Blank Dd 137 5 PDF Template

The DD Form 137-5 plays a crucial role in the lives of military members who have incapacitated children over the age of 21. Aimed at establishing the relationship and dependency status of such children, it’s instrumental in determining eligibility for benefits and entitlements under the member's military service. The form outlines the necessity for detailed information on various fronts, including personal and household expenses, income, and school attendance, requiring thorough documentation and verification. Notably, it stresses on the accuracy of provided details, subject to legal penalties for wilful misinformation, reflecting the government's commitment to ensuring rightful access to benefits while preventing abuse. The form's structure facilitates a comprehensive overview of the child’s financial and dependency status, mandating notarization to affirm the authenticity of the information. With its clear directives and structured format, the DD Form 137-5 embodies a significant procedural step for military families navigating the complexities of care and support for incapacitated dependents beyond the traditional age thresholds.

Preview - Dd 137 5 Form

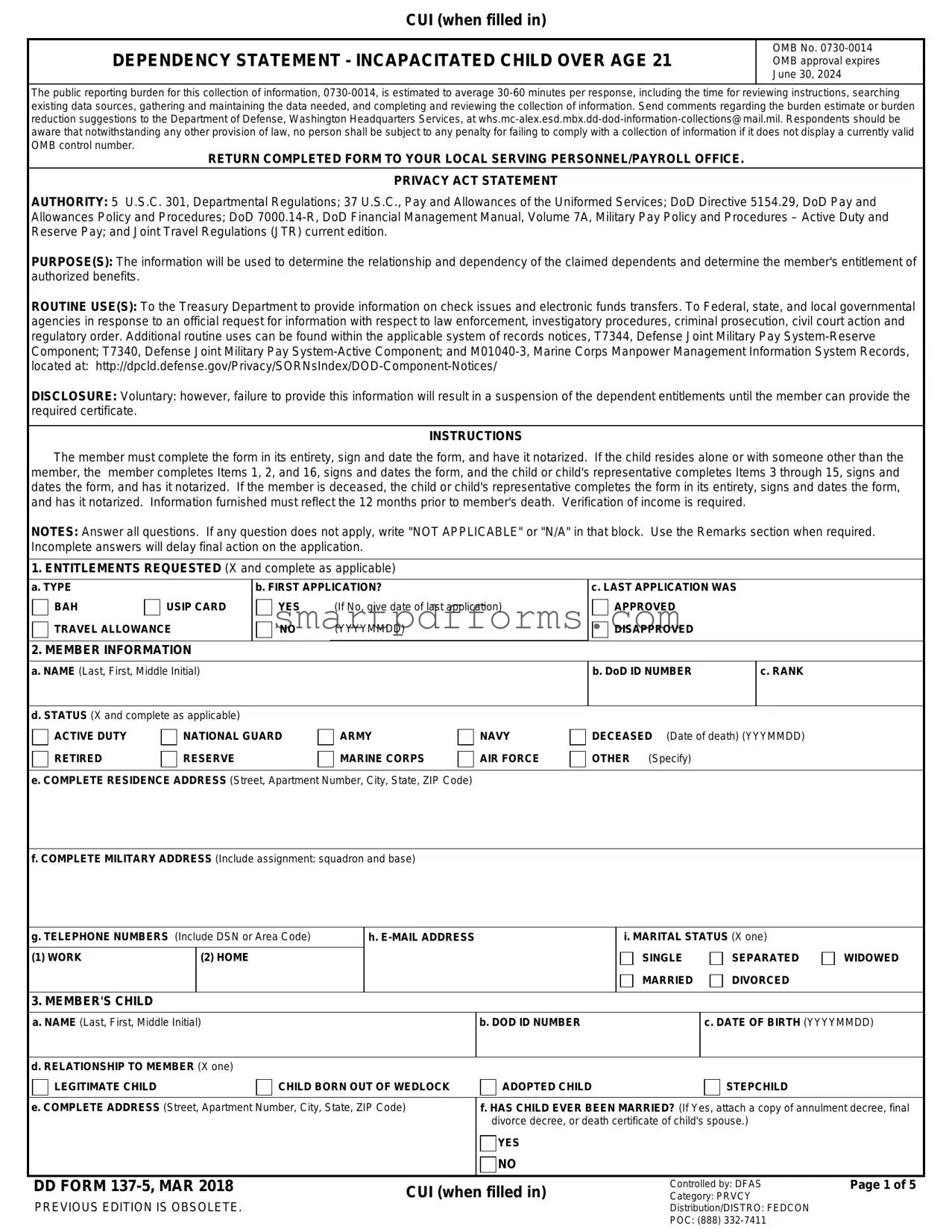

CUI (when filled in)

DEPENDENCY STATEMENT - INCAPACITATED CHILD OVER AGE 21

OMB No.

The public reporting burden for this collection of information,

RETURN COMPLETED FORM TO YOUR LOCAL SERVING PERSONNEL/PAYROLL OFFICE.

PRIVACY ACT STATEMENT

AUTHORITY: 5 U.S.C. 301, Departmental Regulations; 37 U.S.C., Pay and Allowances of the Uniformed Services; DoD Directive 5154.29, DoD Pay and Allowances Policy and Procedures; DoD

PURPOSE(S): The information will be used to determine the relationship and dependency of the claimed dependents and determine the member's entitlement of authorized benefits.

ROUTINE USE(S): To the Treasury Department to provide information on check issues and electronic funds transfers. To Federal, state, and local governmental agencies in response to an official request for information with respect to law enforcement, investigatory procedures, criminal prosecution, civil court action and regulatory order. Additional routine uses can be found within the applicable system of records notices, T7344, Defense Joint Military Pay

DISCLOSURE: Voluntary: however, failure to provide this information will result in a suspension of the dependent entitlements until the member can provide the required certificate.

INSTRUCTIONS

The member must complete the form in its entirety, sign and date the form, and have it notarized. If the child resides alone or with someone other than the member, the member completes Items 1, 2, and 16, signs and dates the form, and the child or child's representative completes Items 3 through 15, signs and dates the form, and has it notarized. If the member is deceased, the child or child's representative completes the form in its entirety, signs and dates the form, and has it notarized. Information furnished must reflect the 12 months prior to member's death. Verification of income is required.

