Blank De 9C PDF Template

Navigating the intricacies of employment documentation is crucial for businesses, and among the forms that require attention is the DE 9C, also known as the Quarterly Contribution Return and Report of Wages (Continuation). This form plays a pivotal role in ensuring accurate reporting of wages and withholdings to the State of California's Employment Development Department (EDD). Employers must submit this form quarterly, detailing each employee's earnings and deductions, regardless of whether payroll was issued during the period. The DE 9C encompasses various critical sections including the identification of full-time and part-time employees, reporting of Social Security numbers, personal income tax (PIT) wages, total subject wages, and the necessary PIT withheld. Employers who fail to submit this form by the designated deadline face the risk of penalties. This form is not only a compliance requirement but also a tool for maintaining clear records of payroll, which can be beneficial for both the employer and the employees. Additionally, the form accommodates different types of employment and payment classifications, providing flexibility yet demanding precision in reporting. Employers seeking ease in submission can utilize the EDD’s e-Services for Business, marking an efficient method for fulfilling this obligation. The form's design includes specific instructions on completion, ensuring all necessary data is captured accurately and in full compliance with California’s employment laws.

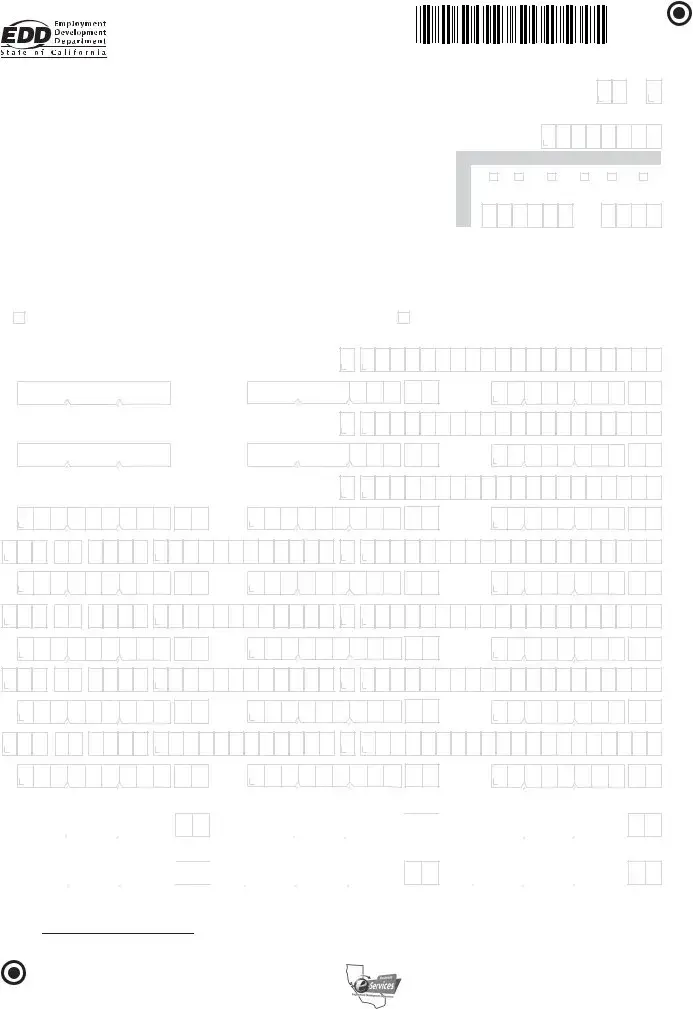

Preview - De 9C Form

Page number _______ of ______

QUARTER

ENDED

QUARTERLY CONTRIBUTION |

|

RETURN AND REPORT OF WAGES |

|

(CONTINUATION) |

009C0111 |

REMINDER: File your DE 9 and DE 9C together. |

You must FILE this report even if you had no payroll. If you had no payroll, complete Items C and O.

DUE

YRQTR

EMPLOYER ACCOUNT NO.

B.

