Blank Dd 1561 PDF Template

Navigating the intricacies of military benefits can often feel like a daunting task, especially when dealing with the complexities of separation allowances. Among the pivotal documents in this realm is the DD Form 1561, a crucial piece of paperwork for service members seeking to substantiate entitlement to Family Separation Allowance (FSA). Governed by Title 37 of the U.S. Code, Section 427, this form serves multiple key functions, including serving as a substantiating document for FSA payments, providing an audit trail to validate the propriety of payments, assisting in the recovery of erroneous payments, and maintaining a record in the service member's pay account for safekeeping. Completing the form requires detailed personal information, ranging from basic identification and service details to specific statements about dependent status and housing circumstances. It aims to evaluate a member’s application for FSA thoroughly, ensuring the allowance is correctly awarded. The instructions indicate the necessity of disclosing one's social security number among other personal details, albeit on a voluntary basis, with a clear stipulation that failure to provide requested information may result in the FSA not being considered. With parts that need completion by both the member and a certifying officer, the DD Form 1561 encapsulates essential data ensuring service members separated from their families due to duty requirements are fairly compensated. Understanding each section's requirements simplifies the process, aiding in the accurate completion of the form to secure rightful benefits.

Preview - Dd 1561 Form

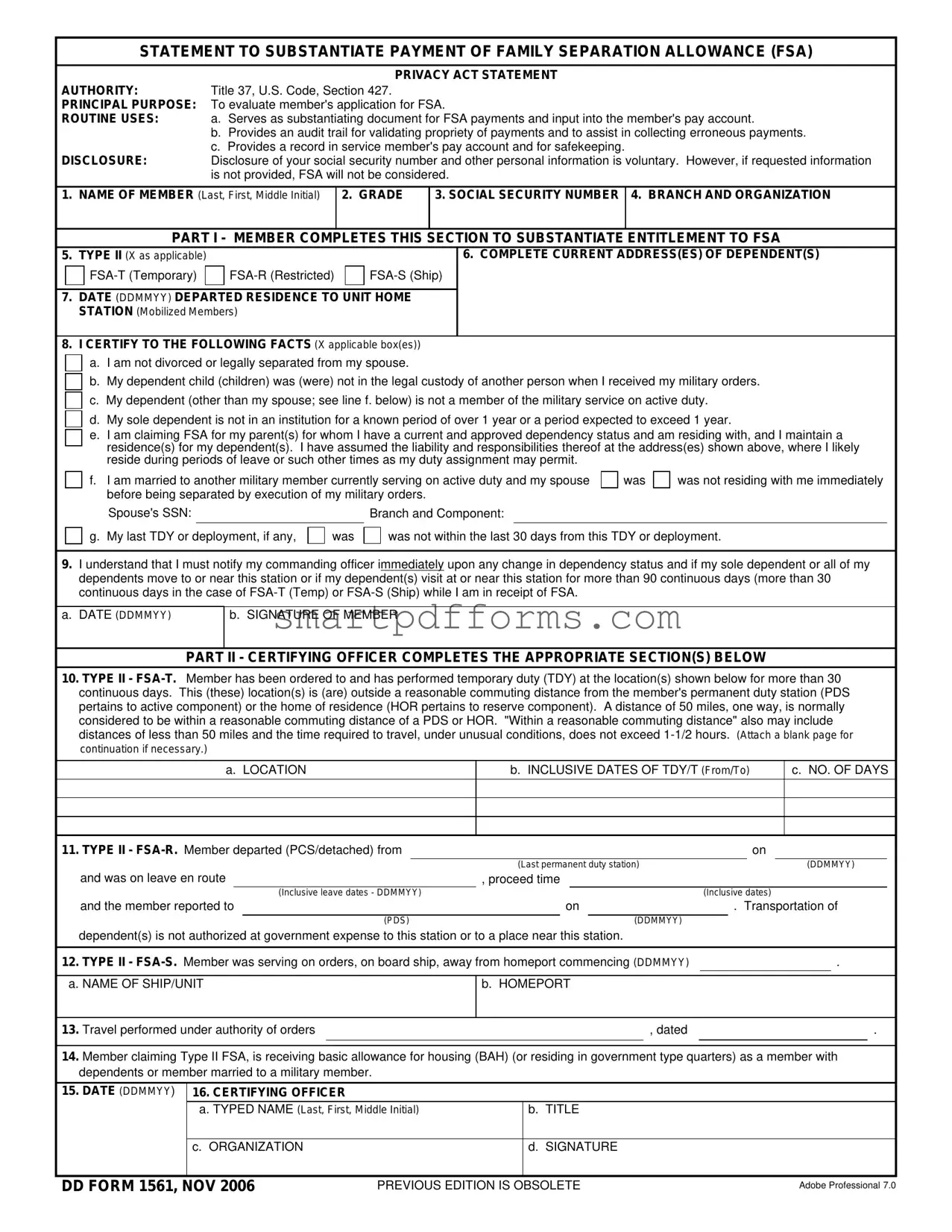

STATEMENT TO SUBSTANTIATE PAYMENT OF FAMILY SEPARATION ALLOWANCE (FSA)

PRIVACY ACT STATEMENT

AUTHORITY:Title 37, U.S. Code, Section 427.

PRINCIPAL PURPOSE: To evaluate member's application for FSA.

ROUTINE USES: a. Serves as substantiating document for FSA payments and input into the member's pay account.

b.Provides an audit trail for validating propriety of payments and to assist in collecting erroneous payments.

c.Provides a record in service member's pay account and for safekeeping.

DISCLOSURE:Disclosure of your social security number and other personal information is voluntary. However, if requested information is not provided, FSA will not be considered.

1.NAME OF MEMBER (Last, First, Middle Initial)

2. GRADE

3. SOCIAL SECURITY NUMBER 4. BRANCH AND ORGANIZATION