NOTES: Answer all questions. If any question does not apply, write "NOT APPLICABLE" or "N/A" in that block. Use the Remarks section when required. Incomplete answers will delay final action on the application.

1.ENTITLEMENTS REQUESTED (X and complete as applicable)

a. TYPE |

|

b. FIRST APPLICATION? |

|

BAH |

USIP CARD |

YES |

(If No, give date of last application) |

TRAVEL ALLOWANCE |

NO |

(YYYYMMDD) |

|

|

|

|

|

2. MEMBER INFORMATION

c. LAST APPLICATION WAS

APPROVED

APPROVED

DISAPPROVED

DISAPPROVED

a. NAME (Last, First, Middle Initial)

b. DoD ID NUMBER

c. RANK

d. STATUS (X and complete as applicable) |

|

|

|

|

ACTIVE DUTY |

NATIONAL GUARD |

ARMY |

NAVY |

DECEASED (Date of death) (YYYMMDD) |

RETIRED |

RESERVE |

MARINE CORPS |

AIR FORCE |

OTHER (Specify) |

e. COMPLETE RESIDENCE ADDRESS (Street, Apartment Number, City, State, ZIP Code)

f. COMPLETE MILITARY ADDRESS (Include assignment: squadron and base)

g. TELEPHONE NUMBERS (Include DSN or Area Code)

(1) WORK |

(2) HOME |

|

|

h.

i. MARITAL STATUS (X one)

SINGLE

MARRIED

WIDOWED

3. MEMBER'S CHILD

a. NAME (Last, First, Middle Initial)

b. DOD ID NUMBER

c. DATE OF BIRTH (YYYYMMDD)

d. RELATIONSHIP TO MEMBER (X one) |

|

|

|

|

LEGITIMATE CHILD |

CHILD BORN OUT OF WEDLOCK |

ADOPTED CHILD |

STEPCHILD |

|

|

|

|||

e. COMPLETE ADDRESS (Street, Apartment Number, City, State, ZIP Code) |

f. HAS CHILD EVER BEEN MARRIED? (If Yes, attach a copy of annulment decree, final |

|||

|

|

divorce decree, or death certificate of child's spouse.) |

|

|

|

|

YES |

|

|

|

|

NO |

|

|

|

|

|

|

|

DD FORM |

CUI (when |

filled in) |

Category: PRVCY |

Page 1 of 5 |

|

|

|

Controlled by: DFAS |

|

PREVIOUS EDITION IS OBSOLETE. |

|

|

Distribution/DISTRO: FEDCON |

|

|

|

|

POC: (888) |

|

CUI (when filled in)

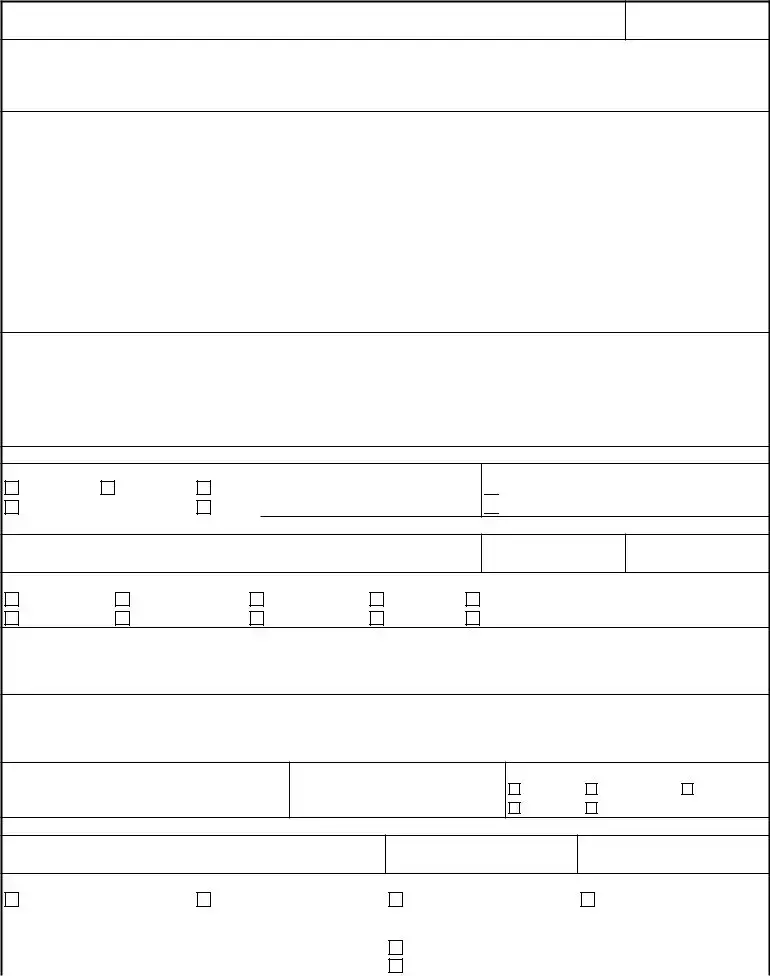

4. CHILD'S OTHER PARENT(S)

a. |

(1) NAME (Last, First, Middle Initial) |

b. |

(1) NAME (Last, First, Middle Initial) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(2) RELATIONSHIP TO CHILD |

(2) RELATIONSHIP TO CHILD |

|

|

|

||

|

|

|

||||

(3) COMPLETE ADDRESS (Street, Apartment Number, City, State, ZIP Code) |

(3) COMPLETE ADDRESS (Street, Apartment Number, City, State, ZIP Code) |

|

||||

|

|

|

|

|

|

|

c. IS/ARE OTHER PARENT(S) IN ANY BRANCH OF SERVICE, INCLUDING RESERVE OR NATIONAL GUARD (X one) |

YES |

NO |

|

|||

(If Yes, show rank, name, SSN, and military address.) |

|

|

|

|||

|

|

|

|

|

||

|

|

|

||||

|

|

|

|

|

|

|

d. DOES OTHER PARENT CLAIM CHILD FOR BASIC ALLOWANCE FOR HOUSING (BAH), TRAVEL ALLOWANCE, OR USIP CARD (X one) |

YES |

NO |

||||

(If Yes, explain.) |

|

|

|

|||

|

|

|

|

|

||

5. CHILD'S RESIDENCE

a. TYPE OF RESIDENCE (X and complete as applicable)

