Blank De2501Fc PDF Template

Filing for Paid Family Leave (PFL) benefits in California requires careful attention to detail and thorough documentation. The DE2501FC form, specifically designed for claims related to PFL for caregiving, is a crucial document for individuals who need to take time off work to care for a seriously ill family member. The form has several parts, each requiring specific information from the claimant, the care recipient, and the medical professional overseeing the care recipient's condition. It outlines the need for the care recipient to complete and sign the relevant section of the form, or, in cases where they're unable to do so, provides instructions on alternative steps. Furthermore, it mandates the completion of a medical certification by the care recipient's physician or practitioner, which can be submitted electronically for faster processing. The instructions stress the importance of accuracy and completeness in filling out the form, as any missing information could delay the processing of the PFL claim. Additionally, it includes guidelines on how to submit the form either electronically via SDI Online or by mail. The form also touches on privacy acts and the legal implications of falsifying information, emphasizing the legal framework within which the PFL operates, ensuring claimants understand both their rights and responsibilities.

Preview - De2501Fc Form

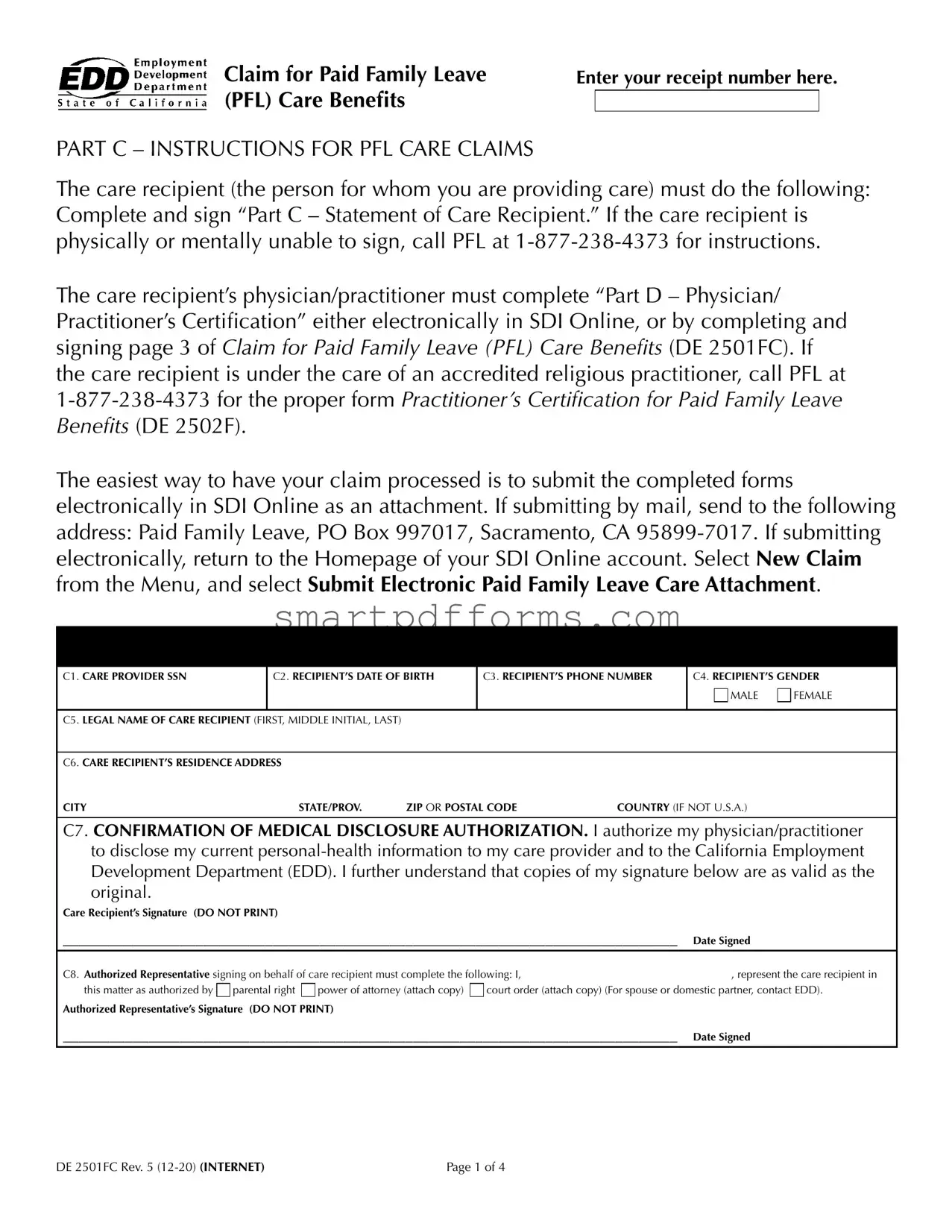

Claim for Paid Family Leave (PFL) Care Benefits

Enter your receipt number here.

PART C – INSTRUCTIONS FOR PFL CARE CLAIMS

The care recipient (the person for whom you are providing care) must do the following: Complete and sign “Part C – Statement of Care Recipient.” If the care recipient is physically or mentally unable to sign, call PFL at