Check this box if you are reporting ONLY Voluntary Plan Disability Insurance wages on this page. |

C. |

|

Report Personal Income Tax (PIT) Wages and PIT Withheld, if appropriate. (See instructions for Item B.) |

||

|

DO NOT ALTER THIS AREA

P1 |

C |

T |

S |

W |

A |

|

EFFECTIVE DATE |

|

|

|

|

Mo. |

|

Day |

Yr. |

|

WIC |

A.EMPLOYEES

|

|

|

1st Mo. |

|

|

|

|

|

2nd Mo. |

|

|

|

3rd Mo. |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NO PAYROLL

D. SOCIAL SECURITY NUMBER |

E. EMPLOYEE NAME (FIRST NAME) |

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F. TOTAL SUBJECT WAGES |

|

|

|

|

|

|

|

|

|

|

|

G. PIT WAGES |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

D. SOCIAL SECURITY NUMBER |

E. EMPLOYEE NAME (FIRST NAME) |

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F. TOTAL |

SUBJECT WAGES |

|

|

|

|

|

|

|

|

|

|

|

G. PIT WAGES |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

D. SOCIAL SECURITY NUMBER |

E. EMPLOYEE NAME (FIRST NAME) |

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F. TOTAL |

SUBJECT WAGES |

|

|

|

|

|

|

|

|

|

|

|

G. PIT WAGES |

|||||||||||||||||||||||

(M.I.) (LAST NAME)

|

H. PIT WITHHELD |

. |

. |

(M.I.) (LAST NAME)

|

H. PIT WITHHELD |

. |

. |

(M.I.) (LAST NAME)

H. PIT WITHHELD

|

. |

D. SOCIAL SECURITY NUMBER |

E. EMPLOYEE NAME (FIRST NAME) |

F. TOTAL SUBJECT WAGES |

G. PIT WAGES |

|

. |

D. SOCIAL SECURITY NUMBER |

E. EMPLOYEE NAME (FIRST NAME) |

F. TOTAL SUBJECT WAGES |

G. PIT WAGES |

|

. |

D. SOCIAL SECURITY NUMBER |

E. EMPLOYEE NAME (FIRST NAME) |

F. TOTAL SUBJECT WAGES |

G. PIT WAGES |

|

. |

D. SOCIAL SECURITY NUMBER |

E. EMPLOYEE NAME (FIRST NAME) |

F. TOTAL SUBJECT WAGES |

G. PIT WAGES |

|

. |

. |

. |

(M.I.) (LAST NAME)

|

H. PIT WITHHELD |

. |

. |

(M.I.) (LAST NAME)

|

H. PIT WITHHELD |

. |

. |

(M.I.) (LAST NAME)

|

H. PIT WITHHELD |

. |

. |

(M.I.) (LAST NAME)

|

H. PIT WITHHELD |

. |

. |

I. TOTAL SUBJECT WAGES THIS PAGE |

J. TOTAL PIT WAGES THIS PAGE |

K. TOTAL PIT WITHHELD THIS PAGE |

.

.

.

.

.

.

L. GRAND TOTAL SUBJECT WAGES |

M. GRAND TOTAL PIT WAGES |

N. GRAND TOTAL PIT WITHHELD |

.

.

.

.

O. I declare that the information herein is true and correct to the best of my knowledge and belief.

.

.

|

Signature Required |

Title ___________________________ Phone ( |

) _____________________ Date _________________________________ |

|

|

|

(Owner, Accountant, Preparer, etc.) |

|

|

|

|

|

||

|

MAIL TO: State of California / Employment Development Department / P.O. Box 989071 / West Sacramento CA |

|

||

|

|

|

Fast, Easy, and Convenient! |

CU |

DE 9C Rev. 1 |

Page 1 of 2 |

|

||

Visit EDD’s Web site at www.edd.ca.gov |

|

|||

|

|

|

|

|

INSTRUCTIONS FOR COMPLETING THE

QUARTERLY CONTRIBUTION RETURN AND REPORT OF WAGES (CONTINUATION) (DE 9C)

PLEASE TYPE ALL INFORMATION

Did you know you can file this form online using the EDD’s

For a faster, easier, and more convenient method of reporting your DE 9C information, visit the EDD’s website at www.edd.ca.gov.

Contact the Taxpayer Assistance Center at (888)

reporting wages or the subject status of employees. Refer to the California Employer’s Guide (DE 44) for additional information.

