Blank De Ins Illinois PDF Template

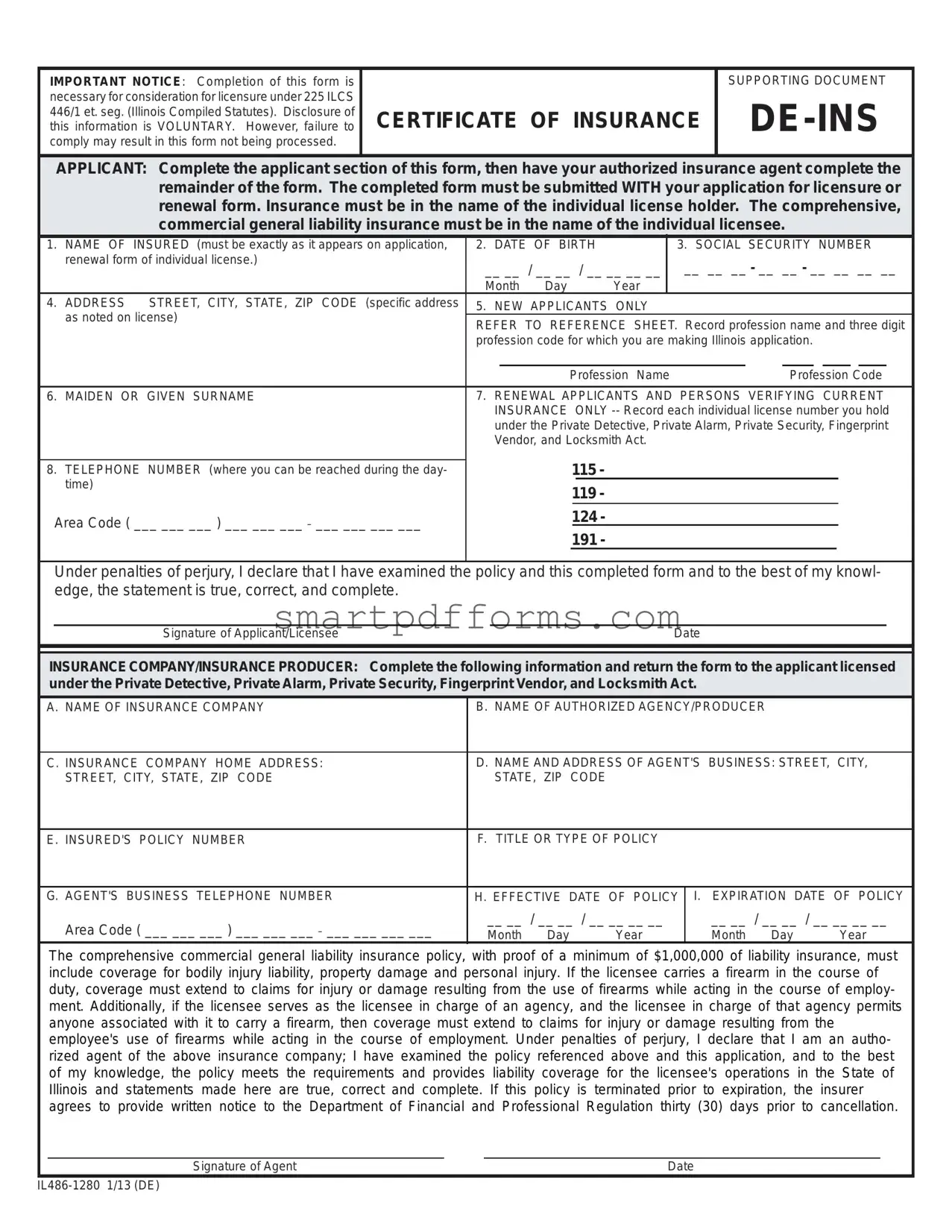

Understanding the nuances of ensuring compliance with state regulations is paramount for professionals seeking licensure in Illinois. The De Ins Illinois form plays a crucial role in this process as it is essential for those applying for or renewing a license under the Private Detective, Private Alarm, Private Security, Fingerprint Vendor, and Locksmith Act (225 ILCS 446/1 et seq.). This form serves as a supporting document, acting as proof of the comprehensive, commercial general liability insurance required for individual licensees. The necessity of this form cannot be understated; it must be accurately completed and submitted alongside the application for licensure or renewal. The form requires detailed input from both the applicant and their authorized insurance agent, including personal information, insurance policy details, and a declaration under penalties of perjury confirming the accuracy and completeness of the provided information. Furthermore, it specifies the insurance policy must cover bodily injury, property damage, and personal injury, with additional requirements for those carrying a firearm during the course of their duties. Failure to provide this form, or providing incomplete or incorrect information, may impede the processing of the licensure application, underscoring the importance of meticulous attention to its completion. This document not only ensures compliance with Illinois Compiled Statutes but also safeguards the interests of both the licensee and the public they serve.

Preview - De Ins Illinois Form

IMPORTANT NOTICE: Completion of this form is |

|

SUPPORTING DOCUMENT |

necessary for consideration for licensure under 225 ILCS |

|

|

446/1 et. seg. (Illinois Compiled Statutes). Disclosure of |

CERTIFICATE OF INSURANCE |

|

this information is VOLUNTARY. However, failure to |

||

comply may result in this form not being processed. |

|

|

|

|

|

APPLICANT: Complete the applicant section of this form, then have your authorized insurance agent complete the remainder of the form. The completed form must be submitted WITH your application for licensure or renewal form. Insurance must be in the name of the individual license holder. The comprehensive, commercial general liability insurance must be in the name of the individual licensee.