The care recipient’s physician/practitioner must complete “Part D – Physician/ Practitioner’s Certification” either electronically in SDI Online, or by completing and signing page 3 of Claim for Paid Family Leave (PFL) Care Benefits (DE 2501FC). If the care recipient is under the care of an accredited religious practitioner, call PFL at

The easiest way to have your claim processed is to submit the completed forms electronically in SDI Online as an attachment. If submitting by mail, send to the following address: Paid Family Leave, PO Box 997017, Sacramento, CA

PART C – STATEMENT OF |

(MAY BE COMPLETED BY CLAIMANT IF CARE RECIPIENT IS MENTALLY OR PHYSICALLY UNABLE TO DO SO. |

||||||

|

CARE RECIPIENT |

MUST BE SIGNED BY CARE RECIPIENT OR CARE RECIPIENT’S AUTHORIZED REPRESENTATIVE.) |

|

||||

C1. |

CARE PROVIDER SSN |

C2. RECIPIENT’S DATE OF BIRTH |

C3. RECIPIENT’S PHONE NUMBER |

C4. RECIPIENT’S GENDER |

|||

|

|

|

|

|

|

MALE |

FEMALE |

|

|

|

|

|

|

|

|

C5. |

LEGAL NAME OF CARE RECIPIENT (FIRST, MIDDLE INITIAL, LAST) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C6. |

CARE RECIPIENT’S RESIDENCE ADDRESS |

|

|

|

|

|

|

CITY |

STATE/PROV. |

ZIP OR POSTAL CODE |

COUNTRY (IF NOT U.S.A.) |

|

|||

C7. CONFIRMATION OF MEDICAL DISCLOSURE AUTHORIZATION. I authorize my physician/practitioner to disclose my current

Care Recipient’s Signature (DO NOT PRINT)

_______________________________________________________________________________ |

Date Signed |

C8. Authorized Representative signing on behalf of care recipient must complete the following: I, |

, represent the care recipient in |

this matter as authorized by parental right power of attorney (attach copy) court order (attach copy) (For spouse or domestic partner, contact EDD). |

|

Authorized Representative’s Signature (DO NOT PRINT) |

|

_______________________________________________________________________________ |

Date Signed |

E 2501FC Rev. 5 |

Page 1 of 4 |

Enter your receipt number here.

