Blank Deposit Refund PDF Template

In the realm of rental agreements, the conclusion of a tenancy period marks a critical juncture where financial accounts between the landlord and tenant are settled, primarily focusing on the security deposit. The deposit refund form serves as a comprehensive statement that encapsulates the intricate process of reconciling the initial deposit against any applicable deductions. This document meticulously itemizes any charges levied against the deposit, such as for repairs or unpaid rent, offering transparency and clarity in what can often be a contentious aspect of the landlord-tenant relationship. Furthermore, it provides essential details like the date, identities of the tenant and landlord, and the rental property address, thus personalizing the document to the specific agreement. It calculates the total amount deducted from the deposit and, importantly, delineates the remainder of the deposit due back to the tenant, including any interest accrued if the deposit held exceeds one month's rent. This interest payment underscores the obligation to treat the tenant's deposit as a trustable amount, albeit under certain conditions. Conversely, the form also outlines the procedure should the tenant owe money beyond the deposit amount, setting a clear deadline for payment before legal actions are considered. Issued by Screening Services Inc., this form not only aims to streamline the closing process of tenancy but also enforces a structure that promotes fairness and accountability in dealings between landlords and tenants. By doing so, it transcends the simplicity of its appearance, embodying a critical step towards ensuring that the end of a lease is concluded with as much clarity and mutual respect as its initiation.