PART I - MEMBER COMPLETES THIS SECTION TO SUBSTANTIATE ENTITLEMENT TO FSA

5.TYPE II (X as applicable)

7.DATE (DDMMYY) DEPARTED RESIDENCE TO UNIT HOME STATION (Mobilized Members)

6. COMPLETE CURRENT ADDRESS(ES) OF DEPENDENT(S)

8. I CERTIFY TO THE FOLLOWING FACTS (X applicable box(es))

a. I am not divorced or legally separated from my spouse.

b. My dependent child (children) was (were) not in the legal custody of another person when I received my military orders.

c. My dependent (other than my spouse; see line f. below) is not a member of the military service on active duty.

d. My sole dependent is not in an institution for a known period of over 1 year or a period expected to exceed 1 year.

e.I am claiming FSA for my parent(s) for whom I have a current and approved dependency status and am residing with, and I maintain a residence(s) for my dependent(s). I have assumed the liability and responsibilities thereof at the address(es) shown above, where I likely reside during periods of leave or such other times as my duty assignment may permit.

f.I am married to another military member currently serving on active duty and my spouse before being separated by execution of my military orders.

was

was not residing with me immediately

Spouse's SSN:

g. My last TDY or deployment, if any,

was

Branch and Component:

was not within the last 30 days from this TDY or deployment.

9.I understand that I must notify my commanding officer immediately upon any change in dependency status and if my sole dependent or all of my dependents move to or near this station or if my dependent(s) visit at or near this station for more than 90 continuous days (more than 30 continuous days in the case of

a.DATE (DDMMYY)

b. SIGNATURE OF MEMBER

PART II - CERTIFYING OFFICER COMPLETES THE APPROPRIATE SECTION(S) BELOW

10.TYPE II -

a. LOCATION

b. INCLUSIVE DATES OF TDY/T (From/To)

c. NO. OF DAYS

11. TYPE II - |

|

|

|

|

|

|

on |

||||

|

|

|

|

(Last permanent duty station) |

|

|

|

(DDMMYY) |

|||

and was on leave en route |

, proceed time |

|

|

|

|

||||||

|

|

(Inclusive leave dates - DDMMYY) |

|

|

|

|

(Inclusive dates) |

||||

and the member reported to |

|

on |

|

. Transportation of |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(PDS) |

|

|

|

(DDMMYY) |

|

|

|

|

|

dependent(s) is not authorized at government expense to this station or to a place near this station.

