Blank Da 3072 2 PDF Template

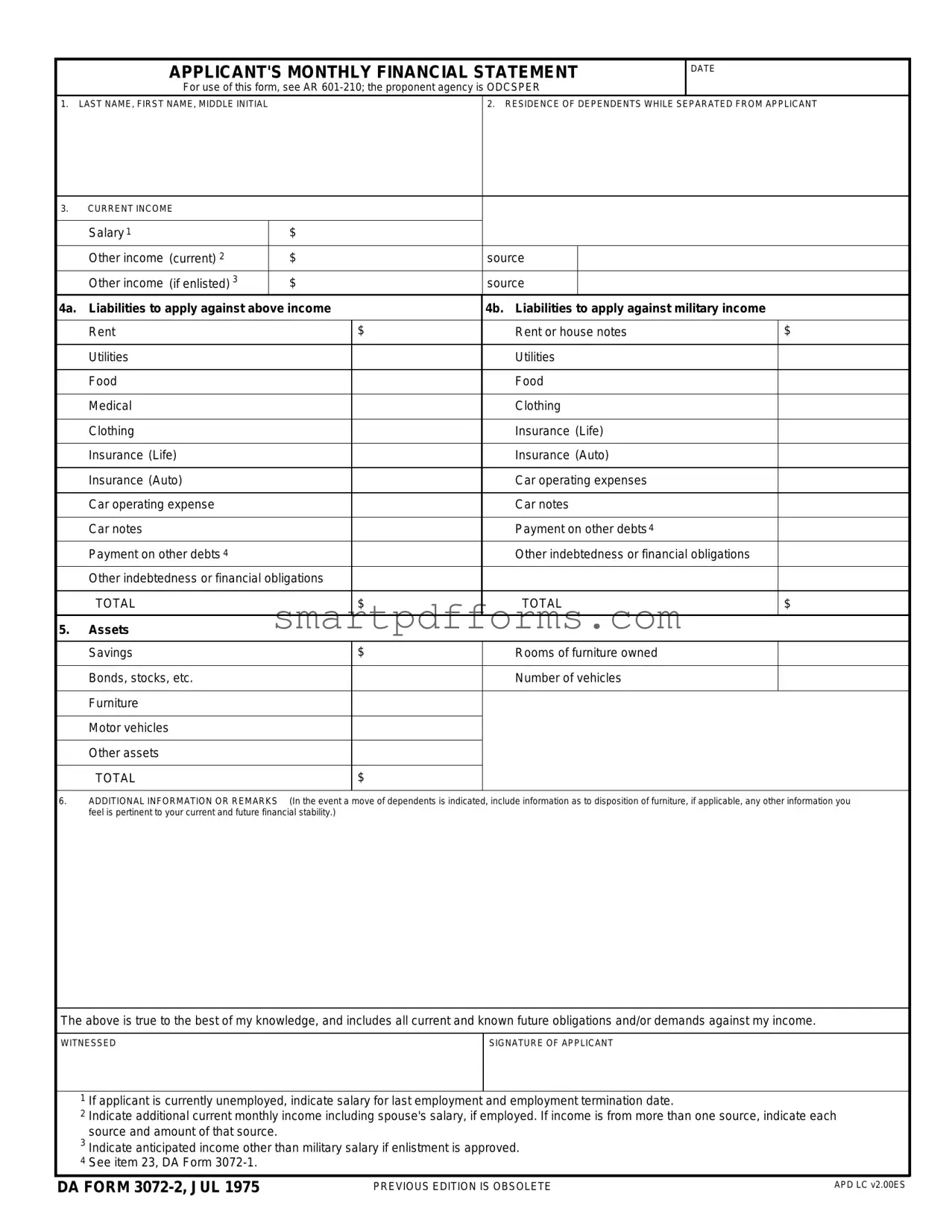

Navigating through the complexities of financial documentation is essential for individuals seeking to understand or manage their financial obligations, especially when it comes to engaging with military service in the United States. The DA Form 3072-2, known as the Applicant's Monthly Financial Statement, serves a critical role in this endeavor. This form, which must be completed in conjunction with regulations outlined in AR 601-210 and is overseen by the proponent agency ODCSPER, provides a structured method for applicants to disclose their current financial status comprehensively. It requires detailed information regarding the applicant’s income, including salary and other sources of income, both current and anticipated. Additionally, it outlines liabilities against this income, demanding a breakdown of monthly expenses such as rent, food, utilities, and other debts. Assets too are covered, asking for details on savings, valuable possessions, and more. Furthermore, the form offers space for applicants to include any pertinent additional information or remarks that might affect their financial situation, particularly focusing on any changes that military enlistment might bring. This allows for a transparent assessment of an applicant's fiscal health and preparedness for the financial responsibilities that come with military service. Completing this form accurately is crucial for applicants to demonstrate their current and future financial stability, making it an indispensable step for those considering a military career.

Preview - Da 3072 2 Form

|

APPLICANT'S MONTHLY FINANCIAL STATEMENT |

DATE |

|

|||||

|

|

|

||||||

|

For use of this form, see AR |

|

|

|||||

1. LAST NAME, FIRST NAME, MIDDLE INITIAL |

|

|

2. RESIDENCE OF DEPENDENTS WHILE SEPARATED FROM APPLICANT |

|||||

|

|

|

|

|

|

|

|

|

3. |

CURRENT INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salary 1 |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (current) 2 |

|

$ |

|

source |

|

|

|

|

Other income (if enlisted) 3 |

|

$ |

|

source |

|

|

|

4a. |

Liabilities to apply against above income |

