Blank De 1 Edd PDF Template

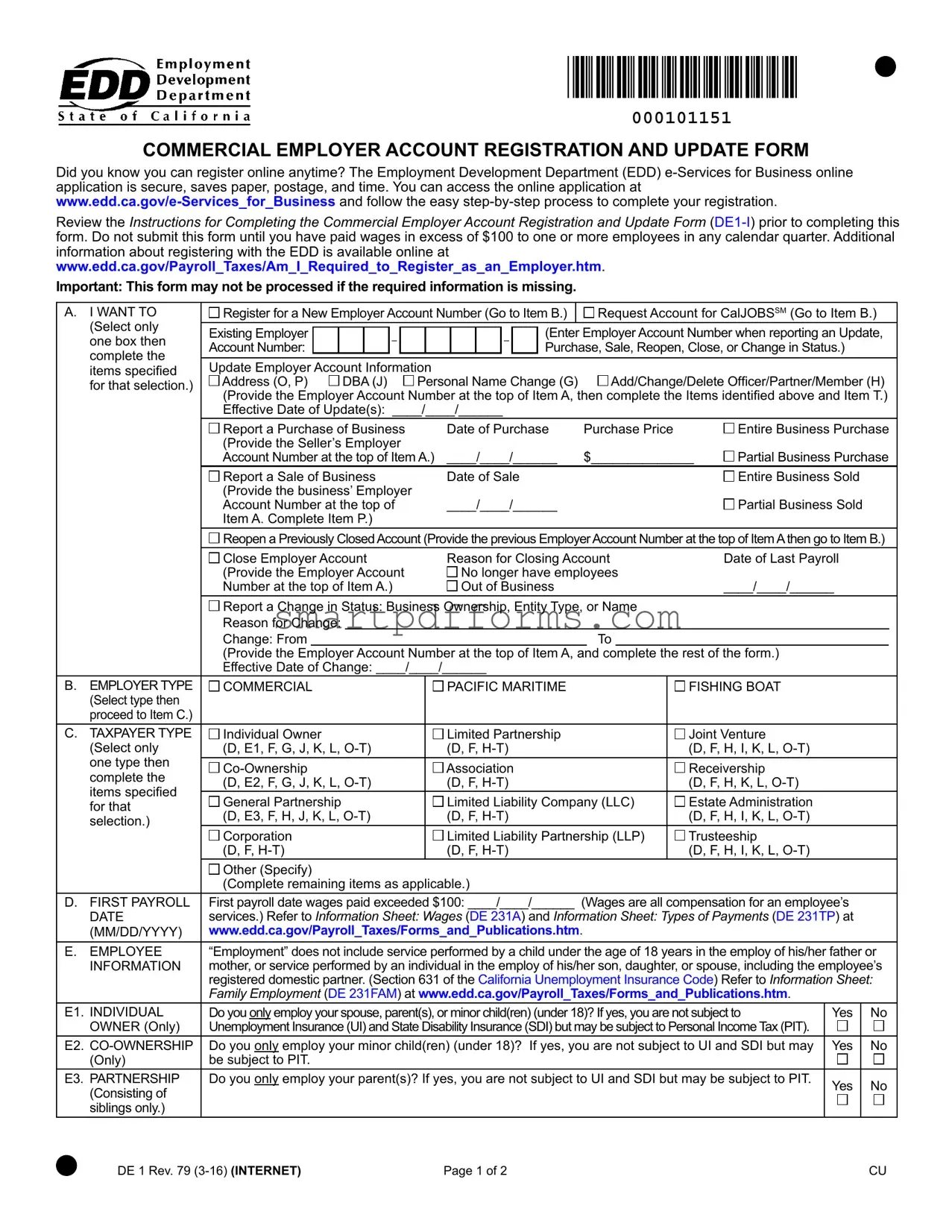

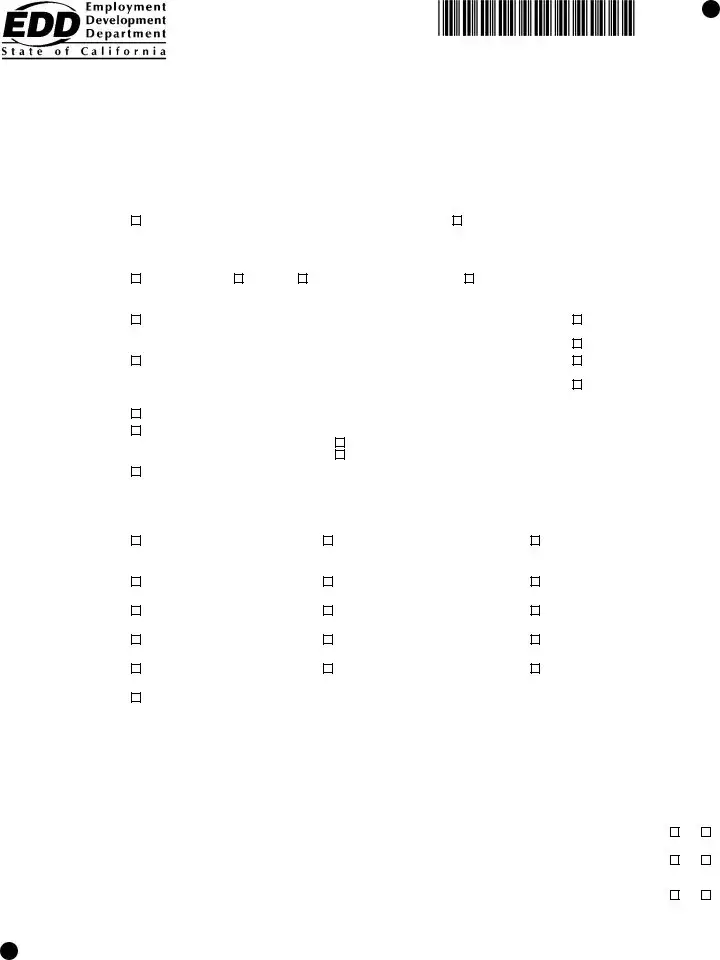

When diving into the realm of establishing or updating commercial employer accounts within the California Employment Development Department (EDD), the DE 1 EDD form emerges as a fundamental document. This pivotal form, officially titled the Commercial Employer Account Registration and Update Form, serves as the cornerstone for employers navigating the registration process or updating their account details with the EDD. It encapsulates a broad spectrum of employer actions, from registering a new employer account number to updating existing account information such as business address, officer or partner details, and business status changes, among other critical updates. Additionally, the form covers various employer types and taxpayer categories, ensuring a comprehensive framework for the accurate reporting of employer information. It’s crucial for employers to review the instructions meticulously before proceeding to ensure all relevant sections are completed accurately. Submission of this form is essential once an employer has paid wages exceeding $100 to one or more employees within a calendar quarter, underlining its importance in maintaining compliance with California's payroll tax obligations. Engaging with this form not only facilitates compliance but also streamlines the process through the EDD’s e-Services for Business online application, highlighting a commitment to efficiency and environmental sustainability.

Preview - De 1 Edd Form

000101151