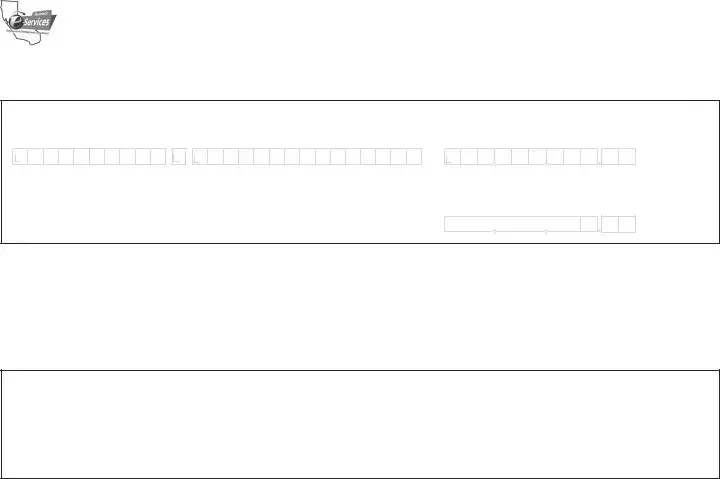

Please record information in the spaces provided. If you use a typewriter or printer, ignore the boxes and type in UPPER CASE as shown.

Do not use dollar signs, dashes, commas, or slashes ($

EMPLOYEE (FIRST NAME) |

M.I. |

(LAST NAME) |

TOTAL SUBJECT WAGES |

IMOGENE |

A |

SAMPLE |

12345.67 |

If you must hand write this form, print each letter or number in a separate box as shown.

Do not use dollar signs, dashes, commas, decimal points, or slashes ($

EMPLOYEE (FIRST NAME) |

M.I. (LAST NAME) |

TOTAL SUBJECT WAGES |

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

2 |

|

3 |

|

4 |

|||

|

|

I |

M |

O |

G |

E |

N |

E |

|

|

|

|

A |

|

S |

A |

M |

P |

L |

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

5

6 7

Retain a copy of the DE 9C form(s) for your records. If you have more than seven employees, use additional pages or a format approved by the Employment Development Department (EDD). If using more than one page, number the pages consecutively at the top of the form. If the form is not preprinted, enter your account number, business name and address, the year and quarter, and the quarter ended date. For information, specifications, and approvals of alternate forms, contact the Alternate Forms Coordinator at (916)

ITEM A. NUMBER OF EMPLOYEES: Page 1 only: Enter the number of

Blank fields will be identified as missing data.

ITEM B. Check this box ONLY if the employees reported are covered by an employer sponsored Voluntary Plan for the payment of disability benefits. If you also have employees covered under the State Plan for disability benefits, report their wages and withholdings separately on another page of the DE 9C.

WAGES AND WITHHOLDINGS TO REPORT ON A SEPARATE DE 9C

Prepare a DE 9C to report the types of exemptions listed below. All three exemptions can be reported on one DE 9C. Write the exemption title(s) at the top of the form (e.g., SOLE SHAREHOLDER), and report only those individuals under these categories. Report all other employees or individuals without exemptions on a separate

DE 9C.

•Religious Exemption: Employees who file and are approved by the EDD for an exemption from State Disability Insurance (SDI) taxes under Section 2902 of the California Unemployment Insurance Code (CUIC).

•Sole Shareholder: An individual who elects and is approved by the EDD to be excluded from SDI coverage for benefits and taxes under Section 637.1 of the CUIC.

•

ITEM C. NO PAYROLL: Check this box if you had no payroll this quarter. Please sign and complete the information in Item O.

ITEM D. SOCIAL SECURITY NUMBER (SSN): Enter the SSN of each employee or individual to whom you paid wages in subject employment, paid Personal Income Tax (PIT) wages, and/or from whom you withheld PIT during the quarter. If someone does not have an SSN, report their name, wages, and/or withholdings without the SSN and TAKE IMMEDIATE STEPS TO SECURE ONE. Report the correct SSN to the EDD as soon as possible on a Quarterly Contribution and Wage Adjustment Form (DE 9ADJ).

ITEM E. EMPLOYEE NAME: Enter the name of each employee or individual to whom you paid wages in subject employment, paid PIT wages, and/or from whom you withheld PIT during the quarter.

ITEM F. TOTAL SUBJECT WAGES: Enter the total subject wages paid (including cents) to each employee during the quarter. Generally, most wages are considered “subject” wages. For special classes of employment and payments considered subject wages, refer to the California Employer’s Guide

(DE 44) under “Types of Employment” and “Types of Payments.”

