Blank Dependent Care Receipt PDF Template

Managing the expenses associated with dependent care requires careful attention to detail and adherence to certain procedures, especially when aiming to avail of dependent care benefits through one's employment. A pivotal component of this process is the Dependent Care Receipt form, a document that plays a crucial role in ensuring transparency and accountability in the financial interactions between parents and caregivers. This form serves as a formal acknowledgment of the payment made by parents for services rendered over a specified period. It requires basic information such as the names of the parent and the service provider, the amount paid, and the service period, culminating with the provider's signature. It's essential to note that this form, by itself, is not sufficient for reimbursement purposes. Rather, it must be submitted alongside a Dependent Care Reimbursement Request Form, highlighting the interconnected nature of paperwork required to facilitate the reimbursement process. Such meticulous documentation is not only beneficial for record-keeping but also necessary for verifying the legitimacy of the expenses claimed, ultimately aiding parents in managing the financial aspects of dependent care.

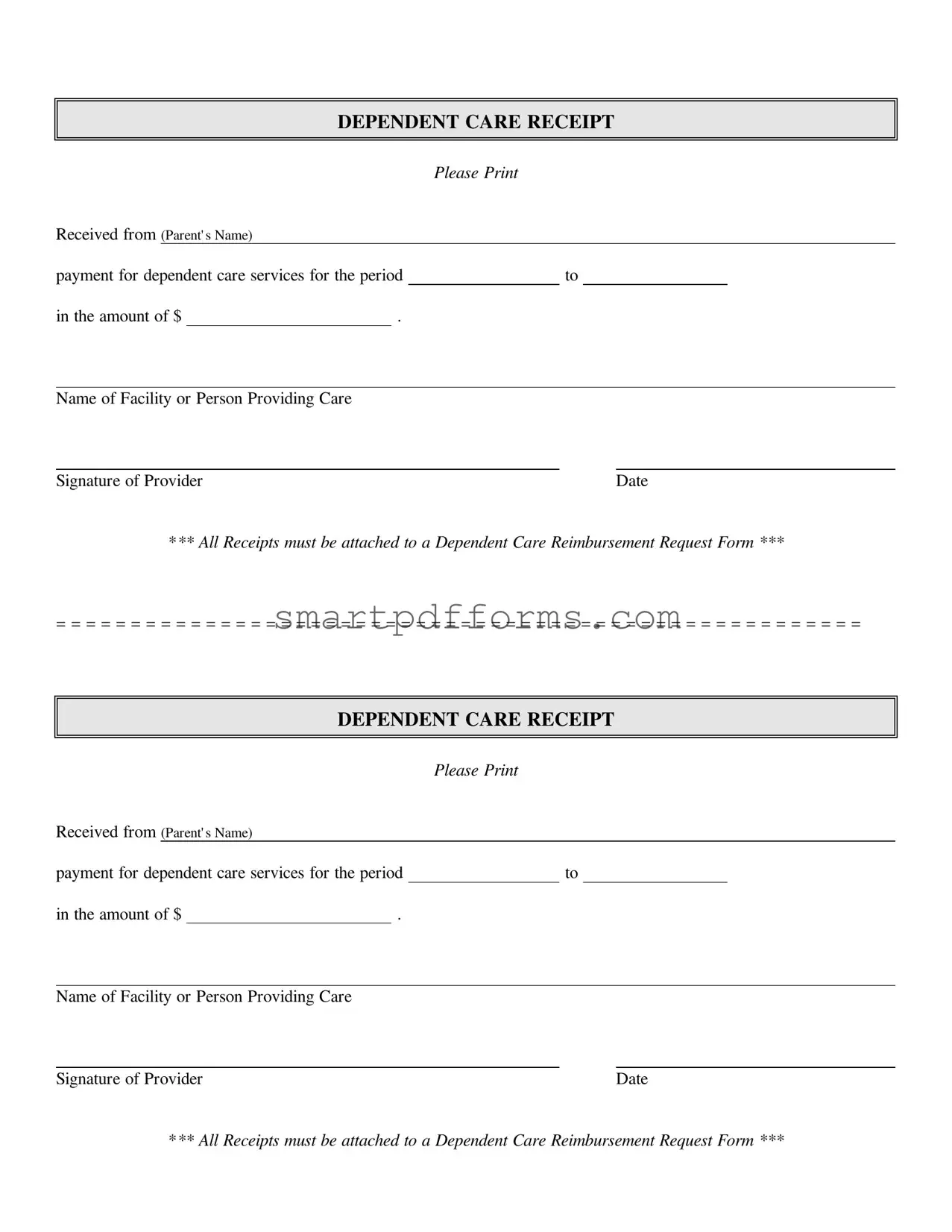

Preview - Dependent Care Receipt Form

|

|

|

|

DEPENDENT CARE RECEIPT |

|||||

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please Print |

|||

Received from (Parent' s Name) |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

||

payment for dependent care services for the period |

|

to |

|||||||

in the amount of $ |

|

|

. |

|

|

|

|

||

Name of Facility or Person Providing Care

Signature of Provider |

Date |

*** All Receipts must be attached to a Dependent Care Reimbursement Request Form ***

= = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = =

|

|

|

DEPENDENT CARE RECEIPT |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please Print |

|

|||

Received from (Parent' s Name) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

payment for dependent care services for the period |

|

to |

|

||||||

in the amount of $ |

|

|

. |

|

|

|

|

|

|

Name of Facility or Person Providing Care

Signature of Provider |

Date |

*** All Receipts must be attached to a Dependent Care Reimbursement Request Form ***

Form Data

| Fact Number | Dependent Care Receipt Fact |

|---|---|

| 1 | This form serves as a formal acknowledgment of payment received from a parent or guardian for dependent care services. |

| 2 | It specifies the period during which the care services were provided. |

