Blank Dd PDF Template

The DD Form 2058, also known as the State of Legal Residence Certificate, serves a pivotal role for members of the United States uniformed services in determining their state of legal residence for the purpose of withholding state income taxes from their military pay. Underpinned by the authority of 50 U.S.C 571 and 37 U.S.C., this form requires detailed information about the service member's legal residence or domicile, which directly impacts their financial and legal responsibilities. Its completion is voluntary, but failing to provide the necessary information results in state income taxes being withheld according to the tax laws of the state listed as the service member's home of record. The DD Form 2058 outlines a clear distinction between the concepts of "legal residence/domicile" and "home of record," emphasizing that certain criteria must be met for a change of legal residence to be recognized. Such criteria include physical presence in a new state with the intent of making it one's permanent home, alongside other demonstrable actions indicative of this intent. The implications of one's legal residency status extend beyond tax considerations, affecting eligibility for various state-specific privileges and benefits. Consequently, individuals are encouraged to consult with a Legal Assistance Officer (JAG Representative) if there's any uncertainty about their state of legal residence before completing this form. This document's proper completion and submission ensure that service members' pay and allowances are accurately reflected according to their true state of residence.

Preview - Dd Form

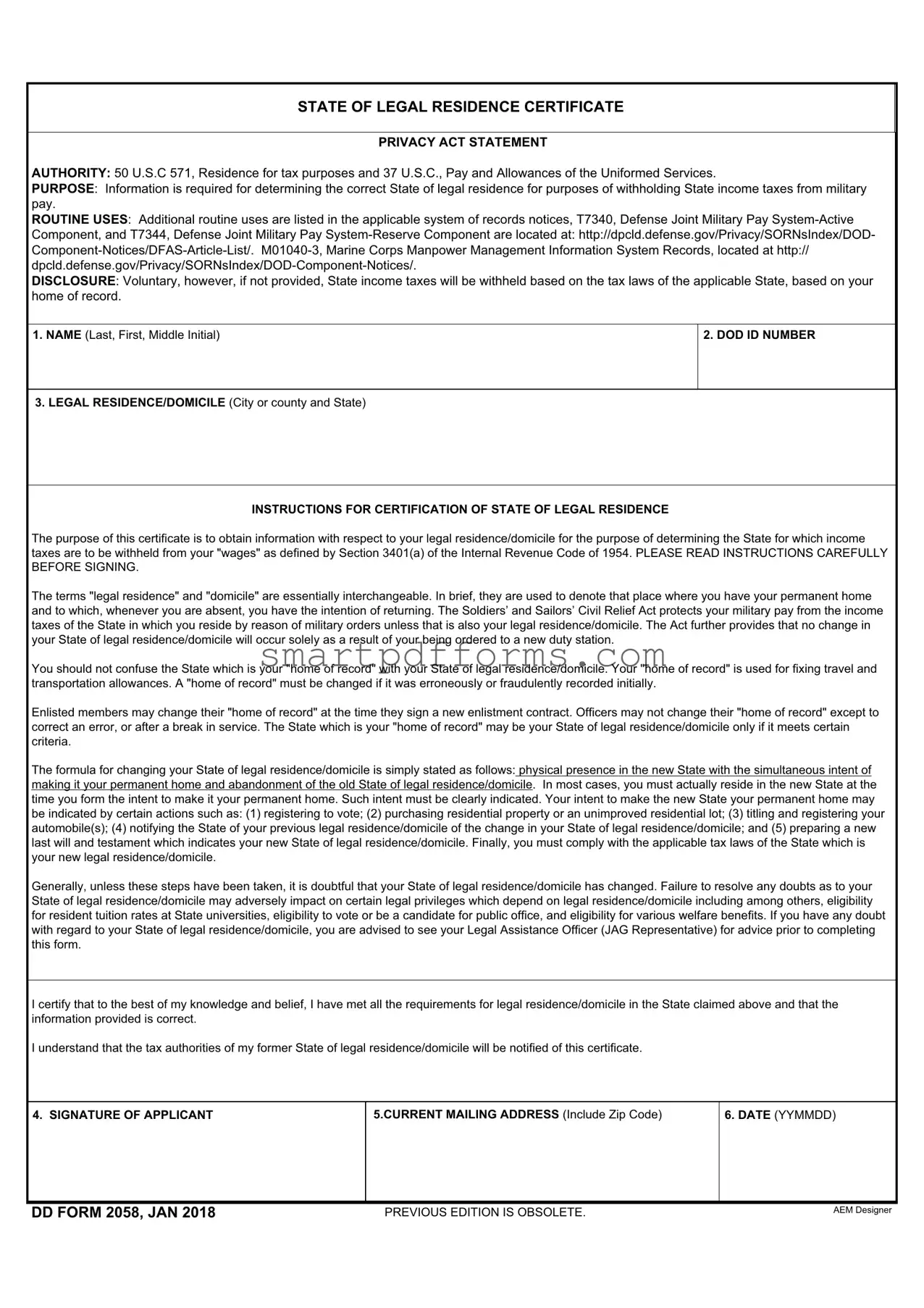

STATE OF LEGAL RESIDENCE CERTIFICATE

PRIVACY ACT STATEMENT

AUTHORITY: 50 U.S.C 571, Residence for tax purposes and 37 U.S.C., Pay and Allowances of the Uniformed Services.

PURPOSE: Information is required for determining the correct State of legal residence for purposes of withholding State income taxes from military pay.

ROUTINE USES: Additional routine uses are listed in the applicable system of records notices, T7340, Defense Joint Military Pay

Component, and T7344, Defense Joint Military Pay

DISCLOSURE: Voluntary, however, if not provided, State income taxes will be withheld based on the tax laws of the applicable State, based on your home of record.

1.NAME (Last, First, Middle Initial)

2. DOD ID NUMBER

3. LEGAL RESIDENCE/DOMICILE (City or county and State)

INSTRUCTIONS FOR CERTIFICATION OF STATE OF LEGAL RESIDENCE

The purpose of this certificate is to obtain information with respect to your legal residence/domicile for the purpose of determining the State for which income taxes are to be withheld from your "wages" as defined by Section 3401(a) of the Internal Revenue Code of 1954. PLEASE READ INSTRUCTIONS CAREFULLY BEFORE SIGNING.

