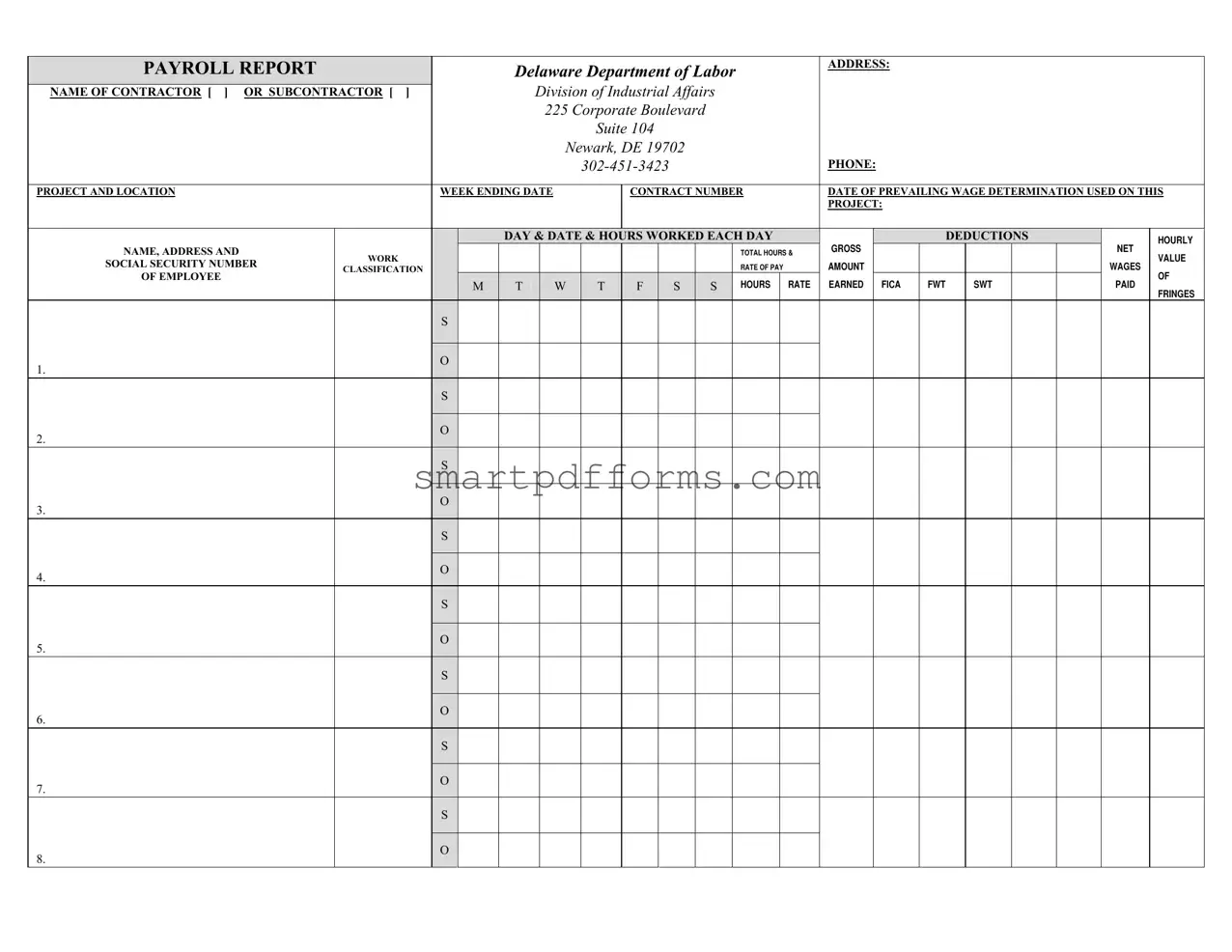

Blank Delaware Payroll Report PDF Template

The Delaware Payroll Report form serves as a crucial document for contractors and subcontractors operating within the state, detailing the wages paid to employees on specific projects. This comprehensive form, maintained by the Delaware Department of Labor, requires the submission of various pieces of information including contractor or subcontractor identification, project location, weekly ending date, contract number, and prevailing wage determinations. Additionally, it captures day-to-day details such as hours worked, gross to net wages, deductions, and the hourly rate of pay alongside employee classifications. The form plays a significant role in ensuring compliance with the prevailing wage regulations of the State of Delaware, illustrating the commitment to fair labor practices. It mandates the listing of any applicable fringe benefits, further underscoring the importance of accuracy in reporting. Violations, such as failure to submit these reports weekly, can result in substantial fines. Its strict requirements for truthful and complete submissions, verified by a signatory party under oath, highlight the state's effort to protect workers’ rights and enforce labor laws effectively. With spaces for sworn attestations by the reporting party and verification by a notary public, the form underscores the legal obligations of employers to adhere to set wage standards, aiming to foster a transparent and fair work environment.

Preview - Delaware Payroll Report Form

|

PAYROLL REPORT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of Labor |

ADDRESS: |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

DelawareDepartmentof Labor |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

NAME OF CONTRACTOR [ ] OR SUBCONTRACTOR [ ] |

|

|

|

|

|

|

|

|

|

State of Delaware |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

Division of Industrial Affairs |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Department of Labor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

225 Corporate Boulevard |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

4425 N. Market Street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Suite 104 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

Wilmington, DE 19802 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Newark, DE 19702 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PHONE: |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

PROJECT AND LOCATION |

|

WEEK ENDING DATE |

|

|

|

|

|

|

CONTRACT NUMBER |

