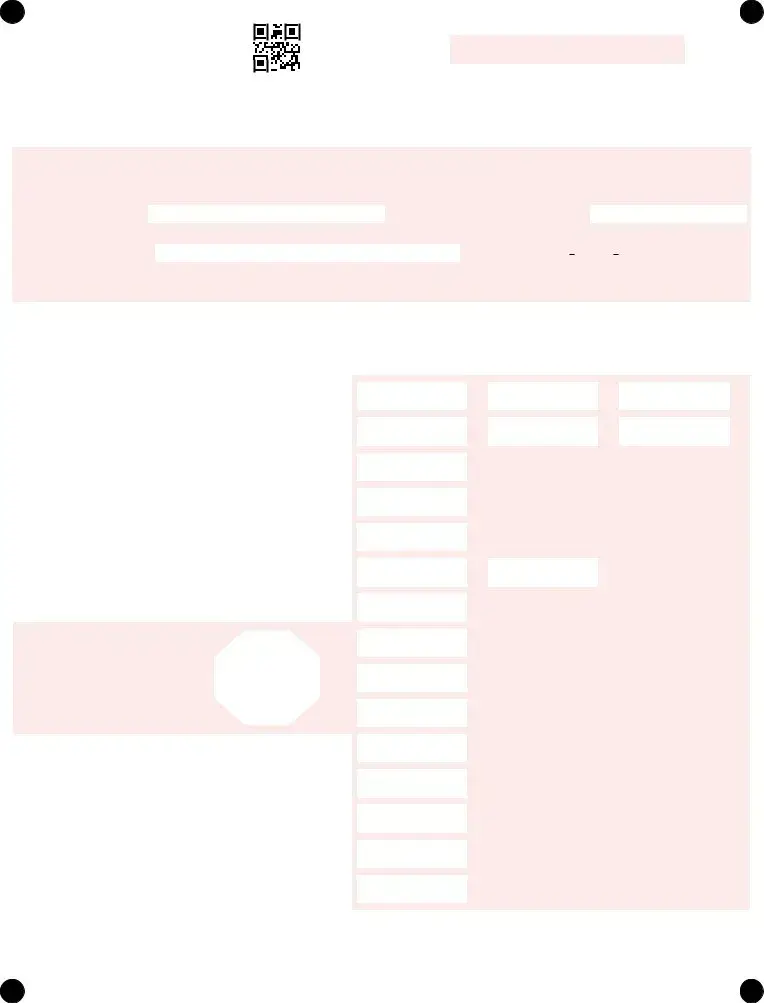

Page 2 of 4 (Rev. 09/20)

OS114 0819W 02 9999

See instructions (Form

Connecticut Tax |

_ _ _ _ _ _ _ _ _ _ _ _ _ |

Registration Number |

All quarterly and monthly filers must file Form

If applicable, provide the following information:

Enter new mailing address:

Enter new physical location (PO Box is not acceptable.):

Enter new trade name: |

First return - Enter business start date: |

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

New owners must obtain a new Connecticut Tax Registration Number. |

M |

|

|

M |

|

D |

D |

|

Y |

Y |

Y |

Y |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Enter new owner name: |

Date sold: |

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

M |

M |

D |

D |

|

|

|

Y |

Y |

|

Y |

|

Y |

|||||||||||||||||||

Address:

Deductions (See instructions, Form

15. |

Sales for resale or sales through a registered marketplace facilitator |

|

|

- sales of goods |

15. |

16. |

Sales for resale or sales through a registered marketplace facilitator |

|

|

- leases and rentals |

16. |

17. |

Sales for resale or sales through a registered marketplace facilitator |

|

|

- labor and services |

17. |

18. |

All newspapers and subscription sales of magazines and puzzle |

|

|

magazines |

18. |

19. |

Trucks with GVW rating over 26,000 lbs. or used exclusively for |

|

|

carriage of interstate freight |

19. |

21. |

Food for human consumption, food sold in vending machines, items |

|

|

purchased with food stamps |

21. |

23. |

Sale of fuel for motor vehicles |

23. |

Column 1 |

|

Column 2 |

Column 3 |

|

General Sales |

|

Meals and Beverages |

Luxury |

|

6.35% Tax Rate |

(Effective 10/1/19. See instructions.) |

7.75% Tax Rate |

||

|

|

7.35% Tax Rate |

|

|

|

.00 |

.00 |

.00 |

|

|

.00 |

|

|

.00 |

|

|

|

||

.00

.00

.00

.00.00

.00

24.Sales of electricity, gas, and heating fuel for residential dwellings

25.Sales of electricity - $150 monthly charge per business

26.Sales of electricity, gas, and heating fuel

for manufacturing or agricultural production

For Utility |

24. |

|

and Heating Fuel

Companies 25.

Only

26.

.00

.00

.00

27. |

Aviation fuel |

27. |

29. |

Tangible personal property to persons issued a Farmer Tax |

|

|

Exemption Permit |

29. |

30. |

Machinery, its replacement, repair, component and enhancement |

|

|

parts, materials, tools and fuel for manufacturing |

30. |

31. |

Machinery, materials, tools, and equipment used in commercial |

|

|

printing process or publishing |

31. |

32. |

Vessels, machinery, materials, tools, and fuel for commercial fishing |

32. |

.00

.00

.00

.00

.00

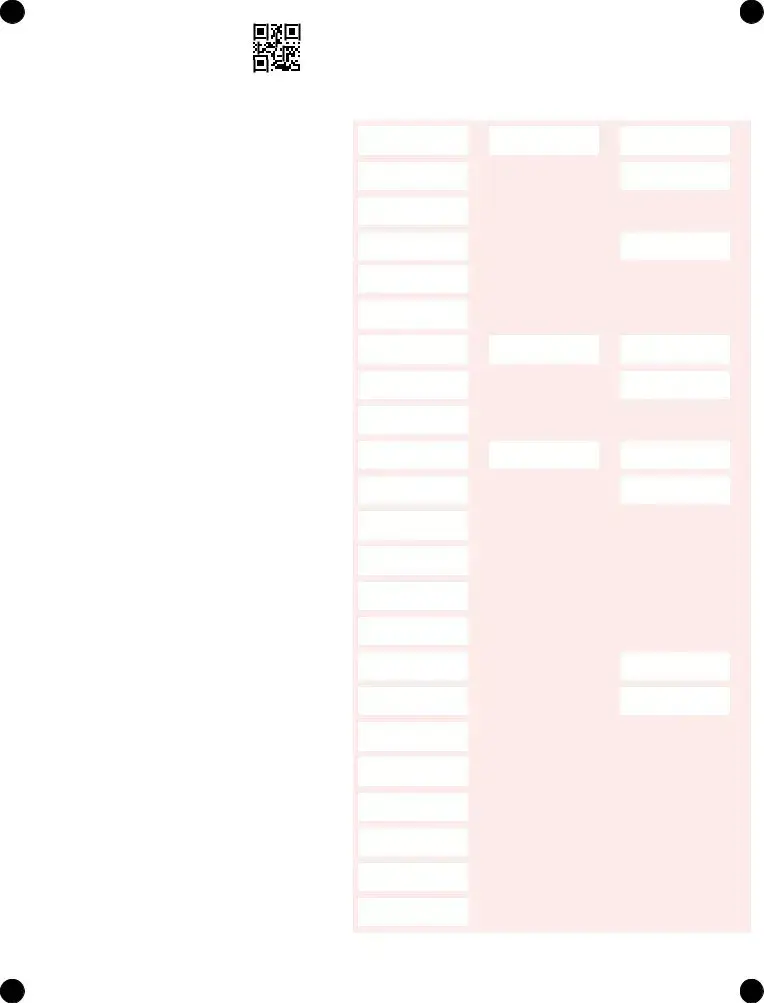

Form

Page 3 of 4 (Rev. 09/20)