LEFT BLANK INTENTIONALLY

E 2501FC Rev. 5 |

Page 2 of 4 |

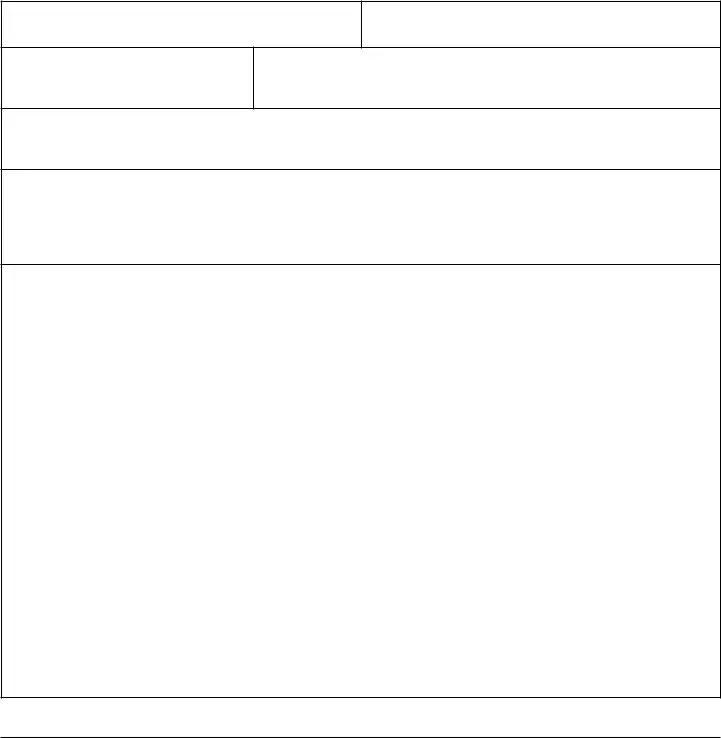

Medical certifications must be completed by a licensed physician or practitioner authorized to certify to a patient’s disability/serious health condition pursuant to California Unemployment Insurance Code Section 2708.

Enter your receipt number here.