DATE OF PREVAILING WAGE DETERMINATION USED ON THIS |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROJECT: |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

DAY & DATE & HOURS WORKED EACH DAY |

|

|

|

DEDUCTIONS |

|

HOURLY |

|||||||||||||||||||||||

|

NAME, ADDRESS AND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL HOURS & |

GROSS |

|

|

|

|

|

|

NET |

|

|

|

WORK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VALUE |

|||

|

SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMOUNT |

|

|

|

|

|

|

WAGES |

||

|

CLASSIFICATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RATE OF PAY |

|

|

|

|

|

|

|

||||

|

OF EMPLOYEE |

|

|

|

M |

|

|

T |

|

|

W |

|

|

T |

|

|

F |

|

|

S |

|

|

S |

|

|

HOURS |

RATE |

EARNED |

FICA |

FWT |

|

SWT |

|

|

PAID |

OF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FRINGES |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

DATE

I, |

|

|

|

(Name of signatory party) |

|

(Title) |

|

do hereby state: |

|

|

|

1.That I pay or supervise the payment of persons employed by

|

|

|

|

|

|

|

|

|

|

on the |

||

(Contractor or Subcontractor) |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

: |

|||

(public project) |

|

|

|

|

|

|

|

|

||||

that during the payroll period commencing on the |

|

day of |

||||||||||

|

, 20 |

|

and ending on the |

|

|

day of |

||||||

|

|

|

|

|

|

|

|

|

||||

|

, 20 |

|

|

|

all persons employed on said project |

|||||||

have been paid the full weekly wages earned, that no rebates have been or will be made either directly or indirectly to or on behalf of the contractor or subcontractor from the full weekly wages earned by any person and that no deductions have been made either directly or indirectly from the full wages earned by any person, other than permissible deductions as defined in the prevailing wage regulations of the State of Delaware.

2.That any payrolls otherwise under this contract required to be submitted for the above period are correct and complete; that the wage rates for laborers or mechanics contained therein are not less than applicable wage rates contained in any wage determination incorporated into the contract; that the classifications set forth therein for each laborer or mechanic conform with the work performed.

3.That any apprentices employed in the above period are duly registered in a bona fide apprenticeship program registered with a state apprenticeship agency recognized by the Bureau of Apprenticeship and Training, United States Department of Labor, and that the worksite ratio of apprentices to mechanics does not exceed the ratio permitted by the prevailing wage regulations of the State of Delaware.