1. |

NAME OF INSURED (must be exactly as it appears on application, |

2. |

DATE OF BIRTH |

|

3. SOCIAL SECURITY NUMBER |

||||||||||||

|

renewal form of individual license.) |

__ __ / __ __ / __ __ __ __ |

|

__ __ __ - __ __ - __ __ __ __ |

|||||||||||||

|

|

|

|||||||||||||||

|

|

Month Day |

|

|

Year |

|

|

|

|

|

|

|

|

|

|

||

4. |

ADDRESS STREET, CITY, STATE, ZIP CODE (specific address |

5. |

NEW APPLICANTS ONLY |

|

|

|

|

|

|

|

|

|

|||||

|

as noted on license) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REFER TO REFERENCE SHEET. Record profession name and three digit |

||||||||||||||||

|

|

||||||||||||||||

|

|

profession code for which you are making Illinois application. |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profession Name |

|

|

Profession Code |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6. |

MAIDEN OR GIVEN SURNAME |

7. RENEWAL APPLICANTS AND PERSONS VERIFYING CURRENT |

|||||||||||||||

|

|

|

INSURANCE |

|

ONLY |

||||||||||||

|

|

|

under the Private Detective, Private Alarm, Private Security, Fingerprint |

||||||||||||||

|

|

|

Vendor, and Locksmith Act. |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

115 - |

|

|

|

|

|

|

|

|

|

|

||

8. |

TELEPHONE NUMBER (where you can be reached during the day- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

time) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

119 - |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Area Code ( ___ ___ ___ ) ___ ___ ___ _ ___ ___ ___ ___ |

|

|

|

|

124 - |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

191 - |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Under penalties of perjury, I declare that I have examined the policy and this completed form and to the best of my knowl- edge, the statement is true, correct, and complete.

Signature of Applicant/LicenseeDate

INSURANCE COMPANY/INSURANCE PRODUCER: Complete the following information and return the form to the applicant licensed under the Private Detective, Private Alarm, Private Security, Fingerprint Vendor, and Locksmith Act.