HOME OR APARTMENT OF OTHER PARENT |

|

|

HOME OR APARTMENT OF FRIEND OR RELATIVE (State relationship) |

|

|

HOME OR APARTMENT OF MEMBER |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

HOME OR APARTMENT OF CHILD |

|

|

HOSPITAL OR INSTITUTION |

|

|

HOME OR APARTMENT OF FORMER SPOUSE OF MEMBER |

|

|

OTHER (Explain) |

|

|

STUDENT DORMITORY OR OTHER |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

b. OWNER OF RESIDENCE |

|

|

|

|

|

|

|

|

|||

(1) NAME (Last, First, Middle Initial) |

(2) ADDRESS (Street, Apartment Number, City, State, ZIP Code) |

|

|||

|

|

|

|||

c. IS RESIDENCE SUBSIDIZED HOUSING? |

d. DATE CHILD STARTED LIVING AT CURRENT ADDRESS (YYYYMMDD) |

|

|||

YES |

NO |

|

|

|

|

|

|

|

|

|

|

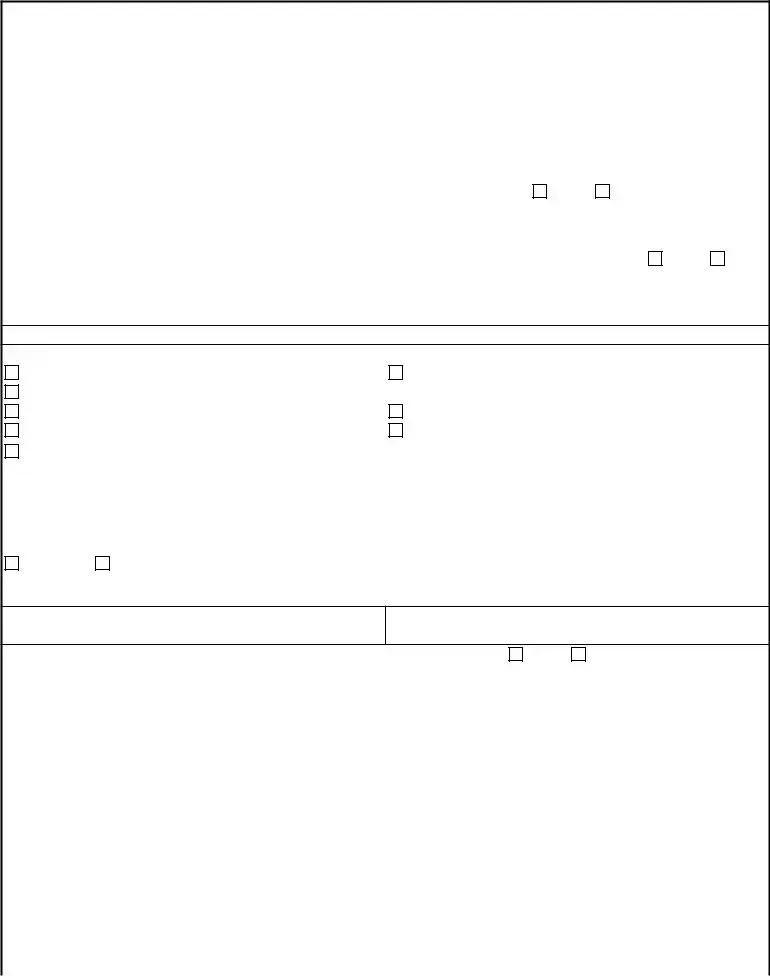

6.IF CHILD IS IN HOSPITAL OR INSTITUTION

If child is in a hospital or institution, all of the following information must be furnished. Obtain this information from the hospital or institution.

a. DATE CHILD ENTERED HOSPITAL/INSTITUTION (YYYYMMDD)

b. ANTICIPATED DATE OF DISCHARGE (If known) (YYYYMMDD)

c. WILL CHILD RETURN TO MEMBER'S HOME AFTER DISCHARGE? (If "NO," explain where child will reside) |

YES |

NO |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d. CHILD'S EXPENSES IN HOSPITAL OR INSTITUTION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

(2) |

|

|

|

(1) |

(2) |

ITEM |

PRESENT MONTHLY |

TOTAL EXPENSE FOR |

ITEM |

|

PRESENT MONTHLY |

TOTAL EXPENSE FOR |

|

|

EXPENSE |

PAST 12 MONTHS |

|

|

|

EXPENSE |

PAST 12 MONTHS |

(1) ROOM |

|

|

(8) EDUCATION |

|

|

|

|

|

|

|

|

|

|

|

|

(2) FOOD |

|

|

(9) TRANSPORTATION |

|

|

|

|

|

|

|

|

|

|

|

|

(3) REHABILITATION CLASSES |

|

|

(10) PERSONAL INSURANCE |

|

|

|

|

|

|

(Specify) |

|

|

|

|

|

OR SERVICES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4) SPECIALIZED EQUIPMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(5) MEDICAL CARE |

|

|

(11) OTHER (Specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(6) CLOTHING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(7) LAUNDRY/DRY CLEANING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DD FORM |

CUI (when filled in) |

|

|

|

Page 2 of 5 |

||

PREVIOUS EDITION IS OBSOLETE.