Preview - Deposit Refund Form

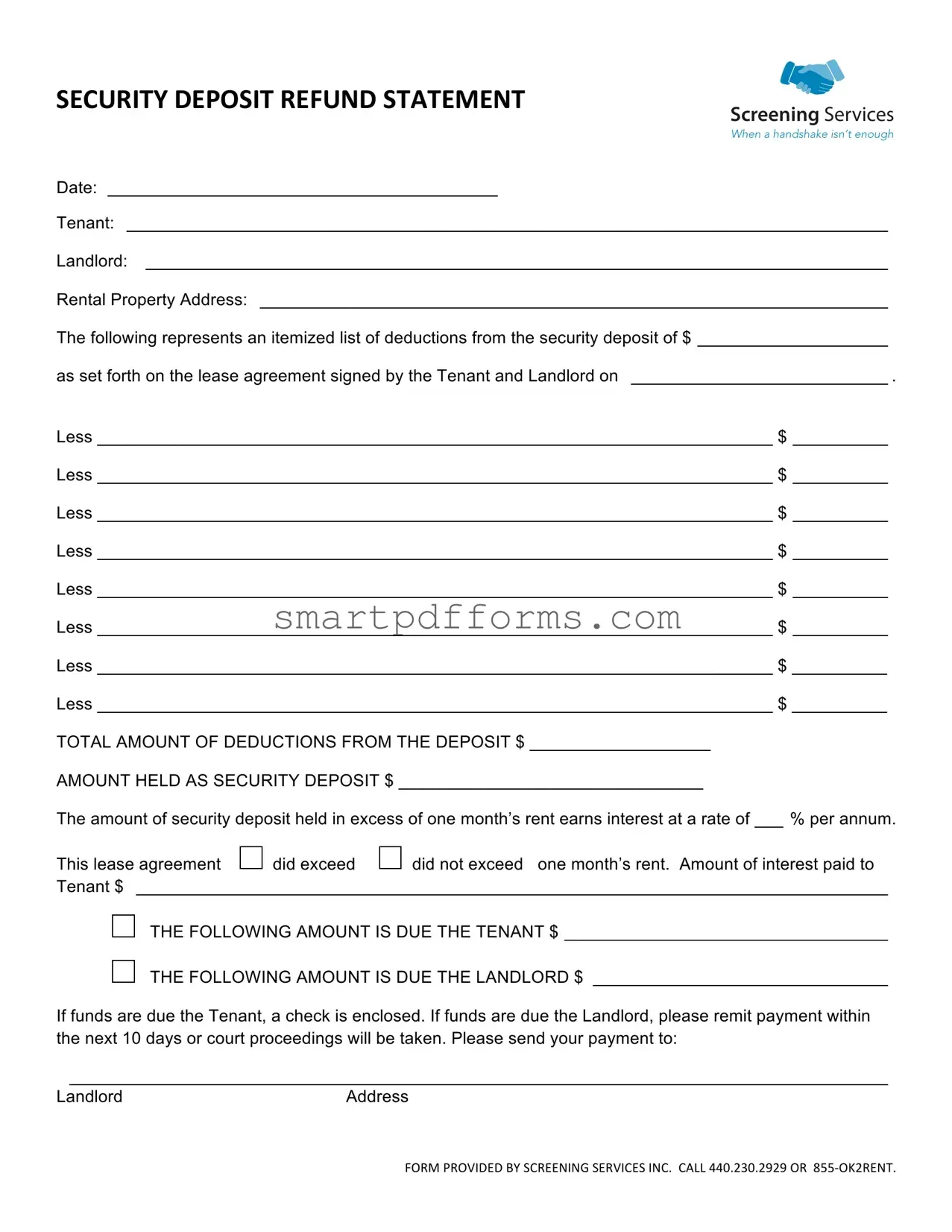

SECURITY DEPOSIT REFUND STATEMENT

SCREENING SERVICES

When a handshake isn’t enough

Date: _________________________________________

Tenant: ________________________________________________________________________________

Landlord: ______________________________________________________________________________

Rental Property Address: __________________________________________________________________

The following represents an itemized list of deductions from the security deposit of $ ____________________

as set forth on the lease agreement signed by the Tenant and Landlord on ___________________________ .

Less _______________________________________________________________________ $ __________

Less _______________________________________________________________________ $ __________

Less _______________________________________________________________________ $ __________

Less _______________________________________________________________________ $ __________

Less _______________________________________________________________________ $ __________

Less _______________________________________________________________________ $ __________

Less _______________________________________________________________________ $ __________

Less _______________________________________________________________________ $ __________

TOTAL AMOUNT OF DEDUCTIONS FROM THE DEPOSIT $ ___________________

AMOUNT HELD AS SECURITY DEPOSIT $ ________________________________

The amount of security deposit held in excess of one month’s rent earns interest at a rate of ___ % per annum.

This lease agreement |

did exceed |

did not exceed one month’s rent. Amount of interest paid to |

Tenant $ _______________________________________________________________________________

THE FOLLOWING AMOUNT IS DUE THE TENANT $ __________________________________

THE FOLLOWING AMOUNT IS DUE THE LANDLORD $ _______________________________

If funds are due the Tenant, a check is enclosed. If funds are due the Landlord, please remit payment within the next 10 days or court proceedings will be taken. Please send your payment to:

______________________________________________________________________________________

Landlord |

Address |

|

FORM PROVIDED BY SCREENING SERVICES INC. CALL 440.230.2929 OR 855‐OK2RENT. |

Form Data

| Fact Name | Detail |

|---|---|

| Purpose | The form is used for providing an itemized list of deductions from a security deposit according to a lease agreement. |

| Parties Involved | It involves the Tenant, who has provided the security deposit, and the Landlord, who held and possibly deducted from the deposit. |

| Property Information | Requires the address of the rental property for which the deposit was provided. |

| Deductions Itemization | Lists all deductions made from the security deposit with individual amounts. |

| Deposit and Deductions Summary | Summarizes total deductions and showcases the initial amount of the security deposit. |

| Interest on Deposit | Includes provisions for interest payments on security deposits held in excess of one month’s rent. |

| Governing Law(s) | State-specific laws govern the handling of security deposits and any applicable interest. For precise legality, refer to local state statutes. |

Instructions on Utilizing Deposit Refund

To effectively process a Deposit Refund, thorough documentation and detailed calculations are necessary to ensure transparency and accuracy. A Deposit Refund form serves as a concise breakdown of deductions made from a tenant’s security deposit, in accordance with the terms laid out in the lease agreement. Accurately completing this form is vital for both tenant and landlord, as it facilitates a clear understanding of any charges, refunds, or payments due post-tenancy. Below are steps to properly fill out the Deposit Refund form.

- Fill in the Date at the top of the form with the current date to document when the form is being filled out.

- Enter the Tenant's full name where indicated to specify to whom the security deposit pertains and who is potentially receiving a refund.

- Write the Landlord's full name in the designated area to identify the individual or entity responsible for managing the security deposit and executing the refund or charges.

- Provide the Rental Property Address to clearly identify the property in question regarding the lease and security deposit.

- In the section specifying the original amount of the security deposit, input the total deposit amount that was received from the tenant at the beginning of the lease term.

- Under the itemized list of deductions, detail each deduction made from the security deposit. This includes the reason for the deduction and the corresponding amount. Ensure each item is clearly described, with a dollar amount next to each entry.

- Sum up the total amount of deductions and enter this figure next to TOTAL AMOUNT OF DEDUCTIONS FROM THE DEPOSIT.