COMMERCIAL EMPLOYER ACCOUNT REGISTRATION AND UPDATE FORM

Did you know you can register online anytime? The Employment Development Department (EDD)

Review the Instructions for Completing the Commercial Employer Account Registration and Update Form

www.edd.ca.gov/Payroll_Taxes/Am_I_Required_to_Register_as_an_Employer.htm.

Important: This form may not be processed if the required information is missing.

A. |

I WANT TO |

Register for a New Employer Account Number (Go to Item B.) |

|

|

Request Account for CalJOBSSM (Go to Item B.) |

||||||||||||||||||||||||

|

(Select only |

Existing Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Enter Employer Account Number when reporting an Update, |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

one box then |

|

|

|

|

|

– |

|

|

|

|

|

|

– |

|

||||||||||||||

|

Account Number: |

|

|

|

|

|

|

|

|

|

|

|

|

Purchase, Sale, Reopen, Close, or Change in Status.) |

|

|

|||||||||||||

|

complete the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Update Employer Account Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

items speciied |

|

|

|

|

|

|

|

|

Add/Change/Delete Oficer/Partner/Member (H) |

|||||||||||||||||||

|

for that selection.) |

Address (O, P) |

DBA (J) |

Personal Name Change (G) |

|

||||||||||||||||||||||||

|

|

(Provide the Employer Account Number at the top of Item A, then complete the Items identiied above and Item T.) |

|||||||||||||||||||||||||||

|

|

Effective Date of Update(s): ____/____/______ |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