PART D – PHYSICIAN/PRACTITIONER’S CERTIFICATION

D1. |

PFL CLAIMANT’S (CARE |

|

|

|

|

|

|

|

|

PROVIDER’S) SOCIAL |

|

|

|

|

|

|

|

|

SECURITY NUMBER |

D2. PFL CLAIMANT’S NAME (FIRST, MIDDLE INITIAL, LAST) |

|

|

||||

|

|

|

|

|

|

|||

D3. |

PATIENT’S DATE OF BIRTH |

D4. DOES YOUR PATIENT REQUIRE CARE BY THE CARE PROVIDER? |

|

|

||||

|

|

|

YES |

NO (SKIP TO D15) |

|

|

|

|

|

|

|

|

|

|

|

|

|

D5. |

PATIENT’S NAME (FIRST, MIDDLE INITIAL, LAST) |

|

|

|

|

|

||

|

|

|

|

|

||||

D6. |

DIAGNOSIS OR, IF NOT YET DETERMINED, A DETAILED STATEMENT OF SYMPTOMS |

|

|

|||||

|

|

|

|

|

|

|

||

D7. |

PRIMARY ICD CODE |

D8. SECONDARY ICD CODES |

|

|

|

D9. DATE PATIENT’S CONDITION COMMENCED |

||

|

|

|

|

|

|

|||

|

|

|

D11. DATE YOU ESTIMATE PATIENT WILL NO LONGER REQUIRE CARE BY |

|

||||

D10. |

FIRST DATE CARE NEEDED |

THE CARE PROVIDER |

|

|

|

D12. DATE YOU EXPECT RECOVERY |

||

|

|

|

|

|

PERMANENT CARE REQUIRED |

NEVER |

||

|

|

|

|

|

||||

D13. |

APPROXIMATELY HOW MANY TOTAL HOURS PER DAY WILL PATIENT REQUIRE CARE BY A CARE PROVIDER? |

|

||||||

HOURS |

COMMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

D14. |

WOULD DISCLOSURE OF THE MEDICAL INFORMATION ON THIS |

|

D15. PHYSICIAN/ |

|

D16. STATE OR COUNTRY (IF NOT U.S.A.) IN WHICH |

|||

|

CERTIFICATE BE MEDICALLY OR PSYCHOLOGICALLY DETRIMENTAL TO |

|

PRACTITIONER’S |

|

PHYSICIAN/PRACTITIONER IS LICENSED TO |

|||

|

YOUR PATIENT? |

|

|

|

LICENSE NUMBER |

|

PRACTICE |

|

|

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|||

D17. |

PHYSICIAN/PRACTITIONER’S NAME (FIRST, MIDDLE INITIAL, LAST) |

|

|

|

|

|||

|

|

|

|

|||||

D18. |

PHYSICIAN/PRACTITIONER’S ADDRESS (POST OFFICE BOX IS NOT ACCEPTABLE AS THE SOLE ADDRESS) |

|

|

|||||

CITY |

|

|

STATE/PROV. |

ZIP OR POSTAL CODE |

COUNTRY (IF NOT U.S.A.) |

|||

|

|

|

|

|

|

|

||

D19. |

TYPE OF PHYSICIAN/PRACTITIONER |

|

|

D20. SPECIALTY (IF ANY) |

|

|

||

|

|

|

|

|

|

|

||

D21. |

Physician/Practitioner’s Certification: |

|

|

|

|

|

||

|

I certify under penalty of perjury that this patient has a serious health condition and requires a care provider. I have performed a physical examination and/or treated |

|||||||

|

the patient. I am authorized to certify a patient disability or serious health condition pursuant to California Unemployment Insurance Code section 2708. |

|||||||

|

Original Signature of physician/practitioner – |

|

|

|

|

|

||

|

RUBBER STAMP IS NOT ACCEPTABLE |

|

|

|

|

|

|

|

|

__________________________________________________________________________ |

|

|

|||||

|

PHYSICIAN/PRACTITIONER’S PHONE NUMBER |

|

|

DATE SIGNED |

|

|

||

Under sections 2116 and 2122 of the California Unemployment Insurance Code, it is a violation for any individual who, with intent to defraud, falsely certifies the medical condition of any person in order to obtain disability insurance benefits, whether for the maker or for any other person, and is punishable by imprisonment and/or a fine not exceeding $20,000. Sections 1143 and 3305 require additional administrative penalties.

E 2501FC Rev. 5 |

Page 3 of 4 |

FEDERAL PRIVACY ACT. The EDD requires disclosure of Social Security numbers on a mandatory basis to comply with California Unemployment Insurance Code, sections 1253 and 2627; with California Code of Regulations, Title 22, sections 1085, 1088, and 1326; with Code of Federal Regulations, Title 20, Part 604; and with U.S. Code, Title 8, sections 1621, 1641, and 1642.

INFORMATION COLLECTION AND ACCESS. State law requires the following information to be provided when collecting information from individuals:

Agency Name:

Employment Development Department (EDD)

Title of Official Responsible for Information Maintenance:

Manager, EDD Paid Family Leave Office

Local Contact Person:

Manager, EDD Paid Family Leave Office

Address and Telephone Number:

The address and phone number of Paid Family Leave will appear on the Notice of Computation (DE 429D), issued at the time your benefit determination is made.

Maintenance of the Information is authorized by:

California Unemployment Insurance Code, sections 2601 through 3306.

California Code of Regulations, Title 22, sections

Consequences of not providing all or any part of the requested information:

•Failure to supply any or all information may cause delay in issuing benefit payments or may cause you to be denied benefits to which you are entitled.

•If you willfully make a false statement, representation, or knowingly withhold a material fact to obtain or increase any benefit or payment, the EDD will disqualify you from receiving benefits and/or services and may initiate criminal prosecution against you.

Principal purpose(s) for which the information is to be used:

•To determine eligibility for Paid Family Leave benefits.

•To be summarized and published in statistical form for the use and information of government agencies and the public. (Neither your name and identification nor the name and identification of the care recipient will appear in publications.)

•To be used to locate persons who are being sought for failure to provide child or spousal support.

•To be used by other governmental agencies to determine eligibility for public social services under the provisions of California Welfare and Institutions Code, Division 9.

•To be used by the EDD to carry out its responsibilities under the California Unemployment Insurance Code.

•To be exchanged pursuant to California Unemployment Insurance Code, section 322, and California Civil Code, section 1798.24, with other governmental departments and agencies, both federal and state, which are concerned with any of the following:

(1)Administration of an unemployment insurance program.

(2)Collection of taxes which may be used to finance unemployment insurance or disability insurance.

(3)Relief of unemployed or destitute individuals.

(4)Investigation of labor law violations or allegations of unlawful employment discrimination.

(5)The hearing of workers’ compensation appeals.

