Blank Death Of Joint Tenant PDF Template

When someone holds property jointly with another, the mechanism set in place for the transfer of property upon one's death is significantly streamlined through a document known as the Death of Joint Tenant form. This document serves as a formal declaration that one of the property's joint owners has passed away. It is required for the legal and unambiguous transfer of the deceased's interest in the jointly held property to the surviving co-owner(s), without going through the often lengthy and costly probate process. The form requires information such as the full name of the deceased, a certified copy of the death certificate, and details regarding the property in question and its deed. It must be sworn before a notary and then recorded with the county recorder's or land registry’s office to update the official records, reflecting the change in ownership. This essential affidavit ensures that the property is seamlessly and legally transferred, while also updating public records to reflect the current ownership status. Such meticulous documentation can significantly ease the administrative burden on the surviving owner(s), facilitating a smoother transition during what is invariably a difficult time.

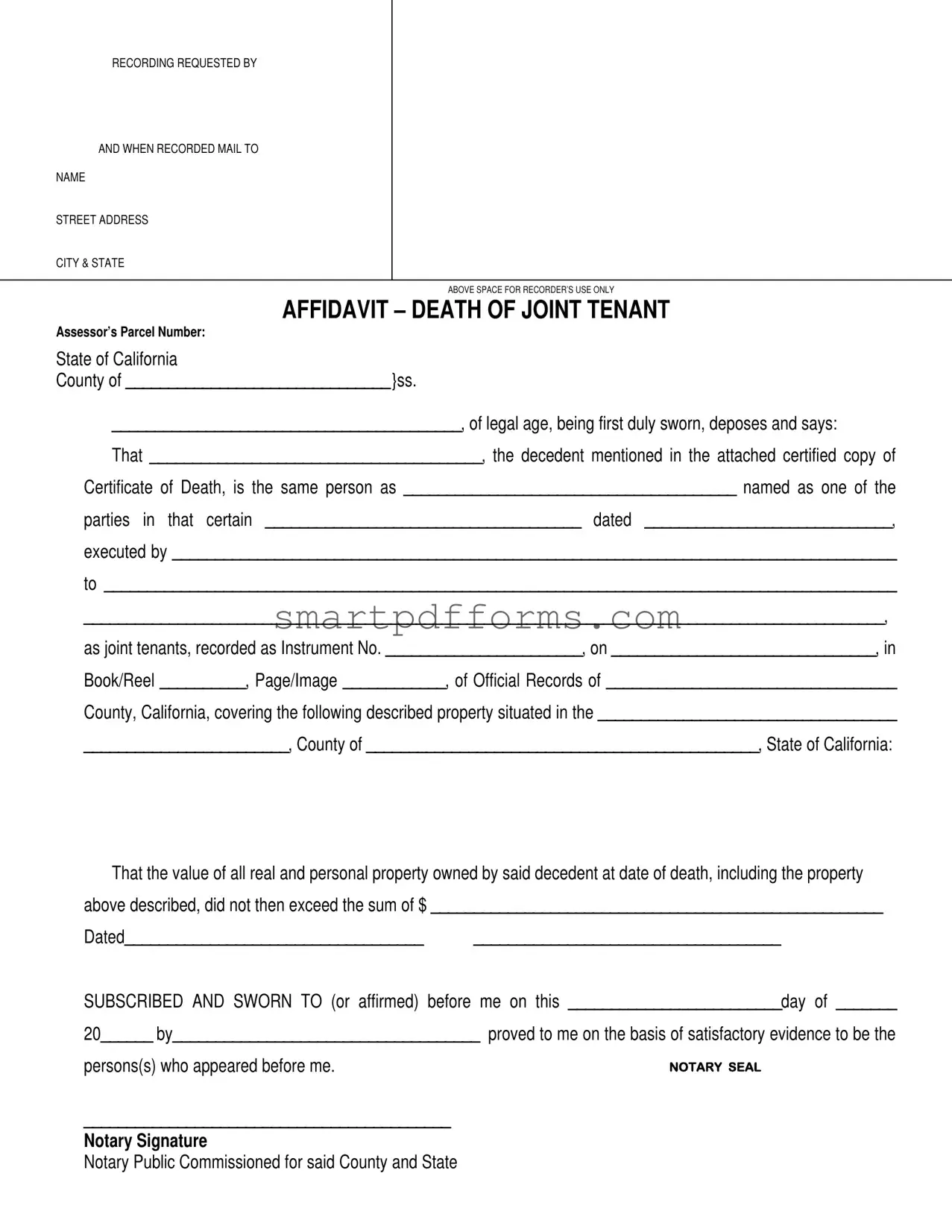

Preview - Death Of Joint Tenant Form

RECORDING REQUESTED BY

AND WHEN RECORDED MAIL TO

NAME

STREET ADDRESS

CITY & STATE

ABOVE SPACE FOR RECORDER’S USE ONLY

AFFIDAVIT – DEATH OF JOINT TENANT

Assessor’s Parcel Number:

State of California

County of _______________________________ }ss.

