Blank Declaration Canada E311 PDF Template

When travelers enter Canada, they encounter a crucial document designed to facilitate a smooth process at the border: the Declaration Canada E311 form. This form serves multiple purposes, chief among them to ensure travelers can quickly declare their goods, thereby adhering to Canadian laws and regulations. The Canada Border Services Agency (CBSA) Declaration Card allows up to four individuals residing at the same address to be listed on a single card, streamlining the process for families or groups traveling together. Each traveler is mandated to declare if they are carrying CAN$10,000 or more in currency or monetary instruments, a critical step in combating illegal financial activities. Non-compliance with the declaration requirements can lead to severe consequences, including seizure of goods, monetary fines, or even criminal prosecution. The form is also an essential tool for gathering duties and taxes on imported goods, with specific sections dedicated to visitors and residents of Canada, outlining their duty-free allowances and exemptions based on their stay duration and purchased items. This meticulously designed system not only aids in the efficient collection of duties and taxes but also ensures compliance with Canadian legislation, safeguarding both government and citizen interests.

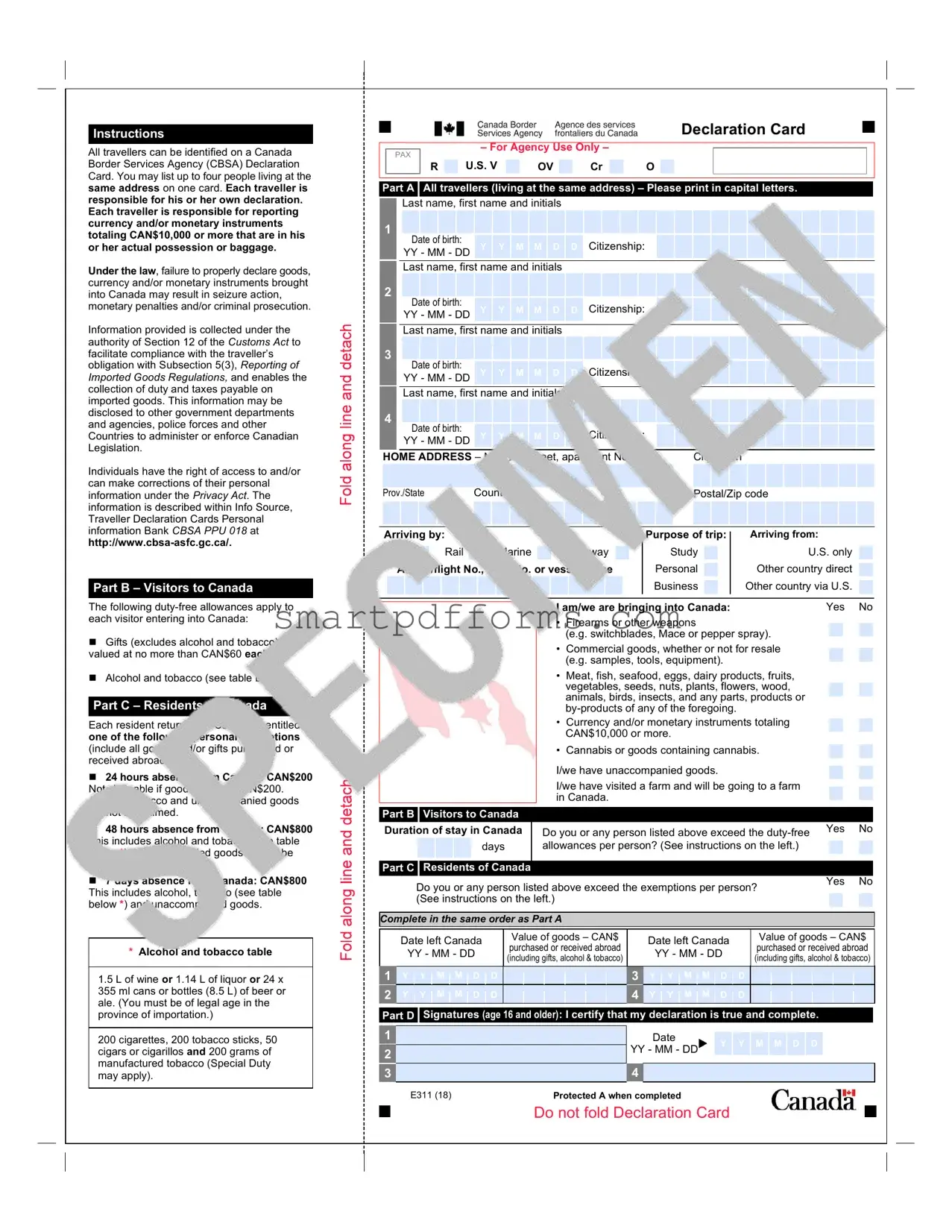

Preview - Declaration Canada E311 Form

Instructions

All travellers can be identified on a Canada Border Services Agency (CBSA) Declaration Card. You may list up to four people living at the same address on one card. Each traveller is responsible for his or her own declaration. Each traveller is responsible for reporting currency and/or monetary instruments totaling CAN$10,000 or more that are in his or her actual possession or baggage.

Under the law, failure to properly declare goods, currency and/or monetary instruments brought into Canada may result in seizure action, monetary penalties and/or criminal prosecution.

Information provided is collected under the authority of Section 12 of the Customs Act to facilitate compliance with the traveller’s obligation with Subsection 5(3), Reporting of Imported Goods Regulations, and enables the collection of duty and taxes payable on imported goods. This information may be disclosed to other government departments and agencies, police forces and other Countries to administer or enforce Canadian Legislation.

Individuals have the right of access to and/or can make corrections of their personal information under the Privacy Act. The information is described within Info Source, Traveller Declaration Cards Personal information Bank CBSA PPU 018 at