12. |

TYPE II - |

. |

|

||||

|

|

|

|

|

|

|

|

a. NAME OF SHIP/UNIT |

b. HOMEPORT |

|

|

|

|||

|

|

|

|

|

|

|

|

13. |

Travel performed under authority of orders |

|

, dated |

. |

|||

|

|

|

|

|

|

|

|

14.Member claiming Type II FSA, is receiving basic allowance for housing (BAH) (or residing in government type quarters) as a member with dependents or member married to a military member.

15.DATE (DDMMYY)

16. CERTIFYING OFFICER

a. TYPED NAME (Last, First, Middle Initial) |

b. TITLE |

c. ORGANIZATION

d. SIGNATURE

DD FORM 1561, NOV 2006 |

PREVIOUS EDITION IS OBSOLETE |

Adobe Professional 7.0 |

Form Data

| Fact Name | Description |

|---|---|

| Authority | The DD Form 1561 is authorized under Title 37, U.S. Code, Section 427. |

| Principal Purpose | Its main purpose is to evaluate a member's application for Family Separation Allowance (FSA). |

| Routine Uses | The form serves multiple roles, including substantiating FSA payments, providing an audit trail, and being kept for safekeeping. |

| Disclosure | Disclosure of personal information is voluntary but required for FSA consideration. |

| Types of FSA | There are three types of FSA: Temporary (FSA-T), Restricted (FSA-R), and Ship (FSA-S). |

| Member Certification | Members are required to certify their and their dependents’ eligibility conditions to substantiate entitlement to FSA. |

Instructions on Utilizing Dd 1561

Filling out the DD Form 1561 is a crucial step for service members in substantiating their entitlement to Family Separation Allowance (FSA). This document is designed to verify the service member's eligibility based on their family situation, especially when assignments require them to be apart from their dependents. Following a clear, step-by-step approach ensures the form is completed accurately, facilitating a smoother processing of the FSA claim.

- Enter the name of the member in the format: Last, First, Middle Initial.

- Fill in the grade of the service member.

- Provide the service member’s Social Security Number (SSN).

- List the branch and organization to which the member belongs.

- Select the type of FSA for which you are applying by marking an 'X' in the appropriate box for FSA-T (Temporary), FSA-R (Restricted), or FSA-S (Ship).

- Enter the complete current address(es) of dependent(s). Include all locations if dependents live separately.

- For the date departed residence to unit home station (for mobilized members), provide the date (DDMMYY).

- Under section 8, certify to the following facts by marking ‘X’ in the applicable boxes. This section requires the member to confirm:

- Marital status and conditions of not being divorced or legally separated.

- The dependency status of children not in legal custody of another person based on the received military orders.

- That the dependent (other than a spouse or unless specified) is not an active duty military service member.

- The status concerning dependents being in an institution for an expected period of over a year.

- Claiming FSA for parent(s) with current and approved dependency status, and assuming liability and responsibilities for the maintained residence(s) for dependents.

- If married to another military member, stating whether the spouse was residing with the member before separation due to military orders, including the spouse’s SSN.

- The last Temporary Duty (TDY) or deployment status with respect to the last 30 days from the current TDY or deployment.

- Understand and acknowledge the necessity to notify the commanding officer immediately upon any change in dependency status, or if dependents move to or near the station, or if they visit for more than the specified continuous days. Provide the date (DDMMYY) and sign in the signature of member section.

- Part II is to be completed by the certifying officer, not the member. This section includes details about the nature of the duty that substantiates the type II FSA.

Once the form is filled out, ensure all provided information is accurate and complete. Submitting the form through the appropriate channels starts the process for FSA consideration. Remember, the DD Form 1561 is a formal document and must be treated with the importance it warrants to support your financial entitlements effectively.

Obtain Answers on Dd 1561

What is the DD Form 1561?

The DD Form 1561 is a document used by members of the United States military to apply for Family Separation Allowance (FSA). This allowance is intended to compensate qualifying service members for the added expenses incurred when they are separated from their dependents due to military duty. The form outlines necessary personal information and the criteria needed to substantiate payment eligibility.

Who is eligible to receive the Family Separation Allowance?

Eligibility for the FSA requires that a service member be on active duty, away from their usual duty station, and physically separated from their dependents for more than 30 continuous days. The member must not be divorced or legally separated from their spouse, and the dependent children must not be in the legal custody of another person. It's also necessary that no dependent is a member of the military on active duty.