4b. Liabilities to apply against military income |

|

|||||

|

|

|

|

|

|

|

||

|

Rent |

|

$ |

Rent or house notes |

|

$ |

||

|

|

|

|

|

|

|

|

|

|

Utilities |

|

|

Utilities |

|

|

||

|

|

|

|

|

|

|

|

|

|

Food |

|

|

Food |

|

|

||

|

|

|

|

|

|

|

|

|

|

Medical |

|

|

Clothing |

|

|

||

|

|

|

|

|

|

|

|

|

|

Clothing |

|

|

Insurance (Life) |

|

|

||

|

|

|

|

|

|

|

|

|

|

Insurance (Life) |

|

|

Insurance (Auto) |

|

|

||

|

|

|

|

|

|

|

|

|

|

Insurance (Auto) |

|

|

Car operating expenses |

|

|

||

|

|

|

|

|

|

|

|

|

|

Car operating expense |

|

|

Car notes |

|

|

||

|

|

|

|

|

|

|

|

|

|

Car notes |

|

|

Payment on other debts4 |

|

|

||

|

|

|

|

|

|

|

|

|

|

Payment on other debts 4 |

|

|

Other indebtedness or financial obligations |

|

|||

|

|

|

|

|

|

|

|

|

|

Other indebtedness or financial obligations |

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

TOTAL |

|

$ |

TOTAL |

|

$ |

||

|

|

|

|

|

|

|

|

|

5. |

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Savings |

|

$ |

Rooms of furniture owned |

|

|

||

|

|

|

|

|

|

|

|

|

|

Bonds, stocks, etc. |

|

|

Number of vehicles |

|

|

||

|

|

|

|

|

|

|

|

|

|

Furniture |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Motor vehicles |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

ADDITIONAL INFORMATION OR REMARKS |

(In the event a move of dependents is indicated, include information as to disposition of furniture, if applicable, any other information you |

||||||

feel is pertinent to your current and future financial stability.)

The above is true to the best of my knowledge, and includes all current and known future obligations and/or demands against my income.

WITNESSED |

SIGNATURE OF APPLICANT |

|

|

1 If applicant is currently unemployed, indicate salary for last employment and employment termination date.

2 Indicate additional current monthly income including spouse's salary, if employed. If income is from more than one source, indicate each source and amount of that source.

