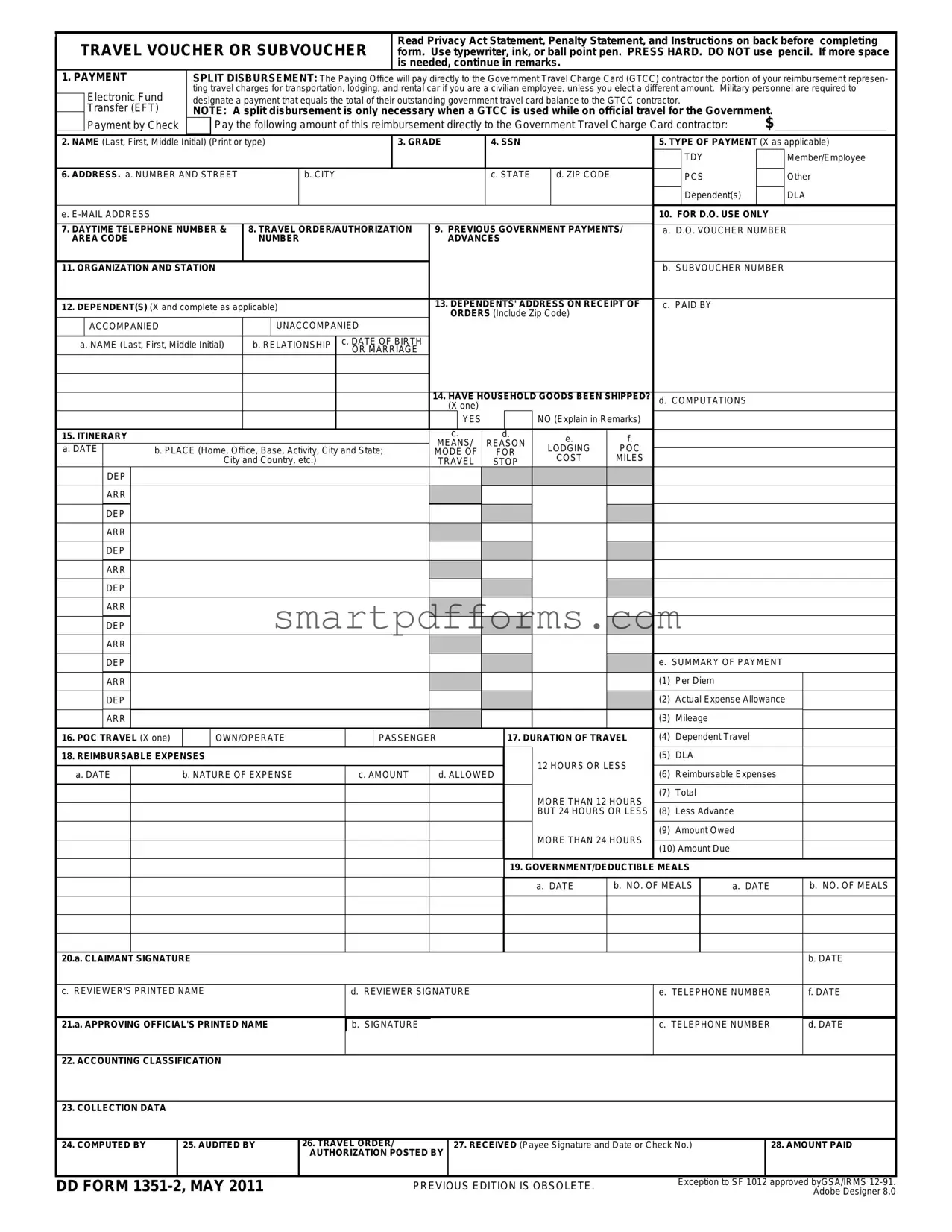

Blank DD 1351-2 PDF Template

The journey through military life is dotted with paperwork, each form playing a pivotal role in the smooth operation of personnel affairs. Among these, the DD 1351-2 form stands out as an essential document for members of the U.S. military. It is the primary form used by service members to claim reimbursement for travel expenses incurred during official duty. Whether it’s a permanent change of station (PCS), temporary additional duty (TAD), or any official travel, understanding the intricacies of this form can save a lot of time and headaches. Filing this form requires careful attention to detail, as it covers a wide array of travel-related expenses, from transportation fees to lodging and meal costs. Moreover, the form ensures that service members are fairly compensated for the expenses they bear on behalf of their mission, underscoring the department's commitment to taking care of its personnel. Navigating its sections, understanding the eligibility criteria, and knowing the required documentation are critical steps in submitting a successful claim. The DD 1351-2 form, with its comprehensive nature, encapsulates the logistical aspect of military life, demonstrating how bureaucracy and service go hand in hand in the armed forces.