CUI (when filled in)

6. IF CHILD IS IN HOSPITAL OR INSTITUTION (Continued)

e. CHILD'S EXPENSES IN HOSPITAL OR INSTITUTION ARE PAID BY:

|

|

(1) |

(2) |

|

(1) |

(2) |

|

SOURCE |

PRESENT MONTHLY |

TOTAL EXPENSE FOR |

SOURCE |

PRESENT MONTHLY |

TOTAL EXPENSE FOR |

|

|

EXPENSE |

PAST 12 MONTHS |

|

EXPENSE |

PAST 12 MONTHS |

(1) |

(a) CIVILIAN MEDICAL |

|

|

(3) STATE OR LOCAL AGENCY |

|

|

U |

TREATMENT FACILITY |

|

|

(Give name and address |

|

|

S |

(CHAMPUS) |

|

|

in Remarks section) |

|

|

I |

|

|

|

|

||

P |

|

|

|

|

|

|

(b) MILITARY MEDICAL |

|

|

|

|

|

|

C |

|

|

(4) MEMBER |

|

|

|

A |

TREATMENT FACILITY |

|

|

|

|

|

R |

|

|

|

|

|

|

D |

|

|

|

|

|

|

(2) PRIVATE INSURANCE |

|

|

(5) OTHER (Explain and give |

|

|

|

|

(Give name and address |

|

|

name and address in |

|

|

|

in Remarks section) |

|

|

Remarks section) |

|

|

7. PERSONS LIVING IN HOUSEHOLD WITH CHILD

When child resides in a hospital or institution and Item 6 is completed, do not complete this item. List all persons who live in the household, including claimed child. If employed, show hours per week worked. Continue in Remarks if more space is needed.

a. NAME (Last, First, Middle Initial)

b.RELATIONSHIP TO CHILD

c. AGE

d. MARRIED (X) |

e. EMPLOYED |

|

|

|

|

|

|

YES |

NO |

HOURS PER WEEK |

NO (X) |

|

|

|

|

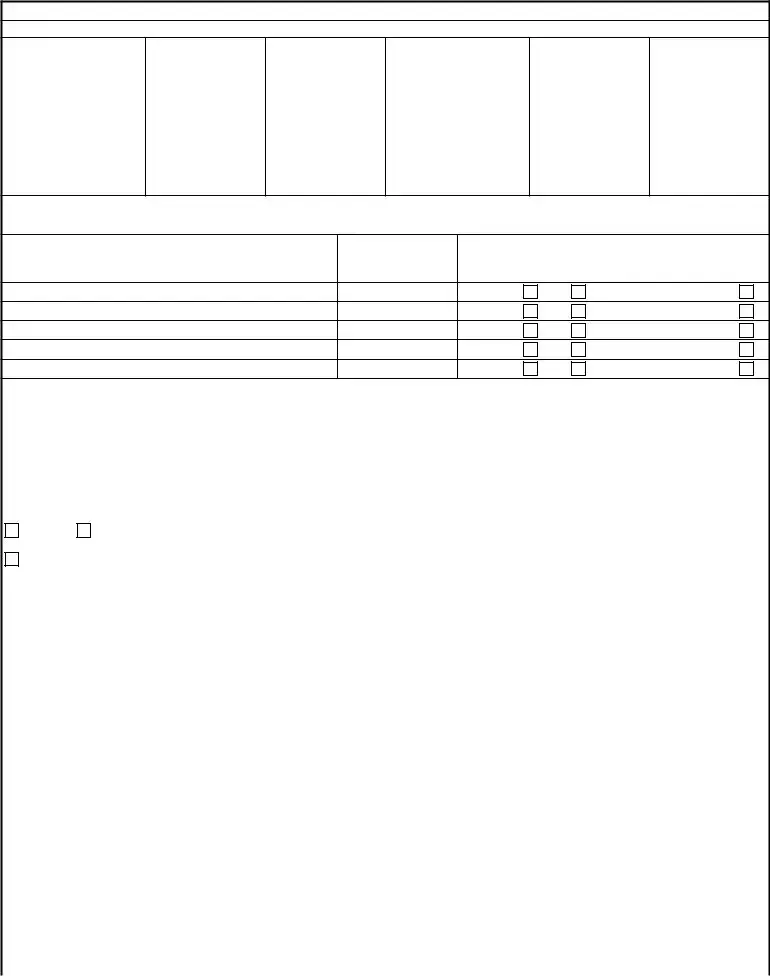

8. HOUSEHOLD EXPENSES

When child resides in a hospital or institution and Item 6 is completed, do not complete this item. List the household expenses for all persons living in the home. If expense was

FAIR RENTAL VALUE (FRV): FRV is a single monthly sum for the entire dwelling where the child lives. This sum is an amount the owner can reasonably expect to receive from a stranger to rent the dwelling. FRV will not include food, utilities, furniture, and home repairs, which are listed separately.

|

|

(1) |

(2) |

|

(1) |

(2) |

ITEM |

|

PRESENT MONTHLY |

TOTAL EXPENSE FOR |

ITEM |

PRESENT MONTHLY |

TOTAL EXPENSE FOR |

|

|

EXPENSE |

PAST 12 MONTHS |

|

EXPENSE |

PAST 12 MONTHS |

a. (X one) |

|

|

|

|

|

|

RENT |

FRV |

|

|

d. FURNITURE AND |

|

|

|

|

APPLIANCES |

|

|

||

MORTGAGE (Specify |

|

|

|

|

||

|

|

|

|

|

||

amount of tax and |

|

|

|

|

|

|

|

|

|

|

|

||

insurance if applicable) |

|

|

|

|

|

|

TAX |

|

|

|

e. REPAIRS ON HOME |

|

|

|

|

|

|

|

||

INSURANCE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. FOOD |

|

|

|

|

|

|

|

|

|

|

f. OTHER (Itemize in Remarks |

|

|

c. UTILITIES (Heat, power, |

|

|

|

|

||

|

|

section) |

|

|

||

water, and telephone) |

|

|

|

|

|

|

|

|

|

|

|

|

|

9. CHILD'S PERSONAL EXPENSES

When child resides in a hospital or institution and Item 6 is completed, do not complete this item. List all of the child's personal expenses regardless of who is paying for

them.