A. NAME OF INSURANCE COMPANY |

B. NAME OF AUTHORIZED AGENCY/PRODUCER |

|

|||

|

|

|

|||

C. INSURANCE COMPANY HOME ADDRESS: |

D. NAME AND ADDRESS OF AGENT'S BUSINESS: STREET, CITY, |

||||

STREET, CITY, STATE, ZIP CODE |

STATE, ZIP CODE |

|

|

|

|

|

|

|

|

||

E. INSURED'S POLICY NUMBER |

F. TITLE OR TYPE OF POLICY |

|

|

||

|

|

|

|||

G. AGENT'S BUSINESS TELEPHONE NUMBER |

H. EFFECTIVE DATE OF POLICY |

I. EXPIRATION DATE OF POLICY |

|||

Area Code ( ___ ___ ___ ) ___ ___ ___ _ ___ ___ ___ ___ |

__ __ / __ __ / __ __ __ __ |

__ __ / __ __ / __ __ __ __ |

|||

Month Day |

Year |

Month Day |

Year |

||

|

|||||

The comprehensive commercial general liability insurance policy, with proof of a minimum of $1,000,000 of liability insurance, must include coverage for bodily injury liability, property damage and personal injury. If the licensee carries a firearm in the course of duty, coverage must extend to claims for injury or damage resulting from the use of firearms while acting in the course of employ- ment. Additionally, if the licensee serves as the licensee in charge of an agency, and the licensee in charge of that agency permits anyone associated with it to carry a firearm, then coverage must extend to claims for injury or damage resulting from the employee's use of firearms while acting in the course of employment. Under penalties of perjury, I declare that I am an autho- rized agent of the above insurance company; I have examined the policy referenced above and this application, and to the best of my knowledge, the policy meets the requirements and provides liability coverage for the licensee's operations in the State of Illinois and statements made here are true, correct and complete. If this policy is terminated prior to expiration, the insurer agrees to provide written notice to the Department of Financial and Professional Regulation thirty (30) days prior to cancellation.

Signature of Agent |

Date |

Form Data

| Name | Fact |

|---|---|

| Form Purpose | It is a supporting document necessary for licensure under 225 ILCS DE-INS 446/1 et. seq. |

| Voluntary Disclosure | Disclosing information on this form is voluntary but necessary for processing. |

| Applicant Action | The applicant must complete their section and then have their authorized insurance agent complete the remainder. |

| Submission Requirement | This form must be submitted with the application for licensure or renewal. |

| Insurance Requirement | Insurance must be comprehensive, commercial general liability and in the name of the individual licensee. |

| Liability Coverage Minimum | The policy must include a minimum of $1,000,000 of liability insurance covering bodily injury, property damage, and personal injury. |

| Additional Coverage for Firearm | If the licensee carries or permits the carrying of a firearm in the course of duty, the insurance must cover claims resulting from firearm use. |

| Agent's Certification | The insurance agent certifies that the policy meets state requirements and covers the licensee's operations in Illinois. |

| Notification of Termination | If the policy is terminated prior to expiration, the insurer must notify the Department of Financial and Professional Regulation 30 days before cancellation. |

| Governing Law | The form and related licensure are governed by 225 ILCS DE-INS 446/1 et. seq. of the Illinois Compiled Statutes. |

Instructions on Utilizing De Ins Illinois

Filling out the DE Ins Illinois form is a crucial step in ensuring you are eligible for licensure or renewal under the specific statutes governing private detectives, private security, fingerprint vendors, and locksmiths in Illinois. This process requires attention to detail, as providing accurate information is essential for the form to be processed successfully. Here's a simplified guide on how to complete the form.

- Start by entering your full name in the "NAME OF INSURED" field, making sure it matches exactly as it appears on your licensure application or renewal form.

- Fill in your date of birth in the format MM/DD/YYYY in the "DATE OF BIRTH" section.

- Provide your Social Security Number in the "SOCIAL SECURITY NUMBER" field without any dashes or spaces.

- Enter your complete address in the "ADDRESS" section, including street, city, state, and ZIP code.

- If you are a new applicant, refer to the reference sheet provided to record your profession name and the three-digit profession code in the respective fields.

- For those with a maiden or given surname that differs from the one provided, enter it in the "MAIDEN OR GIVEN SURNAME" field.

- Renewal applicants and those verifying current insurance should list each individual license number held under the relevant act in the designated area.

- Input your daytime telephone number, including the area code, in the "TELEPHONE NUMBER" field.

- Sign and date the form under the penalty of perjury statement to confirm the accuracy of the information provided.

- The insurance section of the form should be completed by your authorized insurance agent, including details such as the name and address of the insurance company, the policy number, policy type, and the effective and expiration dates of the policy. The agent must also sign and date the form, certifying the policy meets the requirements and provides the necessary liability coverage in the State of Illinois.