Preview - DD 1351-2 Form

|

TRAVEL VOUCHER OR SUBVOUCHER |

|

Read Privacy Act Statement, Penalty Statement, and Instructions on back before completing |

|

|||||||||||||||||||||||||||||

|

|

form. Use typewriter, ink, or ball point pen. PRESS HARD. DO NOT use pencil. If more space |

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

is needed, continue in remarks. |

|

|

|

|

|

|

|

|

|

|

|

||||||

1. PAYMENT |

|

|

SPLIT DISBURSEMENT: The Paying Office will pay directly to the Government Travel Charge Card (GTCC) contractor the portion of your reimbursement represen- |

|

|||||||||||||||||||||||||||||

|

|

Electronic Fund |

|

ting travel charges for transportation, lodging, and rental car if you are a civilian employee, unless you elect a different amount. Military personnel are required to |

|||||||||||||||||||||||||||||

|

|

|

designate a payment that equals the total of their outstanding government travel card balance to the GTCC contractor. |

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

Transfer (EFT) |

|

NOTE: A split disbursement is only necessary when a GTCC is used while on official travel for the Government. |

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

Payment by Check |

|

|

Pay the following amount of this reimbursement directly to the Government Travel Charge Card contractor: |

$ |

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

2. NAME (Last, First, Middle Initial) (Print or type) |

|

|

|

3. GRADE |

4. SSN |

|

|

|

5. TYPE OF PAYMENT (X as applicable) |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TDY |

|

|

|

|

Member/Employee |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. ADDRESS. a. NUMBER AND STREET |

|

|

b. CITY |

|

|

|

|

|

|

c. STATE |

|

d. ZIP CODE |

|

|

PCS |

|

|

|

|

Other |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dependent(s) |

|

|

|

DLA |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. FOR D.O. USE ONLY |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

7. DAYTIME TELEPHONE NUMBER & |

8. TRAVEL ORDER/AUTHORIZATION |

9. PREVIOUS GOVERNMENT PAYMENTS/ |

a. D.O. VOUCHER NUMBER |

|

|

|

|

||||||||||||||||||||||||||

|

AREA CODE |

|

|

|

|

NUMBER |

|

|

|

|

ADVANCES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. ORGANIZATION AND STATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. SUBVOUCHER NUMBER |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

12. DEPENDENT(S) (X and complete as applicable) |

|

|

|

|

13. DEPENDENTS' ADDRESS ON RECEIPT OF |

c. PAID BY |

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ORDERS (Include Zip Code) |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

ACCOMPANIED |

|

|

|

|

UNACCOMPANIED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

a. NAME (Last, First, Middle Initial) |

b. RELATIONSHIP |

c. DATE OF BIRTH |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OR MARRIAGE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. HAVE HOUSEHOLD GOODS BEEN SHIPPED? |

d. COMPUTATIONS |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(X one) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

|

|

NO (Explain in Remarks) |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. ITINERARY |

|

|

|

|

|

|

|

|

|

|

|

c. |

d. |

|

e. |

f. |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MEANS/ |

REASON |

LODGING |

POC |

|

|

|

|

|

|

|

|

|

|

|||

|

a. DATE |

|

b. PLACE (Home, Office, Base, Activity, City and State; |

MODE OF |

FOR |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

City and Country, etc.) |

|

|

|

|

TRAVEL |

STOP |

|

COST |

MILES |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

DEP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ARR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DEP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ARR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DEP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ARR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DEP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ARR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DEP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ARR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DEP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e. SUMMARY OF PAYMENT |

|

|

|

|

|||||

|

|

|

|

ARR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Per Diem |

|

|

|

|

|

|

|

|

|

|

|

|

|

DEP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) Actual Expense Allowance |

|

|

|

|

|||||

|

|

|

|

ARR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3) Mileage |

|

|

|

|

|

|

|

|

|

16. POC TRAVEL (X one) |

|

|

OWN/OPERATE |

|

|

PASSENGER |

|

17. DURATION OF TRAVEL |

(4) Dependent Travel |

|

|

|

|

||||||||||||||||||||

18. REIMBURSABLE EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

12 HOURS OR LESS |

(5) DLA |

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

a. DATE |

|

b. NATURE OF EXPENSE |

|

c. AMOUNT |

d. ALLOWED |

|

(6) Reimbursable Expenses |

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MORE THAN 12 HOURS |

(7) Total |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BUT 24 HOURS OR LESS |

