Blank Disclaimer Inheritance PDF Template

When an individual inherits property, stocks, or any form of asset, they are confronted with a choice that not everyone knows exists—the option to refuse the inheritance. This is where the Disclaimer Inheritance form, specifically the Affidavit of Disclaimer of Interest by Heir comes into play, a legal document that plays a critical role within the framework of estate planning and inheritance law. It serves as a formal declaration made by an heir or beneficiary to legally renounce their right to part or all of an inheritance, including shares of stock in corporations like Tanadgusix Corporation. By completing this affidavit, which requires detailed information including the decedent's full legal name, the date of their death verified by a death certificate, the specific shares owned, and the heir's relationship to the deceased, one can effectively disclaim the interest in the inherited assets. This process, governed under specifics like AS 13.12.801, not only necessitates a clear understanding of one's rights and obligations but also imposes a responsibility to act within a limited timeframe, in order to appropriately redirect the inheritance. Furthermore, this action carries with it a promise to defend, indemnify, and hold harmless the corporation from any resultant claims, demands, fees, or expenses, showcasing the serious legal and financial implications tied to such a disclaimer. This affidavit, therefore, is not just a formality but a significantly impactful legal strategy that can alter the distribution of an estate, thereby affecting not just the immediate parties involved but potentially shaping the broader family legacy.

