Blank Db 450 Disability PDF Template

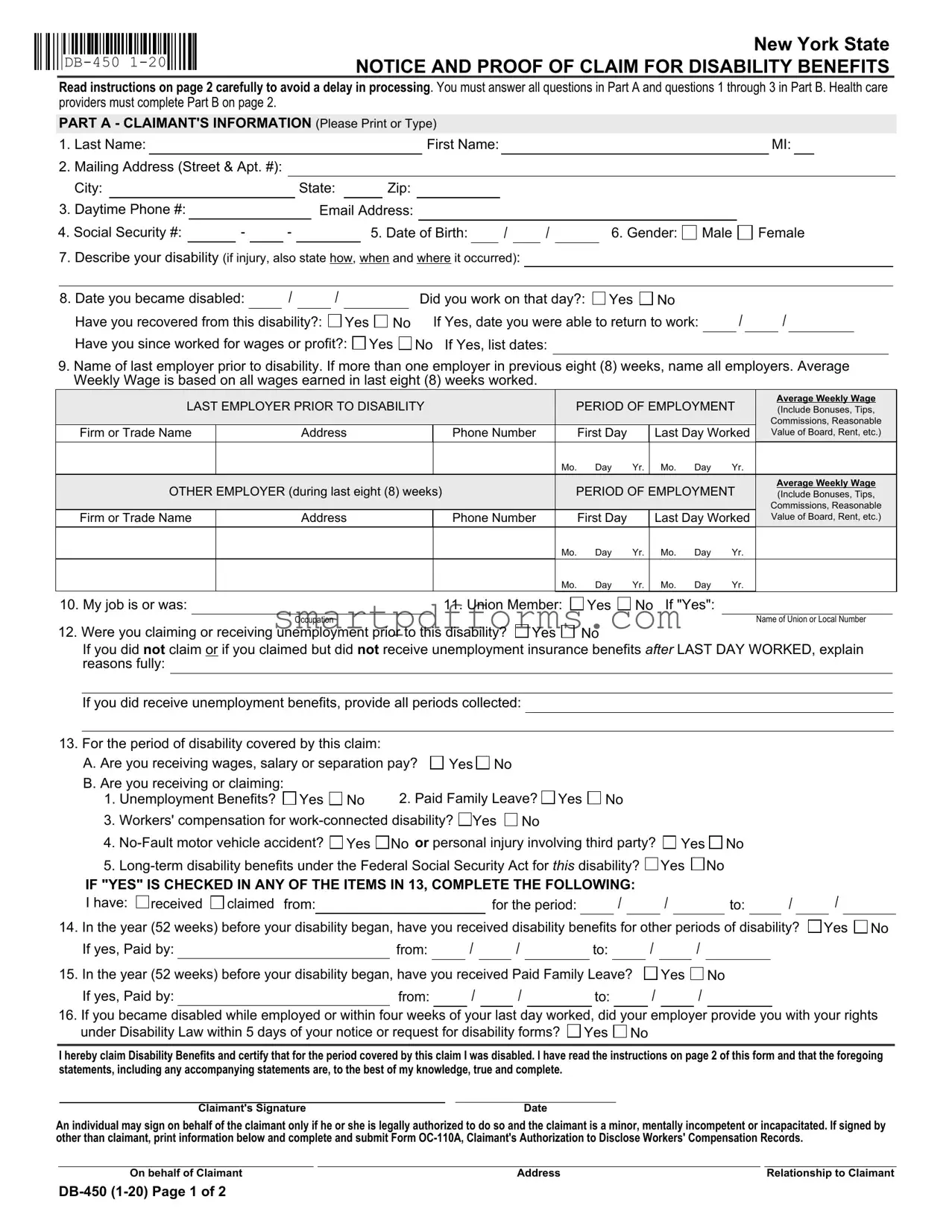

Navigating the complexities of disability claims in New York can be a challenging process, but understanding the purpose and requirements of the DB-450 Disability Form is a crucial step for anyone seeking disability benefits. This form, known officially as the "Notice and Proof of Claim for Disability Benefits," serves as a key document in the claims process, requiring detailed information from both the claimant and their health care provider. For claimants, it involves furnishing personal and employment details, such as name, address, social security number, last day worked, and a description of the disability. Interestingly, the form also delves into other aspects such as previous employment, wages earned, and questions related to other sources of income or benefits, which can be pivotal in determining the claim's validity and the benefit amount. Health care providers are tasked with completing a section that includes diagnosis, treatment dates, and an estimation of when the claimant might return to work, among other medically related inquiries. Submitted timely, this form not only initiates the claims process but also articulates the claimant's eligibility for benefits, making it an indispensable document for employees navigating the aftermath of a disability in New York State.