|

(1) |

(2) |

|

(1) |

(2) |

ITEM |

PRESENT MONTHLY |

TOTAL EXPENSE FOR |

ITEM |

PRESENT MONTHLY |

TOTAL EXPENSE FOR |

|

EXPENSE |

PAST 12 MONTHS |

|

EXPENSE |

PAST 12 MONTHS |

a. CLOTHING |

|

|

g. PRIVATE AUTO PAYMENTS |

|

|

|

|

|

(If auto is registered in |

|

|

b. LAUNDRY AND DRY |

|

|

|

|

|

|

|

child's name) |

|

|

|

CLEANING |

|

|

|

|

|

|

|

|

h. MONTHLY TRANSPORTA- |

|

|

c. MEDICAL (Do not include |

|

|

|

|

|

|

|

TION PAYMENTS (Specify |

|

|

|

expenses paid by insurance, |

|

|

|

|

|

|

|

type) |

|

|

|

welfare, or Medicare) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d. VALUE OF USIP CARD |

|

|

|

|

|

(Verification of amount is |

|

|

|

|

|

|

|

|

|

|

|

required) |

|

|

i. SCHOOL EXPENSES |

|

|

|

|

|

|

|

|

e. PERSONAL INSURANCE |

|

|

|

|

|

(Specify) |

|

|

j. OTHER (Specify) |

|

|

|

|

|

|

|

|

f. PERSONAL TAXES (Specify) |

|

|

|

|

|

|

|

|

|

|

|

DD FORM |

2018 |

CUI (when filled in) |

|

Page 3 of 5 |

|

PREVIOUS EDITION IS OBSOLETE.

CUI (when filled in)

10. CHILD'S INCOME

All gross income received by or in behalf of the child, whether taxable or nontaxable, and whether received monthly, quarterly, or yearly, must be listed. This includes any income you receive as custodian or administrator for the child. If any income received during the past 12 months was a

|

(1) |

(2) |

|

(1) |

(2) |

|

SOURCE |

PRESENT |

TOTAL INCOME |

SOURCE |

PRESENT |

TOTAL INCOME |

|

MONTHLY |

FOR PAST 12 |

MONTHLY |

FOR PAST 12 |

|||

|

|

|||||

|

INCOME |

MONTHS |

|

INCOME |

MONTHS |

|

a. WAGES, SALARIES, TIPS, OR |

|

|

g. SOCIAL SECURITY PAYMENTS, |

|

|

|

|

|

DISABILITY OR REGULAR |

|

|

||

OTHER CASH GRATUITIES |

|

|

|

|

||

|

|

(Specify) |

|

|

||

|

|

|

|

|

||

b. INTEREST ON INVESTMENTS, |

|

|

|

|

|

|

BONDS, SAVINGS, TRUST |

|

|

|

|

|

|

|

|

h. SUPPLEMENTAL |

|

|

||

FUNDS, ETC. |

|

|

|

|

||

|

|

SECURITY INCOME (SSI) |

|

|

||

|

|

|

|

|

||

c. INSURANCE OR PUBLIC/ |

|

|

i. VETERANS ADMINISTRATION |

|

|

|

GOVERNMENT PENSION |

|

|

PAYMENTS (Specify type) |

|

|

|

PAYMENTS,UNEMPLOYMENT |

|

|

|

|

|

|

OR DISABILITY COMPENSATION |

|

|

|

|

|

|

(Specify type) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

j. STATE OR LOCAL WELFARE AID, |

|

|

|

|

|

|

|

|

||

d. CONTRIBUTIONS FROM |

|

|

INCLUDING AID TO DEPENDENT |

|

|

|

PERSONS OTHER THAN |

|

|

CHILDREN (Include agency and |

|

|

|

MEMBER |

|

|

address in Remarks section) |

|

|

|

|

|

|

|

|

|

|

e. SCHOLARSHIPS OR |

|

|

k. OTHER (Specify) |

|

|

|

EDUCATIONAL GRANTS |

|

|

|

|

|

|

f. TAX REFUNDS (Specify) |

|

|

|

|

|

|

|

|

|

|

|

|

11. CHILD'S EMPLOYMENT (Show additional periods of work in the Remarks section.)

HAS CHILD BEEN EMPLOYED DURING THE PAST 12 MONTHS? |

YES |

NO (If Yes, furnish the following:)

|

(1) NAME OF EMPLOYER |

(2) |

DATE EMPLOYMENT |

(3) |

DATE EMPLOYMENT |

(4) |

MONTHLY SALARY |

|

|

|

STARTED (YYYYMMDD) |

|

ENDED (YYYYMMDD) |

|

(Gross) |

a. |

|

|

|

|

|

|

|

(5) TYPE OF WORK PERFORMED |

(6) REASON EMPLOYMENT ENDED |

|

|

|

|||

|

|

|

|

|

|

|

|

|

(1) NAME OF EMPLOYER |

(2) |

DATE EMPLOYMENT |

(3) |

DATE EMPLOYMENT |

(4) |

MONTHLY SALARY |

|

|

|

STARTED (YYYYMMDD) |

|

ENDED (YYYYMMDD) |

|

(Gross) |

b. |

|

|

|

|

|

|

|

(5) TYPE OF WORK PERFORMED |

(6) REASON EMPLOYMENT ENDED |

|

|

|

|||

|

|

|

|

|

|

|

|

|

(1) NAME OF EMPLOYER |

(2) |

DATE EMPLOYMENT |

(3) |

DATE EMPLOYMENT |

(4) |

MONTHLY SALARY |

|

|

|

STARTED (YYYYMMDD) |

|

ENDED (YYYYMMDD) |

|

(Gross) |

c. |

|

|

|

|

|

|

|

(5) TYPE OF WORK PERFORMED |

(6) REASON EMPLOYMENT ENDED |

|

|

|

|||

|

|

|

|

|

|

|

|

d. IS OR WAS CHILD'S JOB CONSIDERED AS BEING A "SHELTERED WORKSHOP" - THAT IS, OPEN ONLY TO DISABLED OR HANDICAPPED PEOPLE?

YES

YES

NO (If Yes, and child is currently working, attach a statement from the employer verifying this information.)

12. CHILD'S SCHOOL ATTENDANCE

|

HAS CHILD ATTENDED COLLEGE SINCE AGE 21? |

YES |

NO |

(If Yes, furnish the following:) |

||

|

|

|

|

|

|

|

|

(1) NAME AND ADDRESS OF SCHOOL |

|

|

|

|

(2) (X as applicable) |

|

|

|

|

|

|

VOCATIONAL |

a. |

|

|

|

|

|

FOR RECEIVING DEGREE |

|

(3) DATES ATTENDED |

|

(4) (X) |

(5) CHILD'S MAJOR |

||

|

|

|

|

|

||

|

|

|

|

|

|

|

|

(1) NAME AND ADDRESS OF SCHOOL |

|

|

|

|

(2) (X as applicable) |

|

|

|

|

|

|

VOCATIONAL |

b. |

|

|

|

|

|

FOR RECEIVING DEGREE |

|

(3) DATES ATTENDED |

|

(4) (X) |

(5) CHILD'S MAJOR |

||

|

|

|

|

|

||

|

|

|

|

|

|

|

DD FORM |

CUI (when filled in) |

|

|

Page 4 of 5 |

||

PREVIOUS EDITION IS OBSOLETE.