(6)Whenever necessary to permit a state agency to carry out its mandated responsibilities where the use to which the information will be put is compatible with the purpose for which it was gathered.

(7)When mandated by state or federal law. Disclosures under California Unemployment Insurance Code, section 322, will be made only in those instances in which it furthers the administration of the programs mandated by that Code.

•Pursuant to California Unemployment Insurance Code, sections 1095 and 2714, information may be revealed to the extent necessary for the administration of public social services or to the Director of Social Services or his/her representatives.

•Information shall be disclosed to authorized agencies in accordance with California Unemployment Insurance Code, sections 1095 and 2714.

E 2501FC Rev. 5 |

Page 4 of 4 |

Form Data

| Fact Name | Description |

|---|---|

| Form Identification | The form is identified as DE 2501FC, titled "Claim for Paid Family Leave (PFL) Care Benefits". |

| Submission Methods | Claims can be submitted either electronically through the SDI Online system or by mail to Paid Family Leave, PO Box 997017, Sacramento, CA 95899-7017. |

| Physician/Practitioner Certification Requirement | The care recipient's physician or accredited religious practitioner must complete the "Physician/Practitioner’s Certification" (Part D) for the claim to be processed. |

| Governing Law | The form is governed by the California Unemployment Insurance Code, specifically sections 2708 for medical certification and 2116 and 2122 regarding penalties for fraudulent claims. |

| Privacy and Information Collection | The form is subject to the Federal Privacy Act. The Employment Development Department (EDD) requires Social Security numbers and other personal information under various sections of the California Unemployment Insurance Code and California Code of Regulations. |

Instructions on Utilizing De2501Fc

Completing the DE2501Fc form is a crucial step in applying for Paid Family Leave (PFL) Care Benefits. This document is designed to facilitate the provision of care benefits to individuals providing care for a family member with a serious health condition. It's important to submit this form accurately and comprehensively to ensure the process moves forward without delay. Following a detailed, step-by-step guide will help in filling out the form correctly. Once submitted, the form will be reviewed, and any additional instructions or requirements will be communicated to the applicant.

- Start by entering your receipt number at the top of the form where indicated.

- Under PART C – Statement of Care Recipient, if the care recipient is unable to complete their section due to physical or mental incapacity, ensure to call PFL at 1-877-238-4373 for further instructions.

- The care recipient or their authorized representative must complete and sign the Statement of Care Recipient. Enter:

- The care provider’s Social Security Number (SSN) in section C1.

- The recipient's date of birth in C2.

- The recipient's phone number in C3.

- Select the recipient’s gender in C4.

- Fill in the legal name of the care recipient in C5.

- Enter the care recipient’s residence address, city, state/province, zip or postal code, and country (if not the U.S.A.) in C6.

- Check the box to confirm the medical disclosure authorization in section C7, and ensure the care recipient (or authorized representative) signs and dates this section.

- In section C8, if an authorized representative is completing the form on behalf of the care recipient, fill out the necessary information and attach the required documents as indicated.

- Move to PART D – Physician/Practitioner’s Certification, to be completed by the care recipient’s physician/practitioner. This section must accurately document the care recipient's medical condition and need for care.

- Ensure the physician/practitioner includes their contact information, diagnosis, and the estimated duration of care required in the appropriate sections (D1 - D21).

- The form provides specific instructions for if the care is under the supervision of an accredited religious practitioner, indicating a different procedure and potentially another form to complete. Prompt action to secure the correct documentation is necessary if this is the case.

- If choosing to submit the form via mail, send it to Paid Family Leave, PO Box 997017, Sacramento, CA 95899-7017. For electronic submissions, return to the SDI Online account, select New Claim, and follow the prompts for Submit Electronic Paid Family Leave Care Attachment.

It is essential to ensure all parts of the DE2501Fc form are filled out correctly and to verify that all the required documentation is attached before submission. Accuracy and completeness are critical to avoid any delays in the processing of the care benefits. Upon receipt of the form, the relevant department will review the application and initiate the next steps in the benefits provision process.

Obtain Answers on De2501Fc

What is the DE2501FC form?