(8) Less Advance |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MORE THAN 24 HOURS |

(9) Amount Owed |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(10) Amount Due |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19. GOVERNMENT/DEDUCTIBLE MEALS |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. DATE |

b. NO. OF MEALS |

a. DATE |

|

b. NO. OF MEALS |

||||||||

20.a. CLAIMANT SIGNATURE

b. DATE

c. REVIEWER'S PRINTED NAME

d. REVIEWER SIGNATURE

e. TELEPHONE NUMBER

f. DATE

21.a. APPROVING OFFICIAL'S PRINTED NAME

b. SIGNATURE

c. TELEPHONE NUMBER

d. DATE

22.ACCOUNTING CLASSIFICATION

23.COLLECTION DATA

24. COMPUTED BY |

25. AUDITED BY |

26. TRAVEL ORDER/ |

27. RECEIVED (Payee Signature and Date or Check No.) |

28. AMOUNT PAID |

AUTHORIZATION POSTED BY |

DD FORM |

PREVIOUS EDITION IS OBSOLETE. |

Adobe Designer 8.0 |

|

|

Exception to SF 1012 approved byGSA/IRMS |

PRIVACY ACT STATEMENT

AUTHORITY: 5 U.S.C. Section 301; Departmental Regulations; 37 U.S.C. Section 404, Travel and Transportation Allowances, General: DoD Directive 5154.29, DoD Pay and Allowance Policy and Procedures; Department of Defense Financial Management Regulation (DoDFMR) 7000.14.R., Volume 9; and E.O. 9397 (SSN), as amended.

PRINCIPAL PURPOSE(S): To provide an automated means for computing reimbursements for individuals for expenses incurred incident to travel for official Government business purposes and to account for such payments.

Applicable SORN: T7333 (http://privacy.defense.gov/notices/dfas/T7333.shtml).

ROUTINE USE(S): Certain "Blanket Routine Uses" for all DoD maintained systems of records have been established that are applicable to every record system maintained within the Department of Defense, unless specifically stated otherwise within the particular record system notice. These additional routine uses of the records are published only once in each DoD Component's Preamble in the interest of simplicity, economy, and to avoid redundancy. Applicable SORN: http://dpclo.defense.gov/privacy/SORNs/component/dfas/preamble.html.

DISCLOSURE: Voluntary; however, failure to furnish the requested information may result in total or partial denial of the amount claimed. The Social Security Number is requested to facilitate the possible collection of indebtedness or credit to the DoD traveler's pay account for any residual or shortage.

PENALTY STATEMENT

There are severe criminal and civil penalties for knowingly submitting a false, fictitious, or fraudulent claim (U.S. Code, Title 18, Sections 287 and 1001 and Title 31, Section 3729).

INSTRUCTIONS

ITEM 1 - PAYMENT

Member must be on electronic funds (EFT) to participate in split disbursement. Split disbursement is a payment method by which you may elect to pay your official travel card bill and forward the remaining settlement dollars to your predesignated account. For example, $250.00 in the "Amount to Government Travel Charge Card" block means that $250.00 of your travel settlement will be electronically sent to the charge card company. Any dollars remaining on this settlement will automatically be sent to your predesignated account. Should you elect to send more dollars than

ITEM 15 - ITINERARY - SYMBOLS

15c. MEANS/MODE OF TRAVEL (Use two letters)

GTR/TKT or CBA (See Note) - T |

|

Government Transportation |

- G |

Commercial Transportation |

- C |

(Own expense) |

|

Privately Owned |

- P |

Conveyance (POC) |

|

Automobile - A Motorcycle - M

Bus - B

Plane - P

Rail - R Vessel - V

you are entitled, "all" of the settlement will be forwarded to the charge card company. Notification: you will receive your regular monthly billing statement from the Government Travel Charge Card contractor; it will state: paid by Government, $250.00, 0 due. If you forwarded less dollars than you owe, the statement will read as: paid by Government, $250.00, $15.00 now due. Payment by check is made to travelers only when EFT payment is not directed.

