Blank Dfas Notification Of Death PDF Template

During the challenging period following the death of a military retiree, it's essential to promptly report the event to the Defense Finance and Accounting Service (DFAS) using the DFAS Notification of Retiree Death form. This process is not only a matter of protocol but also a critical step to ensure the cessation of monthly payments, thereby preventing potential overpayments and the ensuing need for repayment. The form itself is designed to collect comprehensive information about the deceased retiree, along with details concerning the reporting individual and, if applicable, information about the spouse, family members, and beneficiaries of the deceased. It’s structured to be user-friendly, with guidance on navigating through various fields using keyboard shortcuts or a mouse, and clear instructions on the format required for entering data such as names, social security numbers, dates, zip codes, and phone numbers. Moreover, the form acknowledges the possibility of circumstances requiring special attention, thereby including a section for additional comments that the submitter thinks might be helpful. To access and submit the form, individuals might encounter a security certificate warning due to accessing the site from a non-DFAS network computer; however, they are advised to proceed to ensure the form reaches DFAS for processing. Upon successful submission, the form’s prompt reporting facilitates a smoother transition to handling the retiree’s affairs, including the issuance of any owing payments or benefits to survivors, which are communicated through follow-up correspondence from DFAS. For those who need assistance or have questions regarding the completion or submission of the form, DFAS offers support through their customer service representatives.

Preview - Dfas Notification Of Death Form

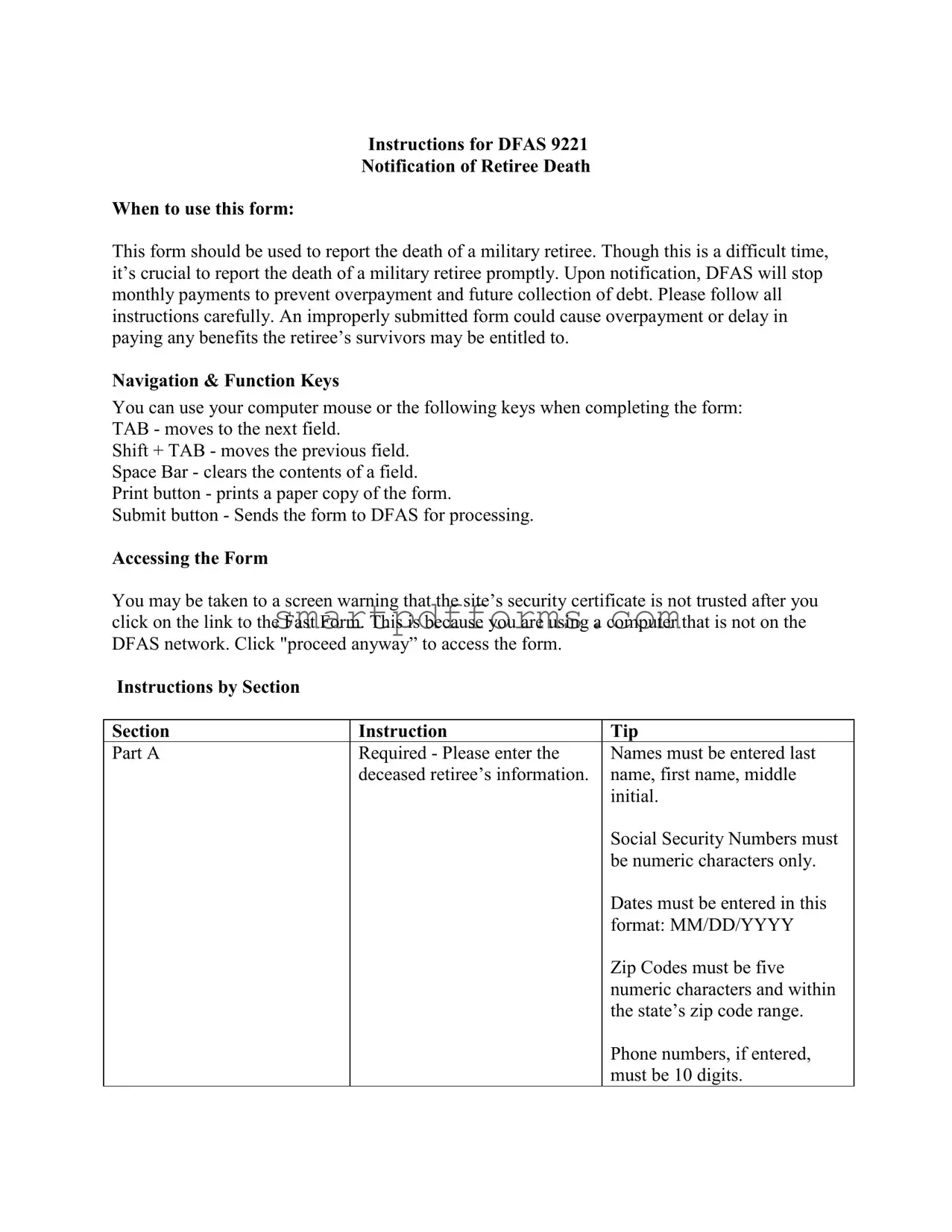

Instructions for DFAS 9221

Notification of Retiree Death

When to use this form:

This form should be used to report the death of a military retiree. Though this is a difficult time, it’s crucial to report the death of a military retiree promptly. Upon notification, DFAS will stop monthly payments to prevent overpayment and future collection of debt. Please follow all instructions carefully. An improperly submitted form could cause overpayment or delay in paying any benefits the retiree’s survivors may be entitled to.

Navigation & Function Keys

You can use your computer mouse or the following keys when completing the form: TAB - moves to the next field.

Shift + TAB - moves the previous field. Space Bar - clears the contents of a field. Print button - prints a paper copy of the form.

Submit button - Sends the form to DFAS for processing.

Accessing the Form

You may be taken to a screen warning that the site’s security certificate is not trusted after you click on the link to the Fast Form. This is because you are using a computer that is not on the DFAS network. Click "proceed anyway” to access the form.

Instructions by Section

Section

Part A

Instruction |

Tip |

Required - Please enter the |

Names must be entered last |

deceased retiree’s information. |

name, first name, middle |

|

initial. |

|

Social Security Numbers must |

|

be numeric characters only. |

|

Dates must be entered in this |

|

format: MM/DD/YYYY |

|

Zip Codes must be five |

|

numeric characters and within |

|

the state’s zip code range. |

|

Phone numbers, if entered, |

|

must be 10 digits. |

Part B |

Required - Please enter your |

Names must be entered last |

|

own information. |

name, first name, middle |

|

|

initial. |

|

|

Zip Codes must be five |

|

|

numeric characters and within |

|

|

the state’s zip code range. |

|

|

Phone numbers, if entered, |

|

|

must be 10 digits. |

Part C |

Optional – If available, please |

Names must be entered last |

|

enter information about the |

name, first name, middle |

|

spouse of the deceased retiree. |

initial. |

|

|

Social Security Numbers must |

|

|

be numeric characters only. |

|

|

Dates must be entered in this |

|

|

format: MM/DD/YYYY |

|

|

Zip Codes must be five |

|

|

numeric characters and within |

|

|

the state’s zip code range. |

|

|

Phone numbers, if entered, |

|

|

must be 10 digits. |

Part D |

Optional – Please enter |

Same as above. |

|

information about the family |

|

|

and beneficiaries of the |

Up to five family members or |

|

deceased military retiree. |

beneficiaries may be entered. |

Part E |

Optional – Please enter any |

|

|

comments you think will be |

|

|

helpful. |

|

Submission and Questions

If you need to clear the form and start over, click “Reset.” After filling out the form, please use the “Print” button at the bottom of the page to print a copy for your records. Then, click “Submit” to send the form to DFAS for processing.

Within

If you need assistance completing your claim forms, please call our customer service representatives at

Form Data

| Fact Name | Detail |

|---|---|

| Form Purpose | The DFAS 9221 form is designed to report the death of a military retiree. |

| Importance of Prompt Reporting | Reporting a retiree's death quickly is crucial to stop monthly payments and prevent future overpayment and debt collection. |

| Submission Instructions | Instructions include using specific keys for navigation and ensuring all requested information is completed accurately to avoid delays or overpayments. |

| Accessing the Form | Users may encounter a security certificate warning when accessing the form from a non-DFAS network computer but are advised to proceed anyway. |

| Submission Details | After submitting the form, it may take 7-10 business days to receive a letter with claim forms for any money due to the retiree or benefits available to survivors. |

| Assistance with the Form | For help completing the form or the claim process, individuals are encouraged to contact customer service representatives at 800-321-1080. |

Instructions on Utilizing Dfas Notification Of Death

After losing a loved one who was a military retiree, one of the essential steps required is notifying the Defense Finance and Accounting Service (DFAS) of their passing. This action is not only a part of handling their affairs with honor and respect but also vital in ensuring the to-financial-transactions ceases, thus preventing any potential overpayments and the challenges they could present. The DFAS Notification Of Death form is a structured way to report this event and set the process in motion for any benefits the survivors might be eligible for. Following the steps accurately is crucial for a smooth process.