Part B – Visitors to Canada

The following

Gifts (excludes alcohol and tobacco) valued at no more than CAN$60 each.

Alcohol and tobacco (see table below *).

Part C – Residents of Canada

Each resident returning to Canada is entitled to one of the following personal exemptions (include all goods and/or gifts purchased or received abroad):

24 hours absence from Canada: CAN$200 Not claimable if goods exceed CAN$200. Alcohol, tobacco and unaccompanied goods cannot be claimed.

48 hours absence from Canada: CAN$800 This includes alcohol and tobacco (see table below *). Unaccompanied goods cannot be claimed.

7 days absence from Canada: CAN$800 This includes alcohol, tobacco (see table below *) and unaccompanied goods.

* Alcohol and tobacco table

1.5L of wine or 1.14 L of liquor or 24 x 355 ml cans or bottles (8.5 L) of beer or ale. (You must be of legal age in the province of importation.)

200 cigarettes, 200 tobacco sticks, 50 cigars or cigarillos and 200 grams of manufactured tobacco (Special Duty may apply).

Declaration Card

– For Agency Use Only –

PAX

R |

U.S. V |

OV |

Cr |

O |

Part A

All travellers (living at the same address) – Please print in capital letters.

All travellers (living at the same address) – Please print in capital letters.

Last name, first name and initials

1

Date of birth: |

Y |

Y |

M |

M |

D |

D |

Citizenship: |

YY - MM - DD |

|||||||

|

|

||||||

Last name, first name and initials |

|

||||||

2 |

|

|

Date of birth: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Y |

Y |

M |

M |

|

D |

D |

Citizenship: |

|

|

|

|

|||||||

|

|

YY - MM - DD |

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Last name, first name and initials |

|

|

|

|

|

|

|

|

|

||||||||||

3 |

|

|

Date of birth: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Y |

Y |

M |

M |

|

D |

D |

Citizenship: |

|

|

|

|

|||||||

|

|

YY - MM - DD |

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last name, first name and initials |

|

|

|

|

|

|

|

|

|

||||||||||

4 |

|

|

Date of birth: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Y |

Y |

M |

M |

|

D |

D |

Citizenship: |

|

|

|

|

|||||||

|

|

YY - MM - DD |

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||

HOME ADDRESS – Number, street, apartment No. |

City/Town |

|

|||||||||||||||||||

Prov./State |

Country |

|

|

|

|

|

Postal/Zip code |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Arriving by: |