3 Indicate anticipated income other than military salary if enlistment is approved.

4 See item 23, DA Form

DA FORM |

PREVIOUS EDITION IS OBSOLETE |

APD LC v2.00ES |

|

|

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | The DA 3072-2 form is used as an applicant's monthly financial statement. |

| Regulatory Guidance | This form's use is governed by AR 601-210. |

| Proponent Agency | The agency responsible for this form is the Office of the Deputy Chief of Staff for Personnel (ODCSPER). |

| Content Overview | The form includes sections for personal information, dependents' residence information, current income, liabilities, assets, and additional remarks. |

| Form Version | This form, DA Form 3072-2, was updated in July 1975, with the current version being APD LC v2.00ES. |

Instructions on Utilizing Da 3072 2

Once you have received the DA 3072-2 form, it is essential to fill it out accurately to ensure a comprehensive understanding of your financial situation. This document, known as the Applicant's Monthly Financial Statement, plays a critical role in assessing the financial readiness of individuals for specific situations. The instructions provided below aim to guide you through the process of completing the form correctly. Ensure that all information is current and represents your financial situation truthfully to avoid any potential issues.

- Start by entering the DATE at the top right corner of the form.

- Fill in your LAST NAME, FIRST NAME, MIDDLE INITIAL in the space provided for question 1.

- For question 2, detail the RESIDENCE OF DEPENDENTS WHILE SEPARATED FROM APPLICANT, including their living arrangements.

- Under question 3, record your CURRENT INCOME details:

- Enter your Salary amount in the space next to Salary 1.

- List any Other income (current), including the source and amount.

- If applicable, detail any Other income (if enlisted), specifying the source and amount.

- In sections 4a and 4b, itemize your Liabilities against both your current and potential military income respectively. Include amounts for:

- Rent or house notes

- Utilities

- Food

- Medical expenses

- Clothing expenses

- Life and Auto insurance

- Car operating expenses

- Car notes

- Payments on other debts (See item 23 on DA Form 3072-1 for guidance)

- Any other financial obligations

- For question 5, disclose your Assets, including:

- Amount in Savings

- Value of furniture owned

- Number and value of Bonds, stocks, etc.

- Number of vehicles and their total value

- Value of any other assets

- In the ADDITIONAL INFORMATION OR REMARKS section under question 6, provide any relevant information concerning dependents' move, disposition of furniture, or any other facts that influence your current and future financial stability.

- Verify that all the information provided is accurate and complete. Then, sign the form in the space provided for the SIGNATURE OF APPLICANT.

- If applicable, have the form WITNESSED by the required party, completing the witness section.

After you have completed and reviewed the DA 3072-2 form for accuracy, submit it according to the instructions provided by the requesting authority. This document is a formal declaration of your financial status and commitments, thus ensuring its accuracy is paramount for its intended use. Remember, the details you provide should reflect your present financial situation and anticipate any known changes to your income or obligations.

Obtain Answers on Da 3072 2

What is the purpose of the DA Form 3072-2?

How is the DA Form 3072-2 organized?

Who needs to fill out the DA Form 3072-2?

What information is required in the "Additional Information or Remarks" section?

How should income from multiple sources be reported on this form?

What are the liabilities sections used for in the DA Form 3072-2?

How do applicants account for assets on the DA Form 3072-2?

Is there a section to report anticipated military income?

What verification is required at the end of the DA Form 3072-2?

The DA Form 3072-2, titled "Applicant's Monthly Financial Statement," is primarily used to compile a comprehensive overview of an applicant's current financial situation, including income, liabilities, and assets. This form plays a crucial role in the application process for individuals seeking to join the military, as outlined in AR 601-210. Its completion helps the relevant authorities evaluate the financial readiness of the applicant to undergo the transition into military life.