_________________________________________, of legal age, being first duly sworn, deposes and says:

That _______________________________________, the decedent mentioned in the attached certified copy of

Certificate of Death, is the same person as _______________________________________ named as one of the

parties in that certain _____________________________________ dated _____________________________,

executed by _____________________________________________________________________________________

to _____________________________________________________________________________________________

______________________________________________________________________________________________,

as joint tenants, recorded as Instrument No. _______________________, on _______________________________, in

Book/Reel __________, Page/Image ____________, of Official Records of __________________________________

County, California, covering the following described property situated in the ___________________________________

________________________, County of ______________________________________________, State of California:

That the value of all real and personal property owned by said decedent at date of death, including the property above described, did not then exceed the sum of $ _____________________________________________________

Dated___________________________________ ____________________________________

SUBSCRIBED AND SWORN TO (or affirmed) before me on this _________________________day of _______

20______ by____________________________________ proved to me on the basis of satisfactory evidence to be the

persons(s) who appeared before me.

___________________________________________

Notary Signature

Notary Public Commissioned for said County and State

Form Data

| Fact Name | Description |

|---|---|

| Document Purpose | This form is an affidavit used to notify of a joint tenant's death, facilitating the transfer of the property to the surviving joint tenant(s). |

| Key Component | It includes a sworn statement by an individual attesting to the identity of the deceased and their ownership interest in the specified property. |

| Location Specificity | The form specifically mentions its use in the State of California, highlighting the necessity of state-specific compliance. |

| Attachment Requirement | A certified copy of the Certificate of Death must be attached, affirming the decedent's death. |

| Property Description | Details about the property, including its location and the assessor’s parcel number, must be thoroughly described. |

| Notarization | The affidavit requires notarization, indicating it must be signed in the presence of a Notary Public who verifies the identity of the signer. |

| Property Value Declaration | The affiant must declare the value of the decedent's real and personal property at the time of death, highlighting the property's significance. |

| Recording Request | There are specific instructions for recording the document, including a request for who should receive the recorded document and the space for the recorder's use. |

| Governing Law | The document operates under California law, which governs the procedure for the affidavit's creation, submission, and the resultant property transfer process. |

Instructions on Utilizing Death Of Joint Tenant

Filling out the Death of Joint Tenant form is a necessary step in formally updating property records following the death of a joint tenant. This process ensures that the property's title accurately reflects the current ownership status. Clear documentation is essential for a smooth transition, making it crucial to accurately complete and submit this form.

- Start by entering the name, street address, city, and state of the person requesting the recording in the "RECORDING REQUESTED BY AND WHEN RECORDED MAIL TO" section.

- Locate the Assessor’s Parcel Number for the property and enter it in the designated space.

- Fill in the county name within the State of California where the property is located in the provided blank on the "County of" line.

- Identify the declarant by writing their full name where indicated. This person should be legally capable of making this declaration, typically a surviving joint tenant or legal representative.

- Complete the section that starts with "That," using the deceased's name as it appears on the attached certified death certificate in both provided blanks.

- Specify the type of document (e.g., deed) and its date that named the decedent as a joint tenant, including the names of all parties involved, as originally executed. Also, detail where and when this document was recorded (Instrument No., date, Book/Reel, and Page/Image numbers).

- Describe accurately the property affected, including its location (e.g., address, city, county) within the State of California.

- Enter the estimated value of the decedent's real and personal property at the time of death, including the described property, in the space provided.

- Sign and date the form at the bottom where indicated.

- Have the form notarized. This involves signing the form in front of a notary public, who will then complete the "SUBSCRIBED AND SWORN TO" section, including their signature, commission details, and the date of notarization.

After completing the above steps, review the form to ensure all information is accurate and no sections have been overlooked. The filled form, along with the certified copy of the death certificate, should then be submitted to the appropriate county recorder's office. This submission will update the property records to reflect the change in ownership due to the death of the joint tenant.