Steps for Filling Out the DFAS Notification Of Death Form:

- Access the form by clicking the link provided. If a security certificate warning appears, select "proceed anyway" to continue to the form. This warning might show up because the DFAS form is accessed from outside the DFAS network.

- Begin with Part A by entering the deceased retiree's information. Make sure to input the last name, first name, and middle initial in the designated fields. The Social Security Number should only contain numeric characters, and the dates should follow the MM/DD/YYYY format. Ensure the Zip Code is accurate and phone numbers, if provided, are 10 digits long without any dashes or spaces.

- Move to Part B, where you'll provide your information as the notifier. Follow the same guidelines for names, Social Security Numbers, Zip Codes, and phone numbers as outlined in Part A.

- If you have details about the deceased retiree's spouse, include them in Part C. Again, adhere to the specified formats for names, Social Security Numbers, dates, Zip Codes, and phone numbers.

- In Part D, you have the option to provide information about the family and beneficiaries of the deceased military retiree. You can list up to five family members or beneficiaries, using the same format guidelines as before.

- Part E is an optional section where you can add any comments or additional information you think might be helpful for the DFAS to know.

- Before submitting the form, utilize the “Print” button at the bottom of the page to print a copy for your records.

- Finalize the process by clicking the “Submit” button, sending the form directly to DFAS for processing.

After the submission, you should expect to receive a letter from DFAS within 7-10 business days. This letter will contain claim forms for any money that was due to the retiree or benefits that are now available to the survivors. Should you need any assistance in completing these claim forms or have questions about the process, DFAS customer service representatives are available at 800-321-1080. Following these steps carefully ensures that you have fulfilled your duty in notifying the appropriate agency about the retiree's passing and helps in the smooth transition of benefits to eligible survivors.

Obtain Answers on Dfas Notification Of Death

Frequently Asked Questions about the DFAS Notification Of Death Form

- When should I use the DFAS Notification Of Death form?

- What are the key instructions for completing the form?

Ensure that all required fields in each section are correctly filled out. For names, input the last name, first name, and middle initial. Social Security Numbers should only contain numeric characters.

Enter dates in the format MM/DD/YYYY. Zip codes must be five numeric characters and match the state’s range. When adding phone numbers, include all 10 digits without spaces or dashes.

There's a functionality available for navigation and entry, such as using the TAB key to move forward through fields, Shift + TAB to move backward, and the space bar to clear a field’s contents.

- How do I submit the form after completing it?

- What should I do after submitting the form?

This form is specifically designed for reporting the passing of a military retiree. In the unfortunate event of a retiree's death, it's important to submit this form promptly. Doing so ensures that the Defense Finance and Accounting Service (DFAS) can halt monthly payments, thereby preventing the accumulation of debt through overpayment.

Upon completing the form, you should first click the “Print” button at the bottom of the page to create a hard copy for your records. Afterward, click “Submit” to send the form directly to DFAS for processing. If any assistance is needed or any mistakes were made, the form can be reset and started over before submission.

After the notification has been reported to DFAS, a letter containing claim forms for any money due to the retiree or benefits available to survivors will be sent to you within 7-10 business days. Should you require any help completing these claim forms or have further questions, DFAS's customer service representatives can be reached at 800-321-1080.

Common mistakes

When filling out the DFAS Notification of Death form, it's paramount to avoid common mistakes to ensure the process moves smoothly and to prevent any delays in handling the retiree's affairs. Below is a list of mistakes often made during this important task:

Incorrect Information: Many people inadvertently enter incorrect details for the deceased retiree. This includes mistyping names, social security numbers, dates, and zip codes. Ensuring accuracy in these fields is crucial for the processing of the form.

Overlooking Required Fields: Skipping required sections such as Part A for the deceased retiree’s information or Part B for the informant's information can lead to an incomplete submission, which could delay the form's processing and the execution of benefits.

Format Issues: Dates and social security numbers must be entered in specific formats (MM/DD/YYYY for dates and numeric characters only for social security numbers). Not adhering to these formats can cause the form to be processed incorrectly.

Security Certificate Warning Ignored: A common mistake is hesitation or failure to proceed past the security certificate warning when accessing the form online. Users must click "proceed anyway" to access and complete the form, a step that can sometimes be overlooked or misunderstood due to concerns about internet security.

In addition to these common errors, it’s helpful to keep in mind some general tips for ensuring a smooth submission:

Always double-check the information entered for accuracy before submitting the form.

Use the navigation and function keys as instructed for an easier form-filling experience.

Print a copy of the completed form using the Print button at the bottom of the form for your records.

Do not hesitate to contact DFAS customer service for assistance if any questions arise during the process.