Once the form is fully completed by both the applicant and the insurance agent, it must be submitted along with your application for licensure or renewal. This ensures that your professional activities are properly insured according to Illinois state regulations, safeguarding your practice and the public. Remember, insurance must specifically cover bodily injury, property damage, and personal injury, and if applicable, include coverage for firearm use in the course of employment. Regularly review insurance policy details to stay compliant and protected.

Obtain Answers on De Ins Illinois

- What is the purpose of the DE INS Illinois form?

The DE INS Illinois form serves as a supporting document necessary for the consideration of licensure under the Illinois Compiled Statutes (225 ILCS 446/1 et. seq.). It is used for both initial licensure and renewal applications for individuals operating under the Private Detective, Private Alarm, Private Security, Fingerprint Vendor, and Locksmith Act in Illinois. The form requires comprehensive commercial general liability insurance details, ensuring the licensee has adequate coverage, including bodily injury liability, property damage, and personal injury.

- Is completing the DE INS Illinois form mandatory?

Completion of the DE INS Illinois form is voluntary. However, not providing the requested information may result in the non-processing of the related licensure application. It's critical for both initial licensure and renewal processes, underlining the importance of having the proper insurance coverage in line with state requirements.

- What specific insurance requirements does the form address?

The form specifies that the licensee must hold a comprehensive commercial general liability insurance policy in their name, with a minimum liability coverage of $1,000,000. This coverage must include protection against bodily injury, property damage, and personal injury. Moreover, if the licensee carries a firearm during the course of their duties or if they are in charge of an agency allowing the use of firearms, the insurance must also cover claims related to firearm use while on duty.

- What are the responsibilities of the insurance company or producer when completing the form?

The insurance company or authorized producer is responsible for providing details about the insurance company, the insurance policy, and asserting that the policy meets the necessary requirements for the licensee’s operations in Illinois. They must verify that the policy covers the mandatory liabilities and provide the policy's effective and expiration dates. Additionally, if the policy is terminated before its expiration date, the insurer must notify the Department of Financial and Professional Regulation at least thirty days prior to cancellation.

- What information must the applicant provide on the DE INS Illinois form?

The applicant must accurately complete the section designated for them, including their full name (as it appears on the application or renewal form), date of birth, social security number, address, and contact information. New applicants must also refer to a reference sheet to include their profession name and three-digit profession code. Renewal applicants and those verifying current insurance must list each individual license number they hold relevant to the Private Detective, Private Alarm, Private Security, Fingerprint Vendor, and Locksmith Act. They must also sign the form under penalty of perjury, affirming the accuracy and completeness of the information provided.

Common mistakes

When filling out the DE INS Illinois form, there are several common mistakes that can lead to processing delays or issues with licensure. Understanding and avoiding these errors can streamline the application process.

Not ensuring the name of the insured matches exactly as it appears on the application or renewal form. This includes any middle initials, spaces, or hyphens used in the name on the application.

Forgetting to include the date of birth or filling it out incorrectly. The form requires the date in a month/day/year format, and any deviation might cause the form to be returned or not processed.

Omitting or inaccurately reporting the social security number. This is a crucial piece of information that must be accurately provided.

Failing to specify the correct address with exact details as noted on the license. This includes street names, city, state, and zip code.

New applicants not referring to the reference sheet to record the profession name and three-digit profession code correctly. This information must match the intended licensure area.

Renewal applicants overlooking to list each individual license number they hold when verifying current insurance. This is essential for identifying the correct records and existing licenses.

Incorrectly listing the insurance details, such as the policy number, type of policy, or the effective and expiration dates of the policy. Inaccurate information in this section can result in the need for resubmission.

Additionally, there are a few other considerations when completing the form:

Ensuring that the signature and date section is duly filled out by both the applicant/licensee and the insurance agent. An unsigned or undated form is incomplete.

Verifying that the insurance coverage meets the minimum liability requirements as specified in the form instructions, especially concerning bodily injury, property damage, and, if applicable, firearm usage.

Not providing notice of policy changes or termination to the Department of Financial and Professional Regulation as required may result in licensure issues.

By paying careful attention to these details, applicants can ensure their DE INS Illinois form is correctly filled out and submitted, thereby avoiding unnecessary delays or complications in the licensure process.