|

|

|

|

|

|

|

|

|

|

|

|

Purpose of trip: |

|

|

Arriving from: |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Air |

|

|

Rail |

|

Marine |

|

|

Highway |

|

|

|

Study |

|

|

U.S. only |

||||||

|

|

|

|

|

|

|

|

||||||||||||||

|

Airline/flight No., train No. or vessel name |

|

Personal |

|

|

Other country direct |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business |

|

|

Other country via U.S. |

|

|

|

|

|

|

|

I am/we are bringing into Canada: |

|

Yes |

No |

||||

|

|

|

|

|

|

|

• |

Firearms or other weapons |

|

|

|

|

||

|

|

|

|

|

|

|

|

(e.g. switchblades, Mace or pepper spray). |

|

|

|

|||

|

|

|

|

|

|

|

• |

Commercial goods, whether or not for resale |

|

|

|

|||

|

|

|

|

|

|

|

|

(e.g. samples, tools, equipment). |

|

|

|

|

||

|

|

|

|

|

|

|

• |

Meat, fish, seafood, eggs, dairy products, fruits, |

|

|

|

|||

|

|

|

|

|

|

|

|

vegetables, seeds, nuts, plants, flowers, wood, |

|

|

|

|||

|

|

|

|

|

|

|

|

animals, birds, insects, and any parts, products or |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

• |

Currency and/or monetary instruments totaling |

|

|

|

|||

|

|

|

|

|

|

|

|

CAN$10,000 or more. |

|

|

|

|

||

|

|

|

|

|

|

|

• |

Cannabis or goods containing cannabis. |

|

|

|

|||

|

|

|

|

|

|

|

I/we have unaccompanied goods. |

|

|

|

|

|||

|

|

|

|

|

|

|

I/we have visited a farm and will be going to a farm |

|

|

|

||||

|

|

|

|

|

|

|

in Canada. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part B |

|

Visitors to Canada |

|

|

|

|

|

|

|

|

|

|||

Duration of stay in Canada |

|

Do you or any person listed above exceed the |

No |

|||||||||||

|

|

|

days |

|

|

allowances per person? (See instructions on the left.) |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part C |

|

Residents of Canada |

|

|

|

|

|

|

|

|

|

|||

|

Do you or any person listed above exceed the exemptions per person? |

Yes |

No |

|

||||||||||

|

|

|

|

|||||||||||

|

(See instructions on the left.) |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||

Complete in the same order as Part A |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date left Canada |

Value of goods – CAN$ |

|

Date left Canada |

Value of goods – CAN$ |

|||||||||

|

purchased or received abroad |

|

purchased or received abroad |

|||||||||||

|

YY - MM - DD |

|

YY - MM - DD |

|||||||||||

|

(including gifts, alcohol & tobacco) |

|

(including gifts, alcohol & tobacco) |

|||||||||||

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Y Y M M D D |

|

|

|

|

|

3 |

Y Y M M D D |

|

|

|

|

||

2 |

Y Y M M D D |

|

|

|

|

|

4 |

Y Y M M D D |

|

|

|

|

||

Part D

Signatures (age 16 and older): I certify that my declaration is true and complete.

Signatures (age 16 and older): I certify that my declaration is true and complete.

1 |

|

|

|

Date |

|

|

|

|

|

|

|

Y |

Y |

M |

M |

D |

D |

|

|||||

2 |

|

|

YY - MM - DD |

|

|||||||

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

4 |

|

|

|

|

|

|

|

|

|

E311 (18) |

Protected A when completed |

|

|

|

|

|

|

|

||

Do not fold Declaration Card

Form Data

| Fact Name | Description |

|---|---|

| Group Declaration Allowed | Up to four individuals residing at the same address may be listed on a single CBSA Declaration Card. |

| Currency Declaration Requirement | Travellers must declare if they are carrying currency and/or monetary instruments totaling CAN$10,000 or more. |

| Personal Information Collection Authority | Information is collected under the authority of Section 12 of the Customs Act, facilitating compliance with reporting obligations. |

| Resident Personal Exemption Limits | Residents of Canada are entitled to personal exemptions depending on the duration of absence from Canada, with specific allowances for alcohol and tobacco. |