By avoiding these common mistakes and following the additional tips provided, individuals can ensure they are correctly reporting the death of a military retiree, thus preventing overpayment issues and facilitating a smoother transition for the retiree’s beneficiaries.

Documents used along the form

Dealing with the loss of a loved one is profoundly challenging, especially when it involves navigating through the administrative aftermath pertaining to a military retiree. Reporting the death of a military retiree to the Defense Finance and Accounting Service (DFAS) by using the DFAS Notification Of Death form is a critical first step. However, this task is often accompanied by the necessity of handling several other forms and documents. These are essential for ensuring that all relevant benefits, entitlements, and obligations are properly addressed. Let's take a closer look at some of these crucial documents that frequently accompany the DFAS Notification Of Death form.

- Certificate of Death (Official Death Certificate): This official document, issued by a government authority, verifies the death. It is essential for legal and financial matters following a retiree’s passing.

- DD Form 214 (Certificate of Release or Discharge from Active Duty): Cited as proof of military service, this document is indispensable for verifying the retiree's service details and eligibility for benefits.

- Retiree’s Last Will and Testament: This legal document outlines how the retiree’s estate should be distributed and is critical for estate planning and executing the retiree's wishes.

- Life Insurance Policies: Documentation relating to any life insurance policies held by the retiree, crucial for processing claims and determining beneficiaries.

- Marriage Certificate: Required to establish the legal relationship between the retiree and a surviving spouse, often necessary for benefits claims.

- Birth Certificates of Dependents: Needed to identify and verify beneficiaries, especially for dependent children’s benefits.

- Survivor Benefit Plan (SBP) Documents: Essential for determining continued benefits for survivors and outlining the plan chosen by the retiree.

- Power of Attorney or Legal Representation Documentation: If someone is handling affairs on behalf of the deceased retiree or the family, these documents verify their authority to do so.

To navigate the period following a retiree's death, it’s imperative that survivors or responsible parties manage these documents with diligence and care. Each plays a unique role in the wider process of ensuring affairs are in order, benefits are claimed, and the retiree’s wishes are honored. Given the bulk of administrative duties that fall to the bereaved during a time of grief, seeking experienced guidance can provide clarity and ease the burden. Remember, timely and accurate completion of necessary forms and proper management of these documents will facilitate smoother transactions with agencies like DFAS and ensure that survivors receive the support and benefits they are due.

Similar forms

The DFAS Notification Of Death form is an essential document used to report the death of a military retiree. It ensures the proper handling of the retiree's affairs, including the cessation of monthly payments and the initiation of benefits for survivors. Several other documents share similar purposes or processes, each critical in its respective context. Here are seven documents similar to the DFAS Notification Of Death form:

- Life Insurance Claim Form: Similar to the DFAS Notification Of Death form, this document is used to notify an insurance company about a policyholder's death. It initiates the process for the beneficiaries to claim the life insurance benefits, outlining the necessary information and documentation required to prove the claim.

- Social Security Administration (SSA) Notification of Death: This notification informs the SSA about the death of an individual, which is crucial for stopping benefits such as Social Security payments. Like the DFAS form, it prevents overpayments and helps in the transition of benefits to eligible survivors.

- Pension Plan Beneficiary Claim Form: Similar to reporting a death to DFAS for military retirees, this form is used by beneficiaries to claim pension benefits after the death of a retiree from a private or public sector job. It requires detailed information about the deceased and the claimant to process the benefits.

- Bank Account Closure or Change Form due to Death: This document is required to close or modify bank accounts after an account holder's death. It shares similarities with the DFAS Notification Of Death form in that it requires verification of death to protect against unauthorized access and ensure proper disposition of the funds.

- Vehicle Title Transfer Form upon Death: When a vehicle owner passes away, this form facilitates the transfer of ownership. It requires information about the deceased, similar to the DFAS form, to legally transfer the vehicle to a new owner or beneficiary.

- Probate Court Death Notification: This legal document notifies a probate court of an individual's death, initiating the process of estate distribution according to the will or state law. Comparable to the DFAS Notification Of Death form, it's a necessary step in managing the deceased's financial affairs.

- Death Certificate Request Form: While not a notification form, the Death Certificate Request Form is intrinsically linked with forms like the DFAS Notification Of Death. It's used to obtain a death certificate, a crucial document required for many of the aforementioned processes, including closing accounts, transferring ownership, and claiming benefits.

Each of these documents serves a vital role in the administration of an individual's affairs after their death. While their purposes and the entities they are associated with may vary, they collectively facilitate the orderly management of the deceased's legal and financial responsibilities, ensuring rights and benefits are properly accorded to survivors or beneficiaries.