Report a Purchase of Business |

|

|

Date of Purchase |

Purchase Price |

|

Entire Business Purchase |

|||||||||||||||||||||

|

|

(Provide the Seller’s Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Account Number at the top of Item A.) |

____/____/______ |

|

$______________ |

Partial Business Purchase |

|||||||||||||||||||||||

|

|

Report a Sale of Business |

|

|

Date of Sale |

|

|

|

|

|

|

|

Entire Business Sold |

|

|

||||||||||||||

|

|

(Provide the business’ Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Account Number at the top of |

|

|

____/____/______ |

|

|

|

|

|

|

Partial Business Sold |

|

|

|||||||||||||||

|

|

Item A. Complete Item P.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Reopen a Previously ClosedAccount (Provide the previous EmployerAccount Number at the top of ItemAthen go to Item B.) |

|||||||||||||||||||||||||||

|

|

Close Employer Account |

|

|

Reason for Closing Account |

|

Date of Last Payroll |

|

|

||||||||||||||||||||

|

|

(Provide the Employer Account |

|

|

|

No longer have employees |

|

|

|

|

|

|

|||||||||||||||||

|

|

Number at the top of Item A.) |

|

|

|

Out of Business |

|

|

|

|

|

____/____/______ |

|

|

|

||||||||||||||

|

|

Report a Change in Status: Business Ownership, Entity Type, or Name |

|

|

|

|

|

|

|||||||||||||||||||||

|

|

Reason for Change: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Change: From |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To |

|

|

|

|

|

|

|

|||

|

|

(Provide the Employer Account Number at the top of Item A, and complete the rest of the form.) |

|

|

|

|

|||||||||||||||||||||||

|

|

Effective Date of Change: ____/____/______ |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

B. |

EMPLOYER TYPE |

COMMERCIAL |

|

|

|

|

|

|

|

PACIFIC MARITIME |

|

|

|

|

FISHING BOAT |

|

|

|

|

||||||||||

|

(Select type then |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

proceed to Item C.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C. |

TAXPAYER TYPE |

Individual Owner |

|

|

|

|

|

|

|

Limited Partnership |

|

|

|

|

Joint Venture |

|

|

|

|

||||||||||

|

(Select only |

(D, E1, F, G, J, K, L, |

|

|

(D, F, |

|

|

|

|

|

|

(D, F, H, I, K, L, |

|

|

|

|

|||||||||||||

|

one type then |

|

|

|

|

|

|

|

Association |

|

|

|

|

|

|

Receivership |

|

|

|

|

|||||||||

|

complete the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

(D, E2, F, G, J, K, L, |

|

|

(D, F, |

|

|

|

|

|

|

(D, F, H, K, L, |

|

|

|

|

||||||||||||||

|

items speciied |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

General Partnership |

|

|

|

|

|

|

|

Limited Liability Company (LLC) |

|

Estate Administration |

|

|

|

|

||||||||||||||

|

for that |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

(D, E3, F, H, J, K, L, |

|

|

(D, F, |

|

|

|

|

|

|

(D, F, H, I, K, L, |

|

|

|

|

||||||||||||||

|

selection.) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

Corporation |

|

|

|

|

|

|

|

Limited Liability Partnership (LLP) |

|

Trusteeship |

|

|

|

|

|||||||||||||

|

|

(D, F, |

|

|

|

|

|

|

|

(D, F, |

|

|

|

|

|

|

(D, F, H, I, K, L, |

|

|

|

|

||||||||

|

|

Other (Specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

(Complete remaining items as applicable.) |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

D. |

FIRST PAYROLL |

First payroll date wages paid exceeded $100: ____/____/______ (Wages are all compensation for an employee’s |

|

|

|||||||||||||||||||||||||

|

DATE |

services.) Refer to Information Sheet: Wages (DE 231A) and Information Sheet: Types of Payments (DE 231TP) at |

|

|

|||||||||||||||||||||||||

|

(MM/DD/YYYY) |

www.edd.ca.gov/Payroll_Taxes/Forms_and_Publications.htm. |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