ITEM G. PIT WAGES: Enter the amount of wages paid (including cents) that are subject to PIT, even if you do not withhold PIT from the

wages. You must enter PIT wages even if they are the same as total subject wages. For additional information regarding PIT wages, refer to the Information Sheet: Personal Income Tax Wages Reported on the Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C) (DE 231PIT).

ITEM H. PIT WITHHELD: Enter the amount of PIT withheld from each individual during the quarter.

ITEM I. Enter the total subject wages paid (Item F) for each separate page. Do not carry this total forward from page to page.

ITEM J. Enter the total amount of PIT wages (Item G) for each separate page. Do not carry this total forward from page to page.

ITEM K. Enter the total PIT withheld (Item H) for each separate page. Do not carry this total forward from page to page.

ITEM L. ON PAGE 1 or the last page, enter the grand total of total subject wages paid (Item I) for all pages for the quarter.*

ITEM M. ON PAGE 1 or the last page, enter the grand total of PIT wages (Item J) for all pages for the quarter.*

ITEM N. ON PAGE 1 or the last page, enter the grand total of PIT withheld (Item K) for all pages for the quarter.*

*NOTE: Provide separate grand totals for Voluntary Plan Disability Insurance reporting and special exemption reporting (Religious Exemption, Sole Shareholder,

pages to arrive at the grand totals for Items L, M, and N.

ITEM O. ON PAGE 1 ONLY, signature of preparer or responsible individual, including title, telephone number, and signature date.

DE 9C Rev. 1 |

Page 2 of 2 |

Form Data

| Fact | Detail |

|---|---|

| Form Number | DE 9C |

| Title | Quarterly Contribution Return and Report of Wages (Continuation) |

| Purpose | To report wages and personal income tax withholdings to the State of California. |

| Key Item for No Payroll | Must be filed even if no payroll was conducted during the quarter; complete Items C and O in such cases. |

| Requirement for Multiple Pages | Use additional pages or an approved format by the Employment Development Department (EDD) for more than seven employees, with pages numbered consecutively. |

| Special Exemption Reporting | Prepare separate DE 9C for Religious Exemption, Sole Shareholder, and Third-Party Sick Pay exemptions and label accordingly. |

| Electronic Filing Encouragement | The EDD encourages filing this form online for a faster and more convenient process. |

| Information Required | Details such as social security number, employee name, wages paid, and PIT withheld for each employee must be reported. |

| Governing Law | California Unemployment Insurance Code (CUIC) |

| Submission Address | State of California / Employment Development Department / P.O. Box 989071 / West Sacramento, CA 95798-9071 |

Instructions on Utilizing De 9C

Filing the DE 9C form is a critical step for employers in California, as it involves reporting wages and withholdings for their employees. This process ensures that employees are properly accounted for in the eyes of the state, particularly for unemployment insurance benefits and state disability insurance. The following steps will guide you through the process of accurately completing the DE 9C form.

- Prepare your documents: Before starting, ensure you have the employment and payroll data for all employees for the quarter you are reporting.

- Access the form: The DE 9C form can be downloaded from the California Employment Development Department (EDD) website, or you may choose to file it online for a more streamlined process.

- Enter employer information: At the beginning of the document, fill in the employer account number, your business name, and address, the year and quarter you are reporting, and the quarter end date.

- Page numbering: If you are using multiple pages to report your employees, remember to number the pages consecutively at the top.

- Item A - Number of Employees: On the first page, indicate the number of employees who worked or received pay during each month of the quarter. This includes both full-time and part-time workers.

- Item B - Voluntary Plan: Check this box only if the wages being reported are exclusively for employees covered under a Voluntary Plan for disability benefits. If this is not applicable, proceed to the next step.

- Item C - No Payroll: If you had no payroll for the quarter, mark this box and jump to Item O for certification.

- Item D to H - Employee Details: For each employee, enter their Social Security Number (SSN), full name, total subject wages, PIT (Personal Income Tax) wages, and PIT withheld. Ensure accuracy to avoid processing delays.

- Item I to K - Totals Page by Page: Calculate and enter the totals for subject wages, PIT wages, and PIT withheld for each page separately. Do not carry these totals forward from one page to the next.

- Items L to N - Grand Totals: On the first or last page, provide the grand total of subject wages, PIT wages, and PIT withheld for all pages combined. If applicable, report separate totals for Voluntary Plan Disability Insurance and exemptions.