An employer who fails to submit sworn payroll information to the Department of Labor weekly shall be subject to fines of $1,000.00 and $5,000. for each violation.

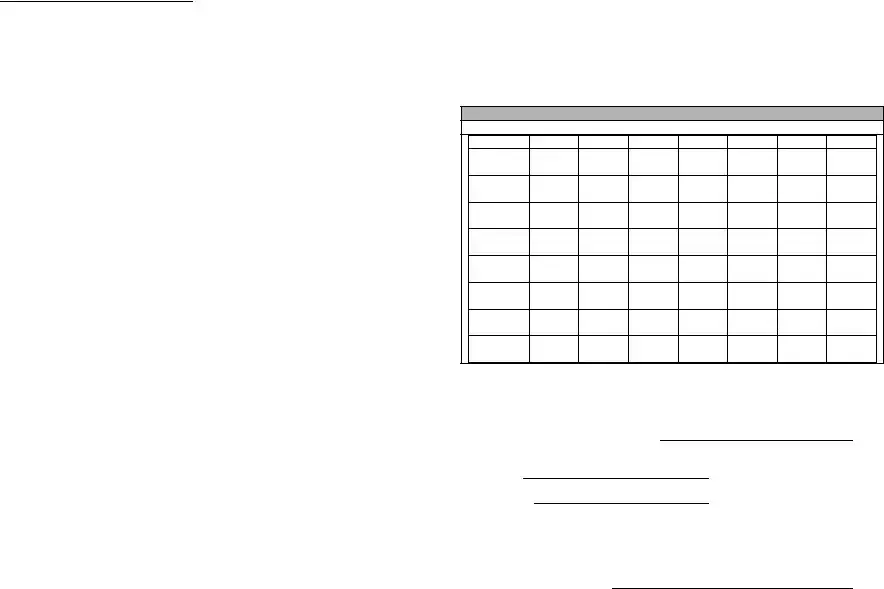

List only those fringe benefits:

For which the employer has paid; and

Which have been used to offset the full prevailing wage rate.

(See Delaware Prevailing Wage Regulations for explanation of how hourly value of benefits is the be computed.)

HOURLY COST OF BENEFITS

(List in same order shown on front of record)

Employee

1.

2.

3.

4.

5.

6.

7.

8.

I hereby certify that the foregoing information is true and correct to the best of m knowledge and belief. I realize that making a false statement under oath is a crime in State of Delaware

Signature

STATE OF

COUNTY OF

SWORN TO AND SUBSCRIBED BEFORE ME, A NOTARY PUBLIC,

THIS |

|

DAY OF |

|

, A.D. 20 |

|

. |

Notary Public

Form Data

| Fact Name | Fact Detail |

|---|---|

| Purpose | The Delaware Payroll Report form is used to report wages, hours worked, and deductions for employees on public projects in the State of Delaware. |

| Governing Law | This form is governed by the prevailing wage regulations of the State of Delaware. |

| Filing Requirement | Employers must submit this payroll information to the Delaware Department of Labor weekly. |

| Penalties for Non-Compliance | Employers failing to submit payrolls as required may face fines ranging from $1,000 to $5,000 for each violation. |

| Apprenticeship Clause | Any apprentices employed must be registered in a program recognized by the Bureau of Apprenticeship and Training, U.S. Department of Labor, adhering to the state's work-site ratio regulations. |

| Fringe Benefits Reporting | Employers must list fringe benefits that have been paid and used to offset the full prevailing wage rate, as per state regulations. |

Instructions on Utilizing Delaware Payroll Report

Filling out the Delaware Payroll Report form requires attention to detail and a thorough understanding of the project and its workers. This form is crucial for reporting accurate labor and payroll data to the Delaware Department of Labor. It ensures that workers are paid according to the prevailing wage regulations set forth by the State of Delaware. The process involves listing detailed information about each employee, including hours worked, wages earned, and deductions made. By completing this report diligently, employers fulfill their legal obligations and support the enforcement of fair labor practices. Here are the step-by-step instructions for completing the form:

- Start by entering the Department of Labor Address relevant to your location from the options provided.