| 3 | The amount paid for the care services is clearly stated on the form. |

| 4 | Identification of either the facility or individual provider receiving the payment is required. |

| 5 | The provider's signature is necessary to validate the receipt. |

| 6 | The date of the signature provides a temporal reference for the transaction. |

| 7 | These receipts must be attached to a Dependent Care Reimbursement Request Form to facilitate the reimbursement process. Specific governing laws vary by state related to dependent care services and reimbursements. |

Instructions on Utilizing Dependent Care Receipt

Filling out a Dependent Care Receipt form is a straightforward process, but its importance cannot be overstated. This document serves as a proof of payment for the services provided, and it's a crucial step in ensuring that caregivers are properly compensated. The following steps will guide you through this process, ensuring accuracy and compliance with necessary procedures.

- Start by writing the full name of the parent or guardian who made the payment in the space provided after "Received from."

- Next, fill in the total amount of money paid for dependent care services in the blank space before the dollar sign ($).

- Indicate the start and end date of the service period you are paying for in the spaces provided.

- Enter the name of the facility or person who provided the care in the space allocated for "Name of Facility or Person Providing Care."

- The care provider must sign the form in the "Signature of Provider" section to validate the receipt.

- Finally, the date when the form is filled out should be written in the "Date" section at the end of the form.

Once the Dependent Care Receipt form is completed and signed, remember to attach it to the Dependent Care Reimbursement Request Form. This step is essential for ensuring the documentation is processed seamlessly and reimbursements are made in a timely manner.

Obtain Answers on Dependent Care Receipt

-

What is a Dependent Care Receipt form?

A Dependent Care Receipt is a document that formally acknowledges the payment made by a parent or guardian for dependent care services. This form specifies the amount paid, the service period, the name of the facility or individual providing the care, and includes the provider’s signature. It is a crucial piece of documentation for those seeking to be reimbursed through programs like a Flexible Spending Account (FSA) for child or adult dependent care expenses.

-

Why do I need to attach the Dependent Care Receipt to a Reimbursement Request Form?