REQUIRED ATTACHMENTS

1.Original and/or copies of all travel orders/authorizations and amendments, as applicable.

2.Two copies of dependent travel authorization if issued.

3.Copies of secretarial approval of travel if claim concerns parents who either did not reside in your household before their travel and/or will not reside in your household after travel.

4.Copy of GTR, MTA or ticket used.

5.Hotel/motel receipts and any item of expense claimed in an amount of $75.00 or more.

6.Other attachments will be as directed.

Note: Transportation tickets purchased with a CBA must not be claimed in Item 18 as a reimbursable expense.

15d. REASON FOR STOP |

|

|

|

Authorized Delay |

- AD |

Leave En Route |

- LV |

Authorized Return |

- AR |

Mission Complete - MC |

|

Awaiting Transportation |

- AT |

Temporary Duty |

- TD |

Hospital Admittance |

- HA |

Voluntary Return |

- VR |

Hospital Discharge |

- HD |

|

|

ITEM 15e. LODGING COST

Enter the total cost for lodging.

ITEM 19 - DEDUCTIBLE MEALS

Meals consumed by a member/employee when furnished with or without charge incident to an official assignment by sources other than a government mess (see JFTR, par.

29.REMARKS

a.INDICATE DATES ON WHICH LEAVE WAS TAKEN:

b.ALL UNUSED TICKETS (including identification of unused

DD FORM

Form Data

| Fact Number | Fact Detail |

|---|---|

| 1 | The DD Form 1351-2 is the main form used by military members to apply for reimbursement for travel expenses. |

| 2 | This form is required to be filled out for both official temporary duty travels (TDY) and permanent change of station (PCS) moves. |

| 3 | Travelers are required to provide detailed information about their travel itinerary, expenses, and any advances received. |

| 4 | Supporting documentation, such as receipts and tickets, must be attached to the DD Form 1351-2 for the claim to be processed. |

| 5 | The form allows for the calculation of mileage, per diem, and other reimbursable expenses. |

| 6 | Claims submitted without proper completion or documentation may result in delays or denial of reimbursement. |

| 7 | The form is governed by the Department of Defense (DoD), which sets the regulations for travel reimbursement. |

| 8 | While the DD Form 1351-2 is a federal form, specific states may have additional requirements or forms for state National Guard members. |

Instructions on Utilizing DD 1351-2

Filling out the DD 1351-2 form meticulously is a crucial step for individuals seeking reimbursement for travel expenses during official duties. This process ensures that claims are processed smoothly and efficiently, helping to avoid any unnecessary delays. It’s important for claimants to provide accurate and comprehensive information to substantiate their travel expenditures. The following steps are designed to guide individuals through the process of completing the form effectively.

- Start by entering your personal information in the designated boxes at the top of the form, including your name, rank, social security number, and contact information.

- In the section labeled "Orders/Authorization Number," input the corresponding number that authorizes your travel.

- For the "Travel From" and "Travel To" fields, specify the starting point and destination of your travel, including the dates you departed and arrived.

- Detail your travel route in the section provided, indicating any modes of transportation used, such as air, car, or train, including all intermediate stops or changes.

- Under "Dependents", list any family members who accompanied you on the trip, if applicable, providing their names and their relationship to you.

- Fill in the information related to lodging and meal expenses, attaching receipts as required. Specify the amounts claimed for each day of travel, breaking down costs by category.

- Include any other expenses related to your travel in the designated section, such as taxi fares, parking fees, or conference registration fees, ensuring to attach supporting documentation.

- Review the form carefully to ensure all information is accurate and complete. Incomplete or inaccurate forms can delay processing times.

- Sign and date the form in the designated area, certifying that the information provided is true and correct to the best of your knowledge.

- Submit the completed form along with all necessary supporting documents to the appropriate department or officer as instructed.