E. |

EMPLOYEE |

“Employment” does not include service performed by a child under the age of 18 years in the employ of his/her father or |

|||||||||||||||||||||||||||

|

INFORMATION |

mother, or service performed by an individual in the employ of his/her son, daughter, or spouse, including the employee’s |

|||||||||||||||||||||||||||

|

|

registered domestic partner. (Section 631 of the California Unemployment Insurance Code) Refer to Information Sheet: |

|||||||||||||||||||||||||||

|

|

Family Employment (DE 231FAM) at www.edd.ca.gov/Payroll_Taxes/Forms_and_Publications.htm. |

|

|

|

|

|||||||||||||||||||||||

E1. |

INDIVIDUAL |

Do you only employ your spouse, parent(s), or minor child(ren) (under 18)? If yes, you are not subject to |

Yes |

|

No |

||||||||||||||||||||||||

|

OWNER (Only) |

Unemployment Insurance (UI) and State Disability Insurance (SDI) but may be subject to Personal Income Tax (PIT). |

|

|

|

|

|||||||||||||||||||||||

E2. |

Do you only employ your minor child(ren) (under 18)? If yes, you are not subject to UI and SDI but may |

Yes |

|

No |

|||||||||||||||||||||||||

|

(Only) |

be subject to PIT. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

E3. |

PARTNERSHIP |

Do you only employ your parent(s)? If yes, you are not subject to UI and SDI but may be subject to PIT. |

Yes |

|

No |

||||||||||||||||||||||||

|

(Consisting of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

siblings only.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DE 1 Rev. 79 |

Page 1 of 2 |

CU |

COMMERCIAL EMPLOYER ACCOUNT

REGISTRATION AND UPDATE FORM

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

000101152 |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F. |

LOCATION OF |

|

Do you have employees working in California? |

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|||||

|

EMPLOYEE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SERVICES |

|

Do you have employees residing in California that are working outside of California? |

|

|

|

|

|

Yes |

No |

|||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

G. |

INDIVIDUAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CA Driver |

|

|

|

|||

|

OWNER/ |

|

|

NAME |

|

|

TITLE |

|

|

|

SSN |

|

License |

Add |

Chg. |

Del. |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number |

|

|

|

||||

|

INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(If applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H. CORPORATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CA Driver |

Add |

Chg. |

Del. |

||||

|

OFFICER(S), |

|

|

NAME |

|

|

TITLE |

|

|

|

SSN |

|

License |

||||||||||

|

PARTNERS, OR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number |

|

|

|

|||

|

LLC MEMBER(S), |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MANAGER(S), |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AND/OR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OFFICER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

I. |

LEGAL NAME OF ORGANIZATION (Corporation/LLC/LLP/LP: Enter exactly as it appears on your oficial registration documents.) |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

J. |

DOING BUSINESS AS (DBA) (If applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

K. |

FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN) |

|

L. DATE OWNERSHIP BEGAN (MM/DD/YYYY) |

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____/____/______ |

|

|

|

|||||

M. STATE OR PROVINCE OF INCORPORATION/ORGANIZATION |

|

N. CALIFORNIA SECRETARY OF STATE ENTITY NUMBER |

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

O. |

PHYSICAL BUSINESS |

Street Number |

|

|

Street Name |

|

|

|

|

|

Unit Number (If applicable) |

||||||||||||

|

LOCATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(PO Box or Private |

|

City |

|

|

State/Province |

|

ZIP Code |

|

|

Country |

|

|

|

|||||||||

|

Mail Box will not be |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

accepted.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Phone Number |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

P. |

MAILING ADDRESS |

|

Street Number |

|

|

Street Name |

|

|

|

|

|

Unit Number (If applicable) |

|||||||||||

|

(PO Box or Private Mail |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Box is acceptable.) |

|

City |

|

|

State/Province |

|

ZIP Code |

|

|

Country |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Same as above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone Number |

|

|

|

|

|

|

|

|

|

|

||||||

Q. |

|

Valid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Check to allow |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

R. |

INDUSTRY ACTIVITY |

Describe in detail your speciic product/services: |

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

Select your business industry |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

Services |

Retail |

Wholesale |

|

Manufacturing |

|

Temporary Services |

|

|

|

||||||||||

|

|

|

|

Leasing Employer |

Professional Employer Organization |

Other (Specify) _____________________ |

|||||||||||||||||

S. |

CONTACT PERSON |

|

Name |

|

|

|

|

|

|

Contact Phone Number |

|

|

|

|

|||||||||

|

(Complete a Power of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attorney [POA] Declaration |