Obtain Answers on Death Of Joint Tenant

What is the Death of Joint Tenant form?

The Death of Joint Tenant form is a legal document used in the state of California. It serves as an affidavit to officially record the death of one property owner among joint tenants. The form verifies the identity of the deceased joint tenant and the survivor(s), linking the death certificate to the property deed recorded in county records. This action ensures the property transfers smoothly to the surviving joint tenant(s) without the need for probate.

Why is it important to file a Death of Joint Tenant form?

Filing a Death of Joint Tenant form is crucial because it formally updates the property title to reflect the passing of one owner. Without this update, the property may incorrectly appear to still belong to the deceased, complicating future transactions like selling or refinancing the property. Filing the form helps to clear the title and asserts the surviving tenant’s full ownership rights.

What information is needed to complete the form?

To complete the Death of Joint Tenant form, several pieces of information are required:

- The Assessor’s Parcel Number (APN) of the property.

- Details from the certified copy of the deceased’s death certificate.

- Identification of the deceased as the same person named on the property deed.

- Details of the property deed, including the date, parties involved, and recording information.

- An estimation of the value of the deceased’s real and personal property at the time of death.

How is the form filed?

The completed and notarized Death of Joint Tenant form must be filed with the county recorder's office where the property is located. The document will then be added to the official property records. It's advisable to check if there are any specific filing fees or additional documents required by the local recorder's office.

What happens after the form is filed?

After the form is filed and recorded, the property title is officially updated to remove the deceased joint tenant's name, leaving the surviving joint tenant(s) as the full owner(s) of the property. This step is essential for maintaining clear and accurate property records and for the ease of future property-related transactions.

Are there any potential complications in filing the form?

While the process is generally straightforward, complications can arise if the information provided is incorrect or incomplete. Issues can also occur if the surviving tenant cannot locate the original property deed or if the death certificate has errors. To prevent delays, it is important to double-check all information for accuracy before submission and to consult with a legal professional if there are any uncertainties or discrepancies.

Common mistakes

When filling out a Death Of Joint Tenant form, individuals commonly encounter a few hurdles that can result in delays or rejection of the document. Recognizing these mistakes upfront can streamline the process and help to ensure a smoother transfer of property interests. Here are four common pitfalls:

Incorrectly Identifying the Decedent: One of the most critical errors is failing to accurately match the decedent's name on the Death Certificate with the name listed as one of the joint tenants on the property title. This discrepancy can cast doubts on the identity of the person, leading to delays in processing the form.

Not Attaching the Death Certificate: The affidavit requires a certified copy of the Death Certificate to be attached. Omitting this crucial document or attaching an unofficial or photocopied version instead of a certified copy can void the submission, necessitating a resubmission and potentially delaying proceedings.

Misstating Property Information: Another common mistake is providing incorrect property descriptions or assessor’s parcel numbers (APN). Precise details about the location, county, and legal descriptors of the property as registered in county records must be accurately reflected. Misinformation here can lead to confusion and misfiling.

Incomplete Notarization: The affidavit must be notarized to verify the identity of the person submitting the form. Incomplete notarization, such as missing the notary’s signature, seal, or commission details, will result in the rejection of the document. Ensuring that all notarial information is correctly filled out is essential for the document’s validity.

To facilitate a smooth process, careful attention to the above details when completing the Death Of Joint Tenant form is paramount. It's not just about filling out a form; it’s about ensuring that all details are accurate and complete, safeguarding against any potential setbacks in recognizing the transition of property rights.

Documents used along the form

When dealing with the aftermath of a loved one's passing, particularly in matters of property and estate, several forms and documents work concurrently with the Death of Joint Tenant form to ensure the legal and smooth transfer of assets and resolution of the deceased's estate. These documents vary by their purpose, from validating the death and the identity of the deceased to altering titles and ensuring proper tax handling. Below is an illustrative, though not exhaustive, list of documents that are frequently used alongside the Death of Joint Tenant form.

- Certificate of Death: This is a vital record that officially documents the death of an individual. It's issued by a government official such as a registrar of vital statistics and provides proof of death, necessary for the Death of Joint Tenant form to process the transfer of property.

- Last Will and Testament: This legal document articulates the desires of the deceased regarding the distribution of their property and the care of any minor children. While a Death of Joint Tenant form deals specifically with property held in joint tenancy, a will can provide broader context about the decedent's estate intentions.