Instructions on Utilizing Declaration Canada E311

Filling out the Declaration Canada E311 form is a crucial step for accurately informing the Canada Border Services Agency (CBSA) about the items and currency you are bringing into the country. This document is not just a formality—it plays a significant role in ensuring that you comply with Canadian laws regarding the importation of goods, currency, and monetary instruments. Being thorough and honest in your declaration can help prevent potential complications, such as monetary penalties or criminal prosecution. The following instructions will guide you through each section of the form, ensuring your process is as smooth and error-free as possible.

- Begin with Part A. Here, list all travelers arriving at the same address. Use capital letters to fill in the last names, first names, and initials of up to four individuals, along with their dates of birth (YY/MM/DD format) and citizenship.

- Enter your home address, including the number, street, apartment number, city/town, province/state, country, and postal/zip code.

- Specify the method of your arrival by checking the appropriate box: Air, Rail, Marine, or Highway. Follow this by indicating the purpose of your trip (Study, Personal, Business, or Other) and the origin of your trip (Arriving from).

- If applicable, provide information on your airline/flight number, train number, or vessel name.

- Answer yes or no to the queries in Section A, which ask about bringing firearms, commercial goods, prohibited food/plant/animal products, currency over CAN$10,000, or having unaccompanied goods, and if you have visited or will visit a farm in Canada.

- In Part B – Visitors to Canada, note your duration of stay and if you or anyone listed exceeds the duty-free allowances mentioned.

- For Part C – Residents of Canada, indicate if you or anyone listed exceeds the exemptions allowed based on your absence from Canada. Here, you'll need to enter the dates you left Canada and the value of goods purchased or received abroad for each traveler.

- Finally, in Part D, individuals aged 16 and older must sign and date the form, certifying that all information provided is true and complete.

Once completed, ensure you do not fold the Declaration Card. It's meant to be presented in its full size upon arrival. This form is a key part of entering Canada, designed to streamline the process of assessing goods and calculating duties or taxes that may be owed. By filling out this form carefully and accurately, you help ensure a smooth entry process and avoid potential delays or legal issues.

Obtain Answers on Declaration Canada E311

What is the Declaration Canada E311 form?

The Declaration Canada E311 form is a document that travelers entering Canada must complete. It serves to inform the Canada Border Services Agency (CBSA) about the goods travelers are bringing into the country, including currency or monetary instruments totaling CAN$10,000 or more. The form is critical for reporting goods accurately to avoid seizure, penalties, or criminal prosecution under Canadian law.

Can multiple people be included on one E311 form?

Yes, up to four people living at the same address can be listed on one E311 form. This feature is designed to make the process more convenient for families or groups traveling together, but it's important to remember that each traveler is still responsible for his or her individual declaration.

What happens if goods are not properly declared?

If goods, currency, or monetary instruments are not properly declared upon entering Canada, travelers may face severe consequences. These can include the seizure of the undeclared items, monetary fines, and/or criminal charges. It's essential to accurately report all items to CBSA to comply with Canadian laws.

Who can access the information provided on the E311 form?

The information collected on the E311 form under the authority of Section 12 of the Customs Act is used to ensure compliance with customs regulations. This data may be shared with other government departments, agencies, police forces, and even other countries as part of efforts to administer or enforce Canadian legislation.

Are there duty-free allowances for visitors to Canada?

Visitors to Canada can benefit from duty-free allowances on certain items. Gifts valued at no more than CAN$60 each (excluding alcohol and tobacco) can enter the country duty-free. There are also specific allowances for alcohol and tobacco based on quantity, which vary by the province of importation's legal age requirements.

What are the personal exemptions for residents of Canada returning home?