- Item O - Certification: The preparer or the responsible individual (e.g., owner or accountant) must sign and date the form, providing their title and telephone number.

- Review: Double-check all the information for accuracy.

- Submit the form: Mail the completed DE 9C form to the address provided on the form, or submit it online via the EDD’s e-Services for Business for faster processing.

After submitting the DE 9C form, retain a copy for your records and monitor any communications from the EDD for further instructions or confirmations of receipt. This detailed report is essential for maintaining compliance with state employment regulations and providing benefits to your employees. For any questions or assistance with the DE 9C form, the EDD’s Taxpayer Assistance Center is available to help.

Obtain Answers on De 9C

-

What is the DE 9C form used for in California?

The DE 9C form serves as a Quarterly Contribution Return and Report of Wages (Continuation) used by employers in California. Its primary purpose is to report wages paid to employees and personal income tax (PIT) withheld for each employee during the quarter, ensuring compliance with state tax and unemployment insurance requirements. Employers must submit this form even if no payroll was processed during the quarter, by reporting it explicitly on the form to avoid penalties for non-filing.

-

How do I submit the DE 9C form, and is there a deadline?

The DE 9C form can be submitted online through the Employment Development Department’s (EDD) e-Services for Business, offering a more convenient and quicker option for filing. Alternatively, employers can mail it to the specified address provided on the form. All employers are required to file the DE 9C form on a quarterly basis, with the form being considered delinquent if not postmarked or received by the due date stated by the EDD. The specific deadlines align with quarterly reporting periods, generally falling at the end of the month following the end of a quarter (April 30, July 31, October 31, and January 31).

-

What should I do if I have no payroll to report for the quarter?

If there was no payroll for the entire quarter, employers are still required to complete and file the DE 9C form. Item C should be checked to indicate that no payroll was processed, and necessary certification details in Item O should be filled out and signed. This action ensures that employers remain in compliance with reporting requirements and helps maintain accurate records with the EDD.

-

What are the consequences of not filing the DE 9C form?

Failing to file the DE 9C form by its respective deadlines can result in penalties and interest charges imposed by the EDD. The department may also assess estimated contributions due based on available data, which can lead to further discrepancies an employer must resolve. Continued failure to comply with filing requirements not only compounds financial penalties but can also affect an employer’s ability to claim tax credits and benefits pursuant to California law.

Common mistakes

Filling out the Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C) form can be a complex task, and mistakes can often be made if careful attention isn't paid to detail. Here are six common mistakes people make when completing this form:

- Not filing the form even if there was no payroll: Some people mistakenly believe that if they didn't have any payroll during the quarter, they don't need to file the DE 9C. However, the form must be filed every quarter, regardless of whether there was any payroll. If there was no payroll, Items C and O should be completed to reflect this.

- Incorrect employee information: Mistakes can occur when entering Social Security numbers or the names of employees. It's crucial to ensure that the Social Security number provided matches the name of the employee to avoid inaccuracies that could lead to issues with employee records.

- Omitting PIT wages or PIT withheld details: Some filers forget to enter the Personal Income Tax (PIT) wages and the amount of PIT withheld for each employee. It's important to report these figures accurately for tax purposes, even if the PIT wages are the same as the total subject wages.

- Failure to report wages on separate DE 9C forms for certain exemptions: When employees are covered under specific exemptions such as Religious Exemption, Sole Shareholder, or Third-Party Sick Pay, their wages and withholdings should be reported on a separate DE 9C form. Failing to do so can cause confusion and inaccuracies in reporting.

- Incorrect totals on multiple pages: If using more than one page to report wages, it's essential not to carry forward the total subject wages, PIT wages, or PIT withheld totals from page to page. Each page should only include the totals for that page, with grand totals being reported on the first or the last page.

- Miscalculating grand totals: Grand totals for total subject wages, PIT wages, and PIT withheld must be accurately calculated and reported on either the first page or the last page of the form. Combining all DE 9C pages except for those under special exemptions like Voluntary Plan Disability Insurance is necessary to arrive at the correct grand totals.

By avoiding these common mistakes, filers can ensure their DE 9C forms are accurate and compliant with state reporting requirements. Always double-check each entry, and remember, the California Employment Development Department's website offers resources and detailed instructions for completing the DE 9C correctly.