CUI (when filled in)

13.MEMBER'S CONTRIBUTION

a. SHOW THE TOTAL AMOUNT THE MEMBER HAS CONTRIBUTED TO THE CHILD'S SUPPORT FOR EACH OF THE PAST 12 MONTHS.

(1) MONTH AND YEAR |

(2) AMOUNT |

(1) MONTH AND YEAR |

(2) AMOUNT |

(1) MONTH AND YEAR |

(2) AMOUNT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. MEMBER PROVIDES SUPPORT BY (X one) |

ALLOTMENT |

PERSONAL CHECK |

MONEY ORDER |

OTHER (Explain)

OTHER (Explain)

11. REMARKS (Use back if necessary)

READ THE PENALTY PROVISIONS, SIGN AND DATE THE FORM, AND HAVE IT NOTARIZED.

NOTE: Whoever, in any matter within the jurisdiction of any department or agency of the United States, knowingly and willfully falsifies, conceals, or covers up by any trick, scheme, or device, a material fact, or makes any false, fictitious, or fraudulent statements or representations, or makes or uses any false writing or document knowing the same to contain any false, fictitious, or fraudulent statement or entry, shall be fined as provided in Title 18, or imprisoned not more than 5 years, or both (U.S. Code, title 18, section 1001). The information provided in this form may be referred to the appropriate Military Service investigative agency.

I make the foregoing claim with full knowledge of the penalties involved for willfully making a false claim. (U.S. Code, title 18, section 287, formerly section 80, provides a penalty as follows: Imprisonment for not more than five years and subject to a fine in the amount provided in this title.)

15.SIGNATURES a. CUSTODIAN

I/we(print name(s)) will immediately notify

the service concerned of any change in child's financial circumstances, marital status, physical custody, or change in dependency upon the service member as shown in this form.

(1)SIGNATURE OF PERSON WHO HAS PHYSICAL CUSTODY OF THE CHILD (Can be member or other than member)

(2) RELATIONSHIP TO CHILD

(3)DATE SIGNED (YYYYMMDD)

b. NOTARY PUBLIC

Subscribed and duly sworn (or affirmed) to before me according to law by the above named affiant(s). |

|

|

|

|

||||||||||

This |

|

day of |

, |

|

, at city (or town) of |

, county of |

, |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and state (or territory) of |

|

. |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Notary) |

|

|

|

|

(Official Seal) |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

(Official Title) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

c. MEMBER |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||||||

(1) SIGNATURE |

|

|

|

|

|

|

|

(2) DATE SIGNED (YYYYMMDD) |

||||||

|

|

|

|

|

|

|

|

|

|

|||||

DD FORM |

|

|

CUI (when filled in) |

|

|

Page 5 of 5 |

||||||||

PREVIOUS EDITION IS OBSOLETE.

Form Data

| Fact Name | Details |

|---|---|

| Form Purpose | The DD Form 137-5 is used to establish the relationship and dependency of an incapacitated child over age 21 for entitlement to authorized benefits. |

| OMB Control Number | The Office of Management and Budget (OMB) control number for this collection of information is 0730-0014, with an expiration date of June 30, 2024. |

| Reporting Burden | It is estimated that the public reporting burden for this collection of information averages 30-60 minutes per response. |

| Penalty for Non-Compliance | No person shall be subject to any penalty for failing to comply with a collection of information if it does not display a currently valid OMB control number. |

| Privacy Act Statement Authority | Authorities for this form include 5 U.S.C. 301, 37 U.S.C., DoD Directive 5154.29, DoD 7000.14-R, and the Joint Travel Regulations (JTR). |

| Routing | The completed form should be returned to the local serving personnel/payroll office. |

Instructions on Utilizing Dd 137 5

Filling out the DD Form 137-5, the Dependency Statement - Incapacitated Child Over Age 21, is an important step for service members to declare an incapacitated child as a dependent for the purpose of receiving benefits. This form requires accurate and detailed information about the service member, their child, and the financial and living situation of the child. Accuracy and thoroughness in completing this form will ensure the prompt consideration of benefits entitlement. The following steps are designed to guide you through this process smoothly.

- Review the entire form to understand what information is required, including the Privacy Act Statement and the instructions provided at the beginning of the form.

- Start by filling out the "Entitlements Requested" section, clearly indicating the type of benefits you are applying for and whether it's a first application or a subsequent one.

- Provide the "Member Information" requested in section 2, including your name, DoD ID number, rank, status, contact information, and marital status.

- In the "Member's Child" section, input all required details about your child, such as name, DoD ID number, date of birth, relationship to you, and their current address. Add any relevant details about the child's marital status if applicable.

- Section 4 calls for information about the child's other parent(s). Complete each part as applicable, ensuring you include any information about their service status or claims to benefits for the child.

- Describe the child's living arrangement in the "Child's Residence" section. This includes the type of housing, the owner's details, and whether the housing is subsidized.

- If the child resides in a hospital or institution, fill out section 6 with all required information about the facility, expenses, and payment sources.

- For households not in a hospital or institution, list all persons living with the child in section 7 and detail the household expenses in section 8.

- Itemize the child's personal expenses in section 9, ensuring to include all expenses regardless of who pays for them.

- Report all sources of the child's income in section 10, providing documentation for verification as required.

- Detail any employment the child has had in section 11, including employer information, employment period, salary, and the nature of the work.

- Complete the "Child's School Attendance" section if the child has attended college since turning 21, providing school details and attendance dates.

- In section 13, state the total amount you have contributed to the child's support for each of the past 12 months and specify the method of support.

- Use the "Remarks" section to provide additional information as necessary for any section of the form.