Documents used along the form

When submitting the DE-INS Illinois form, crucial for acquiring or renewing licensure under specific Illinois Compiled Statutes, individuals are often required to submit additional forms and documents to ensure compliance and thorough evaluation. These additional documents help in establishing the applicant's qualifications, legal standing, and overall eligibility for the licensure they seek. The comprehensive completion and submission of these documents ensure a smoother processing phase.

- Application for Licensure or Renewal Form: This primary document accompanies the DE-INS Illinois form, detailing the applicant's personal information, qualifications, and professional background essential for new applications or renewals.

- Proof of Identity: Documents like a state-issued ID card, driver’s license, or passport are required to verify the applicant's identity, ensuring the name matches across all submitted forms.

- Professional Resume or CV: A detailed resume or curriculum vitae provides insight into the applicant’s educational background, work experience, special qualifications, and accomplishments within their profession.

- Background Check Authorization Form: This form permits the conduct of a comprehensive criminal background check, an essential step for positions that demand high levels of trust and security.

- Continuing Education Certificates: For renewal applicants, certificates of completed continuing education courses may be required to demonstrate ongoing proficiency and adherence to evolving industry standards.

- Disciplinary Action Disclosure Form: Applicants must disclose any past disciplinary actions taken against them in any professional context. It aids in the transparent assessment of the applicant's ethical and professional conduct.

Together, these documents play a pivotal role in the licensure process, providing a holistic view of the applicant’s professional stance, dedication to maintaining industry standards, and commitment to legal and ethical practices. Hence, applicants are strongly encouraged to prepare these documents with attention to detail and complete honesty to facilitate a smooth review process by the relevant Illinois authorities.

Similar forms

The California Certificate of Insurance Form: Similar to the De Ins Illinois form, the California Certificate of Insurance serves as proof of insurance for professionals seeking licensure or license renewal. Both forms require detailed information regarding the insurance policy, including the insurer's and agent's details, policy number, coverage type, and effective dates of the policy. However, the specific requirements for coverage amounts and types may differ according to state laws.

Florida Proof of Professional Liability Insurance: This document, much like the De Ins Illinois form, is used by applicants in Florida as evidence of holding adequate professional liability insurance coverage as part of the licensure or renewal process for certain professions. It entails providing comprehensive information about the insurance provider, the policy holder, and the specifics of the insurance coverage. The emphasis on liability coverage, especially related to professional activities within the state, is a commonality between the two.

New York State Professional Liability Insurance Certification: Required by certain professionals in New York, this certification parallels the De Ins Illinois form in its role as a verification document for professional liability insurance. Both documents necessitate detailed insurance information, including the insured's name as it appears on the professional license, the policy number, the insurance company's details, and the insurance coverage's validity period. The primary goal is to ensure that professionals maintain a minimum specified amount of liability insurance.

Texas Certificate of Insurance for Licensed Professionals: Serving a similar purpose as the De Ins Illinois form, this certificate is used in Texas to confirm that individuals hold the necessary professional liability insurance to obtain or renew a professional license. It includes sections for the insurance agent and policy holder to fill out, detailing the insurance policy's specifics, such as coverage amounts, types of coverage, and policy duration. The form acts as a safeguard to ensure professionals are adequately insured against claims related to their professional services.

Pennsylvania Professional Liability Insurance Declaration: Comparable to the De Ins Illinois form, this declaration is a requirement for certain professionals in Pennsylvania for the purpose of licensure or renewal. It requires the professional to declare that they have the required liability insurance coverage in place, including specifics about the insurance policy, insurer, and coverage details. It emphasizes the need for professionals to be insured, protecting both the professional and the public from potential liability issues arising from professional conduct.

Dos and Don'ts

When filling out the DE INS Illinois form, which is essential for licensure under Illinois Compiled Statutes for various professional practices, special care must be taken to ensure accuracy and adherence to required procedures. The following guidance is designed to help applicants navigate this process more effectively.

Things You Should Do:

Ensure the "NAME OF INSURED" matches exactly what appears on your application or renewal form. This accuracy is crucial for the validity of your certificate of insurance.

For new applicants, carefully refer to the reference sheet to accurately record your profession name and three-digit profession code on the Illinois application.