Upon submission, your claim will be reviewed for accuracy and completeness. It's vital to retain copies of all submitted documents for your records. You will be contacted if any additional information is needed or if your claim is approved or denied. Prompt and accurate completion of the DD 1351-2 form is essential for the efficient processing of your reimbursement claim.

Obtain Answers on DD 1351-2

-

What is the DD 1351-2 form used for?

The DD 1351-2 form is utilized by Department of Defense members to apply for reimbursement of travel expenses incurred during official travel. This includes transportation, lodging, and meals, among other expenses.

-

Who needs to fill out the DD 1351-2 form?

Any military or DoD civilian personnel who have traveled for official duties need to complete this form to claim their travel expenses. It's essential for individuals who have undertaken temporary duty travel (TDY) or permanent change of station (PCS).

-

When should the DD 1351-2 form be submitted?

Submission of the DD 1351-2 form should occur promptly after the completion of travel. Most departments require that the form be submitted within 5 working days after return to ensure timely processing of claims.

-

How do you fill out the DD 1351-2 form?

Filling out the form requires following the specific instructions attached with the form. Generally, you will need to provide personal information, travel itinerary, expenses, and any advances received. Providing receipts and other proof of expenses is crucial for the reimbursement process.

-

What documents are required with the DD 1351-2 form?

- Travel orders and any amendments

- Lodging receipts

- Transportation tickets (airplane, train, etc.)

- Rental car receipts

- Meal receipts, if claiming actual expenses

It's important to keep all receipts and documents related to your travel, as they will be needed for your claim.

-

Can you submit the DD 1351-2 form electronically?

Yes, the DD 1351-2 form can often be submitted electronically through your respective department's travel system. Electronic submission speeds up the process and allows for easy tracking of your reimbursement claim.

-

What are common mistakes to avoid when filling out the DD 1351-2?

- Not signing or dating the form

- Forgetting to attach required receipts or documents

- Providing incomplete or inaccurate travel information

- Failing to include necessary endorsements or approvals

Ensuring all information is complete and accurate will help avoid delays in processing your claim.

-

How long does it take to process a DD 1351-2 claim?

Processing times can vary greatly depending on the complexity of the claim and the workload of the processing office. Typically, claims are processed within 30 days from the date of submission. However, delays can occur, so it's advisable to submit your form as soon as possible.

-

Who can I contact if I have questions about my DD 1351-2 form?

If you have questions or need assistance with your DD 1351-2 form, you should contact your unit's finance office or travel processing center. They can provide guidance and help resolve any issues with your travel claim.

Common mistakes

Filling out the DD 1351-2 form, a pivotal document for travel reimbursement in the military, often comes with a set of common mistakes. Recognizing and avoiding these errors can streamline the process, ensuring prompt and accurate reimbursement. Below are ten mistakes frequently made when completing this document:

Not signing or dating the form: The lack of a signature or date can invalidate the entire submission, leading to delays in processing.

Entering incorrect travel dates: It is essential to provide accurate travel dates, as these directly influence the reimbursement amount.

Failing to attach required receipts: Certain expenses require receipts for verification. Omitting these can result in non-reimbursement for those expenses.

Misclassifying the type of travel: Identifying the travel type incorrectly can affect both the reimbursement rate and eligibility for certain allowances.

Omitting authorized expenses: Not listing all authorized expenses can lead to receiving less reimbursement than entitled.

Using incorrect rates for per diem or mileage: This mistake can lead to either overpayment or underpayment. Always use current rates.

Not specifying dependent travel (if applicable): Failure to indicate travel for dependents can result in missing out on entitled reimbursements for their expenses.

Incorrect bank account details for direct deposit: Providing wrong account information will delay the reimbursement process significantly.

Forgetting to list all legs of a trip: Each segment of your journey may qualify for reimbursement, and omitting any can reduce your total reimbursement.

Filling out the form by hand when not necessary: Handwritten forms are more prone to error and can be harder to read, leading to processing delays. If an electronic fill-out option is available, it’s usually the better choice.

Attentiveness to detail and a thorough review of the DD 1351-2 form and its instructions can help prevent these mistakes. By avoiding these common errors, the path to receiving accurate and timely travel reimbursement becomes much smoother.

Documents used along the form

When submitting a DD 1351-2 form, which is primarily used for travel reimbursement within the military, it's important to be thorough and include all required documentation to ensure the process is smooth and efficient. Several other forms and documents may need to accompany your DD 1351-2 form depending on the nature of your travel and specific circumstances. Understanding each document and its purpose can help you prepare your travel claim accurately and comprehensively.