Documents used along the form

When it comes to payroll and employee management, various forms and documents are essential for compliance with state and federal laws. The DE 9C form, a crucial component for reporting quarterly wages and contributions, is often filed alongside other documents to ensure a comprehensive approach to payroll reporting and tax compliance. Here is a list of six other forms and documents commonly used in conjunction with the DE 9C form.

- DE 9 Form: Known as the Quarterly Contribution Return, this form complements the DE 9C by summarizing the total subject wages, total wages paid, and contributions due to the State of California for unemployment insurance (UI), Employment Training Tax (ETT), State Disability Insurance (SDI), and Personal Income Tax (PIT) withholdings.

- DE 34 Form: The Report of New Employee(s) must be submitted by employers to report newly hired or rehired employees to the State of California, aiding in the enforcement of child support obligations.

- DE 4 Form: The Employee's Withholding Allowance Certificate is used by employees to determine the amount of state income tax to be withheld from their paychecks, ensuring accurate withholding to avoid underpayment penalties.

- DE 88 Form: Used for making tax deposits, this Payroll Tax Deposit coupon is critical for businesses to submit their withheld taxes and employer contributions for UI, ETT, and SDI to the state.

- W-4 Form: The Federal Employee's Withholding Certificate, similar to the DE 4, lets employees determine the amount of federal income tax to withhold from wages, helping employers calculate and retain the correct federal tax amount.

- DE 542 Form: The Report of Independent Contractors is required when businesses hire independent contractors and pay $600 or more or enter into a contract for $600 or more. It helps the state monitor and enforce tax compliance for independent contractors.

Together, these forms aid employers in maintaining accurate and compliant payroll processes, ensuring that both state and federal obligations are met. They help in the detailed tracking of wages paid, taxes withheld, and contributions made, safeguarding against potential penalties and fostering a transparent payroll system. Whether managing a small team or overseeing numerous employees, understanding and utilizing these documents in conjunction with the DE 9C form can significantly streamline payroll operations and tax reporting duties.

Similar forms

-

The DE 9 Form, also known as the Quarterly Contribution Return, parallels the DE 9C in its primary function of reporting wages and calculating unemployment insurance contributions. While DE 9C provides detailed wage reporting for each employee, DE 9 summarizes the total payroll expenses and UI contributions due to the state. Both forms interact closely, with DE 9 requiring consolidation of the detailed data provided on the DE 9C, ensuring accurate unemployment insurance and state disability insurance contributions are made.

-

The W-2 Form, or the Wage and Tax Statement, shares similarities with the DE 9C in reporting employees' earnings and tax withholdings to the federal government. Where the DE 9C details wages subject to unemployment insurance and state personal income tax (PIT) for state purposes, the W-2 encompasses broader reporting requirements, including federal income tax, Social Security, and Medicare withholdings. Both documents are crucial for reconciling an employee's annual income and tax obligations.

-

The Form 940, Federal Unemployment Tax Act (FUTA) Tax Return, parallels the DE 9C's unemployment insurance reporting on a federal level. While the DE 9C contributes to state unemployment insurance funds, Form 940 reports employer contributions to federal unemployment taxes. This document ensures that employers contribute to the federal pool that funds state unemployment benefits. The linkage between these two forms underscores a comprehensive approach to unemployment insurance funding, balancing both state and federal mandates.

-

The DE 6 Form, or Quarterly Wage and Withholding Report, before being replaced by the DE 9C, offered a similar function in reporting to the California Employment Development Department (EDD). The DE 6 facilitated the reporting of wages and withholdings for each employee, akin to the DE 9C's objectives. Transitioning to the DE 9C introduced a more streamlined process for employers, consolidating wage reporting and unemployment insurance contributions into a unified format, ultimately enhancing the efficiency of state payroll tax compliance.

Dos and Don'ts

Filling out the DE 9C form, which is important for reporting quarterly wages and contributions, requires attention to detail and accuracy. To help make this process smoother, here are some essential do's and don'ts:

Do's:

Double-check all employee information, including Social Security numbers and names, for accuracy. Mistakes here can lead to processing delays or errors in employee records.

Use the correct format when entering numbers. Avoid using dollar signs, dashes, commas, or slashes. This helps ensure the information is processed correctly by the system.

Report all necessary wage details, including total subject wages and PIT wages, even if they are the same. This is crucial for accurate tax reporting and compliance.

Keep a copy of the DE 9C form(s) for your records. This can be helpful for future reference or if any questions arise about the submitted data.