Preview - Db 450 Disability Form

New York State |

|

NOTICE AND PROOF OF CLAIM FOR DISABILITY BENEFITS |

Read instructions on page 2 carefully to avoid a delay in processing. You must answer all questions in Part A and questions 1 through 3 in Part B. Health care providers must complete Part B on page 2.

PART A - CLAIMANT'S INFORMATION (Please Print or Type)

1. |

Last Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

First Name: |

|

|

|

|

|

|

|

MI: |

|

|

|||

2. |

Mailing Address (Street & Apt. #): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

City: |

|

|

|

|

|

|

State: |

|

|

Zip: |

|

|

|

|

|

|

|

|

|

|

|

||||||

3. Daytime Phone #: |

|

|

|

|

|

|

Email Address: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

4. Social Security #: |

|

- |

|

- |

|

|

|

5. Date of Birth: |

|

|

/ |

|

/ |

|

6. Gender: |

Male |

Female |

|

||||||||||

7.Describe your disability (if injury, also state how, when and where it occurred):

8. Date you became disabled: |

|

/ |

|

/ |

|

|

|

Did you work on that day?: Yes No |

/ |

/ |

|

|

||

Have you recovered from this disability?: |

|

Yes |

No |

If Yes, date you were able to return to work: |

|

|

||||||||

Have you since worked for wages or profit?: |

Yes |

No If Yes, list dates: |

|

|

|

|

|

|

||||||

9.Name of last employer prior to disability. If more than one employer in previous eight (8) weeks, name all employers. Average Weekly Wage is based on all wages earned in last eight (8) weeks worked.

LAST EMPLOYER PRIOR TO DISABILITY |

|

PERIOD OF EMPLOYMENT |

Average Weekly Wage |

|||||||

|

(Include Bonuses, Tips, |

|||||||||

|

|

|

|

|

|

|

|

|

|

Commissions, Reasonable |

Firm or Trade Name |

Address |

|

Phone Number |

|

First Day |

|

Last Day Worked |

Value of Board, Rent, etc.) |

||

|

|

|

|

Mo. |

Day |

Yr. |

Mo. |

Day |

Yr. |

|

OTHER EMPLOYER (during last eight (8) weeks) |

|

PERIOD OF EMPLOYMENT |

Average Weekly Wage |

|||||||

|

(Include Bonuses, Tips, |

|||||||||

|

|

|

|

|

|

|

|

|

|

Commissions, Reasonable |

Firm or Trade Name |

Address |

|

Phone Number |

|

First Day |

|

Last Day Worked |

Value of Board, Rent, etc.) |

||

|

|

|

|

Mo. |

Day |

Yr. |

Mo. |

Day |

Yr. |

|

|

|

|

|

Mo. |

Day |

Yr. |

Mo. |

Day |

Yr. |

|

10. My job is or was: |

|

11. Union Member: |

Yes |

No If "Yes": |

||

|

Occupation |

|

|

|

|

Name of Union or Local Number |

12. Were you claiming or receiving unemployment prior to this disability? |

Yes |

No |

|

|

||

If you did not claim or if you claimed but did not receive unemployment insurance benefits after LAST DAY WORKED, explain reasons fully:

If you did receive unemployment benefits, provide all periods collected:

13. For the period of disability covered by this claim: |

|

|

|

A. Are you receiving wages, salary or separation pay? |

Yes No |

||

B. Are you receiving or claiming: |

|

2. Paid Family Leave? Yes No |

|

1. Unemployment Benefits? |

Yes No |

||

3.Workers' compensation for  Yes

Yes  No

No

4. Yes

Yes  No or personal injury involving third party?