- Orders/Authorization – This document officially authorizes your travel. It specifies the details of your assignment, including the duration and location. It's the foundation of your travel claim.

- Receipts for lodging and transportation – You must submit receipts for any lodging and transportation expenses that you're claiming. These serve as proof of your expenditures.

- Rental car agreement – If you used a rental car during your travel, the rental agreement must be included. It provides details about the rental duration and cost.

- Boarding passes – For air travel, boarding passes are essential to verify travel dates and routes. They are often required along with or in lieu of receipts.

- DA Form 31 (Request and Authority for Leave) – This form is used by Army personnel to request leave. If your travel was part of an approved leave, this form should accompany your travel claim.

- Government meal tickets – If you received government-provided meals during your travel, you should include any meal tickets or similar documentation to account for these provisions.

- Foreign currency conversion receipts – For travel outside the United States, you must provide receipts or other documentation showing the conversion rates used for any expenses incurred in foreign currency.

- Lodging certification – When official lodging is not available and you've secured commercial lodging, a certification or statement explaining the situation is required.

- Travel itinerary – A detailed itinerary of your travel is sometimes needed to provide a clear timeline and context for your expenses and activities.

- Weight tickets (for moves) – In the case of a permanent change of station (PCS) or temporary duty travel involving the relocation of household goods, weight tickets for both the empty and full weight of your moving vehicle may be necessary for reimbursement of moving expenses.

Compiling a complete and accurate travel claim with the DD 1351-2 form and all necessary supporting documents is crucial for timely and full reimbursement. It may seem like a lot of paperwork, but each document serves a specific purpose in verifying and justifying your expenses. Always check with your finance office to confirm the required documentation for your specific travel scenario.

Similar forms

IRS Form 1040: Similar to the DD 1351-2, the IRS Form 1040 is used for submitting annual income tax returns to the Internal Revenue Service. Both forms require detailed personal information and financial calculations, emphasizing accuracy and compliance with federal regulations.

Standard Form 86 (SF-86): This form is used for security clearance processes within the federal government, much like how DD 1351-2 is used in the military for travel reimbursement. Both forms collect in-depth personal data and have stringent requirements for the accuracy of the information provided.

Travel Voucher or Subvoucher (DD Form 1351): The DD Form 1351 is the preceding document to the 1351-2 and serves a similar purpose for travel reimbursement but is more general. Both forms detail travel expenses and require receipts and proof of travel.

Federal Application for Student Aid (FAFSA): Although serving a completely different purpose, the FAFSA, like the DD 1351-2, requires individuals to provide personal and financial information to obtain a benefit— in this case, financial aid for education.

Health Insurance Claim Form (CMS-1500): Used in the healthcare industry for billing insurance, the CMS-1500 form shares similarities with DD 1351-2, as both involve detailed claims made for reimbursement purposes. They require specific information about the services provided and personal identification.

Expense Report Forms: Common in many organizations, expense report forms require employees to document and justify business-related expenses for reimbursement, similar to how military personnel use the DD 1351-2 to claim travel expenses.

VA Form 21-526EZ: Used for applying for disability benefits through the Department of Veterans Affairs, this form, like the DD 1351-2, requires veterans to provide a substantial amount of personal and service-related information to process a claim.

Form I-9, Employment Eligibility Verification: Required by employers in the United States to verify an employee's identity and eligibility to work, Form I-9 is similar to DD 1351-2 in its official capacity for recording specific personal data for verification purposes.

Application for Passport (DS-11): Though it serves a different government function, the DS-11 harbors resemblance to the DD 1351-2 form in requiring detailed personal information and documentation to process an application, in this case for a U.S. passport.

Dos and Don'ts

Completing the DD 1351-2 form, pivotal for reimbursing travel expenses for military and government employees, requires meticulous attention to detail. The following guidance illustrates the key dos and don'ts to ensure the process is smooth and error-free.

Do:

- Ensure all necessary personal information is accurately filled in, including full name, rank, social security number, and banking information for direct deposit.

- Include a thorough explanation of your travel itinerary, including all travel dates, destinations, and modes of transportation used.