The form is structured to capture detailed financial data in several key areas. These include the applicant's income (with sections for salary and other incomes, including any expected military income), liabilities (divided into current liabilities and those against military income), and assets (detailing savings, property ownership, and other assets). Additionally, there is space provided for any remarks that could affect the applicant's financial situation, especially in consideration of a move that would involve dependents.

Individuals applying for enlistment in the military and undergoing the application process as per AR 601-210 are required to fill out this form. It is a crucial step for assessing the financial stability of candidates and their readiness for the potential financial implications of military service.

In the "Additional Information or Remarks" section, applicants are encouraged to provide any relevant details that could impact their current or future financial stability. This may include plans for the disposition of furniture if a move is anticipated, significant anticipated changes to income or expenses, or any other factors that might influence the applicant's financial situation.

For income from multiple sources, each source should be clearly indicated along with the amount that source contributes to the total monthly income. This includes detailing the spouse's salary, if employed, as well as any other incomes, ensuring a comprehensive understanding of the applicant's financial resources.

The liabilities sections on the form are designed to capture all current financial obligations against the applicant's income. This includes regular expenses such as rent or mortgage payments, utilities, food, insurance, and debt repayments. A separate column is provided for the applicant to list liabilities that would apply against military income, allowing for a clear distinction between current financial obligations and those anticipated upon military enlistment.

Applicants must detail their assets in the corresponding section, which includes savings accounts, the number of rooms of owned furniture, bonds, stocks, motor vehicles, and other significant assets. This provides a snapshot of the applicant's net worth and financial stability.

Yes, the form includes a section where applicants can list anticipated income that is separate from their current civilian income. This area allows applicants to indicate expected military salary or any other military-associated income if enlistment is approved.

The end of the DA Form 3072-2 requires the applicant's signature, witnessed by an appropriate party, certifying that to the best of the applicant's knowledge, the information provided includes all current and known future obligations or demands against their income, verifying the truthfulness and completeness of the provided financial statement.

Common mistakes

Completing the DA Form 3072-2 requires attention to detail and a clear understanding of one’s financial situation. Here are eight common mistakes that people often make when filling out this form:

Not providing complete information in the LAST NAME, FIRST NAME, MIDDLE INITIAL section can lead to unnecessary confusion or delays. Every letter counts in ensuring accurate identification.

Omitting RESIDENCE OF DEPENDENTS WHILE SEPARATED FROM APPLICANT details can create gaps in understanding the applicant's full situation, particularly how separation might affect financial responsibilities.

Underreporting in the CURRENT INCOME and Other income (current) sections may result in an inaccurate assessment of financial status, affecting eligibility or support levels.

When listing liabilities (sections 4a and 4b), failing to include all debts or miscalculating amounts can paint an incomplete picture of the applicant's financial obligations.

Overlooking assets in the Assets section, such as not mentioning all rooms of furniture owned or neglecting to list all vehicles, can lead to undervaluing an applicant's financial standing.

The ADDITIONAL INFORMATION OR REMARKS section is often underutilized. Ignoring this space means missing an opportunity to provide context or explanation that could influence the understanding of one’s financial situation.

Inaccurate witness information or an improperly witnessed SIGNATURE OF APPLICANT can nullify the document, undermining the effort put into completing the form.

Misunderstanding how to accurately report anticipated incomes or not including anticipated military income, if enlistment is approved, compromises the form's integrity and can misguide decision-makers.

Avoiding these mistakes not only streamlines the process but also ensures the submitted document accurately reflects the applicant’s financial situation, aiding those in charge of making informed decisions.

Documents used along the form

When completing the DA Form 3072-2, which serves as an applicant's monthly financial statement, individuals are required to provide detailed information concerning their current financial status, including income, liabilities, and assets. To effectively assess and support the financial readiness of an applicant, especially in contexts like military enlistment or other specific circumstances, several additional forms and documents often accompany this form to furnish a comprehensive financial overview.

- DA Form 3072-1: Applicant's Statement of Indebtedness - This document is used to provide a detailed list of an applicant's current debts. It complements the DA Form 3072-2 by offering more granular details about the nature and amount of liabilities reported.