- Indicate whether you are the contractor or subcontractor by checking the appropriate box.

- Fill in the Name of Contractor or Subcontractor, ensuring it matches the name registered with the State.

- Provide the Project and Location, including a detailed description if necessary.

- Include the Week Ending Date, to represent the final day of the reporting payroll period.

- Enter the Contract Number linked to the project for identification.

- Specify the Date of Prevailing Wage Determination used for this project, referencing the official determination date.

- List each employee’s details including Name, Address, Social Security Number, and other required personal information.

- Record the Day & Date & Hours Worked Each Day meticulously for accurate payroll calculation.

- Input the Gross and Net Wages earned by each employee, alongside the corresponding deductions such as FICA, FWT, SWT, etc.

- Detail the Hourly Rate of Pay and Classification for each employee, ensuring they match the prevailing wage rates for their job titles.

- Itemize any Deductions made, ensuring only permissible deductions as defined by the State of Delaware are included.

- For the section on Fringe Benefits, list the benefits paid by the employer that are used to offset the full prevailing wage rate.

- Ensure the Hourly Cost of Benefits is listed in conformity with the State of Delaware's prevailing wage regulations.

- The signing party must then fill in their name and title in the declaration part, affirming the accuracy and compliance of the information provided.

- Complete the form with the Signature of the signatory party, and the date of signing.

- The form must be notarized, so it should be signed in the presence of a notary public who will then also sign and stamp the form.

After finishing the form, it's important to review all entries for accuracy and completeness. Any inaccuracies can lead to fines and penalties, affecting both the employer's standing and the welfare of the employees. Once the form is filled out and verified for accuracy, it should be submitted to the relevant Department of Labor address listed at the top of the form. Staying compliant with these steps not only fulfills legal obligations but also contributes to a fair and just working environment in the State of Delaware.

Obtain Answers on Delaware Payroll Report

Welcome to the FAQ section about the Delaware Payroll Report form. This resource is designed to assist employers in understanding and completing the form accurately.

- What is the Delaware Payroll Report form and who needs to fill it out?

The Delaware Payroll Report form is a document required by the Delaware Department of Labor from all contractors or subcontractors working on public projects within the state. This form is essential for ensuring that employees working on these projects are paid in accordance with the prevailing wages determined by the state. It captures detailed information about each employee, including hours worked, earnings, deductions, and the classification of work performed. Any contractor or subcontractor engaged in public projects must fill out and submit this form weekly.

- What information is required on the Delaware Payroll Report form?

The form requires several pieces of information, including:

- The name and address of the contractor or subcontractor.

- Project location and contract number.

- Name, address, social security number, classification, total hours worked each day, gross and net wages, and deductions for each employee.

- Hourly rate of pay, including the value of any fringe benefits.

Additionally, it requires a declaration from the employer affirming that all obligations regarding wage payments have been fulfilled, compliance with prevailing wage regulations, and the accuracy of the submitted data.

- How do I determine the prevailing wage rate to include on the form?

The prevailing wage rate is determined by the Delaware Department of Labor and must be strictly adhered to for all public works projects. To find the applicable wage rate, contractors must refer to the prevailing wage determination that is issued specifically for their project. This information can typically be obtained from the project’s contracting authority or directly from the Delaware Department of Labor's website. The rate should reflect the classifications of the work performed by each employee.

- Are there penalties for not submitting the Delaware Payroll Report form?

Yes, employers who fail to submit the Delaware Payroll Report form on a weekly basis as required are subject to significant fines. The fines can amount to $1,000.00 for any violation and could be as high as $5,000.00 for subsequent violations. These measures underscore the importance of accurately and promptly completing the payroll form to ensure compliance with state regulations.

- Can fringe benefits be used to meet the prevailing wage rate requirements?