Attaching the Dependent Care Receipt to a Dependent Care Reimbursement Request Form is necessary to provide proof of the expenses you're claiming. Organizations or plans that offer dependent care reimbursement need documented evidence of your expenses to process your claim. This procedure ensures that the amounts claimed are accurately reflective of the services received, and it helps prevent fraudulent claims. It's a standardized step to verify and facilitate your reimbursement process.

-

How do I fill out a Dependent Care Receipt form?

- Start by printing the parent's or guardian’s full name where indicated, identifying the person who made the payment.

- Fill in the specific period during which the dependent care services were provided. This typically includes a start and end date.

- Write the total amount paid for the services in the space provided, ensuring the amount is accurate and corresponds to the period indicated.

- Include the complete name of the facility or individual that provided the dependent care services.

- The care provider must sign the form to validate the receipt. The date when the form is signed should also be included.

Make sure all information is correct and legible to avoid any delays or issues with your reimbursement request.

-

Who needs to sign the Dependent Care Receipt form?

The individual or facility that provided the dependent care services must sign the Dependent Care Receipt form. This signature is a critical part of the document because it confirms that the information provided is accurate and that the payment was indeed received for the services rendered during the specified period. Without this signature, the receipt might not be considered valid for reimbursement purposes.

Common mistakes

When filling out a Dependent Care Receipt form, it's vital to pay attention to detail to ensure accuracy and compliance. Common mistakes can delay reimbursements or cause them to be denied. Here are eight common errors people often make:

- Not printing clearly: A receipt must be legible. If the form is hard to read, it might be processed incorrectly, or worse, rejected.

- Omitting the payment period: Each receipt should clearly state the start and end dates of the service period. Skipping this information can create confusion about what is being claimed.

- Incorrect payment amount: Ensure the payment amount written matches the actual payment made. Mismatched amounts can lead to questioning and potential audit issues.

- Forgetting the provider’s details: The name of the facility or person providing care is crucial. Leaving this section blank or incomplete can invalidate the receipt.

- Missing provider’s signature: A signature is a form of verification. Without it, the form lacks authenticity and will likely be rejected.

- Not including the date: The date when the form was filled out helps in tracking and processing the receipt properly. Missing dates can lead to processing delays.

- Failing to attach the Dependent Care Reimbursement Request Form: The receipt must be attached to a Dependent Care Reimbursement Request Form. Without it, the reimbursement process cannot proceed.

- Mishandling the form: Creases, stains, or tears can make critical information unreadable. Handling the form with care is essential for a smooth processing experience.

Being meticulous when filling out the Dependent Care Receipt form is essential. Taking the time to avoid these common mistakes can streamline the reimbursement process, ensuring that you receive your funds in a timely and hassle-free manner.

Documents used along the form

When managing dependent care, especially for tax purposes or reimbursement from flexible spending accounts, a Dependent Care Receipt form is crucial. However, this form is just one piece of the puzzle. Several other documents often work alongside this form to provide comprehensive proof and justification for dependent care expenses. Understanding these documents can help ensure that all financial aspects of dependent care are properly recorded and accounted for.

- Dependent Care Reimbursement Request Form: This document is mentioned directly on the Dependent Care Receipt form. It is used to formally request reimbursement for dependent care expenses from an employer or a flexible spending account. It typically requires detailed information about the dependent care provided, including attached receipts.

- W-10 Form (Dependent Care Provider's Identification and Certification): This IRS form is used to collect the taxpayer identification number (TIN) of the care provider. It's an essential document for verifying the legitimacy of the care provider for tax purposes.

- Form 2441 (Child and Dependent Care Expenses): For individuals who are planning to claim the Child and Dependent Care Credit on their taxes, this form is necessary. It details the expenses incurred for the care of qualifying individuals, helping taxpayers calculate the credit amount.

- Employment Verification Letter: If the dependent care expense is necessary due to employment reasons, having a letter from an employer that verifies employment status and work hours can be helpful, especially if questioned by the IRS.

- Bank Statements or Check Stubs: These provide additional proof of payment to the care provider. They are useful for verifying the amounts declared on the Dependent Care Receipt and the Reimbursement Request Form.