No or personal injury involving third party?  Yes

Yes  No

No

5. Yes

Yes  No

No

IF "YES" IS CHECKED IN ANY OF THE ITEMS IN 13, COMPLETE THE FOLLOWING:

I have: |

received |

claimed from: |

|

for the period: |

|

/ |

|

/ |

|

to: |

|

/ |

14. In the year (52 weeks) before your disability began, have you received disability benefits for other periods of disability?

If yes, Paid by: |

|

from: |

|

/ |

|

/ |

|

to: |

|

/ |

|

/ |

/

Yes

Yes

No

No

15. In the year (52 weeks) before your disability began, have you received Paid Family Leave?

If yes, Paid by: |

from: |

/ |

/ |

to: |

Yes

/

No

/

16.If you became disabled while employed or within four weeks of your last day worked, did your employer provide you with your rights under Disability Law within 5 days of your notice or request for disability forms?  Yes

Yes  No

No

I hereby claim Disability Benefits and certify that for the period covered by this claim I was disabled. I have read the instructions on page 2 of this form and that the foregoing statements, including any accompanying statements are, to the best of my knowledge, true and complete.

Claimant's Signature |

Date |

An individual may sign on behalf of the claimant only if he or she is legally authorized to do so and the claimant is a minor, mentally incompetent or incapacitated. If signed by other than claimant, print information below and complete and submit Form

On behalf of Claimant |

Address |

Relationship to Claimant |

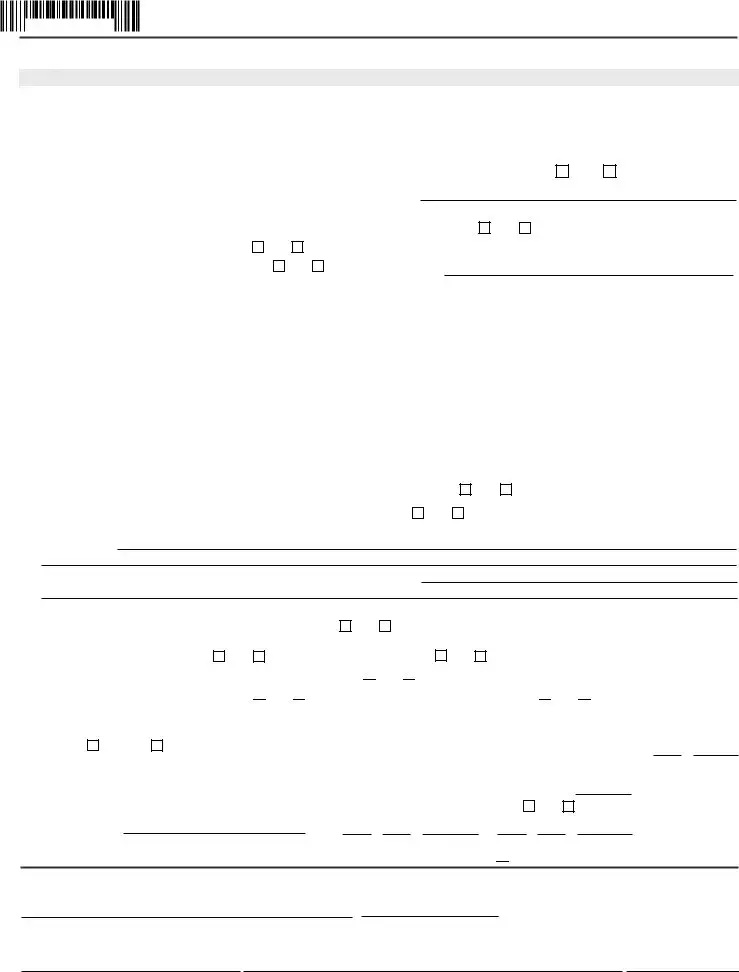

PART B - HEALTH CARE PROVIDER'S STATEMENT (Please Print or Type)