OS114 0819W 03 9999

See instructions (Form

Connecticut Tax |

_ _ _ _ _ _ _ _ _ _ |

_ _ _ |

|

Registration Number |

|

||

|

|

|

|

Column 1 |

Column 2 |

Column 3 |

|

General Sales |

Meals and Beverages |

Luxury |

|

6.35% Tax Rate |

(Effective 10/1/19. See instructions.) |

7.75% Tax Rate |

|

|

7.35% Tax Rate |

|

|

33. |

33. |

|

34. |

34. |

|

35. |

35. |

|

36. |

Motor vehicles or vessels purchased by nonresidents |

36. |

37. |

Prescription medicines and diabetic equipment |

37. |

38. |

Nonprescription drugs and medicines |

38. |

39. |

Sales to charitable or religious organizations - sales of goods |

39. |

40. |

Sales to charitable or religious organizations - leases and rentals |

40. |

41. |

Sales to charitable or religious organizations - labor and services |

41. |

42. |

Sales to federal, Connecticut, or municipal agencies - sales of goods |

42. |

43.Sales to federal, Connecticut, or municipal agencies - leases and rentals 43.

44.Sales to federal, Connecticut, or municipal agencies - labor and services 44.

45.Items certified for air or water pollution abatement - sales, leases,

|

and rentals of goods |

45. |

47. |

Nontaxable labor and services |

47. |

48. |

Services between |

|

|

(See instructions, Form |

48. |

50. |

50. |

|

52. |

Taxed goods returned within 90 days at the rate listed above in |

|

|

Columns 1 or 3 |

52. |

56. |

Oxygen, blood plasma, prostheses, etc. - sales, leases, rentals, |

|

|

or repair services of goods |

56. |

63. |

Funeral expenses |

63. |

69. |

Certain aircraft and repair services, repair or replacement parts |

|

|

for aircraft |

69. |

71. |

Certain machinery under the Manufacturing Recovery Act of 1992 |

|

|

(See instructions, Form |

71. |

72. |

Machinery, equipment, tools, supplies, and fuel used in the |

|

|

biotechnology industry |

72. |

73. |

Repair and maintenance services and fabrication labor to vessels |

73. |

.00 |

.00 |

.00 |

.00 |

|

.00 |

.00 |

|

|

.00 |

|

.00 |

.00

.00

.00 |

.00 |

.00 |

.00 |

|

.00 |

.00 |

|

|

.00 |

.00 |

.00 |

.00 |

|

.00 |

.00

.00

.00

.00

.00 |

.00 |

.00 |

.00 |

.00

.00

.00

.00

.00

.00

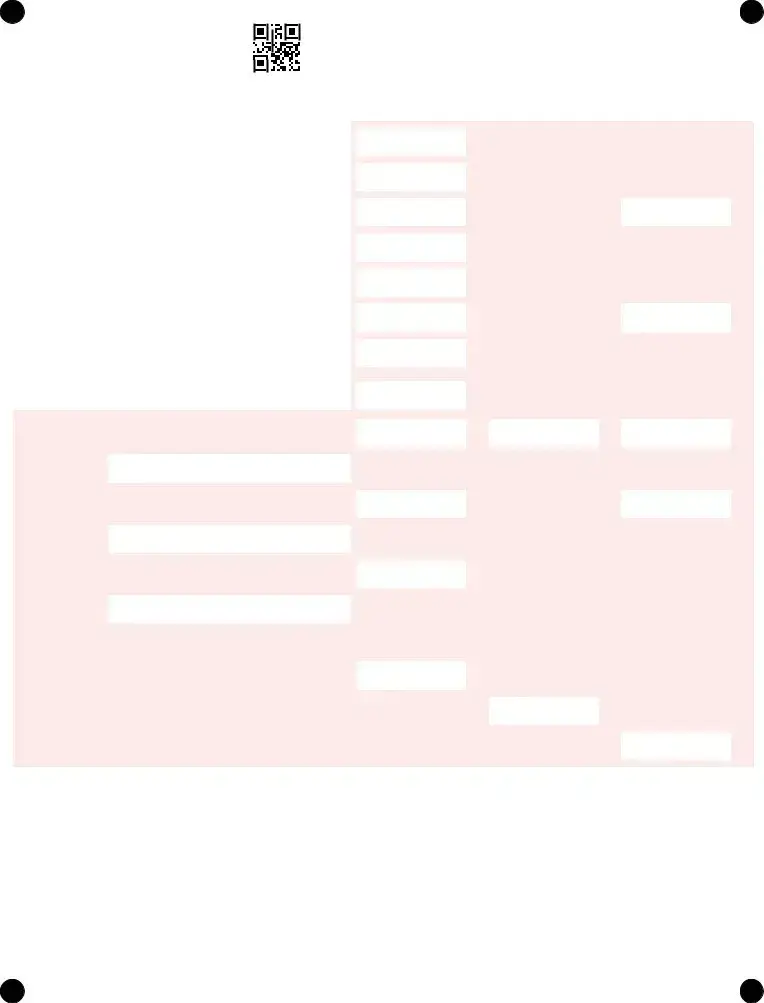

Form

Page 4 of 4 (Rev. 09/20)

OS114 0819W 04 9999

See instructions (Form

Connecticut Tax |

_ _ _ _ _ _ _ _ _ _ |

_ _ _ |

|

Registration Number |

|

||

|

|

|

|

Column 1 |

Column 2 |

Column 3 |

|

General Sales |

Meals and Beverages |

Luxury |

|

6.35% Tax Rate |

(Effective 10/1/19. See instructions.) |

7.75% Tax Rate |