The terms "legal residence" and "domicile" are essentially interchangeable. In brief, they are used to denote that place where you have your permanent home and to which, whenever you are absent, you have the intention of returning. The Soldiers’ and Sailors’ Civil Relief Act protects your military pay from the income taxes of the State in which you reside by reason of military orders unless that is also your legal residence/domicile. The Act further provides that no change in your State of legal residence/domicile will occur solely as a result of your being ordered to a new duty station.

You should not confuse the State which is your "home of record" with your State of legal residence/domicile. Your "home of record" is used for fixing travel and transportation allowances. A "home of record" must be changed if it was erroneously or fraudulently recorded initially.

Enlisted members may change their "home of record" at the time they sign a new enlistment contract. Officers may not change their "home of record" except to correct an error, or after a break in service. The State which is your "home of record" may be your State of legal residence/domicile only if it meets certain criteria.

The formula for changing your State of legal residence/domicile is simply stated as follows: physical presence in the new State with the simultaneous intent of making it your permanent home and abandonment of the old State of legal residence/domicile. In most cases, you must actually reside in the new State at the time you form the intent to make it your permanent home. Such intent must be clearly indicated. Your intent to make the new State your permanent home may be indicated by certain actions such as: (1) registering to vote; (2) purchasing residential property or an unimproved residential lot; (3) titling and registering your automobile(s); (4) notifying the State of your previous legal residence/domicile of the change in your State of legal residence/domicile; and (5) preparing a new last will and testament which indicates your new State of legal residence/domicile. Finally, you must comply with the applicable tax laws of the State which is your new legal residence/domicile.

Generally, unless these steps have been taken, it is doubtful that your State of legal residence/domicile has changed. Failure to resolve any doubts as to your State of legal residence/domicile may adversely impact on certain legal privileges which depend on legal residence/domicile including among others, eligibility for resident tuition rates at State universities, eligibility to vote or be a candidate for public office, and eligibility for various welfare benefits. If you have any doubt with regard to your State of legal residence/domicile, you are advised to see your Legal Assistance Officer (JAG Representative) for advice prior to completing this form.