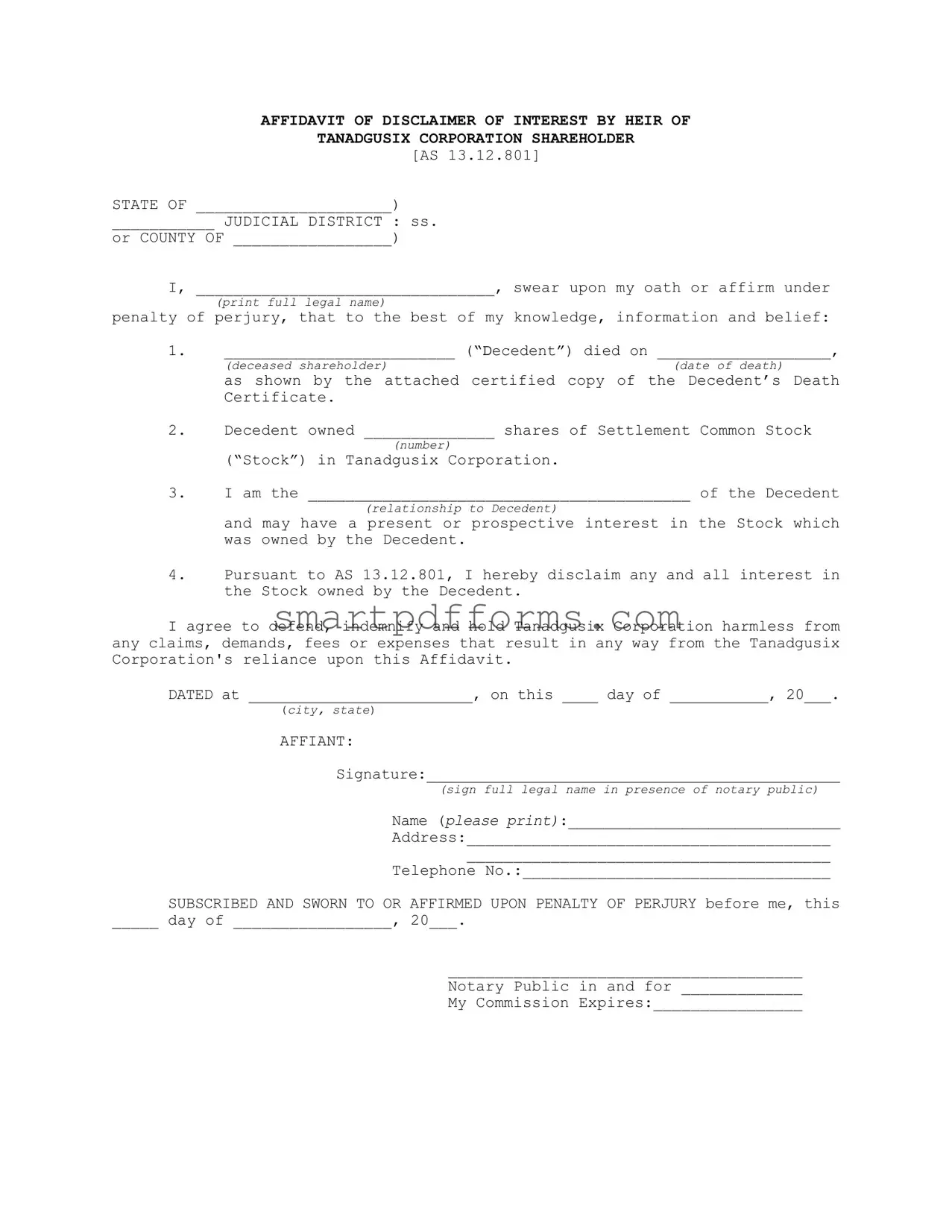

Preview - Disclaimer Inheritance Form

AFFIDAVIT OF DISCLAIMER OF INTEREST BY HEIR OF

TANADGUSIX CORPORATION SHAREHOLDER

[AS 13.12.801]

STATE OF _____________________)

___________ JUDICIAL DISTRICT : ss.

or COUNTY OF _________________)

I, ________________________________, swear upon my oath or affirm under

(print full legal name)

penalty of perjury, that to the best of my knowledge, information and belief:

1._________________________ (“Decedent”) died on ___________________,

(deceased shareholder) |

(date of death) |

as shown by the attached certified copy of the Decedent’s Death Certificate.

2.Decedent owned ______________ shares of Settlement Common Stock

(number)

(“Stock”) in Tanadgusix Corporation.

3.I am the _________________________________________ of the Decedent

(relationship to Decedent)

and may have a present or prospective interest in the Stock which was owned by the Decedent.

4.Pursuant to AS 13.12.801, I hereby disclaim any and all interest in the Stock owned by the Decedent.

I agree to defend, indemnify and hold Tanadgusix Corporation harmless from any claims, demands, fees or expenses that result in any way from the Tanadgusix Corporation's reliance upon this Affidavit.

DATED at _________________________, on this ____ day of ___________, 20___.

(city, state)

AFFIANT:

Signature:______________________________________________

(sign full legal name in presence of notary public)

Name (please print):_______________________________

Address:_______________________________________

_______________________________________

Telephone No.:_________________________________

SUBSCRIBED AND SWORN TO OR AFFIRMED UPON PENALTY OF PERJURY before me, this

_____ day of _________________, 20___.

______________________________________

Notary Public in and for _____________

My Commission Expires:________________

Form Data

| Fact | Detail |

|---|---|

| Purpose of the Form | This form is used by an heir to formally renounce or disclaim any interest in shares of stock from the estate of a deceased shareholder of Tanadgusix Corporation. |

| Applicable Law | AS 13.12.801 guides the process and requirements for disclaiming interest in an inheritance. This law is specific to the state of Alaska. |

| Requirements for Validity | The heir must swear or affirm under penalty of perjury based on their knowledge, information, and belief regarding the decedent and the owned shares. |

| Documentation | A certified copy of the Decedent’s Death Certificate must be attached to the form as evidence of the shareholder's death and the date it occurred. |

| Relationship Declaration | The heir must state their relationship to the decedent, acknowledging a potential present or prospective interest in the stock. |

| Liability Clause | By disclaiming interest in the stock, the heir agrees to defend, indemnify, and hold Tanadgusix Corporation harmless against any claims, demands, fees, or expenses resulting from the corporation's reliance on the affidavit. |

| Execution and Notarization | The affidavit requires the heir's signature, printed name, contact information, and notarization to be legally binding. |

Instructions on Utilizing Disclaimer Inheritance

Filing a Disclaimer of Inheritance form is a legal process that enables individuals to formally renounce any claim or right to an inheritance, including assets like stocks from a corporation. By completing this document, the individual avoids taking ownership of certain assets, for reasons that can range from personal financial planning to tax considerations. The process is straightforward but must be followed carefully to ensure the disclaimer is legally valid and effective.