THE HEALTH CARE PROVIDER'S STATEMENT MUST BE FILLED IN COMPLETELY. THE ATTENDING HEALTH CARE PROVIDER SHALL COMPLETE AND RETURN TO THE CLAIMANT WITHIN SEVEN (7) DAYS OF RECEIPT OF THIS FORM. For item

1. Last Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MI: |

|

|

||||||||||

2.Gender: |

Male |

Female |

|

3. Date of Birth: |

/ |

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

4. Diagnosis/Analysis: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diagnosis Code: |

|

|

|

|

|

|

|

|

|

|||||||||||

|

a. Claimant's symptoms: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

b. Objective findings: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. Claimant hospitalized?: |

Yes |

No |

From: |

|

|

|

/ |

|

|

/ |

|

|

To: |

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

6. Operation indicated?: |

Yes |

No |

a. Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. Date |

/ |

|

/ |

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

ENTER DATES FOR THE FOLLOWING |

|

|

|

|

|

|

|

|

|

|

MONTH |

|

|

|

|

|

|

DAY |

|

|

|

|

YEAR |

|

||||||||||||||||||||

a Date of your first treatment for this disability |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

b.Date of your most recent treatment for this disability |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

c. Date Claimant was unable to work because of this disability |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

d.Date Claimant will again be able to perform work (Even if considerable question |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

exists, estimate date. Avoid use of terms such as unknown or undetermined.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

e.If pregnancy related, please check box and enter the date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

estimated delivery date OR |

actual delivery date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

8. In your opinion, is this disability the result of injury arising out of and in the course of employment or occupational disease?:

|

Yes |

No If "Yes", has Form |

Yes |

No |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

I certify that I am a: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

(Physician, Chiropractor, Dentist, Podiatrist, Psychologist, |

Licensed or Certified in the State of |

|

|

License Number |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Health Care Provider's Printed Name |

|

|

Health Care Provider's Signature |

|

|

|

Date |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Health Care Provider's Address |

|

|

|

|

|

|

|

Phone # |

|||||||

IMPORTANT NOTICE TO CLAIMANT - READ THESE INSTRUCTIONS CAREFULLY

PLEASE NOTE: Do not date and file this form prior to your first date of disability. In order for your claim to be processed, Parts A and B must be completed.

1.If you are using this form because you became disabled while employed or you became disabled within four (4) weeks after termination of employment, your completed claim should be mailed within thirty (30) days of your first date of disability to your employer or your last employer's insurance carrier. You may find your employer's disability insurance carrier on the Workers' Compensation Board's website, www.wcb.ny.gov, using Employer Coverage Search.

2.If you are using this form because you became disabled after having been unemployed for more than four (4) weeks, your completed claim MUST be mailed to: Workers' Compensation Board, Disability Benefits Bureau, PO Box 9029, Endicott, NY

If you do not receive a response within 45 days or if you have questions about your disability benefits claim, please call your employer's insurance carrier. For general information about disability benefits, please visit www.wcb.ny.gov or call the Board's Disability Benefits Bureau at (877)

Notification Pursuant to the New York Personal Privacy Protection Law (Public Officers Law Article

HIPAA NOTICE - In order to adjudicate a workers' compensation claim or disability benefits claim, WCL

Disclosure of Information: The Board will not disclose any information about your case to any unauthorized party without your consent. If you choose to have such information disclosed to an unauthorized part, you must file with the Board an original signed Form

An employer or insurer, or any employee, agent, or person acting on behalf of an employer or insurer, who KNOWINGLY MAKES A FALSE STATEMENT OR REPRESENTATION as to a material fact in the course of reporting, investigation of, or adjusting a claim for any benefit or payment under this chapter for the purpose of avoiding provision of such payment or benefit SHALL BE GUILTY OF A CRIME AND SUBJECT TO SUBSTANTIAL FINES AND IMPRISONMENT.