What are the types of FSA mentioned in the DD Form 1561?

- FSA-T (Temporary): For temporary duty assignments.

- FSA-R (Restricted): For locations where dependents are not authorized.

- FSA-S (Ship): For service members on ship away from homeport.

How does a service member apply for FSA?

To apply for FSA, the service member must complete Part I of the DD Form 1561, indicating their personal and dependent information, the type of FSA being applied for, and certifying their eligibility based on the given criteria. The form must then be submitted to the certifying officer for approval and further processing.

What information is required to complete the DD Form 1561?

The form requires detailed information including the service member's name, grade, social security number, branch, and organization. It also requires the complete current addresses of dependents, specifics on the nature of the duty causing separation, and certification on various aspects of the service member's dependency situation.

Can a service member receive FSA if their dependents visit them?

If dependents visit the service member at or near the duty station for more than 90 continuous days (or more than 30 days in the case of FSA-T or FSA-S), the service member may become ineligible for the FSA benefit for that period. Immediate notification to the commanding officer is required upon any change in dependency status or living arrangements that might affect FSA eligibility.

What happens if a service member provides incorrect information on the DD Form 1561?

Providing inaccurate or false information on the DD Form 1561 can lead to the cessation of payments and potentially require the service member to repay any funds erroneously received. The form serves as an official document that substantiates the need for FSA payments, so accuracy and honesty in completing the form are paramount.

How often must a service member update or re-submit the DD Form 1561?

Service members should submit a new DD Form 1561 whenever there is a change in their duty status, dependent status, or other relevant circumstances that might affect their eligibility for FSA. Regular updates ensure that the allowances are correctly paid and prevent any potential for overpayment or underpayment.

Common mistakes

Filling out the DD Form 1561, crucial for military members to claim Family Separation Allowance (FSA), often involves detailed scrutiny to ensure accuracy and completeness. Common pitfalls can hinder the process, potentially impacting the timely and correct payment of the allowance. Below are ten mistakes commonly made when completing this form:

- Incorrect or incomplete personal information: Not providing full and accurate details such as name, grade, and social security number can delay processing.

- Failing to specify the type of FSA: The form requires checking the exact type of FSA being claimed (FSA-T, FSA-R, FSA-S), and overlooking this can lead to incorrect processing.

- Outdated dependent addresses: Providing outdated or incorrect addresses for dependents can complicate the substantiation process.

- Omitting important dates: Forgetting to include critical dates, such as the departure date from residence to unit home station, affects the determination of entitlement periods.

- Neglecting to certify statements: Not checking the certification boxes or failing to sign can invalidate the application.

- Misunderstanding dependency status: Incorrectly stating the dependency status of spouses or children, especially in regard to custody or military service, can lead to disqualification.

- Overlooking the command notification requirement: It's mandatory to notify commanding officers about any changes in dependency status, and failing to acknowledge this obligation can result in penalties.

- Confusion over previous TDY or deployment: Misremembering or incorrectly reporting the last TDY or deployment date can affect eligibility.

- Failure to attach necessary documentation: Not including required documentation or additional pages when necessary can cause delays.

- Misrepresentation of BAH status: Incorrectly claiming Basic Allowance for Housing (BAH) status, or failing to verify residence in government quarters, compromises the accuracy of the form.

Being meticulous and thorough while filling out the DD 1561 form is paramount. Seeking clarification or assistance when in doubt can prevent these common mistakes, ensuring that the process of claiming Family Separation Allowance proceeds as smoothly as possible.

Documents used along the form

When military members apply for the Family Separation Allowance (FSA) using the DD Form 1561, it's often necessary to supplement this request with additional documentation to substantiate claims and ensure thorough evaluation. These documents serve to provide further evidence regarding the service member's eligibility and the accuracy of the information provided on the DD Form 1561.

- Leave and Earnings Statement (LES): This document offers a detailed breakdown of a service member's pay, deductions, and allowances. When applying for FSA, the LES helps verify the member's pay grade, entitlements, and the basic allowance for housing (BAH), which is relevant for the FSA eligibility and calculation.