Relation |

|

|

Address |

|

|

|

|

|

|

|

|

|

|

||||||||

|

[DE 48], if applicable.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

T. |

DECLARATION |

|

I certify under penalty of perjury that the above information is true, correct, and complete, and that |

||||||||||||||||||||

|

|

|

|

these actions are not being taken to receive a more favorable Unemployment Insurance rate. I further |

|||||||||||||||||||

|

|

|

|

certify that I have the authority to sign on behalf of the above business. |

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

Name |

|

|

|

|

|

Title |

|

|

|

|

|

|

Phone Number |

|

|||||

|

|

|

|

|

|

|

|||||||||||||||||

|

MAIL TO: EDD, Account Services Group, MIC 28, PO Box 826880, Sacramento, CA |

|

|

||||||||||||||||||||

|

DE 1 Rev. 79 |

|

|

Page 2 of 2 |

|

|

|

|

|

|

|

|

|

|

|||||||||

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | Registration and update for commercial employer accounts in California. |

| Online Registration | Employers can register online via the EDD e-Services for Business, saving time, paper, and postage. |

| Wage Requirement for Submission | Employers must have paid over $100 in wages in any calendar quarter before submitting the form. |

| Mandatory Information | Form may not be processed if required information is missing. |

| Governing Law | The form is governed by California law, specifically the California Unemployment Insurance Code. |

| Exemptions for Family Employers | Employment of certain family members (spouse, parent, or minor children) can exempt employers from Unemployment Insurance and State Disability Insurance. |

| Registration for Different Employers | Allows for registration updates such as new accounts, changes in status, or closure for various business structures. |

| Effective Date of Updates | Employers must specify the effective date for any updates or changes made using the form. |

Instructions on Utilizing De 1 Edd

Filing the DE 1 EDD form is a vital step for commercial employers in registering their business with the California Employment Development Department (EDD). This process can seem intricate, but it's designed to establish your company within the state's payroll tax system. The guidelines provided aim to simplify filling out this form by breaking down its components into manageable steps. Following this method ensures the information is accurately conveyed, setting the foundation for your responsibilities as an employer in California.

- Start by accessing the DE 1 EDD form online. You can find this form on the EDD's official website under the 'Forms and Publications' section.

- If you are registering for a new employer account number, mark the appropriate box in section A. Should you wish to request an account for CalJOBSSM or report any changes (such as a purchase, sale, reopen, or close, or change in status), indicate your choice clearly.

- For those updating information, include the effective date of these updates right at the beginning, under the 'Effective Date of Update(s)' section.

- In the "EMPLOYER TYPE" section (B), select the type of activity your business engages in, such as COMMERCIAL, PACIFIC MARITIME, or FISHING BOAT. This choice will dictate which parts of the form you need to complete.

- Under "TAXPAYER TYPE" (C), pinpoint the nature of your business's legal structure. This could range from Individual Owner to Corporation, among others. Each type has specific requirements, so choose the one that most accurately reflects your business.

- Detail when you exceeded the $100 payroll threshold in the "FIRST PAYROLL" section (D). This is crucial for establishing your tax responsibilities.

- Answer the specific questions about employee information in section E, which will determine certain exemptions from Unemployment Insurance (UI) and State Disability Insurance (SDI).

- In sections F through I, provide additional data about your business location, the individuals in ownership or managerial roles, and the legal name of your organization.

- Should your business operate under a Doing Business As (DBA) name, input this information in section J.

- Include your Federal Employer Identification Number (FEIN) in section K, ensuring your business is identifiable for tax purposes.

- Fill out the "DATE OWNERSHIP BEGAN," "STATE OR PROVINCE OF INCORPORATION/ORGANIZATION," and "CALIFORNIA SECRETARY OF STATE ENTITY NUMBER" in the respective sections to offer a brief history of your business establishment.

- Provide the physical business location and mailing address in sections O and P. These will be used for official correspondence and must be accurate.

- Section Q is where you can offer an email for electronic communication. Make sure it is one regularly checked to not miss any important updates or requests from the EDD.