Form Data

| Fact Name | Description |

|---|---|

| Form Identification | The form is identified as DB-450 (1-20), New York State NOTICE AND PROOF OF CLAIM FOR DISABILITY BENEFITS. |

| Form Purpose | This form is used to notify and provide proof of a claim for disability benefits in New York State. |

| Governing Law | The form is governed by the Workers' Compensation Law (WCL) § 20 and § 142 of New York State, facilitating the investigation and administration of claims. |

| Privacy Notice | A Notification pursuant to the New York Personal Privacy Protection Law (Public Officers Law Article 6-A) and the Federal Privacy Act of 1974 (5 U.S.C. § 552a) is included. |

| Submission Instructions | Instructions detail submission based on employment status at the time of disability and mention a 30-day deadline post first disability date for employed or recently unemployed individuals. |

| Healthcare Provider's Role | Part B requires completion by a healthcare provider, with a stipulation for completion and return to the claimant within seven days of receipt. |

Instructions on Utilizing Db 450 Disability

When it comes to securing disability benefits, prompt and accurate completion of the DB-450 form is your first critical step. This document serves as your official notice and proof of claim within New York State. Incorrect or incomplete submissions may lead to delays in processing, affecting the timely receipt of your benefits. Focus on providing detailed, precise information as per the instructions to ensure your claim is processed without unnecessary setbacks. Here is a guide to assist you in filling out the form correctly.

Part A - Claimant's Information

- Enter your Last Name, First Name, and MI (Middle Initial).

- Provide your Mailing Address, including Street, Apt. #, City, State, and Zip code.

- Include your Daytime Phone Number and Email Address for contact.

- Write down your Social Security Number.

- Fill in your Date of Birth in the format MM/DD/YYYY.

- Select your Gender by checking either Male or Female.

- Describe your disability. If related to an injury, explain how, when, and where it occurred.

- Enter the Date you became disabled. Indicate if you worked on that day, if you've recovered, the date you returned to work (if applicable), and if you’ve worked for wages or profit since.

- List your last employer before your disability and any employers in the previous eight weeks, including employment period and average weekly wage.

- Specify your job role or title and whether you're a Union Member (if yes, provide Occupation and Union or Local Number).

- Answer whether you were claiming or receiving unemployment prior to this disability.

- Indicate if you're receiving wages, salary, separation pay, or claiming any benefits.

- If "Yes" is checked for any benefits or compensation in question 13, complete the following details about the period and sources.

- State if you've received disability benefits or Paid Family Leave within the year before your current disability.

- If applicable, confirm if your employer provided you with your rights under Disability Law.

- Sign the claim, date it, and, if someone is signing on your behalf, provide their information.

Part B - Health Care Provider's Statement (To be completed by your health care provider)

- Ensure the Health Care Provider fills in every section completely regarding diagnosis and treatment, including dates significant to your claim.

- They must also specify whether your disability is due to a work-related injury or occupational disease.

After completing the form, verify all details for accuracy to avoid any delays. If disabled while employed or within four weeks of the last day worked, submit the form within thirty days of disability onset to your employer or their insurance carrier. Otherwise, send it to the Workers' Compensation Board at the specified address. Remember, timely and accurate submission is essential for the processing of your claim. For further queries or clarity on your disability benefits claim, reaching out to the employer's insurance carrier or visiting the official Workers' Compensation Board website is advisable.

Obtain Answers on Db 450 Disability

-

What is the DB-450 form?

The DB-450 form, entitled "Notice and Proof of Claim for Disability Benefits," is a document used in New York State for individuals to file a claim for disability benefits. The form requires detailed information from the claimant regarding their personal information, employment history, and the nature of their disability. Health care providers must complete part of the form to verify the disability.

-

How soon must I file the DB-450 form after becoming disabled?

If you became disabled while employed or within four weeks of your last working day, you should mail the completed DB-450 form to your employer or their insurance carrier within thirty days of your disability onset. For those who became disabled after being unemployed for more than four weeks, the form must be mailed directly to the Workers' Compensation Board's Disability Benefits Bureau. Prompt filing is crucial to avoid delays in receiving benefits.

-

What if I am receiving other benefits?

If you are receiving or have claimed other benefits, such as unemployment benefits, paid family leave, workers' compensation for work-connected disability, no-fault motor vehicle accident benefits, or long-term disability benefits under the Federal Social Security Act, you must indicate this on the form. Providing accurate information regarding other benefits is essential for the proper processing of your claim.

- Please note that receiving other types of benefits does not automatically disqualify you from receiving disability benefits, but it may affect the amount you are eligible to receive.