Yes, employers are allowed to count certain fringe benefits towards meeting the prevailing wage rate requirements. However, it's important to note that only those benefits which the employer has actually paid, and that are used to offset the full prevailing wage rate, can be included. The value of these benefits must be calculated hourly and listed on the payroll report form in the order provided. For more detailed guidance on which benefits qualify and how to calculate their hourly value, referring to the Delaware Prevailing Wage Regulations is recommended.

If you have further questions or require assistance with the Delaware Payroll Report form, do not hesitate to contact the Delaware Department of Labor for support.

Common mistakes

Filling out the Delaware Payroll Report form requires attention to detail and a comprehensive understanding of the information being requested. Mistakes can lead to delays in processing or, in some cases, financial penalties. Below are five common errors to avoid:

-

Incorrect or Incomplete Employee Information: One common issue is not fully completing the employee section. This includes missing social security numbers, addresses, and incorrect classification of labor. For accuracy, double-check each entry against your payroll records.

-

Failure to Accurately Report Hours Worked: Reporting the exact hours worked each day for each employee is critical. Mistakes can arise from not accurately tracking overtime or not documenting all the days worked in the week, especially with varying schedules.

-

Incorrect Wage Rates: The form requires that wage rates are not less than the applicable prevailing wage rates. Misinterpreting these rates or failing to update them to reflect current determinations can result in underpayment penalties.

-

Not Properly Documenting Deductions: Not correctly detailing deductions such as FICA, FWT, and SWT is another common error. Ensure that these are accurately calculated and clearly reported to prevent discrepancies between gross and net wages.

-

Omission of Fringe Benefits Information: Lastly, failing to list or incorrectly listing fringe benefits used to meet prevailing wage requirements can be problematic. It's essential to clearly state these benefits as per the instructions and ensure they are correctly calculated and applied.

To avoid these mistakes, thorough review and verification against payroll and project records are essential before submission. This diligence ensures compliance and smooth processing of the Delaware Payroll Report form.

Documents used along the form

When dealing with payroll and employment documentation in Delaware, various forms and documents often accompany the Delaware Payroll Report form, ensuring compliance with state laws and regulations. These documents play a crucial role in maintaining accurate records, ensuring fair labor practices, and providing clear communication between employers, employees, and the state.

- W-4 Form – This IRS form is used by employers to determine the correct amount of federal income tax to withhold from employees’ wages. Each employee must fill out a W-4 form at the start of employment.

- I-9 Employment Eligibility Verification – Employers use this form to verify the identity and employment authorization of individuals hired for employment in the United States. The I-9 form is required for all U.S. employees, and the documentation must be retained by the employer.

- State of Delaware New Hire Reporting Form – This form must be completed by employers for each new employee or rehired employee. It is used to report new hires to the state for the purpose of enforcing child support orders.

- Request for Prevailing Wage Determination (PWD) – Before starting a project subject to prevailing wage rates, employers can use this form to request a prevailing wage determination from the Delaware Department of Labor. This ensures that wages paid on public works projects are compliant with state laws.

- Certified Payroll Records – While the Delaware Payroll Report form is a key component, employers must also maintain certified payroll records that provide a detailed account of wages paid to each worker on public works projects. These records verify compliance with prevailing wage laws and are subject to review by the Delaware Department of Labor.

Employers must ensure these documents are accurately completed, maintained, and submitted as required to comply with Delaware state laws and federal regulations. Handling these forms properly not only protects the business from potential fines and penalties but also supports ethical labor practices and promotes transparency within the workforce.

Similar forms

The Delaware Payroll Report form serves as a crucial document in ensuring compliance with labor laws and regulations, specifically concerning wages, benefits, and working hours. Several other documents share similarities in purpose, structure, or required information with this form:

- W-2 Form (Wage and Tax Statement): Like the Delaware Payroll Report, the W-2 Form is essential for reporting an employee's annual wages and the taxes withheld from their paycheck. Both documents require detailed employee information, although the W-2 is used for annual tax purposes.