- In the "INDUSTRY ACTIVITY" section (R), describe the services or products your business offers. This information helps categorize your business within the state’s economic sectors.

- Name a contact person in section S. This individual will be the EDD's point of contact should there be any questions or updates needed.

- The final section, T, requires you to declare under penalty of perjury that the information provided is truthful and complete. This declaration must be signed by someone with the authority to represent the business, such as an owner or high-ranking officer.

- Upon completion, review the filled form for accuracy. Then, send it to the address provided at the bottom of the form: EDD, Account Services Group, MIC 28, PO Box 826880, Sacramento, CA 94280-0001.

Completing the DE 1 EDD form is a foundational step in ensuring your business meets California's requirements for employers. With careful attention to filling out each section correctly, your business will be well on its way to complying with state payroll tax obligations.

Obtain Answers on De 1 Edd

Below are frequently asked questions about the DE 1 EDD form, focusing on the Commercial Employer Account Registration and Update Form:

What is the DE 1 EDD form used for?

This form is primarily used by employers to register for a new employer account number with the California Employment Development Department (EDD). It's also used to update information about an existing account, such as changes in address, ownership, business name (DBA), or to report the sale or purchase of a business. It's an essential step in ensuring compliance with California's payroll tax requirements.

Can I register using the DE 1 EDD form before paying wages to employees?

No, you should not submit this form until you have paid wages exceeding $100 to one or more employees in any calendar quarter. The form is intended for businesses that have already begun operations and are in the process of fulfilling their tax obligations.

Is online registration available instead of filling out the DE 1 EDD form manually?

Yes, the Employment Development Department offers an e-Services for Business online application that allows you to register anytime. The online process is secure, reduces paper usage, and saves time. It can be accessed at www.edd.ca.gov/e-Services_for_Business. You can follow a simple, step-by-step process to complete your registration online instead of using the traditional paper form.

What information do I need to provide when updating the employer account information?

- For a New Employer Account: You'll directly go to Item B after selecting the purpose in Item A.

- For existing accounts needing updates: Depending on the type of update (e.g., purchase, sale, reopen, close, change in status, or updating officer/partner/member information), fill out the specific sections indicated in the form instructions, and provide the employer account number at the top of Item A.

- Always include the effective date of the updates you're reporting.

What happens if I submit the DE 1 EDD form with missing information?

The form may not be processed if required information is missing. It's crucial to review the Instructions for Completing the Commercial Employer Account Registration and Update Form (DE1-I) prior to completing the DE 1 form to ensure all necessary information is included. This prevents delays in processing and ensures your business remains in compliance with state requirements.

Common mistakes

Filling out the DE 1 EDD form, known as the Commercial Employer Account Registration and Update Form, is a critical step for employers in the process of registering with the Employment Development Department. However, errors can occur during this process. Understanding these common mistakes can help ensure the form is completed accurately and efficiently.

Not reviewing the instructions: A significant number of errors stem from individuals not reviewing the Instructions for Completing the Commercial Employer Account Registration and Update Form (DE1-I) prior to filling out the form. These instructions provide vital information on how to correctly complete the form.

Waiting to submit the form: Employers often delay submitting the form until after they have paid wages in excess of $100 to one or more employees in any calendar quarter. It's important to submit this form timely to avoid penalties and ensure proper registration.

Missing information: The form may be processed without action if required information is missing. Ensuring all necessary fields are completed is essential for the successful processing of the form.

Selecting the incorrect employer or taxpayer type: Confusion may arise when determining the appropriate employer or taxpayer type to select. This selection influences the items specified for completion on the form, and incorrect choices can lead to processing delays.

Incorrectly reporting business changes: Whether reporting a purchase, sale, reopening, closing, or change in status of a business, it is crucial to provide complete and accurate information, including effective dates and, if applicable, the previous or seller’s employer account number.

To avoid these mistakes, employers are encouraged to closely follow the instructions provided, review the entire form before submission, and ensure that all required information is accurately completed. Using the EDD’s e-Services for Business online application can also help streamline the process and reduce the likelihood of errors.

Documents used along the form

The process of employer registration and account management with the Employment Development Department (EDD) often requires the submission of various forms and documents in addition to the Commercial Employer Account Registration and Update Form (DE 1). These additional documents ensure compliance, proper designation of employment types, and accurate payroll tax reporting. Understanding these documents is crucial for business owners, HR professionals, and accountants engaged in the administration of payroll and employment taxation.