Residents of Canada have particular exemptions when returning from abroad, which depend on the length of their absence. For absences of 24 hours, an exemption of CAN$200 applies, but this does not cover alcohol, tobacco, and unaccompanied goods if the value exceeds CAN$200. For absences of 48 hours or more, the exemption amount increases to CAN$800 and includes alcohol and tobacco. The same applies for a 7-day absence, with the addition of unaccompanied goods being claimable.

How does one certify the accuracy of the E311 declaration?

Travelers aged 16 and older must sign Part D of the E311 form to certify that their declaration is true and complete. By signing, individuals affirm that all information provided is accurate, including the value and nature of goods brought into Canada, thereby fulfilling their legal obligations to CBSA.

Common mistakes

Filling out the Declaration Canada E311 form accurately is crucial for travelers entering Canada to ensure compliance with the Canada Border Services Agency (CBSA) regulations. However, individuals often make mistakes during this process, which can lead to potential fines, seizure of goods, or more serious legal consequences. Here are some common errors to avoid:

Incorrectly listing the number of people living at the same address on one card: The form permits up to four individuals residing at the same address to be included on one declaration card. Errors or omissions in this section can cause confusion and delays at the border.

Failing to properly declare currency and monetary instruments over CAN$10,000: Each traveler is responsible for declaring if they are carrying currency or monetary instruments totaling CAN$10,000 or more. Not reporting or inaccurately reporting these amounts can result in monetary penalties or even criminal prosecution.

Underestimating the value of goods, gifts, alcohol, and tobacco brought into Canada: Travelers often miscalculate or deliberately understate the value of items or overlook the duty-free limits. This mistake can lead to charges of duty and taxes on the underestimated portion and potentially more severe penalties for the deliberate act of understating.

Omitting information about visited or intended visits to agricultural locations: If travelers have visited a farm prior to entering Canada and plan to visit a farm in Canada, this must be disclosed on the form. Failing to do so can introduce biohazards into Canada’s agricultural sector, and thus, strict penalties may apply.

It's essential for travelers to take their time filling out the E311 form, carefully reviewing the instructions, and ensuring that all information provided is accurate and truthful. When in doubt, declaring or asking for clarification from a CBSA officer is always the safer route to avoid unintentional non-compliance with Canadian customs regulations.

Documents used along the form

When travelers enter Canada and complete the Declaration Canada E311 form, they are engaging in a necessary step to comply with the Canada Border Services Agency's requirements. This form serves as a primary document for declaring personal goods, currency, and other specific items upon arrival. However, beyond the E311 form, travelers might need to be aware of and potentially prepare several other forms and documents to ensure a smooth entry process into Canada. The following list highlights additional documents often used alongside the E311 form, providing a comprehensive approach to border compliance.

- Personal Identification: A critical component of border crossing, personal identification such as a passport, is required to verify the traveler's identity and citizenship. This documentation is essential for all travelers, including those listed on the Declaration Canada E311 form.

- Visa or Electronic Travel Authorization (eTA): Depending on the traveler's country of origin, a Visa or an eTA may be necessary to enter Canada. This document is linked to the traveler’s passport and is required for visa-exempt foreign nationals traveling to Canada by air.

- Proof of Vaccination: In light of global health concerns, proof of vaccination might be required at the border. This document demonstrates the traveler's compliance with health regulations, particularly in times when public health orders are in place.

- Receipts for Goods Purchased Abroad: Travelers claiming goods or receiving exemptions based on their time away from Canada need to provide receipts for purchased items. This documentation helps in assessing the value of the goods and determining duty and taxes.

- Permits for Restricted Goods: For individuals carrying goods that are restricted or require special permission (e.g., firearms, certain foods, plants, or animal products), the appropriate permits must be presented upon entry to Canada.

- Vehicle Registration: If traveling by a personal vehicle, proof of ownership or vehicle registration should be available. This proves the legal ownership and right to operate the vehicle in Canada.

Proper preparation and documentation streamline the process of entering Canada, ensuring compliance with Canadian laws and regulations. While the Declaration Canada E311 form is a pivotal part of this process, the other documents listed are equally important in various contexts, helping to avoid delays or complications at the border. Travelers should ensure all their documentation is complete and readily available when arriving in Canada to enjoy a smooth entry process.