The DE2501FC form, titled "Claim for Paid Family Leave (PFL) Care Benefits," is a document used in California to apply for Paid Family Leave benefits when one needs time off from work to provide care for a seriously ill family member.How can the care recipient or care provider complete the DE2501FC form?

The care recipient must fill out and sign the "Part C – Statement of Care Recipient" section. If the care recipient cannot sign due to physical or mental inability, contact PFL at 1-877-238-4373 for further instructions. The care recipient’s healthcare provider must complete the "Part D – Physician/Practitioner’s Certification."Is it possible to submit the DE2501FC form electronically?

Yes, the easiest way to have your claim processed is by submitting the forms electronically through SDI Online as an attachment. This method is preferred for faster processing.What if I cannot submit my form electronically?

If you cannot submit the DE2501FC form electronically, you may mail it to Paid Family Leave, PO Box 997017, Sacramento, CA 95899-7017. Ensure all required sections are completed before mailing.Can a care recipient’s religious practitioner complete the medical certification?

Yes, if the care recipient is under the care of an accredited religious practitioner instead of a physician, call PFL at 1-877-238-4373 to obtain the proper form, named "Practitioner’s Certification for Paid Family Leave Benefits (DE 2502F)."What happens if the care recipient is unable to complete their section of the form?

If the care recipient is mentally or physically unable to complete their section, a claimant can do so on their behalf. However, the care recipient or their authorized representative must sign the form, validating its content.What are the penalties for falsifying information on the DE2501FC?

Falsifying information to obtain benefits is illegal and subject to criminal prosecution, including imprisonment and/or fines not exceeding $20,000, in addition to further administrative penalties.Why is the Social Security number required on the DE2501FC form?

The disclosure of Social Security numbers is mandatory to comply with various California laws and regulations related to the administration of the Paid Family Leave program.What are the consequences of not providing all the requested information on the DE2501FC form?

Failing to provide all or part of the requested information may delay the issuance of benefit payments or lead to a denial of benefits. Moreover, willfully making false statements to obtain benefits can result in disqualification and criminal prosecution.

Common mistakes

One common mistake is not ensuring that the care recipient has properly completed and signed "Part C – Statement of Care Recipient." If the care recipient is unable to sign due to physical or mental incapacity, clear instructions provided by the PFL (1-877-238-4373) must be followed, rather than bypassing or incorrectly executing this crucial step.

Another error involves the "Part D – Physician/Practitioner’s Certification," where it is either not fully completed by the care recipient’s physician/practitioner or not submitted correctly. An accredited religious practitioner’s certification involves additional steps, which are often overlooked by applicants not calling PFL for the correct form (DE 2502F).

Many applicants fail to take advantage of the electronic submission process, which is recommended for the swiftest handling. Instead of submitting forms electronically through SDI Online as attachments, they opt for mailing, potentially delaying processing. The correct procedures for electronic submission, including navigating to New Claim from the SDI Online account menu, are often neglected.

Finally, inaccuracies in the completion of the form, such as incorrect or incomplete information in sections like the care recipient’s personal details (C1-C7) and medical disclosure authorization (C8), lead to processing delays or denial of claims. Ensuring that all information is accurate and all necessary documentation is attached, including authorizations and proof of the care provider relationship, is crucial, yet frequently mishandled.

Documents used along the form

When filing a Claim for Paid Family Leave (PFL) Care Benefits through the DE2501Fc form, it’s important to understand that there might be additional forms and documents required to support your claim. These forms help ensure that all necessary information is provided, making the review process smoother and helping to avoid any delays in receiving benefits.

- DE 2502F: Practitioner’s Certification – For care recipients under the treatment of an accredited religious practitioner, this form serves as an alternative to the medical certification provided by licensed physicians.

- DE 429D: Notice of Computation – It informs the claimant about the benefit amounts they are entitled to, based on the information provided in their claim.

- SDI Online Account Registration: Before submitting documents electronically, claimants must create an SDI Online account which is crucial for managing and tracking the status of their claim.

- Authorization for Release of Medical Records: Allows the healthcare provider to share the medical information of the care recipient with the California Employment Development Department (EDD).