|

|

7.35% Tax Rate |

|

|

74. |

Computer and data processing services at 1% |

|

|

(See instructions, Form |

74. |

75. |

Renovation and repair services to residential real property |

75. |

77. |

Sales of qualifying items to direct payment permit holders |

77. |

78. |

Sales of college textbooks |

78. |

79. |

Sales tax holiday |

79. |

82. |

Motor vehicles sold to active duty nonresident members of the armed |

|

|

forces at 4.5% (See instructions, Form |

82. |

83. |

For cigarette dealers only: Purchases of cigarettes taxed by a |

|

|

stamper or distributor |

83. |

84.Sales of vessels, motors for vessels or trailers used for transporting vessels at 2.99%. Effective October 1, 2019, sales of dyed diesel

|

marine fuel at 2.99%. (See instructions, Form |

84. |

|

A. |

Other Adjustments - sales of goods |

A. |

|

|

(Describe: |

|

) |

B. |

Other Adjustments - leases and rentals |

B. |

|

|

(Describe: |

|

) |

.00

.00

.00 |

.00 |

.00

.00

.00 |

|

.00 |

.00 |

|

|

.00 |

|

|

.00 |

.00 |

.00 |

.00 |

|

.00 |

C. Other Adjustments - labor and services |

C. |

.00 |

|

|

|

|

|

|

|

(Describe: |

) |

|

|

|

Total Deductions: |

|

|

|

|

Enter here and in Column 1, Line 8 on the front of this return |

|

.00 |

|

|

|

|

|

|

|

Enter here and in Column 2, Line 8 on the front of this return |

|

.00 |

|

|

|

|

|

|

|

Enter here and in Column 3, Line 8 on the front of this return |

|

|

.00 |

|

|

|

|

|

|

Form Data

| Fact Number | Fact Name | Description |

|---|---|---|

| 1 | Form Purpose | The form is used for Connecticut Sales and Use Tax Return filing. |

| 2 | Revision Date | The form was revised in September 2020. |

| 3 | Electronic Filing Requirement | The return must be filed electronically with the Department of Revenue Services. |

| 4 | Ink Requirement | Complete the form in blue or black ink only. |

| 5 | Multiple Tax Rates | Includes tax rates for General Sales, Meals and Beverages, Luxury, and Rental of Passenger Motor Vehicles. |

| 6 | Governing Law | Subject to the laws of Connecticut governing sales and use tax. |

| 7 | Deductions and Adjustments | Provides sections for reporting deductions and adjustments specific to sales, leases, and services. |

| 8 | Penalty for False Return | Imposes penalties for willfully delivering a false return or document, including fines up to $5,000 or imprisonment. |

| 9 | Filing and Payment Deadline | The form must be filed and the associated taxes paid on or before the last day of the month following the end of the taxable period. |