Dos and Don'ts

Completing the DFAS Notification Of Death form is a crucial step during a challenging time. Ensuring accuracy and promptness can help avoid financial complications and delays. Here are five important dos and don'ts to consider:

Do:

Report the death of a military retiree as soon as possible to stop monthly payments and prevent overpayment issues.

Use the correct format for dates (MM/DD/YYYY), Social Security Numbers (numeric characters only), and phone numbers (10 digits).

Enter names with the correct order: last name, first name, and middle initial, ensuring accuracy in identifying the deceased.

Print a copy of the filled form using the "Print" button at the bottom of the page for your records before submitting it.

Call the customer service representatives at 800-321-1080 if you need help completing any part of the form or have questions.

Don't:

Skip any required fields in sections Part A and Part B, as this could delay the processing of the form and necessary benefits.

Ignore the zip code requirements; ensure that they are five numeric characters and within the correct state’s zip code range.

Forget to click “Submit” after filling out the form, as merely printing the form will not forward it to DFAS for processing.

Use symbols or characters other than numeric ones for Social Security Numbers and zip codes.

Proceed with an incomplete form if unsure about any information. It's better to verify details to avoid processing delays or inaccuracies.

Misconceptions

When discussing the DFAS Notification Of Death form, several misconceptions frequently emerge. Understanding these can help ensure the process is handled as efficiently as possible during a challenging time.

It's optional to report a retiree's death: Reporting the death of a military retiree is not optional but a necessary step. This action prevents overpayments and helps in the timely distribution of benefits to survivors.

A delay in reporting has no financial impact: Delaying the report of a retiree's death can lead to overpayments by DFAS, which will need to be recouped, potentially complicating the financial affairs of survivors.

The form is complicated to submit: The form is designed for straightforward completion, with clear instructions for each section to minimize errors and ensure accurate submission.

Personal information is at risk: Security warnings when accessing the form typically occur due to network security settings, not because personal information is at risk. Proceeding as directed is safe.

Any family member can submit the form: While it's crucial for the defense finance account to be notified promptly of a retiree’s death, the form requires specific information about the retiree and the person reporting, including verification of their relationship and contact information.

Submitting the form is the final step: After submitting the form, there are additional steps, including receiving claim forms for any money due to the retiree or benefits for survivors, which require prompt attention.

Assistance is limited: DFAS offers customer service support to assist survivors through the process, ensuring questions are answered and the necessary support is provided during what is often a difficult time.

Understanding these misconceptions is vital to handling the obligations following a military retiree's death with as much clarity and simplicity as possible. It ensures survivors can focus on what matters most during these moments.

Key takeaways

When faced with the somber task of reporting the death of a military retiree, it is important to use the DFAS Notification Of Death Form (DFAS 9221) meticulously to ensure that the process is handled correctly and respectfully. Here are five key takeaways to remember when filling out and utilizing this form.

- Prompt Reporting is Crucial: It's essential to report the death of a military retiree as quickly as possible. Timely notification allows the Defense Finance and Accounting Service (DFAS) to cease any monthly payments, which helps prevent the complications of overpayment and subsequent recovery efforts.

- Accuracy is Key: The form requires specific details about the deceased retiree and the person reporting. Information such as full names (including middle initial), Social Security Numbers, dates in MM/DD/YYYY format, and phone numbers need to be accurate. Incorrect or incomplete submissions may result in overpayments or delays in processing survivor benefits.

- Accessing the Form: Accessing the form might lead you to a security warning due to the DFAS network's security protocol. Proceeding anyway is safe and necessary to reach and fill out the form.

- Detailed Instructions by Section: The form divides into sections requiring information about the deceased, the person reporting, the deceased’s spouse, family members, beneficiaries, and any additional comments. Notably, while some sections are optional, providing comprehensive information can be helpful.

- Final Steps and Assistance: After completing the form, it's important to print a copy for your records before submitting it. DFAS aims to send a letter containing claim forms for any due money or available survivors' benefits within 7-10 business days following the death report. For any difficulties or queries during this process, DFAS customer service representatives are available to assist.

The completion and submission of the DFAS Notification Of Death Form are more than administrative tasks; they are crucial steps in ensuring the deceased retiree’s affairs are settled with the dignity they deserve. While it represents a challenging responsibility during a sorrowful time, remembering these key takeaways helps navigate the process with greater ease and certainty.

Popular PDF Forms

Air National Guard Retirement - Ensures reservists' rights to retired pay are validated through a detailed application review.

Patient Care Report - Incorporates a dedicated section for the narrative description of the incident and patient care provided.