-

Who can sign the DB-450 form on behalf of the claimant?

An individual can sign the DB-450 form on behalf of the claimant only if they are legally authorized to do so. This is applicable in situations where the claimant is a minor, mentally incompetent, or incapacitated. If the form is signed by someone other than the claimant, the individual must provide their information and relationship to the claimant on the form. Additionally, Form OC-110A, or a notarized authorization letter, must be submitted to confirm the legal authority to act on behalf of the claimant.

Common mistakes

Filling out the DB-450 Disability Benefits form is a crucial step in claiming your benefits correctly and promptly. However, there are common mistakes that individuals make during the process, which can lead to delays or even denial of claims. Awareness of these errors and how to avoid them can significantly streamline the claims process.

- Not reading the instructions carefully: Many claimants start filling out the form without thoroughly reading the instructions provided on page 2. This oversight can lead to incorrect or incomplete information, which in turn can cause delays in processing the claim.

- Omitting information in Part A or Part B: The form requires all questions in Part A and questions 1 through 3 in Part B to be answered. Skipping any of these questions or leaving them blank is a common mistake. Health care providers must complete Part B fully for the claim to be processed.

- Failing to describe the disability in detail: Question 7 requires a detailed description of the disability. If the disability is due to an injury, it is also necessary to state how, when, and where it occurred. A vague or incomplete description can hinder the understanding of the claim's context, potentially affecting its approval.

- Incorrectly reporting the date of disability: In question 8, accurately reporting the date when the disability commenced is crucial. Working on the day you became disabled or providing inaccurate dates can complicate the claim process.

- Lack of clarity regarding employment and wages: The form asks for detailed information about your last employer and any other employers you had in the eight weeks prior to your disability. This includes average weekly wages and other compensations. Failing to include complete details or providing incorrect information can lead to incorrect benefit calculations.

- Not providing information on other benefits: Questions 13 and 14 inquire about other benefits you might be receiving or claiming, such as unemployment benefits, paid family leave, or workers' compensation. Not disclosing these benefits accurately can cause issues with your disability benefits claim.

To ensure that your claim is processed without unnecessary delays, it's important to:

- Fill out the form completely and accurately.

- Double-check that all required sections are completed, and provide detailed information wherever necessary.

- Consult the instructions on page 2 of the form to verify that all the steps are followed correctly.

- Keep a copy of the completed form for your records.

By avoiding these common mistakes and taking the time to carefully complete the DB-450 Disability form, you can help ensure a smoother claims process.

Documents used along the form

When filing a DB-450 Form for disability benefits in New York State, several other forms and documents might often be required to support your claim or to provide additional necessary information to the reviewing entity. Understanding what these documents are and their purposes can streamline the process and improve the clarity of your submission.

- Form DB-450.1: This form is required if you answer "Yes" to receiving workers' compensation for a work-connected disability on the DB-450 form. It provides additional details about the claim.

- Doctor's Medical Report: A detailed report from your healthcare provider outlining your diagnosis, treatment plan, and expected duration of disability. This document supports the medical information provided in Part B of the DB-450 form.

- Form OC-110A: Claimant’s Authorization to Disclose Workers’ Compensation Records. If a claimant wants to authorize the disclosure of their workers’ compensation records to unapproved parties, they must complete this form.

- Proof of Employment and Earnings: Pay stubs or a letter from your employer verifying your employment status and earnings prior to disability. These documents help to determine your benefit amount.

- Proof of Identity: A copy of an official ID (e.g., Driver’s License, Passport) to verify the claimant's identity.

- Direct Deposit Authorization Form: If you prefer to receive your disability payments through direct deposit, completing this form will provide the necessary account information to the disbursing authority.

- Employer’s Report of Employee’s Injury/Illness: Employers may need to fill out this form to document the circumstances under which the disability occurred, if work-related.

- Form W-4S: Request for Federal Income Tax Withholding from Sick Pay. If you want federal taxes withheld from your disability payments, this form must be submitted.

- Appeal Form: If your initial claim for disability benefits is denied, an appeal form is required to contest the decision and request a review of your case.