- Subtract the total deductions from the original security deposit amount and enter the result next to THE FOLLOWING AMOUNT IS DUE THE TENANT if the tenant is owed money, or under THE FOLLOWING AMOUNT IS DUE THE LANDLORD if the tenant owes the landlord money.

- If applicable, fill in the interest rate agreed upon in the lease and calculate any interest that should be paid to the tenant. This applies if the lease specifies that the deposited amount exceeding one month's rent will accrue interest.

- Specify whether the lease agreement did or did not exceed one month’s rent to clarify the necessity of interest calculations.

- Enter the landlord’s address where the tenant should send any payment due to the landlord, if applicable.

- Verify all the information for accuracy. If the tenant is due a refund, prepare a check for the indicated amount and mention that it is enclosed with the form. If the tenant owes money to the landlord, reiterate the requirement for payment within the specified timeframe to avoid legal proceedings.

Completing the Deposit Refund form with precision is critical to ensuring all parties are fairly treated and aware of any final financial transactions at the end of a lease. It’s a crucial step for landlords to comply with legal requirements and for tenants to understand their rights and obligations regarding the security deposit.

Obtain Answers on Deposit Refund

What is a Security Deposit Refund Statement?

A Security Deposit Refund Statement is a document that outlines the amount of security deposit returned to the tenant by the landlord. It lists any deductions made from the deposit for reasons such as repairs or outstanding rent, and shows the final amount refunded to the tenant or owed to the landlord.

Why do I need a Security Deposit Refund Statement?

This statement is necessary to provide a clear, itemized record of how the security deposit has been applied. It helps avoid disputes between landlords and tenants by detailing any charges or deductions in a transparent manner. For landlords, it’s also a crucial piece of documentation to justify any deductions made from the deposit.

When should this statement be issued?

The timing for issuing a Security Deposit Refund Statement varies by state law, but it is typically required to be sent to the tenant within a set period, often 30 to 60 days after the lease has ended and the tenant has vacated the property.

What can be deducted from a security deposit?

Common deductions include unpaid rent, costs for repairing damage to the property beyond normal wear and tear, and charges for extensive cleaning if the property is left in a much worse state than it was found. It’s important to note that normal wear and tear should not result in deductions from the security deposit.

What if the deductions exceed the security deposit?

If the total amount of deductions for damages, unpaid rent, or other obligations exceeds the security deposit, the statement will show an amount due to the landlord. In this case, the tenant is responsible for paying the additional amount owed.

What is the significance of the interest rate mentioned in the statement?

Some states require that landlords pay interest on held security deposits, particularly if the lease term is beyond a certain duration, typically one year. The statement will specify if the security deposit has earned any interest and the amount of interest to be paid out to the tenant.

What happens if there's a dispute over deductions?

Tenants have the right to dispute any deductions they believe are unfair or incorrect. Disputes should be addressed directly to the landlord first, seeking a resolution. If an agreement cannot be reached, tenants may need to pursue legal action or mediation, depending on the laws in their state.

How is the final refund amount calculated?

The final refund amount is determined by subtracting the total deductions from the original security deposit. If interest is applicable, it will be added to the security deposit before deductions are made. The statement will clearly show whether money is owed to the tenant or the landlord after all calculations are done.

Is it mandatory to provide a Security Deposit Refund Statement?

In most states, yes, it is mandatory for landlords to provide a detailed statement if they have made any deductions from the security deposit. Failure to provide such a statement, or not adhering to state laws regarding security deposits and refunds, can result in legal consequences for landlords.

What should I do if I do not receive my Security Deposit Refund Statement?

If you don’t receive your statement within the time frame mandated by state law, contact your landlord to request it. If the landlord fails to provide the statement or refund any owed portion of the security deposit, you may need to consider legal options, such as small claims court, to recover your funds.

Common mistakes

Not providing the exact date the form was filled out leads to a lack of clarity about when the process started, which can be crucial for adhering to state-specific regulations regarding the timeframe for deposit returns.

Failing to clearly specify tenant and landlord information, including full names and contact details, can create confusion and delay the process, especially in cases where communications need to be made.

Omitting the rental property address or providing an incomplete address may result in uncertainties about the property in question, which could lead to disputes or delays in the refund process.

Not itemizing deductions from the security deposit accurately or completely. This mistake can lead to disputes over the deductions made, with tenants possibly challenging the amounts deducted or the reasons for deductions.