- Copy of Power of Attorney or Court Order: For caregivers acting on behalf of the care recipient with an authorized representative, documentation proving legal authority is necessary.

- Proof of Relationship: Documents like birth certificates, marriage certificates, or other legal documents to prove the caregiver’s relationship to the care recipient.

- Patient’s Social Security Number Verification: A copy of the Social Security card or an official document containing the SSN of the patient to ensure accuracy in processing the claim.

- Temporary Disability Insurance Forms: Depending on the care provider’s situation, forms related to temporary disability might be required if the caregiver is also experiencing their own medical issues.

- Job Protection Documentation: While not always required, some caregivers might need to submit additional forms to their employer to ensure their job is protected while they are on leave.

- Appeal Form: If a claim is denied, caregivers have the right to appeal the decision, for which a specific form is required to initiate the review process.

Understanding and gathering the required supporting documents can significantly expedite the review and approval process of a PFL claim. Caregivers should carefully review each document’s instructions and ensure that accurate and complete information is provided to the EDD. This thorough preparation aids in avoiding common pitfalls that may result in delays or denial of the benefits rightfully due to the caregiver.

Similar forms

The DE 2501 form, also known as the Claim for Disability Insurance (DI) Benefits, is similar to the DE 2501FC form in that both require personal and medical information to establish eligibility for benefits. The DE 2501 focuses on disability benefits for individuals unable to work due to their own illness or injury, whereas the DE 2501FC is for those providing care to a seriously ill family member, indicating a shared framework for claiming support under California's Employment Development Department (EDD).

The DE 2502F form, entitled Practitioner’s Certification for Paid Family Leave Benefits, parallels the DE 2501FC through its necessity for a medical professional's certification. Both forms rely on the assessment of a healthcare provider to validate the need for care (in the case of DE 2501FC) or the fact of disability (in DE 2502F), thus facilitating the provision of benefits by demonstrating medical necessity.

SDI Online Registration process is akin to the DE 2501FC form submission in terms of initiating benefit claims digitally. Users must create an account on the State Disability Insurance (SDI) Online platform to submit forms like the DE 2501FC. This similarity underscores the state's initiative to streamline applications and accelerate the evaluation process by utilizing an online ecosystem for document submission and claim management.

The Social Security Disability Insurance (SSDI) Application shares similarities with the DE 2501FC due to both demanding detailed medical and personal information to assess eligibility for benefits. Although one is a federal program and the other state-run, each requires evidence of a medical condition affecting the applicant's or their dependent's life, necessitating either personal disability benefits or caregiver support.

Lastly, the DE 1101I form, or Claim for Unemployment Insurance (UI) Benefits, while serving a different primary function—support during unemployment—parallels the process of claiming for Paid Family Leave care benefits through the DE 2501FC. Each form represents a vital link in the chain of social safety nets provided by the EDD, requiring claimants to submit personal details and, for the DE 2501FC, medical certification, to access their respective benefits.

Dos and Don'ts

When filling out the DE2501FC form for Claim for Paid Family Leave (PFL) Care Benefits, it's crucial to pay attention to the details and follow specific guidelines. Here’s a concise list of dos and don'ts to assist in the process:

- Do ensure that the care recipient completes and signs “Part C – Statement of Care Recipient.”

- Do have the care recipient's physician/practitioner complete “Part D – Physician/Practitioner’s Certification” through the specified methods.

- Do submit the completed forms electronically via SDI Online for faster processing, if possible.

- Do mail the completed forms to the address provided if electronic submission is not an option.

- Do call PFL at the provided number for guidance if the care recipient is under the care of an accredited religious practitioner or if the care recipient is unable to sign due to physical or mental reasons.

- Don’t overlook the need for an authorized representative to sign on behalf of the care recipient when necessary, attaching the appropriate documentation.

- Don’t use a rubber stamp for the physician/practitioner’s signature on the medical certification; it must be an original signature.

- Don’t submit incomplete forms, as missing information can delay the processing time or result in denied benefits.

- Don’t forget to review the form for accuracy before submission, ensuring that all information is true and correct to avoid penalties for false statements.