Renewal applicants and those verifying current insurance should precisely list each individual license number they hold under the specified Acts.

Verify the comprehensive commercial general liability insurance includes at least $1,000,000 of liability insurance, covering bodily injury, property damage, and personal injury. If applicable, ensure it extends to firearm use in the course of employment.

Check the effective and expiration dates of the policy to ensure continuous coverage, particularly if submitting the form in close proximity to these dates.

Things You Shouldn't Do:

Avoid leaving any required fields blank, including your social security number, date of birth, and the specific address as noted on your license. Incomplete forms may result in processing delays or outright rejection.

Do not sign the declaration under penalties of perjury without first verifying all information on the policy and the completed form is true, correct, and complete to the best of your knowledge.

Properly filling out the DE INS Illinois form is a fundamental step in ensuring your professional licensure is processed without delays. Taking the time to carefully review and accurately complete all sections of the form will safeguard against potential administrative or legal challenges.

Misconceptions

There are several common misconceptions about the De Ins Illinois form that need clarifying to ensure that applicants understand the process and requirements. This form is crucial for individuals seeking licensure or renewal in certain professions within Illinois. Here are four misconceptions and the truths behind them:

- It's optional to complete the De Ins Illinois form: While the form mentions that disclosure of information is voluntary, completing the form is necessary for licensure under specific Illinois Compiled Statutes. Not submitting this form with your application could lead to the application not being processed.

- Any type of insurance policy is acceptable: The De Ins Illinois form requires a comprehensive, commercial general liability insurance policy in the name of the individual licensee. This policy must cover bodily injury liability, property damage, and personal injury. If the licensee carries a firearm or is in charge of an agency permitting firearm use, the policy must also cover claims from firearm use in the course of employment.

- The insurance can be in any name: Insurance must specifically be in the name of the individual license holder, exactly as it appears on the application or renewal form. This is crucial for ensuring that the coverage is correctly linked to the licensed individual.

- Any insurance agent can complete the insurance section: The remainder of the form, after the applicant section, must be completed by an authorized insurance agent. This agent must be authorized by the insurance company mentioned in the form and capable of declaring, under penalties of perjury, that the policy meets the state requirements and provides adequate coverage for the licensee's operations in Illinois.

Understanding these facts can help ensure that applicants submit their De Ins Illinois form correctly, supporting their licensure or renewal process smoothly and without unnecessary delays.

Key takeaways

Filling out the De Ins Illinois form correctly is essential for individuals seeking licensure or renewal under the Private Detective, Private Alarm, Private Security, Fingerprint Vendor, and Locksmith Act in Illinois. Below are key takeaways to ensure accuracy and compliance:

- The completion of the De Ins Illinois form is a crucial step in the licensing or renewal process for specific professions in Illinois.

- Applicants must fill out their section accurately, providing details such as name, date of birth, social security number, and contact information as they appear on the application or renewal form.

- The insurance policy must be in the name of the individual license holder, emphasizing the personal accountability in professional liability.

- Commercial general liability insurance is mandatory, with a policy coverage minimum of $1,000,000, including bodily injury liability, property damage, and personal injury.

- Important for individuals carrying firearms in the course of their duties, the insurance must cover claims for injury or damage resulting from the use of firearms.

- If the licensee is in charge of an agency that allows the carrying of firearms, the policy must also extend to cover claims arising from firearm use by employees.

- New applicants are required to provide their profession name and a three-digit profession code, linking their insurance coverage to their specific field of practice.

- Renewal applicants and those verifying current insurance must record each individual license number held under the relevant Illinois statutes.

- The form mandates the signature of both the applicant/licensee and the authorized insurance agent, certifying the accuracy of the information under penalty of perjury.

- Insurance companies are obliged to notify the Department of Financial and Professional Regulation at least 30 days prior to policy cancellation, ensuring continuous coverage.

Understanding these key points before completing the De Ins Illinois form can help ensure that applicants meet all requirements for licensure or renewal, maintaining professional standards and compliance with state regulations.

Popular PDF Forms

Wells Fargo Wire Routing - Repetitive wire transfers in US Dollars have a designated option for streamlined processing.

Proof of Funds Letter - Bankers provide their contact information for verification purposes.