Forgetting to calculate the total amount of deductions and the final amount due to the tenant or landlord accurately can cause financial inaccuracies, potentially leading to legal challenges or the need for correction and reissuance of the refund.

Incorrectly handling the interest calculation on the deposit, especially if the deposit held is in excess of one month’s rent and accrues interest. Misunderstanding state laws regarding interest on security deposits can lead to incorrect refunds or liabilities.

In addition to the above points, people often overlook:

- Ensuring that any amount due to the landlord is clearly stated and justified, to avoid legal issues and disputes.

- Not specifying the method of payment for any amount due to the landlord, which could delay settlements.

- Forgetting to include or incorrectly filling out the landlord's payment address for cases where funds are due to them, potentially delaying any owed payments.

Documents used along the form

When managing rental properties, the Deposit Refund form plays a crucial role in ensuring both landlords and tenants are clear on any deductions made from a security deposit. However, to manage the rental process effectively and protect all parties involved, several other documents are often used alongside the Deposit Refund form. Here's a brief overview of four of these important documents:

- Lease Agreement: This is the primary document that outlines the terms and conditions of the rental arrangement between a tenant and a landlord. It includes details such as the duration of the lease, monthly rent amount, and responsibilities of each party.

- Move-In/Move-Out Checklist: This document is used at the beginning and end of a lease term to record the condition of the rental property. It helps in identifying any changes or damages that occurred during the tenancy, which might affect the security deposit refund.

- Rent Receipt: Every time rent is paid, a rent receipt should be issued by the landlord to the tenant. This serves as a proof of payment and can be important if there is any dispute regarding the payment history.

- Notice of Intent to Vacate: A tenant typically provides this notice to a landlord to indicate their intention to leave the rental property at the end of the lease term or as agreed upon in the lease. It helps landlords prepare for the return of the security deposit and the transition to finding a new tenant.

Together with the Deposit Refund form, these documents create a clear, trackable history of the tenancy and financial transactions related to the lease. They serve to protect the interests of both the tenant and landlord, providing a foundation for a respectful and legal rental arrangement.

Similar forms

Rent Receipt: A rent receipt provides proof of payment for rent, similar to how a Deposit Refund form certifies transactions related to the security deposit. Both documents typically include the date, parties involved (tenant and landlord), and the amount paid or refunded.

Lease Agreement: The lease agreement, like the Deposit Refund form, details the financial and legal arrangements between the tenant and landlord, including the amount of the security deposit, its intended purposes, and conditions under which it is refundable.

Damage Report: This document lists any damages to the rental property, akin to how the Deposit Refund form itemizes deductions from the security deposit for repairs or cleaning.

Property Inspection Checklist: Used before move-in and after move-out, this checklist documents the condition of the rental property, similar to how the Deposit Refund form notes any reasons for withholding part of the security deposit.

Eviction Notice: Although serving a different purpose, an eviction notice shares similarities with a Deposit Refund form in that it is a formal document between a tenant and landlord that can lead to court proceedings if its conditions are not met.

Payment Reminder Letter: This letter reminds the tenant of upcoming or past-due payments. It's comparable to the Deposit Refund form which may request the tenant to remit payment if the deductions exceed the deposit amount.

Final Utility Bill: Just like the Deposit Refund form outlines financial transactions related to the lease, the final utility bill settles accounts for utility use, possibly affecting the total amount refundable from the security deposit.

Moving Out Notice: This notice from the tenant to the landlord specifies the intent to vacate the property, setting the stage for the return of the security deposit and potentially using the Deposit Refund form to finalize this process.

Dos and Don'ts

When filling out the Security Deposit Refund Statement, it’s important to approach the process with diligence and accuracy. This document is a critical part of concluding a rental agreement and ensures that both tenant and landlord obligations are transparently and fairly addressed. Here are eight dos and don'ts to consider:

- Do carefully review the lease agreement before filling out the form. The agreement provides essential details that determine how the security deposit should be handled.

- Do itemize all deductions from the security deposit with clear descriptions and corresponding amounts. This transparency helps in avoiding misunderstandings or disputes.

- Do calculate the interest payable on the deposit if applicable, based on the lease terms and local laws, and clearly indicate the amount on the form.

- Do ensure that the total amount of deductions and the final amount due to the tenant or landlord are accurately calculated and clearly stated.

- Don't leave any fields blank. If a section does not apply, indicate with "N/A" (not applicable) or "0" if no amount is to be entered. Incomplete forms might lead to disputes or processing delays.