- W-4 Form (Employee's Withholding Certificate): This IRS form is completed by employees to indicate their tax situation to the employer, similar to how the Delaware Payroll Report requires information relevant to wage deductions. The W-4 influences the data that will appear in payroll reports and deductions executed.

- I-9 Form (Employment Eligibility Verification): The I-9 verifies an employee's legal right to work in the United States, requiring personal and identification information similar to what is collected in the Payroll Report for identification and compliance purposes.

- Form 941 (Employer's Quarterly Federal Tax Return): This form is used to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks and is similar to the Payroll Report in that it details wages paid and deductions made, albeit on a quarterly basis.

- Certified Payroll Report: Required on federally funded projects, this report proves that workers are being paid the prevailing wage as determined by the Department of Labor, similar to the Delaware Payroll Report's function in ensuring compliance with state wage regulations.

- Employee Benefit Plan Enrollment Forms: These forms, which employees complete to enroll in health insurance, retirement plans, etc., tie in with the Payroll Report’s section on fringe benefits, detailing what benefits are provided and their cost.

- Overtime Authorization Forms: These documents authorize and record overtime work, a critical aspect of payroll management mirrored in the Payroll Report's recording of hours worked each day, including overtime.

- Time-off Request Forms: Similar to how the Payroll Report tracks the hours worked within a week, these forms document approved absences, which ultimately affect payroll calculations, especially in the case of paid time off.

- Direct Deposit Authorization Forms: This authorization mirrors the Payroll Report’s role in ensuring the correct distribution of earned wages by gathering necessary banking information for paycheck deposits.

Despite the differences in specific objectives or the frequency of submission, these documents collectively support a comprehensive payroll system, ensuring legal compliance, accurate wage distribution, and transparent labor practices. Each plays a distinct role yet complements the information and objectives of the Delaware Payroll Report form.

Dos and Don'ts

When completing the Delaware Payroll Report form, it's critical to be meticulous and thorough to ensure accuracy and compliance with legal requirements. Below are essential dos and don'ts to guide you through the process:

Do:- Verify all information before submission. Double-check the details such as employee names, social security numbers, hours worked, and the classifications to ensure they are accurately reported.

- Use the prevailing wage rates determined for the project. These rates should be applied to the respective classifications of labor and mechanics as stipulated in the contract.

- Maintain records of deductions. Clearly list lawful deductions made from the employees' gross wages, including federal, state taxes, and other permissible deductions.

- Include complete information on fringe benefits. For any fringe benefits used to offset the prevailing wage rate, detail the hourly cost as prescribed by the Delaware Prevailing Wage Regulations.

- Sign and date the form in the presence of a Notary Public. The sworn statement at the end of the form is a legal declaration of the accuracy and completeness of the form.

- Leave any fields incomplete. Each section of the form should be filled out with the appropriate information to avoid rejection or penalties for non-compliance.

- Estimate hours or wages. Only report the actual hours worked and wages paid to avoid discrepancies or potential legal issues.

- Forget to list all employees who worked on the project during the reporting period, including apprentices and subcontracted workers, if applicable.

- Ignore deadline submissions. Late submissions can lead to fines as indicated, ensuring weekly reports are submitted on time is crucial.

- Make unauthorized deductions from wages. Only deductions that comply with prevailing wage regulations and have been transparently communicated to employees are permissible.

By adhering to these guidelines, you will help ensure that your Delaware Payroll Report form is accurately and promptly filled out, maintaining compliance with state labor laws and avoiding potential penalties or fines.

Misconceptions

Delaware's payroll reporting requirements can be complex, leading to some common misconceptions. Let's clear up a few of these misconceptions to ensure compliance and avoid potential fines.

- It's only for big companies. Some believe that the Delaware Payroll Report form is exclusively for large corporations. In reality, any contractor or subcontractor working on a public project in Delaware must submit this form, regardless of their company's size.

- Freelancers are exempt. Another misconception is that freelancers or independent contractors are exempt from being listed on the payroll report. If they are working on the project, their information needs to be included if they directly influence the project's workforce.