- Successor Trustee Document: For properties held in a trust, this document designates the successor trustee who will manage the trust's assets after the original trustee's death. It works in tandem with the Death of Joint Tenant form when the property in question is part of a living trust.

- Real Property Value Affidavit: This document assesses the value of the real property at the time of the decedent's death. It's essential for tax purposes and in jurisdictions where the transfer of property is subject to certain thresholds of value.

- Spousal Property Petition: In some cases, especially when the deceased's spouse survives them, this form may be required. It allows the surviving spouse to claim a property without going through probate. It's particularly useful in community property states.

- Change of Ownership Statement: Filed with the local county assessor's office, this document notifies the assessor of a change in property ownership. It's critical for updating property tax records following the transfer of interest resulting from the death of a joint tenant.

Each of these documents plays a unique role in the complex process of estate management following someone's death. They ensure that the legal transfer of property is conducted smoothly, the wishes of the deceased are honored, and all relevant taxes and obligations are properly addressed. The journey through this process often requires not only attention to detail but also a significant emotional toll on those involved. It's imperative to approach these tasks with both understanding and thoroughness.

Similar forms

When dealing with the transfer of property upon the death of an owner, several documents besides the Death of Joint Tenant form can be of similar importance. Each has a unique role in the legal landscape of estate planning and property management, yet they share a common thread in facilitating the transition of ownership or verifying crucial details about the deceased and their assets.

-

Transfer on Death Deed (TOD): Similar to the Death of Joint Tenant form, a Transfer on Death Deed allows property owners to name a beneficiary who will receive their property upon their death, bypassing the probate process. Both documents serve to transfer ownership rights without the need for probate court intervention, although the TOD is specifically for the transfer of real estate upon the owner’s death.

-

Last Will and Testament: A Last Will and Testament specifies how a person’s assets should be distributed after their death. It is similar to the Death of Joint Tenant form in that it deals with the distribution of assets upon death, though the Will covers all assets and requires probate, whereas the Death of Joint Tenant form specifically addresses property held in joint tenancy and allows for automatic transfer to the surviving owner(s).

-

Grant Deed: A Grant Deed is used to transfer ownership of property from one person to another. It is similar to the Death of Joint Tenant form as both involve the transfer of property rights. However, a Grant Deed is used for live transfers, while the Death of Joint Tenant form is used posthumously.

-

Joint Tenancy Agreement: This document establishes joint ownership of property, where each tenant has an equal share and the right of survivorship. It is closely related to the Death of Joint Tenant form, which comes into play to confirm the death of one tenant and the transfer of their interest to the surviving joint tenant(s), pursuant to the agreement’s terms.

-

Life Estate Deed: Similar in its concern with property transfer and ownership succession, a Life Estate Deed grants someone the right to live on a property until their death, after which the property passes to a named remainderman. While the Death of Joint Tenant form directly transfers ownership following a death, a Life Estate Deed sets up a future interest in the property during the owner’s lifetime.

-

Affidavit of Heirship: This document is used to establish ownership of assets when someone dies without a will. It’s similar to the Death of Joint Tenant form in that both are used to facilitate the transfer of assets following someone’s death. However, the Affidavit of Heirship is used to clarify relationships and identify heirs in the absence of a will or other estate planning documents.

While each of these documents serves specific roles within estate planning and property management, they collectively ensure that assets are transferred according to the deceased’s wishes or legal standards, providing clarity and legal documentation to support the transition of ownership.

Dos and Don'ts

When filling out the Death Of Joint Tenant form, certain practices should be adhered to ensure the process is completed accurately and legally. Below are lists of things you should and shouldn't do during this process.

Things You Should Do:

- Ensure all information provided matches the official documents, such as the Certificate of Death and property titles.

- Verify the Assessor’s Parcel Number (APN) for accuracy to avoid processing delays.

- Provide the full legal name of the decedent as it appears on the Certificate of Death and property deeds.

- Include the exact date of the document that declared the property held in joint tenancy to establish the timeline of ownership.

- Accurately record the Instrument Number, Book/Reel, and Page/Image numbers as these details are critical for locating the original joint tenancy document in public records.

- Describe the property in detail, ensuring the description matches that on the official records to prevent any ambiguity.

- State the total value of all real and personal property owned by the decedent at the time of death to comply with legal requirements.

- Sign the form in the presence of a Notary Public to authenticate the document.

- Provide accurate and complete contact information for the requesting party to ensure the recorded document can be returned properly.

- Check for any specific filing requirements or additional documents needed by your local Recorder’s Office.