- Read the penalty provisions carefully, then sign and date the form. Ensure the form is also signed by the person who has physical custody of the child, if different from the member, and have all signatures notarized.

After completing all necessary sections of the DD Form 137-5, double-check the information for accuracy and completeness. Any missing or incomplete information can delay the processing of your application. Once finalized, submit the form to your local serving personnel or payroll office as directed. A prompt submission following these instructions will facilitate a smoother processing of your dependent entitlements.

Obtain Answers on Dd 137 5

What is the DD Form 137-5?

The DD Form 137-5 is a document used by the United States Department of Defense. It's designed to determine if an incapacitated child over age 21 is eligible for military dependent benefits. This form assesses the child's relationship to the service member and their dependency status.

Who needs to fill out the DD Form 137-5?

If you're a service member with an incapacitated child over the age of 21, you need to complete this form. It's also required if the service member is deceased, and in that case, the child or child's representative has to fill out the form.

What information is required on the DD Form 137-5?

You'll need to provide detailed information about yourself (the service member), your child, and any other parents or guardians. This includes employment, school attendance, and income details for your child. Additionally, information about your household expenses and any contributions made towards your child's support is necessary.

How long does it take to complete the DD Form 137-5?

The estimated time to complete the form, including gathering information and reviewing instructions, ranges from 30 to 60 minutes. However, this can vary depending on the amount of information you have readily available.

Where do I submit the completed DD Form 137-5?

Once you've completed the form, it should be returned to your local serving personnel or payroll office. They will process the form and determine if your child qualifies for dependent benefits.

Is completion of the DD Form 137-5 mandatory?

Yes, if you wish to claim benefits for an incapacitated child over the age of 21. Failure to provide the required information will result in the suspension of dependent entitlements until the necessary documentation is provided and verified.

What happens if I don't complete the DD Form 137-5 or provide inaccurate information?

Not completing the form or providing false information can result in a denial of benefits for your child. Additionally, knowingly providing false information could lead to penalties, including fines or imprisonment, under U.S. law.

Common mistakes

Not thoroughly reviewing instructions: A common mistake is rushing through the form without carefully reading the detailed instructions provided, which can lead to errors or incomplete information.

Omitting necessary documents: The form requires verification of income and other details. Forgetting to attach these documents can delay the processing time.

Leaving sections blank: If a question does not apply, writing "NOT APPLICABLE" or "N/A" is crucial rather than leaving the space blank. This indicates that the question was read but was not relevant.

Failing to update information: Changes in the child's financial circumstances, marital status, or dependency status must be promptly reported. Overlooking this can affect the entitlements.

Incorrectly reporting income: All income must be accurately reported, including non-taxable and lump-sum payments. Misreporting, whether intentional or accidental, could have legal consequences.

Not using the Remarks section: Many overlook the importance of the Remarks section for providing additional details that questions on the form might not cover.

Errors in personal details: Simple mistakes like misspelling names, incorrect DoD ID numbers or wrong dates can cause unnecessary delays.

Skipping notarization: The form requires notarization, and failing to have it properly notarized is a critical oversight that makes the submission invalid.

Overlooking the penalty provisions: Not acknowledging or understanding the penalty provisions related to false claims can lead to severe legal consequences.

By avoiding these common pitfalls, individuals can ensure their DD Form 137-5 is filled out accurately and completely, helping to expedite the process and avoid unnecessary complications.

Documents used along the form

The DD Form 137-5 is a crucial document designed to determine the relationship and dependency status of an incapacitated child over age 21, helping to establish the child's eligibility for military benefits. Accompanying this form, several other documents are often required to complete the process, providing a comprehensive view of the child's circumstances and supporting the claim for benefits.

- DD Form 1172-2, Application for Identification Card/DEERS Enrollment: Necessary for registering the dependent in the Defense Enrollment Eligibility Reporting System (DEERS) for military ID card issuance.

- DDS Form 137-3, Dependency Statement - Parent: Similar to the DD Form 137-5, but used for a parent's dependency determination, providing insight into parallel processes if the servicemember is also claiming a parent as a dependent.

- Birth Certificate: An official document required to establish the child's relationship to the servicemember.

- Medical Documentation: Detailed records and letters from healthcare providers that confirm the child's incapacitation and need for care, essential for substantiating the claim.

- Proof of Guardianship or Custody: Legal documents, if any, that establish the servicemember's guardianship or custody rights over the incapacitated child, supporting the claim of dependency.

- Financial Documentation: Includes bank statements, pay stubs, and other relevant financial documents of the child and servicemember, demonstrating the child's financial dependency on the servicemember.

Together, these documents complement the DD Form 137-5, painting a full picture of the incapacitated child's situation. This holistic approach ensures that the Department of Defense can accurately assess the child's eligibility for benefits, reflecting the servicemember's responsibility and care towards their dependent. It's crucial to gather and complete these documents with care to ensure a smooth process in securing the benefits and support deserved.

Similar forms

The DD Form 1172-2 (Application for Identification Card/DEERS Enrollment) is similar because it collects personal and dependent information for the purpose of identifying eligibility for military benefits, similar to how the DD Form 137-5 collects information to determine a child's dependency status and entitlements.

The VA Form 21-686c (Declaration of Status of Dependents) shares similarities as both forms are used to establish the dependency status of family members for benefits purposes, albeit the VA form is specifically targeted towards veterans' benefits.

The I-864 (Affidavit of Support Under Section 213A of the INA) parallels the DD Form 137-5 in that both require the sponsor to provide detailed financial information to ensure the dependent or immigrant will not become a public charge.

The SSA-632 (Request for Waiver of Overpayment Recovery or Change in Repayment Rate) is somewhat similar, as it also requires providing detailed financial information and a statement of expenses, much like the financial documentation needed for the DD Form 137-5.

The HUD-50058 (Family Report) form resembles the DD Form 137-5 because it collects family and income information to determine eligibility and benefits for HUD programs, similar to how DD Form 137-5 assesses benefits eligibility based on dependency status.

The FAFSA (Free Application for Federal Student Aid) shares similarities with the DD Form 137-5 in the sense that both require detailed financial information from applicants to determine eligibility for financial aid, although for different programs and benefits.