Instructions on Utilizing Ct Os 114

Filing the Connecticut Sales and Use Tax Return, Form OS-114, requires accuracy and attention to ensure compliance with state tax laws. Since the Department of Revenue Services mandates electronic submission, be prepared to file online via the myconneCT portal. Gathering accurate sales, purchases, and deduction data before starting will streamline the process. Following these steps will guide you through completing the form correctly.

- Log into the myconneCT portal on the Connecticut Department of Revenue Services website.

- Locate Form OS-114 under the Sales and Use Tax section.

- Enter the period ending and due date in the format MMDDYYYY where indicated.

- Fill in your Taxpayer Name, Address, City, State, and ZIP code in the respective fields.

- Provide your Connecticut Tax Registration Number and Federal Employer Identification Number (FEIN).

- Mark the checkbox if there's a change in address, if it's an amended return, or a final return, and fill in the relevant dates if applicable.

- In the section detailing Gross Receipts, enter the amount in dollars for each category: sales of goods, leases and rentals, labor and services, goods purchased for use tax, leases and rentals for use tax, and services purchased for use tax.

- Add the totals of Lines 1 through 6 for each tax rate category.

- Subtract the deductions (if any) listed in the instructions to arrive at the taxable amount.

- Multiply the taxable amounts by their respective tax rates (6.35%, 7.75%, 7.35%, 9.35%) to calculate the tax due.

- Calculate the Plastic Bag Fee, if applicable, and enter the amount.

- For an amended return, input the tax paid on the prior return.

- Subtract any prepayments to find the net amount due.

- Add interest and penalty fees, if any, to the net amount due for the total amount owed.

- Sign the declaration, acknowledging the accuracy and completeness of the return under penalty of law.

- Complete the preparer's section if prepared by someone other than the taxpayer.

- Before submission, review all entries for accuracy. Ensure no paper copies are mailed as this must be filed electronically.

- Submit the form electronically through the portal and keep a copy of the confirmation for your records.

After submitting Form OS-114, monitor your email or the myconneCT portal for any correspondence from the Department of Revenue Services. They may reach out if there are questions or additional information is required. Compliance with filing deadlines helps avoid penalties and interest. Prompt payment of any taxes due is also essential to remain in good standing with the state. Should your situation change, such as ending business operations in Connecticut or changing your address, update your information promptly through the portal.

Obtain Answers on Ct Os 114

What is the Form OS-114, and who needs to file it?

The Form OS-114 is a Connecticut Sales and Use Tax Return form. It is required to be filed by businesses operating in Connecticut that collect sales tax from customers. This includes sales of goods, leases, rentals, and certain services. All businesses registered with the Connecticut Department of Revenue Services (DRS) to collect sales tax must file this form.

How do I file Form OS-114?

Form OS-114 must be filed electronically. The Connecticut Department of Revenue Services has transitioned to an electronic filing system for greater efficiency and accuracy. Businesses should use the myconneCT portal to submit their sales and use tax return.

When is Form OS-114 due?

The form is due on the last day of the month following the end of the filing period. For example, for sales made in January, the form would be due by the end of February.

Can Form OS-114 be filed by paper?

No, the Connecticut Department of Revenue Services mandates electronic filing for Form OS-114. Paper filings are not accepted, and businesses should not mail paper returns to the DRS.

What information do I need to complete Form OS-114?

To complete Form OS-114, you need information on gross receipts from sales of goods, leases, rentals, and services, purchases subject to use tax, total deductions, and the tax rate applicable to different types of transactions. Additionally, you'll need your Connecticut Tax Registration Number and Federal Employer Identification Number.

Are there any specific instructions for filling out Form OS-114?