Following these guidelines can help streamline the application process for Paid Family Leave Care Benefits, making it easier for both the claimant and the care recipient. Remember, accuracy and completeness are key to ensuring timely and correct benefit payments.

Misconceptions

When it comes to the DE 2501FC form, also known as the Claim for Paid Family Leave (PFL) Care Benefits, there are several misconceptions that can lead to confusion. Understanding what this form is for and how to correctly complete and submit it is crucial for individuals looking to apply for PFL care benefits in California. Below are five common misconceptions clarified:

- Any doctor can sign the medical certification: It's often assumed that any healthcare provider can complete the Physician/Practitioner’s Certification (Part D). However, the care recipient’s physician or practitioner must be licensed and authorized under California Unemployment Insurance Code Section 2708. Additionally, if the care recipient is under the care of accredited religious practitioners, special arrangements must be made by contacting PFL.

- Physical signatures are not necessary: Although digital and electronic processes are increasingly common, the DE 2501FC form requires original signatures. Copies of the care recipient's signature are valid if copied from the original, but each section that requires a signature, including the Statement of Care Recipient and the Physician/Practitioner’s Certification, must be originally signed. The assertion that rubber stamps or digital signatures are acceptable is incorrect; original ink signatures are required unless otherwise specified.

- The form can only be submitted by mail: Some people think the DE 2501FC can only be submitted through postal mail. However, the form and accompanying documentation can also be submitted electronically through SDI Online. This method is encouraged as it tends to be quicker and more convenient than mail submissions.

- Authorization of medical disclosure is optional: The form includes a section for the care recipient to authorize the disclosure of personal health information to the care provider and the California Employment Development Department (EDD). This authorization is crucial for the processing of the claim and is not optional. Without this authorization, the application may not be processed successfully.

- Any family member can complete Part C on behalf of the care recipient: If the care recipient is mentally or physically unable to complete the Statement of Care Recipient, it’s believed that any family member can complete it on their behalf. However, Part C clarifies that only authorized representatives can complete this section under specific conditions, such as having parental right, power of attorney, or a court order. For spouses or domestic partners, additional steps are required and contacting the EDD directly is advised.

Correcting these misconceptions and following the detailed instructions provided in the DE 2501FC form ensures that applicants can efficiently navigate the process of claiming Paid Family Leave care benefits. It is always advisable to reach out directly to the EDD for guidance if there are any questions or concerns during this process.

Key takeaways

- The De2501Fc form is used for claiming Paid Family Leave (PFL) care benefits, highlighting the necessity for individuals to formally request support for caregiving responsibilities.

- Before submission, both the care recipient and their physician or practitioner must complete specified sections of the form. This ensures the accuracy and verification of the claim.

- If the care recipient is unable to sign the form due to physical or mental reasons, the claimant is advised to contact PFL directly for guidance, underscoring the system's flexibility to accommodate unique circumstances.

- The form accommodates claims for care recipients under the care of both licensed medical practitioners and accredited religious practitioners, indicating a broad recognition of diverse healthcare practices.

- Submission of the claim can be done either electronically through SDI Online or by mail, providing options for claimants based on their access to technology or personal preference.

- Electronic submission is highlighted as the easiest and potentially fastest method to have claims processed, guiding claimants towards a more streamlined approach.

- The requirement for medical certification by a licensed physician or practitioner enforces a strict verification process for the claim, aimed at preventing fraud and ensuring legitimacy.

- There are serious consequences for providing false information on the form, including potential disqualification from receiving benefits and criminal prosecution, which underscores the importance of honesty in the claims process.

- The form's design with sections for both the claimant and a medical professional’s input reflects a system aimed at balancing the need for thorough vetting with the need for accessible family support services.

Popular PDF Forms

Truck Wash Receipt - Guidelines for drivers on the required information for a Washout Receipt, pointing out the necessity of details like the wash location and the company name for documentation.

What Is a Wage Theft Prevention Notice - The document must be provided in the primary language of the employee whenever possible, as per New York State Labor Law requirements.

Editable Class List - Its straightforward design is intended to eliminate confusion, ensuring that the focus remains on teaching and learning.