I certify that to the best of my knowledge and belief, I have met all the requirements for legal residence/domicile in the State claimed above and that the information provided is correct.

I understand that the tax authorities of my former State of legal residence/domicile will be notified of this certificate.

4. SIGNATURE OF APPLICANT

5.CURRENT MAILING ADDRESS (Include Zip Code)

6.DATE (YYMMDD)

DD FORM 2058, JAN 2018 |

PREVIOUS EDITION IS OBSOLETE. |

AEM Designer |

Form Data

| Fact Name | Description |

|---|---|

| Form Title | STATE OF LEGAL RESIDENCE CERTIFICATE |

| Primary Legal Authority | 50 U.S.C 571, Residence for tax purposes |

| Secondary Legal Authority | 37 U.S.C., Pay and Allowances of the Uniformed Services |

| Purpose | Determining the correct State of legal residence for withholding State income taxes from military pay |

| Routine Uses | Additional routine uses include Defense Joint Military Pay System-Active Component (T7340) and Reserve Component (T7344), and Marine Corps Manpower Management Information System Records (M01040-3) |

| Routine Uses Links | DFAS Article List, DOD Component Notices |

| Disclosure | Voluntary, but mandatory for correct State income tax withholding; if not provided, taxes will be withheld based on the tax laws of the applicable State, based on your home of record |

| Certification Criteria | Includes physical presence in the new State with intent of making it a permanent home and abandonment of the old legal residence/domicile. Actions indicating such intent include registering to vote, purchasing property, vehicle registration in the new State, among others. |

Instructions on Utilizing Dd

When filling out the DD Form 2058, also known as the State of Legal Residence Certificate, attention to detail is crucial. This document is the key to ensuring that your State income taxes are withheld correctly, based on your true legal residence or domicile, rather than your home of record. It's about establishing where you hold the intent to return, the place you consider your permanent home. The distinction between "legal residence" and "home of record" is significant for tax purposes and can affect other legal privileges like tuition rates, eligibility to vote, and more. Be sure to understand the implications and meet the necessary criteria to claim a new legal residence before proceeding. The following steps guide you through the completion of this form.

- Read the Privacy Act Statement carefully to understand the authority, purpose, routine uses, and disclosure policies related to this form.

- Enter your last name, first name, and middle initial in the space designated for item 1.

- Fill in your DOD ID number in the section provided for item 2.

- In item 3, specify your legal residence/domicile, including both city or county and state. Remember, this must be a place where you have a physical presence and intent to return.

- Carefully read the instructions provided in the section titled "INSTRUCTIONS FOR CERTIFICATION OF STATE OF LEGAL RESIDENCE" to understand the criteria and implications of certifying your state of legal residence.

- After ensuring you meet all the criteria for legal residence in the claimed state, sign your name in the space allocated for item 4.

- Enter your current mailing address, including the zip code, in the field for item 5. This address should be up-to-date and accurate.

- Lastly, fill in the date of submission in the format YYMMDD in the space provided for item 6.

Completion of the DD Form 2058 requires thoughtful consideration and an understanding of the legal implications of your claimed domicile or legal residence. It's not just about where you are currently stationed or where you have lived; it's about where you intend to return and consider your permanent home. If there's any doubt or confusion about this process, seeking the advice of a Legal Assistance Officer (JAG Representative) is strongly recommended. Once filled out, this form notifies tax authorities of your State of legal residence/domicile, impacting your State income tax withholding and other legal rights and benefits.

Obtain Answers on Dd

What is the purpose of the DD Form 2058, State of Legal Residence Certificate?

The DD Form 2058 is utilized to determine an individual's correct State of legal residence for the purpose of withholding State income taxes from military pay. It ensures that taxes are accurately withheld and remitted to the appropriate State based on the service member's legal residence/domicile, rather than merely the location of their military assignment.

Why is providing the information on the DD Form 2058 described as voluntary, yet necessary?

While submission of the DD Form 2058 is considered voluntary, failing to provide this information results in State income taxes being withheld based on the tax laws of the State associated with the service member’s official home of record. This might not accurately reflect their current State of legal residence, potentially leading to incorrect tax withholdings and complications in tax status.

What is the difference between a "legal residence/domicile" and a "Home of Record"?