Yes, detailed instructions for filling out Form OS-114 can be found in Form O-88, which provides line-by-line instructions. It is important to read these instructions carefully to ensure accurate and compliant filing.

What if I need to amend a previously filed Form OS-114?

If you need to amend a previously filed Form OS-114, you can do so electronically via myconneCT. Be sure to indicate that the filing is an amended return, and provide the corrected information as required.

What are the penalties for filing Form OS-114 late or incorrectly?

Penalties for late or incorrect filings can include fines, interest charges on unpaid taxes, and in severe cases, criminal charges. It is crucial to file accurately and on time to avoid these penalties. The specific penalties are detailed in the instructions for Form OS-114.

Common mistakes

Completing the Connecticut Sales and Use Tax Return (Form OS-114) accurately is crucial for businesses to comply with tax laws. However, some common mistakes can lead to errors in filing. Understanding these mistakes can help businesses avoid penalties and ensure their tax returns are processed efficiently. Below are six mistakes frequently made when filling out Form OS-114.

- Failing to file electronically. The form explicitly requires electronic filing, as noted at the beginning and end of the document. Despite this, some taxpayers attempt to mail paper returns, leading to processing delays and potential non-compliance penalties.

- Incorrectly rounding figures. Taxpayers must round off cents to the nearest whole dollar on their return. Overlooking this requirement can result in inaccuracies in tax calculations and payments.

- Omitting or incorrectly filling out the tax registration number or Federal Employer Identification Number. These crucial pieces of information are essential for correctly associating the return with the right business entity.

- Not utilizing the correct tax rates for different categories of sales. The form specifies different tax rates for general sales, meals and beverages, luxury items, and the rental of passenger motor vehicles. Applying the wrong tax rate can lead to an underpayment or overpayment of taxes.

- Overlooking eligible deductions. The form allows for various deductions, including sales for resale, certain types of food, fuel for motor vehicles, and services purchased by the business that are subject to use tax. Neglecting to claim these deductions can result in higher reported taxable sales than necessary.

- Misunderstanding the final total amount due calculation. This involves summing the tax due, any plastic bag fees, and adjusting for any payments already made on an amended return, then adding interest and penalties if applicable. Errors in this calculation can lead to incorrect payment amounts being submitted.

By carefully avoiding these mistakes, businesses can improve the accuracy of their Connecticut Sales and Use Tax Returns, ensuring compliance with tax regulations and minimizing the risk of penalties.

Documents used along the form

When dealing with the Form OS-114, Connecticut Sales and Use Tax Return, various other forms and documents are also commonly utilized to ensure compliance with state tax laws and to facilitate the accurate reporting of sales, use, and other types of tax. This selection of forms serves to complement the OS-114, addressing different facets of tax reporting and business operation needs specific to Connecticut. The descriptions below briefly outline each of these forms and their primary purpose.

- Form O-88: This document provides detailed instructions for completing Form OS-114. It offers guidance on each section and ensures accurate reporting, helping to avoid common mistakes.

- Form REG-1: Businesses use this form to apply for a Connecticut Tax Registration Number. It's essential for new businesses or companies looking to operate in Connecticut, as it's a prerequisite for filing taxes, including sales and use taxes.

- Form CT-941: This quarterly form is for reporting Connecticut Withholding Tax. Employers use it to report income taxes withheld from employees' paychecks.

- Form OP-424: The Business Entity Tax Return, used by business entities such as LLCs, serves to report and pay the biennial tax imposed on certain business types operating within the state.

- Form AU-724: When a business purchases goods subject to sales tax from an out-of-state vendor, this Use Tax Return form is used to report and pay taxes on those purchases directly to the state.

- Form REG-1 O/R: This form is used to apply for, or renew, a Sales and Use Tax Permit in Connecticut. It's critical for businesses engaged in the sale of goods and services that are taxable under state law.

- Form AU-342: This documentation is required for requesting a Refund of Sales and Use Taxes. Businesses or individuals who have overpaid taxes during a specific period can use this form to seek a refund.