- Itemize your expenses clearly. For each day of travel, detail the costs incurred such as lodging, meals, and incidentals, providing receipts where required.

- Review and follow the specific instructions provided by your department or agency regarding allowable expenses and per diem rates.

- Sign and date the form in the designated areas once it is completely filled out to certify the accuracy of the information provided.

- Consult with a superior or a finance officer if you have questions or if any section of the DD 1351-2 form is unclear.

Don't:

- Leave sections blank. If a section does not apply, mark it as 'N/A' (Not Applicable) rather than leaving it empty to avoid delays in processing.

- Round off amounts. Report the expense figures accurately to the cent, ensuring that they match the supporting documentation.

- Forget to attach itemized receipts for all reimbursable expenses. Lack of proper documentation can result in denial of certain claims.

- Misstate travel dates or details. Inaccuracies can lead to audit issues and potential repayment obligations.

- Overlook the necessity to submit the form in a timely manner. Late submissions may result in delayed reimbursements or disqualification of claims.

- Attempt to claim expenses that are not covered or exceed allowable limits without proper justification or approval.

Misconceptions

Many people have misconceptions about the DD 1351-2 form, which can lead to confusion and errors in submission. Understanding what the form is not can be just as important as knowing what it is. Here are nine common misconceptions:

- It’s only for military personnel. While designed mainly for military members, the DD 1351-2 form is also used by civilians who are authorized to claim travel reimbursements when on official duty.

- Submission is optional. Submission of the DD 1351-2 form is mandatory for those seeking reimbursement for official travel expenses. Without this form, reimbursement cannot be processed.

- It can be submitted anytime. There is a specific time frame in which you need to submit the DD 1351-2 form after travel completion. Late submissions may result in delays or denial of reimbursement.

- Only original receipts are accepted. While original receipts are preferred, in some cases, electronic copies or faxed receipts are acceptable if the original documents are not available.

- All expenses are reimbursable. Not all expenses incurred during official travel are reimbursable. The form requires itemization, and only expenses approved by the Department of Defense are covered.

- The form is too complicated to complete without a specialist. Although the form is detailed, with the correct guidance and instructions, anyone can complete it. Various resources are available to help with form completion.

- Corrections cannot be made once submitted. If there are mistakes or missing information, corrections can often be made after submission. However, this may delay the reimbursement process.

- Electronic submissions are always preferred. While electronic submission is increasingly accepted and even preferred in some instances, certain departments or circumstances may require a hard copy submission.

- It requires a lengthy approval process. The approval process can vary, but it typically does not take as long as many assume. Ensuring the form is correctly completed and submitted with all necessary documentation can expedite this process.

Key takeaways

The DD 1351-2 form is crucial for military personnel seeking reimbursement for travel expenses. Here are eight key takeaways to ensure its use is both effective and compliant:

Filling out the form accurately is essential to avoid delays. Every section must be completed with the correct information to ensure the reimbursement process is smooth.

Proof of travel, such as hotel receipts and boarding passes, should be kept organized and submitted along with the DD 1351-2 form.

The form requires a detailed account of the travel itinerary, including all modes of transportation used. This part must reflect the actual journey, as deviations might require additional justification.

Reimbursement rates vary depending on the travel destination and duration. Personnel should consult the official guidelines to estimate their allowances accurately.

Submission deadlines are strict. The completed form should be submitted in a timely manner to avoid forfeiting reimbursements.

Understanding special circumstances, such as travel with dependents or extended stays, is crucial. These situations have specific sections on the form and may influence the reimbursement amount.

Direct deposit is the preferred method of payment. Providing accurate banking information on the form will expedite the reimbursement process.

Finally, seeking assistance when in doubt can prevent mistakes. Supervisors or financial officers can offer guidance on completing the form correctly.

Ensuring all details are accurately captured on the DD 1351-2 form is not just about compliance; it's about enabling military personnel to focus on their duties, confident that their travel expenses will be covered promptly and in full.

Popular PDF Forms

Is a Death Certificate a Legal Document - The death certificate is a critical piece in the mosaic of a society’s health record, painting a picture of population health over time.

IRS 1098 - Mortgage borrowers should ensure they receive this form and verify its accuracy.

Cup Fund - Explore the impact of partner donations on the CUP Fund's ability to provide essential support in times of need.