Similar forms

The U.S. Customs and Border Protection Declaration Form 6059B is quite similar to Canada's E311 form, as both forms are used by travelers entering the respective countries to declare items they are bringing across the border. Each form requires the traveler to list items that may be subject to duties or restrictions, like alcohol, tobacco, and gifts, ensuring compliance with national laws.

The Australian Incoming Passenger Card is another counterpart, requiring travelers to declare goods for border control purposes, including food, plant material, and animal products, paralleling the Canadian emphasis on controlling the entry of potentially harmful substances.

The European Union Passenger Locator Form, while primarily aimed at tracking the movement of travelers to prevent the spread of diseases, shares similarities with the E311 in collecting information from travelers for regulatory and safety purposes.

New Zealand's Passenger Arrival Card asks visitors and returning residents to declare risk goods similar to Canada's requirements for meats, fruits, vegetables, and other potential biohazards, underscoring biosecurity concerns.

India's Arrival Card for Foreigners serves an analogous function, requesting personal information and details about the visit, similar to Canada's E311 form which collects data to facilitate immigration and customs processes.

The United Kingdom's Landing Card, although recently phased out for some travelers, was used to collect arrival information from visitors outside the European Economic Area, focusing on personal identification and travel details, akin to the E311 form's objectives.

Singapore's Disembarkation/Embarkation Card collects information on visitors’ health and travel history, reflecting similar goals as Canada's declaration form in terms of public safety and regulatory compliance.

Japan's Customs Declaration Form, required for both visitors and returning residents, involves declaring currency and certain restricted items, highlighting the international focus on monitoring the cross-border flow of goods and currency parallel to Canada’s practices.

Brazil’s Customs Declaration Form for Travelers, mandatory for both entering and departing passengers, involves declaring goods that exceed duty-free allowances, resonating with the Canadian approach to managing imported goods for taxation and control purposes.

South Africa’s Traveler Card requires incoming and outgoing travelers to declare goods, currency, and agricultural products among other items, underscoring a global emphasis, shared by Canada’s E311, on controlling goods that cross international borders.

Dos and Don'ts

Filling out the Declaration Canada E311 form accurately is crucial for smooth passage into Canada. Here are some dos and don'ts to keep in mind:

Dos:- Print all information in capital letters to ensure clarity and legibility.

- List up to four people living at the same address on one card to streamline the declaration process.

- Accurately report currency and/or monetary instruments totaling CAN$10,000 or more that are in your actual possession or baggage.

- Declare all goods, including gifts, alcohol, and tobacco, as per the allowances mentioned for visitors and residents returning to Canada.

- Check the boxes appropriately to indicate whether you are bringing into Canada items such as firearms, commercial goods, or food-related products.

- For residents of Canada, correctly list the value of goods purchased or received abroad, including the specific dates of departure and return.

- Ensure that every traveler age 16 and older signs the form to certify that the declaration is true and complete.

- Avoid providing false or incomplete information, as this could lead to seizure actions, monetary penalties, and/or criminal prosecution.

- Do not guess the value of items you are declaring; ensure you have receipts or reasonable estimates ready.

- Refrain from listing more than four individuals on one card, even if they live at the same address but exceed the number limit.

- Don't fold the Declaration Card, as indicated on the form, to maintain its integrity for processing.

- Do not overlook your rights under the Privacy Act to access and/or correct your personal information on the form.

- Omit any mention of unaccompanied goods or any agricultural products you're bringing without checking the corresponding box in the form.

- Do not sign the form if you have not reviewed all sections and ensured that each part is completed accurately and truthfully.

By following these guidelines, you can help ensure that your entry process into Canada goes as smoothly as possible, avoiding delays or legal troubles due to inaccuracies or omissions on the Declaration Canada E311 form.