- Don't guess or estimate amounts. Use actual figures for all deductions and interest calculations to avoid disputes and potential legal problems.

- Don't ignore the deadline for returning the security deposit or making claims for deductions. Late actions can result in penalties and undermine your position in case of a dispute.

- Don't forget to provide contact details where the tenant can send payments or inquiries if funds are due to the landlord, or where you will be sending the refund check if money is owed to the tenant.

In sum, the thorough and precise filling out of the Security Deposit Refund Statement is crucial. It not only ensures compliance with the lease agreement and local laws but also facilitates a smoother transition for both parties at the end of a tenancy. Paying attention to detail and following these guidelines will help in avoiding common pitfalls and foster a fair resolution.

Misconceptions

There are several misconceptions regarding the Deposit Refund form that tenants and landlords often believe. Understanding the truth behind these misconceptions can ensure both parties manage security deposits and refunds correctly.

Every tenant automatically gets their full deposit back. The security deposit can be subject to deductions for damages beyond normal wear and tear, unpaid rent, and other lease agreement violations.

Deductions are only for physical damage. Deductions can also cover cleaning costs, unpaid utilities, or other charges outlined in the lease agreement.

The landlord has no obligation to itemize deductions. Landlords must provide an itemized list of deductions from the security deposit, explaining each charge.

The form is the same in every state. Security deposit laws can vary by state, affecting how the Deposit Refund form is prepared and what must be included.

Interest on deposits is not mandatory. In some states or lease conditions, if a security deposit held exceeds one month's rent, it may accrue interest that must be paid to the tenant.

There's no deadline for returning the deposit. Landlords typically have a specific deadline by state law to return the deposit or provide a statement of deductions after the lease ends.

Tenants cannot dispute deductions. Tenants have the right to question or dispute deductions they believe are unfair or not in accordance with the lease agreement.

All deposits earn interest. Not all security deposits earn interest. It depends on the lease duration, state laws, and terms agreed upon in the lease.

A form submission means immediate payment. Even after submitting the form, the process might require additional steps, such as verification of the deductions or dispute resolution.

Signing the form waives further claims. Signing a Deposit Refund form or accepting a refund does not necessarily prohibit a tenant from making future claims related to the lease or property condition.

Both tenants and landlords should review their lease agreement and local state laws to properly understand their rights and obligations concerning security deposits and the refund process.

Key takeaways

Understanding the intricacies of the Security Deposit Refund Form is crucial for both tenants and landlords. It outlines the parameters for returning a tenant's security deposit after they have vacated a rental property. Here are six key takeaways regarding filling out and using this form effectively:

- Clarity is Key: Ensuring that the date, names of the tenant and landlord, and the rental property address are filled out clearly and accurately establishes the basic but vital details of the transaction.

- Accurate Deduction Listing: Itemizing deductions from the security deposit must be done with utmost precision. Each deduction should be listed separately along with its corresponding amount, ensuring both parties understand the reasons for any amounts withheld from the deposit.

- Understanding Lease Terms: Acknowledgement of the lease agreement date is crucial. It confirms that both parties recognize the terms under which the security deposit was held, including any stipulations about interest earned on the deposit.

- Calculating Interest: If the lease agreement entitles the tenant to interest on their security deposit, calculating this interest accurately is essential. This applies specifically when the security deposit held exceeds one month’s rent.

- Final Amounts Due: The form helps clarify the final financial settlement between the tenant and landlord. It indicates clearly whether the tenant is owed a refund or if the tenant owes the landlord money for damages exceeding the deposit amount.

- Timely Settlements: The form outlines the expectation for the settlement of any amounts due. If the tenant is owed money, a check should be enclosed with the form. Conversely, if the tenant owes money, it specifies a timeline (usually 10 days) for the tenant to remit payment to avoid court proceedings.

It’s important for both parties to keep a duly filled copy of this form. Not only does it serve as a record of the security deposit handling, but it also provides a clear pathway to resolve any disputes that might arise from the condition of the property at the end of the lease term. Clear communication, backed by documented evidence like the Security Deposit Refund Form, can help prevent misunderstandings and foster a positive landlord-tenant relationship.

Popular PDF Forms

How Long After Qme Settlement - Mandated by law, this form safeguards the rights of workers by ensuring relevant parties receive necessary medical reports.

Texas Title Transfer Form - Option to apply for nontitle registration, catering to vehicles exempt from or ineligible for titling.