- Permanent Change of Station (PCS) Orders: These orders are issued when a service member is relocated to a new duty station. For FSA eligibility, particularly Type II FSA-R (Restricted), the PCS orders are crucial to prove that the military member has been assigned to a new location, potentially justifying the FSA if the relocation doesn't allow for the transportation of dependents at government expense.

- Declaration of Dependency: This document is instrumental for service members claiming FSA for non-spouse dependents, such as parents or children for whom they provide over half of the financial support. It helps to establish the claimed dependents and the member’s financial responsibility towards them, which is critical, especially when applying for Type II FSA for declared dependents.

- Marriage Certificate or Proof of Dependency: When a service member claims FSA based on marital status or for dependent parents, a marriage certificate or legal documentation proving dependency status is often required. This substantiates the service member's claim that they have eligible dependents for whom they maintain a separate residence, making them eligible for FSA.

These additional forms and documents play a pivotal role in the FSA application process, allowing for a comprehensive review by certifying officers. They help in verifying the information provided on the DD Form 1561, ensuring that only eligible service members receive the Family Separation Allowance, and maintaining the integrity and intention of this financial support system.

Similar forms

The DD Form 1172-2, or "Application for Identification Card/DEERS Enrollment," is similar to the DD 1561 form as it also requires verification of dependent status and personal information for the purpose of benefits eligibility. Both forms play a crucial role in ensuring that military members and their families receive the entitlements they are authorized, such as healthcare benefits in the case of the DD 1172-2 or family separation allowance for the DD 1561.

The DD Form 214, known as the "Certificate of Release or Discharge from Active Duty," shares similarities with the DD 1561 in that it serves as a key document for verifying military service details that are essential for accessing various veteran benefits and services. While the DD 214 substantiates a service member's military career upon separation or retirement, the DD 1561 specifically supports application for family separation allowance.

DD Form 1351-2, the "Travel Voucher or Subvoucher," is akin to the DD 1561 because both necessitate detailed personal and assignment information to process financial entitlements related to military service. The DD 1351-2 is used by service members to claim reimbursement for official travel expenses, whereas the DD 1561 validates eligibility for family separation payments.

The DD Form 2656, or "Data for Payment of Retired Personnel," resembles the DD 1561 due to its requirement for comprehensive personal information and beneficiary details for financial disbursements. While the DD 2656 is essential for setting up retirement pay and selecting survivor benefit plan options, the DD 1561 addresses the need for family separation allowance during active duty.

DA Form 31, the "Request and Authority for Leave," though an Army-specific form, shares procedural similarities with the DD 1561 form. Both documents require authorization from commanding officers and involve the service member's status that could influence their entitlements—leave status in the case of DA Form 31, and family separation for the DD 1561.

The BAH Documentation, or Basic Allowance for Housing documentation, while not a standardized form like the DD 1561, has a comparable function in substantiating a service member’s eligibility for specific financial allowances. In the context of the DD 1561, information relevant to housing and dependent status is crucial for establishing eligibility for family separation allowance, just as BAH documentation confirms eligibility for housing benefits.

PCS Orders (Permanent Change of Station Orders), similar to the DD 1561, involve detailed personal and assignment information that affects a service member’s financial entitlements. PCS Orders authorize and detail the relocation of a service member (and possibly their family), potentially impacting their qualification for family separation allowance as documented by a DD 1561 form, depending on the specifics of the move and the duration of any accompanying separation.

Dos and Don'ts

When filling out the DD Form 1561 to substantiate payment of Family Separation Allowance (FSA), there are specific dos and don'ts to keep in mind to ensure the process goes smoothly and accurately. Here are eight important points to consider:

- Do ensure you read the entire form and instructions carefully before starting to fill it out. It's important to understand what is being requested to avoid any mistakes.

- Do verify that all personal information is correct, including your name, grade, and social security number. This information is crucial for identifying your application and should match your official military records.

- Do select the correct type of FSA for which you are applying. The form includes options for FSA-T (Temporary), FSA-R (Restricted), and FSA-S (Ship). Each type has specific eligibility criteria.

- Do provide complete and current address(es) for your dependent(s). Accurate information is necessary to substantiate your claim for FSA.