Misconceptions

When it comes to international travel, accurately filling out declaration forms is crucial. In the case of the Declaration Canada E311 form, there are several misconceptions that travelers frequently have. Understanding these misconceptions is key to ensuring a smooth entry process into Canada. Below are nine common misconceptions and explanations to clarify them:

- Only one person per household needs to fill out the form. In reality, while up to four people living at the same address can be listed on one card, each traveler is responsible for their own declaration. This includes the declaration of goods and currency.

- It’s not necessary to declare currency under CAN$10,000. While there is no requirement to declare amounts under CAN$10,000, any currency and/or monetary instruments totaling CAN$10,000 or more must be reported. Failing to do so may lead to penalties.

- Declaring goods will always lead to taxes and duties. Not all declared goods are subject to taxes and duties. There are exemptions and allowances, especially for personal items and gifts within certain value limits.

- Personal information provided on the form is used for tax purposes only. The information collected is used not only for customs and taxation but also may be disclosed to other government departments, police forces, and other countries to enforce Canadian legislation.

- Visitors to Canada have no duty-free allowances. Visitors actually have duty-free allowances for gifts valued at no more than CAN$60 each, excluding alcohol and tobacco. Understanding these allowances can help avoid unnecessary taxes.

- Residents returning to Canada cannot claim duty-free purchases if their trip is less than 24 hours. While goods exceeding CAN$200 in value cannot be claimed under the 24-hour exemption, various exemptions apply for longer stays that include allowances for alcohol, tobacco, and other goods.

- All types of goods are treated the same for duty exemptions. Specific goods have different rules. For example, alcohol and tobacco have specific allowances, and unaccompanied goods are treated differently depending on the length of absence from Canada.

- Items received or purchased abroad are automatically duty-free if below the personal exemption limit. The value of goods, including gifts, alcohol, and tobacco, affects whether they can be brought in duty-free under personal exemptions. The limits vary based on the length of absence from Canada.

- You can only make corrections to your declaration at the border. Individuals have the right to access and make corrections to their personal information under the Privacy Act. This means corrections to declarations can potentially be handled through official channels, not just at the point of entry.

Correctly understanding and navigating the instructions and requirements on the Declaration Canada E311 form is essential for a smooth travel experience. Awareness and compliance with these regulations ensure not only adherence to the law but also a more predictable and less stressful entry process into Canada.

Key takeaways

Understanding the intricacies of the Declaration Canada E311 form is essential for travelers looking to enter Canada. Here are key takeaways to smoothly navigate through this process:

- The Declaration Canada E311 form is designed for the Canada Border Services Agency (CBSA) to identify all travelers entering the country.

- Up to four individuals living at the same address can be listed on one declaration card, streamlining the entry process for families and groups sharing the same residence.

- It's crucial for every traveler to accurately report their personal declaration. This includes declaring any currency and/or monetary instruments totaling CAN$10,000 or more, which are in the traveler's possession or baggage.

- Failure to properly declare goods, currency, and/or monetary instruments can lead to severe consequences, including seizure actions, monetary penalties, and potentially criminal prosecution.

- The information requested on the form is collected under the authority of Section 12 of the Customs Act. It serves multiple purposes, including facilitating compliance with imported goods regulations and enabling the collection of duties and taxes on imported items.

- Visitors to Canada should be aware of duty-free allowances, which include gifts valued at no more than CAN$60 per item (excluding alcohol and tobacco) and specific allowances for alcohol and tobacco products based on quantity and type.

- Canadian residents returning to Canada have different exemption levels based on the duration of their absence from Canada, affecting how much they can bring back without incurring duties or taxes. These exemptions include allowances for alcohol and tobacco after being away for 48 hours or more.

- All information provided on the form can be disclosed to various government departments and agencies for the purposes of administering or enforcing Canadian legislation. However, individuals have rights under the Privacy Act regarding access to and correction of their personal information.

Completing the Declaration Canada E311 form accurately is vital for ensuring a smooth entry into Canada, avoiding delays, and preventing legal issues related to undeclared goods or currencies.

Popular PDF Forms

Tc 96-182 - The procedural guidance it offers for original filing, continuation, and termination streamlines the lien documentation process.

Poker Run Sheets - A variety of poker hands, from royal flush to high card, create a competitive playing field.