Here are the steps needed to fill out the Disclaimer Inheritance form correctly:

- Start by stating the full legal name of the decedent (the deceased shareholder) and the exact date of death as indicated on the attached certified Death Certificate.

- Specify the number of shares owned by the decedent in the Tanadgusix Corporation at the time of death.

- Clearly state your relationship to the decedent to establish your potential claim to the stock.

- Declare your intention to disclaim any and all interest in the specified stock by acknowledging your understanding of the relevant state statute, in this case, AS 13.12.801.

- Agree to defend, indemnify, and hold Tanadgusix Corporation harmless from any claims, demands, fees, or expenses arising from their reliance on this Affidavit of Disclaimer.

- Complete the form by entering the city and state where the disclaimer is being executed, along with the date of signing.

- Sign the affidavit in the presence of a notary public to affirm the truthfulness of your statements under penalty of perjury. Your signature should match your full legal name as written in the document.

- Print your full name, address, and telephone number beneath your signature for identification and contact purposes.

- Finally, have the notary public complete their section of the form, which includes the date the affidavit was sworn or affirmed, their signature, commissioning state, and the date their commission expires.

Once the form is fully completed and notarized, it becomes a legal document. It should be submitted to the relevant court or entity overseeing the decedent's estate, such as the executor or probate court, as well as the Tanadgusix Corporation, to officially document your disclaimer of inheritance.

Obtain Answers on Disclaimer Inheritance

-

What is an Affidavit of Disclaimer of Interest?

An Affidavit of Disclaimer of Interest is a legal document used by an heir or beneficiary to formally renounce their rights to inherit property, in this case, shares of stock in the Tanadgusix Corporation, from a deceased individual's estate. This can be for various reasons, such as personal preference, financial planning, or tax implications. It is a binding statement where the heir indicates they do not wish to receive the specified inheritance and are effectively removed from the line of succession for that asset.

-

Why would someone want to disclaim their inheritance?

People might choose to disclaim their inheritance for several reasons. Financial strategy is a common motivation, where disclaiming an inheritance could help avoid high estate taxes, or it might be a way to pass wealth directly to the next generation. Personal reasons can also play a role; for example, an heir might feel that other beneficiaries need the inheritance more. Additionally, disclaiming inheritance can be used as a tool for estate planning, helping to manage the distribution of the deceased's estate in a way that aligns with their wishes or benefits the family as a whole.

-

How does one go about disclaiming inheritance?

To formally disclaim an inheritance, the heir must prepare and sign an Affidavit of Disclaimer of Interest, such as the one described for the Tanadgusix Corporation shareholder's estate. This process generally involves clearly identifying the asset being disclaimed (in this case, Tanadgusix Corporation Stock), stating the heir's relationship to the decedent, and formally renouncing any claim to the specified inheritance in a sworn statement. This document then needs to be notarized and typically filed with the relevant estate or probate court.

-

Are there any deadlines for filing a Disclaimer of Interest?

Yes, deadlines apply when disclaiming an inheritance, and it’s crucial to be aware of them. The specific timeframe can vary depending on state laws, but it is typically within nine months of the deceased individual's death or nine months after the would-be heir turns 21. Given the importance of adhering to these deadlines to ensure the disclaimer is legally valid, consulting with a legal professional to understand the specific requirements in your area is advisable.

-

What happens after disclaiming an inheritance?

After an heir disclaims an inheritance, they are treated as though they had predeceased the decedent with respect to the disclaimed property. This means the asset they would have inherited (such as shares in Tanadgusix Corporation) will pass on to the next entitled beneficiary under the law or the terms of the will or trust. The heir who disclaimed the asset will have no rights to it, and cannot later change their mind and claim the disclaimed inheritance.