- Don't leave any fields blank. If a question does not apply to you, indicate with "N/A" (Not Applicable) or "None," as appropriate. Incomplete forms may result in delays or denial of your FSA claim.

- Don't forget to sign and date Part I after certifying to the facts listed. Your signature is required to affirm the accuracy of the information provided.

- Don't disregard the privacy act statement at the beginning of the form. Understanding how your information will be used and the importance of disclosing your social security number and other personal details is crucial.

- Don't submit the form without reviewing it for errors. Double-check all entries for accuracy to avoid unnecessary complications or delays in processing your FSA.

Following these simple guidelines can help ensure a smoother process for claiming your Family Separation Allowance and avoid common mistakes that could delay or impede your application.

Misconceptions

Many people hold some misconceptions about the DD Form 1561, which is crucial for service members looking to substantiate their entitlement to Family Separation Allowance (FSA). Understanding this form accurately is important for both the service members and their families. Here are six common misconceptions about the DD Form 1561:

- All service members are automatically entitled to FSA. This is not true. FSA is only available to those who meet specific criteria, such as being on duty away from their permanent duty station and being separated from their dependents for more than 30 continuous days under certain conditions.

- FSA is only for married service members. Actually, FSA can be applied for by any service member with dependents, not just those who are married. This includes those with dependent children or parents for whom the service member has an approved dependency status.

- Completing the DD Form 1561 is optional for those who qualify for FSA. On the contrary, this form is mandatory for service members to officially claim and receive their FSA. It serves as a substantiating document to validate the entitlement.

- Any service member can fill out the form on their behalf. While service members do fill out Part I of the form, Part II must be completed by a certifying officer. This ensures accuracy and appropriateness of the FSA claim.

- Personal information disclosed on the DD Form 1561 can be used for any purpose. The use of personal information provided on the DD Form 1561 is strictly limited to aspects related to FSA payments. This includes creating an audit trail and providing a record in the service member’s pay account.

- Once submitted, the DD Form 1561 does not need to be updated. Service members must notify their commanding officer immediately upon any change in dependency status or if their dependents move closer to their station or visit for more than 90 continuous days, as these changes affect FSA eligibility and entitlement.

Clearing up these misconceptions helps ensure that service members can accurately apply for and receive the Family Separation Allowance to which they are entitled, aiding in the financial support of their families during periods of separation due to military duties.

Key takeaways

Understanding the DD Form 1561 is crucial for service members seeking Family Separation Allowance (FSA). Here are key takeaways to guide you through filling out and utilizing the form:

- The authority for collecting information on this form comes from Title 37, U.S. Code, Section 427, ensuring its legality and requirement.

- The primary purpose of the DD Form 1561 is to evaluate a service member's eligibility for FSA, underscoring its importance in providing financial support during separations.

- It serves multiple uses, including substantiating FSA payments, providing an audit trail, and maintaining a record in the service member's pay account.

- Disclosure of personal information, while voluntary, is essential for considering FSA, highlighting the balance between privacy and necessity.

- Service members must complete Part I to substantiate their entitlement to FSA, which requires accurate and current information about dependents and their living arrangements.

- Different types of FSAs are delineated, such as FSA-T (Temporary), FSA-R (Restricted), and FSA-S (Ship), indicating the diverse circumstances under which FSA can be claimed.

- Members are required to certify various conditions about their dependency status, legal separations, and the recent deployment history to qualify for FSA.

- The form mandates continuous notification of any changes in dependency status or living arrangements of dependents, ensuring the information is up-to-date.

- Certifying officers play a crucial role in completing the form, particularly in Part II, which involves validating the details provided by the member.

- The criteria for receiving Type II FSA include performing temporary duty (TDY) outside a reasonable commuting distance or being stationed in locations where dependent transportation is not authorized at government expense.

Completing the DD Form 1561 accurately is not just a bureaucratic requirement; it's a vital step in accessing deserved benefits and ensuring service members' families are supported during periods of separation.

Popular PDF Forms

Usa Patriot Act Independent Review - Requires detailing the duties of the Compliance Officer, ensuring they actively manage compliance protocols.

State Farm Disbursement Request Form - Facilitates a smooth transition from repair completion to the payment process, minimizing the policyholder's involvement in financial transactions.