- DD Form 214: Certificate of Release or Discharge from Active Duty - For veterans, this document outlines their military service, status upon discharge, and other critical information that impacts eligibility and financial considerations for re-enlistment or benefits.

- LES (Leave and Earnings Statement): A comprehensive statement for military personnel detailing their pay, entitlements, deductions, and allotments. It provides proof of current military income, which is required for analyzing financial stability.

- W-2 Form: Wage and Tax Statement - This IRS document is essential for verifying an applicant's income from employment outside of military service. It provides evidence of annual earnings and taxes withheld.

- Bank Statements: Recent bank statements offer a real-time snapshot of an applicant's financial movements, including savings, checking, and any investments, thereby supporting asset declarations.

- Credit Report: An applicant's credit report offers a comprehensive look at their credit history, outstanding debts, and overall financial responsibility, which can affect their perceived reliability and financial stability.

- Mortgage Statements or Rental Agreements: These documents verify housing costs and obligations, which are critical in assessing living expenses against income.

- Insurance Policies: Documents detailing life, auto, and health insurance policies provide insight into monthly or annual premiums that affect an applicant's financial obligations.

- Vehicle Registration and Loan Documents: These indicate ownership and any loan obligations related to personal vehicles, which are necessary to accurately reflect assets and liabilities.

In summary, the comprehensive assessment of an applicant's financial status, as intended through the DA Form 3072-2, often necessitates the support of additional forms and documents. Together, these documents create a detailed financial profile that assists decision-makers in understanding the applicant's financial readiness and stability.

Similar forms

The Form 1040 (U.S. Individual Income Tax Return) shares similarities with the DA 3072-2 form, primarily in its collection of financial information from individuals to assess financial standing. Both forms require the disclosure of income sources, albeit for different purposes; one is for tax assessment by the Internal Revenue Service, and the other is for evaluating a military applicant's financial situation.

Uniform Residential Loan Application (URLA), often used in the mortgage application process, also bears a resemblance to the DA 3072-2 form. Both forms gather extensive financial information from the applicant, including income, liabilities, and assets, to evaluate their financial health and stability, albeit for different end goals: securing a mortgage versus evaluating financial readiness for military separation.

The Consumer Credit Application is similar to the DA 3072-2 form in that it collects detailed information about an applicant's income, debts, and other financial obligations. Both documents are used to assess the financial situation of an individual, although one is for the purpose of obtaining credit, and the other is for military enlistment considerations.

Free Application for Federal Student Aid (FAFSA) parallels the DA 3072-2 form in its requirement for comprehensive financial information to determine eligibility for financial aid. Though one is focused on educational funding and the other on military service eligibility, both require disclosures about income, assets, and dependents.

The Bank Personal Financial Statement Form is akin to the DA 3072-2 form, serving a similar function of compiling personal financial information such as assets, liabilities, income, and expenses. The purpose of both forms is to assess an individual’s financial condition, one for banking purposes perhaps related to loan or credit applications, and the other for evaluating the financial implications of military enlistment.

Dos and Don'ts

When filling out the DA 3072-2 form, it is essential to consider both the actions you should and shouldn't take to ensure the accuracy and integrity of the information you provide. This document, serving as an Applicant's Monthly Financial Statement, requires careful attention to detail. Here are some guidelines to follow:

Things you should do:

- Review the entire form before starting: Understand each section to ensure you have all the necessary information ready.

- Provide accurate and current financial details: Your income, liabilities, and assets should reflect your current financial situation accurately. This includes accurately reporting all forms of income and debts.

- Use additional sheets if necessary: If there's not enough space on the form to detail your financial information or to provide remarks, attach additional sheets and clearly reference them in the relevant section.

- Sign and date the form: Ensure that you witness the signature as required, which serves as a verification that all the information provided is true to the best of your knowledge.