A "legal residence/domicile" refers to the place where a person has their permanent home, to which they intend to return whenever they are absent. It's a designation used for tax purposes among others. A "Home of Record," however, is established at the time of enlistment and is primarily used for determining travel and transportation allowances. While these can coincide, changing one's Home of Record does not necessarily change their legal residence/domicile without meeting specific criteria.

How can a service member change their State of legal residence/domicile?

To change their State of legal residence/domicile, a service member must be physically present in the new State with the intention of making it their permanent home, while simultaneously abandoning their old State of legal residence/domicile. Clear indications of this intent include actions such as registering to vote, purchasing property, titling and registering automobiles in the new State, notifying the former State of the change, and complying with the new State's tax laws.

What are the potential consequences of failing to correctly establish a legal residence/domicile?

Incorrectly establishing or failing to prove a change in legal residence/domicile can adversely affect eligibility for several legal privileges based on residency. These may include, but are not limited to, resident tuition rates at State universities, the ability to vote or run for public office, and eligibility for State-specific welfare benefits. It is crucial for service members to resolve any doubts about their legal residence/domicile to avoid such impacts.

What steps should be taken if there is uncertainty about the correct State of legal residence/domicile?

In cases of uncertainty about one's State of legal residence/domicile, it is strongly recommended to seek advice from a Legal Assistance Officer (JAG Representative). They can provide guidance and ensure the service member takes appropriate steps to correctly establish or change their State of legal residence/domicile according to the laws and regulations.

Common mistakes

Not understanding the difference between "legal residence/domicile" and "home of record" is a common mistake. The form requires specifying your legal state of residence for tax withholding purposes, which may differ from the "home of record" used for travel and transportation allowances. Neglecting this distinction can lead to inaccuracies in tax withholdings and potential legal complications.

Failing to indicate a clear intent to change one's state of legal residence/domicile can also lead to errors on the form. Intent is demonstrated through actions like registering to vote, purchasing property, or changing vehicle registration in the new state. Merely living in a new state isn't enough; these concrete actions must accompany the move to solidify the new legal residence for tax purposes.

Omitting to notify the prior state of legal residence/domicile about the change is another mistake. Informing your previous state about your change in legal residence/domicile is necessary to avoid dual taxation and ensure that your voter registration and other civic duties are correctly reallocated.

Ignoring the advice of a Legal Assistance Officer (JAG Representative) can have repercussions. Individuals often complete the DD Form 2058 without seeking the counsel of a JAG Representative, especially when uncertainty exists about the legality of their residence status change. This oversight can result in the submission of incorrect information, leading to future disputes with tax authorities and possible legal penalties.

Documents used along the form

When managing military documents, the DD Form 2058, or State of Legal Residence Certificate, often used by service members to establish their state of legal residency for tax withholding purposes, isn't the only crucial document in the process. Several other forms and documents typically accompany or are closely associated with the DD Form 2058, facilitating various administrative and legal needs for military personnel.

- SF-180, Request Pertaining to Military Records: This form is essential for service members or veterans seeking to obtain copies of their military records, including DD 214, service medical records, and other personnel files. These records are necessary for verifying military service, benefits eligibility, and other legal purposes.

- DD Form 214, Certificate of Release or Discharge from Active Duty: Often used alongside the DD Form 2058, this document is one of the most important for a service member. It provides a comprehensive overview of a person's military service, including classification, assignments, awards, and reason for discharge. It's vital for accessing veteran benefits, employment, and veterans' preference for government jobs.

- VA Form 10-10EZ, Application for Health Benefits: This form is used by veterans to apply for medical benefits through the Department of Veterans Affairs. It's important for veterans looking to establish their eligibility for health services based on their military service.

- IRS Form W-4, Employee's Withholding Certificate: While not exclusive to military personnel, the IRS Form W-4 is often necessary for those filling out the DD Form 2058, as it instructs employers (or military pay systems) how much federal income tax to withhold from wages. It may need to be updated following a change in legal residence to ensure proper federal tax withholding.

Together, these forms and documents support a service member's personal and legal affairs, ensuring their rights, benefits, and obligations are correctly documented and processed. Whether changing legal residence, accessing military benefits, or managing tax affairs, each plays a critical role in the administrative life of military personnel.