Things You Shouldn't Do:

- Do not leave any sections blank; ensure all required information is provided.

- Avoid guessing or estimating information; refer to official documents for accuracy.

- Do not use nicknames or abbreviations for the names of the decedent or parties involved.

- Avoid signing the document without a Notary Public present, as notarization is a legal requirement.

- Do not ignore state-specific filing requirements or deadlines that may affect the recording of the document.

- Avoid submitting the form without attaching a certified copy of the Certificate of Death, as it is essential for processing.

- Do not inaccurately assess the value of the decedent’s property to avoid legal issues.

- Avoid submitting incomplete or incorrect contact information that could delay the return of the recorded document.

- Do not forget to review the entire form for errors or omissions before submitting it for recording.

- Do not neglect to keep a copy of the submitted form and any correspondence for your records.

Misconceptions

There are several misconceptions about the "Death of Joint Tenant" form that need to be clarified:

It automatically transfers property to the surviving joint tenant(s). While it's true that property held in joint tenancy should pass to the surviving joint tenant(s) upon the death of one tenant, the form itself is not what transfers the property. Rather, it serves as an official declaration of the death, which then allows the property to be transferred according to the law governing joint tenancies.

Filling out the form is all that's needed to change property records. Completing and filing the "Death of Joint Tenant" form with the appropriate county recorder's office is a critical step, but it may not be the only requirement. The form must be correctly filled out, notarized, and then submitted for recording. Sometimes, additional documents or steps are necessary depending on the county or state requirements.

The form triggers immediate reassessment of property for tax purposes. The death of a joint tenant does not automatically trigger a reassessment of the property's value for tax purposes. Property tax laws vary by state, and in some states, there are exclusions or exemptions from reassessment for transfers due to death. It's important to understand the specific tax implications in your area.

Any joint tenant can fill out and file the form without consent from others. While technically any surviving joint tenant can fill out the form, doing so without informing the other joint tenants or aligning with their wishes can lead to disputes or legal complications. It's generally advisable to manage such matters transparently and cooperatively.

A notary from any state can notarize the form. The "Death of Joint Tenant" form typically needs to be notarized in the state where the property is located, or by a notary public who is authorized to act in that state. Using a notary from a different state, who is not commissioned to operate within the property's state, can invalidate the form.

This form is the only way to remove a deceased joint tenant's name from the property title. While filing a "Death of Joint Tenant" form is a common method for removing a deceased joint tenant's name from the title, it's not the only method. Depending on state law and the specifics of the situation, other legal documents or proceedings (such as a court order) might be necessary.

Key takeaways

When dealing with the transfer of property following the passing of a joint tenant, it's crucial to understand the process and legal documentation required. One such essential document is the Death of Joint Tenant form. Here are four key takeaways about filling out and using this form:

- It's necessary to accurately identify the decedent and the surviving joint tenant(s). This form requires clear identification of the deceased individual, linking them to the property held in joint tenancy. Including the deceased's name as it appears on the property deed, along with the property's legal description, ensures proper and legal recognition of the deceased's interest in the property. This accuracy is crucial for the form to be effective.

- The form must be accompanied by a certified copy of the death certificate. To legally establish the death of the joint tenant, a certified copy of the Certificate of Death must be attached to the affidavit. This validates the claim and is a requirement for recording the change in property ownership.

- Proper notarization is critical. As with many legal documents, the Death of Joint Tenant form requires notarization. This step validates the identity of the individual(s) signing the affidavit and ensures that the signee(s) understand the document they're signing. The notary public's signature and seal verify the document's authenticity, a requirement for it to be accepted by the recorder's office.

- The final step involves recording the document. After completion and notarization, the form needs to be filed with the county recorder's office where the property is located. This process formally updates the property records to reflect the change in ownership due to the joint tenant's death. The filed document ensures the surviving joint tenant(s) can assume full ownership rights, adhering to the principle of right of survivorship inherent in joint tenancies.

Filling out and properly using the Death of Joint Tenant form is a vital process for transferring property seamlessly and lawfully after the loss of a loved one. Understanding these steps can simplify this complex procedure, ensuring the remaining joint tenants' rights are protected and upheld.

Popular PDF Forms

Wells Fargo Beneficiary Form - Making deliberate choices about your beneficiaries on this form can prevent disputes among your loved ones and ensure a smoother transition of assets.

Alabama Ppt - The form requests the Federal Business Code, aligning the business with its industry classification.