Collectively, these documents and forms play a crucial role in substantiating your claim for disability benefits. Proper completion and timely submission of the required paperwork can significantly affect the outcome of your claim. Ensure all information provided is accurate and submit the documents as instructed by your employer, insurance carrier, or the Workers' Compensation Board to facilitate the processing of your disability benefits claim.

Similar forms

The DB-450 Disability Form plays a crucial role in the process of claiming disability benefits, necessitating comprehensive information from both the claimant and their healthcare provider. Various other legal documents share similarities with the DB-450 form in terms of their function, requirements for detailed personal information, and involvement in claims or benefits processes within the United States. These documents include:

- Workers' Compensation Claim Form (e.g., Form C-4): Much like the DB-450, this form is used by employees to claim workers' compensation benefits after sustaining a work-related injury or illness. Both forms require detailed information about the nature of the injury or disability, employment details, and verification from a healthcare provider.

- Family and Medical Leave Act (FMLA) Application Forms: Comparable to DB-450's focus on disability, FMLA forms are used to apply for leave due to a serious health condition affecting the employee or a family member. These forms must be supported by medical documentation to substantiate the claim for leave.

- Short-Term Disability Claim Forms: Similar to the DB-450, these forms are utilized by individuals seeking benefits due to a temporary inability to work because of a disability. They require personal information, employment history, and comprehensive medical information to process the claim.

- Long-Term Disability (LTD) Claim Forms: For more prolonged periods of disability, LTD forms collect detailed personal, medical, and employment information, akin to the data required on the DB-450 form, to assess and provide benefits for extended disabilities.

- Paid Family Leave (PFL) Claim Form: Much like the DB-450 form, PFL forms are necessary for individuals seeking to take leave for family-related reasons (such as childbirth or caring for a family member with a serious health condition), requiring detailed personal and medical documentation.

- Social Security Disability Insurance (SSDI) Application: This federal form requires substantial personal, medical, and work history information to establish eligibility for disability benefits, sharing DB-450's emphasis on documented proof of disability.

- Unemployment Insurance (UI) Claim Form: Although focused on unemployment rather than disability, UI claim forms share the DB-450's need for detailed employment information and circumstances surrounding the claimant's current situation.

- No-Fault Insurance Claim Form: Used for claiming medical benefits following a motor vehicle accident, similar to portions of the DB-450 form, this document requires information about the incident, injuries sustained, and subsequent medical treatment, paralleling the requirement for medical provider information in disability claims.

These documents, while serving various specific needs ranging from unemployment to medical leave and injury compensation, all require thorough personal, employment, and medical information to facilitate the respective claim processes, mirroring the DB-450 form's comprehensive approach to collecting data essential for processing disability benefits claims.

Dos and Don'ts

When filling out the DB-450 Disability form, accuracy and thoroughness are key to ensuring that your claim is processed efficiently and accurately. Here are eight tips on what you should and shouldn't do:

- Do read all instructions on the form carefully before beginning. This will help avoid any unnecessary delays in the processing of your claim.

- Don’t leave any fields blank. If a question does not apply to you, it's better to write "N/A" (not applicable) than to leave it empty.

- Do answer all questions in Part A and questions 1 through 3 in Part B precisely. Your health care provider is responsible for completing the rest of Part B.

- Don’t guess dates or information. If you’re unsure about specific details, it's better to take the time to verify the information than to risk inaccuracies on your form.

- Do describe your disability in detail in the designated section, especially if the disability resulted from an injury. Be clear about how, when, and where the injury occurred.

- Don’t forget to list all employers from the previous eight weeks if you had more than one employer during that time. This information is crucial for calculating your benefits accurately.

- Do check every section for completeness, especially the health care provider's section (Part B), to ensure they have provided all the necessary information and signatures.

- Don’t hesitate to reach out to your employer's insurance carrier, the Workers' Compensation Board, or a legal advisor if you have questions or need assistance completing the form. It's important that the information you provide is both complete and accurate to avoid delays.

Filling out the DB-450 form correctly is the first step towards securing your disability benefits. Taking the time to carefully and accurately complete this document can significantly impact the success and timeliness of your claim.