Similar forms

The W-4 Form (Employee's Withholding Certificate): Like the DD Form, the W-4 is used by employees to indicate their tax status to employers for withholding the correct amount of federal income tax from their paycheck. Both documents play crucial roles in ensuring individuals are taxed correctly based on their circumstances.

Voter Registration Forms: Similar to the part of the DD Form that deals with demonstrating intent to make a new state your permanent home through voter registration, these forms also establish residency for state and local elections, influencing an individual's legal ties and responsibilities to that area.

Motor Vehicle Registration Forms: The act of registering a vehicle in a new state, as mentioned in the DD Form instructions for demonstrating intent of residency, shares similarities with motor vehicle registration forms. These forms not only legally tie a person to a state but can also serve as proof of residency.

Last Will and Testament Forms: Changing one's legal residence in the DD Form and indicating such change in a will bear resemblance. Both actions declare an individual's intention concerning their state of domicile, affecting legal and tax implications tied to that designation.

State Income Tax Forms: They are akin to the DD Form's purpose as they are instruments through which individuals report their income and calculate taxes due to the state of their legal residence, directly impacting an individual's financial obligations based on residency.

Change of Address Forms (USPS): While these forms primarily serve to notify the Postal Service of a move, they similarly to the DD Form, signal a change in residence that can affect legal and tax responsibilities, especially when moving across state lines.

College and University Residency Declaration Forms: These documents are used to declare a student's state of residency for tuition purposes, closely paralleling the DD Form's function of establishing state of legal residence for state income tax withholding from military pay.

Employment Eligibility Verification (I-9 Form): This form determines an employee's eligibility to work in the United States, and while its purpose is different, it shares the feature of requiring personal identification and information, similar to the DD Form’s role in identifying legal residence for tax purposes.

Voter Change of Address Forms: These allow individuals to update their voting address, akin to the aspect of the DD Form where service members indicate their new legal residence. Both influence an individual's legal obligations and rights within a specific jurisdiction.

Dos and Don'ts

When filling out the DD Form 2058, also known as the State of Legal Residence Certificate, certain guidelines should ensure the process is completed accurately and efficiently. Here are eight essential dos and don'ts to follow:

- Do take time to carefully read the Privacy Act Statement and instructions before beginning the form to understand the implications of your declarations.

- Do ensure that the name, DoD ID Number, and current mailing address you provide are accurate and up-to-date to avoid any issues with your identification.

- Do consult with a Legal Assistance Officer (JAG Representative) if you have any doubts or questions about your state of legal residence/domicile, especially if you're considering a change. Their guidance can prevent legal and financial ramifications down the line.

- Do clearly indicate your intent to make a new state your permanent home through actions such as registering to vote, purchasing property, or titling and registering your automobile in that state, as these steps can serve as proof of your domicile.

- Don't assume your "home of record" automatically counts as your state of legal residence/domicile. They are designated for different purposes, and changing your domicile involves specific criteria that must be met.

- Don't rush through filling out the form without verifying all details are correct and truly reflect your intentions and current situation; inaccuracies can lead to significant issues, especially concerning tax obligations and entitlements.

- Don't overlook the requirement to comply with the tax laws of your new state of legal residence/domicile once you've decided to change it. Understanding and adhering to these laws is crucial.

- Don't forget to sign and date the form. Your signature and the date serve as your certification that all provided information is accurate to the best of your knowledge and meets all requirements for legal residence in the stated domicile.

Following these guidelines helps ensure that your DD Form 2058 is filled out correctly, reflecting your true state of legal residence. This accuracy is essential for state income tax withholding purposes and maintaining compliance with both military and state laws regarding domicile.

Misconceptions

When dealing with the DD Form 2058, or the State of Legal Residence Certificate, there are several misconceptions that often arise. Understanding the purpose and requirements of this document is crucial, especially for members of the uniformed services aiming to correctly establish their state of legal residence for tax withholding purposes. Here, we clarify common misunderstandings to provide a clearer perspective.

- Misconception 1: The DD Form 2058 is mandatory for all service members.

This form is voluntary; however, not submitting it may result in state income taxes being withheld based on the laws of the state listed as the home of record, which might not be the individual's legal residence/domicile.

- Misconception 2: Legal residence and domicile mean two different things.