- Form OS-114 ATT: The Attachment to the Sales and Use Tax Return is used alongside Form OS-114 to provide additional detail or explanations for certain reported amounts. It aids in the clearer presentation of the return's contents.

Each of these forms plays a vital role in the tax reporting and compliance process for businesses operating in Connecticut. By understanding and using these forms appropriately, businesses can ensure they meet their legal obligations and avoid potential penalties for underreporting or noncompliance. Individuals and businesses are encouraged to consult the instructions provided with each form and seek the advice of tax professionals when necessary to navigate the complexities of Connecticut's tax regulations effectively.

Similar forms

The Ct OS-114 form, a Connecticut Sales and Use Tax Return, shares similarities with various other tax documents due to its function, structure, and the information it collects. Here are nine documents that are similar to the Ct OS-114 form in different aspects:

- Form 1040 (U.S. Individual Income Tax Return): Similar to the Ct OS-114 in that it's a mandatory annual filing for taxpayers, Form 1040 pertains to personal income taxes whereas the Ct OS-114 focuses on business-related sales and use taxes.

- Form 1120 (U.S. Corporation Income Tax Return): Both forms are used by entities to report income and calculate taxes owed to the government. Form 1120 is for corporations reporting their income, gains, losses, deductions, and credits.

- Form 1065 (U.S. Return of Partnership Income): Like the Ct OS-114, Form 1065 is used by businesses (in this case, partnerships) to declare their financial information to the IRS, detailing income, deductions, gains, and losses.

- Schedule C (Profit or Loss from Business): Often filed alongside personal income tax returns, Schedule C is used by sole proprietors, similar to how businesses use the Ct OS-114 to report sales, expenses, and net profit from business operations.

- Form 941 (Employer’s Quarterly Federal Tax Return): This form is used by employers to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks, similar to how the Ct OS-114 is used to report and pay taxes collected from consumers.

- Form W-2 (Wage and Tax Statement): Issued by employers to employees and the IRS at the end of the fiscal year, it reports salary information along with the taxes withheld. While the content differs, both the W-2 and Ct OS-114 are critical for tax reporting purposes.

- Form 1099 (Various): This series of forms is used to report different types of income other than salaries, wages, and tips. Like the Ct OS-114, 1099 forms play a crucial role in accurate tax reporting for individuals and entities.

- State-Specific Sales Tax Forms: Similar to the Ct OS-114 but for different states, these forms are used by businesses to report and pay sales and use taxes specific to the state in which they operate, reflecting state-level tax regulatory requirements.

- Form UST-1 (Universal Sales Tax Form): Used in specific jurisdictions, this form, like the Ct OS-114, is designed for reporting sales and use taxes. Although the form names and precise details may vary, the purpose aligns closely with the Ct OS-114 in facilitating tax compliance for businesses.

While each form serves a specific tax-related purpose, reflecting different aspects of an individual's or business's financial and operational activities, the unifying factor across all these documents is their role in ensuring compliance with tax laws and regulations.

Dos and Don'ts

Filling out the Connecticut OS-114 Sales and Use Tax Return accurately is critical for business owners. To assist, here's a quick guide on what to do and what to avoid during the process:

-

Do:

- File the form electronically, as mandated by the Department of Revenue Services (DRS). Paper submissions are not accepted.

- Use blue or black ink if filling out any portion that will be kept for your records or used in the electronic filing process.

- Round off cents to the nearest whole dollar on your return and schedules.

- Double-check your Connecticut Tax Registration Number and Federal Employer Identification Number for accuracy.

- Review deduction codes and sections carefully to ensure you're maximizing your deductions legally.

- Sign the declaration section to authenticate the submission.

- Keep a copy of the completed form for your records.

-

Don't:

- Attempt to mail in your form; remember, it must be filed electronically.

- Use grayed-out fields on the form, as these are typically disabled for a reason.

- Forget to check the appropriate boxes for any changes in address, amended, or final returns.

- Overlook the rounding rule; cents should not be included in your electronic submission.

- Leave any required fields blank; incomplete forms can lead to processing delays or fines.