- Submission is optional. There's a dangerous misconception that submitting the payroll report is optional. Failing to submit this report on a weekly basis can result in severe fines, highlighting the importance of compliance.

- I can wait to submit until the project is done. Waiting until the end of a project to submit payroll reports is a violation of Delaware's regulations. Reports must be submitted weekly to avoid penalties.

- No need to list fringe benefits. Some employers think fringe benefits do not need to be accounted for in the payroll report. However, the form requires details on fringe benefits for compliance with the prevailing wage regulations of Delaware.

- Apprentices don't need to be included. It's a common mistake to think apprentices are not to be included in the payroll report. All apprentices, as long as they are working on the public project, must be included, and their apprenticeship details accurately reported.

- Address updates are trivial. Neglecting to update the address or contact information on the payroll report might seem minor but can lead to communication issues and non-compliance fines. Accurate and current information is crucial.

- One mistake won't matter. The belief that minor mistakes won't attract penalties is incorrect. Even small errors can lead to fines or the report being rejected. Accuracy is essential in all aspects of the payroll report.

- I can fill it in manually and mail it. Some might think manual completion and postal mailing of the report are sufficient. In reality, the Department of Labor prefers or may require electronic submission for quicker and more secure processing.

Understanding and correcting these misconceptions about the Delaware Payroll Report form are crucial for any contractor or subcontractor. This ensures not only compliance with Delaware's labor laws but also protects against the possibility of fines.

Key takeaways

Filling out the Delaware Payroll Report form accurately is crucial for contractors and subcontractors working on public projects in Delaware. Here are some key takeaways to ensure compliance and avoid penalties:

- Identify Relationship: Clearly indicate whether you are a contractor or a subcontractor at the start of the form, as each has specific reporting obligations.

- Project Information Is Mandatory: Include all requested project details such as the location, week ending date, contract number, and the date of prevailing wage determination. Accurate project information is essential for the Department of Labor to monitor compliance with wage regulations.

- Detailed Employee Information Required: For every employee, you must list their full name, address, social security number, total hours worked, gross and net wages, and any deductions made. This detail is important for verifying that employees are receiving the wages to which they're legally entitled.

- Accurate Classification and Wage Rates: Each worker's job classification and hourly rate of pay must conform to the prevailing wage rates and job titles specified by the state for that project. Misclassification can lead to fines.

- Recording Hours and Earnings: Accurately record the day and date of work alongside hours worked each day, ensuring that overtime rates apply as required.

- Deduction Transparency: Clearly list all deductions made from an employee’s wages, such as FICA, federal withholding tax (FWT), state withholding tax (SWT), and others, to demonstrate compliance with permissible deductions.

- Fringe Benefits and Hourly Costs: If applicable, report any fringe benefits provided to workers, including the total cost. Specify how these benefits offset the prevailing wage rate, as per Delaware Prevailing Wage Regulations.

- Apprenticeship Compliance: If you employ apprentices, they must be registered in a bona fide apprenticeship program. Ensure the worksite ratio of apprentices to mechanics does not exceed state-permitted ratios.

- Legal Attestation: The form requires a signature under oath, attesting to the accuracy and completeness of the payroll records submitted. Falsifying information is a criminal offense in the State of Delaware and is subject to severe fines.

Remember, the Delaware Department of Labor mandates the weekly submission of this payroll information for public projects. Failure to comply can result in hefty fines ranging from $1,000 to $5,000 per violation. Adherence to these guidelines not only ensures compliance but also promotes transparency and fairness in the payment of wages on public works projects.

Popular PDF Forms

Greenwich Association Realtors - The form includes an agreement between the property owner and the broker regarding the payment of rental commissions under various conditions.

Oas Application Form Pdf - Points out the potential financial implications of the Old Age Security pension on personal income tax obligations.

Metroaccess - The instructions make clear the role of healthcare providers in certifying the applicant’s disability.