- Employer's Quarterly Contribution Return and Report of Wages (DE 9): This document is essential for reporting wages paid to employees and calculating employer contributions for Unemployment Insurance (UI), Employment Training Tax (ETT), State Disability Insurance (SDI), and California Personal Income Tax (PIT).

- Employer's Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C): This serves as a detailed wage item report that supplements the DE 9. It itemizes each employee's wages subject to UI and SDI contributions, aiding in the accurate calculation of taxes due.

- Quarterly Contribution Return and Report of Wages Adjustment Form (DE 9ADJ): Employers utilize this document when corrections to previously filed DE 9 and DE 9C forms are necessary. It addresses errors in employee wage reports or adjustments to employer contributions.

- Notice of Change (DE 24): This form is used to inform the EDD of any changes in an employer's status, such as address updates, discontinuation of business, changes in ownership or type of business, and changes to officers or other responsible parties. Keeping the EDD informed of such changes is crucial for maintaining accurate records and ensuring compliance.

Together, these forms encompass the broader needs of employment reporting and account management with the EDD. They help businesses maintain accurate records, fulfill their tax obligations, and ensure that employees have access to benefits when needed. Thus, familiarity with these documents is integral to the effective management of employment and payroll taxes within California.

Similar forms

Form SS-4, Application for Employer Identification Number (EIN): Similar to the DE 1 EDD form, the Form SS-4 is used by businesses to apply for an EIN, also known as a Federal Employer Identification Number. Both forms are essential for new businesses to register with the appropriate government agencies for tax purposes.

Form W-4, Employee's Withholding Certificate: While Form W-4 is for employees to indicate their tax withholding preferences to employers, it relates to the DE 1 EDD form in that both documents are integral to the proper management of payroll taxes by businesses.

Form I-9, Employment Eligibility Verification: This form is used to verify the identity and employment authorization of individuals hired for employment in the United States. It's similar to the DE 1 EDD form in its purpose to ensure compliance with government regulations concerning employment.

Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return: Similar to the DE 1 EDD form, which involves state unemployment insurance, Form 940 relates to the federal aspect of unemployment tax obligations of employers.

Form 941, Employer's Quarterly Federal Tax Return: This form is used by employers to report income taxes, social security tax, or Medicare tax withheld from employee's paychecks. Like the DE 1 EDD form, Form 941 is critical for tax compliance and payroll reporting.

Form W-9, Request for Taxpayer Identification Number and Certification: Similar to sections of the DE 1 EDD form that request business identification information, Form W-9 is used to provide tax identification numbers or Social Security numbers to entities that pay them income.

State Specific New Hire Reporting Forms: Like the DE 1 EDD form, these forms are used to report new or rehired employees to a state directory, assisting in the enforcement of child support orders. Both forms ensure compliance with state employment regulations.

Form UI-1, Report to Determine Liability under the Unemployment Compensation Law: This form, specific to certain states, is similar to the DE 1 EDD form as it serves to register businesses for state unemployment insurance coverage.

Form 1099-NEC, Nonemployee Compensation: Though mainly for reporting payments to non-employees, it's similar to the DE 1 EDD form in the broader context of reporting and tax compliance for various types of payments made by businesses.

Dos and Don'ts

Filling out the DE 1 EDD form, or the Commercial Employer Account Registration and Update Form, is a crucial step for employers in managing their payroll taxes and employer account status with the California Employment Development Department (EDD). To ensure the process goes smoothly, here are several do's and don'ts to consider:

- Do review the Instructions for Completing the Commercial Employer Account Registration and Update Form (DE1-I) before starting the form to understand each section's requirements.

- Do use the online application at www.edd.ca.gov/e-Services_for_Business for a more secure and efficient registration process, saving time, postage, and paper.

- Do wait to submit the form until you have paid wages exceeding $100 to one or more employees within any calendar quarter to comply with registration timing requirements.

- Do provide clear and detailed information about your business, including the legal name of the organization, FEIN, and type of business activity, to avoid processing delays.

- Do ensure that all required sections for your specific employer type and taxpayer type are completed to provide the EDD with accurate and complete information.

- Don't leave any required information blank; incomplete forms may not be processed, delaying your registration or update.