- Use staples or any other binding method on any paperwork that you might need to include with your electronic filing, as advised.

- Ignore the specific tax rates applied to different categories of sales, as inaccuracies can lead to underpayment or overpayment of taxes.

Misconceptions

Understanding the CT OS-114 Form, also known as the Connecticut Sales and Use Tax Return, is crucial for businesses operating in Connecticut. However, there are several misconceptions about the form that can lead to confusion. Here are five common misunderstandings:

- It's optional to file electronically. A significant misconception is that filing the CT OS-114 form electronically is optional. The truth is that this return must be filed electronically, as explicitly stated on the form. Paper submissions are not accepted and can result in penalties or processing delays.

- Amendments can't be made once submitted. Another misunderstanding is that once the CT OS-114 is submitted, it cannot be amended. In reality, if there are errors or omissions, an amended return can and should be filed to correct these mistakes. This ensures compliance and accuracy in tax reporting and can avoid potential legal complications.

- Only sales within Connecticut are reportable. There's a misconception that only sales within Connecticut need to be reported. However, the form covers both sales and use tax, which includes out-of-state purchases brought into Connecticut for use, storage, or consumption that were not taxed at the point of purchase.

- All sales are taxable. Some believe that all sales are subject to sales tax, overlooking that the CT OS-114 form allows for various deductions and exceptions. Sales such as those for resale, specific exempted goods and services, sales to charitable organizations, and certain non-taxable labor and services can be deducted from the taxable total.

- Plastic Bag Fee is universally applied. A final misconception is regarding the Plastic Bag Fee. Some might mistakenly think this fee applies to all businesses. In reality, it is specific to those who distribute plastic bags in certain types of sales and is reported separately on the form.

Dispelling these misconceptions is essential for accurate and compliant tax reporting. Professional advice or assistance may be beneficial for businesses to navigate the complexities of sales and use tax obligations in Connecticut.

Key takeaways

Filling out the Ct Os 114 form, the Connecticut Sales and Use Tax Return, is an important obligation for businesses operating within the state. Understanding the nuances of this form can help ensure compliance with state tax regulations and avoid potential penalties. Here are six key takeaways to guide you through the process:

- Electronic filing is a must: The Form OS-114 must be filed electronically. This mandate facilitates a more streamlined and efficient processing method, reducing errors and ensuring faster handling by the Department of Revenue Services.

- Know your due date: The tax return and any associated payment are due by the last day of the month following the end of the taxable period. Marking this date on your calendar can help avoid late submissions.

- Accurate detail on various tax rates: The form requires taxpayers to apply different tax rates for general sales, meals and beverages, luxury items, and the rental of passenger motor vehicles. Awareness and accurate application of these rates are crucial for correct tax calculation.

- Rounding off to the nearest dollar: When completing the form, round off cents to the nearest whole dollar. This simplification is designed to make calculations easier and reduce confusion.

- Understanding deductions: The form allows for various deductions based on the nature of the sales and services provided. These include sales for resale, sales to registered marketplace facilitators, and sales exempt from taxation under specific conditions. Comprehensive knowledge of what qualifies for deductions can significantly reduce your taxable amount.

- Amended returns: If you discover an error in a previously submitted return, the form accommodates amendments. Correcting inaccuracies is vital to maintain compliance and avoid potential penalties for underreporting.

By familiarizing yourself with these key aspects of the Form OS-114, businesses can navigate the complexities of Connecticut's sales and use tax requirements more confidently. Keeping detailed records, thoroughly understanding applicable tax rates and deductions, and adhering to electronic filing protocols are essential best practices for complying with Connecticut's tax laws.

Popular PDF Forms

Medicaid Nc - Post-application submission procedures include retaining a copy of the initial pages for records, attaching required documentation, and understanding the necessity of a signature for processing.

How Long Does Expungement Take - The legal embodiment in Texas for those wrongfully arrested to petition the court for record removal and restoration of their name.

Lead Generation Agreement Template - States the lead generation agreement's effective date and the involved parties.