- Annual Tax Return Documentation: While not directly used with the Dependent Care Receipt, your annual tax return, including all forms related to income, deductions, and credits, might be referenced to ensure that dependent care claims align with reported income and tax liabilities.

For families and guardians, navigating the documentation required for dependent care can be daunting. Yet, each form and document serves a purpose, from ensuring care providers are qualified to maximizing potential tax benefits. Together, these documents create a thorough record that supports the financial investments made into dependent care, safeguarding against inaccuracies and compliance issues.

Similar forms

Medical Expense Receipt: Similar to a Dependent Care Receipt, a Medical Expense Receipt provides proof of payment for medical services. Both forms serve as critical documentation for reimbursement purposes, particularly in situations where individuals seek to claim these expenses through insurance or tax deductions. The key difference lies in the type of services rendered—medical vs. dependent care—but the overarching purpose of validating a financial transaction remains the same.

Childcare Service Contract: This document outlines the terms and conditions between parents and a childcare provider, similar to how the Dependent Care Receipt acknowledges the provision and payment for childcare services. While the contract is focused on the agreement and expectations (such as hours of service, payment terms, and duties), the receipt acts as tangible evidence that the agreed-upon services were provided and compensated for.

Tuition Receipt: A Tuition Receipt is issued by educational institutions upon receiving payment for educational services, paralleling how a Dependent Care Receipt is given after payment for childcare services. Both serve to confirm payment but apply to different services—one for education, the other for care—demonstrating the diversity in service-oriented receipts.

Pet Care Receipt: Reflecting transactional proof similar to a Dependent Care Receipt, a Pet Care Receipt confirms payment for pet sitting, boarding, grooming, or medical services. The principle of documenting service and payment is consistent across both, albeit directed towards the care of animals instead of humans.

Personal Loan Receipt: A Personal Loan Receipt serves as proof of money transferred between two parties, akin to the payment verification role of a Dependent Care Receipt. Although the nature of the transactions differs—loan repayment vs. service payment—both documents are vital for recording financial transactions and may be necessary for legal or tax reasons.

Service Invoice: Similar to a Dependent Care Receipt, a Service Invoice specifies the services provided, their cost, and confirms that payment was made. Invoices are commonly used across a wide range of services and industries as a request for payment, while the dependent care receipt specifically acknowledges payment received for care services.

Rent Receipt: A Rent Receipt acts as confirmation of payment for the use of property, akin to how a Dependent Care Receipt confirms payment for dependent care services. Both are simple yet essential documents for recording transactions, providing proof of payment that can support claims for deductions or rebates on income taxes.

Donation Receipt: Like a Dependent Care Receipt, a Donation Receipt is issued to acknowledge receipt of a specific amount of money, but in this case, for charitable contributions. Both documents serve a similar function in providing a written record of financial transactions, though their purposes diverge into care services and charitable giving, respectively.

Dos and Don'ts

Filling out a Dependent Care Receipt form accurately is crucial. It ensures that you are reimbursed correctly for your dependent care expenses. Below are guidelines on what you should and shouldn't do when completing this form.

What You Should Do:

- Print Clearly: Ensure all information is written legibly. This makes it easier for the person processing the form to understand the entries, reducing the risk of errors.

- Specify the Period of Service: Clearly indicate the start and end dates of the service period. This detail helps in verifying the period for which the payment was made.

- Include Accurate Payment Information: Enter the exact amount paid for the care services. Correct figures are important for accurate reimbursement and record-keeping.

- Attach to a Dependent Care Reimbursement Request Form: As noted on the form, always attach the receipt to the Dependent Care Reimbursement Request Form. This step is crucial for processing your reimbursement.

What You Shouldn't Do:

- Use Pencil: Avoid using pencil when filling out the form. Pencil marks can easily be erased or smudged, leading to inaccuracies or questions about the form’s authenticity.