Don'ts:

Don't leave fields blank. If you had no payroll for the quarter, you must still complete Items C and O to comply with filing requirements.

Don't guess on employee information. If you are unsure about specific details, verify them before submitting the form to avoid any unnecessary issues.

Don't use handwritten forms unless necessary. If you must hand write the form, print each letter or number clearly in a separate box. However, typing is preferred for clearer readability.

Don't forget to sign the form at Item O. An unsigned form can be considered incomplete and may not be processed until corrected.

Following these guidelines will help ensure your DE 9C form is completed accurately and in compliance with state requirements, making the process as smooth as possible for both you and your employees.

Misconceptions

The DE 9C form, officially known as the Quarterly Contribution Return and Report of Wages (Continuation), is essential for employers in California. Despite its importance, there are several misconceptions about it. Let's clear up a few of these misunderstandings.

It's only necessary if you have payroll. This is not true. Even if you had no payroll for the quarter, you're still required to file the DE 9C form. In such cases, you need to complete specific sections (Items C and O) to indicate that no payroll was processed.

You can only file it by mail. While mailing is an option, you can also file this form online via the EDD’s e-Services for Business. This online method is encouraged for its ease and efficiency.

It's the same as the DE 9 form. Although the DE 9 and DE 9C forms are related and usually filed together, they serve different purposes. The DE 9 form is a Quarterly Contribution Return, while the DE 9C is a detailed report of wages for each employee.

You don't need to list employees without a Social Security Number (SSN). This is incorrect. You must report the wages of all employees, even if they do not have an SSN, and then take immediate steps to secure one.

All wages are considered "subject" wages. Not all wages are treated as subject wages for DE 9C purposes. There are special classes of employment and payments that are not considered subject wages, as outlined in the California Employer’s Guide (DE 44).

There's no need to keep a copy for your records. Employers should always retain a copy of their filed DE 9C forms for their records. This helps in case of any discrepancies or audits by the Employment Development Department (EDD).

Understanding the DE 9C form's requirements can greatly reduce filing errors and ensure compliance with California's Employment Development Department guidelines. Remember, when in doubt, referring to the official instructions or consulting with a professional can provide clarity.

Key takeaways

Filing the DE 9C form accurately is crucial for businesses in California, serving as the Quarterly Contribution Return and Report of Wages (Continuation). Below are key takeaways for filling out and utilizing this form.

- Always pair the DE 9 and DE 9C forms when filing: These forms are designed to be submitted together. Even in quarters without payroll activities, it's mandatory to file the DE 9C form with item C and item O properly filled out.

- Reporting for special employee groups: For employees receiving benefits from a Voluntary Plan Disability Insurance or those categorized under exemptions like Religious Exemption, Sole Shareholder, or Third-Party Sick Pay, ensure to report their wages on a separate DE 9C form, as delineated in the instructions.

- Accuracy in employee information: When entering employee details such as Social Security numbers and names, ensure accuracy. This information is critical for the Employment Development Department (EDD) to correctly process the form. Immediate action is required to correct any incorrect or missing Social Security numbers.

- Wage reporting specifics: Distinguish between total subject wages and Personal Income Tax (PIT) wages. All wages paid to employees during the quarter must be reported, including specifics on PIT wages and amounts withheld, even if they align with total subject wages.

- Keep record copies: Retaining a copy of the filled-out DE 9C form(s) is essential for your records. In instances where the business has more than seven employees, using additional pages or an EDD-approved format for reporting is necessary.

- Filing options and assistance: The DE 9C form can be filed online via the EDD’s e-Services for Business, offering a faster and more convenient way to manage wage reporting. Support and additional forms are available through the Taxpayer Assistance Center, accommodating both voice and non-verbal (TTY) communication.

Understanding these key aspects of the DE 9C form can streamline the reporting process, ensuring compliance with California's employment and tax laws. Additionally, leveraging online resources and EDD support services can further ease the complexities of payroll and wage reporting for businesses.

Popular PDF Forms

Crsc - Form DD 2860 specifically asks if the applicant has engaged in wars or combat operations, necessitating proof such as DD214, awards, or other official documents.

Mv47 - Every detail requested on the MV-47, from personal identification to driving convictions, plays a role in maintaining public safety.

4 Animal Personality Types - Embark on a journey of self-discovery with an easy rating system that unveils your dominant personality features.