Misconceptions

There are several misconceptions about the DB-450 Disability Form that need to be clarified to ensure individuals understand the form and the process. Here are four common misunderstandings:

- Timing for Submission: Many people believe they can submit the DB-450 form at any time during their disability. However, if you became disabled while employed, or within four weeks of your last day worked, you must mail your completed claim within thirty (30) days of your first date of disability to your employer or your last employer's insurance carrier. This is crucial to avoid delays in processing your claim.

- Part B Completion: Another misconception is that the claimant must complete Part B of the form. In reality, Part B must be completed by a healthcare provider. This section is vital for the assessment of the claim as it includes the professional diagnosis, treatment dates, and an estimation of when the claimant can return to work. The healthcare provider must complete and return this part to the claimant within seven (7) days of receipt.

- Need for Social Security Number: Some claimants are concerned that they must provide their Social Security number on the form, fearing denial or reduction of benefits if they do not. However, providing your Social Security number is voluntary and failing to do so will not result in a denial of your claim or lead to a reduction in benefits. The Workers' Compensation Board asks for this information purely to assist in the investigation and administration of claims.

- Impact on Other Benefits: There is a common belief that filing for disability benefits using the DB-450 form will affect one's eligibility for other types of benefits, such as unemployment or Workers' Compensation. It's important to note that while the form does ask if you are receiving or claiming other benefits, such as unemployment benefits, Paid Family Leave, Workers' Compensation, no-fault motor vehicle accident benefits, or long-term disability benefits under the Federal Social Security Act, claiming these benefits does not automatically disqualify you from receiving disability benefits. Each type of benefit has its eligibility criteria, and being eligible for one does not mean you cannot be eligible for another.

Understanding these aspects of the DB-450 form can help individuals navigate their disability claims more effectively, ensuring they provide the correct information and comply with submission timelines.

Key takeaways

When filling out the DB-450 Disability form for New York State, understanding and following the instructions carefully is crucial to avoid delays in processing your disability benefits claim. Below are six key takeaways to assist in accurately completing and using the form:

- Timeliness is Key: If you became disabled while employed or within four weeks after your employment ended, you must mail your completed claim within thirty days from your first date of disability to either your employer or your last employer's insurance carrier. This prompt action helps ensure your claim is considered without unnecessary delays.

- Understand Where to Send the Form Based on Your Employment Status: For individuals who have been unemployed for more than four weeks at the time they became disabled, the completed claim must be sent directly to the Workers' Compensation Board, Disability Benefits Bureau at the specified mailing address.

- Accurate Completion of Parts A and B: The form requires detailed information in both Parts A and B to be processed correctly. Part A focuses on the claimant's information, while Part B must be completed by the healthcare provider. Ensuring both parts are filled out completely and accurately is crucial for the assessment of your claim.

- Provide Detailed Disability Information: Describing your disability in detail, including the circumstances if it was due to an injury, and providing the exact dates regarding the start of the disability, ability to work, and recovery, if applicable, are critical for the claim's evaluation.

- Disclosure of Other Benefits: If you are receiving or claiming other benefits such as unemployment benefits, paid family leave, workers' compensation, no-fault motor vehicle accident benefits, or long-term disability benefits under the Federal Social Security Act, it is important to note this on the form. Providing accurate information helps in determining your eligibility for disability benefits.

- Privacy and Confidentiality: The form includes notices regarding the privacy protection of your personal information, emphasizing that providing your social security number is voluntary and specifying how the Workers' Compensation Board will use and protect your personal data. This ensures your rights to privacy and confidentiality are respected throughout the process.

Completing the DB-450 form accurately is the first step towards securing your disability benefits in New York State. Paying close attention to the details and submitting your claim on time can significantly impact the processing time and outcome of your claim.

Popular PDF Forms

Joint Custody in Florida Form - The FL-311 form is used to outline and request specific arrangements regarding child custody and visitation rights in family law cases.

Comprehensive Coverage Michigan - Advises against allowing excluded individuals from operating the vehicle to avoid the cancellation of liability coverage.

Of-178 - Document the specifics of communications involving visits or conferences, streamlining follow-up actions.