Things you shouldn't do:

- Leave sections blank: If a section does not apply to you, write "N/A" to show that it has been considered but is not applicable, instead of leaving it empty.

- Guess or estimate figures: Provide exact numbers for your income, liabilities, and assets. Estimations can lead to inaccuracies that affect your financial statement's validity.

- Exclude any liabilities or assets: Failing to include all your financial obligations and resources can result in an incomplete representation of your financial health.

- Forget to include additional income sources: It's important to detail all sources of income, including any anticipated income, to present a full picture of your financial situation.

By adhering to these guidelines, you can fill out the DA 3072-2 form accurately and thoroughly, ensuring a fair and complete assessment of your financial status.

Misconceptions

There are several misconceptions about the DA Form 3072-2, which is designed to collect an applicant's monthly financial statement. It's important to understand the form correctly to ensure accurate and complete submissions. Here are four common misunderstandings and their clarifications:

- Only military income is to be reported: A common misconception is that the form only requires the disclosure of military income. In reality, it asks for all current income, including civilian employment, other sources of income, and even anticipated income if enlistment is approved. This ensures a comprehensive view of the applicant's financial situation.

- Liabilities and assets sections are optional: Some people might mistakenly think that filling out information about liabilities and assets is not mandatory. However, these sections are crucial for providing a complete financial picture, which includes rent, utilities, car expenses, savings, and personal property among other things.

- The form is only for personal use and won't impact enlistment: Another misunderstanding is that the form's purpose is purely for the applicant's personal record-keeping and has no bearing on their enlistment process. Contrarily, the form is an important component of the enlistment process, and its accurate completion can impact decisions regarding the applicant’s financial stability and eligibility for service.

- All debts and financial obligations need not be disclosed: Finally, there's an incorrect belief that not all debts or financial obligations must be disclosed, perhaps to present a stronger financial standing. Indeed, the form requires the disclosure of all current and known future debts and obligations to accurately assess an applicant's financial health and readiness for potential military service.

Understanding these aspects correctly ensures the DA Form 3072-2 is filled out accurately, providing clear and comprehensive financial information as part of the enlistment process.

Key takeaways

When dealing with the DA Form 3072-2, it's important to have a clear understanding of how to properly fill it out and use it. Here are 10 key takeaways to keep in mind:

- Accuracy is crucial: Ensure that all information provided on the form is true and accurate to the best of your knowledge, reflecting your current and anticipated financial situation.

- Include all income sources: You must report all current income, including salary, spouse's income, and any other sources, clearly indicating the amount and source for each.

- Anticipate future income: If you expect different income after enlistment, mention this specifically, detailing the source and expected amount.

- Detail your liabilities: List all current and future obligations that apply against your income, such as rent, utilities, food, medical expenses, insurance, car expenses, and other debts.

- Do not overlook military income: If applicable, differentiate between liabilities against your current income and those against potential military income, including distinct expenses like rent or house notes.

- Assets matter: Accurately list all assets, like savings, furniture, vehicles, bonds, stocks, etc., to provide a comprehensive view of your financial health.

- Additional information is helpful: Use the remarks section to provide any pertinent information regarding dependents, relocation of dependents, disposition of furniture, or anything that affects your financial stability.

- Signatures are mandatory: The form must be signed and witnessed, underscoring the importance and veracity of the information provided.

- Special instructions for unemployed applicants: If currently unemployed, specify your last employment's salary and the termination date of that employment.

- Review before submission: Double-check all entries for completeness and accuracy before submitting the form to avoid potential delays or complications in processing.

Effectively managing and presenting your financial information through the DA Form 3072-2 is imperative for accurate assessment and processing within the relevant military or defense contexts.

Popular PDF Forms

Ca Jury Duty - For clarity and official purposes, the form categorizes reasons for ineligibility into distinct sections, aiding in swift determination of one's status.

Njar Forms - Includes a crucial three-day attorney review period for legal consultation, aimed at protecting all parties involved.