-

Can any heir disclaim their inheritance?

While most heirs have the legal right to disclaim their inheritance, there are conditions and limitations. For instance, an heir cannot partially disclaim an inheritance; it's an all-or-nothing decision for the particular asset. Furthermore, the heir must not have accepted any benefit from the inheritance they wish to disclaim. Accepting even a small part of the inheritance or exercising control over it can void the ability to disclaim. Because the laws regulating inheritance disclaimers vary by jurisdiction, it’s essential to consult with a legal professional to navigate the process appropriately.

Common mistakes

Failure to include the certified copy of the Decedent’s Death Certificate. This document is crucial as it serves as the foundation for the entire declaration. Without it, the affidavit lacks the substantiation needed to proceed.

Providing incorrect information about the Decedent, including the date of death or the full legal name. Accuracy in these details is paramount, as they must correspond exactly to official records and documents related to the estate.

Misstating the number of shares owned by the Decedent in Tanadgusix Corporation. An accurate account of the shares is necessary to precisely identify the estate assets being disclaimed.

Incorrectly identifying the relationship to the Decedent. The specific relationship of the heir or beneficiary to the Decedent influences the legal context of the disclaimer and may affect the distribution of the estate.

Not clearly expressing the intention to disclaim any prospective interest in the stock owned by the Decedent. A clear and unequivocal disclaimer ensures that the affiant’s lack of claim is legally acknowledged.

Omitting or inaccurately stating the location and date where the affidavit is signed. The jurisdiction and the timing of the affidavit have legal implications and must be accurately recorded.

Having the Affiant’s signature not properly witnessed by a notary public. For the affidavit to be binding, it is required that the Affiant sign in the presence of a notary public, who can then attest to the authenticity of the signature.

Leaving contact information incomplete or inaccurate. Should there be any need for follow-up or clarification, current and complete contact information is vital for any communications that may arise.

When completing the Affidavit of Disclaimer of Interest, individuals commonly encounter several pitfalls that may undermine the form's validity or its acceptance. Emphasis is placed on details and procedural correctness to ensure that the intent to disclaim inheritance rights is legally recognized.

Mitigating these common mistakes can significantly streamline the process of disclaiming inheritance rights, ensuring that the Decedent's estate is distributed according to the remaining heirs' legal entitlements and the Decedent's wishes.

Documents used along the form

When managing estate matters, specifically regarding the disclaiming of inheritance as seen in the Disclaimer Inheritance form, several other forms and documents are often key to the process. These documents support the disclaiming process, each serving a unique function in ensuring legal compliance and clarity in the distribution of the deceased's assets. Below is a concise overview of these critical documents.

- Certified Copy of Death Certificate: This document is essential for all legal proceedings following a person's death. It serves as official proof of death and is required to validate the disclaimer of inheritance, settle the estate, and for various other legal matters involving the deceased's assets.

- Last Will and Testament: The decedent's last will provides detailed instructions on how their assets should be distributed among heirs and beneficiaries. It's crucial for understanding the decedent's wishes and determining if the disclaimer impacts the distribution outlined in the will.

- Trust Documents: If the decedent had established a trust, these documents are vital. They outline the conditions under which the assets placed in the trust are to be distributed. Disclaiming an inheritance from a trust may require additional steps in accordance with the trust's terms.

- Probate Court Documents: In cases where the estate goes through probate, various court documents will be involved. These can include petitions for probate, inventories of the estate's assets, and court orders for asset distribution. These documents help ensure that the disclaimer is accounted for in the probate process.

Together, these documents play integral roles in the effective management of estate affairs, particularly when an heir chooses to disclaim their inheritance. Having a comprehensive understanding and the correct documents in order ensures that the disclaiming process is handled legally and with respect to the decedent's wishes and the heir's decision.

Similar forms

Will: Just like the Disclaimer Inheritance form, a will outlines a person's wishes concerning how their property should be distributed upon death. Both documents specify the interests of parties regarding the decedent's assets, although a will declares how assets should be divided, while the Disclaimer Inheritance form enables an heir to renounce their share of an inheritance.