On the DD Form 2058, the terms "legal residence" and "domicile" are used interchangeably to denote the place where a service member has their permanent home and intends to return whenever they are absent.

- Misconception 3: Military orders automatically change your state of legal residence/domicile.

The Soldiers’ and Sailors’ Civil Relief Act ensures that a service member's pay cannot be taxed by a state due to military orders unless that state is also their legal domicile. A change in legal residence/domicile cannot occur solely because of new military orders.

- Misconception 4: Your “home of record” and state of legal residence/domicile are always the same.

Your "home of record" is primarily used for determining travel and transportation allowances, whereas your state of legal residence/domicile is for tax purposes. They might not necessarily be the same.

- Misconception 5: Changing your state of residence/domicile is complicated and involves numerous steps.

While the process does require concrete steps such as registering to vote, purchasing property, and complying with state tax laws, the essential formula is straightforward: physical presence in the new state plus intent to make it your permanent home.

- Misconception 6: You can change your legal residence/domicile at any time, with minimal proof.

Changing your legal residence/domicile requires significant proof of intent, such as voter registration, property purchase, and compliance with state-specific tax laws. It is a decision that requires deliberate action and clear evidence.

- Misconception 7: Service members do not need to notify their previous state of residence when they change their domicile.

One advisable step in changing your domicile is notifying the state of your previous legal residence/domicile about this change. This aids in clarifying your intent and ensuring proper tax obligations are met.

- Misconception 8: All actions related to changing domicile have the same weight.

Certain actions, like buying a home in the new state or registering to vote there, strongly indicate an intention to change your domicile. Such actions carry significant weight in proving your new state of legal residence.

- Misconception 9: Consulting a Legal Assistance Officer (JAG Representative) is optional and generally not necessary.

If you have any doubts regarding your state of legal residence/domicile or the process of changing it, seeking advice from a Legal Assistance Officer is strongly advised to ensure that you are fully informed and compliant with legal requirements.

Understanding the nuances and requirements of the DD Form 2058 is vital for every service member. By debunking these misconceptions, one can better navigate the complexities of establishing or changing their state of legal residence/domicile, ensuring compliance with military and state tax laws.

Key takeaways

Understanding how to accurately fill out the DD Form 2058, or the State of Legal Residence Certificate, carries significant importance for members of the uniformed services. This document influences where state income taxes are withheld from military pay, impacting overall financial health and compliance with state laws. Here are key takeaways to guide service members through this process:

- The authority for requesting this information rests on established laws, specifically 50 U.S.C 571, which pertains to residence for tax purposes, and 37 U.S.C., addressing pay and allowances.

- The purpose of the DD Form 2058 is to determine the correct state of legal residence or domicile for withholding state income taxes.

- Several routine uses of the information provided on the form are outlined, which include but are not limited to, systems that manage military pay for active and reserve components.

- Disclosure is voluntary, but failing to provide the information results in state income taxes being withheld based on the tax laws of the service member's home of record, potentially leading to incorrect withholdings.

- The form clarifies the distinction between a "legal residence"/"domicile" and a "home of record," the former being the state where one intends to return and reside permanently.

- Changing one's state of legal residence/domicile involves not only a physical presence in the new state but also a demonstrated intent to make it one's permanent home.

- Intent to establish a new domicile can be shown through actions such as registering to vote, buying property, titling and registering automobiles in the new state, and updating vital legal documents to reflect the new domicile.

- Compliance with the tax laws of the new state of legal residence/domicile is essential to the validity of the domicile change.

- Service members with uncertainties about their state of legal residence/domicile are encouraged to seek advice from a Legal Assistance Officer (JAG Representative) before completing this form.

It is paramount for service members to approach the completion of the DD Form 2058 with careful consideration of their residency intentions and activities. As this decision carries with it financial and legal implications, obtaining clear and concise advice can safeguard against potential challenges related to state tax liabilities and legal rights within the chosen state of domicile.

Popular PDF Forms

Texas 5506 Nar - The form serves not only as a mechanism for employment verification but also as a tool for maintaining high standards in caregiving.

Pearl Carroll Disability Claim Form - Applicants must provide detailed personal information, including a statement of recovery or return to work, if applicable.

Dance Admission Form - Enhances communication channels between the dance team management and applicants through collection of multiple contact points.