- Leave Sections Blank: Do not skip any sections. If a section does not apply, write "N/A" (not applicable) to indicate this. Incomplete forms may delay processing.

- Forget the Provider’s Signature: The signature of the person or facility providing care is mandatory. A missing signature can invalidate the receipt.

- Detach the Receipt from the Reimbursement Form: Keep the receipt attached to the Reimbursement Request Form until submitted. This helps in ensuring that all your documents stay together and are processed as a unit.

Misconceptions

There are several common misconceptions about the Dependent Care Receipt form that need clarification to ensure both providers and parents understand its importance and the correct way to use it.

- Only formal care facilities need to provide receipts: Some believe that only daycare centers or formal after-school programs need to issue these receipts. However, any individual or entity that provides care services and receives payment for those services must provide a Dependent Care Receipt.

- Handwritten receipts are not acceptable: It's often thought that receipts must be printed or come from a software system to be valid. The truth is, as long as all required information is present and legible, handwritten receipts are perfectly acceptable.

- Receipts are only necessary for tax purposes: While it's true that these receipts are crucial for tax filing, especially for claiming the Child and Dependent Care Credit, they also serve as a record of payment for both parties in case of disputes or misunderstandings about payment amounts or periods covered.

- Personal information is not required on the receipt: A misconception exists that the receipt need only include the amount and the date. However, including the parent's name, the period the service covers, and the provider's name and signature ensures the receipt is comprehensive and can be linked to specific care periods and individuals.

- All receipts must be submitted at the end of the year: Parents often believe all receipts have to be collected and submitted with their tax return at year-end. In reality, many dependent care flexible spending account (FSA) plans require receipts to be submitted periodically for reimbursement throughout the year.

- Electronic signatures are not allowed: With the increasing use of digital documentation, there's a misconception that electronic signatures are not valid on a Dependent Care Receipt. Electronic signatures are indeed acceptable, as long as they follow the provider's legal requirements for validity.

- The amount paid doesn’t need to be exact: Sometimes, there's a belief that an approximate amount is sufficient. However, for accuracy in tax deductions and reimbursements, the exact amount of payment should be recorded on the receipt.

- A receipt is not required if payment is made by check: It's mistakenly thought that if payment is made via check, the cancelled check can serve as a receipt. Despite the check serving as proof of payment, a detailed receipt is still needed to prove that the payment was for dependent care services rather than for other purposes.

By dispelling these misconceptions, caregivers and parents can ensure that the process of documentation and reimbursement for dependent care services goes smoothly for both parties.

Key takeaways

Filling out the Dependent Care Receipt form correctly is essential for individuals to get reimbursed for dependent care expenses. Below are key takeaways to ensure the process is handled efficiently and accurately:

- Complete All Required Fields: Information such as the parent's name, payment amount, and the period during which the services were provided must be clearly filled out. Additionally, the name of the facility or person providing care is crucial for the form's validity.

- Signature Is Mandatory: The care provider's signature is a vital component of the form. It serves as a verification of the services provided and the amount received for those services. Ensure this section isn't overlooked.

- Attach All Receipts: The form explicitly states that all receipts must accompany a Dependent Care Reimbursement Request Form. This is to document and verify the expenses claimed for reimbursement. Without attaching the necessary receipts, the request may be delayed or denied.

- Keep Copies: For your records, it's advisable to keep copies of the filled-out form along with the receipts. This practice helps in tracking expenditures and can be crucial if discrepancies need to be resolved or if the original documents are lost or misplaced.

Adhering to these guidelines will streamline the process of claiming dependent care expenses, ensuring that individuals are reimbursed in a timely and efficient manner.

Popular PDF Forms

Bill of Sale Dmv Pdf - For tax purposes, this form can be invaluable in documenting the sale's financial details and supporting value assessments.

Separation Notice - Georgia employers must complete this notice when an employment relationship ends, regardless of the reason for separation.

Texas Drivers Permit Rules - Successful issuance of a VOE reflects a student's commitment to their education, presenting it as a prerequisite for the freedom and responsibility of driving.