Trust Agreement: This document also shares similarities with the Disclaimer Inheritance form as it involves the transfer of property; however, it does so by placing assets under the control of a trustee for the benefit of others, known as beneficiaries. The heir disclaiming their interest might do so in favor of trust arrangements pre-established by the decedent.

Power of Attorney: While primarily allowing someone to act on another’s behalf concerning financial or health decisions, it relates to the Disclaimer Inheritance form in terms of delegating control over personal interests or assets. Both allow an individual to manage their connection to certain assets, either by assuming control or renouncing it.

Beneficiary Designation Form: Commonly associated with retirement accounts or insurance policies, this document directs who will receive the assets upon the policyholder's or account holder's death. It aligns with the Disclaimer Inheritance form as both specify intentions regarding asset distribution after death.

Life Estate Deed: This deed allows a person to own property for the duration of their life before it passes to another designated person upon their death. The life estate deed parallels the Disclaimer Inheritance form in ensuring property is transferred according to the owner's or heir’s wishes, albeit through different mechanisms.

Quitclaim Deed: Used to transfer any ownership interest in property without guaranteeing the title's status, this document is similar to a disclaimer inheritance form in that it can rearrange interests in property. Both allow an individual to relinquish rights or claims to property but with different legal implications and requirements.

Death Certificate: Essential for the legal process, including the Disclaimer Inheritance form, it verifies the death of an individual, enabling the transfer or disclaimer of inheritance. Though not a directive document like the disclaimer, its necessity intertwines with processes that require formal acknowledgment of death.

Gift Deed: A gift deed allows an individual to give away assets or property without compensation. This parallels the act of disclaiming an inheritance since both actions involve transferring interests in property without financial exchange from the receiver, based on the giver's or disclaimant’s wishes.

Revocable Living Trust: This document enables an individual to manage their assets during their lifetime and specify how they should be distributed after their death, offering an alternate route to manage an estate similar to a will. The connection with a Disclaimer Inheritance form comes from the capacity to specify how assets are handled posthumously, albeit through disclaimer, the heir opts out of receiving assets directed by such a trust.

Dos and Don'ts

When filling out a Disclaimer of Inheritance form, it's important to handle the document with care and accuracy, ensuring that all legal requirements are met. Below are lists of things you should and shouldn't do to assist in this process.

Do:

- Review the Entire Form Before Filling It Out: Understand all the requirements and sections to ensure that every detail is accurately completed.

- Attach the Required Documents: Including a certified copy of the Decedent’s Death Certificate is crucial, as stated in the form. Make sure to attach any other necessary documentation as required by the specific instructions or by law.

- Print Clearly in Black Ink: To ensure readability and prevent any issues with legibility, use black ink and ensure your handwriting is clear and legible.

- Legally Acknowledge Your Actions: Recognize that you are disclaiming your interest under penalty of perjury and understand the legal significance of this action, including the agreement to defend, indemnify, and hold Tanadgusix Corporation harmless from any claims.

Don't:

- Fill Out the Form in a Hurry: Take your time to carefully enter the required information and review each section to avoid mistakes.

- Use Pencil or Colored Inks: Writing in pencil can be easily altered, and colored inks might not be legible or photocopy well, which could lead to legal ramifications or rejection of the form.

- Forget to Have the Form Notarized: The form requires notarization; ensure that it is signed in the presence of a Notary Public to validate the affidavit.

- Ignore State-Specific Requirements: Laws can vary significantly from one state to another. Even though this form cites a specific Alaska Statute (AS 13.12.801), it's important to consider any additional requirements your state may have regarding disclaiming an inheritance.

Taking these steps seriously when filling out a Disclaimer of Inheritance form will help ensure that the disclaiming process is completed smoothly and in accordance with the law, thereby minimizing potential legal complications.