The IRS Form 1040 (U.S. Individual Income Tax Return) can be related to the income verification aspect of the DD Form 137-5, requiring detailed disclosures of income and financial status for different purposes.

The DS-2029 (Application for Consular Report of Birth Abroad of a Citizen of the United States of America) also gathers detailed family and personal information to establish citizenship, similar to how DD Form 137-5 establishes dependent status for military benefits.

The CMS-L564 (Request for Employment Information) is similar in the aspect of verifying employment and income details for Medicare purposes, akin to the income verification aspect of the DD Form 137-5 for determining benefits eligibility.

The FL-150 (Income and Expense Declaration) in family law proceedings shares similarities with the DD Form 137-5, as both provide a comprehensive overview of an individual’s financial situation to assess child support, alimony, or benefits eligibility.

Dos and Don'ts

Filling out the DD Form 137-5, the Dependency Statement - Incapacitated Child Over Age 21, is a crucial process for service members to ensure their incapacitated dependents receive the benefits and entitlements they deserve. It's important to approach this form thoughtfully, providing accurate and comprehensive information. Below are four dos and four don'ts to keep in mind during this process.

Do:

- Read the instructions carefully. Before you start filling out the form, take the time to thoroughly read through the instructions provided. This ensures you understand what information is required and how to provide it correctly.

- Answer all questions truthfully and completely. If a question does not apply to you or your situation, explicitly write "NOT APPLICABLE" or "N/A." Never leave a field blank, as this could cause delays or issues in processing the form.

- Provide proof of income and expenses. Since the form requires verification of income and certain expenses, be prepared with the necessary documentation. This includes but is not limited to tax returns, pay stubs, and receipts.

- Have the form notarized. After completing the form, don't forget to sign it in the presence of a notary public. This step is mandatory and validates the authenticity of your submission.

Don't:

- Skip questions or provide incomplete answers. Doing so can significantly delay the processing time or even result in the denial of benefits. If you're unsure about how to answer a question, seek clarification rather than leaving it unanswered.

- Forget to update the information if circumstances change. If there's a change in the child's financial situation, marital status, or dependency, it's essential to update the information promptly.

- Esign or leave sections intended for official use. Certain parts of the form may be designated for use by officials only. Be sure not to fill these sections out or sign them unless specifically instructed to do so.

- Submit without double-checking for accuracy. Once you believe you've completed the form, take the time to review it thoroughly. Ensure all information is accurate and that there are no contradictions or missing documents.

Misconceptions

When it comes to the DD Form 137-5, "Dependency Statement - Incapacitated Child Over Age 21," there are several misconceptions that often arise due to its complexity and the specificity required in its completion. Below are six common misconceptions and clarifications to help demystify the process and ensure accurate understanding.

- Only military personnel can complete the form: While it is designed to assess dependency for military benefits, if the service member is deceased, the child or child's custodian can complete the form, ensuring all necessary information reflects the 12 months prior to the member's death.

- It's only about financial support: While financial dependency is a significant aspect, the form also considers the child’s living situation, health care coverage, and other forms of support such as education and employment status, offering a holistic view of the child's dependency status.

- Completion guarantees approval of benefits: Completing the DD Form 137-5 is a necessary step, but not a guarantee for approval. It initiates the process by providing required documentation. The approval depends on a thorough review of the provided evidence against the criteria set by the governing bodies.

- No penalty for not updating information: There is a stern warning on the form about the legal implications of failing to update any change in the child's financial circumstances, marital status, or dependency status. Accurate and current information is crucial for maintaining entitlements.

- Personal expenses don’t need to be detailed: Contrary to what some might think, detailing the child's personal expenses, regardless of who pays for them, is crucial. This includes clothing, personal taxes, and educational expenses, among others, to accurately determine the dependency status.

- The form is only for determining Basic Allowance for Housing (BAH): While BAH is a significant aspect, the form's purpose extends to assessing eligibility for a broader range of authorized benefits, including travel allowances and medical care, emphasizing the form's role in ensuring comprehensive support for incapacitated dependents over age 21.

In navigating the complexities of the DD Form 137-5, understanding these misconceptions is pivotal. Accurately completing the form not only supports the due process but also significantly contributes to securing the well-deserved benefits for the dependents, hence the importance of meticulous attention to detail and adherence to the guidelines provided.

Key takeaways

Filling out the DD Form 137-5 accurately is essential for members of the armed forces who are seeking to establish the dependency of an incapacitated child over the age of 21. This form plays a crucial role in determining the child's eligibility for certain military benefits. Here are nine key takeaways to remember when completing and using the DD Form 137-5:

- The purpose of the DD Form 137-5 is to verify the dependency status of an incapacitated child over age 21, allowing them to receive benefits from the military.

- The form requires detailed information regarding the child's living situation, income, employment history, and educational background to assess dependency accurately.

- It is mandatory for the service member, or the child's representative if the service member is deceased, to complete and sign the form. Additionally, notarization of the form is required to certify the authenticity of the information provided.

- Disclosure of the information on the DD Form 137-5 is voluntary, but failing to provide the requested details will result in a suspension of dependent entitlements until the necessary information is submitted.

- Information concerning any other parent of the child, including their military status and any benefits claimed, must be thoroughly documented.

- Verification documents for the child’s income and expenses are required to support the claims made in the form.

- When documenting the child's income and employment, all sources, including wages, benefits, and contributions from others, must be disclosed to ensure an accurate evaluation of dependency.

- Should the incapacitated child reside in a hospital or institution, specific information regarding their stay, including expenses and payment sources, must be provided in detail.

- Upon completion and submission of the DD Form 137-5, the service member commits to notifying the respective service department of any changes to the child's financial circumstances, marital status, physical custody, or dependency status.

Remember, meticulous attention to detail and full disclosure are vital when filling out the DD Form 137-5 to ensure that incapacitated dependents receive the support and benefits they are entitled to.

Popular PDF Forms

Allodial Title Template - Allodial title pursuit aims to extinguish or discharge any remaining tax obligations on the land, freeing the owner from traditional property taxes.

Imm 1344 Form 2023 Pdf - Applicants must decide if they want to proceed or withdraw their application if found ineligible to sponsor.