- Don't use a P.O. Box address for the physical business location section, as the EDD requires a physical address for processing the form.

- Don't forget to sign and date the declaration at the end of the form certifying that the information provided is accurate and complete to the best of your knowledge.

- Don't overlook the option to allow email contact by checking the appropriate box in section Q, which can facilitate faster communication with the EDD.

By following these guidelines, you can help ensure that your DE 1 EDD form submission is successful and complies with California's requirements for employer registration and account updates.

Misconceptions

Understanding the DE 1 EDD form, officially known as the Commercial Employer Account Registration and Update Form, can sometimes be challenging due to prevailing misconceptions. Let's clarify the most common misunderstandings:

- Online Registration is Optional: Many believe registering online with the EDD's e-Services is just an alternative, not realizing it streamlines and speeds up the entire process, reducing errors and wait times.

- Immediate Registration Not Required: A common error is thinking one must register immediately upon hiring. In truth, registration is mandatory only after paying wages over $100 in any calendar quarter.

- All Employers Must Register: Some small businesses or startups assume they're exempt from registration. However, almost every business needs to register once they meet the wage payment threshold.

- Limited to Certain Business Types: The misconception here is that the form is only for specific businesses. The DE 1 EDD form caters to a broad spectrum of employers, from individual owners to corporations and partnerships.

- Complex and Time-consuming: Many dread the form, anticipating complexity and long hours. While thorough, following the step-by-step instructions provided makes the process manageable.

- Only for Reporting New Employees: The scope of the DE 1 EDD form extends beyond reporting new hires. It's also essential for updates regarding business changes like purchase, sale, or closure.

- Inapplicable to Family Employment: Businesses employing only family members under certain conditions might believe the form doesn't apply to them. While there are exemptions regarding unemployment and disability insurance, registration might still be necessary.

- Requires Immediate Payment: The misunderstanding here is that registering your business or making updates necessitates immediate fee payment. In reality, the form starts the account setup process, with any payments due following state guidelines thereafter.

- Data Privacy Concerns: Some employers are hesitant to submit information online due to privacy fears. The EDD guarantees the security of data submitted through its e-Services, ensuring user privacy and data protection.

- Static and Unchangeable: Another myth is that once submitted, the information on the DE 1 form is final. Employers can update their account information as the business evolves, using the same form for changes like address updates or ownership changes.

Dispelling these myths ensures that employers approach the DE 1 EDD form with confidence and clarity, recognizing its role in lawful and efficient business operation within California.

Key takeaways

Filling out and using the DE 1 EDD form accurately is crucial for commercial employers to establish and update their account information with the Employment Development Department. Here are key takeaways that should be considered:

- Employers can register online at any time using the EDD's e-Services for Business, which offers a secure and convenient way to complete registration, saving on paper, postage, and time.

- Before submitting the DE 1 form, ensure that wages in excess of $100 have been paid to one or more employees in any calendar quarter.

- The form allows for multiple types of updates, including registering for a new employer account number, updating account information following a purchase, sale, or change in business status, and adding, changing, or deleting officers, partners, or members.

- It is important to accurately fill out the form and provide all the required information to avoid processing delays. Missing information can result in the form not being processed.

- The DE 1 form is diverse, allowing commercial employers, as well as specific entities like fishing boats and maritime organizations, to use it, highlighting the importance of selecting the correct employer and taxpayer type as per the nature of the business.

- Special considerations are given to family employment, indicating that certain family employees may exempt an employer from unemployment insurance and state disability insurance obligations.

- Physical business locations must be accurately reported, with a clear distinction between physical and mailing addresses. Post office boxes are not acceptable for physical location addresses, but they are permitted for mailing purposes.

- The declaration section at the end of the form is a legal certification of the accuracy and truthfulness of the information provided, underscoring the seriousness with which the form should be completed.

By adhering to these key points, employers can ensure they successfully navigate the process of registering and updating their account with the EDD, meeting all legal obligations and maintaining accurate records.

Popular PDF Forms

Whats Hvac - The form facilitates the identification of inadequate access for maintenance, which could impact the long-term functionality and safety of the HVAC system.

State Farm Disbursement Request Form - The document clarifies the policyholder's responsibility for any additional costs not covered by their insurance policy.