Misconceptions

When it comes to the intricacies of managing an inheritance, particularly through vehicles like the Disclaimer of Inheritance Form, several misconceptions often cloud the judgment of those involved. A clear understanding is crucial to navigating these legal waters seamlessly. Below are four common misunderstandings associated with the Disclaimer Inheritance form:

- Misconception 1: Disclaiming an inheritance is the same as transferring it to someone else.

This belief is fundamentally incorrect. When an individual disclaims an inheritance, they are legally stating that they never want to take ownership of the asset. This act does not allow the disclaimant to choose who receives their portion next. Instead, the inheritance passes as if the disclaimant had predeceased the decedent, generally following the terms outlined in the will or, absent a will, the state's succession laws.

- Misconception 2: The disclaimer must be filed after receiving the inheritance.

Quite the opposite, action must be taken quickly if one intends to disclaim an inheritance. Most states require the disclaimer to be filed within a specific period, usually within nine months of the decedent's death. Waiting until after the inheritance has been received could result in the disclaimer being invalid. This is crucial because it emphasizes the importance of promptly making such legal decisions.

- Misconception 3: A disclaimer can be used to evade creditors.

This is a dangerous assumption. Disclaiming an inheritance to avoid creditors or legal obligations can be seen as fraudulent. Courts have mechanisms to address such situations, potentially resulting in the disclaimer being set aside to satisfy creditors' claims. This highlights the legal responsibility individuals have towards their debts, even in the context of inheritance.

- Misconception 4: Disclaiming inheritance requires lengthy court involvement.

Though legal formalities must be observed, the act of disclaiming an inheritance often does not require a court's approval. The disclaimer needs to be properly executed, notarized, and then filed as appropriate—usually with the estate executor or possibly with a court if required by state laws. This process typically is more administrative than litigious, streamlining the disclaiming process.

Correcting these misconceptions is critical for everyone involved in an inheritance process. Each situation has its unique complexities and legal subtleties. Therefore, consulting with a legal professional to navigate the disclaiming process and its implications on an estate is always recommended. Understanding the nuances of a Disclaimer Inheritance form can both protect individuals from unintended legal consequences and ensure that the decedent's assets are distributed as intended.

Key takeaways

Filling out and using a Disclaimer Inheritance form is a significant legal process that allows an heir to formally refuse an inheritance. This process must be approached with care to ensure legal compliance and fulfillment of the person’s intentions. Below are key takeaways to consider:

- Understanding the Purpose: By completing this form, an individual expressly declares their intention to refuse the inheritance of specific assets, in this case, shares in the Tanadgusix Corporation. This legal action removes the heir from any future claims or benefits related to the disclaimed property.

- Accurate Identification of the Decedent and Property: It is imperative to clearly state the full legal name of the deceased (Decedent) and accurately identify the inheritance in question, including the precise number of shares. Misidentification can lead to processing delays or the invalidation of the disclaimer.

- Clarification of Relationship: The claimant must clearly articulate their relation to the Decedent. This information helps in establishing the legal standing of the individual to disclaim the inheritance.

- Legal Obligations: By signing the form, the claimant agrees not only to refuse the shares but also to indemnify the Tanadgusix Corporation against any resultant claims, demands, or expenses. This aspect underscores the seriousness of the declaration and its potential legal implications.

- Requirement for Notarization: The form necessitates notarization, which implies that the heir must sign the document in the presence of a notary public. This step is crucial for verifying the authenticity of the signatory’s identity and their voluntary decision without duress to disclaim the inheritance.

It's essential for individuals considering the disclaimer of inheritance to be fully aware of these elements to ensure the process aligns with their intentions and legal requirements. Consulting with a legal professional before taking such a step is highly recommended to avoid unintended consequences.

Popular PDF Forms

Section 245 of Income Tax Act - For corporate taxpayers, Form C-245 requires the inclusion of the business entity name and an authorized signature.

Navsup Form 306 - Contributes to the safeguarding of high-value or sensitive items through meticulous record-keeping.

Af Form 1297 - The form acts as a proactive measure to identify and address any special requirements, reducing potential stress and challenges associated with relocations.